Overview

The article centers on executing a thorough risk assessment for financial services institutions, underscoring the necessity for a systematic evaluation of potential threats to bolster organizational resilience. It articulates key steps in the risk assessment process, categorizing risks into operational, credit, market, and compliance areas. Furthermore, it highlights the critical importance of integrating technology and compliance frameworks to effectively address the evolving challenges within the financial landscape.

Introduction

In the ever-evolving landscape of financial services, the significance of effective risk assessment is paramount. As institutions confront a myriad of challenges—from operational hurdles to regulatory compliance—grasping and mitigating risks has become essential for sustaining growth and stability.

Notably, the BFSI sector is experiencing a slight uptick in prevention effectiveness; thus, the urgency for robust evaluation methodologies cannot be overstated. This article delves into the fundamental aspects of risk assessment, exploring various risk types, the crucial role of compliance, and the transformative power of technology.

By examining these elements, financial institutions can develop strategic frameworks that not only meet regulatory requirements but also enhance overall performance in a competitive marketplace.

Understanding the Basics of Risk Assessment in Financial Services

The risk assessment for financial services institutions entails a thorough evaluation of potential threats, including the identification, analysis, and assessment of dangers that could impede an organization's objectives. In 2024, the BFSI sector has recorded a modest improvement in prevention effectiveness, with scores rising from 67% to 68%, underscoring the persistent necessity for robust evaluation methodologies. A comprehensive approach commences with a clear definition of the scope and objectives, followed by the meticulous collection of relevant data and insights.

Our team will collaboratively identify underlying business issues and devise a plan to mitigate weaknesses, thereby enabling the organization to reinvest in its key strengths. Financial organizations typically categorize threats into operational, credit, market, and compliance categories, which aids in effectively prioritizing management efforts. As these organizations face escalating costs associated with technology modernization, they encounter a critical strategic challenge: the imperative to aggressively reduce expenses while the costs of modernization continue to rise.

Consequently, the integration of Continuous Threat Exposure Management (CTEM) is recommended to bolster both prevention and detection capabilities, complemented by ongoing business performance monitoring through real-time analytics. Moreover, the outlook for 2034 has shifted regarding the management of remote or hybrid work settings, with survey findings suggesting that the market anticipates challenges related to remote work will be addressed, indicating a long-term move away from hybrid work models. By grasping these fundamental concepts and methodologies, organizations can implement for financial services institutions that fosters effective management strategies, ensuring compliance with regulatory requirements while enhancing overall business performance.

Prioritizing investments in exposure validation and CTEM will be crucial for improving prevention and detection capabilities. Furthermore, we advocate for a 'Test & Measure' approach to rigorously test every hypothesis, ultimately leading to streamlined decision-making and measurable returns on invested capital.

Exploring Different Types of Financial Risks

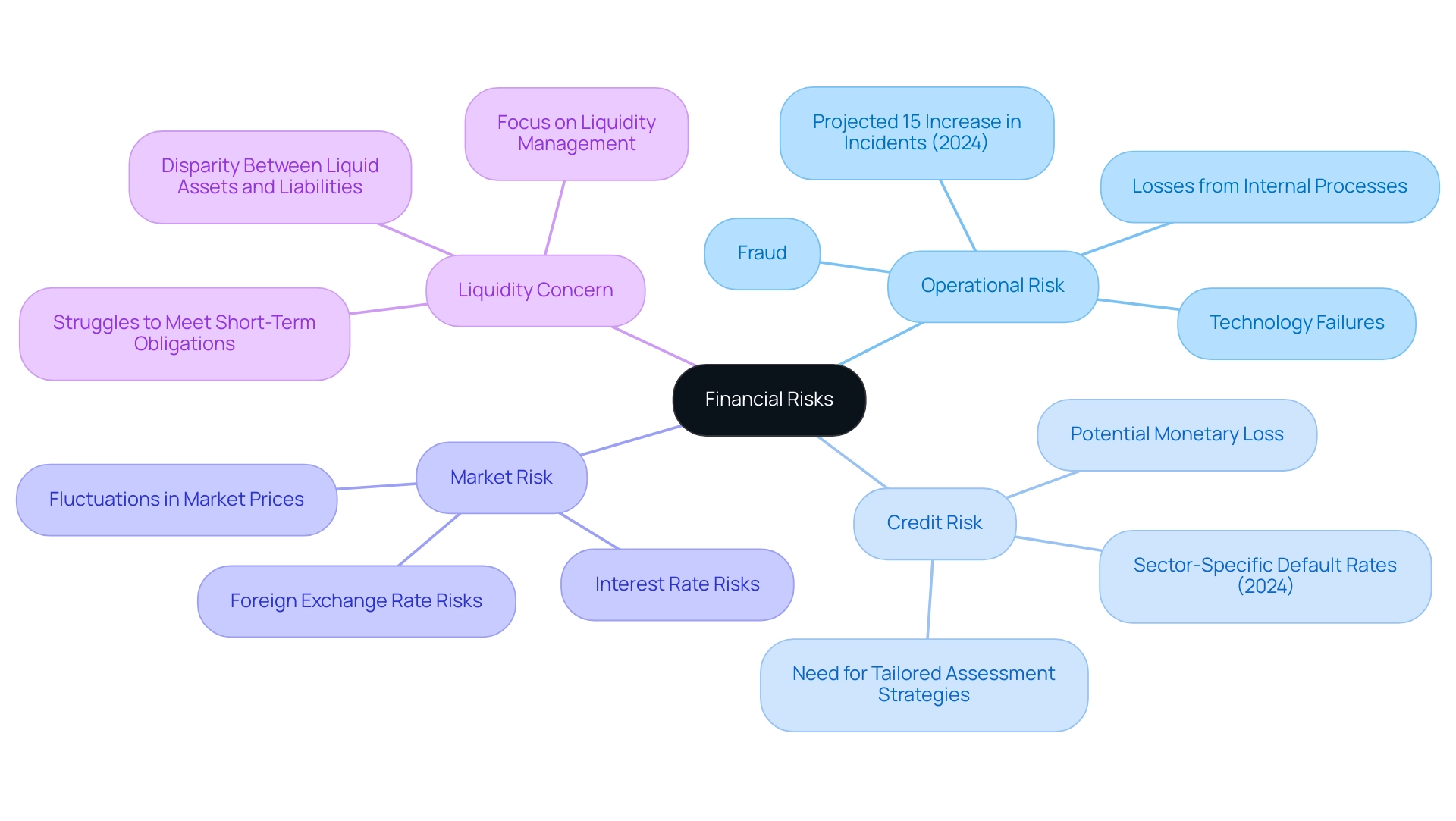

Financial institutions face a myriad of challenges that can significantly affect their operations and profitability. Comprehending these threats is essential for the risk assessment of financial services institutions and the creation of effective mitigation strategies. Key risk categories include:

- Operational Risk: This encompasses losses resulting from inadequate or failed internal processes, systems, or external events, including fraud and technology failures. Recent operational loss data from 2018 to 2023 emphasizes a pressing need for organizations to upgrade their technology while managing expenses efficiently, as operational incidents in the services sector are anticipated to increase by 15% in 2024. This trend highlights the urgency for organizations to embrace innovative solutions to alleviate these challenges.

- Credit Risk: This refers to arising from a borrower's inability to meet their loan obligations. As financial institutions maneuver through a challenging economic environment, effective credit assessment strategies are more essential than ever. For instance, the latest insights reveal that credit exposure default rates are projected to vary significantly by sector in 2024, underscoring the need for tailored assessment and management approaches.

- Market Risk: This threat arises from fluctuations in market prices, including interest rates, equity prices, and foreign exchange rates. Monetary organizations must stay alert regarding market fluctuations, as they can result in significant monetary losses if not properly managed.

- Liquidity Concern: Liquidity concern arises when an organization struggles to fulfill its short-term obligations due to a disparity between liquid assets and liabilities. With ongoing economic pressures, liquidity management has become a focal point for monetary entities aiming to ensure operational resilience.

Navigating these challenges requires a strategic approach, particularly as the demand for risk assessment for financial services institutions grows amidst cost-cutting pressures. As one expert observed, this presents a critical strategic challenge as monetary entities attempt to cut expenses aggressively even as the cost of technology modernization efforts continues to rise. Furthermore, the case study titled "Workforce Management Expectations" demonstrates the evolving difficulties in handling uncertainties associated with remote or hybrid work environments, suggesting a conviction that these challenges will be overcome by 2034.

By thoroughly evaluating these threat categories, organizations can improve their ability to endure possible negative impacts and strengthen their overall stability.

The Role of Compliance in Risk Assessment

Compliance is essential to the risk assessment for financial services institutions during the evaluation process. It requires a deep understanding of regulations, including the Bank Secrecy Act (BSA) and Anti-Money Laundering (AML) laws. A well-organized compliance framework is crucial for risk assessment for financial services institutions to recognize potential issues related to non-compliance, as these can lead to significant fines and serious reputational damage.

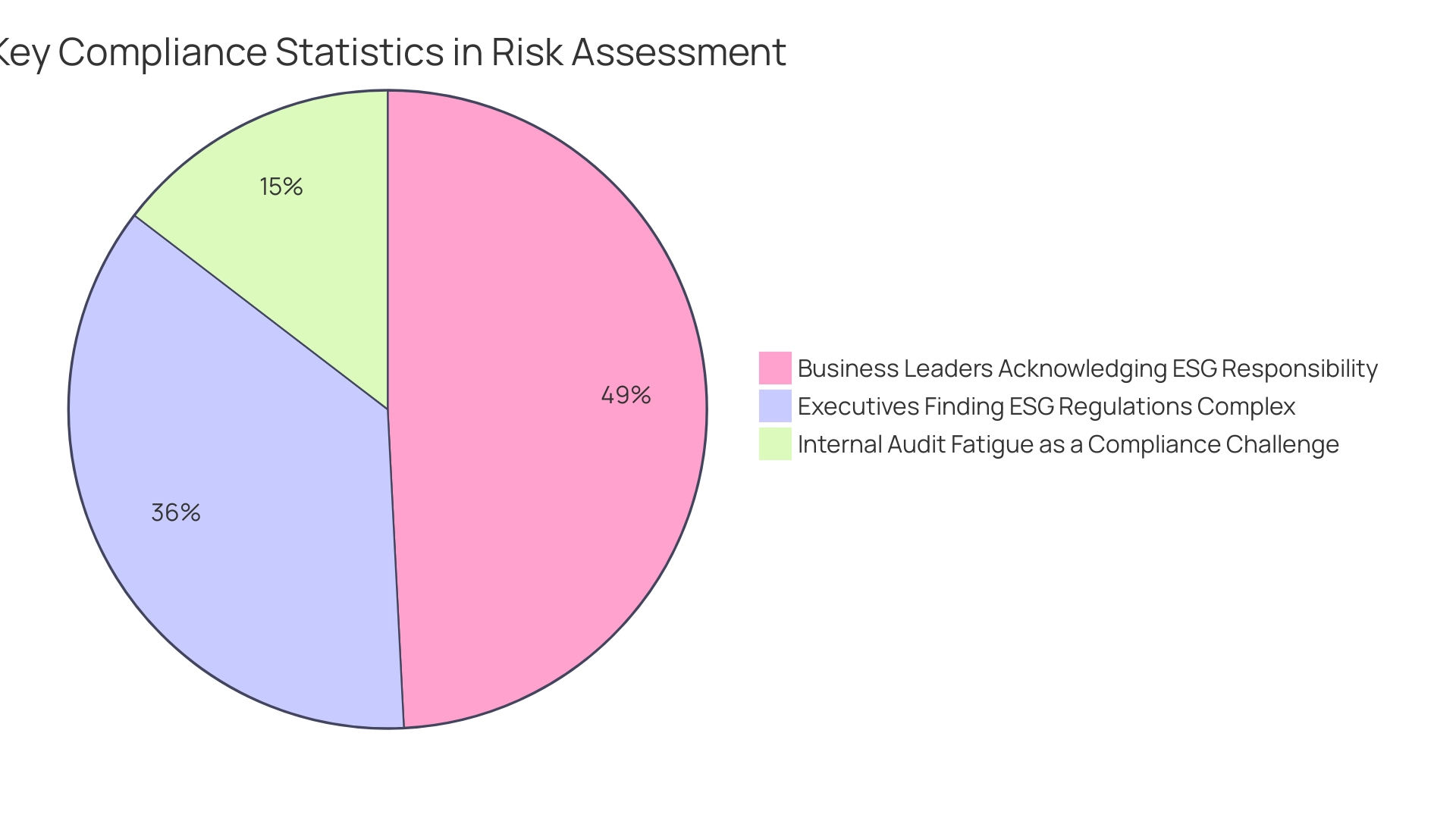

In fact, 91% of business leaders acknowledge their company's responsibility to address Environmental, Social, and Governance (ESG) issues, indicating a growing awareness of compliance's broader implications. Furthermore, 67% of executives find ESG regulations complex and are actively seeking more guidance from regulators, underscoring the need for clarity in compliance processes. Regular compliance audits and risk assessment for financial services institutions should be meticulously integrated into management strategies to ensure adherence to all regulatory requirements.

Moreover, with 27% of security and IT professionals identifying internal audit fatigue from assessments as a top compliance challenge, it is clear that financial institutions must prioritize efficient compliance practices, such as conducting risk assessments for financial services institutions. A significant 77% of corporate compliance professionals agree that it is important or very important to stay updated on , highlighting the necessity for ongoing education in this area. Continuous training for personnel on compliance policies is essential for fostering a culture of awareness and adherence, thus reducing issues related to insufficient security practices.

For instance, the case study revealing that 60% of organizations have over 500 accounts with non-expiring passwords exposes them to potential data breaches, which underscores the critical need for robust compliance frameworks. By promoting a strong compliance culture, organizations can more effectively manage the intricacies of regulatory frameworks and shield themselves from the serious consequences of non-compliance.

Leveraging Technology for Enhanced Risk Assessment

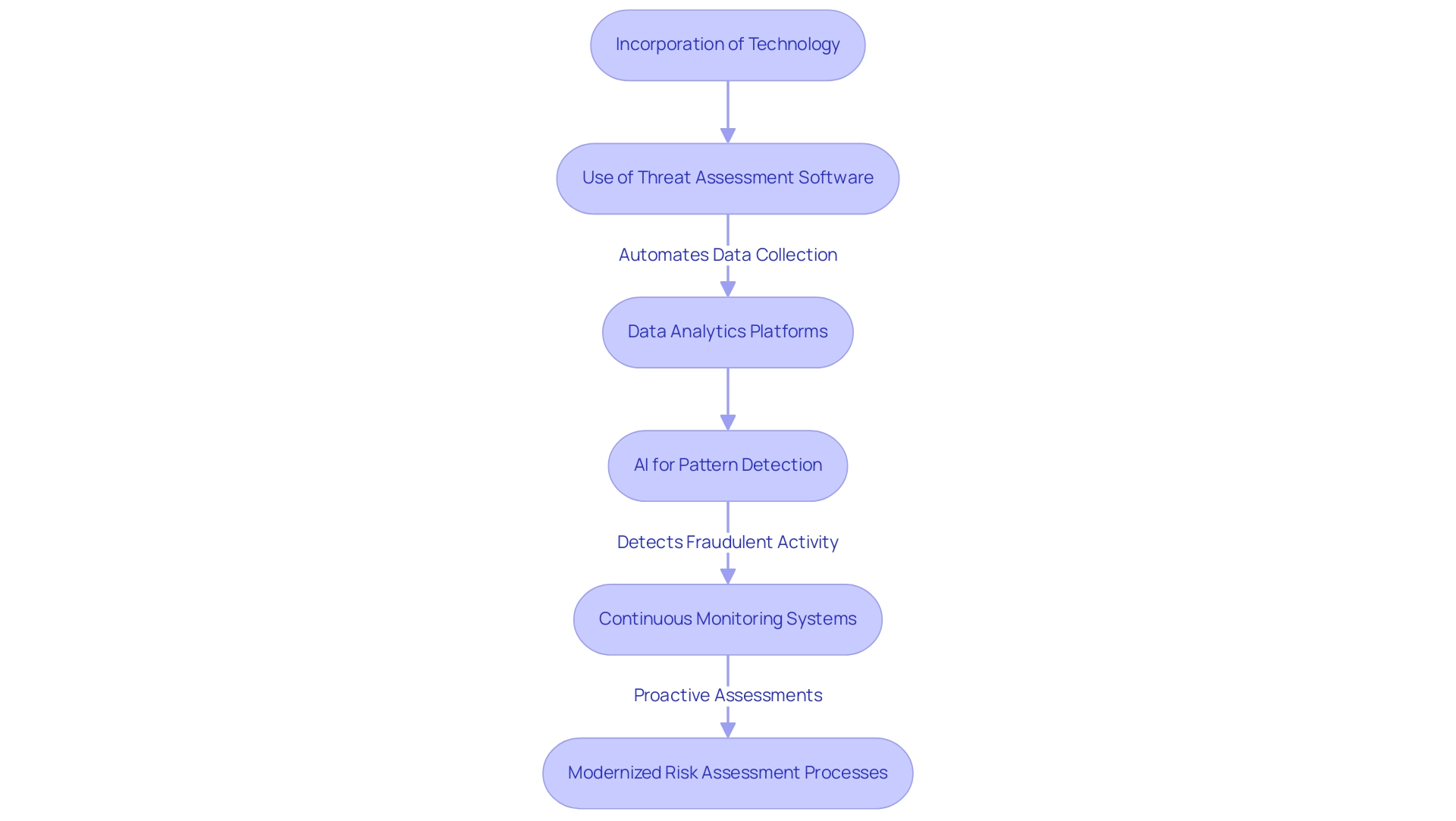

The incorporation of technology into evaluation processes is essential for enhancing the effectiveness of financial organizations. Sophisticated tools, including threat assessment software and data analytics platforms, are becoming indispensable as they automate crucial tasks such as data collection, analysis, and reporting. For instance, artificial intelligence plays a pivotal role in detecting patterns within transaction data that may signal fraudulent activity, thereby enabling swift interventions.

Moreover, the expansion of data science and AI facilitates the examination of unconventional data, such as social media sentiments, which can assist organizations in better understanding emerging threats. In addition, internal audit and technology oversight functions should evaluate data governance and pinpoint administrative gaps, ensuring that safety practices are robust and efficient. The implementation of real-time monitoring systems allows for continuous assessments, empowering institutions to adopt a proactive rather than reactive stance in managing challenges.

As Gartner emphasizes, by 2025, 70% of organizations will have adopted DevOps and infrastructure automation, indicating toward modernizing governance. Financial services that leverage these technologies can significantly streamline their risk assessment processes, thereby improving compliance and operational efficiency. However, monetary entities also grapple with that fails to meet performance expectations, underscoring the necessity for modernization.

This modernization is not merely advantageous but crucial, especially as organizations face the urgent need to balance cost-reduction strategies with strategic investments in technology to remain competitive amid evolving threats.

Key Steps in Conducting a Comprehensive Risk Assessment

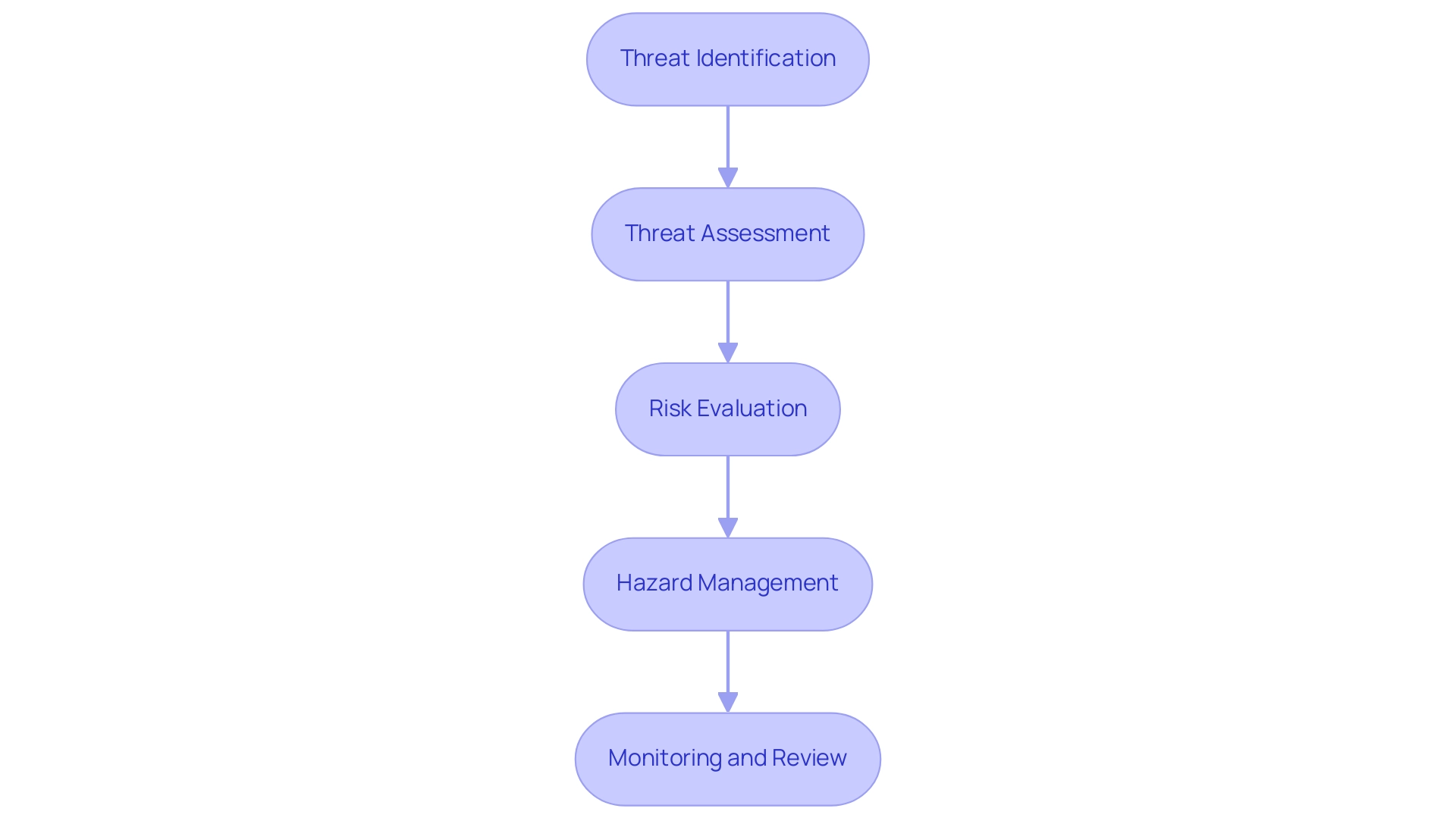

Conducting a comprehensive risk assessment for financial services institutions requires a structured approach that encompasses several critical steps:

- Threat Identification: This initial phase aims to uncover potential threats through collaborative brainstorming sessions, detailed interviews, and thorough analysis of historical data. Notably, 61% of leaders acknowledge attracting and retaining talent as a significant concern in 2034, highlighting the evolving challenges that CFOs must navigate.

- Threat Assessment: This section evaluates the probability and potential impacts of identified threats using both qualitative and quantitative techniques. This dual approach guarantees a thorough understanding of each threat's implications.

- Risk Evaluation: Risks are prioritized based on their potential impact on the organization and the effectiveness of existing controls. This prioritization enables institutions to allocate resources to the most pressing threats.

- Hazard Management: Developing strategies to mitigate identified dangers is essential. This may involve avoidance, reduction, transfer, or acceptance, tailored to the specific context of the organization.

- Monitoring and Review: Regular reviews and updates to the assessment are crucial to reflect changes within the organization or the external environment, ensuring ongoing resilience. Furthermore, integrating Procurement and Third-Party Risk Oversight (TPRM) throughout the lifecycle enhances visibility and efficiency in addressing threats.

According to Donna MacLellan, Lead at Continuity2,

From identifying potential threats to implementing suitable strategies, I ensure clients can recover and thrive in the face of challenges.

This organized method not only fortifies threat handling practices but also enhances the organization's capacity for risk assessment as it navigates the shifting financial landscape. Moreover, with the average annual cost of insider threats now at $16.2 million, the importance of effective threat identification and analysis cannot be overstated as organizations invest in robust insider threat programs.

Navigating Emerging Trends and Challenges in Risk Management

Financial services organizations must adeptly navigate the evolving landscape of emerging trends and management challenges. A pivotal trend is the recognition of climate-related challenges, as organizations increasingly acknowledge the economic ramifications of climate change. The integration of environmental risks into traditional assessments is vital, especially considering recent research indicating that the threshold for instigating long-term changes to planetary systems is likely to be breached at or before 1.5°C of global warming, a milestone projected to be reached by the early 2030s.

Christophe Lumsden, the EY Global Climate Change and Sustainability Services Leader, underscores the necessity for institutions to enhance their adoption of transition plans, link scenario analysis with economic data, and establish scientifically validated targets across various timeframes.

Another significant trend is the escalation of cybersecurity threats. As digital banking becomes increasingly prevalent, the frequency and sophistication of cyberattacks continue to rise. Statistics indicate that cybersecurity threats in banking are expected to intensify in 2024, necessitating the implementation of robust cybersecurity measures within safety strategies. This emphasis on cybersecurity is proactive; such measures can significantly mitigate potential financial losses and reputational harm.

Furthermore, the landscape of regulatory changes is in constant flux. Financial institutions must remain vigilant, adapting to new regulations that impact safety protocols. The recent introduction of voluntary standards by (ISSB) reflects a growing commitment among jurisdictions, including Taiwan and the UK, to enhance climate-related disclosures. The Barometer reports a readiness score of 68%, signaling a positive trend toward compliance and improved evaluations.

Additionally, the fact that 186 North American companies referenced ISSB Standards, with 60% providing a general reference, illustrates broader industry engagement with these standards, further emphasizing the significance of regulatory compliance.

Finally, technological advancements present both opportunities and challenges. Innovations such as blockchain and artificial intelligence have the potential to revolutionize management strategies but necessitate careful handling to minimize associated risks.

By proactively addressing these emerging trends, financial institutions can strengthen their resilience and ensure sustainable growth through comprehensive risk assessment in an increasingly complex risk landscape.

Conclusion

In the intricate world of financial services, effective risk assessment stands as a cornerstone for institutional success. This article elucidates the essential components of risk assessment, emphasizing the importance of identifying and categorizing risks—operational, credit, market, and liquidity—while also addressing the pressing need for compliance and technological integration. As financial institutions grapple with rising operational risk incidents and the complexities of regulatory frameworks, the implementation of robust methodologies becomes critical.

The integration of technology in risk assessment processes not only enhances efficiency but also empowers institutions to adopt a proactive approach to managing risks. Utilizing advanced tools and analytics allows for continuous monitoring and swift responses to emerging threats, ensuring that organizations remain resilient in an ever-evolving landscape. Coupled with a structured risk assessment framework that includes:

- Identification

- Analysis

- Evaluation

- Treatment

financial institutions can fortify their defenses against potential vulnerabilities.

Moreover, as the financial sector faces growing challenges from climate-related risks and cybersecurity threats, adapting to these emerging trends is vital for long-term sustainability. By embracing a culture of compliance and prioritizing investments in innovative technologies, institutions can navigate the complexities of today’s risk landscape while positioning themselves for future growth. Ultimately, a comprehensive and strategic approach to risk assessment will empower financial institutions to thrive amidst challenges, ensuring they not only meet regulatory requirements but also enhance overall performance in a competitive market.

Frequently Asked Questions

What is the purpose of risk assessment for financial services institutions?

The purpose of risk assessment for financial services institutions is to thoroughly evaluate potential threats, identify, analyze, and assess dangers that could impede the organization's objectives.

How has the BFSI sector's prevention effectiveness changed in 2024?

In 2024, the BFSI sector has recorded a modest improvement in prevention effectiveness, with scores rising from 67% to 68%.

What are the key steps involved in a comprehensive risk assessment approach?

A comprehensive risk assessment approach begins with a clear definition of the scope and objectives, followed by the meticulous collection of relevant data and insights.

How do financial organizations categorize threats?

Financial organizations typically categorize threats into operational, credit, market, and compliance categories to effectively prioritize management efforts.

What strategic challenge do financial organizations face regarding technology modernization?

Financial organizations face the strategic challenge of needing to aggressively reduce expenses while the costs of technology modernization continue to rise.

What is Continuous Threat Exposure Management (CTEM)?

Continuous Threat Exposure Management (CTEM) is recommended to bolster both prevention and detection capabilities within financial organizations.

What does the outlook for remote or hybrid work settings look like for 2034?

The outlook for 2034 suggests that challenges related to remote work will be addressed, indicating a long-term move away from hybrid work models.

What are the main categories of risk that financial institutions need to understand?

The main categories of risk include operational risk, credit risk, market risk, and liquidity concern.

What is operational risk?

Operational risk encompasses losses resulting from inadequate or failed internal processes, systems, or external events, including fraud and technology failures.

What does credit risk refer to?

Credit risk refers to the potential monetary loss arising from a borrower's inability to meet their loan obligations.

What is market risk?

Market risk arises from fluctuations in market prices, including interest rates, equity prices, and foreign exchange rates.

What does liquidity concern entail?

Liquidity concern arises when an organization struggles to fulfill its short-term obligations due to a disparity between liquid assets and liabilities.

Why is it essential for financial institutions to evaluate these threat categories?

It is essential for financial institutions to evaluate these threat categories to improve their ability to endure possible negative impacts and strengthen their overall stability.