Overview

The article focuses on understanding financial terrorism risk assessment, emphasizing its importance in identifying and mitigating risks associated with money laundering and terrorism financing. It highlights key methodologies, regulatory frameworks, and emerging trends, demonstrating that effective risk assessments are essential for organizations to enhance their compliance strategies and adapt to the evolving financial landscape.

Introduction

In the intricate world of finance, the specter of financial terrorism looms large, necessitating a proactive approach to risk assessment. Organizations must navigate the complex interplay of money laundering and terrorism financing, understanding the sources and methods that underpin these illicit activities. As financial systems face unprecedented threats, it becomes imperative for institutions to adopt robust methodologies and comply with evolving regulatory frameworks.

This article delves into the foundational aspects of financial terrorism risk assessment, exploring the methodologies that can be employed, the regulatory landscape that governs these practices, and the emerging trends that are reshaping the compliance landscape.

By equipping themselves with the right strategies, organizations can not only safeguard their assets but also contribute to the integrity of the global financial system.

Foundations of Financial Terrorism Risk Assessment

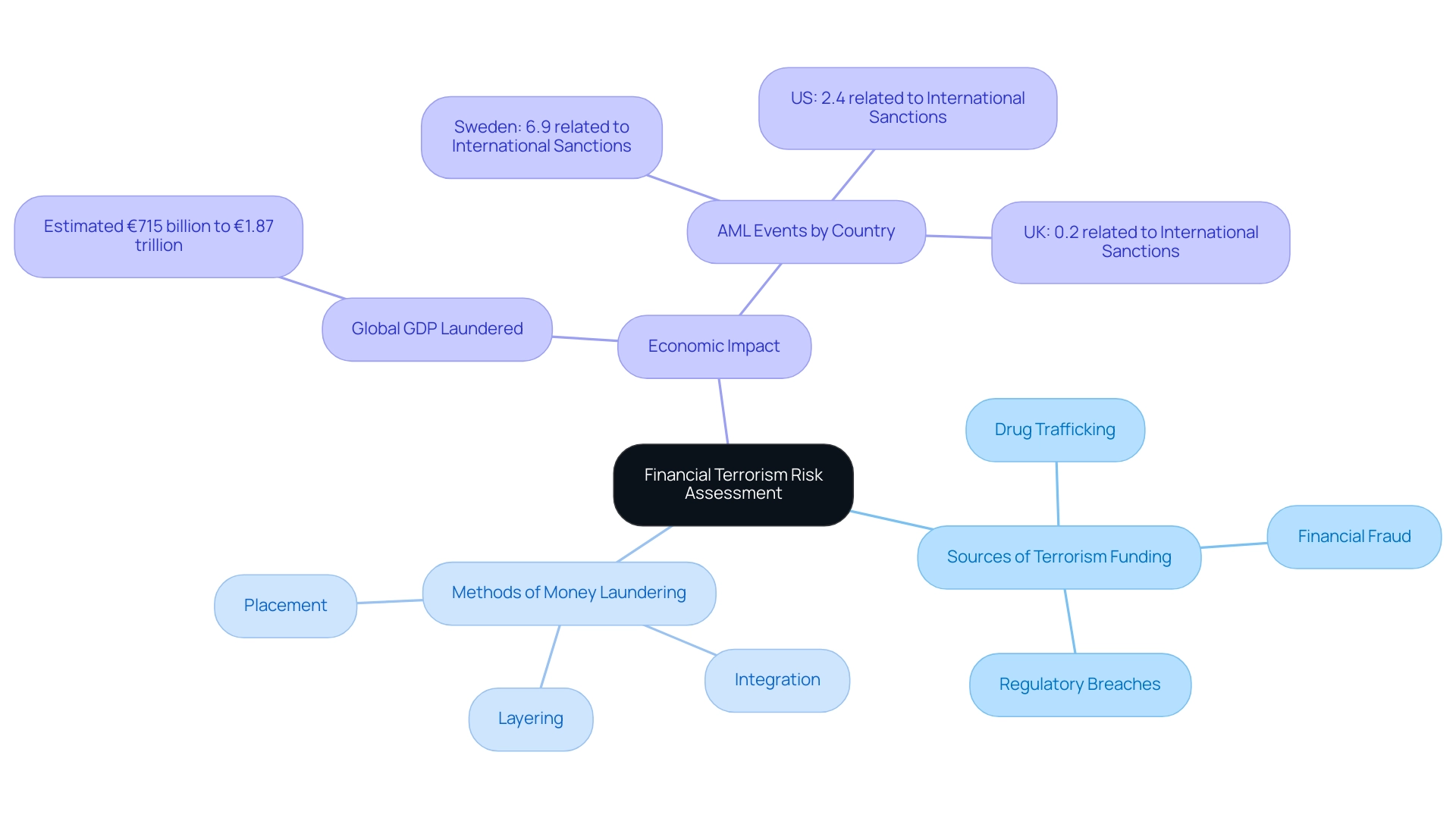

Evaluating the financial terrorism risk assessment is a critical process that involves identifying and analyzing the dangers associated with money laundering and terrorism financing activities. This evaluation begins by comprehending the intricate relationships between monetary transactions and potential illegal operations. Key components of this process include:

- Recognizing the sources of terrorism funding

- Understanding the various methods employed to launder money

- Acknowledging the significant effects these activities have on economic systems worldwide

According to the United Nations Office on Drugs and Crime, 'between two and five percent of global GDP is laundered each year, which is between €715 billion and €1.87 trillion each year.' This statistic highlights the extensive scale of money laundering. For instance, various AML events include:

- Drug trafficking

- Financial fraud

- Regulatory breaches

With 6.9% of Sweden's AML events relating to international sanctions, compared to 2.4% in the US and a mere 0.2% in the UK.

Furthermore, recent developments indicate that the UAE has made substantial improvements in its Anti-Money Laundering and Counter Financing of Terrorism (AML/CFT) regime, moving out of the Financial Action Task Force's increased monitoring process. By establishing a solid understanding of these concepts, organizations can effectively prepare for the complexities involved in threat evaluation and management, ensuring they remain vigilant in combating these pervasive dangers.

Methodologies for Assessing Money Laundering and Terrorism Financing Risks

The evaluation of financial crime and terrorism funding threats is fundamentally anchored in the financial terrorism risk assessment, a methodology that strategically allocates resources relative to the threat level associated with various clients and transactions. This approach is supported by compliance with guidelines set by the Financial Action Task Force (FATF), which provide a comprehensive framework for institutions to operate within. Key techniques essential to the financial terrorism risk assessment process include:

- Transaction monitoring

- Customer due diligence

- Ongoing threat evaluation

These methodologies not only facilitate the identification of suspicious activities but also enhance the overall capability of organizations to perform a financial terrorism risk assessment and manage potential threats. As Dr. Abdullahi U. Bello, a seasoned expert in the field with over 20 years of experience in banking and law enforcement, emphasizes the critical need for organizations to implement a financial terrorism risk assessment and adopt structured methodologies to bolster their defenses against economic terrorism. Moreover, the AMLE WG's promotion of enhancing regulatory innovations mirrors the changing environment of money laundering and terrorist financing challenges, encouraging institutions to adjust proactively.

With the European Banking Authority (EBA) scheduled to carry out a final evaluation in 2025 concerning anti-money laundering (AML) and counter-terrorist financing (CFT) oversight, it is essential that institutions enhance their strategies for financial terrorism risk assessment in alignment with changing regulatory expectations. Additionally, FinCEN's focus on ensuring AML programs provide useful information to authorities exemplifies the importance of collaboration between institutions and law enforcement, ultimately enhancing the effectiveness of national AML efforts.

Regulatory Frameworks Governing Financial Terrorism Risk Assessment

Several regulatory frameworks, notably the USA PATRIOT Act and the Bank Secrecy Act (BSA), alongside guidelines established by the Financial Crimes Enforcement Network (FinCEN), critically shape financial terrorism risk assessment. These frameworks mandate that institutions, particularly Registered Investment Advisers (RIAs) and Exempt Reporting Advisers (Eras) classified under NAICS subsector 523, implement comprehensive anti-money laundering (AML) programs. Such programs are not just regulatory obligations; they are essential protections against economic crimes.

Institutions must conduct regular financial terrorism risk assessments to identify potential vulnerabilities and promptly report any suspicious activities. FinCEN's recent regulatory alterations, including the exemption of mid-sized RIAs from specific burdens, emphasize a shift towards more practical adherence measures, aiming to align the investment adviser industry with broader economic sector standards. As noted in their comments, stakeholders expressed both support and concerns regarding the proposed rule, indicating a mixed reception to the changes.

FinCEN anticipates incurring operating expenses of around $2.99 million when updates to its priorities are released, highlighting the substantial investment in regulatory adherence. As stated by FinCEN, 'The final rule will also align the investment adviser industry more closely with its counterparts in the U.S. economic sector and globally.' This evolution in regulatory requirements highlights the necessity for CFOs to remain informed and adaptable in their strategies, ensuring that their organizations are not only adhering to regulations but also conducting a financial terrorism risk assessment to enhance resilience against economic terrorism.

Impact of Risk Assessments on Financial Institutions

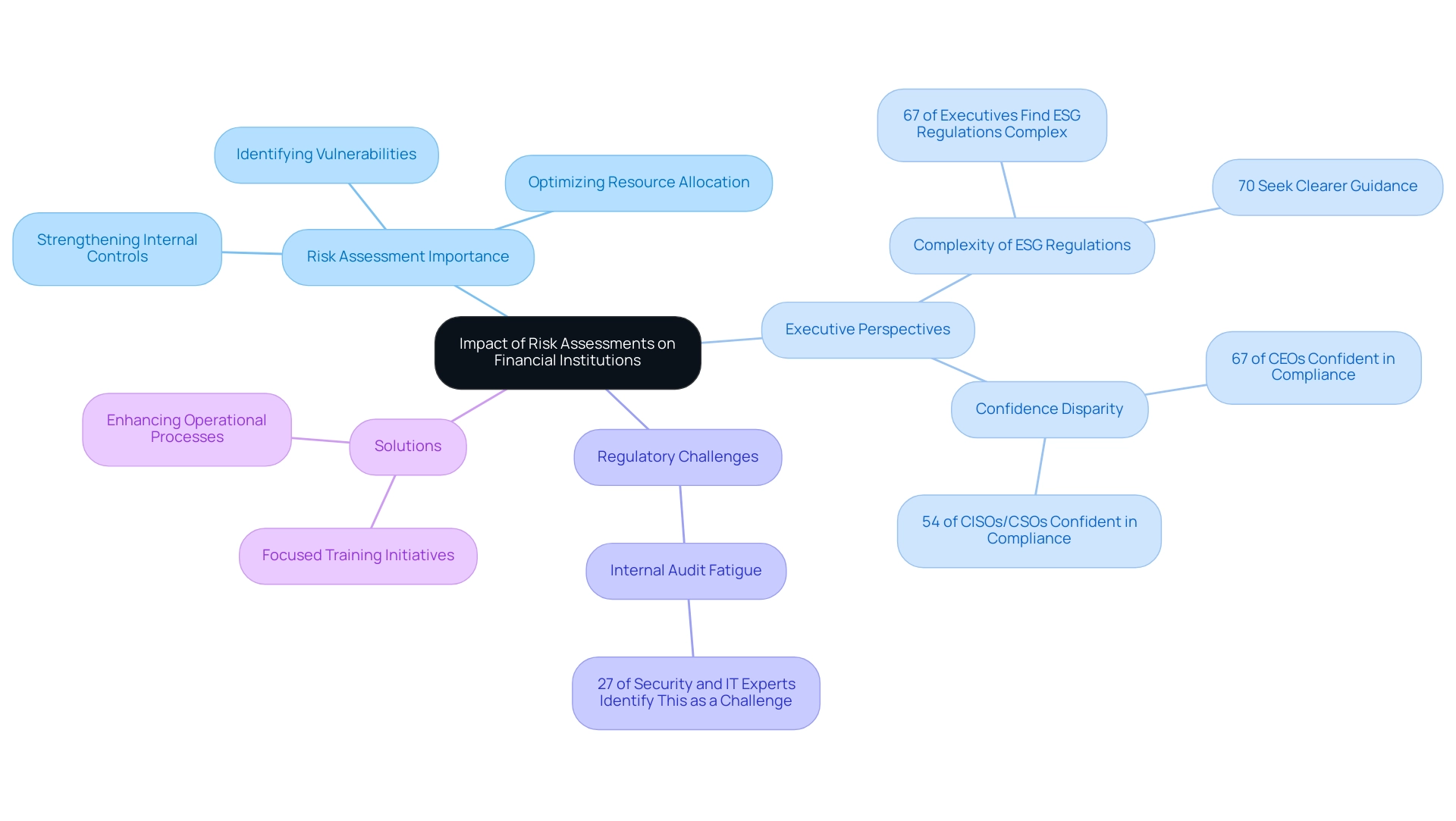

Financial institutions rely on risk assessments, particularly financial terrorism risk assessment, to shape their regulatory strategies and operational frameworks. By systematically identifying vulnerabilities, organizations can optimize resource allocation and strengthen internal controls, which are essential for maintaining regulatory standards in an increasingly complex landscape. A UserEvidence survey conducted in February 2024 revealed that:

- 67% of global executives believe ESG regulations are overly complex.

- 70% express a desire for clearer guidance from regulators.

This highlights the critical need for customized regulatory strategies that reflect the unique risks faced by each institution.

Moreover, the disparity in confidence regarding adherence to AI between executives is striking; while 67% of CEOs express confidence in their organization’s adherence, only 54% of CISOs and CSOs share this sentiment. This disparity, emphasized in the case study titled "CEO vs. CISO Confidence in Compliance," indicates differing perceptions of regulatory confidence between executive leadership and security professionals. Such differences highlight the significance of aligning regulatory strategies with insights from financial terrorism risk assessments, which not only inform decision-making processes but also enhance an institution's agility in responding to emerging threats.

Furthermore, 27% of security and IT experts identified reducing internal audit fatigue as a primary challenge in their programs, further highlighting the complexities that organizations encounter.

By implementing focused training initiatives and enhancing operational processes, monetary organizations can protect their reputation and economic stability while navigating the challenges of regulations in 2024. Ultimately, effective evaluations of potential issues, such as financial terrorism risk assessment, serve as a foundation for robust compliance strategies, ensuring that organizations can adapt to the evolving regulatory environment and protect their stakeholders.

Emerging Trends and Challenges in Financial Terrorism Risk Assessment

The terrain of financial terrorism risk assessment is swiftly changing, with a significant focus on incorporating advanced technologies like artificial intelligence (AI) and machine learning. These innovations significantly improve transaction monitoring and threat detection capabilities, enabling organizations to identify suspicious activities more effectively. However, the increasing complexity of monetary products, coupled with the rise of cryptocurrency, presents formidable challenges.

Cryptocurrency's distinctive features complicate evaluation and regulation, necessitating innovative methods to keep pace with these developments. In this context, the appropriateness of a six-month effective date from the final rule issuance is critical, as it reflects the urgency for institutions to adapt to these regulatory changes. Moreover, the suggested regulation mandates that institutions create a risk evaluation procedure, specifically a financial terrorism risk assessment, as the basis of their AML/CFT programs, highlighting the significance of adherence.

As Secretary Mayorkas indicated, the Department of Homeland Security (DHS) is focusing on three critical pillars:

- Transitioning to quantum-resistant encryption

- Collaborating with NIST to provide tools for individual entities

- Developing a financial terrorism risk assessment as part of its strategy for priority sectors

This multifaceted approach underscores the importance of global cooperation among regulatory bodies to address the nuances of modern financial systems. Furthermore, a robust culture of adherence is crucial for the effective execution of AML/CFT programs, as emphasized in the case study 'Culture of Adherence in Financial Institutions.'

Organizations must remain vigilant and continuously adapt their risk assessment practices to navigate these challenges effectively, fostering a robust culture of compliance that integrates these evolving technologies and methodologies.

Conclusion

Financial terrorism risk assessment is an essential component for organizations seeking to navigate the complexities of money laundering and terrorism financing. By understanding the intricate relationships between financial transactions and potential illicit activities, institutions can proactively identify and mitigate risks. The adoption of a Risk-Based Approach (RBA), in line with guidelines from the Financial Action Task Force (FATF), empowers organizations to allocate resources effectively and enhance their defenses against financial crimes.

The regulatory landscape surrounding financial terrorism is continually evolving, with frameworks such as the USA PATRIOT Act and the Bank Secrecy Act setting the stage for robust compliance measures. As financial institutions face increasing pressure to adapt to new regulatory expectations, staying informed and agile becomes paramount. The integration of advanced technologies, including AI and machine learning, further underscores the need for organizations to refine their risk assessment methodologies to keep pace with modern financial challenges.

Ultimately, effective risk assessments serve as the backbone of a resilient compliance strategy. By systematically identifying vulnerabilities and aligning operational frameworks with insights from these assessments, organizations can safeguard their assets and contribute to the integrity of the global financial system. As the landscape of financial terrorism continues to evolve, the commitment to robust risk assessment practices will be crucial in addressing emerging threats and fostering a culture of compliance that protects stakeholders and strengthens institutional reputation.

Frequently Asked Questions

What is the purpose of evaluating financial terrorism risk assessment?

The evaluation aims to identify and analyze the dangers associated with money laundering and terrorism financing activities, helping organizations understand the relationships between monetary transactions and potential illegal operations.

What are the key components of financial terrorism risk assessment?

Key components include recognizing the sources of terrorism funding, understanding the methods used to launder money, and acknowledging the significant effects these activities have on global economic systems.

What is the estimated scale of money laundering globally?

According to the United Nations Office on Drugs and Crime, between two and five percent of global GDP is laundered each year, amounting to between €715 billion and €1.87 trillion.

What types of activities are considered Anti-Money Laundering (AML) events?

AML events include drug trafficking, financial fraud, and regulatory breaches.

How do AML event rates compare between Sweden, the US, and the UK?

In Sweden, 6.9% of AML events relate to international sanctions, compared to 2.4% in the US and only 0.2% in the UK.

What recent improvements have been made by the UAE regarding its AML/CFT regime?

The UAE has made substantial improvements, moving out of the Financial Action Task Force's increased monitoring process.

What methodologies are essential for conducting a financial terrorism risk assessment?

Essential methodologies include transaction monitoring, customer due diligence, and ongoing threat evaluation.

Why is it important for organizations to implement a financial terrorism risk assessment?

Implementing a financial terrorism risk assessment enhances organizations' capabilities to identify suspicious activities and manage potential threats effectively.

What role does the Financial Action Task Force (FATF) play in financial terrorism risk assessments?

The FATF provides guidelines that offer a comprehensive framework for institutions to operate within, supporting the strategic allocation of resources based on threat levels.

What upcoming evaluation is the European Banking Authority (EBA) set to conduct?

The EBA is scheduled to carry out a final evaluation in 2025 concerning anti-money laundering (AML) and counter-terrorist financing (CFT) oversight.

How is collaboration between institutions and law enforcement important for AML efforts?

Collaboration enhances the effectiveness of national AML efforts by ensuring that AML programs provide useful information to authorities.