Overview

Effective cash flow management strategies are crucial for small business success. They encompass meticulous monitoring of financial inflows and outflows, budgeting practices, and leveraging technology. By implementing these strategies—such as developing cash flow forecasts and negotiating favorable payment terms—businesses can maintain liquidity, navigate economic challenges, and position themselves for sustainable growth. Moreover, understanding the significance of these practices not only fosters resilience but also empowers businesses to thrive in competitive markets. Consequently, small business owners must prioritize cash flow management to secure their financial future.

Introduction

In the dynamic landscape of small business management, cash flow emerges as a critical pillar for sustainability and growth. As entrepreneurs navigate the complexities of financial health, understanding and managing cash flow effectively becomes paramount. This involves:

- Meticulous tracking of inflows and outflows

- Creating robust cash flow forecasts

Small business owners must adopt proactive strategies to ensure their financial stability. This article delves into essential practices for optimizing cash flow management, including:

- Effective budgeting

- Negotiating favorable payment terms

- Leveraging technology to streamline processes

By implementing these strategies, businesses can not only weather economic fluctuations but also position themselves for long-term success in an increasingly competitive market.

Understand Your Cash Flow

Effective cash flow management strategies for small businesses begin with meticulous monitoring of all financial inflows and outflows. Business owners must employ these strategies to account for every income source, including sales revenue and loan proceeds, alongside all expenses such as rent, utilities, and payroll. Regularly examining these figures is vital, as it helps in identifying spending trends and potential financial shortages. This proactive approach enables businesses to apply cash flow management strategies effectively, ensuring they can navigate challenges like inflation, which can lead to diminished consumer demand and stagnant liquidity. For instance, companies facing price fluctuations are encouraged to adopt bulk buying tactics to mitigate inflation's impact, thereby preserving competitiveness and economic stability.

Moreover, a comprehensive financial projection is crucial, as it guides cash flow management strategies, informing prudent monetary decisions and ensuring sufficient liquidity for growth and operations. In 2025, the importance of monitoring financial inflows and outflows cannot be overstated, as it remains a cornerstone of sustainable business success. As Melanie Velasquez, President and CEO of New Mexico Bank & Trust, aptly states, 'The future of SMBs lies in harnessing digital and integrated solutions for sustainable growth and success.'

Furthermore, small enterprises should consider implementing cash flow management strategies, such as Net 30 credit terms, which allow clients 30 days to settle invoices, as a method to enhance financial management. By overcoming outdated payment systems, businesses can position themselves for sustainable growth. The integration of real-time commercial analytics through client dashboards can significantly improve cash flow management strategies by continuously assessing organizational health and facilitating timely decision-making. The importance of forecasting in cash flow management is further illustrated by case studies that highlight how proactive tracking can lead to informed financial choices, ultimately supporting organizational operations.

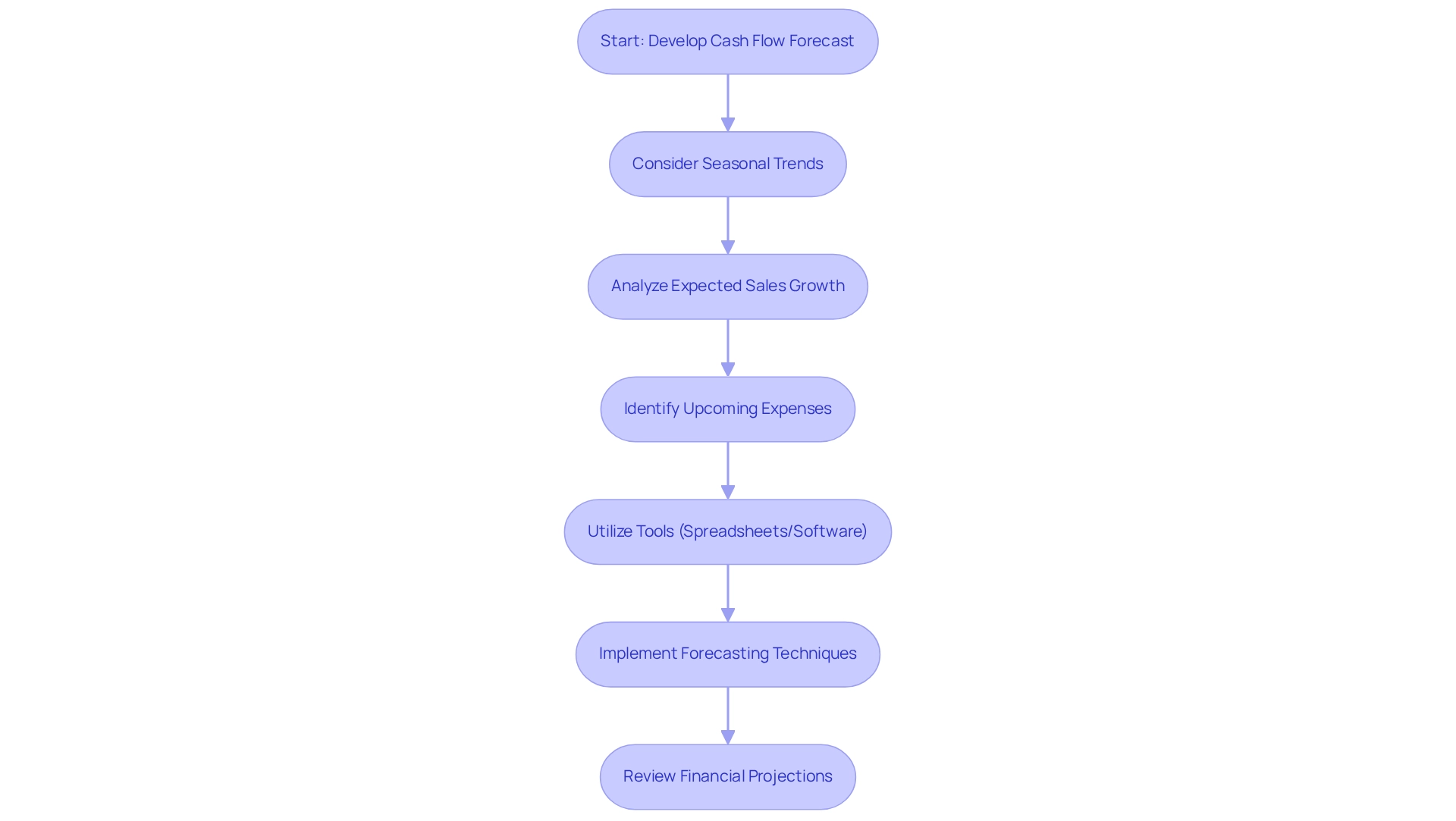

Create a Cash Flow Forecast

Developing effective cash flow management strategies is essential for the success of small businesses. This process involves predicting future monetary inflows and outflows over a specific timeframe, typically on a monthly basis. Business owners must consider seasonal trends, expected sales growth, and upcoming expenses to ensure accuracy. Utilizing tools such as spreadsheets or dedicated software can simplify this process, providing a comprehensive view of liquidity and potential deficits.

Experts emphasize that efficient financial forecasting, which encompasses cash flow management strategies for small businesses, not only aids in daily operations but also enhances strategic decision-making. By leveraging real-time analytics and streamlined decision-making processes, CFOs can improve their forecasting accuracy and responsiveness to market fluctuations. For instance, implementing techniques from 'Mastering the Cash Conversion Cycle' can significantly bolster liquidity management. A recent study revealed that small businesses with precise revenue projections experience a 20% higher success rate in securing funding, reflecting the growing trend of increased loan requests amid ongoing economic pressures. In fact, the median monthly income for small enterprises in Q3 2024 was $54,928, providing a benchmark for CFOs to better understand the economic landscape.

Case studies illustrate the duality of optimism and concern among small business owners regarding liquidity management. While many are hopeful about growth, they remain wary of liquidity fluctuations influenced by seasonal trends and inflation. As Sasha Solomon, co-owner and partner, notes, navigating these challenges necessitates a profound understanding of the economic environment. By employing robust forecasting methods tailored to local economic conditions and implementing cash flow management strategies based on the cash conversion cycle, organizations can adeptly navigate these challenges, ensuring preparedness for both opportunities and obstacles in their financial landscape.

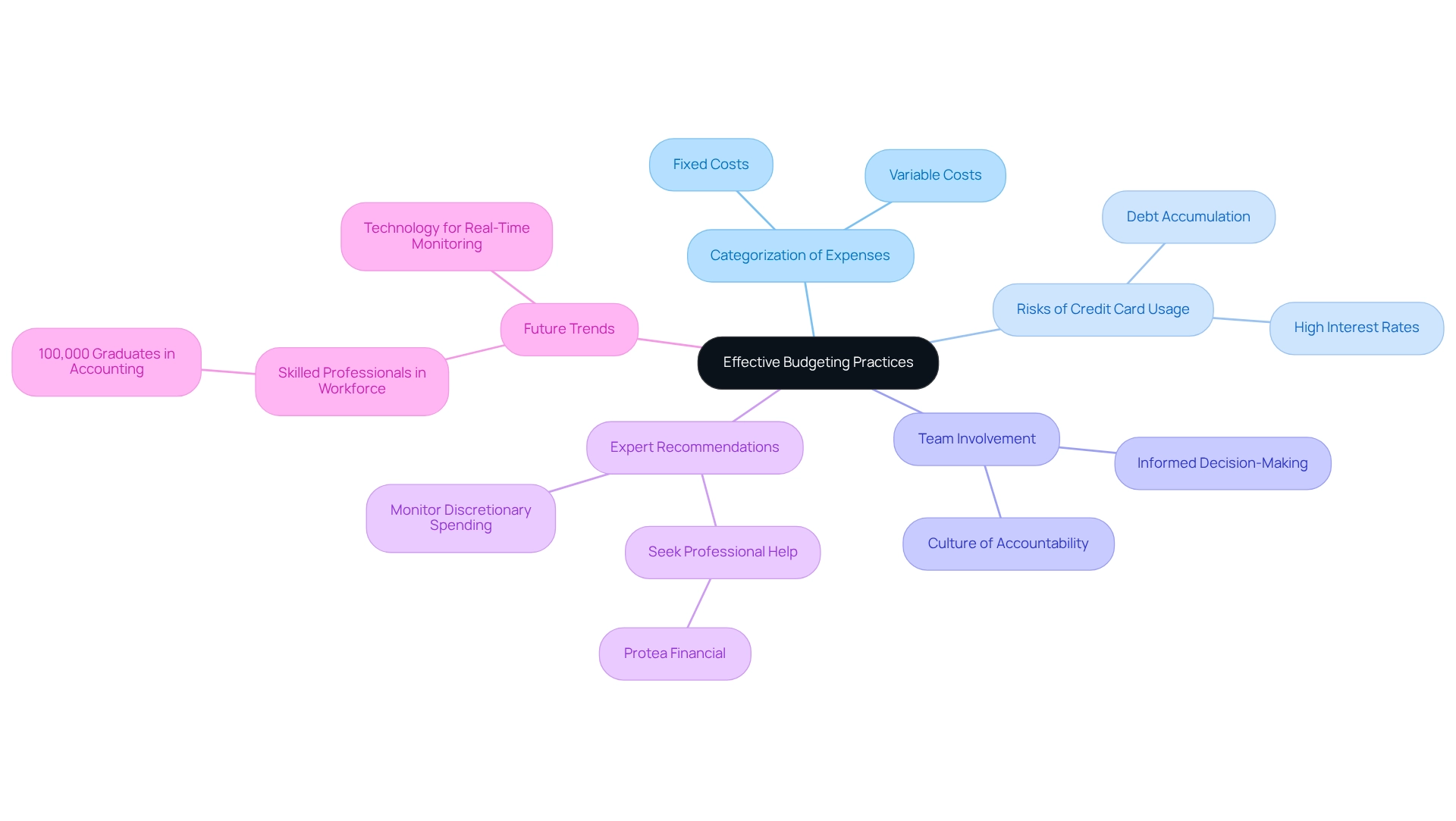

Implement Effective Budgeting Practices

To implement effective budgeting practices, small enterprises must categorize their expenses into fixed and variable costs. This approach clarifies spending patterns and highlights areas for potential cost reductions. A recent study revealed that nearly 50% of small enterprise owners acknowledge the risks associated with credit card usage, primarily due to concerns about debt accumulation and high interest rates. By understanding these categories, organizations can leverage cash flow management strategies to navigate their finances and mitigate risks, particularly regarding credit card expenditures.

Consistently evaluating and adjusting the budget based on actual performance is essential for maintaining financial well-being. This practice empowers companies to respond proactively to fluctuations in revenue and expenses, ensuring they remain on track. Involving team members in the budgeting process fosters a culture of accountability and transparency, leading to more informed decision-making.

Expert opinions underscore the significance of effectively categorizing expenses. For instance, CFOs often recommend that companies closely monitor discretionary spending to identify potential savings. Effective cash flow management strategies for small businesses, akin to those employed by firms that have optimized their operations, illustrate that a well-structured budget can significantly enhance economic stability and growth.

By 2025, adopting optimal budgeting methods, including leveraging technology for real-time fiscal monitoring and analysis, will be crucial for small enterprises aiming to thrive in a competitive landscape. By thoughtfully classifying expenses and engaging the entire team in the budgeting process, organizations can build a robust financial framework that encourages sustainable growth. Furthermore, with nearly 100,000 graduates in bookkeeping, accounting, and auditing fields entering the workforce, small enterprises have access to skilled professionals who can assist in implementing these effective budgeting practices.

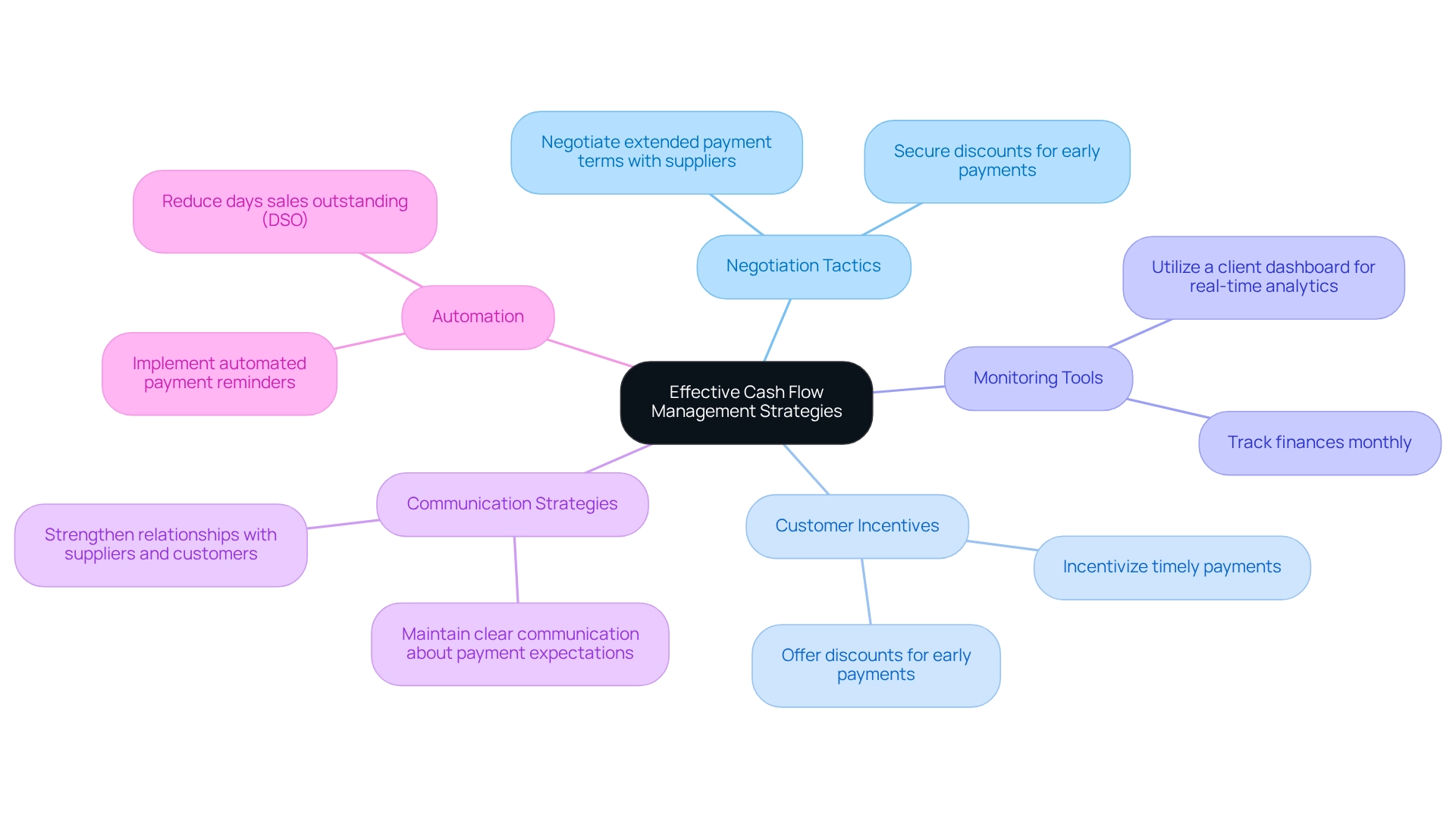

Negotiate Favorable Payment Terms

Actively discussing cash flow management strategies with vendors is essential for small business owners seeking to enhance their liquidity. By negotiating extended payment periods or securing discounts for early payments, businesses can significantly bolster their cash flow management. Statistics reveal that SMEs employing cash flow management strategies and tracking their finances monthly enjoy an 80% survival rate, underscoring the critical importance of effective financial management. Furthermore, incentivizing customers for early payments can expedite cash inflows and is a key component of successful cash flow management, fostering a more favorable cash flow cycle. Clear communication about payment expectations and deadlines is vital, as it strengthens relationships with suppliers and customers while improving cash flow management. Notably, 51% of SMEs regard accounts receivable and collections as a primary concern, highlighting the necessity for effective cash flow management in this domain. Concentrating on cash flow management can substantially enhance a company's financial position. Implementing automated payment reminders is an effective strategy, as it has proven beneficial; organizations adopting this approach can reduce days sales outstanding (DSO) and enhance collection efficiency. Additionally, leveraging real-time analytics through a client dashboard can support monitoring the effectiveness of cash flow management strategies, enabling timely adjustments and informed decision-making. As noted by ForwardAI, 34% of participants indicated that their financial management improved slightly after implementing such strategies. By focusing on cash flow management, small enterprises can adeptly navigate cash flow challenges and position themselves for sustainable growth.

Actionable Tips for Effective Cash Flow Management:

- Negotiate extended payment terms with suppliers to improve liquidity.

- Offer discounts to customers for early payments to accelerate cash inflows.

- Utilize a client dashboard for real-time analytics to monitor cash flow health.

- Implement automated payment reminders to streamline collections and reduce DSO.

- Maintain clear communication with suppliers and customers regarding payment expectations.

Manage Expenses Effectively

To efficiently handle expenses, small enterprises must implement cash flow management strategies, including regular expense audits that reveal unnecessary costs and guide improved monetary decisions. Statistics indicate that companies can aim to streamline supply chain costs by 10%, underscoring the potential for significant savings through diligent expense management practices. Implementing cost-control measures, such as renegotiating contracts or transitioning to more affordable suppliers, can further enhance financial health. A structured four-step process for project cost management—planning, estimating costs, creating a budget, and monitoring expenses—ensures resources are allocated efficiently and budgets are adhered to. Moreover, utilizing expense management software streamlines tracking and reporting, allowing organizations to uphold budgetary discipline. Expert insights emphasize that aligning cost-reduction efforts with overall organizational objectives is crucial for achieving long-term success. As Michael Seaman, co-founder and CEO of Swipesum, states, 'These goals should be aligned with your overall organizational objectives, ensuring that your cost-reduction efforts contribute to long-term success.' Furthermore, our team will identify underlying organizational issues and work collaboratively to create a plan to mitigate weaknesses, enabling companies to reinvest in key strengths. Communicating audit findings to stakeholders is essential for collaboratively identifying areas for improvement in financial control. By performing detailed expense audits, small enterprises can not only recognize trends but also achieve significant savings, ultimately promoting sustainable growth. To maximize returns on investment, it is essential to test and measure the effectiveness of these strategies regularly. Here are some actionable tips:

- Conduct monthly expense audits to track spending patterns.

- Establish precise cost-reduction objectives aligned with organizational goals.

- Utilize expense management software for real-time tracking and reporting.

By implementing cash flow management strategies for small businesses, companies can improve their economic well-being and ensure sustainable growth.

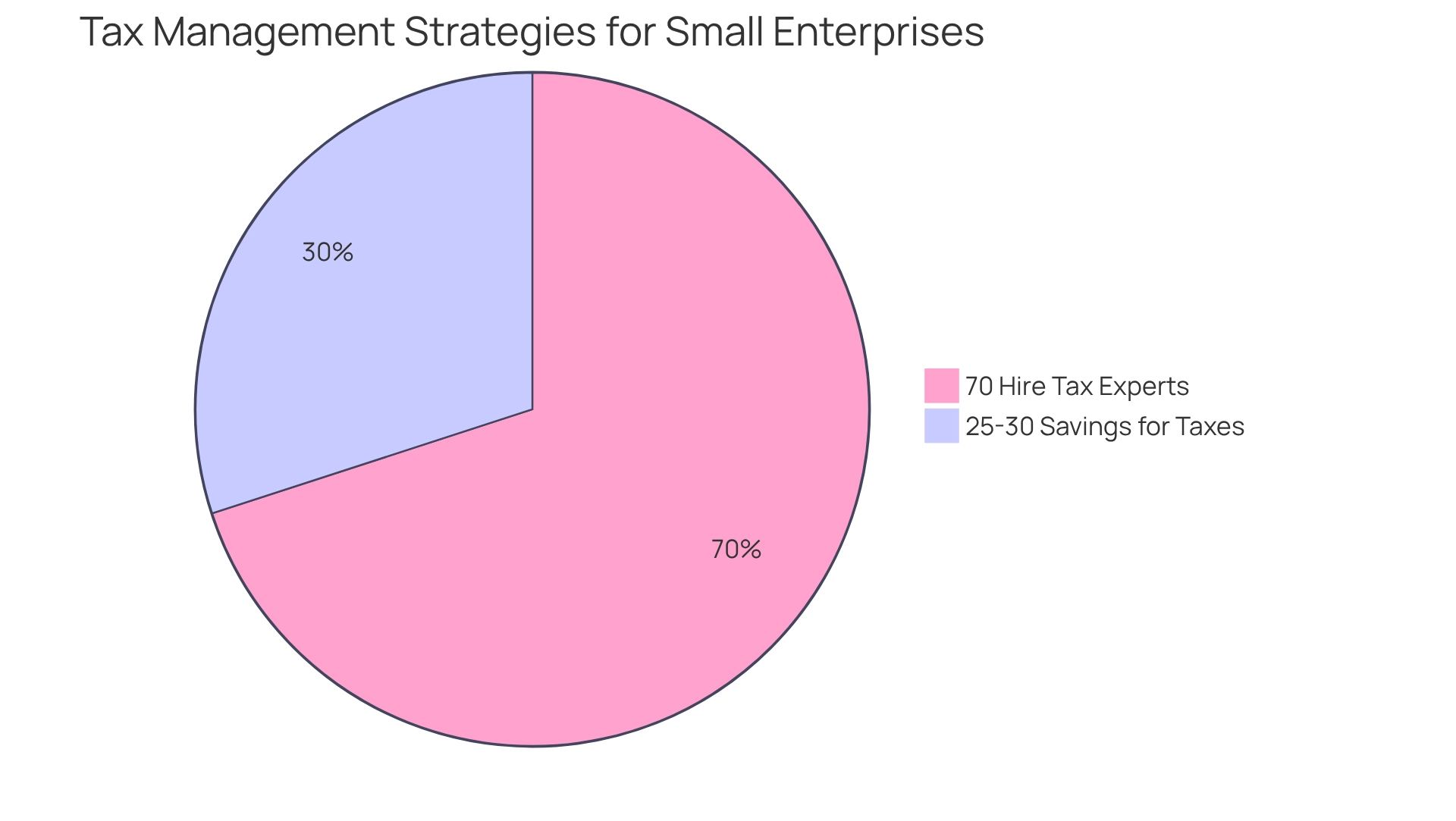

Set Aside Funds for Taxes

Small enterprise owners must prioritize estimating their tax obligations and consistently reserving a portion of their income to cover these expenses. A widely accepted guideline suggests saving 25-30% of profits for taxes. This proactive strategy not only mitigates the risk of financial strain during tax season but also supports effective cash flow management strategies for small businesses throughout the year. By adopting this practice, organizations can prevent the last-minute scramble for funds, ensuring they stay compliant and financially stable.

Significantly, 70% of small enterprises hire tax experts to prepare and submit their tax returns annually, highlighting the significance of tax planning. Furthermore, successful instances of tax fund distribution show that companies utilizing this method frequently encounter enhanced economic well-being and decreased pressure during tax seasons. As one tax professional noted, 'Setting aside funds for taxes is not just a best practice; it's essential for maintaining financial stability.'

Additionally, understanding that the IRS requires expenses to be 'ordinary and necessary' for deductions further emphasizes the need for accurate tax liability estimation. Integrating these cash flow management strategies for small businesses can result in considerable advantages, as demonstrated by several case studies on tax savings approaches for small enterprises.

Establish a Cash Reserve

To create a robust cash reserve, small enterprises should aim to save between three to six months' worth of operating costs. This guideline is essential for maintaining stability during unforeseen circumstances. Experts recommend that companies gradually build this reserve by setting aside a portion of their monthly profits. Such a financial cushion not only aids in navigating unexpected challenges but also safeguards operational integrity and overall financial well-being.

Strategic planning is vital; our team identifies underlying organizational challenges and collaborates to develop actionable plans that mitigate weaknesses, enabling companies to reinvest in their strengths. For instance, a case study on establishing suitable financial reserves reveals that companies with adequate reserves are better equipped for uncertainties, ensuring they can meet their operational commitments. The findings of this case study illustrate that businesses that effectively built reserves managed to sustain operations and avoid economic hardship during recessions.

Furthermore, financial advisors emphasize that implementing cash flow management strategies is crucial for maintaining a strong cash reserve, empowering enterprises to withstand economic fluctuations and uphold growth trajectories. Continuous performance evaluation through real-time analytics can further enhance decision-making, allowing organizations to adapt effectively to changing circumstances.

In specific situations, it may be prudent for companies to save beyond six months of expenses to account for heightened risks. By adopting a 'Test & Measure' strategy, companies can evaluate the efficiency of their financial reserves and make data-informed decisions to optimize returns. This approach ensures they are not only prepared for immediate challenges but also positioned for long-term success.

Monitor and Review Your Cash Flow Regularly

Creating a schedule for examining financial statements and projections is crucial for entrepreneurs, as it aligns with effective cash flow management strategies for small businesses, preferably on a monthly basis. This process involves a comprehensive examination of variances between projected and actual financial movements, identifying the reasons for any inconsistencies. By adjusting forecasts accordingly, companies can remain agile and responsive to evolving financial conditions.

Routine financial monitoring not only helps in spotting potential weaknesses—70% of small enterprise failures arise from owners' inability to recognize these issues—but also enhances overall performance by implementing effective cash flow management strategies for small businesses. As stated by the U.S. Small Business Administration, there are 28.8 million small firms in the United States, providing jobs for 56.8 million individuals, highlighting the essential importance of efficient financial management in supporting these enterprises.

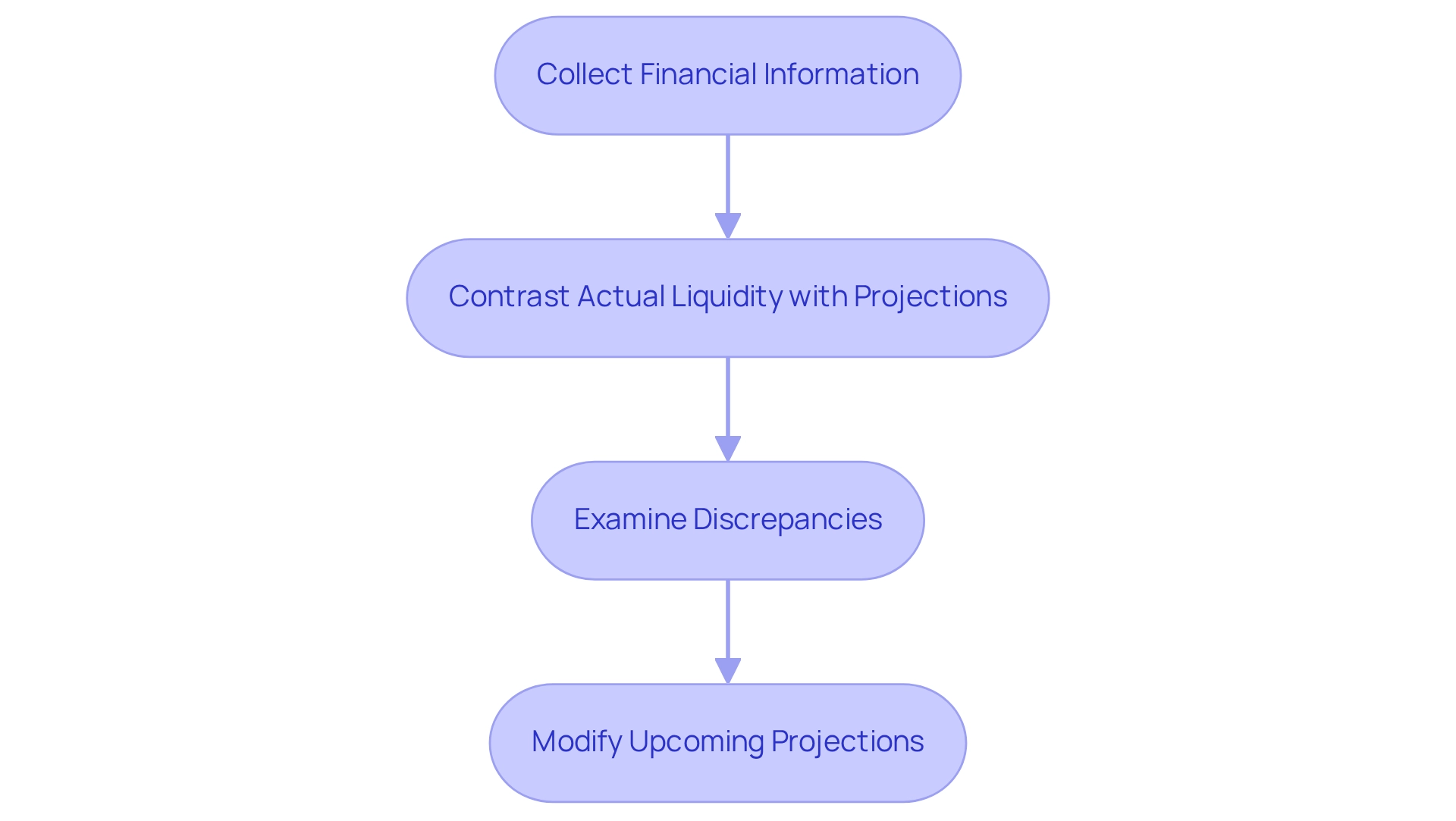

Economic analysts emphasize that consistent reviews lead to better decision-making and enhanced fiscal health, ultimately fostering sustainable growth through effective cash flow management strategies for small businesses. To execute efficient monetary movement assessments, CFOs should adopt a systematic method:

- Collect all pertinent financial information

- Contrast actual liquidity with projections

- Examine discrepancies to recognize patterns

- Modify upcoming projections based on insights acquired

Utilizing real-time analytics through a client dashboard can further streamline this process, enabling companies to continuously monitor their performance and make informed decisions swiftly. This organized approach not only streamlines the procedure but also enables companies to manage the intricacies of financial resource management.

Seek Professional Guidance

Engaging cash flow specialists or advisors can transform the landscape for small enterprises. These experts conduct comprehensive evaluations of financial health, offering tailored recommendations that align with the unique needs of each organization. Their expertise is crucial in navigating the complexities of economic environments, empowering businesses to implement optimal strategies that foster sustainable growth.

For instance, research shows that enterprises leveraging professional guidance witness improved operational efficiency and profitability through effective cash flow management strategies tailored for small businesses. Furthermore, the U.S. Small Business Administration reports that there are 28.8 million small enterprises in the U.S., underscoring the immense potential for advisors to create a significant impact.

Notably, 93% of leading B2B organizations are committed to content marketing, highlighting the critical role of professional guidance within a broader commercial context. By adopting a long-term investment perspective, as illustrated in the case study, companies can make more informed financial decisions.

Additionally, with the support of financial advisors, businesses can refine their decision-making processes and utilize real-time analytics via a client dashboard to continuously monitor performance. This dashboard provides vital insights into organizational health, facilitating timely adjustments.

Akash Bagrecha, co-founder of Jordensky, underscores the value of financial advisors, having successfully raised over ₹400Cr for startups. By taking a proactive stance and seeking professional guidance, small enterprises can not only stabilize their financial resources but also position themselves for enduring success by employing cash flow management strategies from 'Mastering the Cash Conversion Cycle.

Leverage Technology for Cash Flow Management

Investing in liquidity management software is essential for small enterprises aiming to optimize their financial procedures. Automation tools such as QuickBooks, Xero, and specialized cash flow forecasting software not only streamline invoicing and track expenses but also generate real-time reports that offer valuable insights into cash positions. By leveraging these technologies, enterprises can significantly reduce manual errors, save time, and enhance their decision-making capabilities.

Our team champions an expedited decision-making cycle during the turnaround process, empowering your team to take decisive action to protect your organization. Notably, 83% of small to medium enterprises are already utilizing artificial intelligence for data analysis and resource management, underscoring the trend towards technological adoption in this domain.

Furthermore, 54% of U.S. small enterprises sought a loan or line of credit in 2018, highlighting the financial challenges they face and the critical role of liquidity management in securing funding. Effective implementation of financial management software has been shown to enhance operational efficiency, with many companies reporting improved transparency regarding their fiscal health.

For instance, while 91% of small enterprises succeed in their first year, liquidity issues remain a significant barrier, with 82% of unsuccessful firms citing liquidity as a primary factor in their struggles. This underscores the necessity of robust financial management strategies, particularly through technology, to ensure long-term sustainability and growth.

Additionally, financial forecasting assists organizations in recognizing trends, anticipating gaps, and preparing for the future. As Kennedy Langebartels observes, 30% of small business owners rely on external accountants, indicating a dependence on outside expertise for financial management, which aligns with the theme of leveraging technology. This emphasizes the importance of integrating technology into cash flow management strategies for small businesses to effectively navigate challenges.

Conclusion

Effective cash flow management is not just a necessity; it is a cornerstone of small business sustainability and growth. By meticulously tracking cash inflows and outflows, creating accurate cash flow forecasts, and implementing robust budgeting practices, small business owners can navigate financial challenges with greater confidence. Strategies such as negotiating favorable payment terms, managing expenses diligently, and establishing a cash reserve are critical for maintaining liquidity and ensuring operational stability.

Moreover, leveraging technology and seeking professional guidance can significantly enhance cash flow management processes. Automation tools and real-time analytics empower businesses to make informed decisions swiftly, while expert insights provide tailored strategies that align with specific financial needs. Regular monitoring and reviewing of cash flow statements reinforce this proactive approach, allowing businesses to adapt effectively to changing financial landscapes.

In conclusion, adopting these essential cash flow management practices positions small businesses not only to survive economic fluctuations but also to thrive in a competitive market. By prioritizing financial health and implementing these strategies, entrepreneurs can lay a strong foundation for long-term success. This ensures their businesses are well-equipped to face future challenges and capitalize on growth opportunities.

Frequently Asked Questions

What is the importance of cash flow management for small businesses?

Effective cash flow management is essential as it allows small businesses to monitor all financial inflows and outflows, helping to identify spending trends and potential financial shortages. This proactive approach ensures businesses can navigate challenges like inflation, which may affect consumer demand and liquidity.

What strategies can small businesses use to manage cash flow effectively?

Small businesses can implement strategies such as meticulous monitoring of all income sources and expenses, adopting bulk buying tactics to mitigate price fluctuations, using Net 30 credit terms for clients, and integrating real-time commercial analytics through client dashboards.

How can financial projections aid in cash flow management?

Comprehensive financial projections guide cash flow management strategies by informing prudent monetary decisions and ensuring sufficient liquidity for growth and operations, ultimately enhancing strategic decision-making.

What tools can assist in cash flow forecasting?

Tools such as spreadsheets or dedicated software can simplify the cash flow forecasting process, providing a comprehensive view of liquidity and potential deficits.

Why is it important to categorize expenses in budgeting practices?

Categorizing expenses into fixed and variable costs clarifies spending patterns and highlights areas for potential cost reductions, helping organizations navigate their finances and mitigate risks, especially regarding credit card expenditures.

How can small businesses ensure their budgeting practices remain effective?

Small businesses should consistently evaluate and adjust their budgets based on actual performance, involve team members in the budgeting process, and monitor discretionary spending to identify potential savings.

What role does technology play in cash flow management and budgeting?

Leveraging technology for real-time fiscal monitoring and analysis is crucial for small enterprises to thrive in a competitive landscape, allowing for more informed decision-making and enhanced economic stability.