Overview

Financial institutions must regularly update their risk assessments to effectively adapt to evolving threats and regulatory changes. This practice is essential for maintaining compliance and ensuring operational resilience. Triggers for these updates include:

- New products

- Regulatory shifts

- Mergers

- Emerging market challenges

Such factors highlight the necessity of a proactive and systematic approach to risk management in today’s dynamic financial landscape.

Introduction

In the intricate world of finance, the ability to swiftly identify and manage risks is paramount for institutions aiming to safeguard their assets and ensure compliance. As the financial landscape continues to evolve, marked by rising fraud incidents and regulatory complexities, the necessity for robust risk assessment strategies has never been more critical.

With over half of financial institutions reporting increases in debit card fraud, the spotlight is on effective risk management practices that not only protect against financial losses but also bolster organizational resilience.

This article delves into a multifaceted approach to risk assessment, highlighting the importance of:

- Regular updates

- Technological integration

- Proactive strategies

These elements are essential for navigating the challenges of 2025 and beyond.

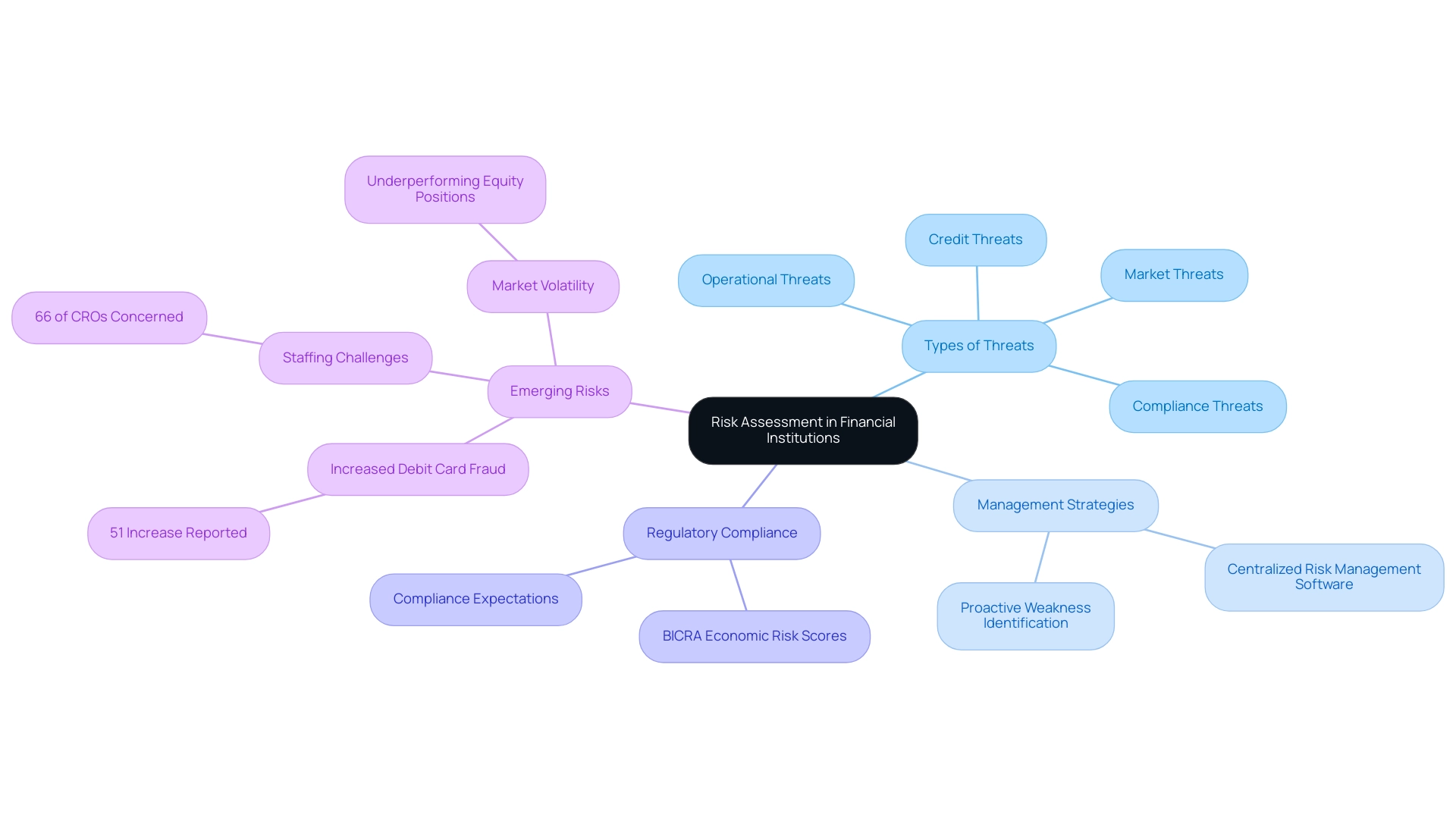

Understanding Risk Assessment in Financial Institutions

Evaluating potential threats in monetary organizations is an essential procedure that encompasses the identification, analysis, and appraisal of dangers that could negatively impact the entity. This continuous assessment is crucial not only for adherence to regulatory mandates but also for determining when a financial institution should update its risk assessment to safeguard assets and ensure overall economic well-being. As we look to 2025, the landscape of threat evaluation has evolved significantly, with 51% of financial organizations reporting an increase in debit card fraud, underscoring the necessity for robust management strategies.

Financial organizations must regularly assess a range of threats, including:

- Credit threats

- Operational threats

- Market threats

- Compliance threats

A comprehensive grasp of these challenges enables organizations to create effective mitigation strategies, thus improving their resilience and guaranteeing long-term stability. Recent developments indicate that as financial institutions grapple with rising costs and staffing challenges—66% of Chief Compliance Officers (CROs) express concerns about attracting and retaining talent—centralized management software for compliance is becoming increasingly crucial for operational efficiency.

The case study titled "Rising Costs and Talent Concerns in Financial Institutions" illustrates how these rising costs across various areas, including technology and compliance, strain budgets and highlight the need for effective resource management.

Moreover, increased volatility has led to certain equity positions underperforming market indexes, prompting hedge funds to liquidate positions at a loss. This reality further emphasizes the necessity for strong management strategies. Effective management strategies in banks involve not only the implementation of advanced technology but also a proactive approach to identifying potential weaknesses.

Organizations are urged to implement an all-encompassing evaluation framework that incorporates expert insights and up-to-date statistics to determine when a financial institution should update its risk assessment in order to remain proactive against emerging dangers. As Alfredo E Calvo, Primary Credit Analyst at S&P Global Ratings, observes, "S&P Global Ratings utilizes its BICRA economic vulnerability and sector threat scores to set the anchor for an organization, which is the starting point of a rating," emphasizing the significance of these scores in establishing an organization's rating anchor, which is essential for effective evaluation.

In conclusion, the significance of evaluating uncertainties in monetary organizations cannot be exaggerated. As the sector continues to encounter changing challenges, understanding when a financial institution should update its risk assessment will be essential for navigating uncertainties and attaining sustainable growth.

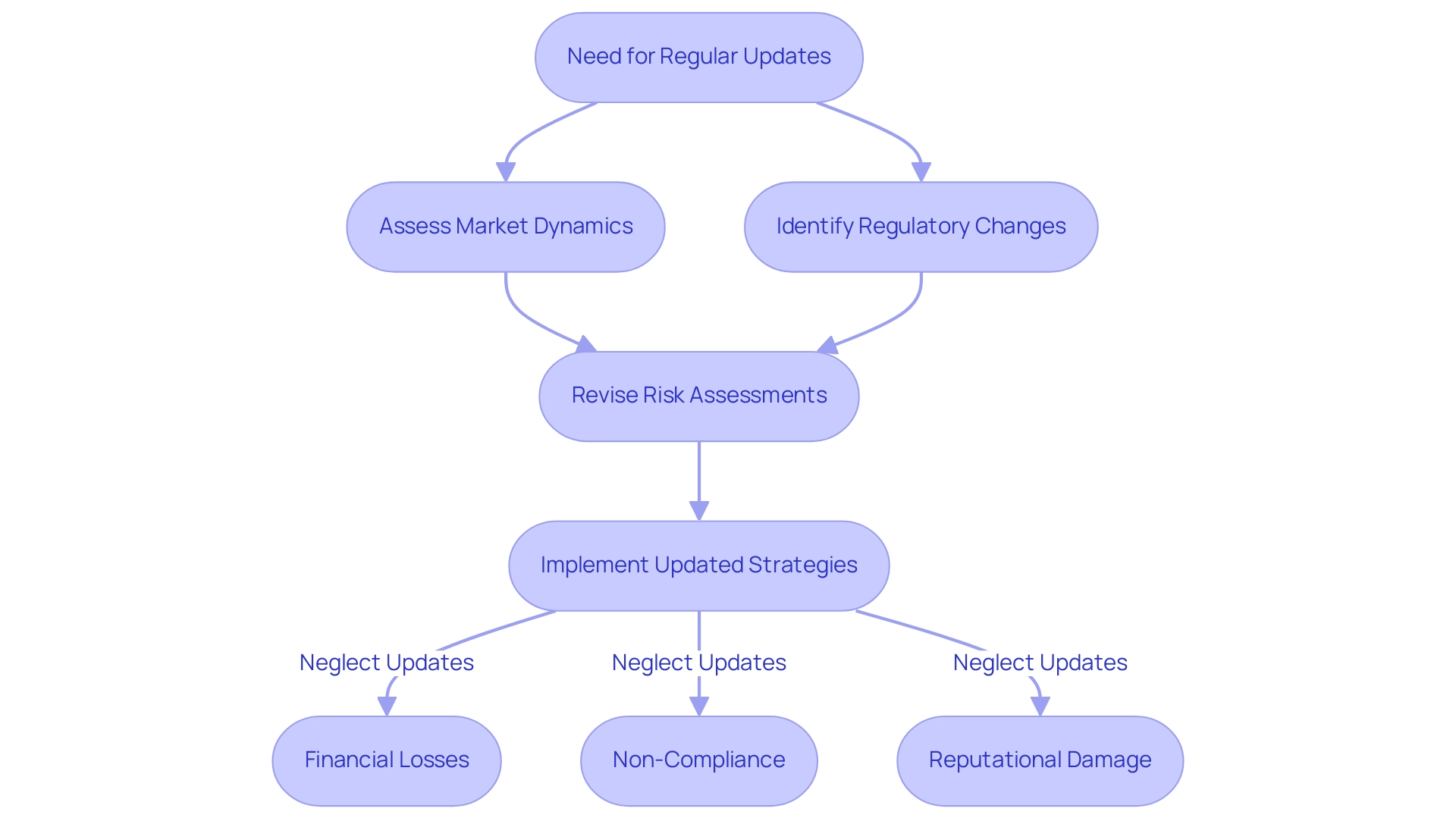

The Importance of Regularly Updating Risk Assessments

Frequent revisions to evaluations are crucial for monetary organizations aiming to uphold strength against changing dangers. As market dynamics, regulatory frameworks, and internal operations evolve, it is essential that evaluations are adjusted accordingly. Organizations that fail to refresh their evaluations expose themselves to considerable dangers, including non-compliance, financial losses, and reputational damage.

According to the PwC Pulse Survey:

- 33% of leaders in this area intend to boost their expenditure on management in the upcoming year, highlighting the increasing acknowledgment of the necessity for strong strategies.

- Moreover, 35% of executives in charge of management identify compliance and regulatory challenges as their primary concern, as noted by Secureframe, emphasizing the critical nature of staying ahead of regulatory changes.

The importance of establishing a routine for assessment updates cannot be overstated. By doing so, organizations can ensure that their management strategies are not only aligned with current realities but also equipped to tackle emerging challenges effectively. The recent leadership changes at the SEC, including the appointment of acting directors, signal a shift in regulatory expectations that monetary entities must heed.

Furthermore, the expected emphasis on capital and liquidity management for 2025-26 further highlights the need for monetary entities to stay alert and proactive in their evaluations.

Neglecting to refresh evaluations can result in severe repercussions. For example, a case study on funding and liquidity challenges revealed that despite a stable liquidity environment, geopolitical tensions could trigger market confidence issues, resulting in liquidity shocks. The interdependence of funding and liquidity markets implies that uncertainties can spread quickly, making it essential for organizations to observe market conditions attentively and modify their evaluations accordingly.

In summary, the frequency of uncertainty evaluation updates is not just a regulatory necessity but a strategic priority for economic entities in 2025. By prioritizing regular updates, organizations can safeguard their operations and ensure sustainable growth in an increasingly complex financial landscape.

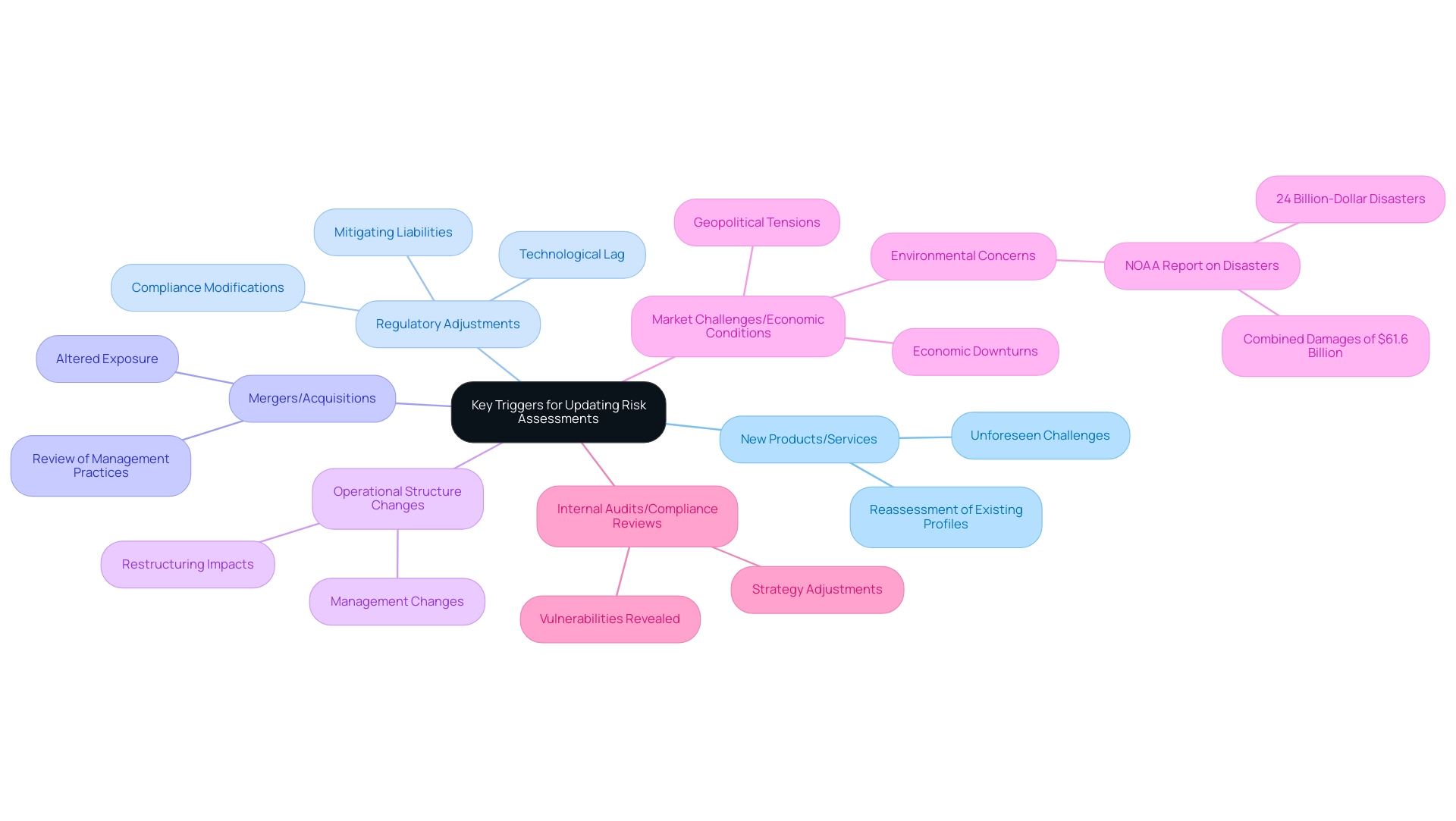

Key Triggers for Updating Risk Assessments

Financial organizations must remain vigilant regarding the timing of updates to their risk assessments in order to navigate an ever-evolving landscape. Several critical triggers indicate when a financial institution should reassess its risk profile.

- Introduction of New Products or Services: The launch of new offerings can present unforeseen challenges that necessitate a reassessment of existing profiles.

- Notable Adjustments in the Regulatory Landscape: As regulations evolve, organizations must modify their assessments to ensure compliance and mitigate potential liabilities. The regulatory landscape often lags behind technological advancements, creating compliance uncertainties that organizations must address proactively.

- Mergers and Acquisitions: These strategic moves can significantly alter an institution's exposure to uncertainty and operational dynamics, requiring a thorough review of management practices.

- Changes in Operational Structure: Organizational shifts, such as restructuring or changes in management, can influence vulnerability profiles and necessitate updates to assessments.

- Emergence of New Market Challenges or Economic Conditions: Factors such as geopolitical tensions or economic downturns can introduce new challenges that must be evaluated. For instance, in the first ten months of 2024, NOAA reported 24 billion-dollar weather and climate disasters, with combined damages of $61.6 billion. This underscores the necessity for organizations to consider environmental concerns in their evaluations.

- Results from Internal Audits or Compliance Reviews: Findings from these evaluations can reveal vulnerabilities that require immediate attention and adjustment of strategies.

Recognizing these triggers is essential for understanding when a financial institution should update its risk assessment and adapt strategies accordingly.

Expert insights indicate that by focusing on aspects like cybersecurity, adopting new technologies, and prioritizing talent management, organizations can effectively mitigate operational challenges and position themselves for long-term success. As Casey CSchlatter pointed out, these strategies are vital for navigating the intricacies of the financial landscape.

Additionally, pension oversight will enhance uncertainty assessment and bolster trust in the pension sector by addressing stakeholder inquiries, emphasizing the significance of proactive management of challenges in the context of regulatory compliance. Moreover, as illustrated by OSFI's focus on caution in capital and liquidity management, organizations must be prepared to withstand stress conditions and manage technology-related challenges effectively. This proactive approach not only enhances threat assessment but also strengthens stakeholder trust in the organization's resilience.

The compliance uncertainties stemming from regulatory frameworks that lag behind technological progress further highlight the necessity for financial institutions to update their risk assessments.

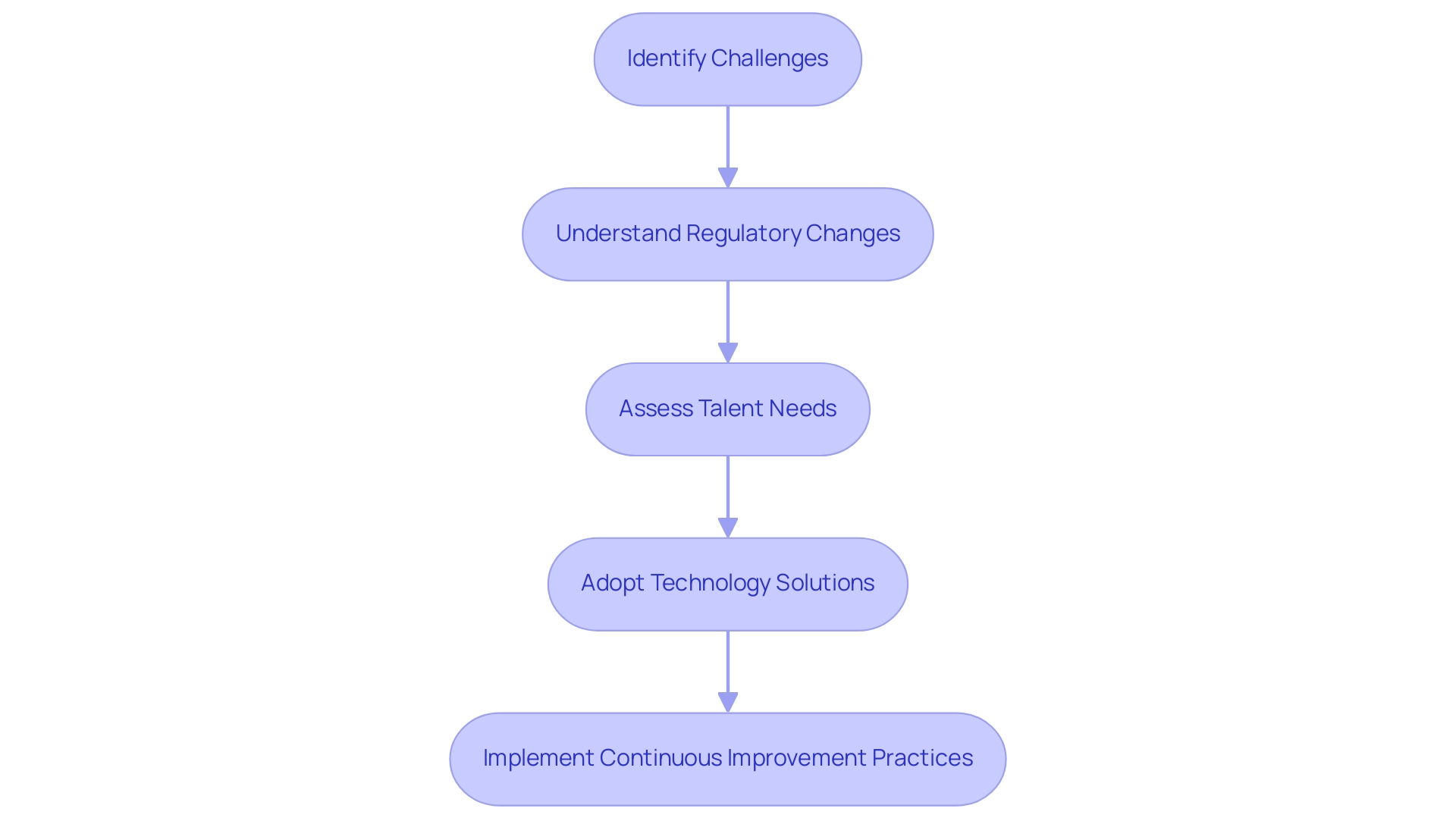

Step-by-Step Process for Updating Risk Assessments

To effectively update risk assessments, financial institutions must adhere to a series of comprehensive steps:

- Review Existing Threat Evaluation: Begin by thoroughly examining the current threat evaluation to pinpoint outdated information and areas that require updates.

- Data Collection on New Threats: Gather pertinent data regarding emerging threats and any changes in the operational environment. This encompasses examining industry trends, regulatory updates, and technological advancements to determine when a financial institution should update its risk assessment.

- Impact Analysis: Evaluate how these new threats and changes influence the institution's overall exposure profile. This analysis should consider both quantitative and qualitative factors to provide a holistic view of potential vulnerabilities.

- Stakeholder Engagement: Involve key stakeholders in discussions about the findings. Their insights can offer valuable viewpoints on implications and help identify additional threats that may not have been previously considered.

- Revise the Risk Evaluation Document: Update the evaluation document to accurately reflect current dangers and the corresponding mitigation strategies. This revision should incorporate best practices for managing uncertainties, ensuring that the document is both comprehensive and actionable.

- Communication and Integration: Convey the updated evaluation to all pertinent parties within the organization. It is essential to ensure that the updated evaluation is seamlessly incorporated into the organization's management framework, facilitating ongoing monitoring and compliance.

In 2025, financial organizations are encouraged to utilize advanced analytic capabilities to improve their monitoring and response strategies, particularly regarding when a financial institution should update its risk assessment. By integrating technology effectively with existing processes, organizations can achieve greater visibility and efficiency in compliance tasks, as demonstrated by case studies like Sprinto's automated compliance program. This proactive method not only aids in ensuring compliance but also promotes a culture of continuous improvement within the organization.

Based on recent statistics, the organization has attained industry-leading security standards while upholding high customer satisfaction levels, emphasizing the significance of strong management practices. Furthermore, as Natalia Kazankova mentioned, "We examined the 2024 CWE Top 25 Most Dangerous Software Weaknesses list developed by Common Weakness Enumeration (CWE™) and..." emphasizing the essential need for monetary organizations to remain aware of emerging threats. Moreover, continuous oversight and regular assessments of compliance procedures are essential for ongoing enhancement, particularly regarding when a financial institution should update its risk assessment to ensure that organizations stay robust against changing challenges.

Leveraging Technology for Effective Risk Assessment Updates

In today's swiftly changing financial environment, technology plays a crucial role in determining when a financial institution should update its risk assessment. Financial organizations can leverage data analysis, machine learning, and automated reporting tools to significantly enhance their evaluations of potential challenges. By implementing software solutions that integrate real-time data, institutions can swiftly identify emerging threats and adapt their assessments promptly.

The shift towards AI-powered platforms has been particularly notable. Recent regulatory actions against sponsor banks have underscored the need for improved transaction monitoring and compliance technology. These advanced systems not only analyze vast amounts of data in real-time but also reduce false positives, thereby streamlining compliance efforts. In fact, real-time monitoring systems can manage hundreds of thousands of events each second, enabling a more proactive approach to the management of potential issues.

Moreover, effective segregation of duties practices are essential in complex software environments, ensuring compliance and enhancing management. Technology promotes collaboration among stakeholders, ensuring that all relevant parties are informed and engaged in the management process. This collaborative method is vital for sustaining a thorough comprehension of threats throughout the organization.

As emphasized by the UK Government's suggested Cyber Governance Code of Practice released in 2024, organizations of all sizes are anticipated to manage cyber threats effectively, which further underscores the significance of strong evaluation frameworks.

A case study on strategic workforce planning illustrates the necessity of prioritizing skills development amid rapid technological advancements, particularly in automation and AI. Organizations that focus on enhancing their workforce's capabilities can improve their resilience and adaptability, essential for navigating evolving business needs. Cultivating essential abilities connected to managing uncertainties can significantly enhance the efficiency of evaluation procedures within financial entities.

As financial entities prepare for 2025 and beyond, determining when to update risk assessments will be crucial, particularly through the incorporation of data analytics into evaluation processes. By leveraging these technologies, organizations can not only meet regulatory expectations but also position themselves for sustainable growth in an increasingly complex environment. Furthermore, by adopting a streamlined decision-making approach and utilizing real-time analytics through the client dashboard provided by Transform Your Small/Medium Business, organizations can continuously monitor their performance and operationalize lessons learned during turnaround efforts, ultimately enhancing their overall business resilience.

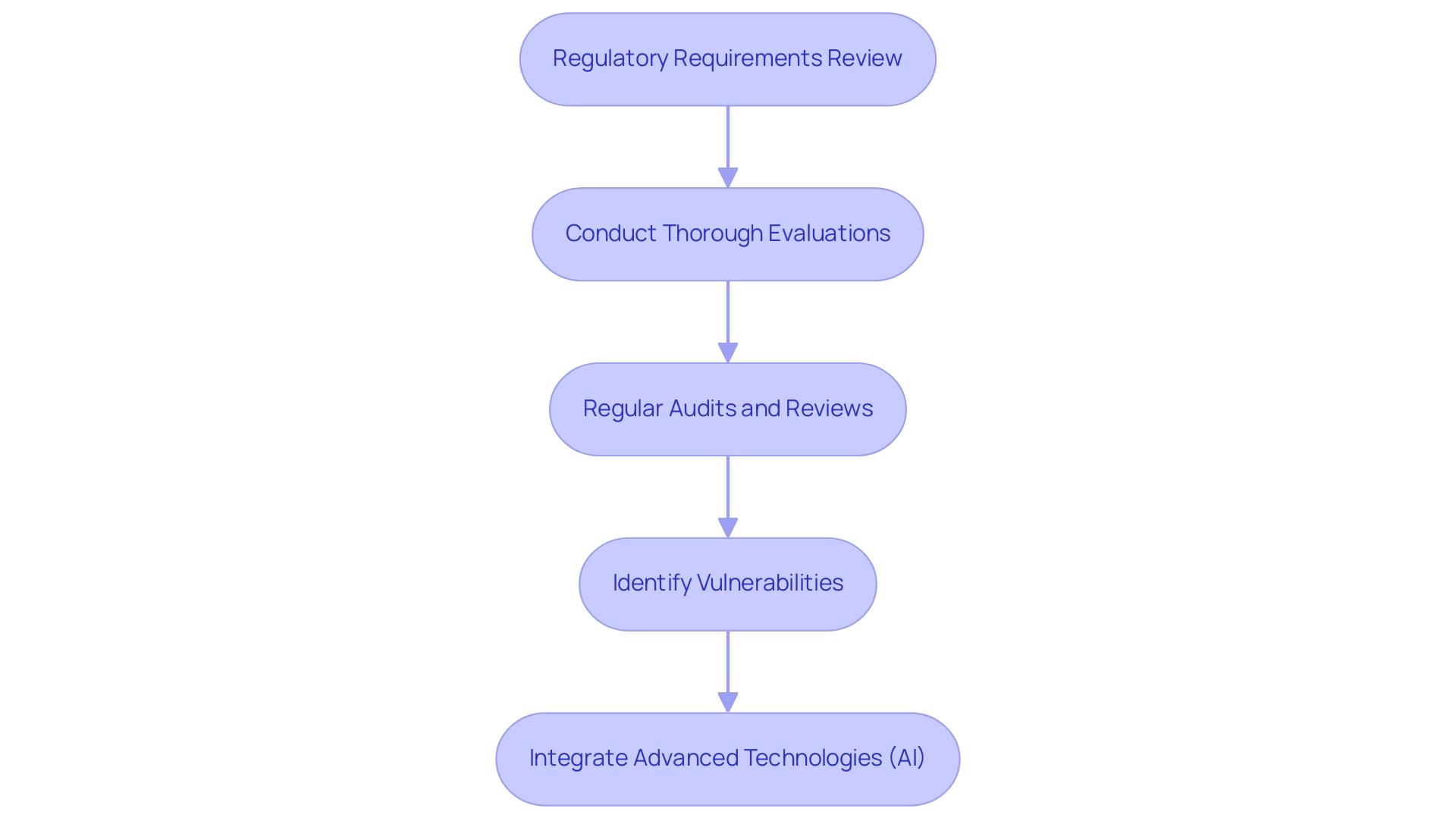

Regulatory Considerations in Risk Assessment Updates

Financial institutions must navigate a complex landscape of regulatory requirements to determine when to update their risk assessments of potential dangers. Compliance with guidelines established by regulatory bodies such as the Federal Reserve, FDIC, and OCC is paramount. Institutions are expected to conduct thorough and comprehensive evaluations that align with applicable laws and regulations.

Regular audits and reviews are essential, not only for maintaining compliance but also for identifying potential vulnerabilities that could lead to fines or sanctions.

In 2025, the landscape of compliance is evolving, with 70% of financial professionals expressing concern about building a robust financial services ecosystem that incorporates open banking and data sharing. This shift highlights the necessity for strong management and governance programs as institutions develop their open banking strategies. Additionally, a notable 27% of security and IT experts have recognized alleviating internal audit fatigue as a major compliance issue, emphasizing the necessity for effective procedures in update evaluations.

Statistics indicate that 68% of bankers remain apprehensive about the implications of cryptocurrencies, particularly concerning economic crime and regulatory guidance. This concern further underscores the significance of remaining updated on regulatory requirements and adjusting evaluations accordingly. As Tarrian L. Ellis observes, "The regulatory environment for monetary products and services is continually changing, and organizations must be proactive in their compliance endeavors to reduce hazards efficiently."

This insight strengthens the necessity for monetary organizations to determine when to update their risk assessments.

As monetary organizations face increasing scrutiny, integrating advanced technologies, such as AI, is becoming a pivotal strategy. A recent survey indicated that 70% of compliance and management leaders believe AI will significantly transform their functions within the next five years. This trend is illustrated by a case study titled "AI's Role in Compliance," which highlights how AI technologies can enhance compliance processes and decision-making.

In conclusion, monetary organizations must emphasize when to update their risk assessments to ensure their evaluations align with changing regulatory demands and efficiently handle emerging challenges in a dynamic economic environment.

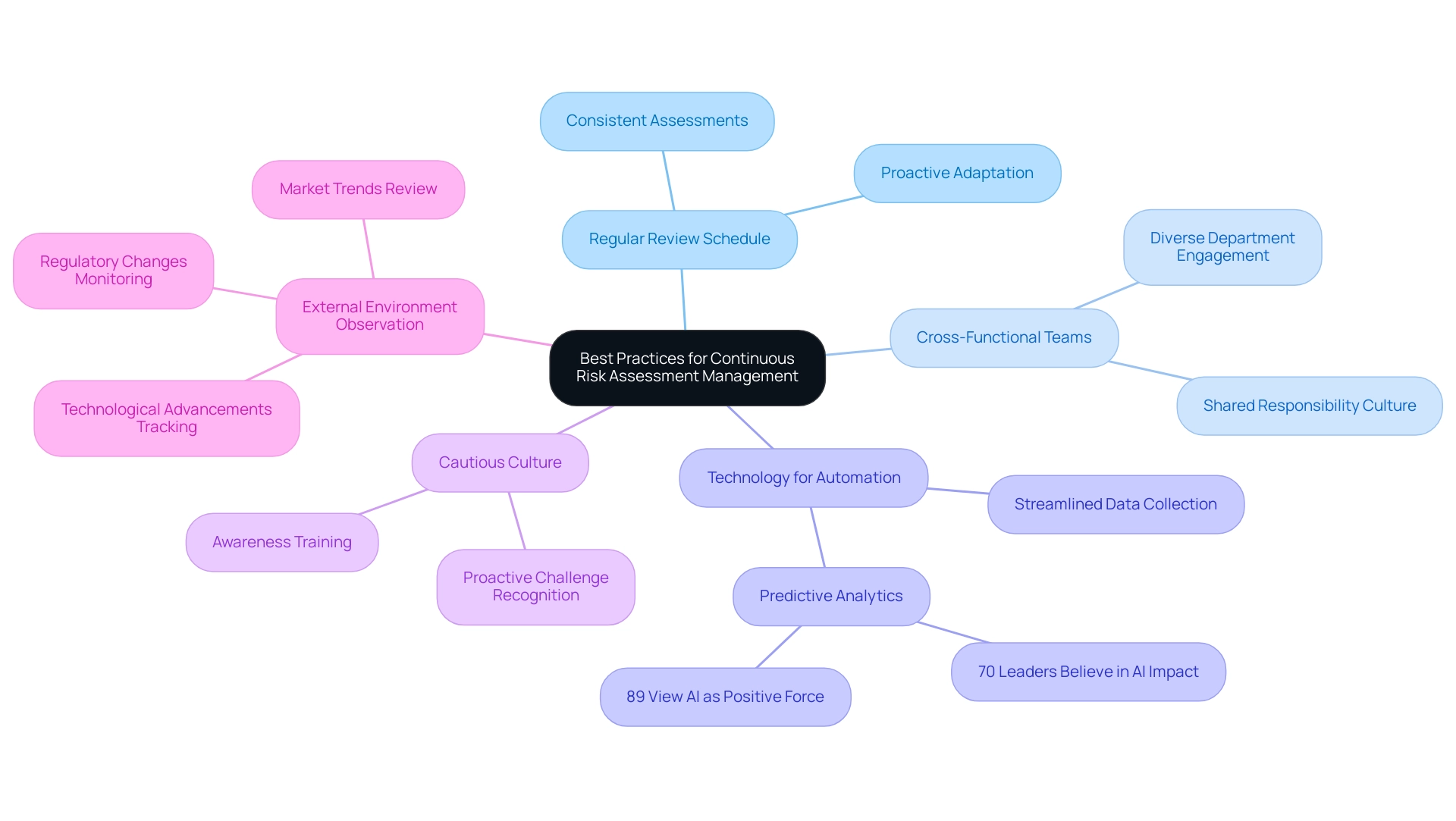

Best Practices for Continuous Risk Assessment Management

To maintain an effective risk assessment framework, financial institutions must implement best practices that ensure adaptability and resilience in the face of evolving threats.

- Establish a Regular Review Schedule: Performing assessments consistently is crucial for institutions to remain vigilant and responsive. This proactive approach is essential for adapting to the fast-paced financial landscape of 2025.

- Involve Cross-Functional Teams: Engaging diverse teams from various departments fosters a comprehensive understanding of challenges. This collaboration not only enhances the assessment process but also cultivates a culture of shared responsibility for managing potential issues.

- Utilize Technology for Automation: Leveraging modern management software streamlines data collection and reporting, allowing institutions to focus on analysis and decision-making. Predictive analytics can identify potential threats before they escalate, significantly enhancing mitigation strategies. A survey indicated that 70% of compliance and management leaders believe AI will have a transformative impact on their functions within the next one to five years. Furthermore, 89% of fraud and compliance professionals view AI as a force for good in their profession, underscoring the necessity for technological integration.

- Foster a Cautious Culture: Cultivating an organizational culture that prioritizes awareness of potential challenges is crucial. Training and communication initiatives empower employees at all levels to recognize and address challenges proactively.

- Continuously Observe the External Environment: Staying updated about emerging threats in the economic sector is essential. Institutions should regularly review market trends, regulatory changes, and technological advancements to adjust their evaluation frameworks accordingly.

By adhering to these optimal methods, monetary organizations can ensure that their evaluations remain adaptable and effectively aligned with the challenges of 2025. The case study titled 'AI in Compliance' illustrates how organizations are leveraging AI technologies to enhance compliance processes and improve overall management strategies.

Conclusion: The Path Forward for Financial Institutions

Financial institutions must prioritize understanding when to update their risk assessments to effectively navigate the complexities of the evolving financial landscape. As we approach 2025, the future of evaluation will be shaped by increasing regulatory scrutiny and management complexities. A significant 66% of Chief Risk Officers (CROs) acknowledge that attracting and retaining skilled talent will become increasingly challenging, underscoring the need for robust management frameworks that can adapt to these changes.

Joe Peiser, Chief Executive Officer, emphasizes, "The future of insurance lies in its ability to adapt and innovate, ensuring that clients are equipped to thrive in a dynamic economic ecosphere." This viewpoint highlights the critical nature of continuous enhancement in management practices, essential for long-term success. Organizations adopting technology-driven solutions, such as centralized compliance management software, can automate and streamline their compliance processes, making them more efficient and cost-effective.

Moreover, this shift is particularly vital as monetary entities face rising expenses in technology and compliance, which place additional burdens on budgets and resources.

Case studies demonstrate the significance of proactive threat evaluation. For instance, financial organizations that have embraced thorough management strategies have effectively managed staffing shortages and improved their product offerings while meeting compliance expectations. The case study titled "Rising Costs and Talent Concerns in Financial Organizations" illustrates that as these entities adopted centralized compliance management software, they effectively addressed the challenges posed by rising expenses and staffing shortages.

These organizations exemplify that a commitment to ongoing enhancement in evaluations can yield sustainable growth and resilience in a dynamic economic environment.

As the economic landscape continues to evolve, organizations must consider when to update their risk assessments to remain alert and adaptive. By leveraging technology, adhering to regulatory requirements, and fostering a culture of continuous improvement, financial institutions can enhance their risk management frameworks and position themselves for long-term success.

Conclusion

Financial institutions find themselves at a critical juncture, navigating the complexities of an evolving financial landscape. The necessity for regular updates to risk assessments cannot be overstated. Embracing a proactive approach to risk management is fundamental for compliance, safeguarding assets, and ensuring organizational resilience in the face of rising threats such as fraud and regulatory changes.

Key elements, including the integration of technology and the establishment of a culture centered on risk awareness, play a pivotal role in shaping effective risk management strategies. Insights shared by industry leaders emphasize the importance of adapting to emerging risks and leveraging data analytics to enhance decision-making processes. As financial institutions prepare for 2025 and beyond, their commitment to continuous improvement in risk assessments will be crucial for sustainable growth.

Ultimately, by prioritizing regular updates, fostering collaboration across departments, and utilizing advanced technologies, financial institutions can not only meet regulatory expectations but also build a robust framework that positions them for long-term success. The journey ahead requires vigilance, innovation, and a steadfast dedication to risk management, ensuring that institutions remain resilient in an increasingly complex economic environment.

Frequently Asked Questions

Why is evaluating potential threats important for monetary organizations?

Evaluating potential threats is essential for identifying, analyzing, and appraising risks that could negatively impact the organization. This ongoing assessment ensures compliance with regulatory mandates and helps determine when to update risk assessments to protect assets and maintain economic stability.

What types of threats should financial organizations regularly assess?

Financial organizations should regularly assess the following types of threats: 1. Credit threats 2. Operational threats 3. Market threats 4. Compliance threats

How has the landscape of threat evaluation changed recently?

The landscape has evolved significantly, with 51% of financial organizations reporting an increase in debit card fraud, highlighting the need for robust management strategies to address these emerging threats.

What challenges are financial institutions currently facing?

Financial institutions are grappling with rising costs and staffing challenges, with 66% of Chief Compliance Officers expressing concerns about attracting and retaining talent.

What is the significance of centralized management software for compliance?

Centralized management software for compliance is becoming increasingly crucial for operational efficiency, especially as financial institutions face rising costs across various areas, including technology and compliance.

What does the case study 'Rising Costs and Talent Concerns in Financial Institutions' illustrate?

The case study illustrates how rising costs in technology and compliance strain budgets and emphasize the need for effective resource management in financial institutions.

Why is it important for organizations to implement a comprehensive evaluation framework?

A comprehensive evaluation framework that incorporates expert insights and up-to-date statistics is necessary for organizations to determine when to update their risk assessments and remain proactive against emerging threats.

What are the potential consequences of failing to refresh evaluations?

Organizations that do not refresh their evaluations expose themselves to significant risks, including non-compliance, financial losses, and reputational damage.

What trends are emerging regarding expenditures on management in financial organizations?

According to the PwC Pulse Survey, 33% of leaders intend to increase their expenditure on management in the upcoming year, reflecting the growing recognition of the need for strong management strategies.

How do recent leadership changes at the SEC impact monetary entities?

Recent leadership changes at the SEC signal a shift in regulatory expectations that monetary entities must pay attention to, emphasizing the importance of staying ahead of regulatory changes.

What is the expected focus for capital and liquidity management in 2025-26?

There is an expected emphasis on capital and liquidity management for 2025-26, highlighting the need for monetary entities to remain alert and proactive in their evaluations.

How can geopolitical tensions affect market confidence and liquidity?

Geopolitical tensions can trigger market confidence issues, leading to liquidity shocks, even in stable liquidity environments, underscoring the need for organizations to monitor market conditions and adjust their evaluations accordingly.