Overview

This article highlights how CFOs can effectively reduce operating expenses through a systematic evaluation of current costs and the implementation of targeted strategies. By categorizing expenses, negotiating with suppliers, and utilizing automation, CFOs can enhance financial health and ensure long-term sustainability.

These key steps not only streamline operations but also position businesses for future growth. Moreover, adopting these strategies can lead to significant cost savings, allowing organizations to allocate resources more efficiently.

Consequently, CFOs are encouraged to take action by evaluating their current expense management practices and implementing these targeted strategies to foster a more sustainable financial future.

Introduction

Operating expenses serve as the lifeblood of any business, wielding influence over profitability and growth potential. For CFOs, grasping and managing these costs transcends mere financial necessity; it emerges as a strategic imperative. As companies grapple with escalating expenses in domains such as software subscriptions and utilities, a pivotal question surfaces: how can financial leaders adeptly reduce operating expenses without sacrificing operational efficiency? This guide explores actionable strategies that equip CFOs to streamline costs, bolster financial health, and ensure their organizations flourish in an increasingly competitive landscape.

Define Operating Expenses and Their Impact on Business

Operating expenditures (OpEx) encompass the ongoing charges essential for managing a business, including rent, utilities, payroll, and other daily operational outlays. For financial executives, a comprehensive understanding of these expenses is crucial, as they significantly impact profitability and cash flow. Increased operating costs can diminish profit margins, hindering a company's ability to invest in growth initiatives. By precisely defining these expenses, CFOs can formulate targeted strategies on how to reduce operating expenses in business without sacrificing operational efficiency.

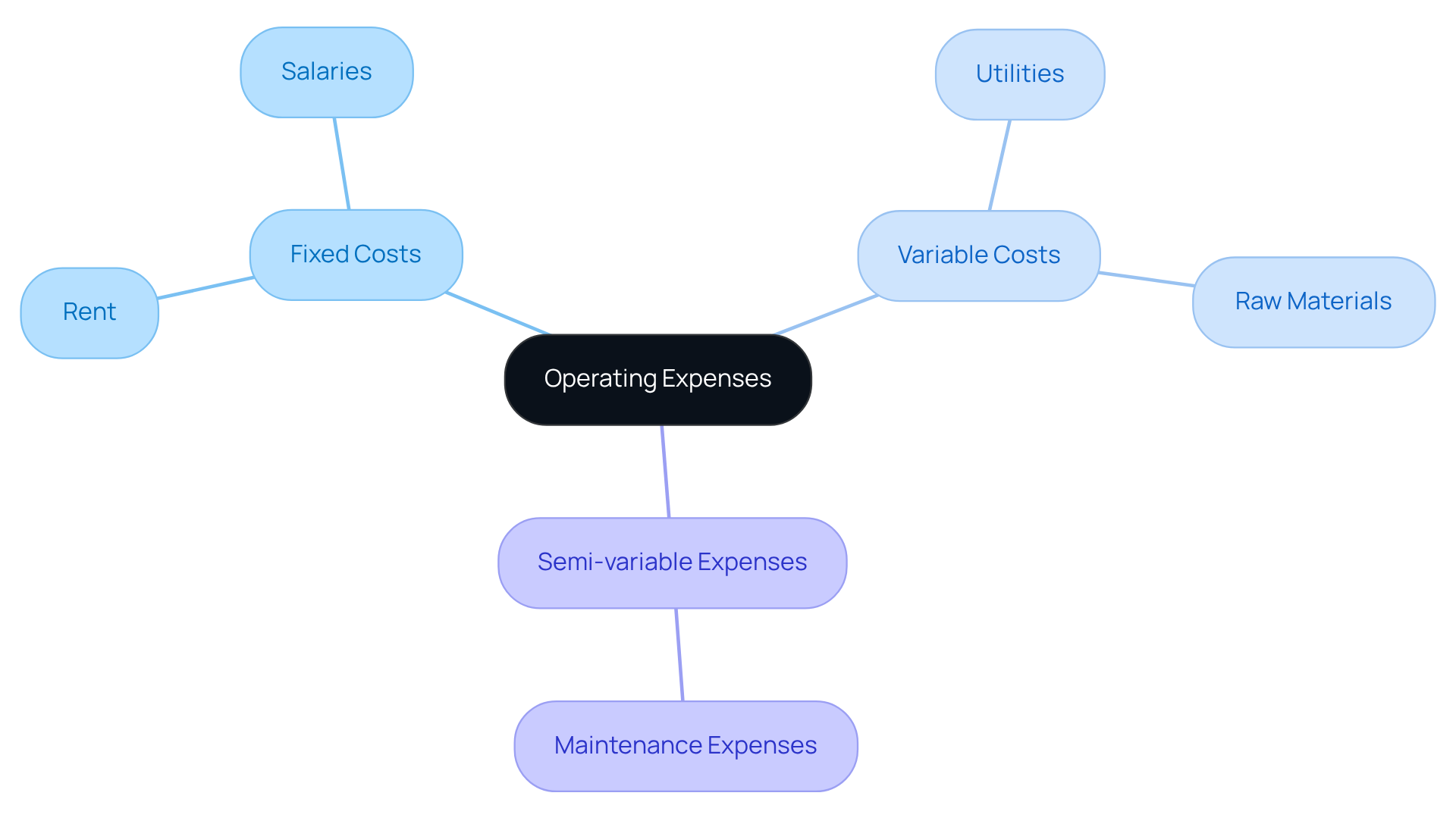

Key Types of Operating Expenses:

- Fixed Costs: These remain constant regardless of business activity, such as rent and salaries.

- Variable Costs: These fluctuate with business activity, including utilities and raw materials.

- Semi-variable Expenses: These encompass both fixed and variable elements, such as maintenance expenses.

Recognizing how to reduce operating expenses in business enables financial leaders to concentrate on reduction initiatives in specific sectors, ultimately enhancing financial health and sustainability. Recent trends indicate that software licenses and subscriptions have emerged as the third largest expense on company income statements, following payroll and real estate outlays. This shift underscores the imperative for financial leaders to adapt their strategies on how to in business effectively in 2025, ensuring their organizations remain competitive and financially robust.

Assess Current Operating Expenses and Identify Key Areas for Reduction

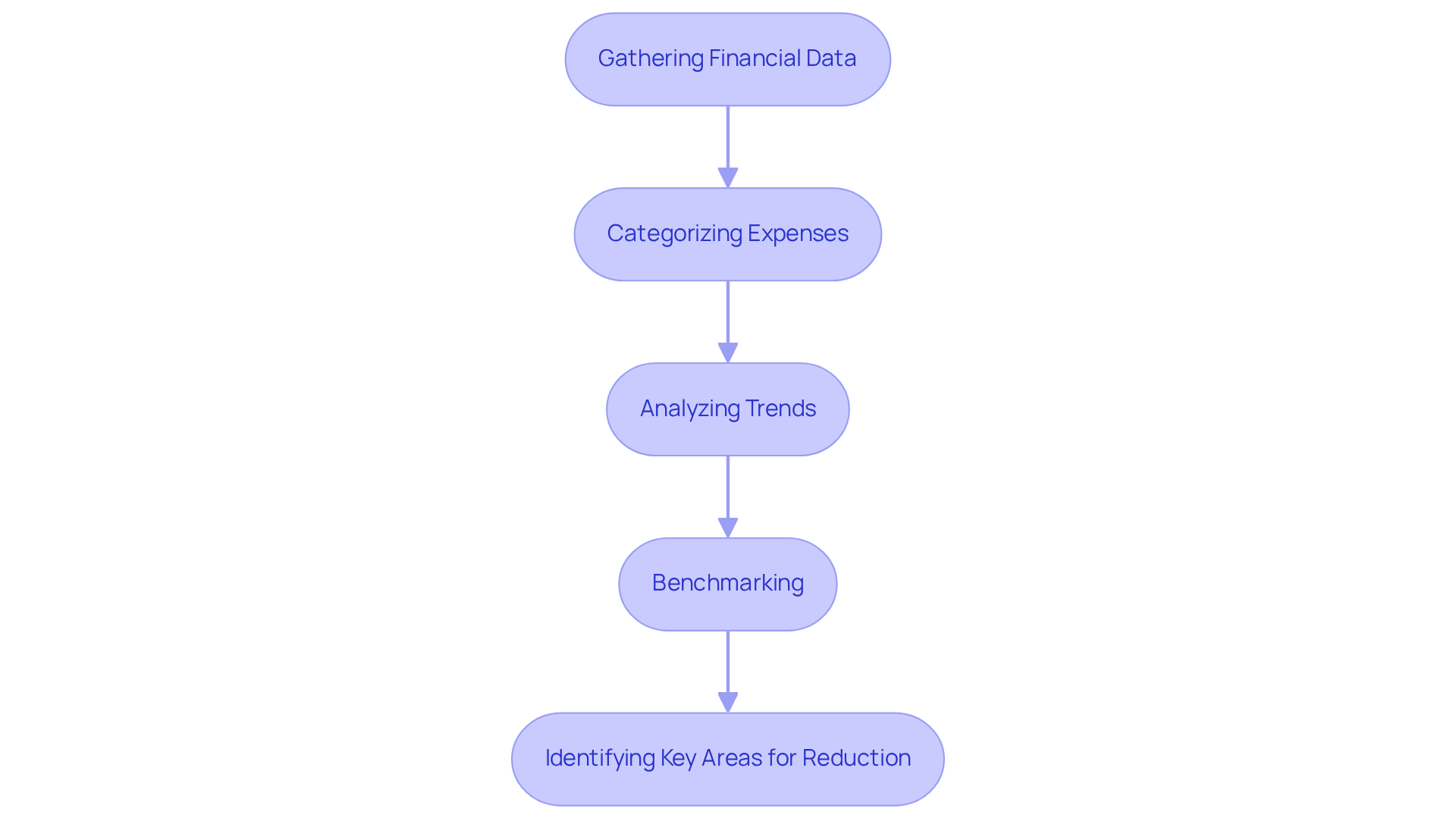

To efficiently learn how to in business, CFOs must perform a comprehensive evaluation of current outlays. This process includes the following steps:

- Gathering Financial Data: Compile all relevant financial statements, invoices, and cost reports to obtain a comprehensive view of current operating costs. This foundational step is crucial for informed decision-making, especially when utilizing real-time analytics to monitor business health.

- Categorizing Expenses: Classify expenses into fixed, variable, and semi-variable categories. This analysis aids in recognizing expenditure patterns and trends that may uncover inefficiencies, which is essential for understanding how to reduce operating expenses in business and enabling a more strategic approach to financial management.

- Analyzing Trends: Examine historical data to spot trends over time, particularly any spikes in expenses that could indicate operational inefficiencies or areas requiring immediate attention. For instance, 51% of firms struggle with uneven cash flows, highlighting the need for careful analysis and hypothesis testing to ensure maximum return on invested capital.

- Benchmarking: Compare your operating costs against industry standards. This benchmarking can highlight areas where your business may be overspending, which is essential for understanding how to reduce operating expenses in business. Engaging employees in decision-making can enhance their commitment, leading to a 23% increase in profits, as noted by Gallup.

- Identifying Key Areas for Reduction: Focus on high-cost areas such as utilities, payroll, and supply chain expenses. For instance, if utility expenses surpass industry averages, consider implementing energy-efficient upgrades or renegotiating contracts to attain savings. Shipware's successful shift from GPO rates to in-house contracts led to a 14% decrease in parcel expenses, saving their client $8.5 million each year.

By systematically evaluating current operational costs and applying the insights gained from this analysis, financial executives can effectively identify particular areas on how to reduce operating expenses in business. This organized method not only prepares the groundwork for effective financial management strategies but also conforms to best practices in financial data gathering, guaranteeing that decisions are data-informed and strategically solid. Additionally, ongoing monitoring and adjustments based on real-time analytics are essential to adapt strategies and maximize returns on invested capital.

Implement Strategies to Reduce Operating Expenses Effectively

To effectively reduce operating expenses, CFOs can implement several key strategies:

- Automate Processes: Utilizing technology to automate repetitive tasks can significantly reduce labor expenses and enhance efficiency. For instance, automating invoice processing can save over $10 per invoice, leading to substantial annual savings when handling large volumes. Automation not only reduces errors but also allows for real-time visibility into processes, enabling teams to focus on higher-value activities and operationalize lessons learned for continuous improvement.

- Negotiate with Suppliers: Regularly reviewing contracts and negotiating better terms with suppliers can yield considerable savings. Small enterprises frequently attain typical savings of 10-20% through successful supplier negotiations. Investigating different suppliers can also result in savings, guaranteeing that the company stays competitive and flexible to market shifts.

- Outsource Non-Core Functions: Delegating tasks like IT support or payroll processing to specialized companies can improve efficiency and lower expenses. By involving specialists in these areas, organizations can gain from economies of scale and enhanced service delivery, enabling internal teams to concentrate on primary activities that enhance profitability while utilizing lessons learned from earlier outsourcing experiences.

- Implement Remote Work Policies: Allowing employees to work remotely can significantly cut overhead costs associated with office space and utilities. This method not only lowers costs but also improves employee satisfaction and productivity, leading to a healthier workplace and implementing flexible work strategies.

- Conduct Regular Cost Evaluations: Creating a routine for assessing costs aids in recognizing new chances for savings and guarantees that spending aligns with organizational goals. Regular assessments can uncover inefficiencies and promote a culture of cost-consciousness within the organization. Utilizing can further enhance this process, enabling financial leaders to continually diagnose business health and adjust strategies as needed, operationalizing insights gained from these reviews.

By implementing these strategies, financial leaders can understand how to reduce operating expenses in business, ultimately aiding in improved profitability and financial stability.

Monitor and Adjust Expense Management Strategies for Continuous Improvement

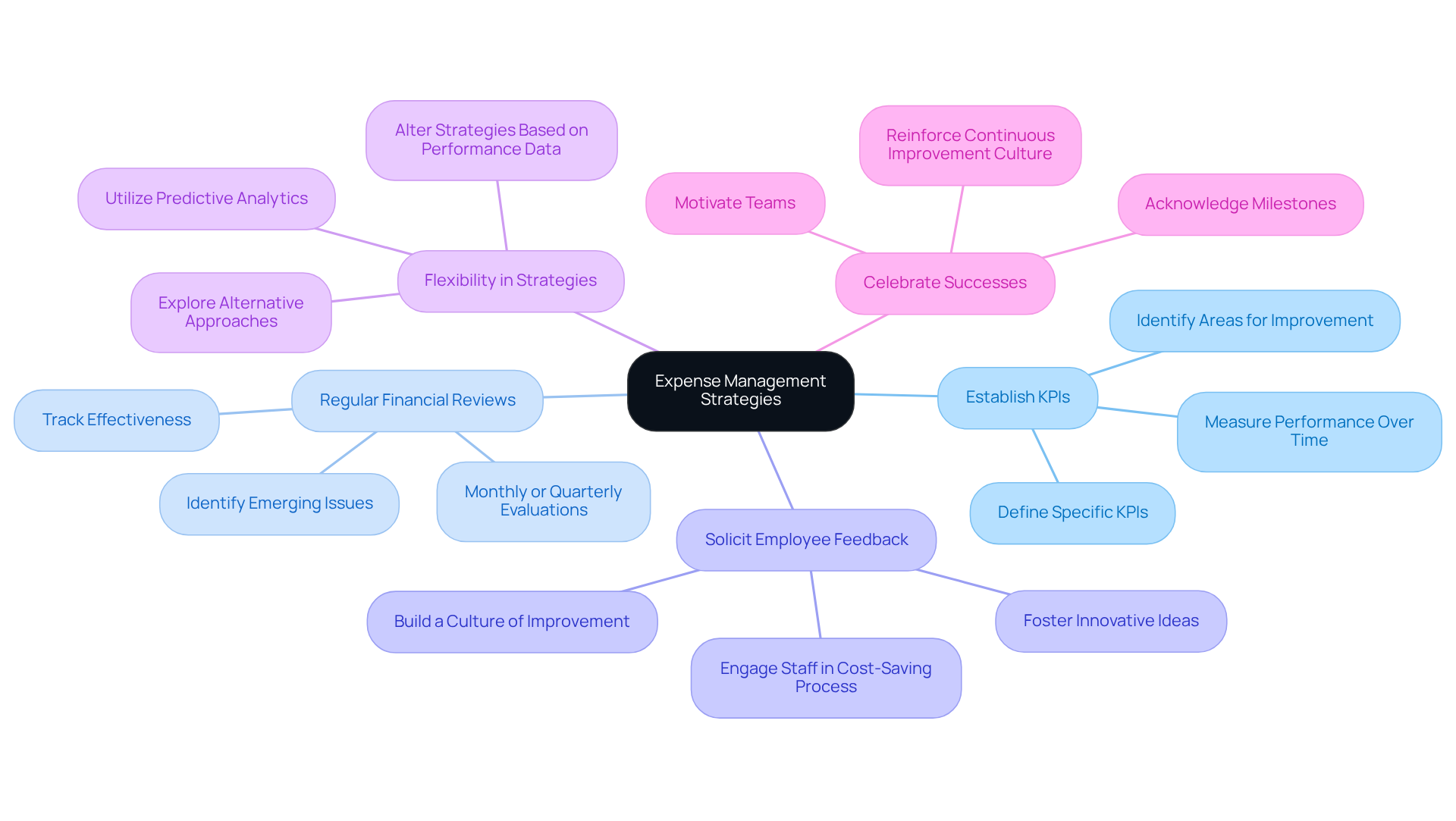

To maintain the effectiveness of expense management strategies, CFOs should implement the following practices:

- Establish Key Performance Indicators (KPIs): Define specific KPIs related to operating costs, such as cost ratios and cost per unit of output. These metrics provide a framework for measuring performance over time and identifying areas for improvement, ensuring a data-driven approach to decision-making.

- Regularly reviewing financial reports will help in understanding how to reduce operating expenses in business by conducting monthly or quarterly evaluations to monitor progress against cost reduction goals. This practice not only helps in but also aids in identifying emerging issues that may require immediate attention. Research shows that organizations that participate in regular financial reviews can significantly improve their effectiveness in learning how to reduce operating expenses in business. For instance, companies that implement automated approval workflows have discovered how to reduce operating expenses in business, as they have seen processing times reduced by up to 50%, leading to more efficient expense management.

- Solicit Employee Feedback: Actively involve employees in the cost-saving process by soliciting their feedback on potential improvements. Engaging staff can lead to innovative ideas and foster a culture focused on how to reduce operating expenses in business throughout the organization. As Peter Drucker famously stated, "What gets measured gets managed," emphasizing the importance of involving all levels of the organization in financial oversight.

- Be flexible and prepared to alter strategies as needed, particularly in relation to how to reduce operating expenses in business, based on performance data and changing market conditions. For instance, if a specific cost-saving initiative is underperforming, it may be necessary to explore alternative approaches to achieve desired outcomes. The case study on "Predictive Analytics" illustrates how organizations leverage data to optimize budgets and prevent overspending effectively. This aligns with the need for continuous business performance monitoring and operationalizing turnaround lessons to ensure maximum return on invested capital.

- Celebrate Successes: Acknowledge and celebrate milestones accomplished in cost reduction efforts. Acknowledging these successes not only motivates teams but also reinforces a culture focused on continuous improvement and financial responsibility.

By consistently monitoring and refining expense management strategies, CFOs can ensure their organizations remain agile and responsive to both internal and external challenges, ultimately driving sustainable growth.

Conclusion

Reducing operating expenses is not merely a financial necessity; it is a strategic imperative for businesses striving to thrive in a competitive landscape. By comprehensively understanding the various types of operating expenses and their implications on profitability, CFOs can formulate targeted strategies that enhance financial health without sacrificing operational efficiency.

This article delineates a systematic approach to expense reduction, underscoring the importance of thorough assessment, strategic implementation, and continuous monitoring. Key strategies—such as automating processes, negotiating supplier contracts, and conducting regular cost evaluations—offer actionable insights for financial executives. Furthermore, engaging employees and leveraging technology are highlighted as essential components for cultivating a culture of cost-consciousness and operational excellence.

In light of these insights, organizations are urged to take proactive measures in managing their operating expenses. By harnessing data-driven decision-making and remaining agile in their strategies, companies can not only bolster their bottom line but also position themselves for sustainable growth. Embracing these practices will empower businesses to navigate financial challenges effectively, ensuring they remain competitive and resilient in an ever-evolving market.

Frequently Asked Questions

What are operating expenses (OpEx)?

Operating expenses (OpEx) are the ongoing charges necessary for managing a business, including costs such as rent, utilities, payroll, and other daily operational outlays.

Why is understanding operating expenses important for financial executives?

Understanding operating expenses is crucial for financial executives because these expenses significantly impact profitability and cash flow. Increased operating costs can reduce profit margins and hinder a company's ability to invest in growth initiatives.

What are the key types of operating expenses?

The key types of operating expenses include: - Fixed Costs: Expenses that remain constant regardless of business activity, such as rent and salaries. - Variable Costs: Expenses that fluctuate with business activity, including utilities and raw materials. - Semi-variable Expenses: Expenses that have both fixed and variable elements, such as maintenance expenses.

How can reducing operating expenses benefit a business?

Reducing operating expenses allows financial leaders to focus on specific reduction initiatives, ultimately enhancing the financial health and sustainability of the organization.

What recent trend has been observed regarding operating expenses?

Recent trends indicate that software licenses and subscriptions have become the third largest expense on company income statements, following payroll and real estate outlays.

What should financial leaders do to adapt to changing operating expenses in 2025?

Financial leaders should adapt their strategies for reducing operating expenses effectively to ensure their organizations remain competitive and financially robust in 2025.