Introduction

In an increasingly complex financial landscape, organizations must navigate a myriad of risks that threaten their stability and growth. Financial risk assessment emerges as a critical practice that not only identifies potential vulnerabilities but also empowers decision-makers to implement effective strategies for mitigation. With categories ranging from operational and credit risks to regulatory challenges, understanding these nuances is essential for safeguarding an organization’s financial health.

As executives anticipate significant shifts in business continuity planning, the urgency for robust risk management frameworks has never been more pronounced. This article delves into the fundamental concepts of financial risk assessment, offering a comprehensive guide to identifying, categorizing, and managing risks effectively, while also highlighting the tools and continuous monitoring practices that can enhance resilience in an unpredictable environment.

Understanding Financial Risk Assessment: Key Concepts and Importance

Monetary threat evaluation, also known as financial product risk assessment, is a crucial procedure that examines the different hazards impacting an organization’s economic well-being. Understanding key concepts in this area is essential for effective management. Key types of financial risks include:

- Operational Risk: These risks arise from internal processes, systems, and people, leading to potential losses or inefficiencies.

- Credit Exposure: This concern pertains to the possibility of default by counterparties, impacting cash flow and profitability.

- Market Uncertainty: Referring to uncertainties stemming from fluctuations in market prices, this category can significantly affect assets and investments.

The significance of performing regular financial product risk assessments cannot be overstated. They enable organizations to enhance strategic decision-making and allocate resources effectively through a financial product risk assessment that pinpoints vulnerabilities. In fact, 92% of leaders in the field are now closely monitoring developments in cyber threats, reflecting a growing awareness of the need for robust management strategies.

According to Secureframe, "35% of compliance executives recognized regulatory challenges as their primary concerns," highlighting the importance of continuous evaluations to manage intricate regulatory environments.

Moreover, as 75% of leaders expect substantial shifts in their company's strategy for business continuity planning and crisis management, it is evident that a financial product risk assessment is essential for preserving economic stability and promoting long-term growth. A recent case study on the rise in cyberattacks shows that "52% of surveyed cybersecurity experts have encountered more attacks than the prior year," emphasizing the necessity for entities to adopt effective management strategies.

To reduce monetary risk, entities can utilize various strategies, including:

- Insurance

- Investment diversification

- Maintaining emergency funds

- Developing multiple income streams

By applying these evaluations and strategies, organizations can better prepare for potential disruptions and ensure resilience in an increasingly volatile environment.

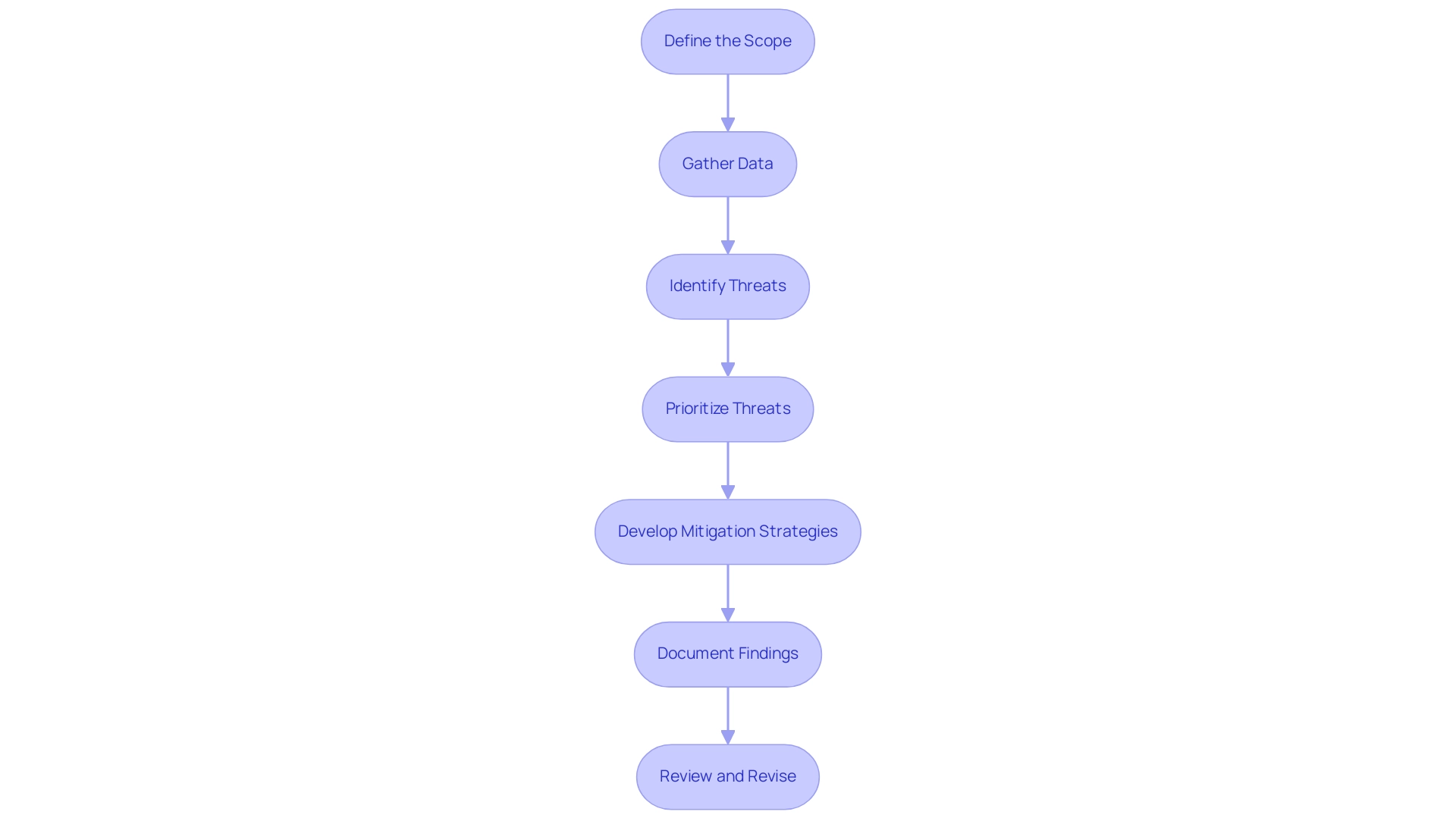

Step-by-Step Guide to Conducting a Financial Product Risk Assessment

- Define the Scope: Start by identifying the particular monetary products that will be included in the financial product risk assessment and clarify the objectives behind this evaluation. This initial step is crucial for focusing efforts effectively.

- Gather Data: Collect comprehensive economic data, encompassing historical performance metrics and current market conditions. Effective data collection is essential for an accurate evaluation, as it lays the foundation for subsequent analysis.

- Identify Threats: Utilize established categories to pinpoint potential hazards associated with each financial product in the financial product risk assessment. This organized method guarantees that no major threat is overlooked. Financial product risk assessment requires evaluating both the potential impact of each identified threat on the organization and the likelihood of its occurrence. This dual assessment offers a clearer comprehension of which dangers could present the greatest threat.

- Prioritize Threats: Use a financial product risk assessment to rank the identified threats according to their significance, allowing you to concentrate on the most critical areas that require immediate attention. This prioritization is essential for effective resource allocation.

- Develop Mitigation Strategies: Formulate action plans to address high-priority risks through various strategies, including financial product risk assessment, risk transfer, avoidance, or reduction. Establishing these strategies is vital for minimizing potential negative impacts on the organization.

- Document Findings: Thoroughly record the evaluation results and the developed strategies in the context of financial product risk assessment. Documentation not only aids future reference but also ensures compliance with regulatory requirements.

- Review and Revise: Set a timeline for periodic evaluations to keep it relevant as conditions change. Ongoing assessment is crucial for sustaining an effective management framework.

Considering that 75% of executives think there will be substantial changes in their entity's approach to business continuity planning, it is vital to highlight the significance of this evaluation process. By quantifying threats in monetary terms, as emphasized by industry specialists, entities can better comprehend the economic consequences of their threats. For example, the case study on 'Derivatives Pricing and Risk Modeling' demonstrates how effective modeling of uncertainties ensures precise pricing of derivatives, which is essential for economic stability and profitability.

By adhering to this methodical strategy, entities can obtain a clearer understanding of their financial challenges, facilitating informed decision-making and promoting enhanced financial stability. Additionally, leveraging real-time analytics through a client dashboard can enhance ongoing performance monitoring and support streamlined decision-making. This allows businesses to quickly adapt to changes, operationalize lessons learned, and effectively execute strategies while continuously updating their assessments based on current data.

Identifying and Categorizing Financial Risks

Financial risks can be distinctly categorized into several key areas, each posing unique challenges that organizations must address:

- Operational Risks: These risks stem from internal processes and systems and include factors such as fraud, system failures, and human errors. The downfall of Barings Bank is a stark reminder of how operational challenges can lead to catastrophic outcomes.

- Credit Risks: This category encompasses the possibility that a counterparty may default on its financial obligations, which can severely impact cash flow and profitability. As credit exposure default rates are projected to evolve across industries in 2024, proactive management in this area is crucial.

- Market Threats: These threats arise from fluctuations in market prices, including interest rates, currency exchange rates, and commodity prices. Understanding these dynamics is essential for safeguarding against potential losses.

- Liquidity Challenges: Organizations encounter liquidity challenges when they cannot meet short-term monetary obligations due to cash flow imbalances. Effective liquidity management is vital for sustaining operations during economic stress.

- Regulatory Challenges: These challenges arise from shifts in laws and regulations that can impact financial performance and compliance. Noteworthy instances encompass substantial legal agreements by Citigroup and JPMorgan Chase associated with Enron and WorldCom, emphasizing the significance of comprehending and handling regulatory challenges. Given the increasing scrutiny from regulatory bodies, staying ahead of these changes is imperative.

By thoroughly identifying and classifying these threats, entities can develop customized strategies to reduce their impacts effectively.

According to Eric Holmquist, a leading authority in operational assessments, understanding these fundamentals is essential for integrating management into strategic planning, especially in relation to financial product risk assessment. Moreover, with 75% of executives expecting significant shifts in their organization’s approach to business continuity planning, there is a pressing need for strong management frameworks that align with these anticipated changes. Establishing robust connections with senior executives can further enhance the influence of professionals, as 54% of them seek to strengthen collaboration for more effective decision-making in management of uncertainties.

Tools and Frameworks for Effective Risk Assessment

For effective monetary threat evaluations, conducting a financial product risk assessment using the appropriate tools and frameworks is crucial. A thorough monetary review can identify opportunities to preserve cash and reduce liabilities, enhancing your overall strategy. Here are several essential tools that can greatly enhance your management strategy:

- SWOT Analysis: This strategic planning instrument allows entities to recognize their strengths, weaknesses, opportunities, and threats (SWOT) associated with monetary products. Its organized method assists CFOs in evaluating internal and external elements that influence monetary stability, ultimately revealing opportunities for cash conservation.

- Threat Matrix: Acting as a visual prioritization instrument, the threat matrix classifies dangers according to their probability and possible effect. This helps in concentrating resources on the most important threats, ensuring that the entity can tackle them quickly and effectively, minimizing potential liabilities.

- Modeling Software: Using tools like Excel or specialized modeling software enables thorough analysis of various economic scenarios and their associated dangers. This ability is essential for informed decision-making and forecasting, ensuring efficiency and value generation.

- Regulatory Compliance Tools: These software solutions are designed to guarantee that entities adhere to monetary regulations and reporting standards, thus minimizing the chance of non-compliance and associated penalties, which can further safeguard cash reserves.

- Data Analytics Platforms: Advanced analytics technologies can process large datasets to uncover trends and potential challenges, enhancing the decision-making process. By examining historical data, entities can more effectively foresee upcoming challenges and apply strategies for mitigation.

Integrating these tools into your financial product risk assessment processes not only enhances their effectiveness but also boosts efficiency in managing monetary challenges. As mentioned by CyberSource, this management solution is adaptable and multi-layered to better fit businesses of various sizes and with diverse requirements, which is essential as organizations maneuver through the changing economic landscape. Significantly, with the predicted value for May 1st, 2024, assessed at 100 with a variance of 2.00% as of April 29, 2024, having strong tools in place is more crucial than ever.

Moreover, Actico's integration with the Avaloq Core banking system illustrates how modern management software can serve enterprise clients, improving their capacity to handle economic uncertainties effectively. Furthermore, the case study of ThreatMetrix illustrates the challenges of integrating management solutions into existing systems, emphasizing the importance of choosing adaptable tools to mitigate churn while maintaining customer intelligence.

To explore how our Financial Assessment service can help you leverage these tools effectively, click here to get started.

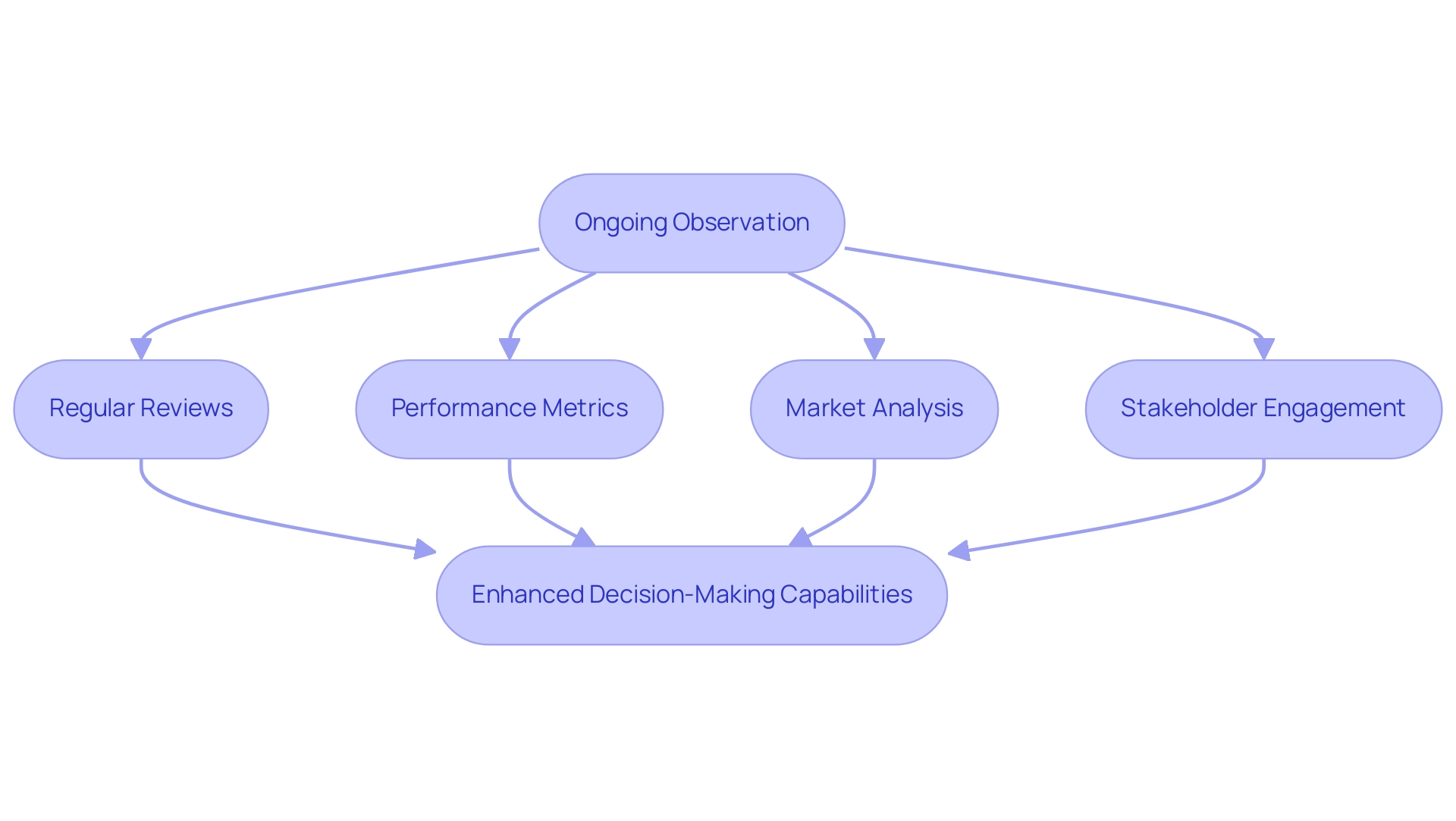

The Role of Continuous Monitoring in Financial Risk Management

Ongoing observation is essential for entities seeking to adjust to the constantly changing economic environment. It includes frequently evaluating and revising evaluations to ensure they stay pertinent and efficient. Essential practices to implement include:

- Regular Reviews: Establish a schedule for periodic assessments, enabling teams to evaluate the ongoing relevance of identified threats and the effectiveness of mitigation strategies.

- Performance Metrics: Develop key performance indicators (KPIs) to quantitatively measure the success of threat management initiatives, allowing for data-driven adjustments where necessary.

- Market Analysis: Maintain an informed perspective on market trends and regulatory changes, as these factors can significantly influence financial vulnerability profiles.

- Stakeholder Engagement: Actively involve key stakeholders in the monitoring process, ensuring a diverse range of insights and perspectives are considered in decision-making.

As entities move towards transforming threat management practices from manual controls to automated fine-grained controls, the importance of continuous monitoring cannot be overstated. Our team's method facilitates a streamlined decision-making cycle throughout the turnaround process, empowering your entity to take decisive action backed by real-time business analytics provided through our client dashboard. This ongoing oversight is crucial, as Rebecca Kappel emphasizes, stating,

Many businesses depend significantly on external vendors, and these partnerships carry their own set of challenges.

Ongoing vendor assessment allows companies to track and oversee vendor performance continuously, ensuring that third-party dangers don’t go unnoticed. This proactive approach helps prevent compliance issues and service disruptions resulting from vendor vulnerabilities, safeguarding the entity against external threats. In fact, the case study titled 'Better Vendor Risk Management' illustrates how continuous oversight of vendor performance can help avert compliance issues and service disruptions, thereby protecting the business from external threats.

By committing to continuous monitoring, organizations can adeptly conduct financial product risk assessments and swiftly adapt to emerging challenges, ultimately preserving business health and enhancing decision-making capabilities.

Conclusion

In today's dynamic financial landscape, conducting thorough financial risk assessments is paramount for organizations aiming to maintain stability and foster growth. This article has outlined the critical components of financial risk assessment, including the identification and categorization of risks such as:

- Operational risks

- Credit risks

- Market risks

- Liquidity risks

- Regulatory risks

By understanding these categories, organizations can develop tailored strategies to mitigate potential threats effectively.

The step-by-step guide provided emphasizes the importance of a structured approach to risk assessment, from defining the scope and gathering data to prioritizing risks and developing mitigation strategies. Utilizing tools like:

- SWOT analysis

- Risk matrices

- Financial modeling software

can further enhance the effectiveness of these assessments, ensuring that organizations remain agile and informed in their decision-making processes.

Moreover, the role of continuous monitoring cannot be overstated. Regularly reviewing risk assessments and engaging stakeholders ensures that organizations can adapt to evolving market conditions and regulatory changes. This proactive approach not only safeguards against compliance issues but also strengthens overall risk management frameworks.

Ultimately, embracing a comprehensive financial risk assessment strategy is essential for organizations seeking to navigate uncertainties and seize new opportunities. By prioritizing risk management and leveraging the right tools, businesses can enhance their resilience and secure a more stable financial future. Now is the time for organizations to take decisive action and integrate robust risk management practices into their strategic planning.

Frequently Asked Questions

What is monetary threat evaluation?

Monetary threat evaluation, also known as financial product risk assessment, is a process that examines the various hazards impacting an organization’s economic well-being.

What are the key types of financial risks?

The key types of financial risks include: Operational Risk (risks arising from internal processes, systems, and people), Credit Exposure (the possibility of default by counterparties affecting cash flow and profitability), and Market Uncertainty (uncertainties from fluctuations in market prices that can impact assets and investments).

Why is performing regular financial product risk assessments important?

Regular financial product risk assessments enhance strategic decision-making and help organizations allocate resources effectively by identifying vulnerabilities.

What percentage of leaders monitor developments in cyber threats?

92% of leaders in the field are closely monitoring developments in cyber threats, indicating a growing awareness of the need for effective management strategies.

What challenges do compliance executives recognize as primary concerns?

According to Secureframe, 35% of compliance executives recognized regulatory challenges as their primary concerns, highlighting the need for continuous evaluations.

What strategies can entities use to reduce monetary risk?

Entities can utilize several strategies to reduce monetary risk, including insurance, investment diversification, maintaining emergency funds, and developing multiple income streams.

What are the steps involved in conducting a financial product risk assessment?

The steps involved in conducting a financial product risk assessment include: 1. Define the Scope, 2. Gather Data, 3. Identify Threats, 4. Prioritize Threats, 5. Develop Mitigation Strategies, 6. Document Findings, 7. Review and Revise.

How can entities ensure their financial product risk assessment remains relevant?

Entities can ensure their financial product risk assessment remains relevant by setting a timeline for periodic evaluations to adapt to changing conditions.

What role does real-time analytics play in financial product risk assessment?

Real-time analytics through a client dashboard enhances ongoing performance monitoring, supports streamlined decision-making, and allows businesses to quickly adapt to changes.