Overview

To conduct a financial risk tolerance assessment, one should follow a structured process that includes gathering financial information, identifying monetary goals, assessing risk capacity and appetite, and documenting findings for future reference. The article emphasizes that understanding concepts like risk capacity and perception of danger is crucial, as these factors guide the development of tailored financial strategies that align with individual or organizational objectives.

Introduction

In the complex world of finance, understanding risk tolerance is not just an academic exercise; it’s a strategic imperative for CFOs navigating investment landscapes. As organizations grapple with fluctuating market conditions and evolving financial goals, grasping the nuances of financial risk tolerance becomes essential.

This article delves into the critical components of risk tolerance:

- Risk capacity

- Appetite

- Perception

It outlines actionable steps for conducting thorough assessments:

- Employ effective tools

- Recognize psychological influences

- Commit to regular reassessments

By following these steps, CFOs can align their strategies with organizational objectives and client expectations, ultimately driving sustainable financial success.

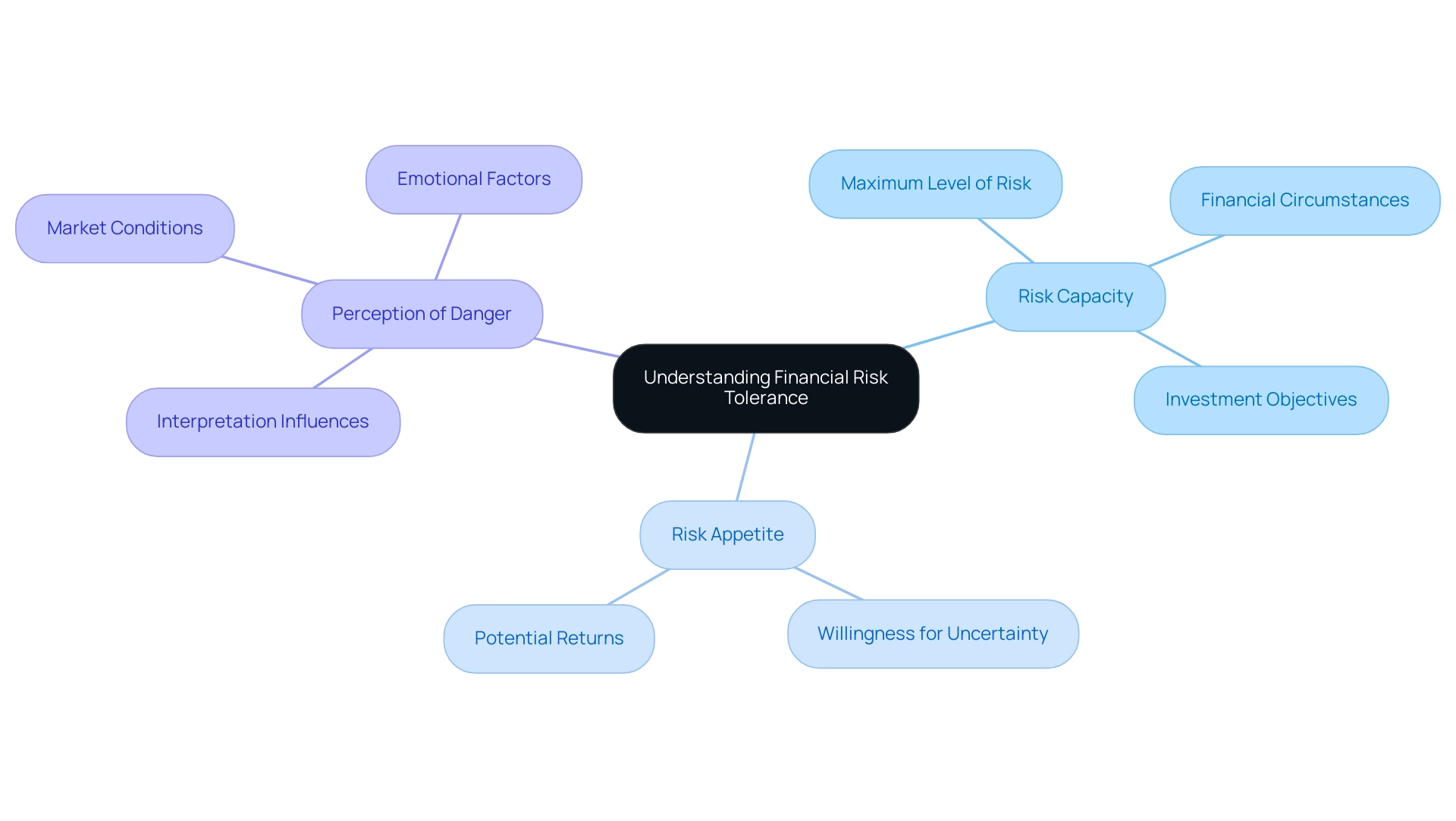

Understanding Financial Risk Tolerance: Key Concepts and Definitions

Financial tolerance includes the ability and readiness of a person or entity to endure changes in asset values. Grasping this concept is essential for creating effective monetary strategies, particularly given that participants possess products valued at $10,000 or more. Key components include:

- Risk Capacity: This represents the maximum level of risk an investor can assume, grounded in their financial circumstances and investment objectives. For CFOs, precisely evaluating capacity for uncertainty is essential to guarantee that financial choices correspond with organizational objectives.

- Risk Appetite: This indicates the extent of uncertainty an investor is willing to tolerate to attain potential returns. It is crucial for CFOs to assess the willingness for uncertainty of their organization to customize financial strategies accordingly.

- Perception of Danger: This involves how individuals interpret uncertainty, which can be shaped by personal experiences, prevailing market conditions, and emotional factors. A subtle comprehension of uncertainty perception can greatly influence financial decision-making.

Mastering these concepts is essential, as they establish the foundation for a of one’s capacity. By aligning monetary strategies with established uncertainty profiles, businesses can navigate the complexities of investment choices more effectively. Recent studies have emphasized that monetary aversion and uncertainty acceptance are not conflicting elements; instead, they enhance one another.

For example, results from the case study titled "Complementary Nature of Monetary Uncertainty Aversion and Tolerance" indicate that monetary uncertainty aversion inversely correlates with portfolio volatility, while tolerance positively influences it. This duality enhances the explanatory power of models evaluating portfolio uncertainties, a critical insight for CFOs aiming to optimize investment approaches. Moreover, as emphasized by a recent quotation, 61% of leaders recognize 'attracting and retaining talent' as a major concern in 2034, highlighting the wider consequences of monetary management for CFOs.

Step-by-Step Guide to Conducting a Financial Risk Tolerance Assessment

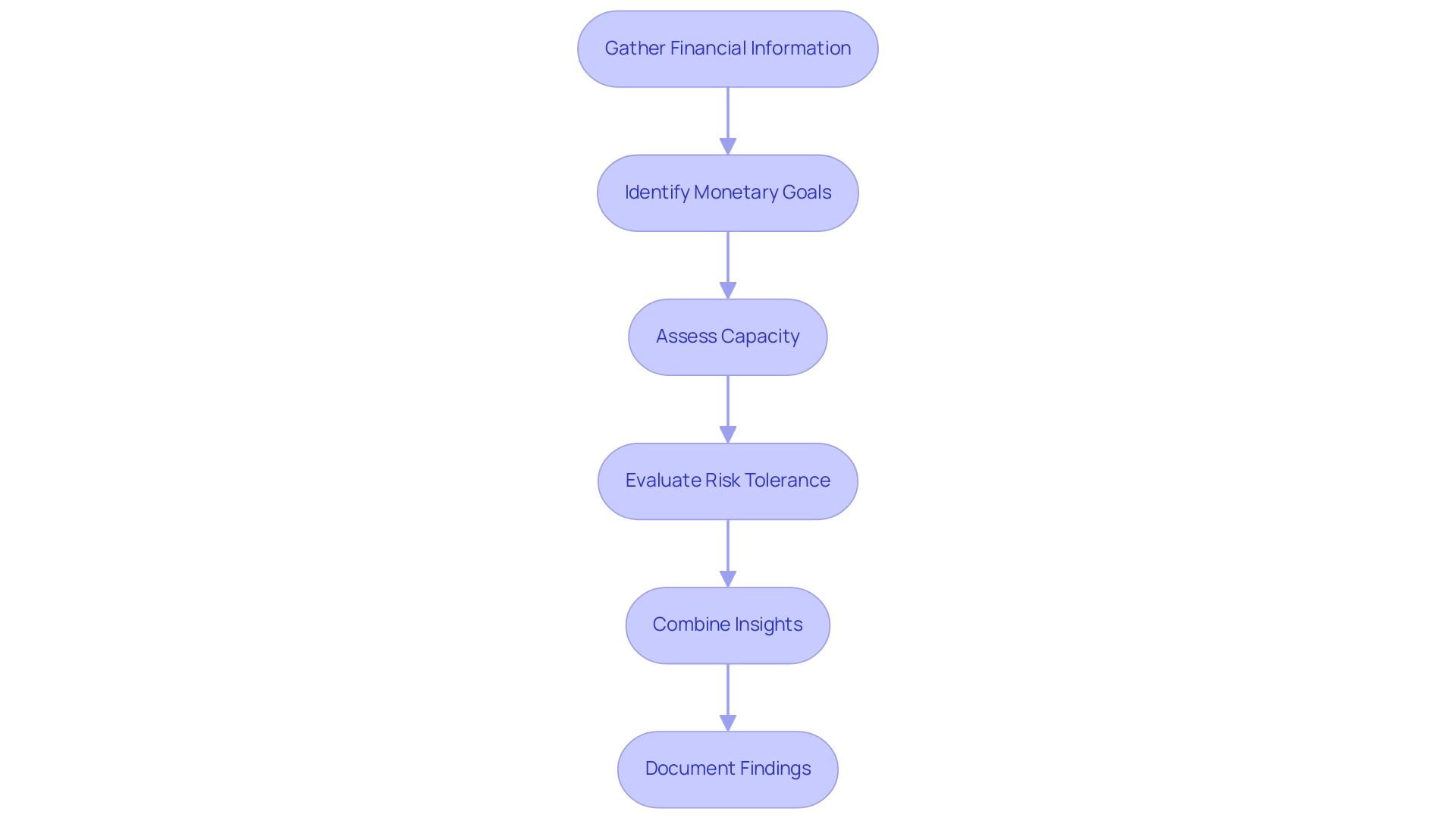

To perform a comprehensive assessment of economic vulnerability, follow these strategic steps:

- Gather Financial Information: Begin by collecting comprehensive data on current assets, liabilities, income, and expenses. This foundational information is critical for an accurate assessment.

- Identify Monetary Goals: Clearly define both short-term and long-term monetary objectives. Comprehending these objectives offers crucial context for and aligning it with organizational strategies.

- Assess Capacity: Evaluate your monetary situation through a financial risk tolerance assessment to determine the level of uncertainty that can be comfortably absorbed without compromising economic stability. This involves an in-depth analysis of your financial position and potential future liabilities.

- Evaluate Risk Tolerance: Conduct a financial risk tolerance assessment to reflect on your willingness to accept uncertainty based on investment goals and personal comfort levels. This psychological aspect is vital, as it often influences decision-making processes.

- Combine Insights: Examine the collected data to create a thorough understanding of your overall comfort level. This step is crucial, as the average Root Mean Squared Error from five-fold cross-validation was 4.85, highlighting substantial variance in risk tolerance and portfolio choices.

- Document Findings: Systematically record your assessment results for future reference. This documentation is not only essential for tracking changes over time but also for ensuring strategic alignment with your monetary goals.

Incorporating various assessment methods, such as propensity measures, stated-preference items, and revealed-preference tests, can enhance the accuracy of your evaluations. Each method has its strengths and weaknesses; understanding these can lead to more informed monetary decision-making. Furthermore, it is essential to recognize that future investigations should examine the effect of significant occurrences on acceptance of uncertainty, and the constraints of earlier studies, including the limited sample size and the impact of the COVID-19 pandemic, indicate the necessity for additional research with larger and more varied samples.

Utilizing Tools and Questionnaires for Effective Risk Assessment

To effectively improve your financial capacity evaluation and ensure cash preservation, utilizing a variety of tools and questionnaires is essential. Consider the following options:

- Tolerance Questionnaires: These structured surveys are invaluable for gauging an individual's preferences. By posing specific inquiries about financial options and emotional responses to market changes, they promote a deeper comprehension of individual comfort levels through a financial risk tolerance assessment. This is particularly crucial, as studies indicate that older adults may experience increased loss aversion, which directly impacts their investment strategies. Moreover, studies indicate that this decrease in tolerance for uncertainty in later life may be connected to a considerable reduction in memory and problem-solving abilities, which highlights the necessity for financial risk tolerance assessments for senior clients.

- Planning Software: Advanced tools such as MoneyGuidePro and eMoney Advisor provide thorough assessments by combining personal monetary data with individual objectives. These platforms are increasingly recognized for their effectiveness in identifying opportunities to preserve cash and reduce liabilities. They offer comprehensive forecasts and scenario evaluations that assist clients in grasping the potential effects of their monetary choices. Usage statistics indicate a rising trend among monetary experts employing such software for assessment in 2024.

- Consultation with Advisors: Engaging with a qualified advisor can yield personalized insights and professional evaluations rooted in established methodologies. Advisors generally utilize a methodical strategy that incorporates a financial risk tolerance assessment while examining clients' financial circumstances, objectives, and profile. According to Wayne Duggan,

Dividend stocks provide long-term investors distinct advantages, which emphasizes the significance of knowledgeable financial strategies that correspond with assessments of potential challenges. For example, dividend stocks can be a fitting choice for clients with lower exposure to uncertainty, offering steady income while reducing volatility and safeguarding cash. - Case Study: Adopting a long-term perspective on quantum computing stocks, as highlighted in recent case studies, demonstrates the significance of sustaining a long-term investment outlook. Investors are urged to embrace this approach, especially concerning , to prevent hasty transitions to cash that might postpone reaching monetary objectives and ultimately obstruct .

By utilizing these resources, including customized questionnaires, sophisticated software, and professional consultations, you can guarantee a comprehensive and effective evaluation of economic vulnerability, which is essential in guiding clients, particularly during market declines. This proactive method aids in avoiding premature transitions to cash that could otherwise postpone objectives and raise liabilities.

The Psychological Dimension of Risk Tolerance: Understanding Client Behavior

Comprehending the psychological aspect of financial risk tolerance assessment is essential for efficient resource management. This encompasses several key areas:

-

Emotional Reactions: Investors are often influenced by emotions such as fear and greed, which can significantly affect their investment decisions. For instance, studies indicate a strong correlation between loss aversion and decision-making, wherein individuals' fear of losses outweighs their desire for gains.

However, some studies also report a weaker or even insignificant relationship, highlighting the complexity of emotional influences on monetary decisions. This emotional terrain can result in illogical decisions that stray from solid economic principles.

-

Behavioral Biases: Common biases, including overconfidence and loss aversion, can skew an investor's view of uncertainty. Research has shown that the bias-generating effect of negative emotions, such as those arising from market downturns, is particularly pronounced among individuals with lower self-esteem. As noted by Smith and Petty, the bias-generating effect of negative affect (mood congruence recall) was found only among individuals with low self-esteem, not among those with high self-esteem. Identifying these biases enables financial experts to perform a financial risk tolerance assessment to tackle illogical behaviors that can result in less than ideal financial results.

-

Client Communication: Involving clients in open conversations about their emotions regarding uncertainty is priceless. This dialogue can reveal insights into their true financial risk tolerance assessment, which may differ from their stated preferences regarding uncertainty. By understanding the emotional drivers behind client decisions, CFOs can tailor their strategies to better meet client expectations and enhance satisfaction, which is crucial in the financial risk tolerance assessment highlighted by the Stock Investment Simulation Study involving 118 investors over 20 days. Participants made choices based on various metrics of 12 anonymous stocks, allowing researchers to analyze the impact of age and prior financial experience on decision-making. The findings revealed how emotional reactions and affective influence regulation mediate relationships between threat perception and decision performance, producing 1,870 valid cases for analysis through structural equation modeling (SEM). The study utilized , including chi-square and RMSEA, to assess the SEM results, offering a comprehensive analysis of the implications for economic decision-making.

By thoroughly examining these psychological factors, professionals can align their strategies with client behaviors, resulting in more effective investment outcomes.

The Importance of Regular Reassessments in Risk Tolerance

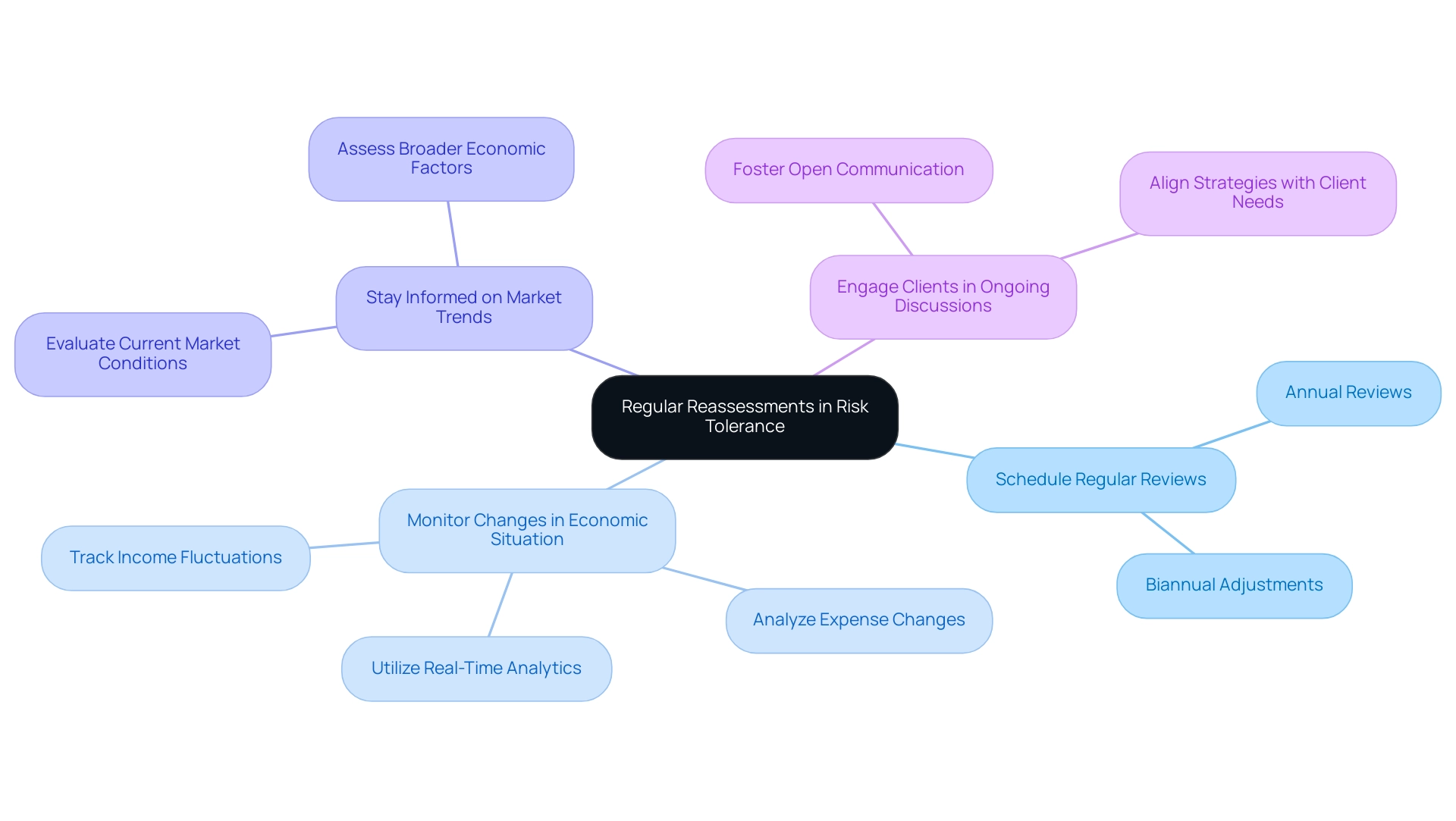

To maintain an effective risk tolerance assessment process, CFOs should implement the following strategies:

- Schedule Regular Reviews: Establish a routine for reviewing risk tolerance assessments at specific intervals, such as annually or biannually. This consistent method ensures that assessments reflect any changes in the economic landscape and allows for timely adjustments that preserve business health.

- Monitor Changes in Economic Situation: Actively track significant shifts in income, expenses, or monetary objectives that could affect tolerance to risk. Using real-time analytics from client dashboards can aid in this tracking, ensuring CFOs remain aware of fluctuations essential for precise evaluation. These analytics support a shortened decision-making cycle, enabling quicker responses to emerging financial challenges.

- Stay Informed on Market Trends: Regularly evaluate how current market conditions and broader economic factors may influence perceptions of uncertainty. Understanding these dynamics helps in adjusting strategies proactively and capitalizing on opportunities for turnaround.

- Engage Clients in Ongoing Discussions: Foster a culture of open communication with clients, inviting them to share their evolving viewpoints on uncertainty. This conversation is crucial for aligning monetary strategies with clients' present tolerance levels, thereby strengthening relationships and enhancing responsiveness.

Prioritizing these regular reassessments, alongside streamlined decision-making processes, equips organizations to ensure that remain agile and aligned with clients' needs. Bill Schaninger highlights that organizations which prioritize health in their operations generate three times higher returns than their less engaged counterparts. This statistic emphasizes the critical significance of maintaining a healthy organizational approach to management of uncertainties.

Moreover, the case study titled "Covariates in Retirement Research" demonstrates the importance of managing systematic differences in evaluations, emphasizing the necessity for regular reassessments in planning. By incorporating continuous performance monitoring and regular risk assessments into financial strategies, CFOs can position their organizations to achieve similar high performance.

Conclusion

Understanding financial risk tolerance is crucial for CFOs aiming to navigate the complexities of investment landscapes effectively. By dissecting the core components—risk capacity, appetite, and perception—leaders can develop robust strategies that align with both organizational goals and client expectations. Assessing these elements through structured steps, including:

- Gathering financial information

- Recognizing psychological influences

empowers CFOs to make informed decisions that resonate with their unique financial contexts.

Utilizing effective tools such as:

- Risk tolerance questionnaires

- Financial planning software

enhances the assessment process, providing deeper insights into individual and organizational risk profiles. This, combined with a thorough understanding of the psychological dimensions that drive investor behavior, fosters more strategic and tailored investment approaches.

Regular reassessments are not merely advisable; they are imperative in a fluctuating financial environment. By scheduling routine reviews and maintaining open lines of communication with clients, CFOs can ensure that their strategies remain relevant and responsive to changing circumstances. As organizations prioritize health in their operations, the potential for delivering superior returns increases significantly.

In conclusion, mastering the nuances of financial risk tolerance equips CFOs with the tools necessary to drive sustainable success in their organizations. By committing to comprehensive assessments and fostering a culture of continuous evaluation, financial leaders can navigate challenges with confidence and position their organizations for long-term growth.

Frequently Asked Questions

What is financial tolerance?

Financial tolerance refers to the ability and readiness of a person or entity to endure changes in asset values, which is essential for creating effective monetary strategies.

What are the key components of financial tolerance?

The key components include: Risk Capacity: The maximum level of risk an investor can assume based on their financial circumstances and investment objectives. Risk Appetite: The extent of uncertainty an investor is willing to tolerate to achieve potential returns. Perception of Danger: How individuals interpret uncertainty, influenced by personal experiences, market conditions, and emotional factors.

Why is understanding financial tolerance important for CFOs?

Understanding financial tolerance helps CFOs ensure that financial choices align with organizational objectives by evaluating risk capacity, appetite, and perception of danger.

How do monetary aversion and uncertainty acceptance relate to each other?

Recent studies suggest that monetary aversion and uncertainty acceptance are complementary rather than conflicting; they enhance one another, influencing portfolio volatility and investment strategies.

What steps should be taken for a comprehensive assessment of economic vulnerability?

The steps include: 1. Gather Financial Information: Collect data on assets, liabilities, income, and expenses. 2. Identify Monetary Goals: Define short-term and long-term objectives. 3. Assess Capacity: Evaluate the level of uncertainty that can be absorbed without compromising stability. 4. Evaluate Risk Tolerance: Reflect on willingness to accept uncertainty based on investment goals. 5. Combine Insights: Analyze collected data for an overall comfort level. 6. Document Findings: Record assessment results for future reference.

What methods can enhance the accuracy of financial risk tolerance evaluations?

Incorporating various assessment methods such as propensity measures, stated-preference items, and revealed-preference tests can improve the accuracy of evaluations, as each method has its strengths and weaknesses.

What challenges exist in current financial risk tolerance research?

Challenges include the need for further investigation into the effects of significant occurrences on uncertainty acceptance and the limitations of earlier studies, such as small sample sizes and the impact of the COVID-19 pandemic.