Overview

Mastering distressed asset recovery involves key steps:

- Thorough assessment

- Vigilant monitoring

- Strategic adjustments aimed at enhancing the value of underperforming properties

By gathering financial data, conducting market analysis, and establishing key performance indicators (KPIs), businesses can effectively navigate the recovery process. This approach not only capitalizes on opportunities but also leads to significant returns on investment. Consequently, understanding these processes is crucial for any organization aiming to optimize its asset portfolio.

Introduction

In the intricate realm of finance, the recovery of distressed assets embodies a distinctive fusion of challenges and opportunities that can significantly influence the trajectory of businesses. As organizations confront the aftermath of financial instability, grasping the nuances of distressed asset recovery becomes essential. This process encompasses not only the identification and valuation of underperforming assets but also necessitates a strategic management approach capable of unlocking substantial potential for revitalization.

With appropriate methodologies in place, companies can adeptly navigate the tumultuous market landscape, converting liabilities into profitable investments. This exploration will examine the critical steps for evaluating distressed assets, overseeing recovery initiatives, and refining strategies to secure successful outcomes in an ever-changing economic environment.

Understand Distressed Asset Recovery

Distressed asset recovery involves the identification, valuation, and management of underperforming or financially troubled properties, which can encompass real estate, corporate holdings, or financial securities. A thorough understanding of troubled properties is essential, as they present both unique challenges and significant opportunities. Key characteristics of distressed assets include:

- Financial Instability: These assets are frequently associated with companies facing bankruptcy or severe cash flow challenges, making their recovery critical for overall financial health.

- Market Value Fluctuations: Distressed properties often sell at prices significantly below their true value, influenced by market perceptions and investor sentiment.

- Potential for Recovery: With effective strategies, troubled properties can be revitalized, yielding substantial returns on investment. For example, auction prepacks have demonstrated lower costs compared to traditional bankruptcy cases, highlighting a strategic avenue for revitalization.

In 2025, the landscape of troubled property retrieval is shaped by ongoing financial instability, with the typical pre-filing book value of total properties for medium companies ranging from $0.9 million to $2.1 million. This context emphasizes the necessity of timely intervention and strategic management. To formulate a successful improvement plan, businesses must adopt a pragmatic approach to data, rigorously testing every hypothesis to maximize returns on invested capital. The ability to make swift decisions is crucial, empowering teams to take decisive actions that preserve business health.

As Warren Buffett wisely stated, "Investing is a lifelong journey. Stay disciplined, keep learning, and never stray from the principles that have built enduring wealth." This perspective is particularly relevant in the domain of distressed asset recovery, where systematic approaches can yield favorable outcomes.

The case study titled "Industry Distress and Bankruptcy Costs" illustrates how industry distress impacts bankruptcy costs, indicating that heightened levels of distress can lead to increased expenses due to the efforts required to attract high-valuation bidders. Successful turnaround cases, such as companies that have effectively employed auction prepacks or strategic restructuring, demonstrate that with the right methodology, businesses can enhance their fortunes, even in challenging environments. Financial analysts underscore that understanding the characteristics of troubled properties is vital for effective distressed asset recovery and developing restoration plans. By grasping these concepts and leveraging real-time analytics, you will be better equipped to navigate the recovery process successfully.

Assess Distressed Assets Thoroughly

To effectively assess distressed assets, follow these key steps:

- Gather Financial Statements: Begin by collecting the most recent financial statements, including balance sheets, income statements, and cash flow statements. This data is essential for evaluating the financial health of the property and recognizing any unusual patterns that may suggest deeper issues. As Hamid Waqas, a PhD candidate, observes, "This unexpected indication of NITA may arise due to some unusual patterns in the financial statements of the troubled firms."

- Conduct a Market Analysis: Examine current market trends and comparable property sales to determine the troubled property's market value. Understanding these dynamics is crucial for establishing a realistic baseline for negotiations, particularly in the context of the 2025 market landscape. Notably, the p-value from the independent samples t-test for total resources was 0.944, indicating no statistically significant difference between companies involved in distressed asset recovery and non-distressed companies, which can inform your valuation approach.

- Evaluate Liabilities: Identify all outstanding debts and obligations associated with the asset. A clear understanding of these liabilities is vital for calculating the net value of the asset and determining the overall financial exposure.

- Assess Operational Factors: Examine operational aspects such as management effectiveness, market position, and potential for improvements. This evaluation can uncover opportunities for operational enhancements that may significantly influence restoration potential. By applying insights gained from earlier assessments, you can refine your strategy for restoration.

- Determine Restoration Capability: Using your thorough evaluation, assess the item's restoration capability. This involves examining the viability of various turnaround plans and estimating the timeline for restoration, which is essential for planning and execution. Employing models such as Piotroski’s F-Score, which has demonstrated effectiveness in forecasting financial distress, can further enhance your predictive abilities in evaluating financial distress, ensuring a robust strategy for reclaiming resources. Additionally, utilizing real-time business analytics can assist in consistently tracking the effectiveness of your improvement plans, enabling prompt adjustments as necessary.

By conducting a comprehensive assessment, you can make informed decisions regarding the feasibility of distressed asset recovery and the most effective approaches for revitalization.

Monitor and Adjust Recovery Efforts

Once restoration efforts are initiated, vigilant monitoring and timely adjustments are essential for success. Here’s how to effectively manage this critical process:

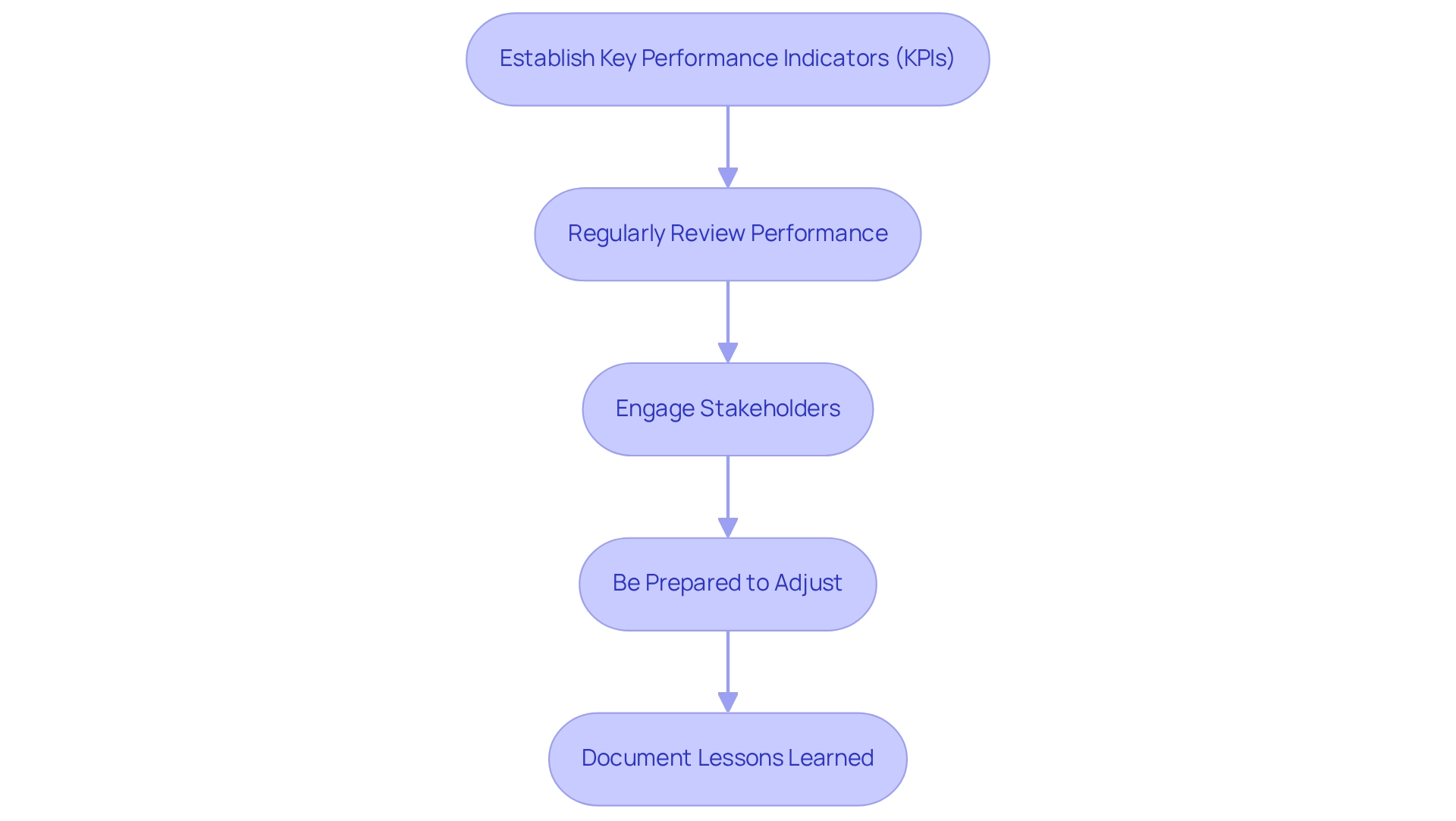

- Establish Key Performance Indicators (KPIs): Define specific KPIs to measure the success of restoration efforts. Key metrics may include cash flow improvements, debt reduction, and operational efficiency, which are vital for assessing progress. Based on industry insights, firms that efficiently track these KPIs can experience cash flow enhancements of up to 30% during rebound phases.

- Regularly Review Performance: Conduct frequent reviews of asset performance against the established KPIs. This practice helps pinpoint areas of success and identifies where strategic adjustments may be necessary. Utilizing real-time business analytics through a client dashboard can enhance this process, allowing for continuous diagnosis of business health.

- Engage Stakeholders: Foster open communication with all stakeholders involved in the restoration process, including investors, creditors, and management teams. Their insights can offer valuable input and improve the restoration plan. As pointed out by turnaround advisors, involving stakeholders can result in more informed decision-making and enhanced outcomes. Building strong relationships with these stakeholders is crucial for a successful recovery.

- Be Prepared to Adjust: If certain approaches fail to deliver expected results, be ready to pivot. This may involve revisiting the assessment phase to uncover new opportunities or challenges that have emerged. The dynamics influencing public credit markets highlight the necessity for flexibility in restoration plans, ensuring that decision-making cycles are reduced to permit decisive action. Testing hypotheses during this phase can reveal insights that drive better outcomes.

- Document Lessons Learned: Throughout the restoration journey, meticulously document effective strategies and those that fell short. This knowledge will be invaluable for future restoration efforts and can enhance your approach. Operationalizing the lessons learned through the turnaround process can strengthen relationships and enhance overall performance, ultimately maximizing return on invested capital. By actively monitoring and adjusting recovery efforts, businesses can significantly enhance their chances of successfully achieving distressed asset recovery. With the average risk of default for US public companies remaining elevated throughout 2025, understanding credit risk and implementing robust KPIs is crucial for sustainable growth.

Conclusion

The recovery of distressed assets presents a pivotal opportunity for organizations facing financial instability. By grasping the intricacies of distressed asset recovery—spanning the identification and valuation of underperforming assets to the implementation of strategic management practices—businesses can effectively transform liabilities into opportunities for revitalization. The key characteristics of distressed assets underscore the necessity for timely intervention and a disciplined approach to recovery, empowering companies to navigate the complexities of the market landscape.

Thorough assessments of distressed assets are essential for crafting effective recovery strategies. By gathering financial statements, conducting market analyses, evaluating liabilities, and assessing operational factors, organizations can unveil the true potential of these assets. Identifying recovery potential through robust models and real-time analytics ensures that businesses remain agile and responsive to the ever-changing economic environment.

Successful recovery efforts hinge on continuous monitoring and the willingness to adapt strategies as needed. Establishing key performance indicators, engaging stakeholders, and documenting lessons learned are crucial steps in enhancing recovery outcomes. As the economic landscape continues to evolve, the ability to pivot and refine recovery strategies will be vital for sustaining growth and maximizing returns on investment.

In conclusion, the journey of distressed asset recovery is fraught with challenges; however, it also offers significant rewards for those who approach it with diligence and strategic foresight. By mastering the art of recovery, organizations can not only stabilize their operations but also unlock new avenues for growth in a competitive market. The time to act is now—embracing the complexities of distressed asset recovery can lead to transformative change and lasting success.

Frequently Asked Questions

What is distressed asset recovery?

Distressed asset recovery involves the identification, valuation, and management of underperforming or financially troubled properties, which can include real estate, corporate holdings, or financial securities.

What are the key characteristics of distressed assets?

Key characteristics of distressed assets include financial instability, market value fluctuations, and the potential for recovery through effective strategies.

Why is financial instability significant in distressed asset recovery?

Financial instability is significant because distressed assets are often linked to companies facing bankruptcy or severe cash flow issues, making their recovery crucial for overall financial health.

How do market value fluctuations affect distressed properties?

Distressed properties often sell at prices significantly below their true value, influenced by market perceptions and investor sentiment.

What is the potential for recovery of distressed assets?

With effective strategies, troubled properties can be revitalized, yielding substantial returns on investment. For example, auction prepacks can demonstrate lower costs compared to traditional bankruptcy cases.

What is the typical pre-filing book value of total properties for medium companies in 2025?

The typical pre-filing book value of total properties for medium companies ranges from $0.9 million to $2.1 million.

What approach should businesses take to formulate a successful improvement plan for distressed assets?

Businesses must adopt a pragmatic approach to data, rigorously testing every hypothesis to maximize returns on invested capital, and the ability to make swift decisions is crucial.

How does industry distress impact bankruptcy costs?

Heightened levels of industry distress can lead to increased expenses due to the efforts required to attract high-valuation bidders, as illustrated in the case study 'Industry Distress and Bankruptcy Costs.'

What role does understanding troubled properties play in distressed asset recovery?

Understanding the characteristics of troubled properties is vital for effective distressed asset recovery and for developing restoration plans.

How can real-time analytics assist in the recovery process?

Leveraging real-time analytics helps navigate the recovery process successfully by providing insights that inform decision-making and strategy formulation.