Introduction

Are you a CFO looking to improve your company's financial health and cash flow management? If so, then refinancing your business debt might be a strategic move worth considering. This article provides a comprehensive overview of debt refinancing, offering practical advice and solutions to help you make informed decisions.

From understanding your current debt structure to exploring refinancing options, you'll learn about the key benefits, potential challenges, and essential considerations in the refinancing process. We'll also delve into case studies and real-world examples to illustrate how businesses have successfully navigated debt refinancing. So, if you're ready to take control of your company's financial future, read on to discover how debt refinancing can be a game-changer for small businesses like yours.

Understanding Your Current Debt Structure

Restructuring corporate liabilities necessitates a thorough evaluation of your existing monetary commitments. It's crucial to carefully document your company's liabilities, which may involve various forms of debt like bank loans, lines of credit, or credit card debts. For each, it's critical to know the interest rates, the terms of repayment, and the monthly dues. By doing so, you position your business to potentially secure better terms—be it , extended repayment periods, or both—thereby easing financial pressure and enhancing . When contemplating , keep in mind that the lending environment is changing, with non-bank lenders now providing rates that are becoming more competitive with traditional banks. This change could create fresh possibilities for restructuring that may not have been accessible before. Using information on industry-specific economic patterns and credit circumstances can also guide your strategy for adjusting your finances, making sure it is consistent with the wider economic situation.

When to Consider Refinancing Business Debt

Considering the possibility of refinancing is wise when striving to improve the . Through the , enterprises can take advantage of lower interest rates, extended periods for repayment, or the convenience of a unified consolidated loan. Assessing the Service Coverage Ratio (DSCR) is crucial in this process—it's a metric that demonstrates the capacity of a business to fulfill its financial obligations. If your company's yearly net operating income is $100,000 with a total service of $50,000, this leads to a DSCR of 2, indicating a strong ability to cover obligations. can be accomplished by either increasing earnings or lowering obligations, such as negotiating reduced expenses with suppliers or seeking improved loan conditions. This strategic manipulation not only shows lenders a strong capacity to handle liabilities but also sets the company up for more advantageous loan terms in the future.

Key Benefits of Refinancing Business Debt

Strategically reorganizing debt by refinancing can be a game-changer for . This maneuver not only potentially but also lowers monthly payments, directly benefiting . It's like opening a window to a breath of fresh financial air, allowing enterprises to breathe easier with the prospect of more manageable payments. Additionally, the process of consolidating by restructuring loans is similar to organizing a messy space; it simplifies the payment procedure by combining different obligations into one, streamlined responsibility, reducing the hassle of administration.

It's important to note that, as we step into 2023, the landscape of lending is shifting. Non-bank lending options are starting to give traditional banks a run for their money with increasingly competitive rates. This implies that additional opportunities are emerging for [small enterprises](https://blog.smbdistress.com/10-key-benefits-of-interim-management-financial-services) to obtain advantageous funding alternatives.

In essence, consolidation can be likened to a strategic move in chess, where combining multiple moves into one can corner your opponent â in this case, overwhelming debt. By strategically allocating resources and implementing effective monetary tactics, small enterprises can utilize loan restructuring as a potent instrument to not just sustain but also establish a foundation for expansion and security in the foreseeable future.

How Debt Refinancing Works

is a strategic move that can alleviate burdens and pave the way for growth and stability. When you , you're securing a new loan that pays off existing responsibilities, ideally under more advantageous conditions. Companies often seek out loans with lower interest rates or extended repayment terms to create a more sustainable structure. For example, Rite Aid Corporation successfully employed a restructuring strategy to not just decrease its burdensome liabilities but also to improve its operational flexibility, enabling the company to remain dedicated to delivering high-quality healthcare services and products. This strategy reflects the principles of sound , where aligning liabilities with current market conditions can significantly enhance a company's liquidity and flexibility. As the market for loans for enterprises advances, with non-bank lenders progressively providing rates comparable to conventional banks, it's crucial for enterprises to scrutinize all accessible avenues to secure the best possible terms for their distinct circumstance. By taking this action, companies can evade the disadvantages of excessive leverage, as mentioned in the growing worries about corporate borrowing levels in Canada, where 25% of businesses feel restricted by their present financial responsibilities. Refinancing can be a lifeline, particularly when economic headwinds threaten to increase the cost of servicing obligations, making it an essential consideration in any robust business strategy.

Documents Needed to Apply for Debt Refinancing

To successfully navigate the complexities of , meticulous preparation of the is paramount. Important documents such as thorough statements, recent tax returns, and bank statements should be collated. A clear evidence of ownership is also required. The lender may request an , which provides insights into the company's trajectory and strategic direction. This plan should outline the , balance sheet, and both current and future objectives, illustrating the and stability of the enterprise. Additionally, an appraisal of assets or collateral, when applicable, may be necessary to assess the market value and to satisfy the lender's need for security on the new loan. The documentation should provide a comprehensive overview of the and its ability to fulfill loan obligations, ensuring the lender can make an informed decision.

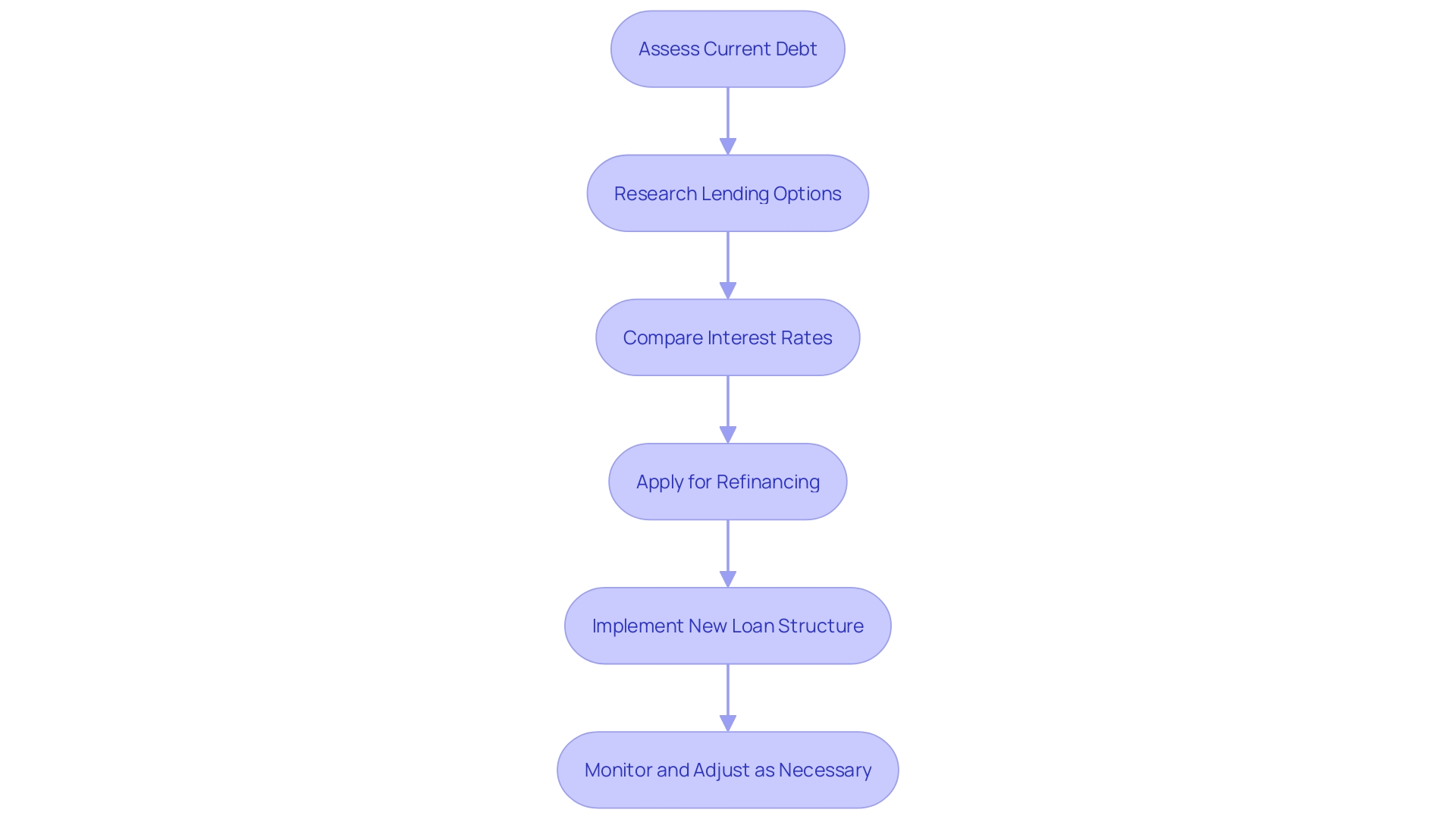

The Refinancing Process: Timeline and Steps

Refinancing your is a strategic move that can offer numerous benefits, from improved to . The process begins with due diligence, where you compare lenders to find the most favorable terms. This groundwork is essential, as the varying terms and rates can significantly impact your . When you've selected a suitable lender, you prepare and submit an application, complete with necessary documentation.

Following your application, the lender conducts a thorough review, including a credit check, to assess your eligibility. Approval hinges on a good credit history and the maturity of the existing loan—typically, a loan at least a year old is preferred. If your application is successful, the lender will present a loan offer. Accepting this offer paves the way for the funds to be released, allowing you to settle your current obligations.

While considering a new loan can lead to faster repayment terms and potential interest savings, it's essential to , such as , which can average around $5,000. Moreover, the new loan will have its terms, which may differ substantially from your original agreement. It is also wise to take into account the market conditions and the policies of the Treasury Department, as these factors can impact your options for borrowing and the total cost involved.

Impact of Refinancing on Business Credit

is a strategic move that involves careful consideration of both benefits and potential pitfalls. Successfully securing a with a lower interest rate and maintaining consistent, timely payments can bolster your . It's a positive signal to lenders and credit bureaus alike, reflecting . However, the process isn't without its challenges. A history of missed payments or defaults can complicate your refinancing efforts and may even be detrimental to your credit profile.

Recent trends show that lenders are applying more stringent criteria when evaluating loan applications. According to the Senior Loan Officer Opinion Survey on Bank Lending Practices from October 2023, there's been a noticeable tightening of standards and a dip in demand for commercial loans. This implies that enterprises aiming to refinance must present a convincing argument for . A solid credit score is crucial; while there's no universally mandated minimum for loans, scores around 620 might be the baseline for consideration, with 720 or higher increasing your chances for favorable loan terms.

Moreover, the credit landscape is evolving with technological advancements. Platforms such as Upstart are pioneering the use of AI and machine learning to assess credit risk, claiming to offer broader access to credit. Despite this, skepticism remains regarding the efficacy and reliability of such models compared to traditional credit evaluation methods.

Another aspect to consider is the cost of credit. With the Federal Reserve's rate hikes, from nearly zero in March 2022 to 5.33% as of September 2023, the has increased substantially. This uptick directly affects the interest rates for various types of debt, from credit cards to auto loans. Hence, the process of obtaining new financing may be more costly at present than in the past, a crucial element for businesses in overseeing .

Given these dynamics, companies must manage the process of obtaining new funding with a clear comprehension of their credit position and the present economic climate. Maintaining a good payment history is paramount, as it's the most significant factor affecting credit scores. Addressing any late payments promptly can prevent the compounding of interest charges and late fees, which not only weighs down your credit but also your company's financial flexibility.

Debt Consolidation vs. Refinancing: What’s the Difference?

Consolidation and refinancing are two separate approaches that can employ to address their . Consolidation involves the merging of various financial obligations into a single loan, often with the objective of securing a lower overall interest rate and a simplified payment process. This can be particularly useful for businesses juggling multiple payments across different lines of credit, credit cards, and loans.

On the other hand, refinancing is the procedure of acquiring a fresh loan to substitute current obligations, ideally with more advantageous circumstances such as a decreased interest rate, reduced monthly installments, or a prolonged repayment period. This strategy can lead to over time and can .

One must note, however, that while these strategies can ease the repayment process, they are not without risks. Refinancing, for example, may prolong the duration of the liability, potentially resulting in increased overall interest expenses in the long run. It's crucial to thoroughly of any new loan and to assess how these align with the company's monetary strategies and goals.

The application of these management techniques can demonstrate a company's shrewdness in fiscal discipline, as witnessed in the case of Credit Corp, which efficiently handled its cash flows and endured the economic effects of the pandemic better than its rival, Collection House.

Moreover, with the emergence of advanced monetary technology, enterprises now have the opportunity to utilize instruments that can support the streamlined merging and analysis of information for hazard assessment and portfolio insights, as exemplified by the worldwide alternative asset manager who gained advantages from switching to an investor-focused resolution.

As small enterprises navigate their expansion paths, comprehending and strategically utilizing consolidation and can be crucial to managing their economic well-being and ensuring long-term viability.

Assessing Your Repayment Capacity and Financial Situation

In order to assess the viability of , small enterprises need to . A comprehensive review of , profit margins, and the debt-to-income ratio provides essential insights into the . This self-examination of one's finances not only clarifies whether the act of restructuring debt is a prudent step to improve long-term solvency but also aligns with that puts a premium on a well-informed approach to decision-making regarding personal finances. In a changing credit environment where alternative lenders are increasingly offering the historically lower rates of banks, the selection of partners for loan restructuring has expanded. By conducting thorough market analysis and creating strong as part of a solid plan, small enterprises can effectively , optimizing their financial approach in the pursuit of stability and expansion.

Evaluating the Terms of Existing Debts

When managing the restructuring of business , it's crucial to thoroughly examine your . Evaluate the interest rates, maturity terms, potential prepayment penalties, and all associated costs of your current financial obligations. This deep dive will clarify the potential advantages of refinancing and whether a new agreement could offer more favorable conditions. Take into account as a strategic choice, which can synchronize obligations with particular development goals, possibly resulting in a more sustainable monetary strategy while guaranteeing responsibility. Recent advancements, like the Biden administration's effort to eliminate medical obligations from credit reports, highlight the significance of precise information and the influence of liabilities on consumers' economic well-being. Additionally, the Federal Reserve's dedication to a stable economic system supports the requirement for solid fiscal management practices. When choosing between investment and repayment, let objective financial calculations guide your decision-making process. , for instance, might offer immediate relief but requires careful consideration of the long-term implications. Always weigh the benefits against the drawbacks, keeping in mind expert advice such as Melissa Cohn's benchmark for interest rate reductions. In the context of financial obligation consolidation, keep in mind that merging multiple debts into one loan could streamline finances but requires a comprehensive analysis to ensure it's the right move for your company.

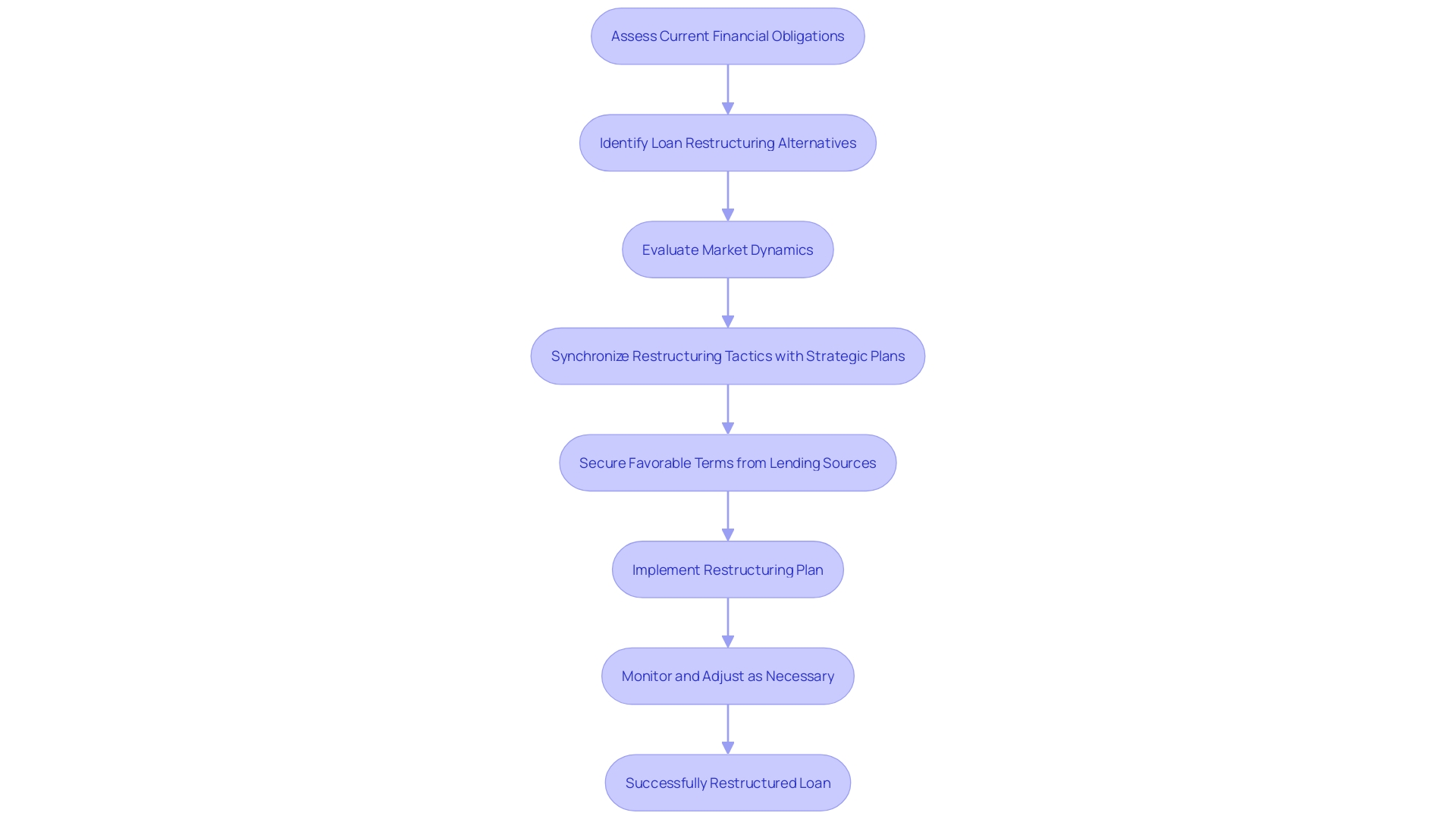

Exploring Debt Restructuring and Refinancing Options

Exploring the most effective approach to managing is crucial for sustainability and growth. is a with creditors to modify repayment terms, aiming to alleviate the burden. This method can provide immediate relief by adjusting payment schedules, interest rates, or even reducing the principal owed. Companies like WeWork have effectively utilized restructuring, emerging from Chapter 11 with a more robust foundation and improved prospects for profitability.

On the other hand, the process of , often securing lower interest rates or more favorable repayment terms, is about. This can lead to over time. For instance, Pacific Steel & Recycling transformed its management of money by embracing reference-based pricing, which resulted in a significant decrease in healthcare expenses, showcasing the of strategic monetary planning.

Taking into account the possible advantages of both restructuring and refinancing, companies must evaluate their distinct monetary landscapes to select the appropriate path. Essential elements comprise prevailing market conditions, creditor relationships, and long-term objectives. With careful analysis and the proper strategy, companies can navigate through economic challenges and position themselves for future prosperity.

Pros and Cons of Debt Refinancing

Restructuring corporate obligations can result in a plethora of advantages such as decreased interest rates, resulting in minimized monthly installments and enhanced management of . By merging various debts into one loan with favorable terms, companies can , making the management of money more uncomplicated. However, owners must consider the potential downsides such as , the impact on credit scores, and the stringent eligibility criteria that lenders enforce. To obtain approval for a loan, lenders usually require a credit history for the company that is free from late payments, foreclosures, and similar financial blemishes. Moreover, lenders look for confidence through proof of the borrower's industry experience or expertise, as well as a full comprehension of the enterprise being acquired, including its valuation and profitability.

The environment for has evolved, with non-bank lenders gaining traction by offering that challenge those of traditional banks. In 2023, it's more important than ever for entrepreneurs to shop around and explore the diverse financing options available, including secured and unsecured loans from various lenders such as banks, credit unions, and online platforms. When considering , it's crucial to comprehend that it involves combining several loans into one, potentially with a lower interest rate, which can streamline debt management but also requires careful assessment to ensure it aligns with the company's monetary strategy.

Data from the Federal Reserve Bank of New York highlight the significance of upholding a strong and competitive banking system, which is crucial for companies in search of funding alternatives. The bank's endeavors to advance functioning monetary systems and markets, along with its focus on industry and payment services, play a crucial role in shaping the economic environment in which enterprises operate. With the understanding that higher interest rates drive up the cost of capital and affect equity valuations, CFOs must navigate these complex financial landscapes with strategic insight and a clear analysis of how refinancing can support their .

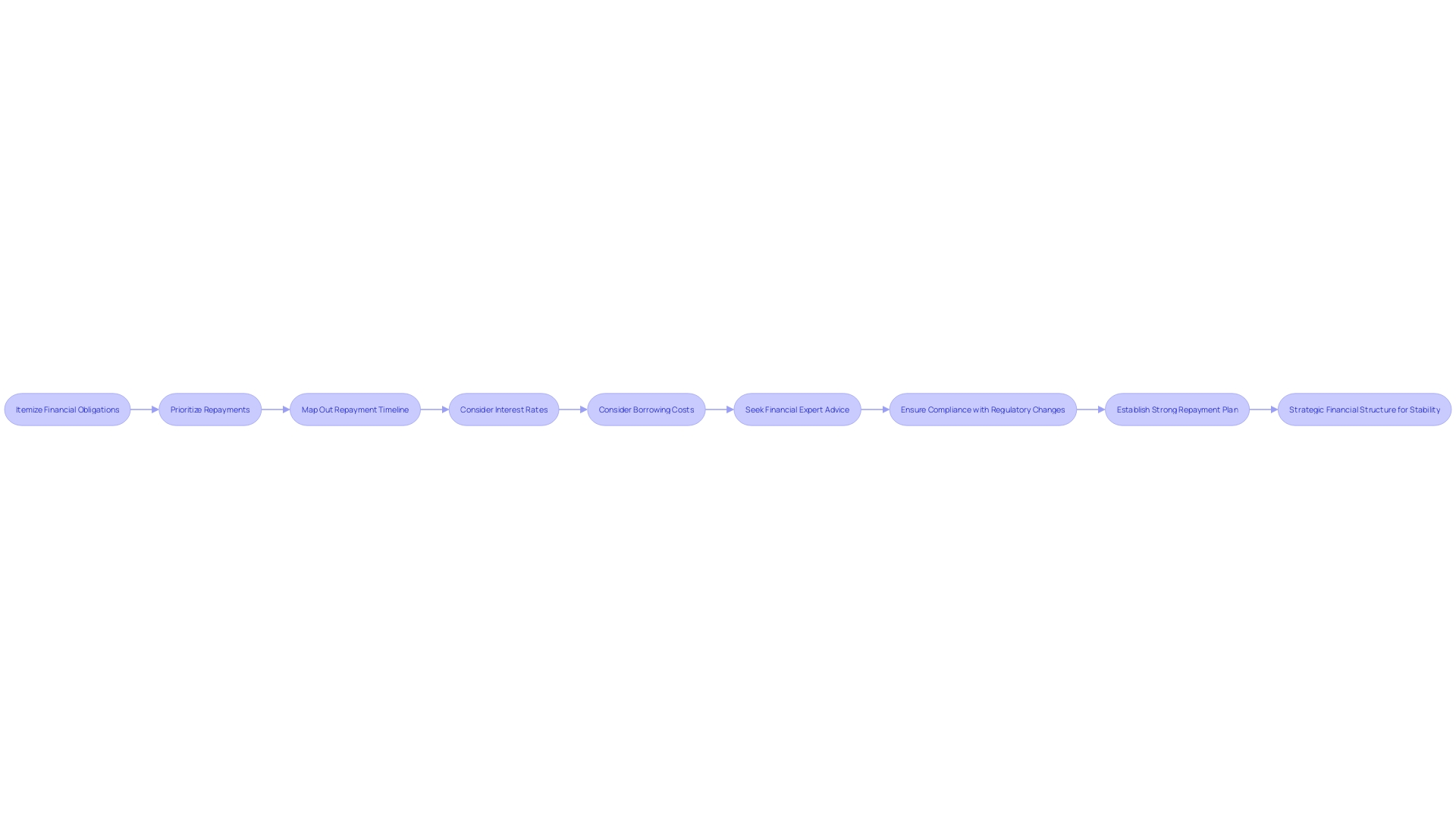

Creating a Debt Repayment Plan

Enhancing your business's structure is a strategic maneuver that can result in more manageable payments and potential savings. The foundation of this process is a . Such a strategy should itemize your financial obligations, highlight which ones to address first, and map out a timeline for repayment. The goal is to organize your obligations in a manner that corresponds with your company's cash flow, enabling you to manage the liability while preserving operational liquidity.

are not one-size-fits-all. They should be customized to the particular kind of liability, your organization's credit history, and the overall financial condition of your company. In a high inflation and rising interest rate environment, where many enterprises are relying on borrowing to manage expenses, a becomes even more essential.

A salient point to consider when crafting your plan is the total cost of borrowing against the potential returns. This involves a clear-eyed assessment of interest rates and how they affect your bottom line. Remember, the psychological impact of financial obligations on you and your team is also a factor. The pressure of substantial financial obligations can hinder decision-making and diminish the overall effectiveness of your enterprise.

To guarantee your plan is extensive, think about seeking advice from who can offer perspectives into your distinct economic situation. They can help in creating a plan that not only focuses on debt payment but also promotes the of your company. This advice can be priceless, particularly for small enterprises with intricate fiscal structures, encompassing multiple income streams or property holdings.

Considering the latest updates from authorities in the field, like the Consumer Financial Protection Bureau's dedication to open and equitable markets, it's clear that keeping up with regulatory changes is vital. A knowledgeable plan to restructure obligations can assist your organization in navigating the intricacies of fiscal compliance while taking advantage of chances to enhance fiscal well-being and reduce risks.

Setting Realistic Goals and Prioritizing Debts

Restructuring business obligations is a strategic maneuver that requires prioritizing financial responsibilities based on their interest rates and terms. High-interest obligations, or those with costly terms, should be prioritized for refinancing to maximize resource allocation. This approach not only streamlines your but also enhances your overall economic well-being by . It's a method similar to how into a single one, as explained by experts who highlight the simplicity and effectiveness of loan consolidation. Aligning with steady interest rates, as reported by the IRS for the third quarter of 2024, solidifies this approach as a financially savvy move for companies aiming to .

Budgeting and Managing Cash Flow During Refinancing

can result in a stronger monetary stance, given that you meticulously handle your cash flow throughout the procedure. This requires a vigilant approach to budgeting, ensuring that every dollar earned is allocated purposefully. The objective is to cover your loan payments and other monetary commitments without putting undue strain on your operations.

To achieve this, consider adopting a , which has been successful for businesses in diverse sectors. For example, a budgeting app helped users become more intentional with their spending, allowing them to save and give more generously. In the , a and leveraging location led to increased sales for a major hotel's restaurant. These highlight the importance of giving each dollar a 'job' to ensure purposeful spending and investment.

It's worth mentioning that recent changes in the , such as updates to the Fannie Mae February Selling Guide, have brought new considerations for mortgage loans. With expanded appraisal waivers and allowances for cash-out loans on manufactured homes, understanding the nuances of current economic conditions is essential.

Melissa Cohn, an executive mortgage banker, suggests that seeking a new loan with an interest rate that is at least 0.75% lower than the current one is advantageous. Alternatively, restructuring the loan could result in increased expenses throughout its duration. Moreover, it's crucial to bear in mind that the process of replacing an existing loan with a new loan often involves closing costs, which, as stated by Freddie Mac, have an average of approximately $5,000.

In conclusion, a strategic and knowledgeable approach to restructuring, supported by a , can improve the stability of your company's finances. Equally important is a comprehensive examination of your financial state and the wider market circumstances to guarantee that the process of modifying your financial arrangements is the correct step for your enterprise.

Seeking Professional Guidance

When contemplating the intricacies of managing , it's frequently wise to seek advice from . with experience in corporate debt can offer valuable perspectives and guidance. Their proficiency lies not only in identifying the most beneficial but also in guiding you through the complexities of the . Through a knowledgeable approach, these experts can assist you in comprehending the market dynamics, and synchronize your restructuring tactic with your strategic plan, guaranteeing that your and organizational goals are achieved. They take into account various lending sources, such as banks, credit unions, and increasingly competitive non-bank lenders. By doing so, they support your aim to secure terms that are favorable in the current economic environment, which is essential for consolidating effectively and positioning your enterprise for success.

Key Considerations in Refinancing Business Debt

For small businesses considering the , it is important to evaluate multiple aspects to prevent possible obstacles and align with overarching monetary plans. First, assess the expenses linked to the process of replacing existing debts and the rates of interest for new loans. It's important to consider how these costs influence overall .

Next, analyze . Transitioning from short-term loans to long term debt can free up cash flow, but it may also involve higher total interest costs over time. Furthermore, enterprises should exercise caution regarding the conditions of new loans, which might encompass covenants or limitations that could affect future operations.

Be mindful of the . These can range from closing costs to transaction fees, and they can significantly affect the total expense of the new loan. It is crucial for enterprises to thoroughly comprehend and consider these expenses in their decision-making procedure.

Given the recent findings in the economy and considering the uncertainties and evolving standards in the markets, it is advisable for enterprises to adopt a forward-looking approach when restructuring their obligations. With the value of outstanding American leveraged loans reaching approximately $1.4 trillion, and private credit lending growing rapidly, small enterprises must with strategic foresight.

Moreover, reports indicate that almost 25% of enterprises are limited from acquiring more liabilities because of unfavorable interest rates. This underscores the importance of that ensure sustainability and growth even as interest rates rise.

In the end, the process of restructuring obligations should align with the business's long-term goals and enhance its ability to flourish in competitive and transparent markets, as recommended by institutions such as the Consumer Financial Protection Bureau. Keeping these considerations in mind will help small enterprises make informed decisions that support their financial stability and growth.

Cost of Refinancing and Potential Fees

When , it is crucial to take into account the expenses involved, as they may impact the overall advantages of the process. These costs may include application fees, which cover the processing of your loan request; origination fees that compensate the lender for creating the loan; appraisal fees to evaluate the value of assets for collateral purposes; and legal fees for any necessary legal counsel. A comprehensive examination of these possible costs is essential to guarantee that the process of will be a financially beneficial decision. Furthermore, it is important to mention that lenders may demand a thorough comprehension of your enterprise, encompassing its credit past, worth, and operational profitability to evaluate the risk linked to restructuring your . Making sure that your business maintains a and being prepared with a solid can help make the process of easier.

Impact on Liquidity and Loan Terms

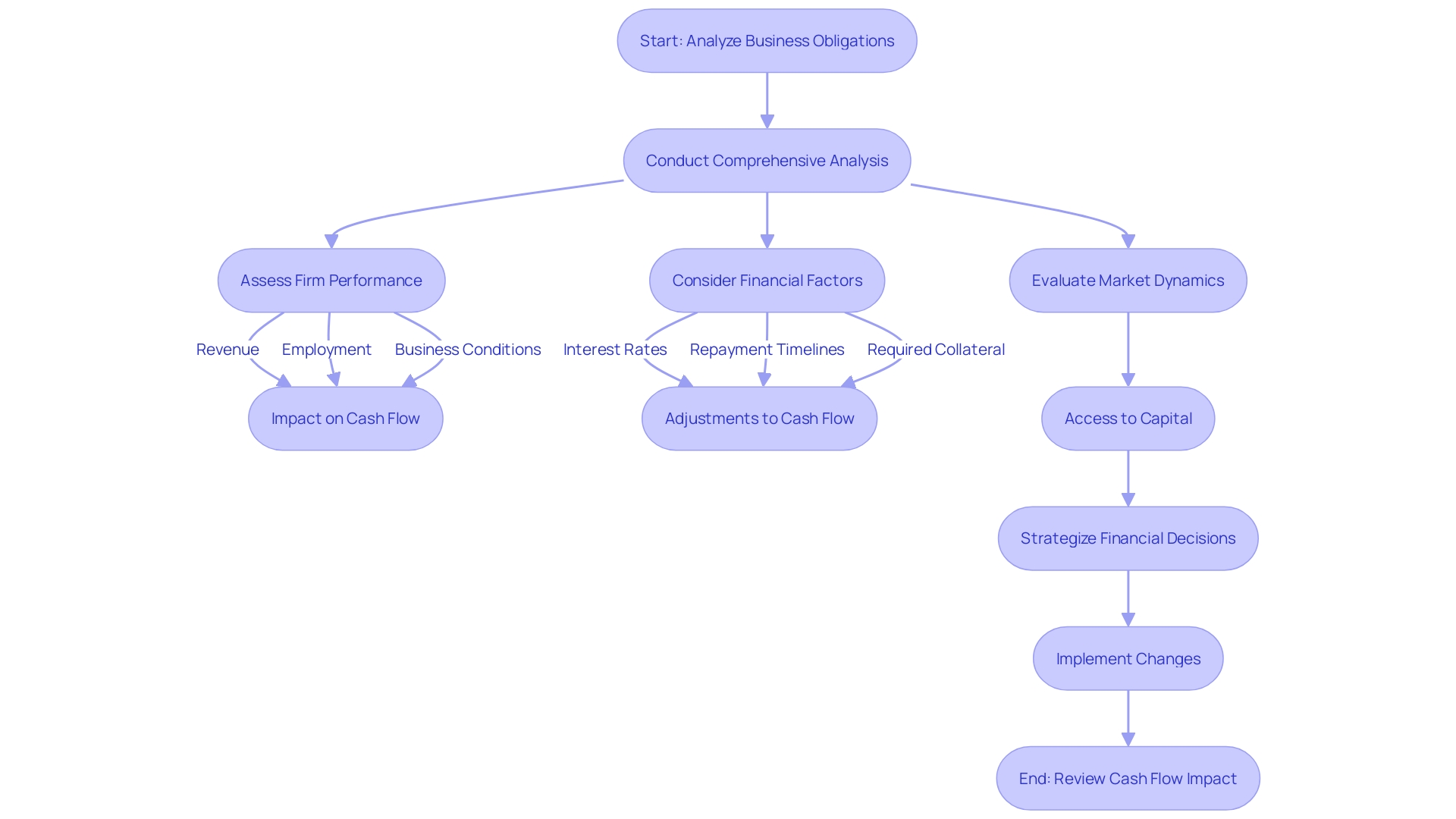

Revising can be a tactical decision for enhancing and modifying loan conditions to more closely align with your company's . Nevertheless, prior to engaging in this maneuver, it's essential to conduct a comprehensive analysis of how this change will impact your company's immediate monetary abilities. Factors such as potential fluctuations in interest rates, alterations in repayment timelines, and newly required collateral should be scrutinized. For instance, the January 2024 Senior Loan Officer Opinion Survey highlighted that both commercial and industrial loan standards have tightened, indicating a more stringent . In addition to this, there has been a reported decline in demand for such loans, signaling a shift in market dynamics that must be considered when refining your company's . Considering these insights, it's clear that any decision to refinance should be made with a thorough understanding of the current economic landscape and its implications for your organization's access to capital.

Case Studies and Real-World Examples

Real-life case studies offer a treasure of wisdom and practical insight when navigating the complex terrain of . Take Liz, a consultant who simplifies personal finance into actionable steps, enabling clients to strategically align their finances with their life goals. Her services cater to a varied clientele, from those seeking reassurance on their monetary path to those requiring a comprehensive analysis of their economic future. Liz's approach exemplifies the tailored strategies needed for small businesses with varied financial situations, including the management of multiple rental properties or business ownership.

In the news, the case of Celsius and its innovative approach to resolving its bankruptcy illustrates the intricate strategies that can be employed in . Celsius managed to secure the approval of a plan that not only satisfied regulatory investigations but also maximized value for its creditors. The plan involved the distribution of over $3 billion to creditors and the formation of a new company, Ionic Digital, Inc., indicating a forward-thinking approach to financial obligations.

It's essential to recognize that is the foundation for any successful . The plan should express your company's mission, target market, and projections, and include all relevant legal documents. In today's economic climate, are becoming increasingly competitive, offering rates that rival those of traditional banks and credit unions. This shift is evident in the data from industry bodies like the , which underscores the importance of transparency and high standards in the debt resolution sector.

can transform your marketing narrative, showcasing your brand's success stories and attracting new customers. By drawing from the experiences of others, such as those provided by financial consultants like Liz or companies like Celsius, you can devise strategies that are not only effective but also tailored to your unique business needs.

Conclusion

In conclusion, debt refinancing is a strategic move that can greatly improve the financial health of small businesses. By understanding their current debt structure and exploring refinancing options, businesses can secure better terms, lower interest rates, and extended repayment periods. This leads to improved cash flow management and reduced financial pressure.

Timing is crucial when considering debt refinancing, as evaluating the Debt Service Coverage Ratio (DSCR) helps determine if restructuring existing debt is beneficial. By boosting profits or negotiating lower costs, businesses can improve their DSCR and position themselves for more favorable loan conditions in the future.

The benefits of refinancing business debt are significant. Lower interest rates and reduced monthly payments directly benefit cash flow, while consolidation simplifies the repayment process. Non-bank lenders are increasingly offering competitive rates, providing more opportunities for favorable refinancing terms.

The process of debt refinancing involves securing a new loan to pay off existing obligations under better conditions. However, businesses should carefully consider the costs associated with refinancing, such as closing fees. It's also important to assess market conditions and the impact of Treasury Department policies on refinancing options and borrowing costs.

Debt refinancing can positively impact business credit if managed responsibly, reflecting financial responsibility and stability. However, lenders now have more stringent criteria, emphasizing the need for a solid credit score.

In summary, debt refinancing is a powerful tool for small businesses to improve their financial stability and pave the way for growth. By understanding their current debt structure, evaluating the right timing, and exploring the benefits and challenges, businesses can make informed decisions and take control of their financial future. Seeking professional guidance can provide valuable insights throughout the refinancing process.

With a strategic approach, businesses can optimize their cash flow management and position themselves for long-term success.

Frequently Asked Questions

What is the purpose of evaluating your current debt structure?

Evaluating your current debt structure helps to document all liabilities, including interest rates and repayment terms. This assessment positions your business to potentially secure better terms in refinancing, such as lower interest rates and extended repayment periods.

When should a business consider refinancing its debt?

A business should consider refinancing when looking to improve its financial condition, particularly if there are opportunities for lower interest rates, longer repayment terms, or the convenience of consolidating multiple loans into one.

What are the key benefits of refinancing business debt?

The main benefits include potentially lower interest rates, reduced monthly payments, improved cash flow, and simplified payment processes through loan consolidation.

How does the debt refinancing process work?

Refinancing involves securing a new loan that pays off existing debts under more favorable conditions. This typically includes a thorough review by the lender, including a credit check, before an offer is made.

What documents are needed to apply for debt refinancing?

Essential documents include financial statements, recent tax returns, bank statements, proof of ownership, a clear business plan, and possibly an asset appraisal.

What steps are involved in the refinancing process?

The process involves comparing lenders, submitting an application with required documents, undergoing a lender review, receiving a loan offer, and accepting it to pay off existing obligations.

How does refinancing affect business credit?

Successfully refinancing with a lower interest rate and making timely payments can improve a business's credit score. However, missed payments or defaults can hinder refinancing efforts.

What is the difference between debt consolidation and refinancing?

Consolidation merges various debts into a single loan with the aim of simplifying payments and possibly securing a lower overall interest rate. Refinancing replaces existing debt with a new loan, ideally under more favorable terms.

How can businesses assess their repayment capacity before refinancing?

Businesses should review cash flow statements, profit margins, and debt-to-income ratios to evaluate their ability to meet new repayment terms.

What factors should be considered when evaluating existing debts?

Key factors include interest rates, maturity terms, potential prepayment penalties, and overall costs associated with current financial obligations.

What are the potential costs associated with refinancing?

Costs may include application fees, origination fees, appraisal fees, legal fees, and any other closing costs, which can average around $5,000.

How does refinancing impact a business's liquidity?

Refinancing can improve cash flow by transitioning from short-term to long-term debt; however, it may also result in higher total interest costs over time.

Why should businesses seek professional guidance when refinancing?

Financial advisors can provide valuable insights, help navigate the complexities of refinancing, and assist in aligning the restructuring strategy with the business's overall financial goals.

What are the key considerations for refinancing in the current economic climate?

Businesses should assess refinancing costs, evaluate how new loan terms will impact liquidity, and understand the current lending environment, including interest rates and borrower criteria.

Can you provide examples of successful debt restructuring?

Companies like WeWork and Rite Aid Corporation have successfully restructured their debts, improving their financial positions and operational flexibility through strategic refinancing and debt management.