Overview

The article centers on best practices for senior stakeholder management, specifically designed for CFOs, underscoring the critical role of effective communication, relationship building, and strategic engagement. It articulates essential skills such as negotiation and conflict resolution, while also presenting actionable strategies like leveraging technology and promoting open dialogue. These approaches not only enhance collaboration but also serve to drive organizational success.

Introduction

In today's increasingly complex business landscape, the role of the Chief Financial Officer (CFO) has evolved beyond traditional financial stewardship to encompass strategic stakeholder management. As organizations strive for success, the effective engagement of senior stakeholders has emerged as a pivotal function that can significantly influence outcomes. This article delves into the intricacies of senior stakeholder management, highlighting essential skills, communication strategies, and best practices that CFOs can adopt to foster collaboration and drive positive change.

By understanding the dynamics of these relationships and leveraging technology, CFOs can navigate challenges and align financial strategies with overarching business objectives. Ultimately, this alignment contributes to sustainable growth and organizational resilience.

Understanding Senior Stakeholder Management

Senior stakeholder management is a critical function that involves identifying, engaging, and influencing key individuals in senior positions who can significantly impact an organization's success. For chief financial officers, this entails acknowledging the varied interests and expectations of stakeholders, including board members, investors, and department leaders. Efficient handling of these connections is crucial for aligning monetary strategies with broader business goals, ensuring that economic decisions support the overall vision of the organization.

Recent statistics indicate that 41% of organizations cite demonstrating the added value of project management offices (PMOs) as their biggest challenge. This statistic underscores the necessity for effective participant involvement, particularly for chief financial officers who must illustrate the worth of their financial plans. Expert opinions emphasize that effective sponsorship is essential for successful change initiatives, reinforcing the significance of financial leaders in nurturing these connections and showcasing their influence on organizational success.

By comprehending the dynamics of senior partner relationships, financial leaders can foster collaboration and drive positive results, especially during periods of change or crisis. Effective engagement strategies involve creating and sustaining a map of stakeholders, prioritizing key individuals, and fostering their commitment to change. Additionally, the integration of real-time analytics enables finance executives to monitor business performance continuously, ensuring that decisions are data-driven and responsive to evolving circumstances.

A case study contrasting formal organizational structures with informal change networks illustrates how recognizing informal power dynamics can enhance engagement and support for change initiatives. This understanding aligns with the insights from Transform Your Small/Medium Business in assisting companies to navigate these complexities, equipping financial leaders with the resources essential for executing effective management strategies.

In 2025, the significance of managing relationships in organizational success cannot be overstated. Effective senior stakeholder management not only facilitates smoother transitions during restructuring but also contributes to sustainable growth. As financial leaders navigate the complexities of their roles, prioritizing the management of stakeholders, supported by streamlined decision-making and continuous performance monitoring, will be crucial in achieving organizational objectives and fostering resilience in challenging times.

Moreover, by utilizing the 'Identify & Plan' and 'Decide & Execute' phases, financial leaders can enhance their strategic approach to managing interests, ensuring that their initiatives are meticulously planned and executed with precision.

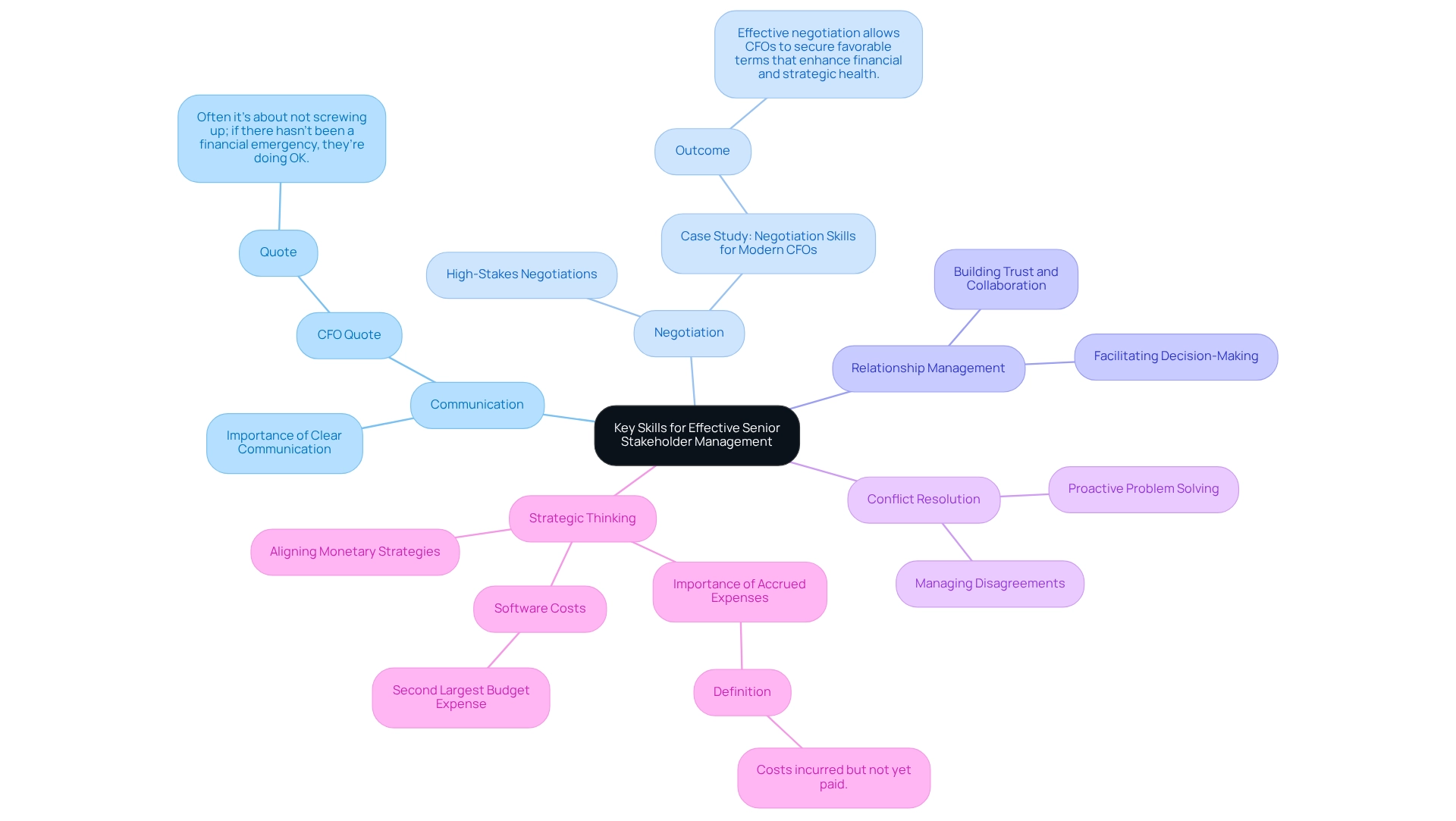

Key Skills for Effective Senior Stakeholder Management

To effectively handle senior stakeholder management, CFOs must cultivate a diverse skill set essential for navigating complex business environments. Key skills include:

- Communication: Mastering clear and concise communication is crucial for conveying monetary information and strategic objectives. Effective communication promotes transparency and guarantees that interested parties are aligned with the organization's objectives. As noted by a Chief Financial Officer, "Often it’s about not screwing up; if there hasn’t been a monetary emergency, they’re doing OK," highlighting the importance of proactive communication in avoiding crises.

- Negotiation: The capacity to negotiate advantageous terms with stakeholders is essential for attaining improved economic results. Chief financial officers frequently participate in high-stakes discussions with investors, suppliers, and partners, where robust negotiation abilities can secure beneficial agreements that improve the organization's economic well-being. A case study titled "Negotiation Skills for Modern CFOs" illustrates how effective negotiation allows CFOs to secure favorable terms that enhance the financial and strategic health of the business.

- Relationship Management: Building and maintaining strong connections with interested parties is essential for promoting trust and collaboration. A CFO who invests in relationship management can create a supportive network that facilitates smoother operations and decision-making processes. This aligns with the need for continuous business performance monitoring, as strong relationships enable real-time analytics and operational insights that inform strategic decisions.

- Conflict Resolution: Managing disagreements among parties involved is crucial for preserving harmony and ensuring that the organization stays concentrated on its goals. Efficient conflict resolution approaches allow financial executives to tackle problems proactively, reducing interruptions to business activities.

- Strategic Thinking: A thorough grasp of the wider business environment enables CFOs to align monetary strategies with the interests of involved parties efficiently. This strategic alignment is essential for advancing organizational success and ensuring that monetary decisions support long-term goals. Significantly, for numerous firms, software costs are the second largest budget category following payroll, highlighting the importance of strategic financial management in interactions with interested parties. By identifying underlying business issues and collaboratively planning solutions, financial leaders can operationalize turnaround lessons that enhance decision-making processes. Additionally, a pragmatic approach to data testing is essential for measuring investment returns and delivering maximum return on invested capital.

By refining these abilities, financial leaders can significantly improve their effectiveness in senior stakeholder management, ultimately driving organizational success. Furthermore, the significance of precise monetary reporting, including comprehending accrued expenses—costs incurred but not yet settled—cannot be overlooked, as it plays a crucial role in managing interested parties.

Effective Communication Strategies for CFOs

CFOs can adopt several effective communication strategies to engage senior participants:

- Tailored Messaging: Customizing communication to align with the audience's interests and expertise is crucial. Streamlining economic reports for non-economic participants ensures that everyone can comprehend key information, promoting inclusivity and understanding.

- Regular Updates: Consistent updates on financial performance and strategic initiatives are vital for keeping interested parties informed and engaged. Adrian Talbot, CFO at Miroma Group, exemplified this by calling every member of staff for a five-minute conversation at the start of the Covid crisis, highlighting the importance of approachability and visibility in fostering trust. This transparency builds trust and reinforces the CFO's role as a reliable source of information. Moreover, utilizing real-time business analytics can improve these updates, enabling financial executives to offer timely insights that reflect the current health of the organization.

- Active Listening: Encouraging feedback and actively listening to concerns from involved parties cultivates a collaborative environment. This method not only improves relationships but also enables financial executives to tackle issues proactively, showcasing responsiveness to the needs of involved parties. By utilizing real-time analytics, CFOs can better comprehend the views of interested parties and adjust their strategies accordingly.

- Visual Aids: Utilizing charts, graphs, and dashboards to present economic data visually can significantly enhance comprehension. Visual aids make complex information more accessible, allowing participants to quickly grasp key insights and trends. Integrating real-time data into these visual presentations can further improve clarity and engagement.

- Storytelling: Framing financial data within the context of the organization's narrative adds relatability and impact. By linking figures to the wider organizational objectives and issues, financial leaders can involve interested parties on a deeper level, rendering the data more significant. As Sue Rosen observes, enhancing 'executive presence' can assist financial leaders in motivating others, even in challenging situations.

Applying these tactics can greatly improve communication efficiency for financial executives, ultimately reinforcing connections through senior stakeholder management. Furthermore, the significance of real-time financial data cannot be overstated; many chief financial officers recognize that trusting their data is essential for effective decision-making, particularly in managing unpredictable market changes. As emphasized by recent insights, cultivating trust through approachability and visibility is crucial for effective management of involved parties in today's dynamic business environment.

Navigating Conflicts with Senior Stakeholders

CFOs can implement several effective strategies to navigate conflicts with senior stakeholders:

- Acknowledge the Conflict: Recognizing and openly addressing conflicts is crucial to prevent escalation. Ignoring issues can lead to a breakdown in communication and trust.

- Gather Information: Collecting relevant data and perspectives from all parties involved helps in understanding the root causes of the conflict. This thorough approach ensures that all viewpoints are considered, which is essential for effective resolution.

- Facilitate Open Dialogue: Creating a safe environment for participants to express their concerns fosters collaboration. Open dialogue not only allows for grievances to be aired but also encourages appreciation for differing viewpoints. A case study titled "Conflict Resolution in the Workplace: Facilitated Dialogue" illustrates this, where a facilitator brought together conflicting parties to discuss their grievances in a neutral setting, leading to mutual understanding and resolution.

- Seek Common Ground: Identifying shared goals and interests is vital for building consensus. By concentrating on shared advantages, CFOs can lead interested parties toward solutions that satisfy everyone, thereby enhancing relationships. Comprehending the distinct concerns of challenging participants is crucial in this process, enabling customized strategies that tackle particular issues. Utilizing real-time business analytics can aid in diagnosing participant sentiments and aligning interests effectively. Furthermore, the abbreviated decision-making process facilitated by Transform Your Small/ Medium Business enables faster resolutions, improving satisfaction among involved parties.

- Follow Up: After addressing a conflict, it is important to follow up with involved parties to ensure the effectiveness of the solution and to maintain strong relationships. Continuous engagement reinforces trust and demonstrates commitment to collaborative success. Moreover, putting into practice the insights gained from the turnaround process can additionally strengthen these connections, ensuring that participants feel appreciated and comprehended.

Incorporating these strategies can significantly enhance stakeholder relationships and contribute to overall business success. As highlighted by statistics, while disruptive behavior occurs in only 3 to 6% of physicians, its impact on morale and productivity is significant, underscoring the importance of proactive conflict management in any organization. As Thomas Paine wisely noted, 'The great remedy for anger is delay,' reminding financial executives that thoughtful engagement can lead to more effective resolutions.

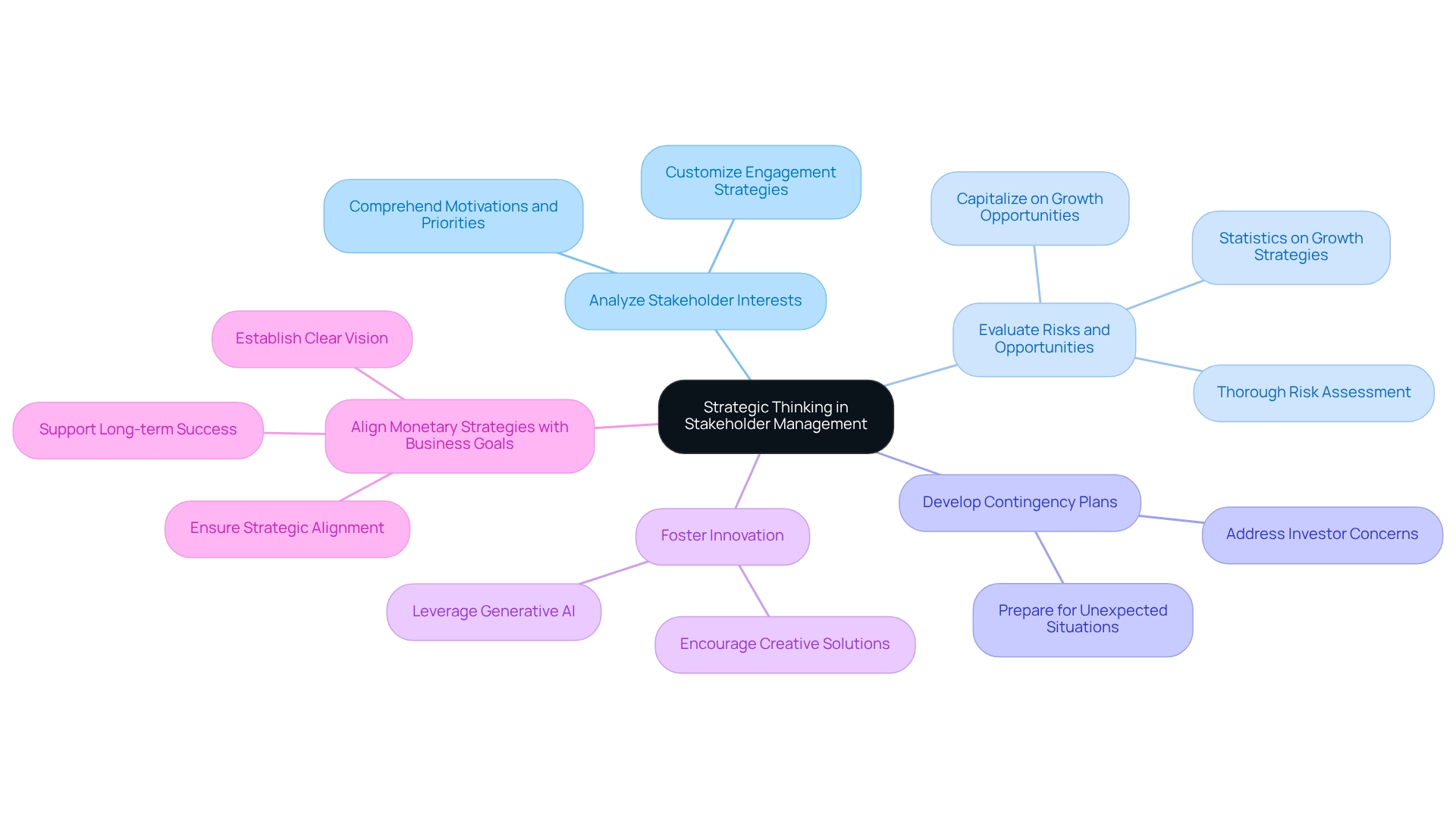

Strategic Thinking and Problem-Solving in Stakeholder Management

CFOs must harness strategic thinking and problem-solving skills to effectively manage senior stakeholders.

- Analyze Stakeholder Interests: Comprehending the motivations and priorities of each stakeholder is essential. This understanding enables financial leaders to customize engagement strategies that resonate with personal interests, fostering stronger relationships and collaboration.

- Evaluate Risks and Opportunities: A thorough assessment of potential risks and opportunities linked to financial decisions is crucial. By evaluating these factors, financial officers can make informed choices that not only mitigate risks but also capitalize on opportunities for growth. Statistics indicate that over two-thirds of chief financial officers intend to pursue growth strategies defined by fewer, more concentrated investments in the upcoming three years, emphasizing the necessity for careful risk assessment.

- Develop Contingency Plans: Preparing for potential challenges is vital. Chief Financial Officers should develop contingency strategies that address investor concerns and expectations, ensuring that the organization is equipped to react efficiently to unexpected situations.

- Foster Innovation: Encouraging innovative thinking among stakeholders can lead to the identification of creative solutions to monetary challenges. By promoting a culture of innovation, CFOs can unlock new avenues for value creation and business reinvention. For instance, utilizing generative AI has been shown to significantly alter various business operations, showcasing the potential for innovation to tackle economic challenges.

- Align Monetary Strategies with Business Goals: It is imperative that monetary decisions align with the organization’s overarching strategic objectives. This alignment not only enhances support from involved parties but also ensures that financial strategies contribute to the long-term success of the organization. As Jason Dess observes, "Their dynamic nature and interaction play a singular role in enabling, or hindering, organizational success," emphasizing the importance of strategic foresight in managing involved parties.

By integrating strategic thinking into stakeholder management, financial leaders can significantly enhance their effectiveness in navigating complex relationships and driving organizational success. Establishing a clear, forward-looking vision for their function will further support these efforts, aligning with the organization's mission to help businesses overcome challenges and achieve sustainable growth. Additionally, by collaboratively identifying underlying business issues and implementing a plan to mitigate weaknesses, financial leaders can ensure continuous performance monitoring and operationalize lessons learned, ultimately leading to streamlined decision-making and improved business outcomes.

Transform Your Small/ Medium Business is dedicated to assisting financial executives in these endeavors.

Leveraging Technology for Enhanced Stakeholder Engagement

CFOs can significantly enhance stakeholder engagement by leveraging technology in various impactful ways:

- Participant Management Software: Implementing specialized software tools allows organizations to meticulously track participant interactions, preferences, and feedback. This capability promotes more personalized interaction, ensuring that participants feel valued and understood.

- Data Analytics: Utilizing data analytics provides deep insights into the behavior and preferences of involved parties. By examining this information, financial leaders can customize their engagement approaches to match the expectations of interested parties, ultimately fostering stronger connections and satisfaction. This approach mirrors the commitment to continuous business performance monitoring and operationalizing lessons learned from turnaround processes, ensuring decisions are informed by accurate, relevant, and timely data.

- Virtual Collaboration Tools: In today’s increasingly remote work environment, virtual collaboration platforms are essential. These tools enable seamless communication and collaboration among involved parties, breaking down geographical barriers and enhancing teamwork, which is crucial for successful turnarounds.

- Automated Reporting: The implementation of automated reporting systems enables CFOs to deliver real-time updates on financial performance and strategic initiatives. This openness not only keeps involved parties informed but also fosters trust and accountability, embodying the fundamental principles of transparency and outcomes.

- Feedback Mechanisms: Establishing digital feedback systems is crucial for gathering participant input and assessing satisfaction levels. By actively seeking feedback, organizations can continuously enhance their engagement efforts, ensuring that the needs of interested parties are met effectively, which is essential for fostering collaboration.

- Reevaluating Talent Acquisition: Prominent finance organizations ought to reconsider talent acquisition and align data and analytics approaches to improve relationships, guaranteeing that the appropriate talent is present to aid in turnaround initiatives.

By adopting these technological advancements, CFOs can enhance their engagement approaches with parties involved, resulting in more effective communication and stronger organizational relationships. Current trends show that top finance firms are progressively embracing these tools, with a significant 71% more likely to invest in software platforms possessing integrated AI features, highlighting the significance of technology in contemporary management. As one CFO remarked, "For many organizations, the implementation of RPA finance technologies is an economical method to enhance accuracy and boost productivity, which is crucial to finance’s long-term plan.

Continuous Improvement in Stakeholder Management Skills

CFOs must prioritize the ongoing enhancement of their management abilities by adopting several key approaches:

- Requesting Input: Consistently seek opinions from stakeholders to identify areas for improvement in engagement methods. This practice not only fosters transparency but also builds trust, which is essential for effective relationships. Financial leaders are encouraged to conduct employee engagement surveys to pinpoint pain points and develop strategies for talent retention and upskilling.

- Identifying Business Issues: Actively recognize underlying business problems that may affect relationships with stakeholders. By understanding these challenges, financial executives can formulate targeted plans to mitigate weaknesses and leverage key strengths, ensuring a more effective engagement strategy.

- Participating in Training: Enroll in professional development courses focused on stakeholder management, communication, and conflict resolution. Ongoing education equips financial leaders with the tools necessary to navigate complex stakeholder relationships and adapt to evolving expectations.

- Testing and Measuring Strategies: Implement a systematic approach to evaluate engagement strategies. This ensures that financial executives can maximize return on invested capital by assessing the effectiveness of their initiatives and making data-driven adjustments as needed.

- Networking with Peers: Connect with fellow CFOs and finance leaders to exchange best practices and insights. Networking provides opportunities to learn from others' experiences, which can lead to innovative methods for managing stakeholders.

- Staying Informed: Remain up-to-date with industry trends and emerging technologies that can enhance management practices. Understanding the latest advancements allows financial leaders to utilize new tools and methodologies that improve engagement and communication, including real-time analytics to track participant interactions and business performance.

- Reflecting on Experiences: Regularly reflect on past stakeholder interactions to identify lessons learned and areas for growth. This introspective practice helps financial executives refine their strategies and enhance future engagements. Additionally, employing real-time business analytics can aid in consistently assessing the well-being and engagement efficiency of stakeholders.

By committing to ongoing enhancement, financial leaders can significantly improve their proficiency in managing senior partners, ultimately driving organizational success. Statistics indicate that over 70% of financial leaders consider enhancing finance metrics, insights, and storytelling, driving change management initiatives, and optimizing expenses as essential to their success, underscoring the necessity for strong management skills. Moreover, case studies highlight the importance of succession planning, demonstrating how proactive engagement with stakeholders can ensure stability and performance during transitions.

As financial executives enhance their skills through training and networking, they position themselves to better navigate the complexities of relationship dynamics and foster sustainable growth. As noted by Rob van der Meulen, Gartner experts will provide further insights on how chief financial officers and senior finance executives can address challenges at the Gartner CFO & Finance Executive Conference 2024, emphasizing the significance of these strategies in today's business landscape.

Best Practices and Actionable Strategies for CFOs

CFOs can significantly enhance their senior stakeholder management efforts by implementing several best practices:

- Establish Clear Objectives: Clearly defined goals for participant engagement are essential. They not only guide interactions but also provide a framework for measuring success. This clarity assists in aligning participant expectations with organizational objectives, ultimately leading to more effective engagement. By enhancing the timeliness of reporting through efficient workflows and utilizing real-time tools, financial leaders can ensure that their objectives are achieved quickly, enabling a more agile response to the needs of involved parties.

- Prioritize Interested Parties: Identifying key individuals based on their influence and interest is crucial. By tailoring engagement strategies to these priorities, CFOs can ensure that the most impactful relationships are nurtured, facilitating better decision-making and resource allocation. This method corresponds with the necessity for a shortened decision-making cycle, enabling faster reactions to concerns from interested parties.

- Encourage Open Communication: Clear communication is essential for establishing trust and cooperation among involved parties. Encouraging an open dialogue allows for the exchange of ideas and feedback, which can lead to more informed and strategic outcomes. As Ajit Kambil, Global Research Director, notes, "The CFO Program brings together a multidisciplinary team of Deloitte leaders and subject matter specialists to help CFOs stay ahead in the face of growing challenges and demands." This underscores the significance of teamwork in managing interested parties, which can be improved through real-time analytics that track engagement effectiveness.

- Utilize Technology: Leveraging technology tools can significantly streamline communication and improve participant engagement processes. Automation in finance, for example, decreases manual effort, improves data accuracy, and speeds up reporting cycles, offering real-time insight into stakeholder interactions and economic performance. Additionally, solutions like Transform Your Small/ Medium Business's client dashboard streamline payment processes, integrating with financial reporting systems to improve cash flow and provide real-time visibility into payment status. This operationalization of technology ensures that financial executives can make data-driven decisions swiftly.

- Continuously Evaluate and Adapt: Regular evaluation of participant management approaches is necessary to ensure their effectiveness. By continuously evaluating outcomes and making necessary adjustments, CFOs can improve engagement and drive better results over time. Insights from case studies, such as "What Is Annual Revenue? 'The Founder's Guide to Financial Literacy,' can inform these approaches by demonstrating how financial evaluation can improve management of interested parties. This ongoing process of testing hypotheses and adjusting strategies is crucial for maintaining a healthy business environment.

By adopting these best practices, CFOs can enhance their senior stakeholder management, ultimately driving organizational success and fostering a culture of collaboration and accountability.

Conclusion

Effective senior stakeholder management is essential for CFOs to navigate today’s complex business environment. By understanding the dynamics of stakeholder relationships and prioritizing engagement, CFOs can align financial strategies with broader organizational objectives. This article highlights the critical skills needed for successful stakeholder management, including:

- Communication

- Negotiation

- Strategic thinking

These competencies enable CFOs to foster collaboration and navigate conflicts, ultimately contributing to sustainable growth and resilience.

Moreover, the use of technology, such as stakeholder management software and data analytics, empowers CFOs to enhance their engagement strategies. By leveraging real-time data and automated reporting, CFOs can provide transparency and build trust with stakeholders, ensuring that their needs are met effectively. Continuous improvement through feedback, training, and networking is vital for refining stakeholder management skills, allowing CFOs to adapt to changing expectations and drive positive outcomes.

In summary, the evolving role of the CFO requires a proactive approach to stakeholder management. By implementing best practices and embracing technology, CFOs can strengthen relationships, enhance decision-making, and support organizational success. As the business landscape continues to change, prioritizing effective stakeholder engagement will be crucial for achieving long-term objectives and fostering a culture of collaboration.

Frequently Asked Questions

What is senior stakeholder management?

Senior stakeholder management is the process of identifying, engaging, and influencing key individuals in senior positions who can significantly impact an organization's success.

Why is senior stakeholder management important for chief financial officers (CFOs)?

For CFOs, senior stakeholder management is crucial for aligning monetary strategies with broader business goals and ensuring that financial decisions support the overall vision of the organization.

What challenges do organizations face in demonstrating the value of project management offices (PMOs)?

Recent statistics indicate that 41% of organizations cite demonstrating the added value of PMOs as their biggest challenge, highlighting the need for effective participant involvement.

How can financial leaders effectively engage with stakeholders?

Effective engagement strategies include creating and maintaining a stakeholder map, prioritizing key individuals, and fostering their commitment to change. Utilizing real-time analytics also helps finance executives monitor business performance continuously.

What skills are essential for CFOs in senior stakeholder management?

Key skills include: 1. Communication - for clear and concise conveyance of monetary information. 2. Negotiation - to secure advantageous terms with stakeholders. 3. Relationship Management - to build trust and collaboration. 4. Conflict Resolution - to manage disagreements and maintain focus on goals. 5. Strategic Thinking - to align monetary strategies with stakeholder interests.

How does understanding informal power dynamics benefit change initiatives?

Recognizing informal power dynamics can enhance engagement and support for change initiatives, allowing financial leaders to navigate complexities more effectively.

What role does continuous performance monitoring play in stakeholder management?

Continuous performance monitoring allows financial leaders to make data-driven decisions and respond to evolving circumstances, thereby enhancing the effectiveness of their stakeholder management strategies.

How can CFOs improve their effectiveness in senior stakeholder management?

By refining their skills in communication, negotiation, relationship management, conflict resolution, and strategic thinking, CFOs can significantly improve their effectiveness in managing senior stakeholders.

What is the significance of managing relationships in organizational success?

Effective senior stakeholder management facilitates smoother transitions during restructuring and contributes to sustainable growth, making it critical for achieving organizational objectives and fostering resilience in challenging times.