Overview

To conduct a financial risk assessment for universities, the process involves systematically identifying potential financial threats, evaluating their impact, and developing mitigation strategies to manage these risks effectively. The article outlines a step-by-step guide that emphasizes the importance of stakeholder engagement, the use of technology for monitoring threats, and the necessity of regular reviews to adapt to changing economic conditions, thereby ensuring the institution's financial stability and resilience.

Introduction

In the realm of higher education, financial stability is paramount, yet it often hangs in the balance due to a myriad of risks. Universities face challenges ranging from fluctuating enrollment numbers to unpredictable government funding, making financial risk assessment an essential practice for safeguarding their future.

This article delves into the critical components of financial risk assessment, outlining a systematic approach that university CFOs can adopt to identify, analyze, and mitigate financial threats. By engaging stakeholders and leveraging technology, institutions can create a dynamic framework that not only addresses current risks but also adapts to the ever-changing financial landscape.

As the importance of proactive financial management continues to rise, understanding these strategies will empower leaders to navigate complexities and ensure their institutions thrive.

Understanding Financial Risk Assessment: Key Concepts and Definitions

The process of financial risk assessment for universities is essential, focusing on the recognition, examination, and prioritization of threats that can negatively impact economic stability. The following key concepts form the backbone of a robust financial risk assessment framework:

- Risk Identification: This involves recognizing that universities may face, such as fluctuating enrollment numbers, changes in government funding, or unexpected expenses that arise from operational inefficiencies.

- Risk Assessment: At this stage, monetary leaders assess the probability and possible consequences of these identified threats. This analytical process is essential for prioritizing which threats require immediate attention and resources in the context of a financial risk assessment for universities.

- Risk Mitigation: Effective strategies are developed to manage or reduce monetary uncertainties. This proactive approach ensures that universities can sustain operations and accomplish their strategic goals by implementing a financial risk assessment for universities to address potential economic challenges.

- Threat Monitoring: Continuous tracking of identified threats and the effectiveness of mitigation strategies is crucial in adapting to changing circumstances. This ongoing vigilance helps institutions remain resilient in the face of evolving economic landscapes.

Grasping these ideas is crucial for university leaders, especially CFOs, as they navigate the intricacies of financial risk assessment for universities. Recent trends indicate a growing focus on these areas, with the number of relevant publications rising from single digits in 1995 to 19 by 2023. This increase indicates a greater awareness of the significance of financial risk assessment for universities within the higher education sector.

A systematic review titled "Monetary Threat Early Warning in Higher Education Institutions" identifies primary sources of economic vulnerability such as instability in fundraising, decreased monetary allocation, and intensified market competition. By understanding these foundational concepts and staying informed on current trends, university CFOs can enhance their financial risk assessment for universities to better protect their institutions' economic futures. As one student observed, there is a need for 'a more inviting space' in tackling these monetary challenges, emphasizing the significance of a supportive atmosphere in managing economic uncertainties.

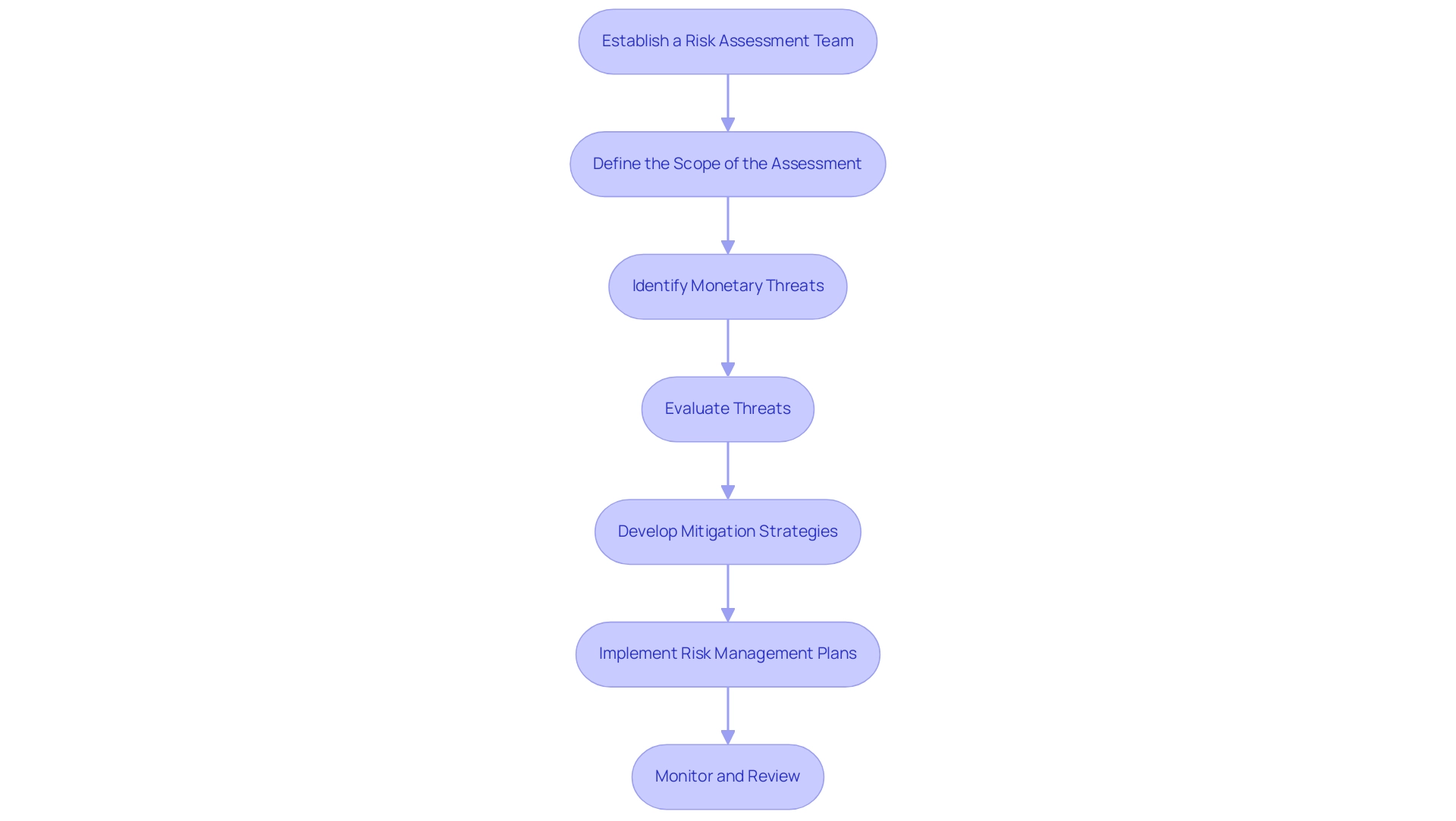

Step-by-Step Process for Conducting a Financial Risk Assessment

- Establish a Risk Assessment Team: Assemble a team that includes essential stakeholders such as the CFO, budget analysts, department heads, and compliance officers. This diverse representation ensures a comprehensive understanding of the economic landscape and promotes a culture of shared responsibility in risk management.

- Define the Scope of the Assessment: Clearly outline the areas of the university to be evaluated, placing emphasis on critical monetary operations, diverse funding sources, and expenditure patterns. A well-defined scope will facilitate a focused assessment that addresses the most significant risks.

- Identify Monetary Threats: Participate in cooperative brainstorming sessions to pinpoint potential monetary threats. Utilize historical data, market trends, and insights from economic specialists to guide discussions, ensuring a thorough identification process.

- Evaluate Threats: For each identified threat, assess its likelihood of occurrence alongside its potential financial impact. Utilize a matrix to categorize these threats into low, medium, and high priority, aiding in strategic decision-making and resource allocation.

- Develop Mitigation Strategies: For threats classified as high priority, create actionable mitigation strategies. This could involve diversifying funding sources, strengthening budgetary controls, or enhancing enrollment strategies to protect economic stability.

- Implement : Assign clear responsibilities to team members for executing the identified mitigation strategies, ensuring that timelines and accountability measures are well defined. This step is essential for encouraging a proactive method to managing monetary uncertainties. It is essential to note that responsibilities for authorizing transactions, maintaining custody of assets, recording transactions, and managing related assets should be divided to minimize exposure, a principle emphasized by the Office of the Controller.

- Monitor and Review: Establish a regular schedule for evaluating the financial assessment, adapting strategies as necessary in response to new data, emerging threats, or shifts in the financial landscape. Ongoing monitoring guarantees that management practices stay pertinent and efficient. Concerns can be reported confidentially or anonymously through the Ethics & Compliance Helpline, as noted by Stanford.

Additionally, the concept of separation of duties is illustrated in a case study where multiple individuals are required to complete a single task, thereby minimizing the chance of error or inappropriate actions. This control activity improves responsibility and oversight in monetary operations.

By following these systematic steps, universities can carry out a financial risk assessment for universities that not only recognizes potential dangers but also provides them with strong tools for effectively managing these challenges.

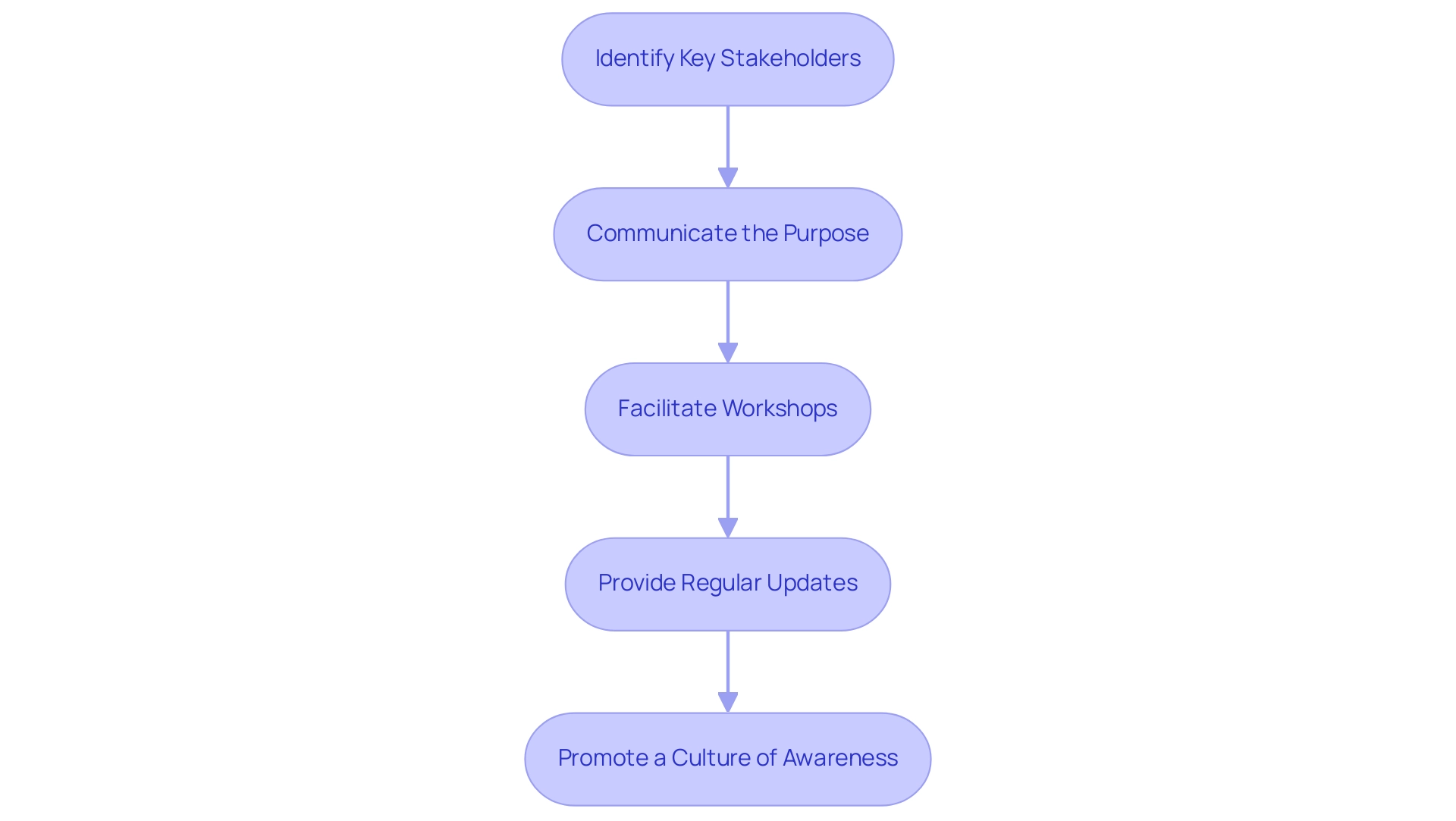

Engaging Stakeholders in the Risk Assessment Process

-

Identify Key Stakeholders: Begin by identifying the individuals and groups within the university who will be most influenced by the financial risk assessment for universities. This encompasses finance divisions, operations groups, procurement, and outside parties, all of whom play essential roles in the evaluation process. As highlighted in the case study on participant engagement in capital forecasting, incorporating diverse perspectives enhances accuracy and aligns investments with organizational goals. Additionally, conducting a financial risk assessment for universities, which includes services such as , can help identify opportunities to preserve cash and reduce liabilities.

Communicate the Purpose: Clearly convey the objectives of the monetary evaluation to interested parties, highlighting how this process aligns with the university's mission and strategic goals. As 92% of CEOs acknowledge, effective communication regarding potential issues is essential for the long-term success of any project. Highlighting how a thorough financial risk assessment for universities can reduce uncertainties and reveal possible savings will further involve interested parties. Additionally, considering the implications of 5G technology on public health and security, it is crucial to address these concerns in the communication strategy.

-

Facilitate Workshops: Organize collaborative workshops or meetings centered on monetary challenges. Involving interested parties in these conversations enables a thorough recognition of challenges while utilizing varied viewpoints and knowledge. Current trends indicate that universities are increasingly adopting innovative methods to engage stakeholders in planning, making these workshops timely and relevant. During these sessions, emphasize how comprehensive financial evaluations, which may include financial risk assessment for universities, modeling uncertainties, and scenario analysis, can lead to efficiency enhancements and mitigation of potential issues.

Provide Regular Updates: Maintain transparent communication throughout the assessment process by sharing findings and soliciting feedback. Frequent updates guarantee that stakeholders stay involved and supportive, promoting a sense of ownership in the management process. Informing them about cash preservation strategies identified during the fiscal review will keep them invested in the outcome.

Promote a Culture of Awareness: Foster an organizational environment that supports open conversations about monetary challenges. When participants feel capable of expressing concerns and contributing to mitigation strategies, it emphasizes the significance of proactive management of challenges. By actively engaging stakeholders in these steps and referencing current trends and insights from pertinent case studies, universities can significantly improve their financial risk assessment for universities, ultimately resulting in a more resilient and adaptive organizational culture.

Utilizing Technology for Financial Risk Assessment

- Implement Management Software: Leverage advanced management software that incorporates analytics and reporting functionalities. This enables real-time monitoring of performance and the identification of potential risks. A robust software solution can enhance decision-making processes by providing actionable insights derived from real-time data, thus supporting a shortened decision-making cycle crucial during a turnaround process. For instance, such software can automate the analysis of key economic indicators, allowing CFOs to make informed decisions swiftly.

- Data Analytics Tools: Integrate data analytics tools that analyze historical monetary data and emerging trends. By utilizing these tools, CFOs can better foresee future challenges and make informed decisions that enhance fiscal stability and strategic planning. Continuous performance monitoring through these analytics facilitates timely adjustments to operational strategies, fostering resilience.

- : Explore dedicated threat management platforms that offer comprehensive frameworks for identifying, assessing, and monitoring financial threats. These platforms enable a systematic method for conducting a financial risk assessment for universities, ensuring that all possible vulnerabilities are thoroughly managed, which is essential during times of considerable change.

- Automated Reporting: Establish automated reporting systems to streamline the communication of assessment findings to stakeholders. This ensures that critical information is disseminated accurately and promptly, fostering transparency and informed decision-making within the organization, particularly important in a turnaround context.

- Continuous Monitoring Solutions: Utilize technology that supports continuous monitoring of economic metrics through a client dashboard. Such solutions facilitate the early identification of possible hazards and enable prompt interventions, significantly decreasing the likelihood of economic disruptions. The client dashboard provides real-time business analytics that helps in diagnosing business health, reinforcing trust among stakeholders through transparency in performance metrics.

By integrating these technologies into the economic threat evaluation framework, CFOs can boost operational effectiveness, enhance precision in tracking challenges, and react more skillfully to new monetary obstacles. As emphasized by Ali Emrouznejad, a prominent authority in business analytics, "the combination of big data and performance analytics is crucial in enhancing management strategies for educational institutions, thereby facilitating sustainable economic practices." Furthermore, the research named "Factors Affecting the Adoption of Financial Technology at Universities" demonstrates that technological elements significantly influence FinTech adoption, which provides valuable insights for conducting financial risk assessment for universities and managing the intricacies of monetary management in the digital era.

Comprehending these dynamics assists institutions in ensuring effective management of uncertainties and maintaining a competitive edge.

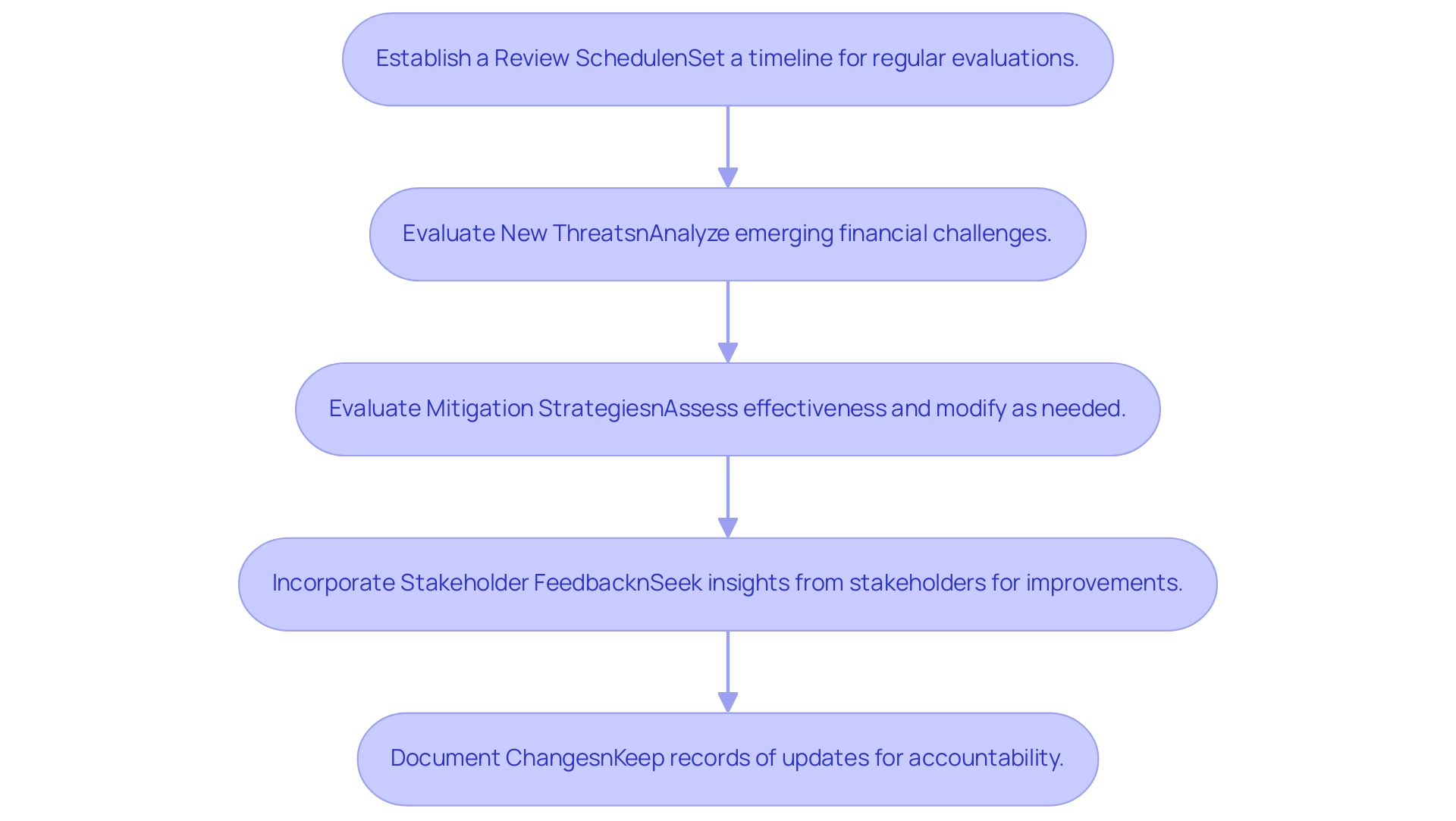

Reviewing and Updating the Risk Assessment

- Establish a Review Schedule: It is crucial to set a specific timeline for carrying out regular monetary evaluations, whether quarterly or annually. This timetable guarantees that your evaluations stay up-to-date and adaptable to changing economic conditions, with impact and likelihood both balanced at 50% each by default.

- Evaluate New Threats: At each review, thoroughly analyze emerging financial challenges that may have arisen since the last evaluation. Take into account shifts in the external environment or changes in university operations that could introduce new vulnerabilities.

- Evaluate Mitigation Strategies: Conduct a detailed analysis of the effectiveness of your current mitigation strategies. Modify these strategies as needed according to performance metrics and participant feedback to improve your management framework.

- Incorporate Stakeholder Feedback: Actively seek insights from stakeholders regarding the relevance and effectiveness of the threat evaluation process. Their feedback is invaluable for refining future evaluations and ensuring that all perspectives are considered.

- Document Changes: Keep detailed records of all updates and modifications made to the hazard evaluation. Recording these changes offers a clear account of how monetary challenges have been handled, which is essential for responsibility and future reference.

By committing to a structured timetable of regular evaluations and updates, universities can transform their monetary assessments into dynamic instruments that effectively support for universities, as well as economic stability and growth. This proactive strategy not only reduces threats but also improves economic resilience. For instance, organizations with tested incident response plans saved an average of $2.66 million in breach costs, underscoring the financial benefits of preparedness.

Additionally, as Guansan Du noted, "Comparison analysis shows that the accuracy of the proposed fusion algorithm is 25% higher than that of the latest CNN (Convolutional Neural Network) algorithm," highlighting the importance of continuously reviewing and improving risk assessment methodologies.

Conclusion

Navigating the complexities of financial risk assessment is crucial for universities aiming to maintain their financial health in an unpredictable environment. By understanding key concepts such as:

- Risk identification

- Analysis

- Mitigation

- Monitoring

CFOs can lay a strong foundation for a robust risk management framework. Engaging stakeholders throughout this process not only enhances the accuracy of risk identification but also fosters a culture of shared responsibility, ensuring that everyone is aligned with the institution's financial objectives.

Implementing a systematic approach to financial risk assessment, including the establishment of a dedicated team and the use of technology, empowers universities to respond proactively to emerging challenges. The integration of advanced financial management software and data analytics tools can streamline processes, enhance decision-making, and facilitate continuous monitoring of financial metrics. This technological leverage is essential for adapting to the fast-paced changes in the higher education landscape.

Finally, maintaining a regular review and update schedule for risk assessments is vital. This practice ensures that financial strategies remain relevant and effective in the face of new risks and changing circumstances. By committing to a dynamic risk management process, universities can not only mitigate potential threats but also position themselves for sustainable growth and success. The time to take decisive action in financial risk assessment is now, as it is the key to safeguarding the future of higher education institutions.

Frequently Asked Questions

What is the purpose of financial risk assessment for universities?

The purpose of financial risk assessment for universities is to recognize, examine, and prioritize threats that can negatively impact their economic stability.

What are the key concepts involved in the financial risk assessment process?

The key concepts include Risk Identification, Risk Assessment, Risk Mitigation, and Threat Monitoring.

What does Risk Identification entail?

Risk Identification involves recognizing potential financial threats such as fluctuating enrollment numbers, changes in government funding, and unexpected operational expenses.

How is Risk Assessment conducted?

Risk Assessment involves analyzing the probability and potential consequences of identified threats to prioritize which require immediate attention and resources.

What is the focus of Risk Mitigation?

Risk Mitigation focuses on developing effective strategies to manage or reduce financial uncertainties, ensuring universities can sustain operations and achieve strategic goals.

Why is Threat Monitoring important?

Threat Monitoring is crucial for continuously tracking identified threats and the effectiveness of mitigation strategies, helping institutions adapt to changing economic circumstances.

How has the focus on financial risk assessment in universities changed over time?

There has been a growing focus on financial risk assessment in universities, with relevant publications increasing from single digits in 1995 to 19 by 2023, indicating greater awareness of its significance.

What are some primary sources of economic vulnerability identified in the systematic review?

Primary sources of economic vulnerability include instability in fundraising, decreased monetary allocation, and intensified market competition.

What steps should universities follow to conduct a financial risk assessment?

Steps include establishing a risk assessment team, defining the scope, identifying monetary threats, evaluating threats, developing mitigation strategies, implementing risk management plans, and monitoring and reviewing the assessment regularly.

What is the significance of the separation of duties in financial risk management?

The separation of duties minimizes exposure to errors or inappropriate actions by requiring multiple individuals to complete a single task, thereby improving responsibility and oversight in monetary operations.