Introduction

In an era where financial terrorism poses significant threats to organizations globally, the need for effective risk assessment tools has never been more critical. Financial terrorism risk assessment software empowers institutions to proactively identify and mitigate these risks, ensuring compliance with evolving regulatory standards.

With the rise of sophisticated cyber threats and the increasing complexity of financial transactions, organizations must leverage advanced technologies to enhance their risk management strategies.

This article explores the landscape of financial terrorism risk assessment software, highlighting:

- Key players

- Regulatory challenges

- The importance of international collaboration

It also delves into future trends driven by artificial intelligence and data analytics, equipping financial leaders with the insights necessary to safeguard their assets and maintain operational integrity in a volatile environment.

Overview of Financial Terrorism Risk Assessment Software

Monetary violence threat evaluation software, such as financial terrorism risk assessment software, is crucial for organizations aiming to proactively recognize, assess, and reduce threats associated with monetary violence. The functionality of these tools varies from basic scoring systems to sophisticated platforms that incorporate data analytics, compliance tracking, and comprehensive reporting features, enabling organizations to make informed decisions. In 2020, the cloud security software market reached an impressive size of $29 billion, illustrating the growing importance of robust cybersecurity solutions.

Additionally, ransom requests targeting small enterprises in 2021 generally varied from $10,000 to $50,000, emphasizing the financial consequences of financial terrorism. Key participants in this market, such as ACAMS, SAS, and Oracle, provide unique features customized to various organizational requirements, each enhancing a more robust management framework. For example, while ACAMS focuses on compliance and regulatory solutions, SAS excels in advanced analytics capabilities.

Additionally, remote workers caused a security breach in 20 percent of organizations during the pandemic, emphasizing the evolving nature of cybersecurity threats. A notable case is the Yahoo data breach in 2013, which compromised 3 billion email accounts and sensitive customer information, illustrating the dire consequences of inadequate cybersecurity measures. Comprehending the strengths and limitations of each tool is essential for CFOs aiming to improve their monetary management strategies.

As monetary threats change, utilizing financial terrorism risk assessment software becomes essential for protecting organizational resources and upholding operational integrity. According to Cybersecurity Ventures, global spending on cybersecurity products and services is predicted to reach $1.75 trillion cumulatively for the five-year period from 2021 to 2025, further underscoring the critical need for effective risk assessment solutions.

In-Depth Look at ACAMS Risk Assessment Tool

The ACAMS Risk Assessment tool stands out as an essential resource for financial institutions seeking to bolster their defenses against financial terrorism and cyber-enabled fraud by utilizing financial terrorism risk assessment software. As highlighted in Singapore’s 2024 National Risk Assessment, cyber-enabled fraud is identified as a key money laundering threat, making compliance solutions like ACAMS crucial. With features like automated threat scoring, customizable reporting, and real-time data integration, the tool is designed for efficiency and effectiveness.

Its intuitive interface simplifies the management and analysis of data, enabling organizations to adhere to stringent regulatory requirements seamlessly. Furthermore, ACAMS provides users with a comprehensive array of industry resources and training materials, empowering them to adeptly navigate the complexities surrounding financial terrorism risk assessment software. By adopting the financial terrorism risk assessment software, institutions can significantly enhance their risk management frameworks and elevate their regulatory stance, directly addressing the increasing prevalence of fraud—a notable concern identified in the U.S. 2024 National Money Laundering Risk Assessment, which cites fraud as the largest crime generating proceeds for laundering.

Furthermore, regulatory breaches and reporting failures represent 1.20% of money laundering incidents, highlighting the importance of strong adherence strategies. The INTERPOL Global Economic Fraud Assessment further illustrates the growing epidemic of fraud affecting individuals and companies, emphasizing the sophistication of fraud methods and the need for coordinated efforts to combat illicit monetary flows. As monetary organizations persist in dealing with a changing environment of challenges, utilizing the ACAMS Risk Assessment tool will be crucial for ensuring strong adherence and protecting against unlawful monetary activities.

Navigating Regulatory Requirements for Risk Assessment

Financial institutions face a complex array of regulatory requirements regarding financial terrorism risk assessment software, notably the Bank Secrecy Act (BSA) and the USA PATRIOT Act. A significant 35% of business and technology leaders identify third-party breaches as one of their most urgent cyber threats, highlighting the essential need for strong regulatory measures. The final Basel III reforms aim to bolster the resilience of banks, which is crucial as institutions adapt their compliance strategies to meet evolving standards.

Additionally, the CFPB's proposed interpretive rule, issued on July 18, 2024, clarifies that many paycheck advance products are subject to the Truth in Lending Act (TILA), impacting disclosure requirements for monetary services. Navigating these regulations requires a comprehensive understanding of the challenges inherent in financial transactions, along with the deployment of effective monitoring systems. Financial terrorism risk assessment software is crucial in this context, automating data gathering, evaluation, and reporting processes to promote adherence to regulatory mandates.

As noted in the 2024 State of Embedded Finance Report, compliance gets complicated for sponsor banks overseeing embedded finance partnerships, with 80% reporting difficulty meeting requirements. By harnessing advanced technology, organizations can not only fulfill regulatory obligations but also improve their overall management strategies, ensuring they remain vigilant against evolving threats.

The Role of International Collaboration in Financial Risk Assessment

In the constantly changing environment of monetary crime, global cooperation surfaces as a fundamental aspect of efficient risk evaluation and reduction. Considering that threats often transcend national borders, organizations must actively collaborate with global regulatory bodies, law enforcement agencies, and monetary institutions to share intelligence and best practices. The Financial Action Task Force (FATF) plays an essential role in this domain, spearheading initiatives that improve the detection of monetary crimes and adherence.

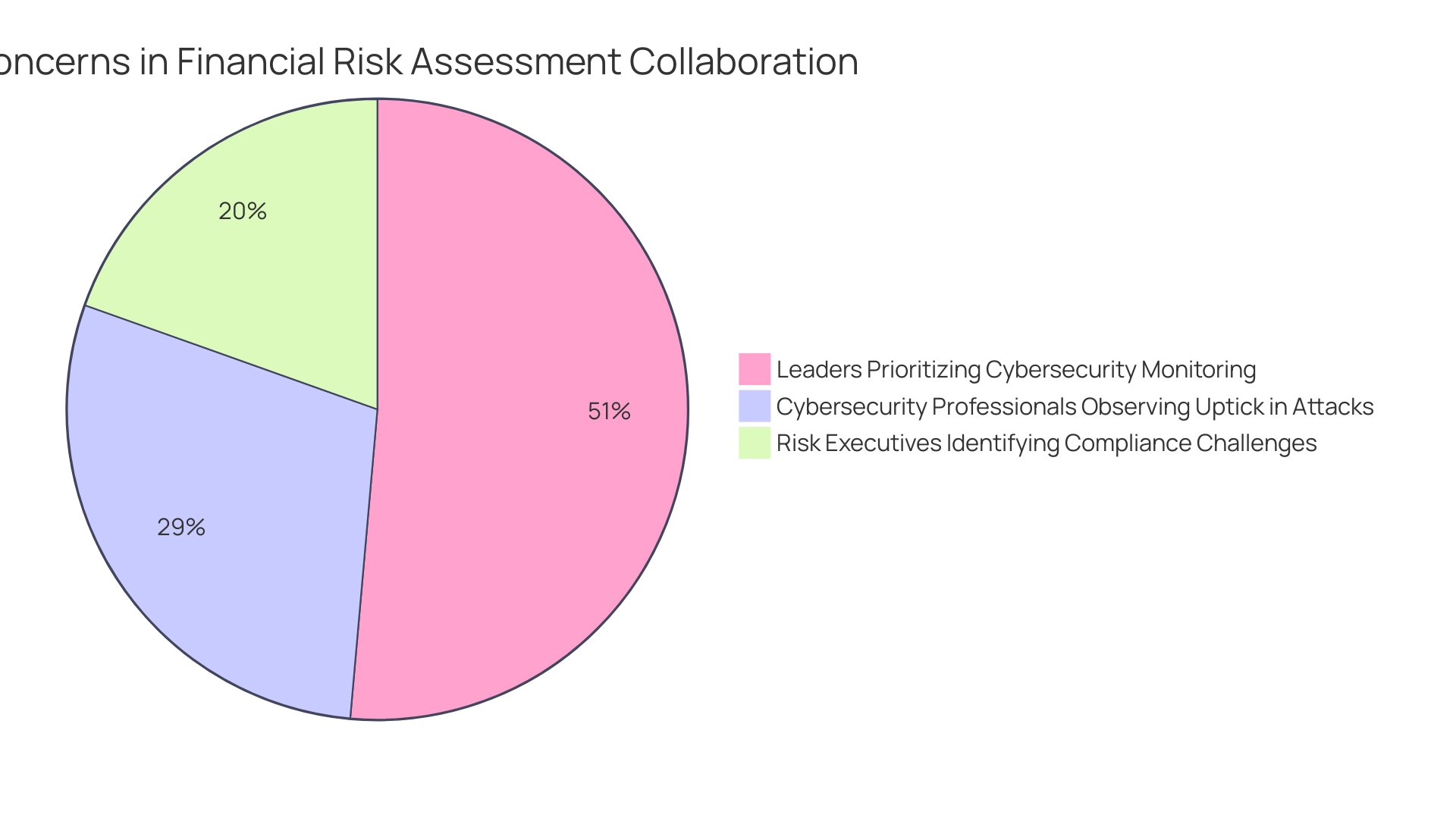

Recent statistics indicate that:

- 52% of cybersecurity professionals have observed an uptick in attacks compared to the previous year, underscoring the urgency for robust collaboration.

- The PwC Pulse Survey shows that 92% of leaders in the field prioritize monitoring cybersecurity advancements, indicating a shared dedication to protecting the economic ecosystem.

- Moreover, 35% of risk executives recognize compliance and regulatory challenges as their primary concern, emphasizing the crucial role of following regulations in reducing monetary dangers.

Financial terrorism risk assessment software is essential in this collaborative effort, offering platforms for effective data sharing and analysis. By leveraging these technologies, organizations can cultivate a comprehensive understanding of emerging threats and vulnerabilities, reinforcing their defenses in the global economic system. As highlighted by Michael Brauneis, Protiviti’s global leader of Industry & Client Programs, the alignment with FATF initiatives not only addresses compliance challenges but also encourages a proactive approach to combating economic crime on a global level.

Furthermore, the International Monetary Fund (IMF) provides significant publications that highlight the necessity of tracking economic crime to uphold global economic stability.

Future Trends in Financial Terrorism Risk Assessment Technology

The terrain of monetary threat evaluation technology is on the verge of a significant transformation, propelled by innovative progress in artificial intelligence (AI), machine learning, and large-scale data analysis. These innovations empower organizations to utilize financial terrorism risk assessment software to process extensive datasets in real-time, significantly enhancing their capability to detect patterns and anomalies that may signal financial terrorism activities. As noted by industry experts at Protiviti,

Cyber threats remain a top concern in both 2024 and 2034, highlighting the critical need for proactive measures.

In light of the Economist Intelligence Unit's forecast of 10 critical global threat scenarios in 2024, the urgency for adopting advanced assessment technologies has never been more pronounced. Furthermore, the OCC Semiannual Risk Perspective for Spring 2024 emphasizes the tightening of regulatory frameworks, compelling organizations to adopt more sophisticated financial terrorism risk assessment software solutions. Recent case studies, like the one named 'Extreme Weather Threats Grow in Importance,' demonstrate the increasing urgency for strong mitigation strategies in response to escalating global challenges.

Companies that strategically invest in these technologies not only bolster their risk management frameworks but also establish themselves as leaders in compliance and operational excellence. This proactive approach is essential for safeguarding assets and preventing disruptions.

Conclusion

Financial terrorism risk assessment software is now an indispensable tool for organizations striving to navigate the complexities of today’s financial landscape. By enabling proactive identification and mitigation of risks, these advanced technologies empower financial leaders to maintain compliance with evolving regulations while safeguarding their assets. Key players in this field, such as ACAMS and SAS, offer tailored solutions that enhance risk management strategies, underscoring the importance of selecting the right tools to meet specific organizational needs.

Navigating the stringent regulatory requirements, including the Bank Secrecy Act and the USA PATRIOT Act, is critical for financial institutions. The integration of risk assessment software simplifies compliance processes, allowing organizations to efficiently manage data collection and reporting. Moreover, as international collaboration becomes increasingly vital in combating financial terrorism, leveraging these technologies facilitates the sharing of intelligence and best practices across borders.

Looking ahead, the adoption of artificial intelligence and big data analytics will revolutionize financial terrorism risk assessment, enabling organizations to respond swiftly to emerging threats. By investing in these innovations, institutions not only enhance their risk management frameworks but also position themselves as frontrunners in compliance and operational integrity. In a world where financial threats are ever-evolving, the commitment to advanced risk assessment solutions is no longer optional; it is a strategic imperative for securing a resilient financial future.

Frequently Asked Questions

What is the purpose of monetary violence threat evaluation software?

Monetary violence threat evaluation software, such as financial terrorism risk assessment software, helps organizations proactively recognize, assess, and reduce threats related to monetary violence.

What features do these software tools typically include?

The functionality of these tools ranges from basic scoring systems to advanced platforms that offer data analytics, compliance tracking, and comprehensive reporting features, enabling informed decision-making.

How significant is the market for cloud security software?

In 2020, the cloud security software market reached $29 billion, highlighting the growing importance of robust cybersecurity solutions.

What were the ransom requests targeting small enterprises in 2021?

Ransom requests targeting small enterprises in 2021 typically ranged from $10,000 to $50,000, underscoring the financial impact of financial terrorism.

Who are the key participants in the financial terrorism risk assessment software market?

Key participants include ACAMS, SAS, and Oracle, each providing unique features tailored to various organizational needs.

What distinguishes ACAMS and SAS in this market?

ACAMS focuses on compliance and regulatory solutions, while SAS is known for its advanced analytics capabilities.

How did remote work impact cybersecurity during the pandemic?

Remote workers caused a security breach in 20 percent of organizations during the pandemic, highlighting the evolving nature of cybersecurity threats.

What was a notable cybersecurity incident mentioned in the article?

The Yahoo data breach in 2013 compromised 3 billion email accounts and sensitive customer information, demonstrating the severe consequences of inadequate cybersecurity measures.

Why is it important for CFOs to understand the strengths and limitations of risk assessment tools?

Understanding these aspects is essential for CFOs to enhance their monetary management strategies and protect organizational resources.

What is the projected global spending on cybersecurity products and services from 2021 to 2025?

Global spending on cybersecurity products and services is expected to reach $1.75 trillion cumulatively during this five-year period.

What specific features does the ACAMS Risk Assessment tool offer?

The ACAMS Risk Assessment tool includes automated threat scoring, customizable reporting, and real-time data integration, designed for efficiency and effectiveness.

How does the ACAMS tool assist organizations with regulatory compliance?

Its intuitive interface simplifies data management and analysis, helping organizations adhere to stringent regulatory requirements.

What is the largest crime generating proceeds for laundering according to the U.S. 2024 National Money Laundering Risk Assessment?

Fraud is identified as the largest crime generating proceeds for laundering.

What percentage of money laundering incidents are attributed to regulatory breaches and reporting failures?

Regulatory breaches and reporting failures account for 1.20% of money laundering incidents.

Why is the ACAMS Risk Assessment tool crucial for monetary organizations?

It is essential for ensuring strong adherence to regulations and protecting against unlawful monetary activities in a changing environment of challenges.