Overview

The article provides a step-by-step guide for CFOs on how to effectively engage with FTI Consulting's corporate finance and restructuring services, highlighting the importance of tailored strategies and thorough evaluations to navigate financial challenges. This guidance is supported by insights into the current economic landscape, the necessity for real-time analytics, and the growing demand for specialized consulting services, all of which emphasize the critical role of expert collaboration in achieving sustainable organizational growth.

Introduction

In an increasingly complex financial landscape, CFOs are tasked with navigating an array of challenges that can threaten organizational stability and growth. From cash flow volatility to stringent regulatory compliance, the pressure to innovate and adapt is higher than ever.

FTI Consulting emerges as a vital partner, offering a comprehensive suite of corporate finance and restructuring services designed to empower CFOs in their decision-making processes. With a focus on tailored strategies, advanced financial assessments, and industry-specific solutions, FTI Consulting equips financial leaders with the tools necessary to not only address immediate financial hurdles but also position their organizations for sustainable success.

As the demand for expert guidance in the financial advisory sector continues to surge, understanding how to leverage these resources effectively becomes essential for navigating the uncertainties of today's economic environment.

Understanding FTI Consulting's Corporate Finance and Restructuring Services

FTI Consulting corporate finance and restructuring stands at the forefront of services, offering critical support to organizations facing economic challenges. Their comprehensive suite of services includes:

- Thorough monetary assessments aimed at cash preservation and liability reduction

- Cash flow management

- Operational restructuring

- Hands-on interim management solutions

Importantly, FTI Consulting also offers bankruptcy case management, ensuring that all aspects of economic distress are addressed.

For chief financial officers, utilizing these services is not merely beneficial; it's crucial for successfully managing monetary crises and driving their organizations toward sustainable growth. With the advisory market projected to expand from over USD 89.13 billion in 2024 to USD 176.58 billion by 2037, growing at a compound annual growth rate (CAGR) of approximately 5.4%, the demand for expert guidance is undeniable. Collaborating with FTI Consulting enables CFOs to execute customized strategies and insights that address specifically small to medium enterprises and their distinct challenges, thus improving their capacity to ensure economic stability and operational efficiency.

Involving teams in decision-making around technology upgrades is vital for maintaining competitiveness in this evolving landscape. Moreover, such collaborations can significantly strengthen communication across organizations, reducing misunderstandings and encouraging a united approach to overcoming economic hurdles. The rapid expansion of the advisory services market in regions like Asia-Pacific, fueled by urbanization and a growing middle class, further highlights the potential benefits of FTI Consulting corporate finance and restructuring services within a dynamic marketplace.

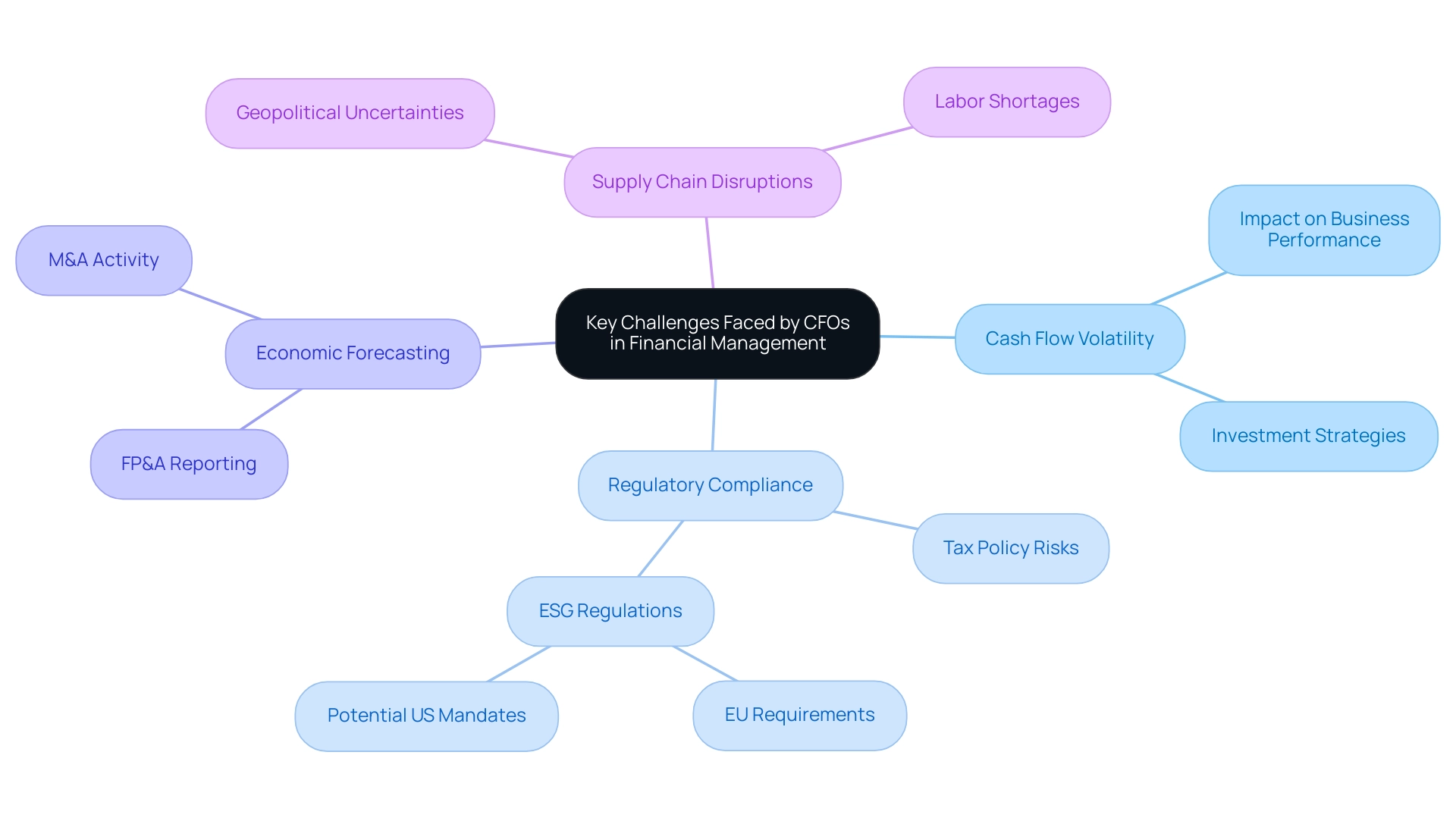

Key Challenges Faced by CFOs in Financial Management

Chief financial officers are navigating a landscape fraught with challenges, including cash flow volatility, stringent regulatory compliance, and the necessity for precise economic forecasting. According to recent findings, 67% of chief financial officers are prioritizing tax policy and regulatory risk, reflecting the growing complexity of compliance, particularly in light of new ESG regulations emerging in the EU and potential similar mandates in the US. Furthermore, ongoing supply chain disruptions due to geopolitical uncertainties and labor shortages add another layer of complexity to their decision-making processes, significantly influencing overall business performance.

As Rick and Chad anticipate for 2025, there will be an intensified focus on FP&A reporting and a surge in M&A activity, emphasizing the need for strong monetary strategies. To effectively handle these challenges, chief financial officers must utilize solutions from FTI Consulting Corporate Finance and Restructuring, which encompass comprehensive evaluations, risk management strategies, and customized restructuring plans tailored to their unique organizational objectives. Our team will identify underlying business issues and work collaboratively to create a plan to mitigate weaknesses, enabling businesses to reinvest in key strengths.

By adopting a pragmatic approach to data, we test every hypothesis to deliver maximum return on invested capital in both the short and long term. For example, companies that implemented our restructuring strategies have seen an average return on investment of 15% within the first year. By recognizing and tackling these challenges, especially those related to resource management in 2024, chief financial officers can pave the way for improved fiscal oversight and resilience in an unpredictable economic climate.

As Owen Ryan, Co-CEO of BlackLine, aptly puts it, 'Companies need to embrace modern, next-generation solutions that automate cumbersome processes... and give them complete visibility and control over their monetary data.' This proactive approach is essential for navigating the complexities of today’s economic landscape, ensuring that CFOs are equipped with the tools necessary for successful decision-making.

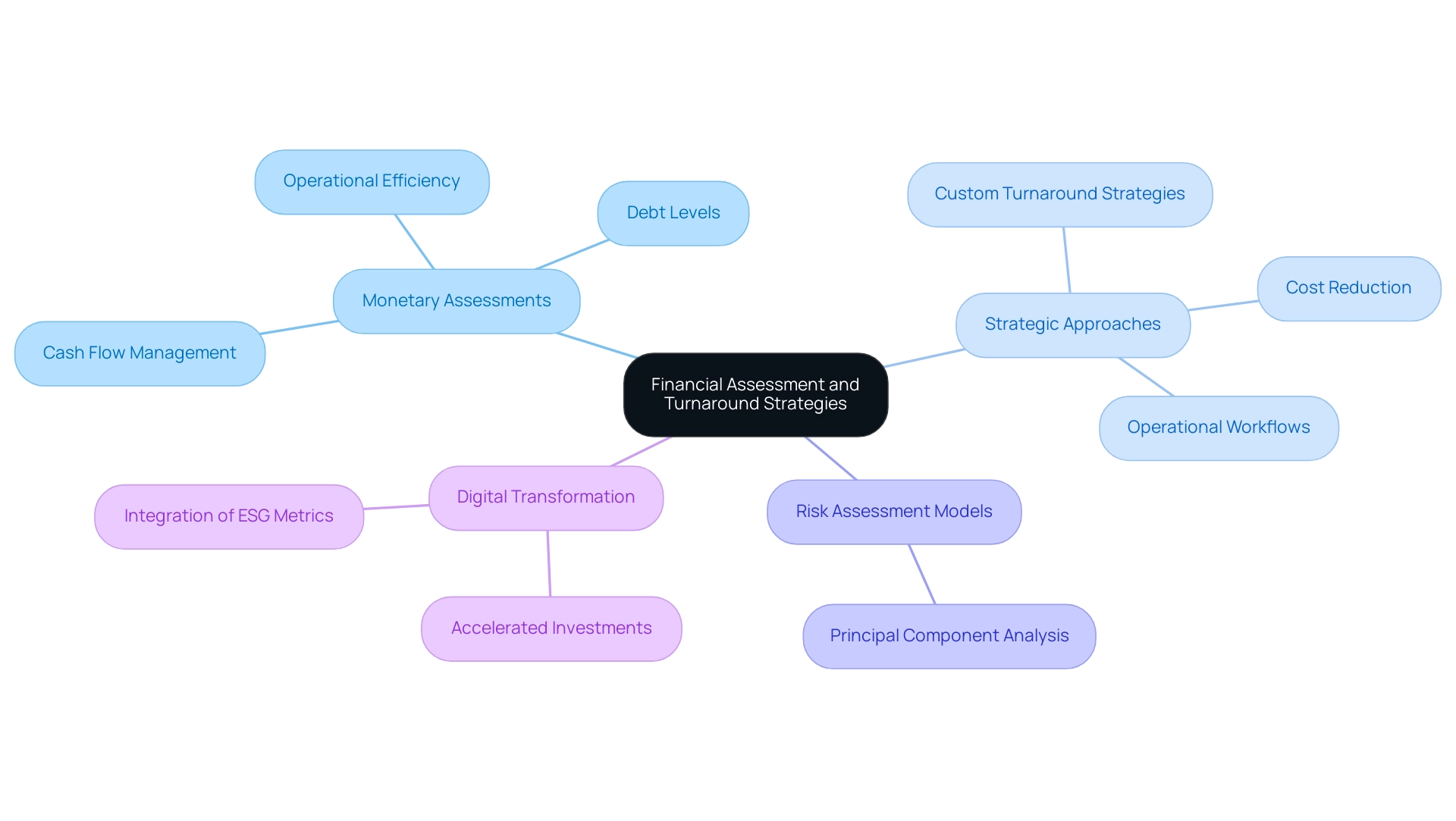

The Role of Financial Assessment and Turnaround Strategies

Conducting thorough monetary assessments is crucial for pinpointing the strengths and weaknesses inherent in an organization's economic health. At FTI Consulting Corporate Finance and Restructuring, we employ advanced financial analysis techniques that concentrate on critical areas such as cash flow management, debt levels, and operational efficiency. By mastering the cash conversion cycle through our 20 strategic approaches, financial leaders can implement customized turnaround strategies tailored to address specific challenges—whether that involves cutting overhead costs or enhancing operational workflows.

Such proactive measures not only stabilize the organization but also strategically position it for sustainable growth. As the landscape evolves, with 82% of CFOs reporting accelerated investments in digital technologies, integrating real-time analytics into monetary assessments becomes essential. The AFP Bank Relationship Management Survey emphasizes that economic stability is a top priority for 98% of treasury professionals, underscoring the importance of robust evaluations in selecting banking partners.

Zheng emphasizes the necessity of a risk assessment model based on principal component analysis, which is vital for navigating economic uncertainties effectively. This analytical approach enhances resilience and operational efficiency in 2024 and beyond. Furthermore, as digital transformation and ESG metrics continue to shape economic performance, their integration into evaluations will be critical for future success.

By operationalizing the lessons learned during the turnaround process, entities can apply these insights to refine their strategies and improve overall performance, ensuring that they remain agile and responsive in a rapidly changing environment. Our services are competitively priced at $99.00, offering exceptional value for organizations aiming to improve their economic well-being and operational success.

Industry-Specific Solutions: Tailoring Services for Unique Needs

FTI Consulting recognizes the unique challenges and opportunities each industry faces, particularly in sectors such as retail, hospitality, and manufacturing. Our experts provide tailored solutions that enhance streamlined decision-making and real-time analytics, critical for effective business turnaround and performance monitoring. We begin by identifying underlying business issues and collaboratively planning actionable solutions.

For instance, in the retail space, we focus on:

- Optimizing supply chain operations to boost efficiency and reduce costs

While in hospitality, we emphasize:

- Improving customer experience

- Enhancing operational agility

Our pragmatic approach includes testing every hypothesis to ensure maximum return on invested capital. By leveraging industry-specific insights and real-time analytics, financial leaders can effectively measure investment returns and adapt strategies as needed.

As the CEO aptly stated, 'Only those institutions that can successfully navigate these waters will reach the safe harbors of profitability and growth.' This perspective is crucial as CFOs adapt to shifting economic conditions and balance loan and deposit rates. Significantly, proposed alterations to capital requirements are anticipated to raise common equity tier 1 ratios by 9% for global systemically important banks, emphasizing the changing economic landscape.

Furthermore, the case study titled 'Integrating Risk Controls in Transformation Initiatives' demonstrates that embedding risk and compliance measures from the outset of transformation projects can lead to sustainable cost reductions and regulatory compliance. By implementing insights gained through ongoing performance evaluation and relationship-building with stakeholders, organizations can effectively tackle current economic challenges and position themselves for success in a dynamic market.

Leveraging Technology in Corporate Finance and Restructuring

In the current digital landscape, the strategic integration of technology is paramount for effective FTI Consulting corporate finance and restructuring. FTI Consulting corporate finance and restructuring employs advanced analytics, state-of-the-art financial modeling software, and sophisticated data visualization tools to provide financial leaders with real-time insights into their financial performance and effectively manage the cash conversion cycle. To enhance the cash conversion cycle, financial leaders can implement strategies such as:

- Optimizing inventory management

- Accelerating receivables collection

- Extending payables without jeopardizing supplier relationships

Recent data indicates that half of organizations have now adopted artificial intelligence across multiple business functions, a significant increase from less than one-third in 2023. This trend underscores the critical need for CFOs to stay ahead of technology advancements. Technologies like open banking, introduced by the Payment Services Directive (PSD2) in 2015, have transformed the sector by facilitating seamless data sharing through standardized APIs.

This advancement not only enhances operational efficiency and cash flow management but also improves accuracy in monetary operations, demonstrating the benefits of collaborative models in practice. As Amanda Luther, a partner at BCG, observes,

Three-quarters of companies have yet to unlock value from AI,

emphasizing an opportunity for financial leaders to leverage these tools effectively. By embracing advanced analytics and fostering collaboration, leaders in finance can utilize FTI Consulting corporate finance and restructuring to make faster, more informed decisions that drive operational excellence and optimize restructuring strategies for long-term success.

For further insights, financial leaders are encouraged to explore our promotional guide on using AI and machine learning to revolutionize operations.

A Step-by-Step Approach to Engaging with FTI Consulting

A strategic approach is essential when engaging with FTI Consulting corporate finance and restructuring to ensure that financial objectives are met effectively. Here are the essential steps for CFOs:

-

Initial Consultation: Schedule a meeting to explore your entity's specific challenges and goals.

This foundational step sets the stage for a customized consulting experience.

-

Comprehensive Business Review: Begin with a thorough business review to align key stakeholders and gain a deeper understanding of your business situation beyond the numbers.

This review is crucial for identifying underlying issues and reinforcing strengths.

-

Monetary Evaluation: Allow FTI Consulting to conduct a comprehensive monetary evaluation, identifying underlying business issues and aligning key stakeholders.

This evaluation emphasizes economic well-being and corresponds with present industry trends, as demonstrated by the fact that 77% of professional client service firms now focus on customized solutions. With over 700,000 consulting businesses operating globally, choosing the right firm is crucial for achieving desired outcomes.

-

Strategy Development: Collaborate with FTI experts to craft a bespoke turnaround strategy that addresses your unique financial landscape.

Throughout this process, we emphasize testing hypotheses to ensure maximum return on invested capital.

-

Implementation: Partner closely to implement the strategies, ensuring all stakeholders are aligned and engaged in the process.

Our team supports a shortened decision-making cycle, allowing your organization to take decisive action.

-

Monitoring and Adjustment: Conduct regular reviews using real-time business analytics from our client dashboard to assess progress and make data-driven adjustments.

This ongoing evaluation is crucial to the success of consulting engagements, especially within corporate finance. By adhering to these steps, CFOs can adeptly navigate the complexities of corporate restructuring by leveraging the specialized expertise offered by FTI Consulting corporate finance and restructuring.

As highlighted in a case study on industry specialization in consulting, clients increasingly prefer consultants with deep expertise in specific industries to address tailored challenges. Furthermore, as Nicole Sheynin, Content Marketing Specialist, emphasizes,

It’s imperative for consultants to understand the ethical implications of generative AI and have the advanced knowledge to guide their clients effectively in their usage.

This insight underlines the importance of ethical considerations throughout the consulting process.

Additionally, we are committed to developing strong, lasting relationships with our clients, operationalizing the lessons learned through the turnaround process.

Conclusion

In the face of a rapidly evolving financial landscape, CFOs must leverage the comprehensive services offered by FTI Consulting to navigate the complexities that threaten organizational stability and growth. By conducting thorough financial assessments and implementing tailored strategies, CFOs can effectively address immediate challenges such as cash flow volatility and regulatory compliance, while positioning their organizations for long-term success.

The importance of industry-specific solutions cannot be overstated. FTI Consulting's expertise in various sectors enables CFOs to adopt pragmatic approaches that enhance operational efficiency and drive performance. Embracing advanced technologies and real-time analytics further empowers financial leaders to make informed decisions that optimize restructuring strategies and improve overall financial health.

Ultimately, the guidance provided by FTI Consulting not only equips CFOs to tackle current financial hurdles but also fosters a culture of resilience and adaptability within their organizations. By engaging with FTI Consulting, CFOs can confidently navigate the uncertainties of today's economic environment and ensure their organizations are well-prepared for the challenges ahead. The time to act is now—embrace these resources and strategies to secure a sustainable future for your organization.

Frequently Asked Questions

What services does FTI Consulting offer for corporate finance and restructuring?

FTI Consulting provides a comprehensive suite of services that includes monetary assessments for cash preservation and liability reduction, cash flow management, operational restructuring, interim management solutions, and bankruptcy case management.

Why are FTI Consulting's services important for chief financial officers (CFOs)?

These services are crucial for CFOs to effectively manage monetary crises and drive their organizations toward sustainable growth, especially in a challenging economic environment.

What is the projected growth of the advisory market, and what does this signify?

The advisory market is projected to grow from over USD 89.13 billion in 2024 to USD 176.58 billion by 2037, indicating a significant demand for expert guidance in navigating economic challenges.

How does FTI Consulting assist small to medium enterprises (SMEs)?

FTI Consulting collaborates with CFOs to implement customized strategies and insights that specifically address the unique challenges faced by small to medium enterprises, enhancing their economic stability and operational efficiency.

What challenges are CFOs currently facing?

CFOs are dealing with cash flow volatility, stringent regulatory compliance, the need for precise economic forecasting, tax policy and regulatory risk, supply chain disruptions, and geopolitical uncertainties.

What future trends are anticipated for CFOs in 2025?

There will be an intensified focus on financial planning and analysis (FP&A) reporting and an increase in mergers and acquisitions (M&A) activity, highlighting the need for robust monetary strategies.

What is the average return on investment for companies that implement FTI Consulting's restructuring strategies?

Companies that have implemented these restructuring strategies have seen an average return on investment of 15% within the first year.

How does FTI Consulting approach data and decision-making?

FTI Consulting adopts a pragmatic approach to data by testing every hypothesis to maximize return on invested capital in both the short and long term.

What does Owen Ryan, Co-CEO of BlackLine, emphasize regarding modern solutions for CFOs?

Owen Ryan emphasizes the need for companies to adopt next-generation solutions that automate cumbersome processes and provide complete visibility and control over their monetary data to navigate the complexities of the economic landscape effectively.