Overview

Risk assessment in financial services is paramount for identifying and mitigating threats that could jeopardize an organization's economic stability, especially as compliance and regulatory challenges intensify.

Effective risk management necessitates a proactive approach. By leveraging technology and conducting comprehensive evaluations, organizations can navigate uncertainties and ensure sustainable growth in a rapidly evolving financial landscape.

Are you prepared to fortify your financial strategy against potential risks? Take action now to enhance your risk management framework.

Introduction

In the dynamic realm of financial services, risk assessment stands as a cornerstone for ensuring organizational stability and compliance. As institutions grapple with an evolving landscape marked by regulatory pressures, technological advancements, and environmental challenges, the necessity for a robust risk management framework has never been more critical. By systematically identifying and analyzing potential threats, organizations can not only safeguard against financial losses but also seize opportunities for growth. Moreover, the year 2025 introduces unique challenges and trends, including a heightened focus on compliance and cybersecurity, compelling financial entities to adapt their strategies accordingly. This article delves into the multifaceted nature of risk assessment in financial services, exploring effective methodologies and the pivotal role of technology in navigating these complexities.

Understanding Risk Assessment in Financial Services

The process of risk assessment in financial services employs a structured method for identifying, analyzing, and assessing threats that could undermine an organization's economic stability. This critical process is essential for monetary institutions striving to safeguard against potential losses, ensure compliance with evolving regulations, and maintain operational integrity. As we approach 2025, the landscape of assessment is influenced by several key trends, notably an intensified focus on compliance and regulatory challenges, which 35% of executives identify as their foremost concern.

Moreover, the demand for cyber insurance is escalating, yet insurers are imposing stricter cybersecurity standards, complicating the procurement of coverage and presenting challenges for monetary institutions.

A comprehensive monetary assessment can unveil opportunities to conserve cash and reduce obligations, making it a vital component of effective oversight. Organizations must navigate various uncertainties, including credit, market, operational, and compliance challenges. The recent climate-related events of 2024 have underscored the necessity for service companies to enhance their strategies for managing climate threats.

As regulatory frameworks evolve to address these climate-related challenges, institutions face mounting pressures to adapt, potentially leading to economic instability if not managed properly. Notably, Standard Chartered has allocated US$1.5 billion over the next three years for its 'Fit for Growth' initiative, exemplifying proactive monetary strategies in risk management.

Effective risk management strategies within banking institutions necessitate a proactive approach to evaluation, enabling organizations to identify vulnerabilities and implement measures to mitigate them. This includes leveraging technology to streamline processes and enhance data analysis capabilities. As Michael J. Hsu, Acting Comptroller of the Currency, emphasized, some banks may find themselves constrained by outdated technology, highlighting the urgent need for modernization in oversight practices.

In conclusion, the importance of thorough risk assessment in financial services cannot be overstated. As the economic environment continues to evolve, organizations must prioritize robust vulnerability management systems, including comprehensive fiscal evaluations, to tackle challenges and secure sustainable growth.

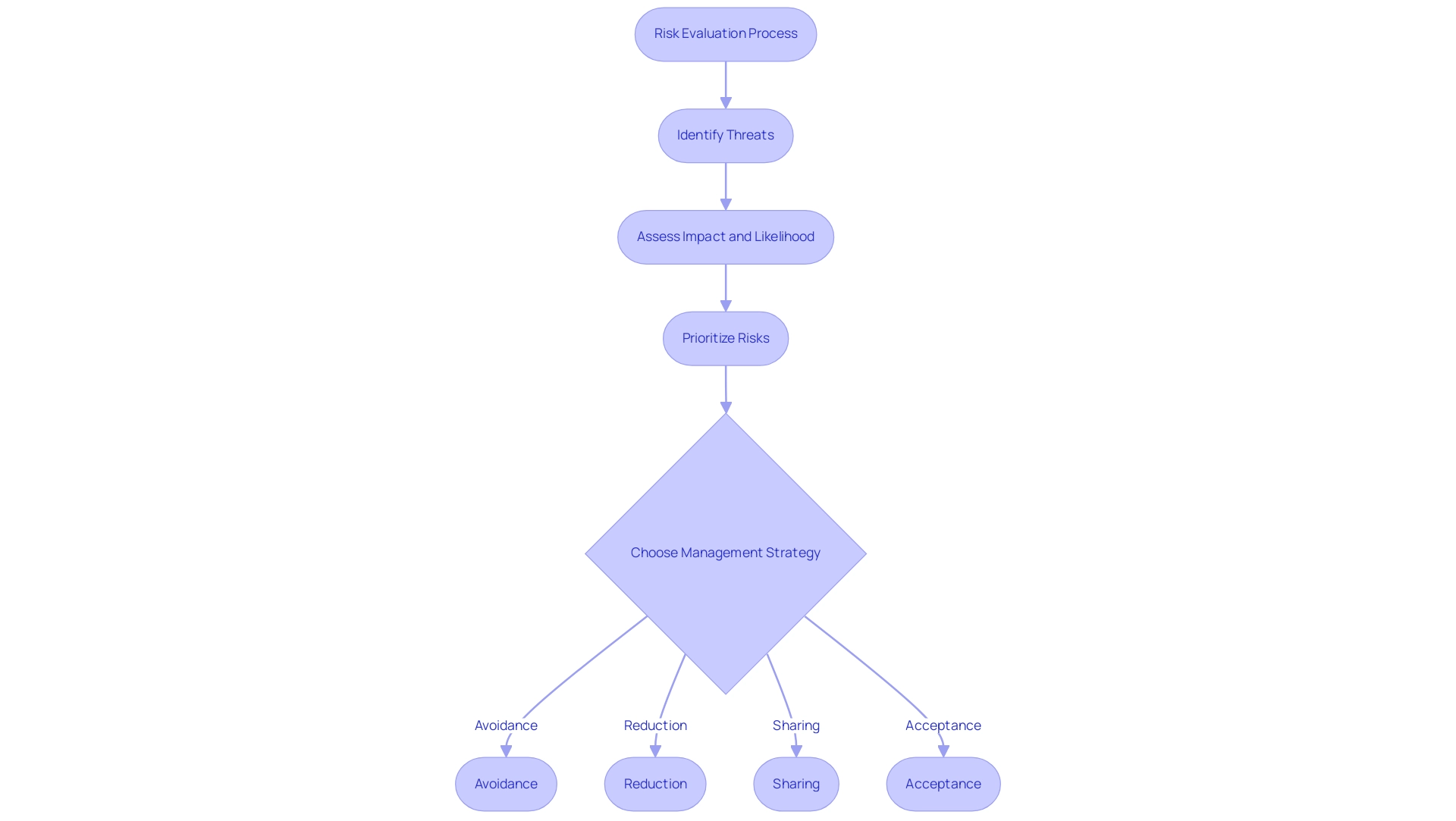

The Risk Management Process: Key Steps and Methodologies

The management process in monetary services serves as a crucial framework encompassing several vital steps, particularly emphasizing the significance of risk assessment in financial services. Initially, entities must conduct a risk assessment to identify potential threats that could impact their operations. Following this, a comprehensive risk assessment is performed to understand the potential effects of these threats on the entity, with a focus on cash preservation and liability reduction.

This examination is essential for risk assessment in financial services, as it allows companies to evaluate and prioritize threats based on their severity and likelihood, while also uncovering opportunities to reduce costs.

Once threats are prioritized, entities implement treatment strategies aimed at mitigating these challenges through risk assessment in financial services. This may involve developing contingency plans, enhancing security measures, or reallocating resources as part of a holistic risk assessment approach to address vulnerabilities. Continuous monitoring of these strategies is critical for effective risk assessment in financial services, ensuring their efficacy over time and enabling organizations to adapt to changing circumstances.

As we look to 2025, effective hazard management techniques are increasingly vital. Qualitative and quantitative analysis methods are commonly utilized in risk assessment in financial services to accurately evaluate uncertainties. Qualitative analysis often relies on expert judgment and scenario analysis, while quantitative approaches employ statistical techniques to forecast potential losses.

Notably, 86% of executives, excluding tax and HR leaders, recognize cybersecurity as a primary focus area, underscoring the growing necessity for robust cybersecurity measures in threat management.

A pertinent case study illustrates the importance of a comprehensive strategy for addressing vulnerabilities. A major financial institution confronted escalating cybersecurity threats and needed to protect sensitive customer data while ensuring compliance with regulatory standards. By implementing a multi-layered approach to address uncertainties, the institution not only achieved industry-leading security standards but also maintained high levels of customer satisfaction.

This case exemplifies how effective strategies can address specific weaknesses while enhancing overall resilience.

As organizations navigate the complexities of uncertainty management, it is noteworthy that only 33% of leaders in this domain plan to increase their total expenditures in the upcoming year, according to the PwC Pulse Survey. This statistic highlights the necessity for monetary institutions to bolster their existing resources and strategies, including comprehensive evaluations from Transform Your Small/Medium Business, to effectively conduct risk assessments in financial services and manage uncertainties in a dynamic environment. Furthermore, with NOAA reporting 24 billion-dollar weather and climate events resulting in total damages of $61.6 billion in the first ten months of 2024, the importance of a well-structured management process becomes increasingly apparent.

By adhering to this process, entities can significantly enhance their resilience against economic uncertainties and improve their risk assessment in financial services, paving the way for sustainable growth.

Identifying and Analyzing Risks: The Foundation of Effective Assessment

Recognizing hazards is an essential procedure involving risk assessment in financial services, aimed at identifying potential dangers that could adversely affect a company's economic performance. In 2025, external factors such as economic downturns, regulatory changes, and competitive pressures are increasingly significant. For instance, Brazil's central bank recently raised its policy Selic rate to 12.25% due to inflation exceeding target levels, illustrating how macroeconomic shifts can influence economic stability.

Moreover, entities such as Standard Chartered are proactively tackling cost reductions, having set aside US$1.5 billion over the next three years for their 'Fit for Growth' initiative. This highlights the significance of strategic financial planning in managing uncertainties.

Internal factors also play a vital role, including operational inefficiencies and financial mismanagement. Organizations must adopt a proactive approach to threat identification, particularly in light of ongoing economic challenges. Expert opinions underscore that incorporating compliance measures into the early stages of transformation initiatives is essential for sustainable cost reductions.

As noted by the Vanguard Investment Strategy Group, policymakers have highlighted that 'headline inflation and measures of underlying inflation are above the inflation target and have increased in recent releases.' This insight strengthens the necessity for organizations to stay alert in their assessment efforts. Once threats are identified, a risk assessment in financial services must be thoroughly analyzed to evaluate their likelihood and potential impact.

Methods like mapping uncertainties and SWOT analysis are essential for visualizing threats and prioritizing them based on severity. For instance, incorporating management measures into banking transformation initiatives has demonstrated effectiveness in tackling challenges related to AI and regulatory adherence, resulting in enhanced economic outcomes. This case study illustrates the concrete advantages of integrating safety metrics early in the transformation process, enabling entities to simplify decision-making and improve real-time analytics for business turnaround and performance oversight.

This essential step in management is vital for creating effective strategies that protect economic performance. By comprehending both external and internal elements influencing monetary uncertainties, entities can navigate the intricacies of the economic environment in 2025 more effectively. Statistics show that entities implementing risk assessment in financial services are better prepared to respond to economic fluctuations and sustain operational resilience.

Furthermore, the manufacturing industry's use of IoT and sensor data for predictive maintenance illustrates how technology can assist in identifying challenges and improving financial stability. Our team at Transform Your Small/Medium Business is dedicated to identifying underlying business issues and collaboratively creating plans to mitigate weaknesses. This ensures that your organization can reinvest in key strengths while continuously monitoring performance. We emphasize a 'Test & Measure' approach, rigorously testing hypotheses to maximize return on invested capital, which is essential for effective management of uncertainties.

Evaluating and Prioritizing Risks: Strategies for Effective Management

Evaluating and prioritizing threats is a critical process for financial institutions, as it entails a comprehensive risk assessment that evaluates both the potential impact and likelihood of each identified issue. In 2025, the utilization of matrices for assessing uncertainties has become increasingly prevalent, enabling organizations to categorize threats into various levels of severity. This categorization allows for a focused approach on high-priority issues that require immediate attention in risk assessment.

According to recent insights, 35% of executives responsible for managing threats cite compliance and regulatory challenges as their foremost concern, underscoring the urgency for effective risk assessment. Organizations can adopt several approaches for managing hazards effectively, including:

- Avoidance

- Reduction

- Sharing

- Acceptance

By prioritizing hazards through risk assessment, institutions can allocate resources more efficiently, ensuring that the most significant threats are addressed promptly.

For instance, a survey conducted in early 2024, which included responses from 44 Secureframe users, revealed that 97% reported a stronger security and compliance posture after implementing management frameworks. This highlights the tangible advantages of organized risk assessment and the efficacy of evaluation matrices in improving compliance.

Real-world instances demonstrate the effectiveness of evaluation matrices in financial institutions. These tools not only assist in recognizing critical threats but also enhance visibility into an organization’s overall vulnerability landscape. Additionally, the risk assessment involves evaluating vendors' data management practices and adherence to regulatory standards, which is crucial as it directly affects an institution's vulnerability profile.

As monetary services continue to evolve, the incorporation of hazard matrices into risk assessment will be vital for navigating the complexities of compliance and operational challenges in 2025. Moreover, 27% of security and IT experts have identified reducing internal audit fatigue from evaluations as a primary compliance obstacle, further emphasizing the necessity for effective solutions in addressing uncertainties.

Monitoring and Reviewing Risks: Ensuring Continuous Compliance and Adaptation

Supervising and assessing monetary challenges is a continuous necessity that empowers organizations to proactively address emerging threats. As we approach 2025, the economic landscape is becoming increasingly intricate, necessitating frequent evaluations to identify new hazards and assess the efficacy of existing strategies for managing uncertainties. Establishing key performance indicators (KPIs) is critical; these metrics not only facilitate compliance with regulatory requirements but also align with internal policies, thereby ensuring a robust oversight framework.

A proactive approach to risk assessment in financial services, bolstered by streamlined decision-making and real-time analytics, enables organizations to swiftly adapt to changes in the financial environment, thereby enhancing their resilience amid uncertainty. For instance, the latest revisions from the Financial Accounting Standards Board (FASB), released on January 6, 2025, underscore the importance of stakeholder input in shaping accounting standards, which directly impacts practices related to uncertainty evaluation. As Sydney Garmong, Partner at the National Office, aptly noted, "Of course, we welcome your feedback – both good and bad."

This statement highlights the pivotal role of stakeholder input in refining management strategies.

By integrating ongoing risk assessment into their operations, financial institutions can adeptly navigate the rigorous regulatory frameworks anticipated for digital assets, including standardized licensing for crypto service providers. Statistics reveal that by 2025, firms will encounter a more stringent regulatory environment, making it imperative to remain informed and compliant.

Real-world examples illustrate the effectiveness of ongoing threat evaluation. Organizations that have instituted regular reviews and monitoring mechanisms, supported by real-time business analytics through the client dashboard provided by Transform Your Small/Medium Business, have reported enhanced visibility into their exposure profiles, enabling informed decision-making. Furthermore, statistics indicate that firms prioritizing KPIs in their management strategies experience a significant reduction in compliance-related costs and improved operational efficiency.

As the monetary services sector evolves, the emphasis on risk assessment in financial services, alongside efficient decision-making and an expedited decision-making process, will be vital for achieving sustainable growth and maintaining a competitive edge.

Leveraging Technology for Enhanced Risk Assessment

In 2025, technology is fundamentally transforming risk assessment in financial services evaluation processes. The incorporation of advanced analytics, artificial intelligence (AI), and machine learning algorithms enables entities to sift through vast datasets, uncovering patterns and predicting potential challenges with unprecedented precision. For example, AI-driven threat assessment software and interactive dashboards provide real-time insights, enabling organizations to quickly respond to emerging challenges and adjust to evolving market conditions.

This streamlined decision-making process is essential for companies undergoing turnaround efforts, as it allows them to take decisive actions based on real-time information—a key focus of Transform Your Small/Medium Business.

The influence of AI and machine learning on monetary uncertainty oversight is particularly noteworthy. Statistics indicate that a significant majority of financial institutions are leveraging these technologies to enhance their risk assessment capabilities in financial services. In fact, 99% of companies are preparing for stricter disclosure requirements, driven by new regulatory sustainability reporting mandates, emphasizing the urgency for strong oversight frameworks.

Ongoing business performance monitoring via client dashboards enables companies to assess their condition and modify strategies accordingly, promoting a proactive approach to managing potential issues.

Furthermore, the realm of assessment is further complicated by the rise in class action claims in Europe, with the UK, Netherlands, Germany, and Portugal representing 78 percent of these claims. This trend necessitates a reevaluation of management strategies that include risk assessment in financial services to mitigate potential legal and financial repercussions. By operationalizing lessons learned from turnaround experiences, organizations can build stronger relationships with stakeholders and enhance their overall resilience.

Real-world applications of these technologies are evident in various case studies. For instance, the insurance industry is experiencing a change as conventional transfer methods struggle to keep up with contemporary business challenges. The decrease in insured losses as a percentage of GDP emphasizes the need for innovative transfer products. This evolution presents an opportunity to bridge the protection and innovation gap, as discussed in the case study titled 'Closing the Protection Gap?', demonstrating how technology can transform evaluation strategies.

Expert insights highlight the importance for monetary organizations to reevaluate their handling policies considering these developments. As David Molony, Head of Cyber Solutions in Europe, Middle East, and Africa, notes, it is crucial for companies to ensure their purchased policies align with their evolving expectations and needs. By adopting technology in their evaluation frameworks, companies not only improve their decision-making processes but also strengthen their overall oversight abilities, positioning themselves for sustainable growth in an increasingly intricate economic environment.

Navigating Regulatory Compliance: Impacts on Risk Assessment Practices

Regulatory compliance is pivotal in shaping risk assessment within financial services. As organizations navigate the complexities of evolving regulations in 2025, including California's state-level mandates like the California Consumer Privacy Act (CCPA), it is imperative that their assessment frameworks are meticulously aligned with these requirements. This alignment necessitates the execution of regular compliance audits, the establishment of robust internal controls, and the maintenance of transparent reporting practices to support effective risk assessment in financial services.

Non-compliance can lead to substantial penalties and irreversible reputational damage, underscoring the necessity of integrating compliance factors into risk assessment processes. A recent survey revealed that 77% of professionals regard it as crucial to stay updated on developments in Environmental, Social, and Governance (ESG) issues, reflecting a broader trend towards accountability in corporate governance. Furthermore, 91% of business leaders believe their organization has an obligation to address ESG matters, highlighting the essential importance of these factors in adherence and mitigation. Additionally, as organizations face pressure to enhance revenue, 43% express a desire to leverage artificial intelligence (AI) and machine learning (ML) technologies to combat economic crime.

This illustrates a proactive approach to compliance and risk management, emphasizing the role of risk assessment in financial services as technology is adopted in response to regulatory pressures. The importance of compliance audits cannot be overstated; they serve as a critical mechanism for identifying potential vulnerabilities and ensuring adherence to regulatory standards. In 2025, the landscape of compliance audits in the banking sector is marked by a growing emphasis on technology-enabled solutions that facilitate more efficient and effective assessments. By prioritizing regulatory compliance, organizations not only safeguard their integrity but also position themselves for sustainable growth in an increasingly complex financial environment.

Conclusion

In the ever-evolving landscape of financial services, effective risk assessment stands as a vital component for organizational stability and compliance. This article has explored the multifaceted nature of risk management, emphasizing the critical importance of identifying, analyzing, and prioritizing risks in the face of increasing regulatory pressures and technological advancements. With a focus on compliance and cybersecurity, financial institutions are compelled to adopt robust frameworks that not only mitigate potential losses but also uncover growth opportunities.

Moreover, the integration of advanced technologies, such as artificial intelligence and machine learning, plays a transformative role in enhancing risk assessment processes. By leveraging these tools, organizations can gain real-time insights into emerging threats, streamline decision-making, and ensure continuous adaptation to the dynamic financial environment. Furthermore, the necessity for comprehensive financial reviews and proactive risk management strategies has never been more pressing, particularly in light of recent climate-related challenges and shifting economic conditions.

As financial institutions navigate the complexities of 2025, the commitment to thorough risk assessment and compliance will be crucial for sustainable growth. By embedding risk management practices into their operational frameworks and embracing technological advancements, organizations can not only safeguard their financial health but also position themselves as resilient players in a competitive landscape. The future of financial services hinges on the ability to adapt and respond effectively to risks, making a proactive approach to risk assessment an indispensable priority for all institutions.

Frequently Asked Questions

What is the purpose of risk assessment in financial services?

The purpose of risk assessment in financial services is to identify, analyze, and assess threats that could undermine an organization's economic stability, helping institutions safeguard against potential losses, ensure compliance with regulations, and maintain operational integrity.

What are the key trends influencing risk assessment as we approach 2025?

Key trends include an intensified focus on compliance and regulatory challenges, an increasing demand for cyber insurance, and the necessity for organizations to enhance their strategies for managing climate-related threats.

How do organizations benefit from comprehensive monetary assessments?

Comprehensive monetary assessments can unveil opportunities to conserve cash and reduce obligations, making them vital for effective oversight and helping organizations navigate uncertainties such as credit, market, operational, and compliance challenges.

What recent events have highlighted the need for improved risk management strategies?

Climate-related events in 2024 have underscored the necessity for service companies to enhance their strategies for managing climate threats, as regulatory frameworks evolve to address these challenges.

How are financial institutions responding to the need for effective risk management?

Financial institutions are responding by allocating resources towards proactive monetary strategies, such as Standard Chartered's US$1.5 billion investment in its 'Fit for Growth' initiative to improve risk management.

What steps are involved in the risk management process within monetary services?

The risk management process involves conducting an initial risk assessment to identify threats, performing a comprehensive assessment to understand potential impacts, prioritizing threats, implementing treatment strategies, and continuously monitoring these strategies for effectiveness.

What analysis methods are commonly used in risk assessment?

Common analysis methods include qualitative analysis, which relies on expert judgment and scenario analysis, and quantitative analysis, which employs statistical techniques to forecast potential losses.

What percentage of executives view cybersecurity as a primary focus area?

86% of executives, excluding tax and HR leaders, recognize cybersecurity as a primary focus area, highlighting the growing necessity for robust cybersecurity measures in threat management.

Can you provide an example of effective risk management in a financial institution?

A major financial institution faced escalating cybersecurity threats and implemented a multi-layered approach to protect sensitive customer data while ensuring regulatory compliance, achieving industry-leading security standards and high levels of customer satisfaction.

What challenges do monetary institutions face regarding expenditures for risk management?

Only 33% of leaders in risk management plan to increase their total expenditures in the upcoming year, indicating a need for monetary institutions to bolster existing resources and strategies for effective risk assessments.

Why is a well-structured management process increasingly important?

A well-structured management process is increasingly important due to the significant economic uncertainties and the impact of climate-related events, which can lead to substantial damages, emphasizing the need for resilience against such uncertainties.