Introduction

In an increasingly complex financial landscape, the ability to identify, assess, and mitigate financial risks is paramount for organizations aiming to thrive. As Chief Financial Officers confront a myriad of challenges—from fluctuating market conditions to rising cybersecurity threats—understanding the nuances of financial risk becomes not just beneficial, but essential.

This article delves into the intricacies of financial risk management, offering a comprehensive guide on:

- Identifying various risk types

- Conducting thorough assessments

- Implementing proactive strategies

These strategies not only safeguard assets but also position organizations for sustainable growth. By embracing these insights, CFOs can navigate potential pitfalls and harness opportunities to enhance their financial resilience in 2024 and beyond.

Understanding Financial Risk: A Foundation for Assessment

Financial uncertainty includes the possibility of monetary loss linked to investments or business activities, stemming from various sources such as market fluctuations, credit defaults, and operational inefficiencies. It is essential for Chief Financial Officers to thoroughly understand these challenges to implement effective business financial risk assessment strategies. The primary categories of monetary uncertainties encompass:

- Market Uncertainty: This involves the chance of incurring losses due to fluctuations in market prices, which can significantly impact investment portfolios.

- Credit Uncertainty: This pertains to the likelihood that a borrower may default on a loan, affecting the stability of lending institutions. Significantly, some banking systems may encounter capital deficiencies in unfavorable situations despite overall capitalization, emphasizing the necessity of thorough credit evaluation.

- Liquidity Concern: This is the threat of failing to meet short-term obligations, which can result in operational interruptions.

- Operational Concern: This includes dangers arising from internal processes, personnel, and systems that may fail or be insufficient.

As we approach 2024, comprehending these challenges is more crucial than ever, particularly considering geopolitical events that could disturb market stability. The shaded green bands in Figure 3 illustrate the range of economic conditions consistent with non-recessionary GDP growth, assuming either a 90 percent or a 95 percent confidence level, providing a quantitative context for evaluating market uncertainties. As noted by Jeffrey Kleintop,

It am not what you don't know that gets you in trouble, it's what you know for sure that just am not so.

Moreover, as companies invest further in AI technologies, the potential for productivity improvements rises, indicating that technology may play a crucial role in managing economic challenges. Acquainting yourself with these monetary uncertainty concepts not only establishes the groundwork for a thorough business financial risk assessment but also prepares your organization to handle possible obstacles efficiently.

![]()

Step-by-Step Guide to Conducting a Financial Risk Assessment

Carrying out [a comprehensive business financial risk assessment](https://smbdistress.com) is crucial for efficient management and strategic planning. Here’s a step-by-step guide:

-

Identify Threats: Gather your finance team to brainstorm possible monetary challenges specific to your business environment.

This collaborative method guarantees that a diverse range of threats is taken into account during the business financial risk assessment, promoting a comprehensive understanding of your exposure landscape. Real-time analytics can assist in identifying trends and anomalies that may indicate emerging risks.

-

Prioritize Threats: Rank the identified threats based on their likelihood of occurrence and potential impact on your organization's financial health.

According to recent insights, 61% of leaders regard 'attracting and retaining talent' as a major concern heading into 2034, highlighting the need for careful prioritization. Utilizing analytics can enhance the business financial risk assessment by helping to quantify these uncertainties, allowing for more informed prioritization.

-

Analyze Risks: Utilize both quantitative and qualitative techniques to evaluate the potential effects of each threat.

This examination should provide a clear understanding of how each threat could impact your economic performance, which is essential for effective business financial risk assessment and informed decision-making. Real-time data can enhance this analysis by providing current market conditions and financial metrics.

-

Document Findings: Create a detailed report that outlines the hazards, their implications, and your evaluation.

This documentation functions not only as a reference but also as a basis for developing actionable plans. Integrating analytics into this documentation can provide a clearer framework for understanding the effects of uncertainties related to business financial risk assessment.

-

Develop Action Plans: For each significant threat, outline specific strategies for monitoring, managing, and mitigating them.

Utilizing tools like Secureframe can aid in assigning risk owners and setting reminders for regular reviews, ensuring accountability and ongoing oversight. Our team supports a shortened decision-making cycle throughout the turnaround process, enabling your organization to take decisive action to preserve business health. Real-time analytics can be integrated into these action plans to track progress and adjust strategies as needed.

-

Review and Revise: Regularly revisit and update your monetary threat evaluation as business conditions evolve.

Staying adaptive is crucial, especially as cyber threats remain a top concern. As Protiviti highlights, ongoing involvement in cybersecurity monitoring is crucial to reduce these threats effectively.

Moreover, utilizing business financial risk assessment can provide leaders with perspectives for long-term strategic planning, especially when contemplating mergers and acquisitions. We continually monitor the success of our plans and teams through our client dashboard, which provides real-time business analytics to diagnose your business health. This dashboard not only monitors the effectiveness of implemented strategies but also emphasizes areas requiring attention, ensuring that management of threats remains proactive.

By following these structured steps, CFOs can enhance their entity's resilience against monetary threats, leverage insights for strategic planning—such as mergers, acquisitions, and market expansions—and align their management strategies with the latest industry guidelines. The case study on monitoring cyber developments illustrates that 92% of leaders in this field are closely observing cybersecurity, reinforcing the need for proactive assessment in this area.

Identifying Different Types of Financial Risks

Effective management of financial hazards relies on a thorough business financial risk assessment to identify various types of financial threats, which are integral to safeguarding your organization’s profitability and sustainability. The primary categories include:

- Credit Risk: This involves assessing the likelihood of clients defaulting on payments, a critical factor in maintaining cash flow. With projections indicating a modest rise in default risk within the US technology sector in 2024, CFOs must remain vigilant in monitoring client creditworthiness.

- Market Risk: Evaluating how fluctuations in market conditions can impact your business is essential. As observed, the apparel retail sector experienced the largest drop in median probability of default scores, decreasing by 0.7 percentage points to 7.7% at the end of Q3 2024, indicating a need for companies to adapt their strategies in light of evolving market dynamics.

- Liquidity Risk: This pertains to your ability to meet short-term obligations without the need to sell assets at a loss, which could jeopardize economic stability. Understanding liquidity positions will be crucial as economic conditions shift in 2024.

- Operational Threat: Identifying dangers related to internal processes—such as system failures or fraud—can prevent substantial monetary losses. A proactive approach to operational challenges can lead to improved efficiency and reduced exposure.

Additionally, the default rate among US oil & gas firms is expected to decline further in 2024, positioning it as a favorable outlier among industries, which underscores the differing trends in economic uncertainties across sectors. By systematically identifying these diverse challenges, businesses can implement tailored strategies through business financial risk assessment to mitigate potential impacts, ensuring resilience and sustained profitability in the face of changing economic landscapes.

Analyzing Financial Risks: Techniques and Tools

Effectively assessing economic uncertainties is essential for any entity, and several methods can be utilized to ensure thorough evaluation:

- Uncertainty Matrix: Implement an uncertainty matrix to systematically evaluate the likelihood and impact of each identified challenge. Tailoring this matrix to particular team requirements permits a clearer depiction of distinct appetite for uncertainty and operational hurdles, responding to the differing levels of tolerance across various groups.

- Scenario Analysis: This method allows entities to evaluate the possible impacts of different scenarios on their economic condition. By examining various outcomes, CFOs can plan strategically for a range of future scenarios, ensuring that their economic approaches are resilient.

- Stress Testing: Conducting stress tests is essential to understand how your business would perform under extreme conditions. This proactive method aids in detecting vulnerabilities that might not be apparent under typical operational conditions, enabling entities to strengthen defenses before crises arise.

- Financial Ratios: Employing financial ratios is a fundamental component of analysis, offering insights into liquidity, profitability, and solvency metrics. These ratios provide a clear snapshot of a company’s health and can indicate areas requiring attention, which is especially important considering that only 10% of insider management budgets, averaging $63,383 per incident, are allocated to pre-incident activities.

In light of recent developments, including a report showing that 52% of cybersecurity professionals have encountered a rise in attacks compared to last year, the necessity for strong management strategies has never been more urgent. As highlighted by BusinessWire, entities must adapt to this growing threat landscape. Moreover, the inability to utilize rigorous data analytics for market intelligence is emerging as a new challenge that CFOs must address.

By utilizing these methods, organizations can conduct a business financial risk assessment to acquire a deeper understanding of their monetary challenges and make informed choices that protect their future.

Creating Proactive Plans for Financial Risk Mitigation

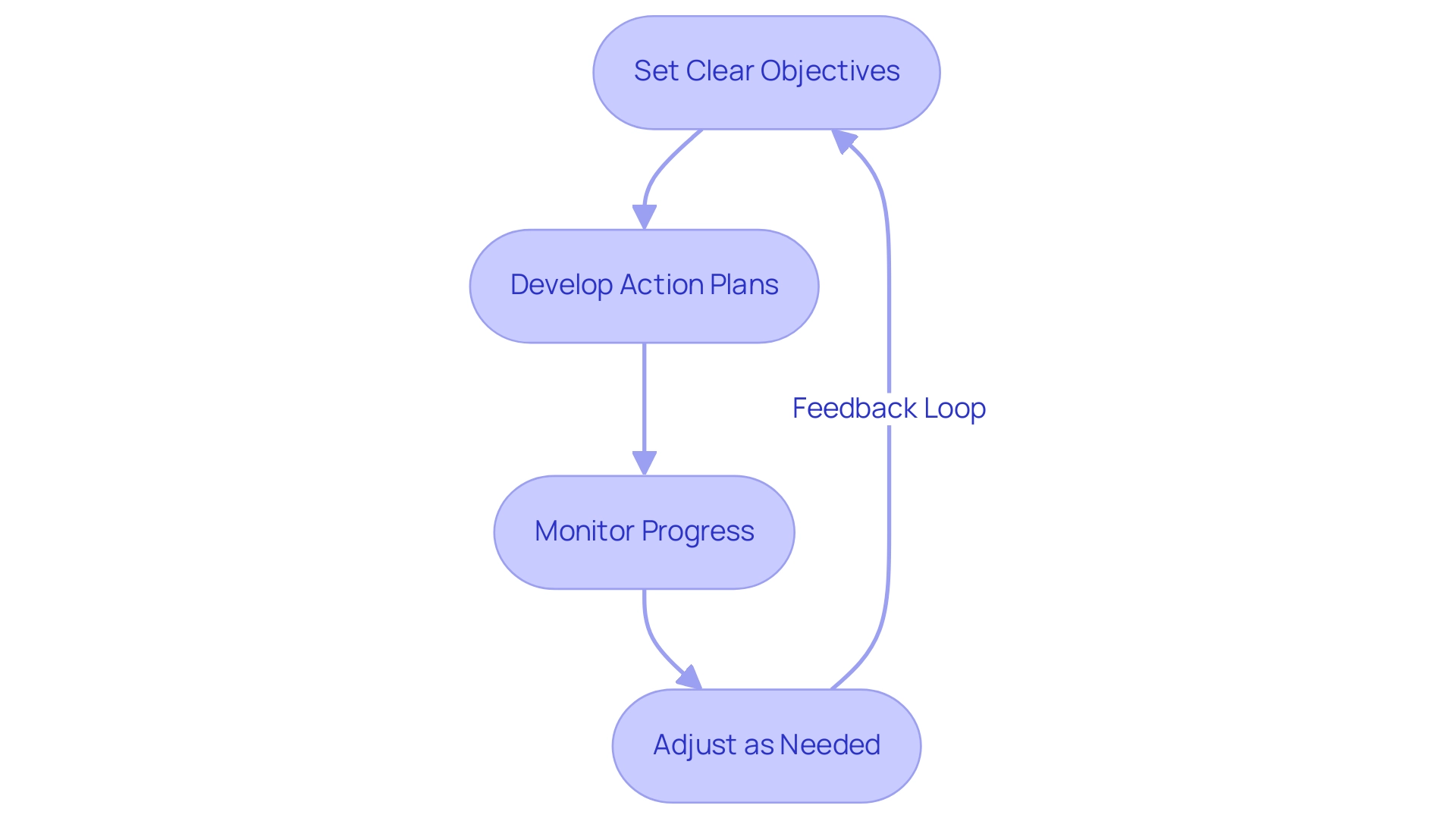

To effectively create proactive financial threat mitigation plans, CFOs should follow these structured steps:

-

Set Clear Objectives: Clearly define what success looks like for mitigating each identified hazard. This clarity will guide your team and provide a benchmark for measuring progress.

-

Develop Action Plans: For each identified threat, outline specific actions that will reduce its likelihood or impact. A thorough business financial risk assessment, similar to our Financial Assessment service, can help identify opportunities to preserve cash and reduce liabilities, ensuring these action plans are tailored to the unique context of your organization.

- Assign Responsibilities: Designate specific team members to oversee the implementation of management strategies related to potential issues. This accountability ensures that there are clear points of contact for each aspect of the plan.

-

Monitor Progress: Establish key performance indicators (KPIs) to measure the effectiveness of your mitigation plans. As emphasized in the latest reports, tracking these KPIs is essential as 92% of leaders in security closely follow cyber developments to stay ahead of potential threats. Additionally, as per Venminder, 66% of respondents have formal procedures established to evaluate residual threat, highlighting the significance of organized monitoring.

-

Adjust as Needed: Be prepared to revise your plans based on ongoing assessments and changing business conditions. This flexibility is essential given the current landscape where only 44% of organizations conduct thorough audits of third-party data handling practices. This statistic emphasizes the necessity for regular audits to ensure that mitigation plans are effective and responsive to evolving threats.

Additionally, the recent case study revealing that 52% of surveyed cybersecurity professionals reported experiencing more cyberattacks compared to the previous year highlights the escalating threat landscape. This trend highlights the significance of proactive risk management strategies, including business financial risk assessment, that not only protect assets but also improve long-term stability and resilience in an increasingly complex environment. Collaborative planning and decisive actions are essential in stabilizing financial positions and enhancing operations, ensuring that your organization is well-prepared to navigate these challenges.

Conclusion

Understanding and managing financial risks is crucial for organizations aiming to thrive in today's dynamic environment. By identifying various risk types such as:

- Market risks

- Credit risks

- Liquidity risks

- Operational risks

CFOs can build a robust foundation for effective financial risk assessment. The step-by-step guide outlined in this article emphasizes the importance of:

- Collaboration

- Prioritization

- Ongoing review

This enables organizations to stay ahead of potential financial pitfalls.

Moreover, employing analytical techniques like:

- Risk matrices

- Scenario analysis

- Stress testing

provides deeper insights into the organization's vulnerabilities and strengths. With proactive planning and clear objectives, organizations can develop tailored action plans that not only mitigate risks but also enhance their overall resilience against financial uncertainties.

As businesses continue to face evolving challenges, particularly in the realm of cybersecurity and market volatility, adopting a comprehensive financial risk management strategy is not just a necessity but a strategic advantage. By embracing these insights and strategies, CFOs can position their organizations for sustainable growth, ensuring they are well-equipped to navigate the complexities of the financial landscape in 2024 and beyond.

Frequently Asked Questions

What is financial uncertainty?

Financial uncertainty refers to the possibility of monetary loss linked to investments or business activities, arising from various sources such as market fluctuations, credit defaults, and operational inefficiencies.

What are the main categories of monetary uncertainties?

The primary categories of monetary uncertainties include: Market Uncertainty (losses due to fluctuations in market prices affecting investment portfolios), Credit Uncertainty (risk of a borrower defaulting on a loan, impacting lending institutions' stability), Liquidity Concern (threat of failing to meet short-term obligations, leading to operational interruptions), and Operational Concern (risks stemming from internal processes, personnel, and systems that may fail or be inadequate).

Why is understanding financial uncertainty important for Chief Financial Officers (CFOs)?

CFOs need to understand financial uncertainties to implement effective business financial risk assessment strategies, which are crucial for managing potential monetary challenges.

How can geopolitical events influence market stability in 2024?

Geopolitical events can disrupt market stability, making it increasingly important for organizations to comprehend and prepare for financial uncertainties as they approach 2024.

What steps should be taken for a comprehensive business financial risk assessment?

The steps for a comprehensive business financial risk assessment include: 1. Identify Threats, 2. Prioritize Threats, 3. Analyze Risks, 4. Document Findings, 5. Develop Action Plans, 6. Review and Revise.

How can companies identify potential monetary challenges?

Companies can identify potential monetary challenges by gathering their finance team to brainstorm and using real-time analytics to spot trends and anomalies that may indicate emerging risks.

What is the significance of prioritizing threats in financial risk assessment?

Prioritizing threats helps organizations focus on the most likely and impactful risks to their financial health, allowing for more effective resource allocation and strategic planning.

What techniques should be used to analyze risks?

Both quantitative and qualitative techniques should be employed to evaluate the potential effects of each threat on the organization's economic performance.

Why is it essential to document findings from the risk assessment?

Documenting findings provides a reference for future decision-making and serves as a basis for developing actionable plans to address identified risks.

How should organizations adapt their risk assessments over time?

Organizations should regularly revisit and update their monetary threat evaluations as business conditions evolve, ensuring that their risk management strategies remain relevant and effective.