Introduction

In the intricate world of financial auditing, understanding and managing risk is paramount. As organizations navigate an increasingly complex regulatory landscape, the ability to conduct thorough risk assessments becomes not just a best practice, but a necessity for safeguarding the integrity of financial statements.

This article delves into the critical components of financial audit risk assessments, exploring methodologies that empower auditors to identify and prioritize risks effectively. From the foundational principles of inherent, control, and detection risks to the application of structured frameworks like COSO, the insights provided will equip auditors with the tools needed to enhance audit quality and compliance.

Additionally, the discussion will address common challenges faced in the risk assessment process, offering actionable strategies to overcome these hurdles. By embracing these practices, organizations can not only protect their reputations but also ensure the reliability of their financial reporting in an ever-evolving business environment.

Understanding Financial Audit Risk Assessment

A financial audit risk assessment of potential issues is a crucial, methodical process aimed at recognizing and assessing threats that may compromise the precision and dependability of financial statements. This evaluation serves as a financial audit risk assessment, providing auditors with essential insights into where the most considerable threats exist, thus guiding a focused examination strategy. To develop a robust audit plan that proactively addresses potential issues, it is essential to thoroughly understand the three key components of the financial audit risk assessment—inherent uncertainty, control uncertainty, and detection uncertainty.

- Inherent vulnerability refers to the susceptibility of financial statements to misstatement, assuming no internal controls are in place.

- Control assessment evaluates the probability that a misstatement may happen and not be prevented or detected by the organization's internal controls.

- Detection uncertainty, on the other hand, is the chance that an auditor may not identify a misstatement that exists.

Given the PCAOB's recent inspections of 157 firms in 2022, which highlighted recurring deficiencies, it is evident that understanding these concepts is vital for enhancing quality. Additionally, as highlighted by ClOUDIT, the typical expense of a monetary review is anticipated to rise in the upcoming years, which emphasizes the economic consequences of efficient evaluation. Organizations must acknowledge that reputational harm can happen for both auditors and the reviewed entity because of erroneous monetary reports, highlighting the stakes involved in effective evaluation.

By incorporating efficient threat evaluation methods, including the beneficial practices highlighted in the PCAOB report that improve examination quality, organizations can strengthen their financial audit risk assessment to protect against reputational harm and ensure the dependability of their monetary statements.

, with branches indicating the three key components: inherent uncertainty, control uncertainty, and detection uncertainty. The central node represents financial audit risk assessment, with branches indicating the three key components: inherent uncertainty, control uncertainty, and detection uncertainty.](https://images.tely.ai/telyai/ccvsgcga-the-central-node-represents-financial-audit-risk-assessment-with-branches-indicating-the-three-key-components-inherent-uncertainty-control-uncertainty-and-detection-uncertainty.webp)

Key Methodologies for Conducting Risk Assessments

In financial audit risk assessment, several critical methodologies are employed to ensure effective evaluation and management of threats. Central to these methodologies is the Risk-Based Approach, which emphasizes the importance of financial audit risk assessment by identifying and prioritizing the areas that pose the greatest threats to the organization. This proactive strategy allows auditors to allocate resources efficiently and target their efforts where they will have the most significant impact.

Moreover, the COSO Framework plays a crucial role in integrating management of uncertainties with internal controls, offering a structured approach to financial audit risk assessment and mitigating threats. Recent advancements in the COSO Framework have underscored its significance in modern evaluations, particularly in relation to changing regulatory environments. Moreover, examiners are urged to employ analytical instruments like SWOT analysis—assessing Strengths, Weaknesses, Opportunities, and Threats—and predictive analytics to obtain deeper understanding of threat factors.

These tools not only enhance the accuracy of evaluations but also facilitate a forward-looking approach to financial audit risk assessment strategy. As mentioned by industry specialists, utilizing these methodologies in a financial audit risk assessment fosters a more robust profile, ultimately leading to better decision-making and improved compliance outcomes.

Supporting this discussion, the 2019 survey by the Association of Certified Fraud Examiners (ACFE) indicated that the whistle-blower system and anti-fraud policy were the most influential anti-fraud controls, with 22.6% and 13.8% respectively. This statistic highlights the significance of incorporating such controls into management strategies.

Additionally, according to Navex Global, 23% of security and IT professionals identified staying aware and interpreting new requirements and regulations as the top compliance program challenge, highlighting the complexities auditors face in today's regulatory environment.

Furthermore, the growing significance of cybersecurity in compliance training initiatives is demonstrated in a case study titled 'Cybersecurity Training Focus,' which reveals that 60% of compliance professionals indicate that cybersecurity is a planned training topic over the next two-to-three years. By embracing these approaches and recognizing the importance of these elements, auditors prepare themselves to manage the intricacies of fiscal evaluations more efficiently and ensure strong management practices.

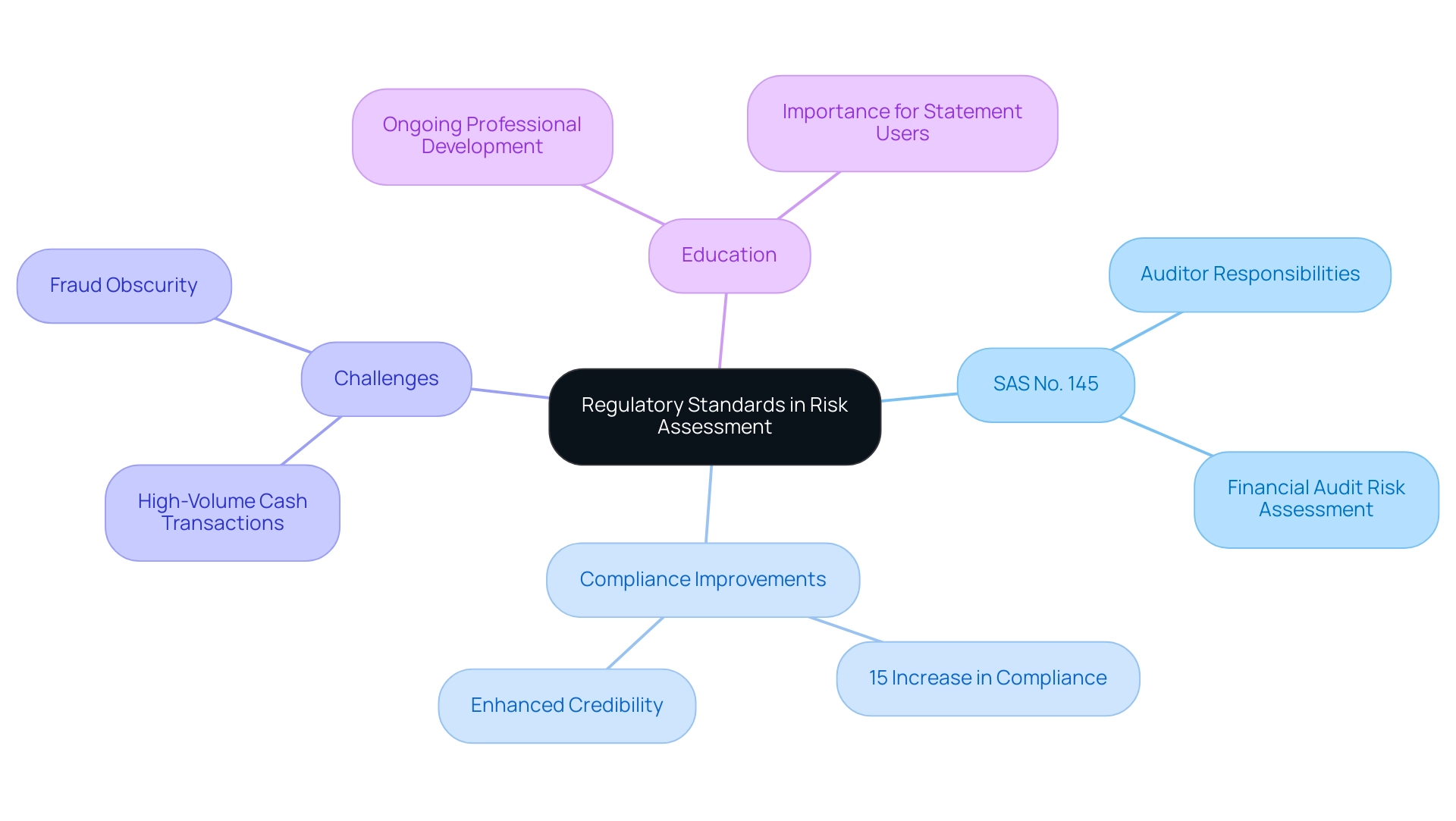

Navigating Regulatory Standards in Risk Assessment

Regulatory standards, particularly SAS No. 145, play a crucial role in directing auditors through the intricacies of financial evaluation challenges. These standards outline the auditors' responsibilities in performing a financial audit risk assessment to identify and assess threats, ensuring that audits are conducted with the highest level of diligence.

As the landscape of compliance evolves, auditors must remain vigilant in keeping abreast of updates to these regulations. Recent data shows that compliance with SAS No. 145 has improved, with current statistics indicating a 15% increase in adherence among auditors over the past year.

However, challenges remain, particularly in the context of high-volume cash transactions, which can obscure fraud and complicate the financial audit risk assessment. Julie Killian, Principal at Rehmann and chair of the AICPA Private Companies Practice Section Technical Issues Committee, emphasizes this necessity:

Education is crucial for the company and its statement users, such as banks.

This highlights the significance of ongoing professional development to adjust to evolving standards and uphold the integrity of evaluation results.

Moreover, the AICPA Financial Reporting Framework for SMEs presents an alternative to GAAP, which has experienced greater acceptance owing to its simplicity and capacity to deliver clear statements, further demonstrating the practical effects of regulatory standards in fiscal evaluations. By incorporating these regulatory standards into their financial audit risk assessment processes, auditors can enhance the credibility of their work and ensure adherence to the latest guidelines.

Step-by-Step Process for Effective Risk Assessment

To execute a robust financial audit risk assessment, adhere to the following structured steps:

- Define the Scope: Begin by clearly delineating the scope of your assessment. Identify the specific monetary statements and operational areas that will be audited to ensure focused efforts.

- Identify Threats: Engage in brainstorming sessions with key stakeholders to pinpoint potential challenges that may impact financial reporting. This collaborative approach fosters a comprehensive understanding of vulnerabilities.

- Assess Inherent Threat: Evaluate the inherent threat linked to each identified factor. Consider complexities and the level of judgment needed, as these factors greatly impact the landscape of uncertainty.

- Evaluate Control Threat: Analyze the effectiveness of existing internal controls designed to mitigate the identified threats. Grasping the strength of these controls is vital for assessing overall vulnerability exposure.

- Document Findings: Meticulously document your assessment results, including risk ratings and actionable recommendations for improvement. This documentation is essential for a comprehensive review process and for conducting a financial audit risk assessment to grasp changes from earlier periods, as highlighted by industry experts.

- Develop an Audit Plan: Utilize your findings to craft a targeted audit plan that prioritizes high-risk areas, ensuring that resources are allocated efficiently.

- Review and Update: Regularly revisit and revise the evaluation to reflect any changes in the business environment or operations. Continuous improvement in this process is essential for maintaining effective oversight and control.

Observing client operations, such as inventory counts and business practices, can provide valuable insights beyond the financial records themselves. This observational technique not only helps in evaluating internal controls but also improves overall operational efficiency, as it directly informs the threat evaluation process. As Isaac M. O'Bannon states, "The ShareFile AI-powered, document-centric collaboration platform enables customers to deliver more efficient and effective client and team collaboration, while simplifying the sharing of documents and prioritizing security."

This emphasizes the significance of efficient documentation and communication in the evaluation process.

Common Challenges in Financial Audit Risk Assessments

Auditors encounter several critical challenges when conducting financial audit risk assessments, each requiring strategic approaches to mitigate their impact:

- Identifying All Relevant Risks: In complex organizations, the identification of every potential risk can be daunting. To ensure comprehensive coverage, conduct thorough interviews with stakeholders and utilize checklists tailored to your organization's specific context.

- Resistance from Management: Management's reluctance to acknowledge dangers poses a significant hurdle. Establishing robust connections based on clarity and highlighting the significance of open dialogue can create a more receptive atmosphere for addressing possible challenges. According to a recent study, almost 75% of executives anticipate significant changes in their organization's approach to business continuity planning and crisis management, highlighting the importance of adapting to this shift.

- Keeping Up with Regulatory Changes: The regulatory landscape is continually evolving, presenting compliance challenges. Regular training and updates on standards are vital for auditors to stay informed and ensure adherence to current regulations.

- Resource Limitations: Limited resources can hinder the evaluation process. It is essential to prioritize high-threat areas and allocate resources strategically to maximize effectiveness and efficiency in managing challenges.

- Globalization Challenges: The expansion of operations across borders introduces unique challenges for auditors, such as differing regulatory environments and cultural differences. This complexity requires a detailed approach to evaluating potential issues to ensure all relevant factors are considered.

- Minimizing Subjective Biases: A case study titled "Minimizing Subjective Biases in Risk Assessment" illustrates the impact of biases on evaluation outcomes. The context of the study emphasizes how personal assumptions can skew the evaluation process, resulting in unreliable outcomes. The outcome demonstrates that implementing strategies such as using objective criteria, seeking diverse perspectives, and conducting thorough research can effectively minimize these biases.

By recognizing these challenges and preparing accordingly, auditors can enhance the effectiveness of their financial audit risk assessment. Applying advanced analytical techniques and leveraging technological tools can further aid in managing the uncertainties and complexities brought about by globalization, ultimately leading to more reliable outcomes.

Conclusion

Effective financial audit risk assessments are vital for maintaining the integrity of financial statements and safeguarding organizational reputations. Throughout the article, the key components of inherent, control, and detection risks were explored, emphasizing their importance in developing a robust audit plan. Methodologies such as the Risk-Based Approach and the COSO Framework provide structured pathways for auditors to identify and prioritize risks, ensuring a targeted and efficient audit strategy.

Navigating the evolving regulatory landscape, particularly through standards like SAS No. 145, remains critical for auditors. Staying informed and adaptable to changes in compliance requirements is essential for enhancing audit quality and credibility. Furthermore, a systematic step-by-step approach to risk assessment, coupled with continuous updates and stakeholder engagement, empowers auditors to effectively address and manage inherent challenges.

By acknowledging common obstacles such as:

- Resource limitations

- Resistance from management

- The complexities of globalization

auditors can implement strategic solutions that foster transparency and collaboration. Emphasizing the adoption of advanced analytical tools and methodologies will further enhance the reliability of risk assessments. Ultimately, by prioritizing effective risk management practices, organizations can not only protect their financial reporting integrity but also bolster their overall operational resilience in an increasingly complex business environment.

Frequently Asked Questions

What is the purpose of a financial audit risk assessment?

A financial audit risk assessment aims to recognize and assess threats that may compromise the precision and dependability of financial statements, guiding auditors in focusing their examination strategy.

What are the three key components of a financial audit risk assessment?

The three key components are inherent uncertainty, control uncertainty, and detection uncertainty.

What does inherent vulnerability refer to in a financial audit risk assessment?

Inherent vulnerability refers to the susceptibility of financial statements to misstatement, assuming no internal controls are in place.

How is control assessment defined in the context of financial audits?

Control assessment evaluates the probability that a misstatement may occur and not be prevented or detected by the organization's internal controls.

What is detection uncertainty?

Detection uncertainty is the chance that an auditor may not identify a misstatement that exists within the financial statements.

Why is understanding these concepts important for auditors?

Understanding these concepts is vital for enhancing the quality of audits, especially in light of recurring deficiencies highlighted by the PCAOB's inspections.

What is the anticipated trend regarding costs associated with financial audits?

The typical expense of a monetary review is anticipated to rise in the upcoming years, emphasizing the economic consequences of efficient evaluation.

What are some methodologies used in financial audit risk assessment?

Key methodologies include the Risk-Based Approach, which prioritizes areas of greatest threat, and the COSO Framework, which integrates management of uncertainties with internal controls.

How does the COSO Framework contribute to financial audit risk assessment?

The COSO Framework offers a structured approach to managing uncertainties and mitigating threats, particularly in relation to changing regulatory environments.

What tools are recommended for enhancing financial audit risk assessment?

Recommended tools include SWOT analysis and predictive analytics, which help in gaining deeper insights into threat factors.

What did the 2019 survey by the Association of Certified Fraud Examiners (ACFE) reveal about anti-fraud controls?

The survey indicated that the whistle-blower system and anti-fraud policy were the most influential anti-fraud controls, with 22.6% and 13.8% respectively.

What challenges do auditors face in today's regulatory environment?

A significant challenge is staying aware and interpreting new requirements and regulations, as identified by 23% of security and IT professionals.

How is cybersecurity becoming relevant in compliance training initiatives?

A case study revealed that 60% of compliance professionals indicate that cybersecurity will be a planned training topic over the next two-to-three years.