Overview

Business financial restructuring involves a strategic reorganization of a company's financial framework to enhance stability and profitability, primarily through debt, equity, and operational restructuring. The article outlines a step-by-step guide that emphasizes the importance of financial assessment, stakeholder engagement, and real-time analytics to ensure effective implementation and ongoing monitoring of restructuring efforts, ultimately aiming to improve cash flow and operational efficiency while mitigating associated risks.

Introduction

In an increasingly volatile economic landscape, financial restructuring has emerged as a critical strategy for organizations seeking to regain stability and enhance profitability. CFOs are tasked with navigating complex challenges, from fluctuating interest rates to declining revenues, necessitating a robust understanding of key restructuring concepts such as:

- Debt and equity management

- Operational efficiency

- Real-time analytics

This article delves into effective strategies for financial restructuring, offering actionable insights that empower decision-makers to optimize their financial frameworks. By examining the legal nuances, weighing potential benefits against inherent risks, and providing a step-by-step guide for implementation, this comprehensive overview equips CFOs with the necessary tools to drive successful restructuring efforts in 2024 and beyond.

Understanding Financial Restructuring: Key Concepts and Definitions

Business financial restructuring is a strategic process aimed at reorganizing a company's economic framework to bolster its stability and enhance profitability. This encompasses several key concepts that are crucial for CFOs and other decision-makers:

- Debt Restructuring: Modifying existing debt agreements improves cash flow and alleviates financial burdens, essential in today’s economic environment where over a third of real estate Chapter 11 filings reported liabilities of less than $10 million. Effective debt management is increasingly critical.

- Equity Restructuring: Adjusting ownership structures or issuing new equity to raise capital enables organizations to better position themselves for growth.

- Operational Restructuring: Streamlining operations is essential for enhancing efficiency and reducing costs, which significantly impacts the bottom line.

Moreover, our approach emphasizes the importance of testing every hypothesis to maximize the return on invested capital in both the short and long term. By endorsing a shortened decision-making cycle, we enable your team to take decisive action throughout the turnaround. Our client dashboard plays a vital role in facilitating real-time business analytics, allowing for continuous monitoring of plan success and diagnostics of business health.

This dashboard not only monitors performance metrics but also assists in implementing lessons learned throughout the reorganization process. Understanding these components, along with the triggers for business financial restructuring—such as declining revenues, high-interest rates, or increased competition—equips CFOs with the knowledge to identify the most applicable strategies for their organizations. Companies that integrate strong brand attributes, particularly those offering compelling experiences, are likely to outperform their peers during challenging times.

Moreover, ongoing innovations in out-of-court solutions and private credit reorganizations highlight the evolving landscape of monetary strategies. As long-term forecasts for bankruptcy filings stay high due to elements such as rising student loan debt and elevated interest rates, companies must stay alert and proactive in their business financial restructuring efforts.

Exploring Strategies for Effective Financial Restructuring

Efficient business financial restructuring necessitates a comprehensive strategy customized to the specific conditions of each entity, backed by simplified decision-making and real-time analytics. Here are several strategies that can be employed:

-

Debt Restructuring: Engaging in negotiations with creditors is crucial.

Modifying repayment terms, such as reducing interest rates or extending payment periods, can alleviate immediate monetary pressures. With new money from governmental bodies decreasing to just 8% in the first half of 2023—down from 11% in the second half of 2022—CFOs must be proactive in securing favorable terms to navigate tighter cash flows effectively.

-

Cost Reduction Initiatives: Identifying non-essential expenses is vital.

Implementing cost-cutting measures—such as workforce optimization and renegotiating supplier contracts—can significantly enhance liquidity. The recent trend indicates a significant rise in negative expectations, with 73% of financial executives predicting more organizational changes, highlighting the need for stringent cost management.

-

Asset Sales: Assessing the performance of assets is critical.

Selling underperforming or non-core assets can free up cash and reduce liabilities, allowing companies to focus on their core competencies. This approach aligns with the current shift in consumer spending trends, which favor experiences over products, particularly affecting sectors like retail and restaurants.

-

Revenue Enhancement: Exploring new revenue streams is essential.

Diversifying product offerings or entering new markets can provide much-needed cash flow. The evolving market landscape necessitates innovation and adaptability to meet changing consumer preferences, supported by real-time business analytics that continuously monitor performance.

-

Temporary Management: Involving skilled interim leaders can offer the direction needed to steer the transformation.

Their expertise in implementing necessary changes can accelerate recovery and ensure effective execution of reorganization strategies. As highlighted in recent case studies, particularly the one contrasting formal and informal reorganization processes, the decreasing trend in consensual out-of-court agreements indicates a growing complexity in cases, making structured leadership indispensable.

In addition to these strategies, it’s essential to test every hypothesis to deliver maximum return on invested capital in both the short and long term. Each of these strategies should be evaluated carefully against the company's specific context and goals, ensuring a tailored approach that maximizes effectiveness. As highlighted by economic experts, to unlock value in deals, understand and invest in these three overlooked elements: culture, purpose, and digital acumen.

This comprehensive viewpoint, along with ongoing assessment of business well-being via client dashboards, will enable CFOs to manage the obstacles of business financial restructuring in 2024 and beyond. By implementing a 'Test & Measure' approach, organizations can evaluate the effectiveness of their strategies, while the 'Update & Adjust' process allows for necessary changes based on real-time analytics, ensuring that decision-making remains agile and responsive.

Navigating Legal Considerations in Financial Restructuring

Navigating business financial restructuring requires a comprehensive understanding of various legal aspects that can significantly impact outcomes. Our bankruptcy and advisory services provide expert assistance customized for Chief Financial Officers, utilizing proven methodologies to guarantee effective outcomes. Here are key considerations:

- Bankruptcy Laws: It is crucial to grasp the implications of bankruptcy filings, particularly the distinctions between Chapter 7 and Chapter 11 in the U.S. Chapter 7 involves liquidation, while Chapter 11 allows for reorganization, which can be pivotal depending on the company's situation. Given that those aged 55 and older account for 20% of all bankruptcy filings, the need for strategic planning is evident. Additionally, as President Joe Biden mentioned, "In 2022, my administration announced new policies that would make it easier for student loan debts to be discharged," emphasizing the current economic pressures that may affect decision-making.

- Contractual Obligations: Conduct a thorough review of existing contracts with creditors, suppliers, and employees. Identifying obligations that may be influenced by restructuring efforts is essential in order to avoid potential legal disputes or complications. Our advisory team can assist in this critical assessment, employing a systematic approach to contract analysis that ensures no detail is overlooked.

- Regulatory Compliance: Adherence to financial regulations is non-negotiable. Ensure that all reporting requirements and disclosures to stakeholders are met to avoid penalties and enhance transparency. Our experts are well-versed in regulatory landscapes to guide you through compliance, utilizing best practices to streamline the process.

- Negotiation with Creditors: Engage experienced legal counsel to assist in negotiations with creditors. Our advisory services include connecting you with skilled negotiators who can ensure that any agreements reached are legally sound and enforceable, providing a solid foundation for recovery. We utilize strategic negotiation techniques to maximize outcomes for our clients.

By proactively addressing these legal considerations with our comprehensive advisory services, businesses can mitigate risks associated with business financial restructuring and significantly enhance their chances of achieving a successful outcome in today's challenging economic environment. We invite CFOs to connect with our team to explore how our customized services can assist with your fiscal reorganization needs. The recent case study titled "Per Capita Bankruptcy Filings Increase" indicates that this week saw approximately 38 bankruptcy cases per million people, up from 32 per million last year, reflecting a rise in financial distress.

With bankruptcy filings expected to remain elevated due to ongoing economic pressures, the stakes have never been higher.

Weighing the Benefits and Risks of Financial Restructuring

Business financial restructuring can provide significant advantages for organizations navigating challenging market conditions. Key benefits include:

- Improved Cash Flow: By strategically renegotiating debt obligations and implementing cost-cutting measures, companies can enhance their liquidity, which is crucial for day-to-day operations. This improvement is especially pertinent as the commercial real estate delinquency rate at commercial banks increased to 1.1% in Q3'23, up from 0.9% in the previous quarter, indicating possible cash flow challenges in the sector.

- Enhanced Operational Efficiency: Streamlining activities and optimizing resources can result in significant cost savings and improved productivity. Publicly traded office REITs currently trading at a median discount of 28% to NAV exemplify the need for operational adjustments to sustain competitive advantage. Our method incorporates real-time analytics that consistently track performance and guide decision-making.

- Improved Economic Stability: Effectively managing reorganization efforts can restore investor trust, strengthening the company's economic position in a changing market. We emphasize a pragmatic approach, testing hypotheses to ensure maximum return on invested capital in both the short and long term.

However, CFOs must also be aware of the inherent risks involved:

- Potential Loss of Control: Engaging with creditors during reorganization can sometimes result in diminished autonomy over critical business decisions, impacting strategic direction.

- Reputation Damage: The public perception of economic distress can adversely affect relationships with customers and suppliers, which is a vital consideration for ongoing operations.

- Legal Challenges: Missteps in the reorganization process may lead to litigation or scrutiny from regulatory bodies, further complicating recovery efforts.

In light of these dynamics, it is essential for CFOs to carefully weigh the benefits of business financial restructuring—such as improved cash flow and operational efficiency—against the risks, ensuring that their reorganization strategy is aligned with the organization's long-term objectives. Furthermore, private capital is increasingly present in the economic environment, allowing for more flexible and creative solutions for struggling companies, which may help them avoid Chapter 11 bankruptcy. As emphasized by industry experts,

To unlock value in deals, understand and invest in these three overlooked elements: culture, purpose, and digital acumen.

This comprehensive method can assist in reducing risks while maximizing the potential for successful reorganization. Additionally, case studies from regions like Germany, France, and the Nordics illustrate the real-world implications of financial distress in the commercial real estate market, highlighting the urgent need for business financial restructuring efforts. To support this effort, our team emphasizes the 'Decide & Execute' approach, allowing for a shortened decision-making cycle throughout the turnaround phase, which enables decisive action to preserve your enterprise.

We also focus on 'Update & Adjust' by continually monitoring the success of our plans through our client dashboard, providing real-time business analytics to diagnose your business health. Our commitment extends to operationalizing the lessons learned throughout the turnaround process, ensuring that these insights are integrated into future strategies.

Step-by-Step Guide to Implementing Financial Restructuring

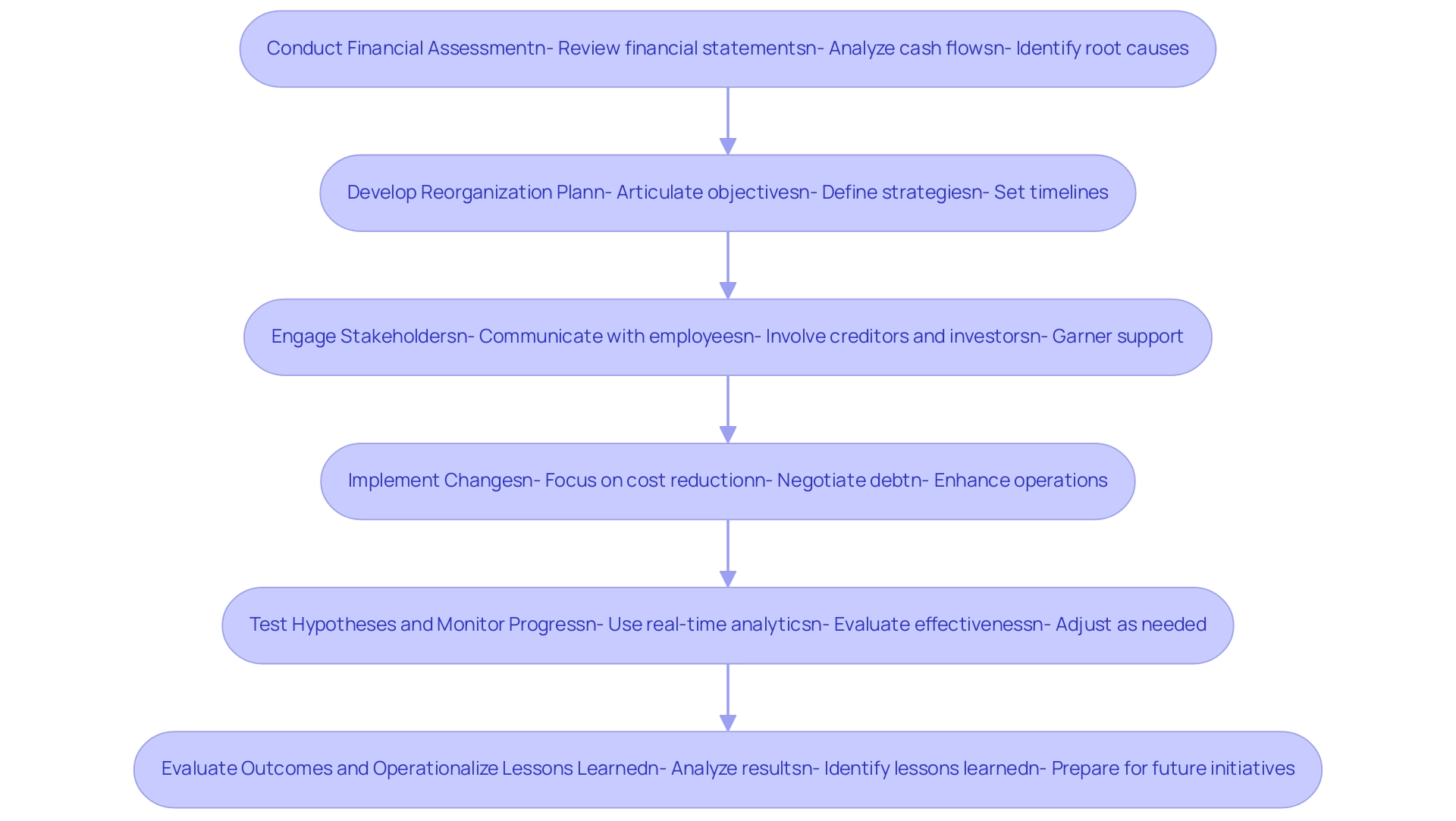

To successfully execute economic reorganization, follow the ensuing comprehensive steps:

- Conduct a Financial Assessment: Begin by meticulously reviewing financial statements, cash flows, and operational performance metrics. This analysis helps pinpoint specific areas requiring urgent improvement, ensuring a focused approach. Identifying root causes of distress is crucial at this stage, as it informs the subsequent steps in the reorganization process.

- Develop a Reorganization Plan: Formulate a detailed reorganization plan that articulates clear objectives, strategies, and timelines. This document acts as a roadmap for the reorganization process, guiding all subsequent actions.

- Engage Stakeholders: Actively communicate with key stakeholders—including employees, creditors, and investors—to garner support and buy-in for the reorganization initiative. As Osheen Jain aptly states, business financial restructuring is an effective strategy for companies aiming to overcome financial distress, improve liquidity, and enhance operational efficiency. Their engagement is pivotal for aligning interests and facilitating smoother implementation.

- Implement Changes: Execute the reorganization plan with a sharp focus on critical areas such as cost reduction, debt negotiation, and operational enhancements. It's essential to prioritize actions that will yield the most significant impact on liquidity and efficiency. Consider utilizing covenant waivers to allow temporary breaches of covenants without immediate penalties, which can provide necessary flexibility during this phase.

- Test Hypotheses and Monitor Progress with Real-time Analytics: Regularly evaluate the effectiveness of the changes using real-time analytics through a client dashboard, which offers current health diagnostics. This continuous monitoring allows for iterative adjustments to maintain momentum and ensure alignment with goals. Testing various hypotheses regarding operational changes can also guide decision-making and improve outcomes.

- Evaluate Outcomes and Operationalize Lessons Learned: After implementation, conduct a thorough analysis of the results to assess the success of the reorganization. This evaluation should include identifying lessons learned, which are invaluable for informing future initiatives and building strong, lasting relationships with stakeholders. In the context of Chapter 11, be aware of first-day motion filings, which are essential for maintaining operations and liquidity during the initial stages of the bankruptcy process.

By following this structured approach, businesses can navigate the complexities of economic reorganization with confidence, positioning themselves for business financial restructuring and ensuring sustainable growth. Case studies, such as Chrysler's significant restructuring in 2009, exemplify how strategic changes can lead to regained financial stability and operational success.

Conclusion

In a landscape marked by economic uncertainty, financial restructuring stands as a vital strategy for organizations aiming to regain stability and enhance profitability. Understanding key concepts such as debt and equity management, operational efficiency, and the importance of real-time analytics equips CFOs with the tools necessary for navigating these turbulent waters. By implementing strategies like debt restructuring, cost reduction, and asset sales, organizations can improve cash flow and operational efficiency, driving them toward a more resilient future.

Legal considerations also play a pivotal role in restructuring efforts, necessitating a thorough understanding of bankruptcy laws, contractual obligations, and regulatory compliance. Engaging skilled negotiators and legal counsel can mitigate risks and enhance the likelihood of a successful outcome. While the benefits of restructuring are substantial, including improved cash flow and increased operational efficiency, CFOs must remain vigilant about potential risks such as loss of control and reputational damage.

A structured, step-by-step approach to implementing financial restructuring is essential. Conducting a comprehensive financial assessment, developing a clear restructuring plan, engaging stakeholders, and continuously monitoring progress through real-time analytics are all critical components of a successful strategy. By adopting a 'Test & Measure' methodology, organizations can refine their approach in real-time, ensuring agility and responsiveness.

Ultimately, the path to financial stability demands proactive and informed decision-making. By embracing these strategies and insights, CFOs can navigate their organizations through financial distress, positioning them not only to survive but to thrive in an ever-evolving economic environment. The time to act is now—seize the opportunity to transform challenges into a foundation for sustainable growth and success.

Frequently Asked Questions

What is business financial restructuring?

Business financial restructuring is a strategic process aimed at reorganizing a company's economic framework to improve stability and enhance profitability.

What are the key concepts involved in financial restructuring?

The key concepts include debt restructuring, equity restructuring, and operational restructuring. These concepts help CFOs and decision-makers manage financial challenges effectively.

How does debt restructuring work?

Debt restructuring involves modifying existing debt agreements to improve cash flow and alleviate financial burdens, which is essential in today's economic environment.

What is equity restructuring?

Equity restructuring refers to adjusting ownership structures or issuing new equity to raise capital, positioning organizations better for growth.

Why is operational restructuring important?

Operational restructuring is crucial for streamlining operations, enhancing efficiency, and reducing costs, which can significantly impact a company’s bottom line.

What triggers the need for business financial restructuring?

Triggers can include declining revenues, high-interest rates, or increased competition, prompting organizations to reassess their financial strategies.

What strategies can be employed for effective business financial restructuring?

Strategies include debt restructuring, cost reduction initiatives, asset sales, revenue enhancement, and involving temporary management for guidance.

How can companies enhance cash flow through cost reduction?

Companies can enhance cash flow by identifying non-essential expenses and implementing cost-cutting measures, such as workforce optimization and renegotiating supplier contracts.

What role do asset sales play in restructuring?

Selling underperforming or non-core assets can free up cash and reduce liabilities, allowing companies to focus on their core competencies.

How can organizations explore new revenue streams?

Organizations can diversify product offerings or enter new markets to provide much-needed cash flow, adapting to changing consumer preferences.

What is the significance of having temporary management during restructuring?

Skilled interim leaders can provide necessary direction and expertise to steer the transformation, ensuring effective execution of reorganization strategies.

How can real-time analytics assist in financial restructuring?

Real-time analytics facilitate continuous monitoring of performance metrics, enabling organizations to evaluate the effectiveness of their strategies and make necessary adjustments.

What is the 'Test & Measure' approach in restructuring?

The 'Test & Measure' approach allows organizations to evaluate the effectiveness of their strategies, ensuring that decision-making remains agile and responsive to changing circumstances.

Why is understanding culture, purpose, and digital acumen important in restructuring?

These elements are essential for unlocking value in deals and ensuring that restructuring efforts align with the company's overall goals and market demands.