Introduction

In the competitive landscape of mining, understanding and controlling costs is paramount for sustaining profitability and ensuring operational efficiency. As industry dynamics shift and external pressures mount—from rising labor costs to environmental regulations—CFOs must adopt a proactive approach to cost management. This article delves into the intricacies of mining cost structures, exploring key strategies for cost reduction, the role of technology in driving efficiency, and the importance of risk management and benchmarking. By focusing on these critical areas, mining companies can not only navigate current challenges but also position themselves for long-term success in a rapidly evolving market.

Understanding the Cost Structure in Mining Operations

To efficiently execute cost reduction strategies in mining operations, it is crucial to start with a thorough examination of the financial framework. This process should encompass the following major expense categories:

- Labor Expenses: Examine the size of your workforce, assess productivity levels, and review compensation structures. Comprehending labor dynamics is essential, particularly as recent predictions suggest that resource extraction labor expenses are anticipated to increase in 2024, affecting overall operational budgets. Recent statistics indicate that labor expenses in the mining industry are expected to rise by X% in 2024, emphasizing the necessity for strategic workforce management.

- Material Expenses: Assess procurement methods for raw materials and supplies, concentrating on productivity and sustainability. For instance, PT Vale Indonesia's innovative use of slag nickel as a substitute for natural stone has resulted in substantial savings of US$2.5 billion, showcasing the potential of strategic material sourcing.

- Equipment Expenses: Analyze the efficiency and maintenance schedules of machinery and tools. This assessment is essential in reducing downtime and enhancing performance efficiency.

- Overhead Expenses: Examine administrative and functional expenditures that may increase total expenses without directly aiding productivity.

Moreover, it is crucial to reflect on the wider consequences of the prediction suggesting that global metals production capacity is threatened due to heat and drought by 2050. This urgency emphasizes the necessity for a comprehensive financial analysis to identify areas for savings. Using financial statements and operational data will enable you to create a detailed expense breakdown.

This understanding not only emphasizes areas ripe for savings but also creates the foundation for targeted cost reduction strategies in mining that can lead to substantial reductions. Moreover, as highlighted by the European Union's Regulation (EU) 2023/1542, incorporating sustainable practices into your operations may not only assist in compliance but also aid in long-term financial efficiency. Moreover, robust cybersecurity protocols are critical for protecting operational and personnel data in resource extraction companies, adding another layer of consideration for CFOs.

By grounding your strategies in a comprehensive financial assessment, you enable your organization to navigate the changing environment of the resource extraction sector effectively.

Key Strategies for Effective Cost Reduction in Mining

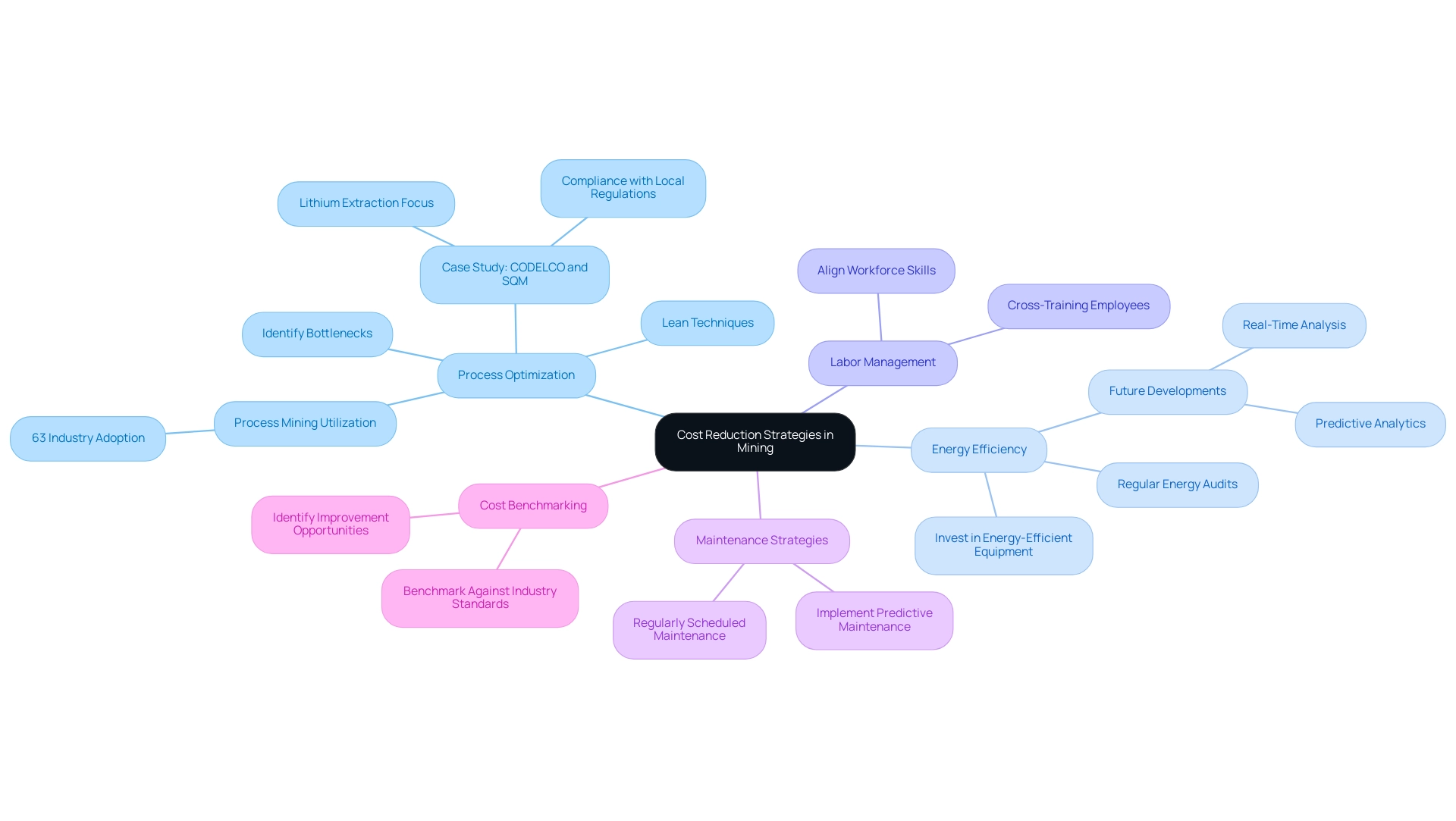

To effectively implement cost reduction strategies in extraction operations, consider the following key approaches:

- Process Optimization: Streamlining operations is crucial. Identify bottlenecks and inefficiencies within your workflows. Lean extraction techniques can be particularly effective in eliminating waste and enhancing productivity. Notably, a recent survey revealed that 63% of industry respondents have already begun utilizing process mining, underscoring its growing importance. The case study of CODELCO and SQM illustrates this well; their joint venture focuses on lithium extraction in the Salar de Atacama salt flat through 2060, aiming to enhance resource access and comply with local regulations while optimizing processes.

- Energy Efficiency: Investing in energy-efficient equipment is crucial for lowering utility expenses. Conduct regular audits of energy consumption to uncover potential savings. Recent developments in energy-saving methods can greatly influence operational expenses, making this a crucial area for focus. Future developments in process mining technology, including real-time analysis and predictive analytics, can further enhance energy efficiency initiatives in mining operations.

- Labor Management: Effective labor supervision is crucial for minimizing expenses. Align workforce skills with business needs to minimize overtime expenses. Cross-training employees not only enhances flexibility but also improves overall productivity, allowing operations to adapt to changing demands.

- Maintenance Strategies: Implementing predictive maintenance is a proactive approach that can minimize equipment downtime and lower repair expenses. Regularly scheduled maintenance extends the lifespan of machinery, ensuring that operations run smoothly and efficiently.

- Cost Benchmarking: Benchmark your operations against industry standards to identify improvement opportunities. By contrasting your performance with that of colleagues, you can reveal areas where savings are achievable, directing strategic choices that improve productivity and profitability.

As the resource extraction sector progresses, adopting these cost reduction strategies in mining will not only promote effective operations but also place your organization advantageously in a competitive environment.

Leveraging Technology for Cost Efficiency in Mining

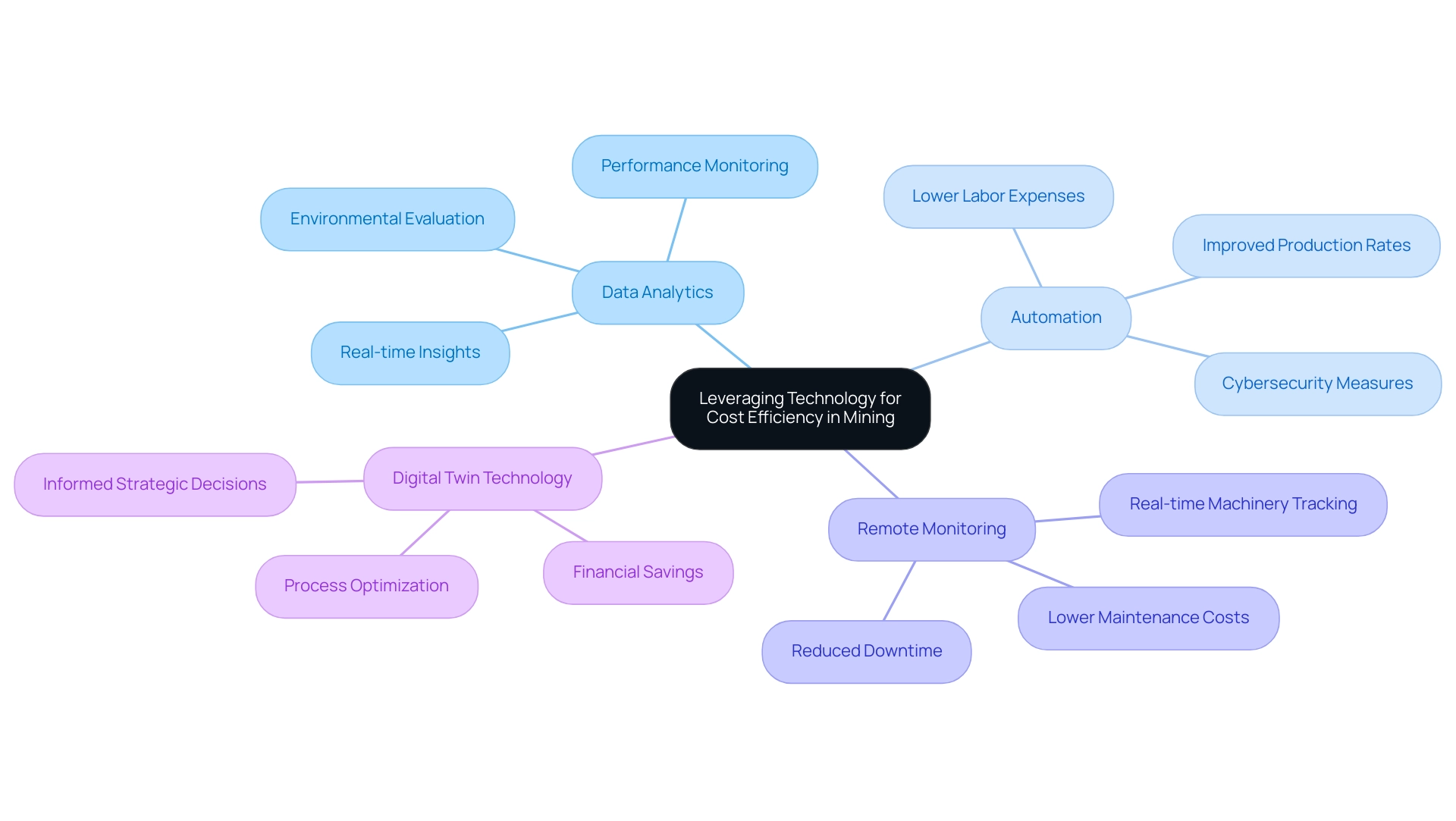

To effectively utilize technology for expense reduction in the extraction industry, CFOs should consider the following strategic approaches:

- Data Analytics: Implement data analytics tools to continuously monitor performance. These solutions can provide real-time insights into production metrics, allowing for timely adjustments and informed decision-making. The recent purchase of Cuprous Capital by MMG for US$3.6 billion highlights the financial stakes in the extraction industry, underscoring the significance of expense management. The use of geospatial data analytics in mining has transformed exploration and efficiency, aiding in the identification of promising mineral areas and optimizing mine design. Particularly, this technology has demonstrated effectiveness in evaluating environmental effects and enhancing procedural methods, resulting in significant savings.

- Automation: Investing in automation technologies for routine tasks, such as drilling and hauling, is essential. This not only lowers labor expenses but also improves consistency in operations. For instance, automation trends in 2024 demonstrate that companies adopting these technologies are witnessing improved production rates and decreased operational risks. As Franz Wentzel, Global Mining Consulting Leader at PwC Australia, observes, automation in the sector enhances productivity while also requiring strong cybersecurity measures to reduce associated risks. This dual focus on productivity and cybersecurity is essential as companies navigate the complexities of modern extraction operations.

- Remote Monitoring: Embrace remote monitoring systems that enable tracking of machinery performance in real-time. By proactively tackling potential problems, such systems substantially decrease downtime and upkeep expenses, improving overall operational efficiency.

- Digital Twin Technology: The application of digital twin technology enables the simulation of resource extraction operations in a virtual environment, aiding process optimization without the dangers of physical changes. This advanced technology empowers CFOs to make better-informed strategic decisions, ultimately resulting in improved productivity and financial savings.

These methods, including cost reduction strategies in mining, collectively improve financial performance and position resource extraction companies to succeed amidst evolving industry challenges and opportunities.

Risk Management and Benchmarking: Essential Tools for Cost Control

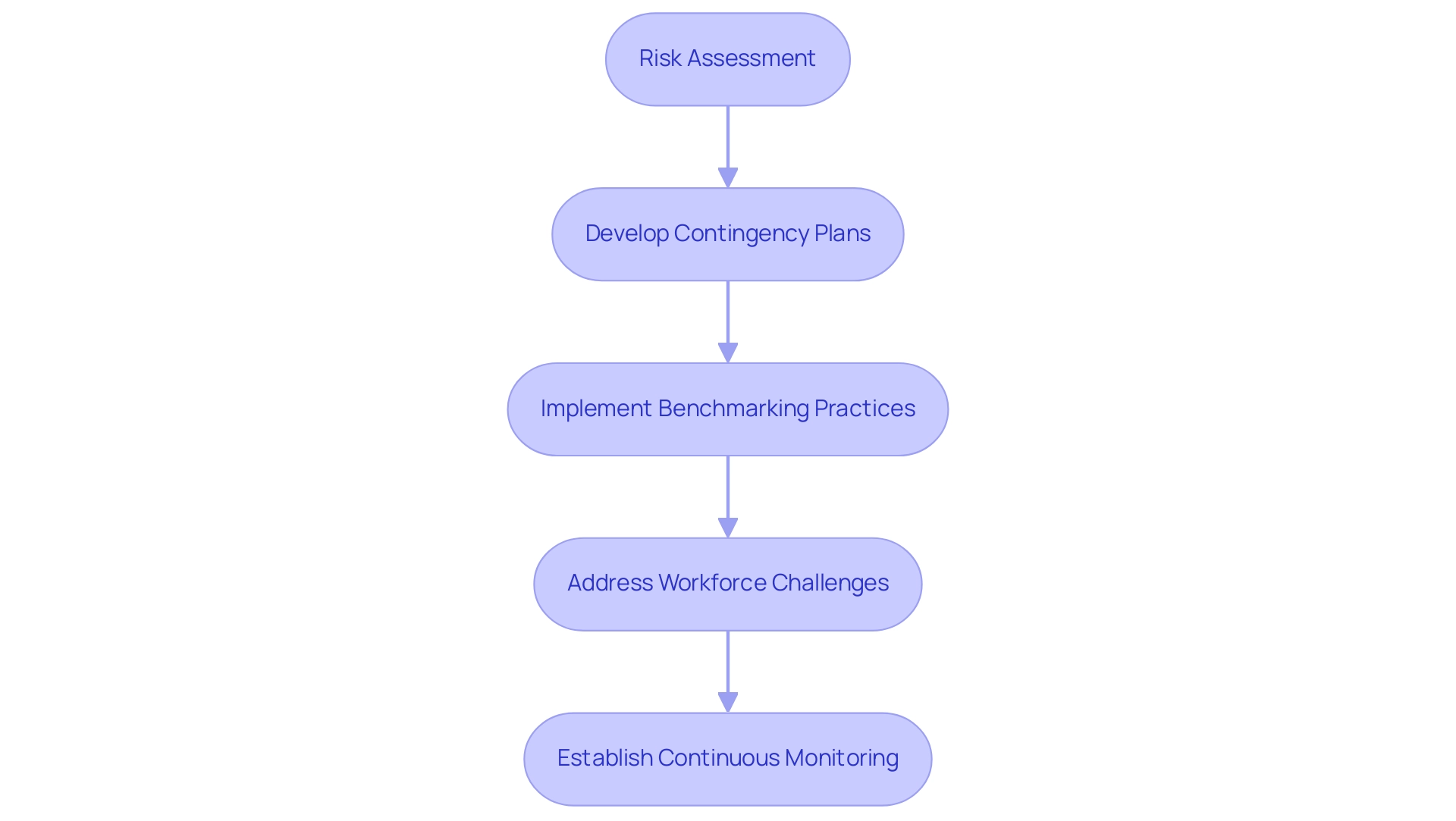

Integrating risk management and benchmarking into your expenditure control strategy is vital for maintaining profitability in today's unpredictable market. Start with a thorough Risk Assessment: conduct regular evaluations to pinpoint potential financial threats, such as market fluctuations and regulatory changes. Developing robust contingency plans is crucial to mitigate these risks effectively.

With insurers exhibiting a cautious stance towards clients facing higher inherent risks—such as tailings, underground operations, and coal—addressing these issues proactively is vital, especially considering that insurers may have a more limited appetite globally for such clients. This proactive approach can significantly enhance your organization's stability.

Next, implement Benchmarking practices. Compare your performance metrics against industry standards and leading practices to highlight gaps and identify areas for improvement.

The most recent benchmarking methods in the extraction industry not only show how your operations compare but also guide strategic choices that enhance efficiency and incorporate cost reduction strategies in mining. As Johnson Matthey emphasizes, compliance with regulatory frameworks like the EU’s Regulation (EU) 2023/1542, which mandates specific shares of recovered materials in production by 2031 and 2036, underscores the importance of strategic alignment in your benchmarking efforts. Understanding the implications of this regulation can guide your organization in adopting best practices that meet compliance requirements while optimizing costs.

Furthermore, consider the insights from the case study on workforce challenges.

Talent recruitment and retention remain significant challenges for mining companies. By focusing on upskilling and creating attractive career pathways, organizations can build a strong work culture that addresses issues like bullying and harassment, ultimately providing a competitive advantage in recruiting and retaining staff. This aspect of workforce management can directly influence financial control and risk management strategies.

Lastly, establish a system for Continuous Monitoring of both internal operations and external factors that could impact expenses. This approach enables your organization to react swiftly to market dynamics and operational changes, ensuring you remain competitive. By integrating cost reduction strategies in mining, you can effectively manage risks and enhance expense management, positioning your organization for sustainable growth in the face of evolving industry challenges.

Optimizing Procurement and Supply Chain for Cost Savings

To achieve significant savings through procurement and supply chain optimization, CFOs should consider the following strategies:

- Supplier Negotiation: Proactive engagement in negotiations with suppliers is essential for securing favorable pricing and payment terms. Building long-term relationships can lead to collaborative opportunities for cost-sharing and innovation. As highlighted by industry expert Germán Millán, effective negotiation tactics are vital for addressing mismatches in the valuation of assets during mergers and acquisitions. This is especially pertinent as firms like PT Vale Indonesia have shown, achieving reductions of US$2.5 billion by utilizing slag nickel as a replacement for natural stone, highlighting the potential impact of strategic supplier engagement.

- Inventory Management: Implementing just-in-time (JIT) inventory systems can drastically reduce holding expenses and minimize waste. Regularly reviewing inventory levels ensures that optimal stock levels are maintained, preventing overstocking and associated costs.

- Supply Chain Collaboration: Cultivating collaboration among supply chain partners is crucial for streamlining processes and reducing expenses. By sharing information and resources, organizations can enhance efficiency and responsiveness, ultimately leading to the implementation of cost reduction strategies in mining and reduced operational expenses. Insights from the case study titled 'Building Trust During Private Equity Exit Strategies' suggest that earning trust from stakeholders through regular communication and transparency about risks can significantly improve collaboration in procurement strategies. Moreover, thorough financial assessments aimed at cash preservation and risk reduction can reveal hidden value and support cost reduction strategies in mining within these collaborative efforts. Our service team is equipped to assist CFOs in implementing these strategies effectively, ensuring that financial reviews align with procurement goals.

- Sourcing Alternatives: Exploring alternative sourcing options, such as engaging local suppliers, can significantly reduce transportation costs while enhancing supply chain resilience. This approach not only fosters community relationships but also mitigates risks associated with global supply chain disruptions. By implementing cost reduction strategies in mining, CFOs can take decisive action to stabilize financial positions and enhance operational efficiency, ultimately uncovering value that may have previously been overlooked. Our financial reviews provide the necessary insights and support to facilitate these strategies, aligning with ongoing efforts to classify and enhance the accessibility of resource data, often held by geological surveys, which can further inform procurement decisions.

Conclusion

Understanding and managing costs in mining operations is not merely a necessity; it is a strategic imperative for ensuring long-term profitability and operational efficiency. By thoroughly analyzing cost structures—including labor, materials, equipment, and overhead—CFOs can identify opportunities for significant savings. Implementing robust cost reduction strategies, such as:

- Process optimization

- Energy efficiency

- Predictive maintenance

can lead to enhanced productivity and reduced operational expenses.

Embracing technology is equally crucial in this endeavor. From leveraging data analytics for real-time insights to incorporating automation and remote monitoring, mining companies can streamline operations and mitigate risks associated with traditional processes. Furthermore, adopting digital twin technology allows for innovative solutions without the inherent risks of physical alterations, ultimately driving cost efficiency.

Risk management and benchmarking serve as essential tools in navigating the complexities of the mining sector. Regular risk assessments and comparative performance metrics provide a clearer picture of operational strengths and weaknesses, enabling informed decision-making. Additionally, optimizing procurement and supply chain processes can yield substantial savings by fostering supplier relationships and implementing effective inventory management strategies.

In summary, a proactive approach to cost management—rooted in thorough analysis, technological integration, and strategic risk management—will empower mining companies to thrive amid evolving industry challenges. As the landscape continues to shift, those who prioritize these initiatives will not only safeguard their current operations but also position themselves for sustainable growth and success in the future. The time to act is now; the path to enhanced profitability and efficiency is clear.

Frequently Asked Questions

What is the first step in executing cost reduction strategies in mining operations?

The first step is to conduct a thorough examination of the financial framework, focusing on major expense categories such as labor, materials, equipment, and overhead expenses.

Why is it important to examine labor expenses in mining operations?

Examining labor expenses is essential because labor costs are predicted to increase in 2024, which will affect overall operational budgets. Understanding labor dynamics helps in strategic workforce management.

How can material expenses be optimized in mining operations?

Material expenses can be optimized by assessing procurement methods for raw materials and supplies, focusing on productivity and sustainability. An example is PT Vale Indonesia's use of slag nickel, which resulted in significant savings.

What should be analyzed regarding equipment expenses?

It is important to analyze the efficiency and maintenance schedules of machinery and tools to reduce downtime and enhance performance efficiency.

What are overhead expenses and why should they be examined?

Overhead expenses are administrative and functional costs that may increase total expenses without directly aiding productivity. Examining these can help identify unnecessary costs.

What broader implications should be considered when analyzing mining expenses?

The potential threat to global metals production capacity due to heat and drought by 2050 emphasizes the need for comprehensive financial analysis to identify savings opportunities.

How can sustainable practices impact cost reduction in mining?

Incorporating sustainable practices can assist in compliance with regulations, such as the European Union's Regulation (EU) 2023/1542, and may also lead to long-term financial efficiency.

What role do cybersecurity protocols play in mining operations?

Robust cybersecurity protocols are critical for protecting operational and personnel data, adding an important layer of consideration for financial managers in resource extraction companies.

What is process optimization and why is it important for cost reduction?

Process optimization involves streamlining operations to identify bottlenecks and inefficiencies. It is important because it can eliminate waste and enhance productivity, contributing to overall cost reduction.

How can energy efficiency contribute to cost savings in mining?

Investing in energy-efficient equipment and conducting regular audits of energy consumption can uncover potential savings and lower utility expenses, significantly impacting operational costs.

What is the benefit of effective labor management in mining operations?

Effective labor management minimizes expenses by aligning workforce skills with business needs, reducing overtime costs, and enhancing overall productivity through cross-training.

What is predictive maintenance and how does it help in cost reduction?

Predictive maintenance is a proactive approach that minimizes equipment downtime and lowers repair expenses by ensuring regular maintenance is conducted, extending the lifespan of machinery.

Why is cost benchmarking important in mining operations?

Cost benchmarking allows organizations to compare their operations against industry standards, revealing areas for improvement and directing strategic choices that can enhance productivity and profitability.