Overview

The article focuses on the importance of financial risk assessment courses in enhancing career opportunities in finance and risk management. It argues that these courses equip professionals with essential skills to navigate financial uncertainties, thereby improving their decision-making capabilities and positioning them for leadership roles, as evidenced by the increasing demand for certified experts in this field amidst rising organizational risks.

Introduction

In an era marked by economic volatility and rapid technological advancement, the ability to assess and manage financial risks has become a cornerstone of professional success. As organizations allocate substantial resources to mitigate insider threats and enhance their risk management strategies, the demand for skilled professionals in this arena is surging. This article delves into the critical importance of financial risk assessment, highlighting its role in career advancement and strategic decision-making.

By exploring essential methodologies, certifications, and emerging career opportunities, professionals can equip themselves with the tools necessary to thrive in a landscape where financial acumen is not just beneficial, but imperative for leadership roles. As the business world continues to evolve, mastering financial risk assessment will pave the way for enhanced career trajectories and organizational resilience.

The Importance of Financial Risk Assessment in Career Advancement

In today’s unpredictable business environment, monetary evaluation has emerged as a crucial skill for experts across sectors. With an astonishing 90% of insider threat budgets assigned to post-incident efforts—averaging $565,363 per incident—organizations are acknowledging the economic consequences of inadequate strategies. As market strategist Ryan Nauman states,

The capability to effectively handle monetary uncertainties is not merely a necessity; it’s a competitive edge in the changing economic environment.

Nevertheless, monetary organizations are facing pressure to reduce expenses while continuing to invest in technology upgrades, creating a challenging atmosphere for oversight. To navigate this landscape effectively, CFOs must leverage streamlined decision-making processes and real-time analytics, allowing for agile responses to emerging threats. This involves identifying underlying business issues and collaboratively planning solutions that enhance overall performance.

Moreover, experts who excel in financial risk assessment courses can recognize possible dangers, develop mitigation plans, and improve their decision-making abilities. This skill set not only adds value to strategic planning initiatives but also positions individuals for upward mobility within their organizations. Insights from the case study titled 'The Future of Risks: Now and 2034' highlight that cyber threats will remain a top concern, alongside challenges in talent development and technology adoption.

As companies progressively emphasize and excel in the cash conversion cycle through strategic enhancements, individuals who complete financial risk assessment courses will have a strong base in financial evaluation, seeing their career paths considerably improved and creating opportunities for leadership positions in finance and oversight. Additionally, the evaluation and assessment of hypotheses to provide optimal returns on invested capital is essential for guaranteeing that investments in safety practices produce concrete advantages. Looking ahead, with 58% of organizations considering their current spending on insider management programs insufficient and nearly half anticipating budget increases, the significance of this competency will only continue to grow.

For those interested in deepening their understanding, the 'Mastering the Cash Conversion Cycle' feature is available for $99, providing valuable insights into enhancing business performance.

Top Courses for Mastering Financial Risk Assessment Skills

- Financial Threat Supervisor (FRM) Certification - Provided by the Global Association of Professionals in Threat (GARP), this certification serves as a standard for professionals in the field. It includes essential subjects such as market uncertainty, credit exposure, operational challenges, and investment management. Achieving the FRM designation is highly respected in the industry and can significantly enhance career prospects. As Timothy Krause, Ph.D. Assistant Professor of Finance, points out,

Earning a certificate in [[[Financial Risk Management](https://bulletins.psu.edu/undergraduate/colleges/behrend/financial-risk-management-certificate)](https://blog.smbdistress.com/understanding-financial-risk-management-consulting-a-complete-tutorial-for-businesses)](https://blog.smbdistress.com/understanding-financial-risk-management-consulting-a-complete-tutorial-for-businesses) can do just that, underscoring its value. Additionally, the program includes simulation components that require 3 credit hours, emphasizing its rigorous nature. - Certificate in Quantitative Finance (CQF) - This program explores the quantitative elements of finance, providing participants with strong tools for modeling and assessment. The CQF is particularly relevant for professionals looking to harness mathematical and statistical techniques to address complex financial challenges. Success stories from graduates highlight its effectiveness in advancing careers in quantitative finance. Significantly, most teaching in computation for statistical research is carried out using the R programming language, which is vital for those following data-driven strategy development.

- Risk Control Specialist (PMI-RMP) - This certification, offered by the Project Management Institute, highlights principles of uncertainty oversight that are relevant across various sectors. The PMI-RMP provides professionals with strategies to identify and minimize threats in projects, thereby enhancing their ability to manage uncertainties effectively.

- Professional Risk Manager (PRM) - Provided by the Professional Risk Managers' International Association, this program is designed for individuals pursuing a thorough understanding of uncertainty management practices. The PRM certification encompasses a broad spectrum of subjects, including assessment and oversight methods, equipping professionals for leadership positions in the field.

- (Coursera) - This collection of online classes from top universities provides a strong foundation in hazard principles. It is suitable for both beginners and seasoned professionals, offering flexible learning options that cater to various experience levels. The program's framework enables a comprehensive examination of uncertainty strategies, particularly in financial risk assessment courses and their practical uses. Furthermore, practical applications can be observed in case studies such as

[[Neural Machine Learning](https://courses.rice.edu/admweb/!SWKSCAT.cat?p_action](https://courses.rice.edu/admweb/!SWKSCAT.cat?p_action=CATALIST&p_acyr-code=2013&p_subj=STAT)=CATALIST&p_acyr-code=2013&p_subj=STAT) and [[Data Mining II](https://courses.rice.edu/admweb/!SWKSCAT.cat?p_action=CATALIST&p_acyr-code=2013&p_subj=STAT)](https://courses.rice.edu/admweb/!SWKSCAT.cat?p_action=CATALIST&p_acyr-code=2013&p_subj=STAT), where students engage with advanced topics in artificial neural networks and their applications in data mining and classification.

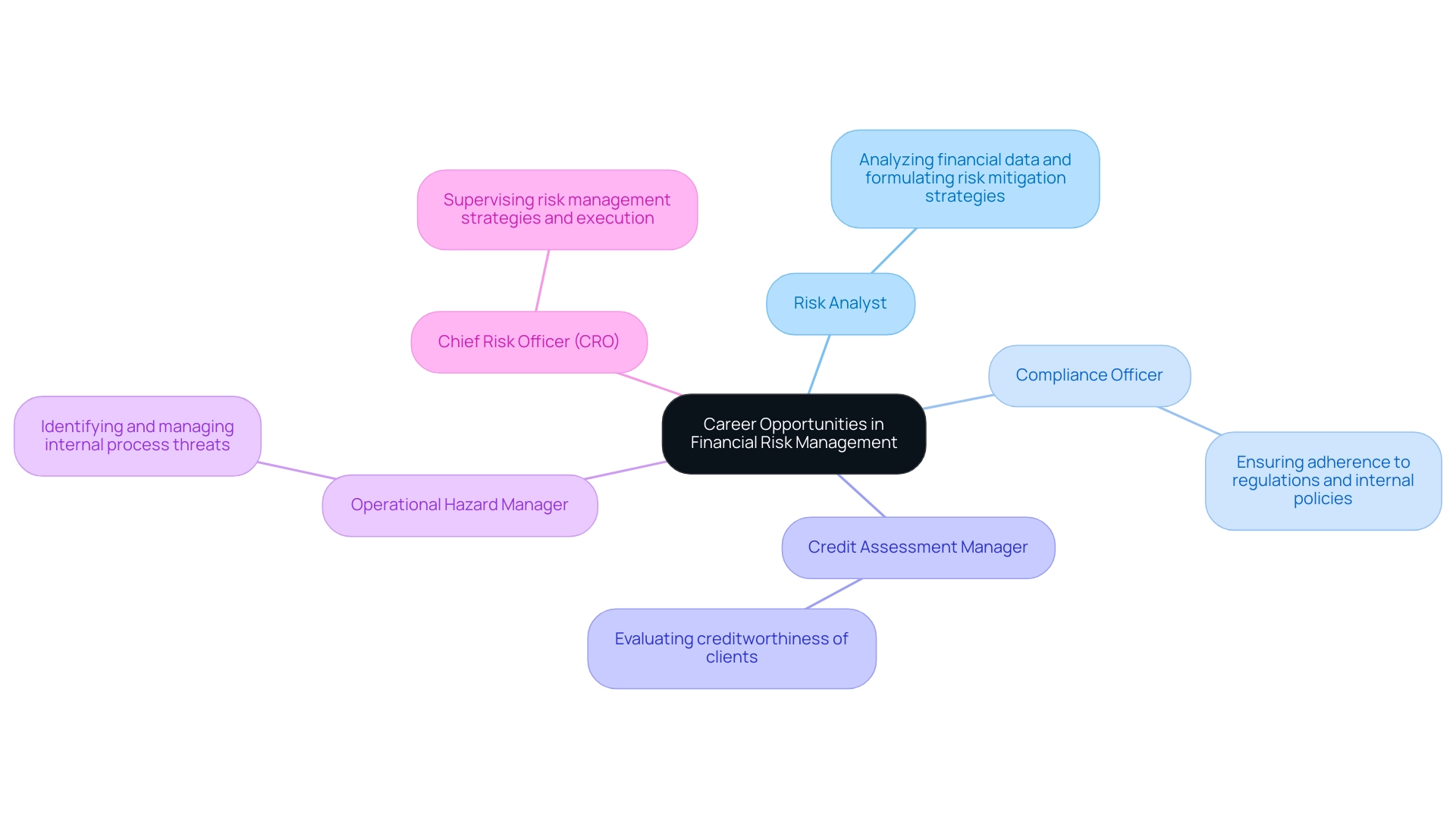

Exploring Career Opportunities in Financial Risk Management

The environment of career prospects in is both varied and growing, reflecting the essential role these courses play in contemporary organizations. Professionals entering this field can explore various roles, including:

- Risk Analyst: Tasked with analyzing financial data to pinpoint potential risks, risk analysts formulate strategies for effective risk mitigation, ensuring organizational stability.

- Compliance Officer: This position centers on guaranteeing that monetary practices adhere to regulations and internal policies, thereby reducing legal uncertainties and promoting ethical standards.

- Credit Assessment Manager: Responsible for evaluating the creditworthiness of clients, credit assessment managers handle the challenges associated with lending, playing a crucial role in maintaining healthy financial practices.

- Operational Hazard Manager: This position involves identifying and managing threats stemming from internal processes, systems, and human factors, enhancing operational efficiency and resilience.

- Chief Risk Officer (CRO): As a senior executive, the CRO supervises the creation and execution of strategies for handling uncertainties, ensuring the organization is equipped to navigate challenges.

Considering the growing significance of hazard oversight across industries—including finance, technology, and more—these positions offer encouraging career opportunities for individuals with the necessary skills and expertise. The demand for such expertise is underscored by recent trends indicating a shift in hiring practices, with organizations prioritizing skilled talent in lower-cost living areas while still maintaining a strong presence in major urban centers. Notably, managing demands on or expectations of the workforce to work remotely or as part of a hybrid work environment dropped nine spots in priority, which reflects changing dynamics in hiring strategies.

As emphasized in the 'Demand for Skilled Talent' report, the necessity for qualified experts who have completed financial risk assessment courses is crucial. Furthermore, a case study on geographic trends in management hiring shows a pattern of relocating positions and second line roles to lower cost of living areas, such as Dallas, while major cities like New York and Chicago remain attractive for talent. This shift poses challenges for businesses in relocating talent from high-cost areas, impacting hiring strategies.

Key Methodologies and Tools for Effective Risk Assessment

Effective assessment of monetary uncertainties can be enhanced through that provide a variety of methodologies and tools designed to equip organizations with the insights needed to navigate potential challenges. Key techniques include:

- SWOT Analysis: This fundamental tool assesses the internal strengths and weaknesses of a business alongside external opportunities and threats, providing a comprehensive view of the organization's exposure landscape.

- Value at Risk (VaR): A crucial statistical measure that quantifies the potential loss in value of a portfolio over a specified time frame at a given confidence level. VaR is essential in guiding investment decisions and exposure oversight.

- Scenario Analysis: This method evaluates the financial consequences of various potential situations, allowing organizations to prepare for and lessen the effects of future challenges effectively.

- Monte Carlo Simulation: A strong computational technique that uses random sampling to produce numerical results, frequently employed in analysis to comprehend the likelihood and influence of different factors.

- Assessment Matrix: This visual tool helps in prioritizing threats based on their probability and potential consequences, promoting a structured approach to informed decision-making.

Mastery of these methodologies is crucial for CFOs and financial professionals who are aiming for excellence in oversight by taking financial risk assessment courses. With 58% of organizations considering their current spending on insider management programs insufficient, embracing these tools is vital to improve organizational resilience and strategic foresight. As highlighted by AICPA and NC State University, nearly three-fourths (75%) of executives think there will be substantial alterations in their organization’s approach to business continuity planning and crisis handling, emphasizing the necessity for effective mitigation strategies.

Furthermore, the Ecological Risk Assessment case study demonstrates the intricacies associated with evaluation, taking into account environmental, social, and contextual elements, which can offer significant insights for economic oversight.

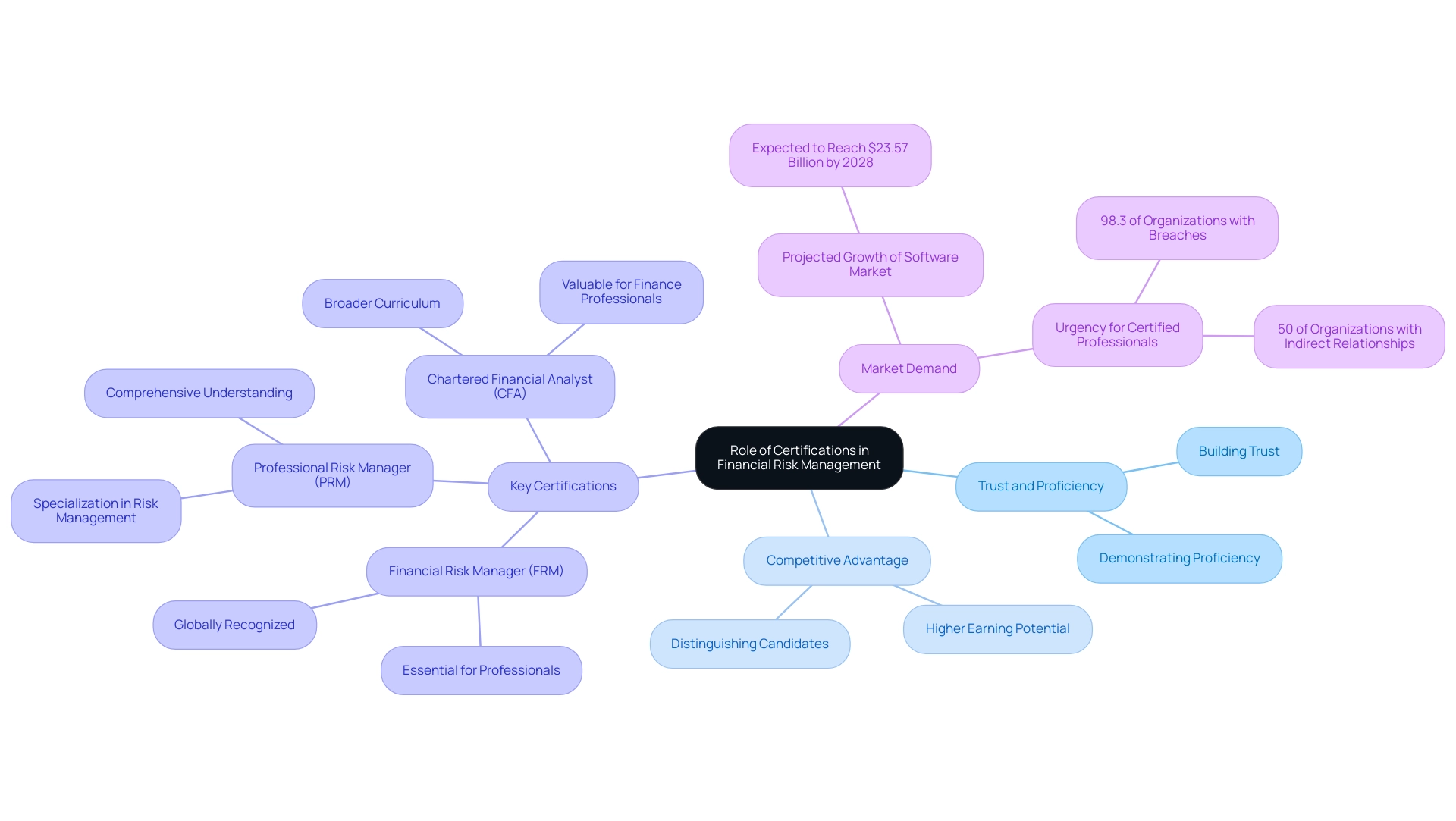

The Role of Certifications in Enhancing Financial Risk Management Expertise

Certifications are crucial in building trust and demonstrating proficiency in financial uncertainty. They not only enhance professional knowledge but also provide a substantial competitive advantage in the job market, often correlating with higher earning potential. Based on recent insights, 98.3% of organizations maintain relationships with third parties that have experienced breaches, emphasizing the urgency for certified professionals who can effectively oversee these challenges.

Moreover, with 50% of organizations having indirect relationships with at least 200 fourth parties that have breaches, the need for skilled professionals in this area is more pronounced than ever.

Key certifications that can bolster your career in this field include:

- Financial Risk Manager (FRM): A globally recognized certification, the FRM is essential for professionals seeking to excel in this area.

- Professional Risk Manager (PRM): Designed for those specializing in this sector, this certification demonstrates a comprehensive understanding of the field.

- Chartered Financial Analyst (CFA): While broader, the CFA curriculum encompasses significant content related to evaluation of uncertainties, making it a valuable asset for finance professionals.

Acquiring these certifications not only enhances one’s knowledge base but also signifies a strong commitment to the field. As is projected to reach $23.57 billion by 2028, the demand for qualified professionals is expected to surge. Having these credentials can distinguish candidates in a competitive job market, ultimately leading to greater career opportunities and advancement.

Conclusion

In the rapidly evolving business environment, financial risk assessment emerges as an essential skill set that significantly influences professional advancement and organizational success. As highlighted, the staggering investments organizations make in managing insider threats underscore the high stakes of inadequate risk strategies. Mastering financial risk assessment not only equips professionals with the tools to identify and mitigate potential threats but also enhances their strategic decision-making capabilities, positioning them favorably for leadership roles.

The article thoroughly examined key methodologies and certifications that empower professionals to excel in this field. From SWOT analysis to Monte Carlo simulations, employing these techniques is crucial for effective risk management. Additionally, obtaining respected certifications such as the Financial Risk Manager (FRM) or the Professional Risk Manager (PRM) can provide a competitive edge and demonstrate a commitment to the discipline.

As the demand for skilled risk management professionals continues to grow, so too do the opportunities within this field. With roles ranging from risk analysts to Chief Risk Officers, individuals equipped with the right skills and certifications are poised to thrive. Organizations that prioritize robust risk management frameworks will not only enhance their resilience but also create pathways for upward mobility for their talent. Embracing financial risk assessment is not merely an advantage; it is a strategic imperative for both personal and organizational success in today’s complex landscape.

Frequently Asked Questions

Why is monetary evaluation important in today's business environment?

Monetary evaluation has become crucial due to the economic consequences of inadequate strategies, with organizations recognizing that effective handling of monetary uncertainties provides a competitive edge.

What are the financial implications of insider threats for organizations?

Organizations allocate 90% of insider threat budgets to post-incident efforts, averaging $565,363 per incident, highlighting the significant economic impact of these threats.

What challenges do monetary organizations face?

Monetary organizations are under pressure to reduce expenses while continuing to invest in technology upgrades, creating a challenging oversight environment.

How can CFOs navigate the current business landscape effectively?

CFOs can leverage streamlined decision-making processes and real-time analytics to respond agilely to emerging threats and collaboratively plan solutions for overall performance enhancement.

What skills do experts gain from financial risk assessment courses?

Experts learn to recognize potential dangers, develop mitigation plans, and improve decision-making abilities, which adds value to strategic planning and positions them for career advancement.

What key concerns will remain for companies in the future?

Cyber threats, challenges in talent development, and technology adoption will continue to be top concerns for companies.

How does completing financial risk assessment courses benefit individuals?

Individuals gain a strong foundation in financial evaluation, improving their career prospects and creating opportunities for leadership positions in finance and oversight.

What is the significance of evaluating hypotheses for investments?

Evaluating hypotheses is essential for ensuring that investments in safety practices yield concrete benefits and optimal returns on invested capital.

What trends are observed regarding organizational spending on insider management programs?

58% of organizations find their current spending insufficient, with nearly half anticipating budget increases, indicating the growing importance of financial evaluation skills.

What resources are available for those looking to enhance their understanding of financial evaluation?

The 'Mastering the Cash Conversion Cycle' feature is available for $99, offering insights into improving business performance.