Introduction

In an increasingly complex financial landscape, the threat of financial terrorism looms large, necessitating a robust approach to risk assessment. Organizations must navigate a myriad of compliance regulations while safeguarding their stability and reputation against potential financial crimes.

With alarming statistics underscoring the persistent danger, it becomes imperative for financial institutions to implement comprehensive risk assessment strategies that not only identify vulnerabilities but also fortify defenses against evolving threats. By leveraging advanced technologies and fostering a culture of continuous improvement, organizations can enhance their risk management frameworks, ensuring they remain resilient in the face of adversity.

This article outlines essential steps for conducting effective financial terrorism risk assessments:

- Defining objectives

- Embracing innovative solutions

These steps equip organizations with the tools needed to thrive in a challenging environment.

Understanding Financial Terrorism Risk Assessment

Monetary terrorism threat evaluation is an essential process that assesses the possible dangers presented by economic crimes, emphasizing the need for a financial terrorism risk assessment solution to protect a company's stability and reputation. The recent statistics indicate that despite a 17% decrease in attributed deaths, IS and its affiliates were responsible for 1,636 deaths in 2023, solidifying their status as the deadliest terrorist group. This reality highlights the significance of vigilance in fiscal supervision, especially for entities that must navigate the complexities of compliance and risk management.

For example, a recent case study named 'Suspicious Activity Report Initiates Material Support of Terrorism Investigation' demonstrates how a Suspicious Activity Report (SAR) can initiate inquiries into material support for terrorism, emphasizing the essential role of fiscal oversight in national security issues. By thoroughly understanding the manifestations of monetary terrorism, including common issues like money laundering and fraud, groups can better strengthen themselves against these significant threats. Key elements of a successful terrorism threat evaluation involve:

- Clearly outlining the assessment's scope

- Recognizing potential weaknesses

- Assessing the impacts of these threats on the entity’s operations and compliance responsibilities

As expressed by the Executive Board of the IMF, policymakers need a fuller view of the consequences of illicit flows, including tallies of the fiscal, monetary, and structural costs. This emphasizes the necessity for entities to take a proactive approach in evaluating the financial terrorism risk assessment solution, ensuring they are well-prepared to manage the complexities of the economic landscape. Additionally, input is requested regarding the suitability of a six-month effective date from the release of the final rule, which could affect compliance schedules for entities as they adjust to changing monetary terrorism evaluation requirements.

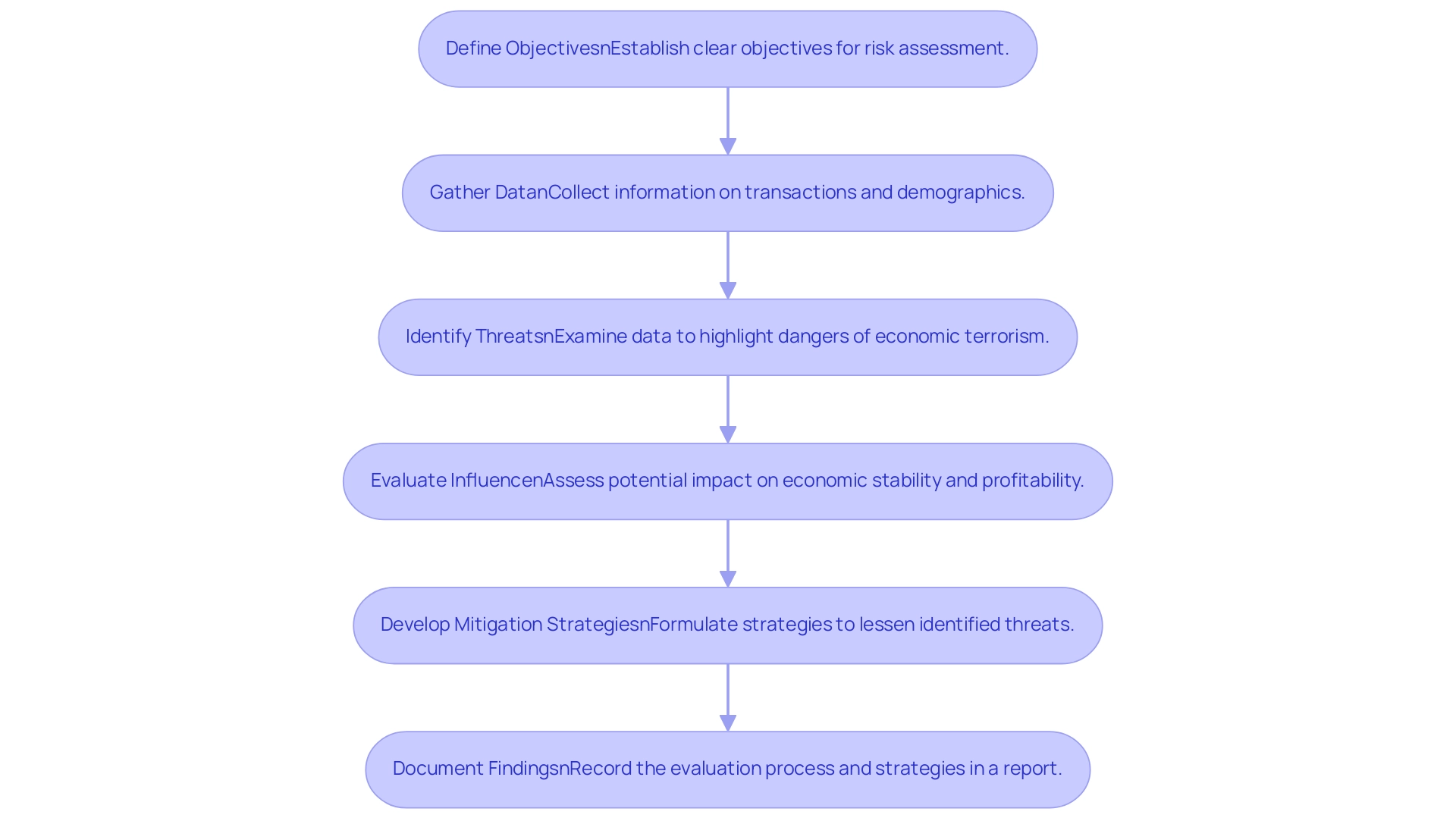

Step-by-Step Implementation of Risk Assessment Solutions

-

Define Objectives: Begin by establishing clear objectives for your risk assessment. This involves identifying specific objectives, such as assessing vulnerabilities related to economic terrorism and utilizing a financial terrorism risk assessment solution to understand the potential monetary implications for your organization. A well-defined objective sets the stage for a focused analysis.

-

Gather Data: Collect comprehensive information on monetary transactions, customer demographics, and industry benchmarks. This data acts as the basis for informed decision-making and assessment. Employing advanced data gathering techniques is crucial, as they offer the insights required for a financial terrorism risk assessment solution to recognize unusual transaction patterns that may suggest terrorism risks.

-

Identify Threats: Examine the collected information to highlight possible dangers associated with economic terrorism. Focus on detecting unusual transaction patterns, high-risk jurisdictions, and any anomalies that deviate from standard operational behaviors. Comprehending these hazards is essential for developing a financial terrorism risk assessment solution.

-

Evaluate Influence: Assess the potential influence of the identified threats on your entity’s economic stability and regulatory adherence. This involves predicting potential consequences and determining how these uncertainties may affect profitability and operational integrity. Utilizing simulation analysis can aid in forecasting future scenarios, as noted by Bhanu Surya Shivakumar, who emphasizes that such analyses allow businesses to project their assets and liabilities effectively over extended periods. Furthermore, it’s crucial to balance uncertainty and profitability, rewarding good credit scores with lower interest rates, which can enhance your organization’s overall financial health.

-

Develop Mitigation Strategies: Formulate robust strategies to lessen the identified threats. This may involve implementing improved due diligence procedures, refining customer verification protocols, and offering specialized training for employees on identifying and responding to warning signs as part of a financial terrorism risk assessment solution. Incorporating findings from case studies, such as the SWOT analysis for strategic decision-making, can further inform the development of these strategies by helping organizations understand their risk landscape.

-

Document Findings: Finally, record the entire evaluation process, including findings and mitigation strategies, in a formal report. This documentation not only ensures compliance but also serves as a valuable reference for future assessments. By keeping a comprehensive record, you can monitor progress and modify strategies as needed, aligning with best practices in management.

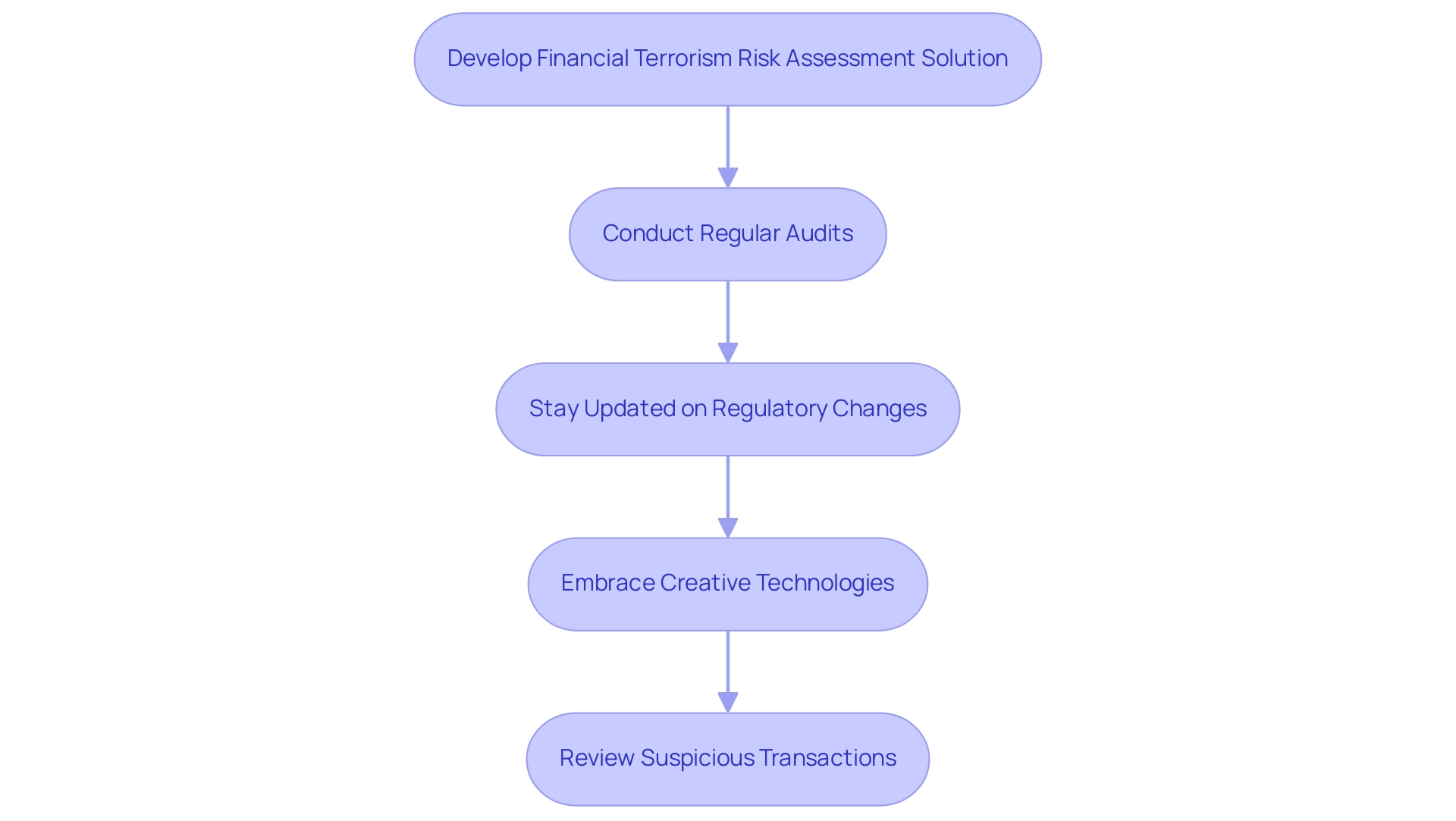

Navigating Regulatory Requirements for Risk Assessments

Adherence to regulations like the USA PATRIOT Act and the Bank Secrecy Act is essential for organizations engaged in services related to finance. These regulations necessitate monetary organizations to develop a financial terrorism risk assessment solution that focuses on recognizing and reducing threats associated with money laundering and terrorist funding. With FinCEN's appropriated budget for fiscal year 2024 set at $190,193,000—potentially representing an opportunity cost of up to 1.57% of current activities annually—institutions must recognize the implications of compliance.

To navigate the changing environment of regulatory obligations, businesses must stay alert to the latest alterations affecting their financial terrorism risk assessment solution for 2024. Regular audits and evaluations not only promote compliance but also show due diligence to regulators. FinCEN emphasizes that "the intention of the proposed program rule is to mitigate the potential for these kinds of distortions of covered institutions' incentives, whether from information asymmetries or externalities, to limit the effectiveness of their AML/CFT programs individually and consequently the national AMF/CFT regime."

By embracing creative technologies and methods as promoted by FinCEN, organizations can enhance their internal controls and bolster their evaluation processes using a financial terrorism risk assessment solution. Additionally, ongoing reviews of suspicious transactions play a crucial role in enhancing these controls, ultimately fostering a more resilient compliance framework.

Leveraging Technology for Effective Risk Management

Organizations today can significantly enhance their financial terrorism risk assessment solution by adopting cutting-edge technologies such as data analytics, machine learning, and tailored software solutions. These tools facilitate streamlined decision-making and automate data collection and analysis of transaction patterns, effectively flagging suspicious activities for further scrutiny. With the B2B Payments Industry anticipated to produce revenues surpassing $2.1 trillion by 2032, the necessity for thorough management strategies is crucial.

Continuous monitoring through real-time analytics is crucial, as comprehensive market data and in-depth regional analysis underscore the necessity for these solutions. Our client dashboard offers real-time business analytics, enabling entities to Update & Adjust their strategies promptly. Software as a Service (SaaS) solutions tailored for threat management, such as a financial terrorism risk assessment solution, provide real-time insights and strong reporting capabilities, allowing entities to quickly respond to emerging challenges.

For instance, the case study on Investor Communications Management demonstrates how automated content creation and delivery have improved efficiency and control in managing investor communications, leading to elevated operational excellence. According to Michael Thor, Managing Director in the Internal Audit practice of Protiviti, 'The integration of advanced data analytics into monetary uncertainty management is crucial for operational excellence.' By adopting these technologies, entities not only improve their operational efficiency but also strengthen their overall management strategies, paving the way for a more robust economic framework.

This approach allows teams to Decide & Execute with confidence, ensuring they are prepared for any potential threats.

Continuous Improvement in Risk Assessment Practices

To improve the efficiency of financial terrorism evaluations, entities must develop a financial terrorism risk assessment solution that fosters a culture of ongoing enhancement backed by efficient decision-making and real-time analytics. This approach necessitates regular reviews of risk assessment processes, ensuring methodologies are updated to address emerging threats and incorporating stakeholder feedback. By supporting a shortened decision-making cycle, our entity enables teams to take decisive action to preserve their business.

Leveraging our client dashboard, entities can monitor the success of their plans in real-time, providing crucial business analytics to continuously diagnose their health. Regular training initiatives designed to enhance employee awareness of new challenges and compliance requirements are essential, as they directly support more effective and timely decision-making. Additionally, companies can obtain an instant free score from SecurityScorecard to assess their cybersecurity status, providing practical insights for CFOs.

Additionally, employing key performance indicators (KPIs) is essential; these metrics enable organizations to assess the efficiency of their management strategies and support data-driven modifications as necessary. Tim Stobierski emphasizes the importance of comprehending economic metrics, stating, "To help you become more comfortable understanding and discussing monetary topics, here’s a list of the top metrics managers need to understand." A pertinent case study is NetSuite, which illustrates how streamlined business processes can enhance efficiency and support ongoing improvement in assessment practices.

Furthermore, employing two new loan officers can act as a statistic emphasizing the need for ongoing enhancement and education in monetary management. By fostering an environment of continuous improvement and utilizing real-time analytics, businesses can significantly bolster their resilience against financial terrorism by implementing a financial terrorism risk assessment solution, adapting proactively to the dynamic landscape of financial risks.

Conclusion

In the face of escalating threats from financial terrorism, the importance of rigorous risk assessment cannot be overstated. Organizations must prioritize:

- Defining clear objectives

- Gathering comprehensive data

- Identifying risks

to effectively evaluate their vulnerability to financial crimes. By understanding the implications of these risks, financial institutions can develop robust mitigation strategies that not only protect their operations but also enhance compliance with regulatory requirements.

Embracing innovative technologies such as data analytics and machine learning is essential for streamlining risk management. These tools empower organizations to monitor transactions in real-time, flagging potential threats before they escalate into significant issues. Furthermore, fostering a culture of continuous improvement ensures that risk assessment practices evolve alongside emerging threats, keeping financial institutions agile and resilient.

Ultimately, a proactive approach to financial terrorism risk assessment is not just a regulatory necessity; it is a strategic imperative. By investing in comprehensive risk management frameworks, organizations can safeguard their stability and reputation while navigating an increasingly complex financial landscape. The time to act is now—fortifying defenses against financial terrorism will pave the way for a more secure and prosperous future.

Frequently Asked Questions

What is monetary terrorism threat evaluation?

Monetary terrorism threat evaluation is a process that assesses the potential dangers posed by economic crimes, emphasizing the need for a financial terrorism risk assessment solution to protect a company's stability and reputation.

Why is vigilance in fiscal supervision important?

Vigilance in fiscal supervision is crucial, especially for entities that must navigate the complexities of compliance and risk management, as it helps to mitigate the risks associated with economic terrorism.

Can you provide an example of how fiscal oversight plays a role in national security?

A recent case study titled 'Suspicious Activity Report Initiates Material Support of Terrorism Investigation' demonstrates how a Suspicious Activity Report (SAR) can trigger investigations into material support for terrorism, highlighting the importance of fiscal oversight.

What are common issues associated with monetary terrorism?

Common issues include money laundering and fraud, which can significantly threaten organizations if not properly monitored and managed.

What are the key elements of a successful terrorism threat evaluation?

Key elements include: 1. Clearly outlining the assessment's scope. 2. Recognizing potential weaknesses. 3. Assessing the impacts of these threats on the entity’s operations and compliance responsibilities.

What do policymakers need to understand regarding illicit flows?

Policymakers require a comprehensive view of the consequences of illicit flows, including the fiscal, monetary, and structural costs, to effectively manage the risks associated with economic terrorism.

What is the significance of the six-month effective date mentioned in the article?

The six-month effective date from the release of the final rule could impact compliance schedules for entities as they adapt to changing monetary terrorism evaluation requirements.

What steps are involved in conducting a financial terrorism risk assessment?

The steps include: 1. Define Objectives 2. Gather Data 3. Identify Threats 4. Evaluate Influence 5. Develop Mitigation Strategies 6. Document Findings.

How can organizations identify potential threats in their financial assessments?

Organizations can identify threats by examining collected data for unusual transaction patterns, high-risk jurisdictions, and anomalies that deviate from standard operational behaviors.

Why is it important to document the evaluation process?

Documenting the evaluation process ensures compliance and serves as a valuable reference for future assessments, allowing organizations to monitor progress and adjust strategies as necessary.