Introduction

In the world of finance, the ability to lead a successful turnaround can define the future of an organization. As companies grapple with financial distress, the role of leadership becomes paramount, requiring a blend of resilience, decisiveness, and strategic foresight. Effective leaders not only establish a clear vision for recovery but also prioritize open communication and collaboration among stakeholders.

By assembling a dedicated turnaround team equipped with diverse expertise, organizations can navigate the complexities of financial recovery more adeptly. This article delves into the critical components of a successful turnaround strategy, emphasizing the importance of:

- Thorough financial assessments

- Stakeholder engagement

- Operational improvements

With actionable insights and real-world examples, it provides a roadmap for leaders aiming to steer their organizations back to stability and growth.

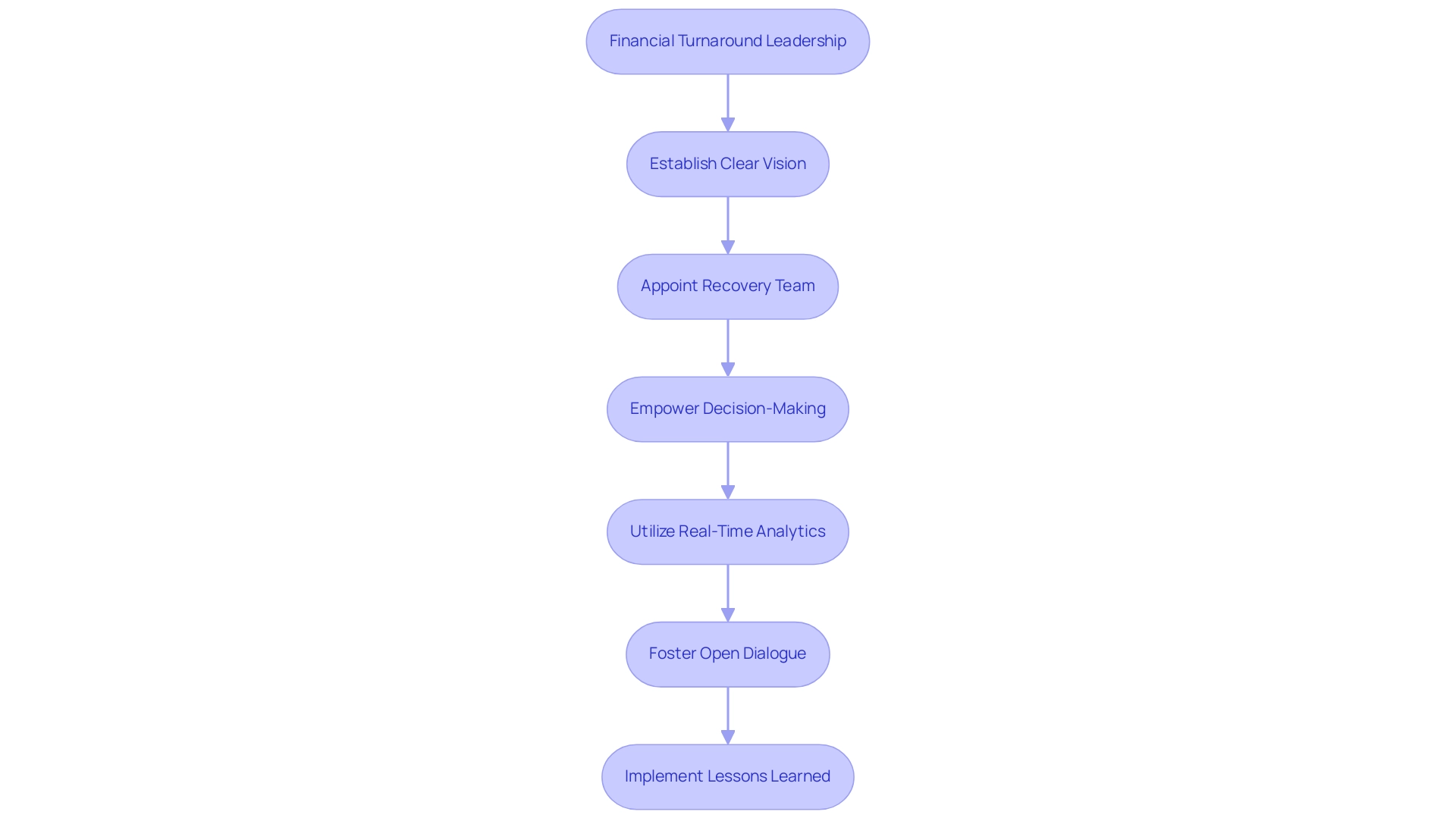

The Crucial Role of Leadership in Financial Turnarounds

Successfully managing a financial recovery through financial services turnaround management demands leadership characterized by resilience and decisiveness, underpinned by a commitment to streamlined decision-making and real-time analytics. It begins with establishing a clear vision for recovery, communicated effectively to all stakeholders. Leaders must prioritize open dialogue with employees, shareholders, and creditors as part of financial services turnaround management, fostering an environment of trust and collaboration.

- Appointing a dedicated recovery team with diverse expertise in financial services turnaround management, operations, and industry-specific knowledge is crucial.

- This team should be empowered to make critical decisions swiftly, enabling the organization to adapt to changing circumstances and implement necessary changes efficiently.

- Ongoing monitoring via real-time business analytics facilitates regular evaluations of progress, ensuring that leaders stay adaptable and prepared to adjust strategies as necessary for effective financial services turnaround management to guide the organization toward recovery.

Furthermore, a dedication to implementing the lessons acquired during the recovery phase is crucial for establishing robust, enduring connections with all stakeholders. Research indicates that effective leadership is crucial in financial services turnaround management, significantly enhancing recovery rates, while only 4.1% of managers recognize the importance of prioritizing changes in top management. Moreover, ANOVA analysis indicates a mean square of 156.003 for ROI reduction exceeding 10%, highlighting the potential economic advantages of strong leadership during financial services turnaround management efforts.

The validation of recovery strategies across various sectors, such as ferry, shipbuilding, and aircraft manufacturing, highlights how a well-executed strategy execution system can translate strategic goals into actionable processes. These studies reveal effective implementation methods and showcase the positive outcomes achieved through strong leadership. Amid recent challenges faced by the industrial sector, which has seen operating expenses exceed gross profits, and the trading sector's decline in sales and profits, organizations must remember that, as Rocío Lorenzo, a BCG alumna, aptly stated, 'Diversity drives innovation, and innovation drives diversity.'

A diverse leadership team can drive the innovative solutions essential for successful recovery in financial services turnaround management while strengthening relationships that are vital for long-term success.

Developing a Comprehensive Turnaround Management Strategy

A successful recovery in financial services turnaround management starts with a thorough monetary evaluation to reveal essential areas requiring focus, including cash flow shortfalls, high overhead expenses, and operational inefficiencies. Notably, the recent surge in Subchapter V elections for small businesses—showing a 30% increase from 465 filings in Q1 2023 to 606 in Q1 2024—highlights the urgency of implementing financial services turnaround management to address financial distress. Importantly, not all recoveries are viable; starting with diagnostics significantly improves the chance of success.

Utilizing data analytics is essential in this stage, as it enables the identification of trends and the forecasting of future performance, ensuring that decisions are data-driven. Our pragmatic approach to data emphasizes testing every hypothesis to deliver maximum return on invested capital both in the short and long term. Regular updates and adjustments through our client dashboard provide real-time business analytics, continually diagnosing your business health.

Following this assessment, it is crucial to create a detailed management plan for financial services turnaround management, setting specific, measurable goals along with realistic timelines. Involving key stakeholders, such as employees and creditors, encourages buy-in and support for the initiative, emphasizing the significance of building strong relationships during the endeavor. Incremental implementation of changes is vital, with an emphasis on achieving quick wins that can build momentum and validate progress.

Regular reviews and adjustments based on performance metrics and stakeholder feedback will support the financial services turnaround management needed to maintain alignment with the organization’s long-term objectives. Furthermore, utilizing technological solutions can greatly boost operational efficiency and refine financial reporting, offering valuable insights and optimizing workflows that are crucial in financial services turnaround management throughout the recovery journey. Moreover, alignment and adaptability are crucial to successful transformations, emphasizing the significance of acknowledging organizational culture in the recovery approach.

Importantly, our commitment to operationalizing the lessons learned throughout this process ensures that insights gained are effectively integrated into future strategies.

Conducting a Thorough Financial Assessment

To execute a comprehensive fiscal assessment crucial for financial services turnaround management and a successful turnaround, it is essential to gather and meticulously analyze key statements, including the balance sheet, income statement, and cash flow statement. This examination should focus on identifying trends in revenue, expenses, and profitability over the past few years. Pay close attention to anomalies, such as unexpected cost spikes or sales declines, and delve into their underlying causes.

Engaging with department heads is essential, as their insights can illuminate operational challenges contributing to monetary difficulties. Furthermore, leveraging economic ratios—ensuring a current ratio ideally above 1—and industry benchmarks will enable you to compare your company's performance against established standards, facilitating a more informed analysis. Using our client dashboard for real-time business analytics improves the decision-making process, enabling you to track success continuously and modify approaches as necessary.

A structured approach, as demonstrated in the case study titled 'Performing Year-Over-Year Trend Analysis,' can be easily implemented using spreadsheet software, allowing users to effectively analyze trends over time. This approach not only identifies areas requiring enhancement but also establishes the foundation for financial services turnaround management by creating a focused recovery plan that tackles specific weaknesses and leverages strengths. As Arnav Gupta, Executive Search & Leadership Consulting at Spencer Stuart, remarked, 'Very well explained!'

This affirmation highlights the effectiveness of a thorough financial assessment in guiding recovery efforts, reinforcing your financial services turnaround management initiatives. Furthermore, our e-commerce product specification features a Business Valuation Report valued at $3,500, advised by specialists like Peter Griscom, M.S., David Bates, CFP, CPA, and Chase Hudson, MBA, Lean Six Sigma Black Belt, who utilize AI/ML approaches to transform operations and improve decision-making.

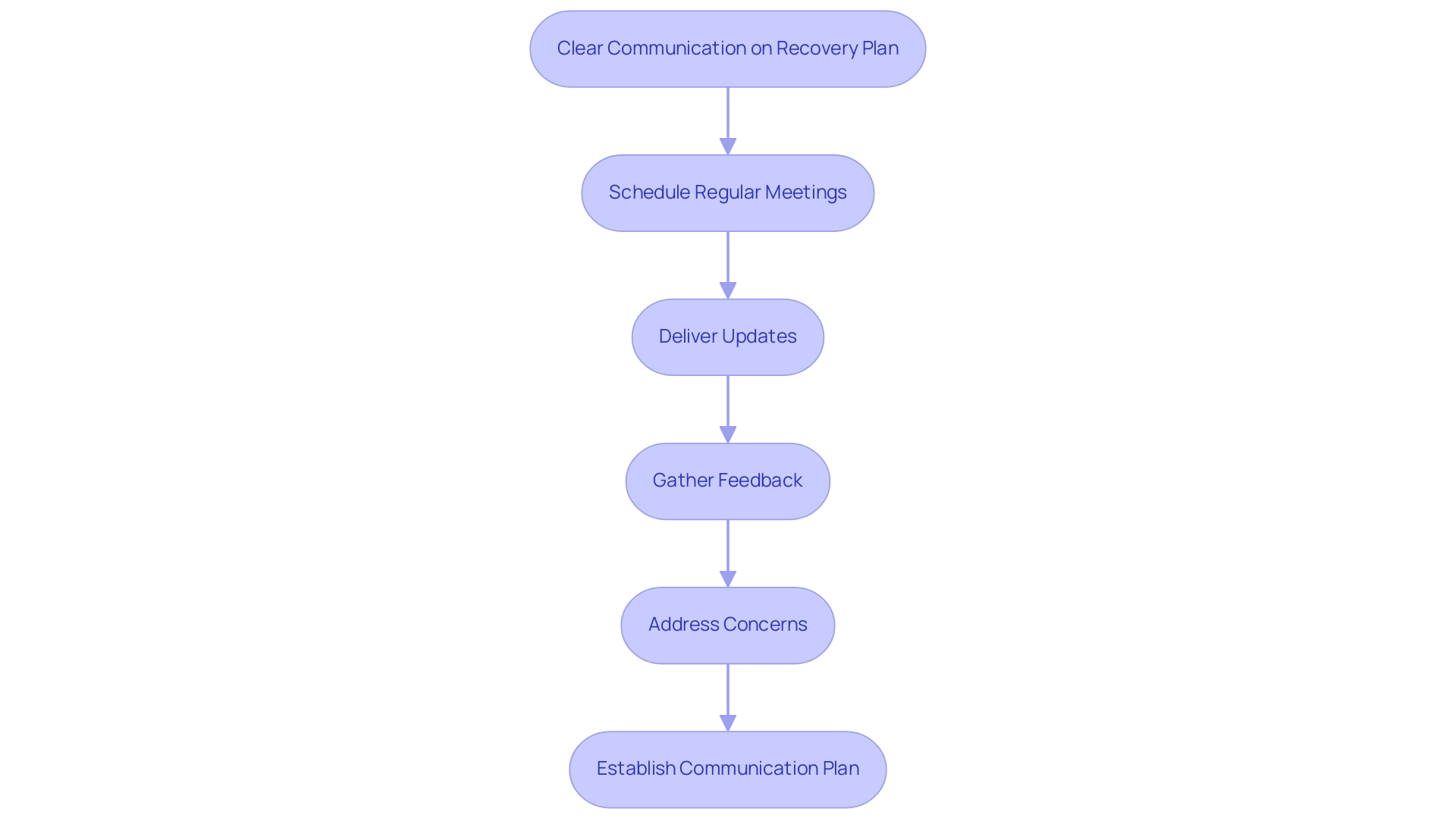

Engaging Stakeholders Effectively

Successful stakeholder involvement relies on clear communication concerning the recovery plan and its objectives. It is essential to schedule regular meetings with key stakeholders—employees, investors, and creditors—to deliver updates and gather valuable feedback. Openly addressing concerns fosters trust and demonstrates a commitment to stakeholder involvement, which is vital for informed decision-making.

As Scott Dylan, Co-Founder of Inc & Co, highlights, engagement is not just a procedure; it is an essential element of successful recovery approaches. Establishing a clear communication plan detailing how information will be disseminated and who is responsible for updates is crucial. One key aspect of our approach is the 'Rapid30' plan, which focuses on diagnosing issues and implementing solutions swiftly.

Client testimonials illustrate this impact:

- One business owner noted, 'Within 100 days of meeting the SMB team, my business was in a better position financially and strategically than it had been in years.'

- Moreover, another client revealed, 'Since finishing SMB's revival efforts, we were able to expand our business without debt and concentrate on what we excel at: serving our customers.'

These experiences showcase the transformative impact of SMB's support.

As you reflect on these approaches, we invite you to connect with us for more information and updates. Contact us at +1 (239) 428-9074 or visit our office at 3200 Bailey Ln, Naples, FL 34105.

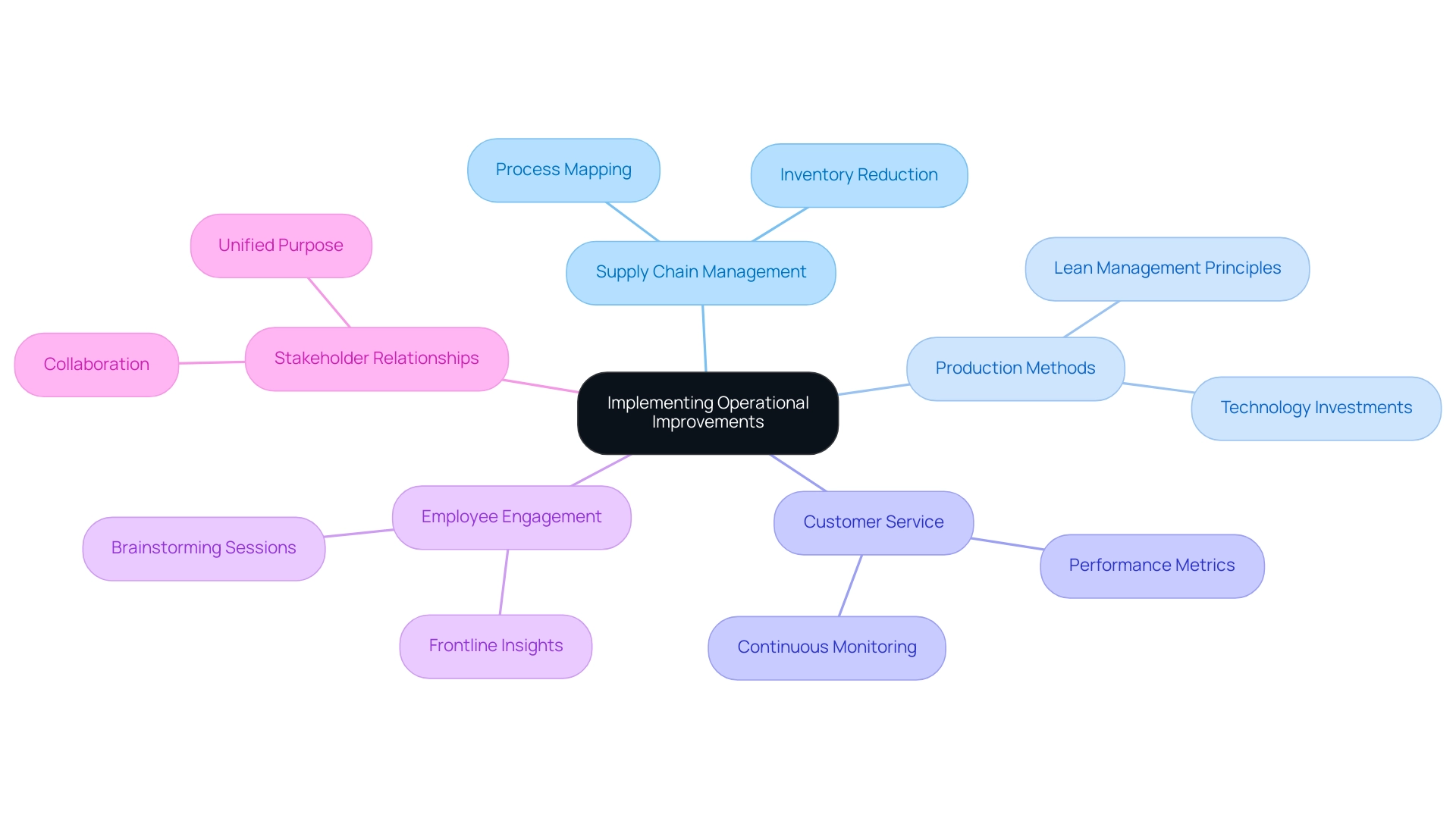

Implementing Operational Improvements

To successfully manage a recovery situation, it is essential to recognize important operational aspects that require enhancement, such as:

- Supply chain management

- Production methods

- Customer service

For instance, during the heavy-duty construction equipment industry's turnaround after the 2008-2009 economic crisis, companies like Caterpillar and Volvo implemented strategies involving layoffs and cost management, which were essential for their recovery. Begin by conducting process mapping to visualize workflows, which will help in pinpointing bottlenecks that hinder efficiency.

Engaging employees through brainstorming sessions is vital; their frontline insights can lead to valuable suggestions for potential improvements. Implementing lean management principles can eliminate waste and streamline operations, significantly enhancing overall performance. Organizations that effectively apply these methodologies in financial services turnaround management often see success rates in financial recovery soar, aligning with the latest trends emphasizing operational efficiency.

Additionally, consider investing in technology solutions designed to enhance productivity and automate manual tasks, thereby freeing up resources for more strategic initiatives. Continuous monitoring of the impact of these changes through performance metrics is essential. A strong method for monitoring progress, backed by real-time business analytics from a client dashboard, will guarantee that operational enhancements are closely aligned with your overall plan.

Testing and measuring hypotheses throughout this process is vital to deliver maximum return on invested capital. Furthermore, a commitment to developing strong lasting relationships with stakeholders can foster collaboration and support operational improvements. The Operational Excellence Index (OEI) indicates that a score above 55 places organizations among the best in terms of operational excellence, providing a clear target for CFOs to aim for in their financial services turnaround management strategies, ultimately leading to sustained success.

Conclusion

Successful financial turnarounds hinge on effective leadership, comprehensive assessments, and robust stakeholder engagement. Leaders must embody resilience and decisiveness, fostering an environment of trust through transparent communication. By assembling a diverse turnaround team and actively involving stakeholders, organizations can create a collaborative atmosphere that is essential for recovery.

A thorough financial assessment serves as the cornerstone of a successful turnaround strategy. Identifying cash flow issues and operational inefficiencies through meticulous analysis allows for data-driven decision-making. Crafting a detailed turnaround management plan with measurable goals and realistic timelines ensures that the organization remains aligned with its long-term objectives. Incremental implementation of changes, paired with regular reviews and stakeholder feedback, builds momentum and validates progress.

Operational improvements play a critical role in navigating the complexities of recovery. By focusing on key areas such as supply chain management and production processes, organizations can enhance efficiency and performance. Embracing technology solutions and lean management principles fosters innovation and drives sustainable success.

In conclusion, the journey of financial recovery demands a strategic approach characterized by strong leadership, diligent assessment, and effective stakeholder engagement. By prioritizing these critical components, organizations can not only navigate their current challenges but also lay the groundwork for future growth and stability. The path forward is clear: take decisive action, leverage insights, and foster collaboration to turn adversity into opportunity.

Frequently Asked Questions

What is essential for successful financial services turnaround management?

Successful financial services turnaround management requires leadership characterized by resilience and decisiveness, a commitment to streamlined decision-making, and real-time analytics. It begins with establishing a clear vision for recovery and fostering open dialogue with stakeholders.

Why is appointing a dedicated recovery team important?

A dedicated recovery team with diverse expertise is crucial because it allows for swift decision-making and the ability to adapt to changing circumstances, which is essential for implementing necessary changes efficiently during the recovery process.

How does real-time business analytics contribute to financial recovery?

Ongoing monitoring through real-time business analytics enables regular evaluations of progress, helping leaders stay adaptable and prepared to adjust strategies as necessary for effective turnaround management.

What role does leadership play in financial services turnaround management?

Effective leadership is vital, significantly enhancing recovery rates. Research indicates that only a small percentage of managers prioritize changes in top management, highlighting the importance of strong leadership in recovery efforts.

What initial steps should be taken for a successful recovery?

A thorough monetary evaluation should be conducted to identify areas needing focus, such as cash flow shortfalls and operational inefficiencies. This initial diagnostic phase is crucial for improving the chances of a successful recovery.

How can data analytics be utilized in financial recovery?

Data analytics helps identify trends and forecast future performance, ensuring decisions are data-driven. Regular updates and adjustments through a client dashboard provide real-time insights into business health.

What should a management plan for turnaround management include?

The management plan should set specific, measurable goals with realistic timelines and involve key stakeholders to encourage buy-in and support for the recovery initiative.

Why is stakeholder communication important during recovery?

Clear communication with stakeholders about the recovery plan and its objectives fosters trust and ensures informed decision-making, which is vital for successful recovery.

What operational aspects should organizations focus on improving?

Organizations should enhance supply chain management, production methods, and customer service. Engaging employees for insights and implementing lean management principles can significantly improve operational efficiency.

How can technology solutions aid in turnaround management?

Investing in technology can enhance productivity by automating manual tasks, allowing resources to be allocated to more strategic initiatives, ultimately supporting operational improvements during the recovery journey.