Overview

The article focuses on the top financial risk assessment tools essential for comprehensive evaluation and effective management of financial uncertainties. It highlights the importance of continuous monitoring and structured strategies, such as the Risk Assessment Matrix and scenario analysis, which empower organizations to identify vulnerabilities and proactively mitigate potential risks, thereby enhancing overall resilience in a volatile economic landscape.

Introduction

In an increasingly complex financial landscape, organizations must prioritize understanding and managing financial risks to maintain stability and profitability. With a diverse array of threats ranging from market volatility to operational inefficiencies, the need for effective assessment tools and strategies has never been more critical.

As recent data reveals, a significant portion of leaders now recognize talent acquisition and retention as a top financial risk, illustrating the evolving nature of vulnerabilities that CFOs must address. By adopting robust frameworks and continuous monitoring practices, businesses can not only identify potential threats but also develop proactive measures to mitigate their impact.

This article explores the essential components of financial risk management, providing actionable insights and strategies that empower organizations to navigate uncertainties and enhance their resilience in the face of change.

Understanding Financial Risks: The Foundation of Assessment Tools

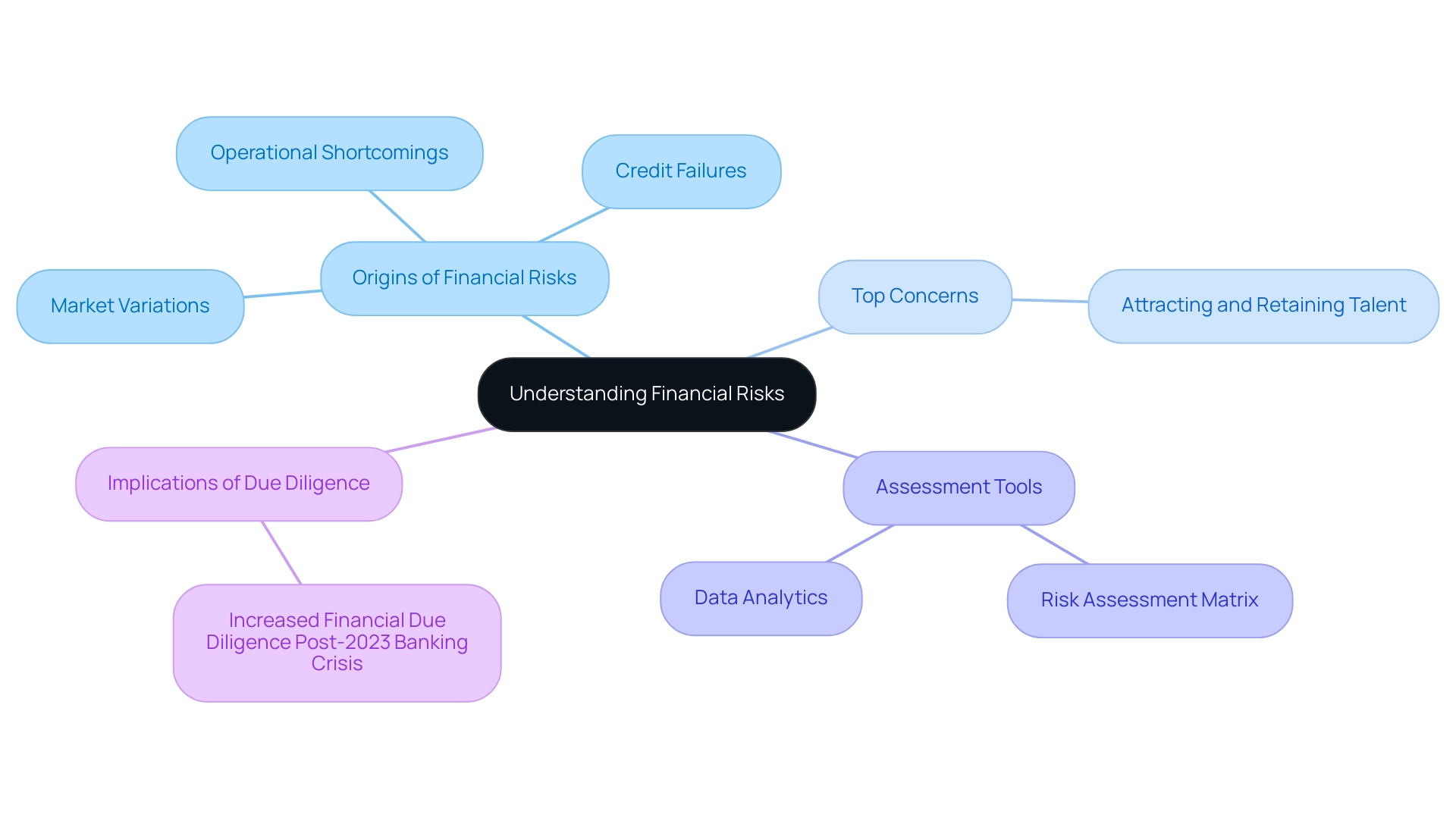

Monetary uncertainties can arise from numerous origins, including market variations, credit failures, and operational shortcomings, making their comprehension vital for effective monetary management. Recent data indicates that in 2024, an alarming 61% of leaders acknowledge 'attracting and retaining talent' as a top concern, reflecting the evolving nature of financial vulnerabilities. The evaluation instruments, including financial risk assessment tools for comprehensive and effective risk evaluation cureinsure.xyz, serve a crucial function in recognizing possible hazards, allowing entities to take a proactive approach in management.

For instance, the case study titled 'Technological Advancements and Risks' highlights how the inability to utilize rigorous data analytics for market intelligence has emerged as a new challenge in 2034, underscoring the growing importance of data-driven decision-making in management. Moreover, after the 2023 regional banking crisis, 52% of organizations heightened the financial due diligence performed on their banking partners, demonstrating the urgency of reevaluating financial uncertainties. Utilizing frameworks such as the Risk Assessment Matrix enables businesses to categorize threats by their likelihood and potential impact.

Organizations such as XYZ Corp have successfully adopted this framework, allowing them to prioritize threats effectively and allocate resources for mitigation. This structured approach not only clarifies vulnerabilities but also serves as a strategic roadmap for addressing them effectively. As the economic environment changes, utilizing financial risk assessment tools for comprehensive and effective risk evaluation cureinsure.xyz will be vital for protecting stability and profitability.

Mitigation Strategies: Tools for Reducing Financial Risk Impact

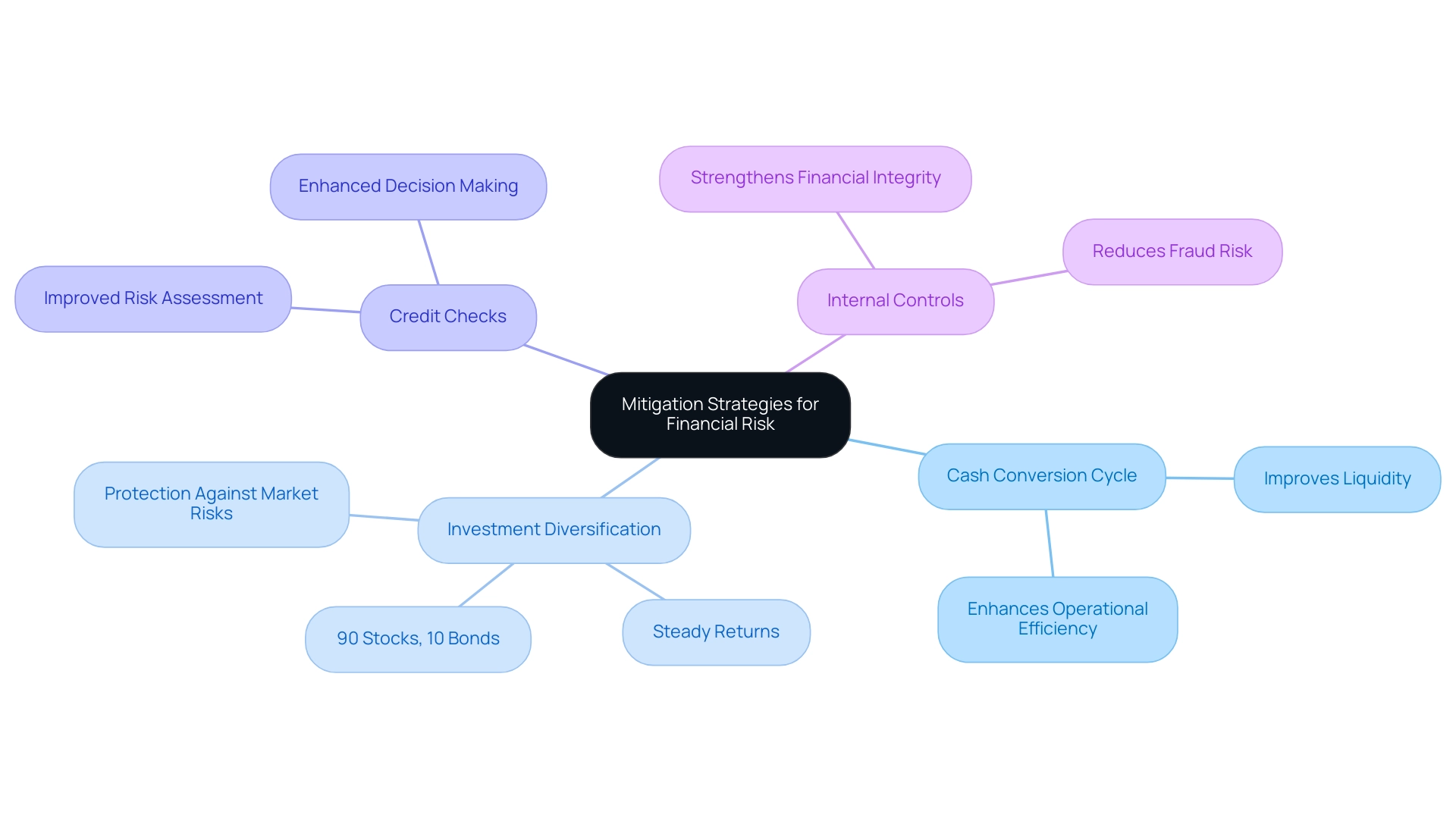

To effectively reduce monetary risks, CFOs should prioritize approaches such as:

- Mastering the cash conversion cycle

- Investment diversification

- Improved credit checks

- Implementation of strong internal controls

As Amy C. Arnott, a Portfolio Strategist, emphasizes, having a well-structured strategy is crucial for navigating financial complexities. By focusing on optimizing the cash conversion cycle, organizations can improve liquidity and operational efficiency.

Diversification remains essential; aggressive investors generally assign approximately 90% of their assets to stocks and 10% to bonds, balancing potential returns with exposure. A well-organized diversification plan not only seeks to produce steady returns but also safeguards against market challenges, as emphasized in the case study 'Importance of Diversification Strategy.' Furthermore, companies can utilize financial risk assessment tools for comprehensive and effective risk evaluation, such as scenario analysis and stress testing, to assess the possible effects of different threat factors on economic results.

For instance, a retail company can utilize inventory management software to monitor stock levels carefully, decreasing the likelihood of overstocking and the related economic pressure. By incorporating financial risk assessment tools for comprehensive and effective risk evaluation and concentrating on the cash conversion cycle into budgeting processes, companies can significantly reduce their exposure to uncertainty and ensure alignment with their monetary objectives. Furthermore, adopting the 20 strategies for optimal business performance, priced at $99.00, can provide CFOs with a comprehensive framework for enhancing their economic strategies and achieving sustainable growth.

The Importance of Continuous Risk Monitoring and Review

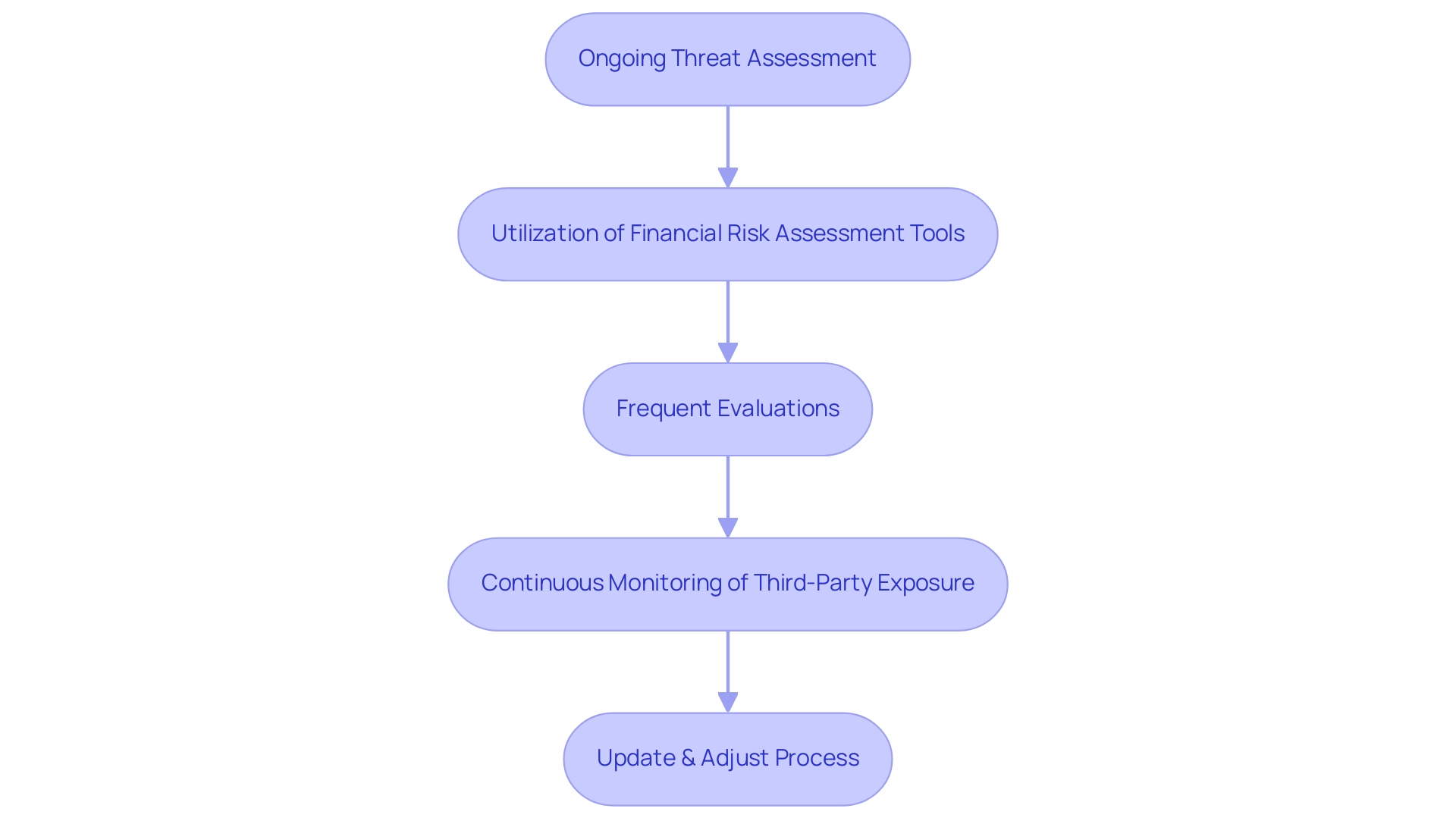

Ongoing threat assessment is crucial for firms that want to leverage financial risk assessment tools for comprehensive and effective risk evaluation cureinsure.xyz to maneuver through the intricacies of the economic environment efficiently. Our team supports a streamlined decision-making cycle throughout the turnaround process, allowing CFOs to take decisive actions that preserve business stability. By routinely analyzing economic data and market conditions, businesses can identify shifts that may pose risks or opportunities.

Utilizing financial risk assessment tools for comprehensive and effective risk evaluation cureinsure.xyz, such as client dashboards and key performance indicators (KPIs), offers real-time insights into an organization's economic health, enabling informed decisions swiftly. A recent report indicates that:

- 75% of executives anticipate significant changes in business continuity planning and crisis management, highlighting the need for proactive approaches.

- 61% of leaders recognize 'attracting and retaining talent' as a top concern in 2034, indicating that challenges in the financial sector are evolving.

Frequent evaluations—preferably carried out at least every three months—are essential for utilizing financial risk assessment tools for comprehensive and effective risk evaluation cureinsure.xyz, ensuring entities stay adaptable and responsive to change. This approach minimizes surprises and significantly enhances organizational resilience. The case study titled 'Continuous Threat Monitoring Helps Detect Emerging Issues' illustrates how constant monitoring of third-party exposure provides an accurate representation of vulnerabilities in the supply chain.

This allows prompt notifications regarding emerging threats and unusual activities, enabling organizations to avert potential breaches and reduce dangers before they develop into significant issues. Such financial risk assessment tools for comprehensive and effective risk evaluation cureinsure.xyz promote a culture of ongoing enhancement and awareness of threats in the sector, ultimately protecting against possible breaches and ensuring sustainable growth. As noted by a monetary expert, 'The integration of continuous risk monitoring tools is vital for maintaining a proactive stance in an ever-changing economic environment.'

Furthermore, our commitment to the 'Update & Adjust' process ensures that we continually monitor the success of our approaches and make necessary adjustments based on real-time analytics.

Crisis Management: Preparing for Financial Uncertainties

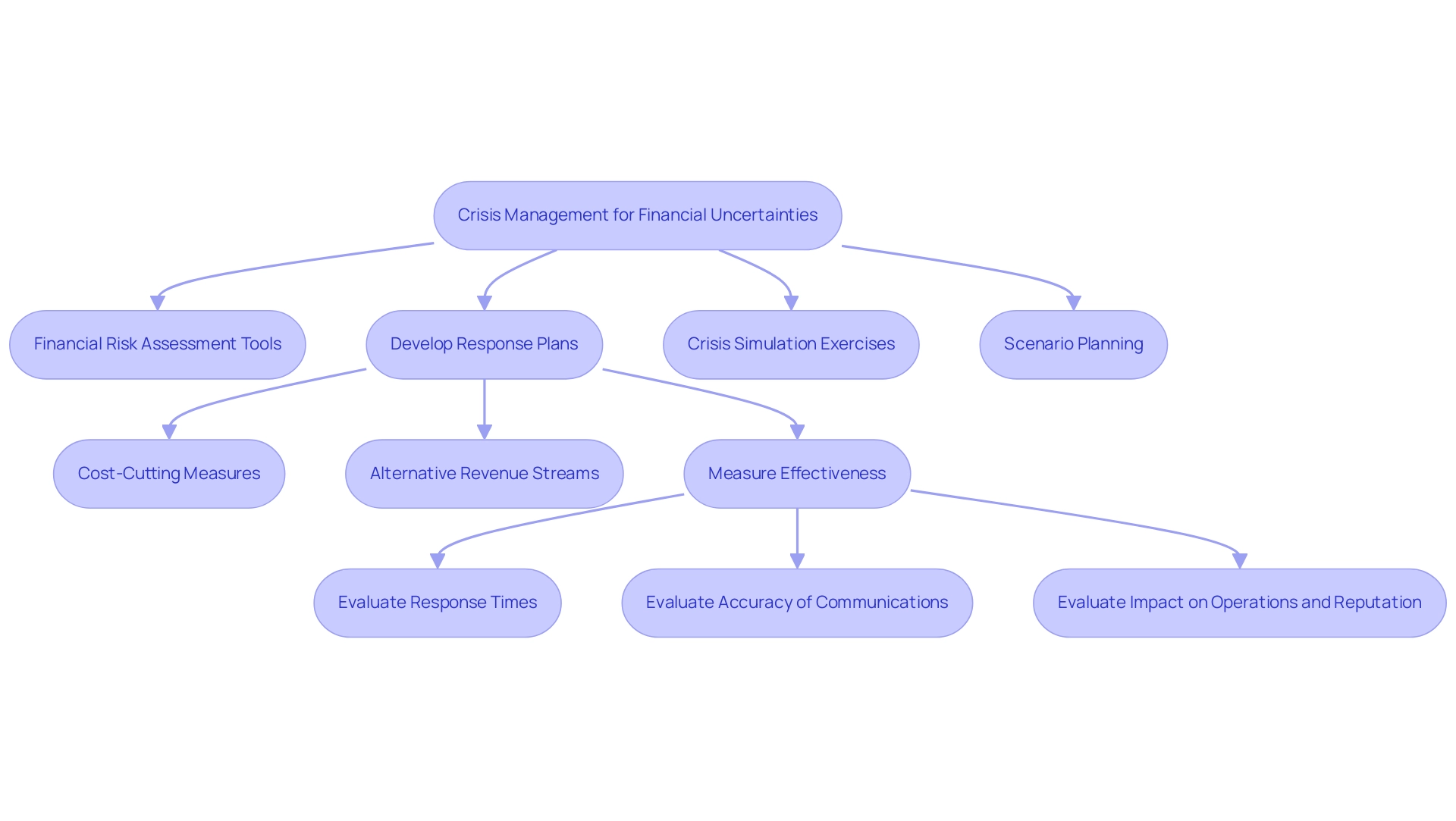

Effective crisis management is essential for navigating potential financial uncertainties, and incorporating financial risk assessment tools for comprehensive and effective risk evaluation cureinsure.xyz can help address issues like economic downturns or sudden market shifts. Chief Financial Officers must prioritize developing robust response plans that utilize financial risk assessment tools for comprehensive and effective risk evaluation cureinsure.xyz, alongside crisis simulation exercises and scenario planning, to prepare for various outcomes. For instance, consider a restaurant chain that devises a contingency plan including cost-cutting measures and alternative revenue streams in anticipation of a downturn.

This pragmatic approach not only ensures operational continuity but also enhances organizational resilience by testing every hypothesis to deliver maximum return on invested capital. As articulated in best practices:

- Measure the effectiveness of your crisis management strategies by evaluating:

- Response times

- The accuracy of communications

- The overall impact on operations and reputation

Additionally, our client dashboard plays a crucial role in providing real-time business analytics to continually diagnose your business health, making it essential for organizations to adapt.

Statistics show that fluctuations in the global unemployment rate from 2004 to 2023 highlight the volatility of financial conditions. The case study titled 'Future of Crisis Management in Banking' emphasizes the necessity for using financial risk assessment tools for comprehensive and effective risk evaluation cureinsure.xyz in response to emerging challenges such as cyber threats and market volatility. Furthermore, the recent ransomware attack on NextGen Software highlights the consequences of outdated crisis plans, reinforcing the significance of having updated protocols in crisis management approaches.

By endorsing a condensed decision-making process and integrating iterative evaluation of approaches, entities can react quickly and efficiently to reduce monetary disruption, aligning with the changing environment of management in finance.

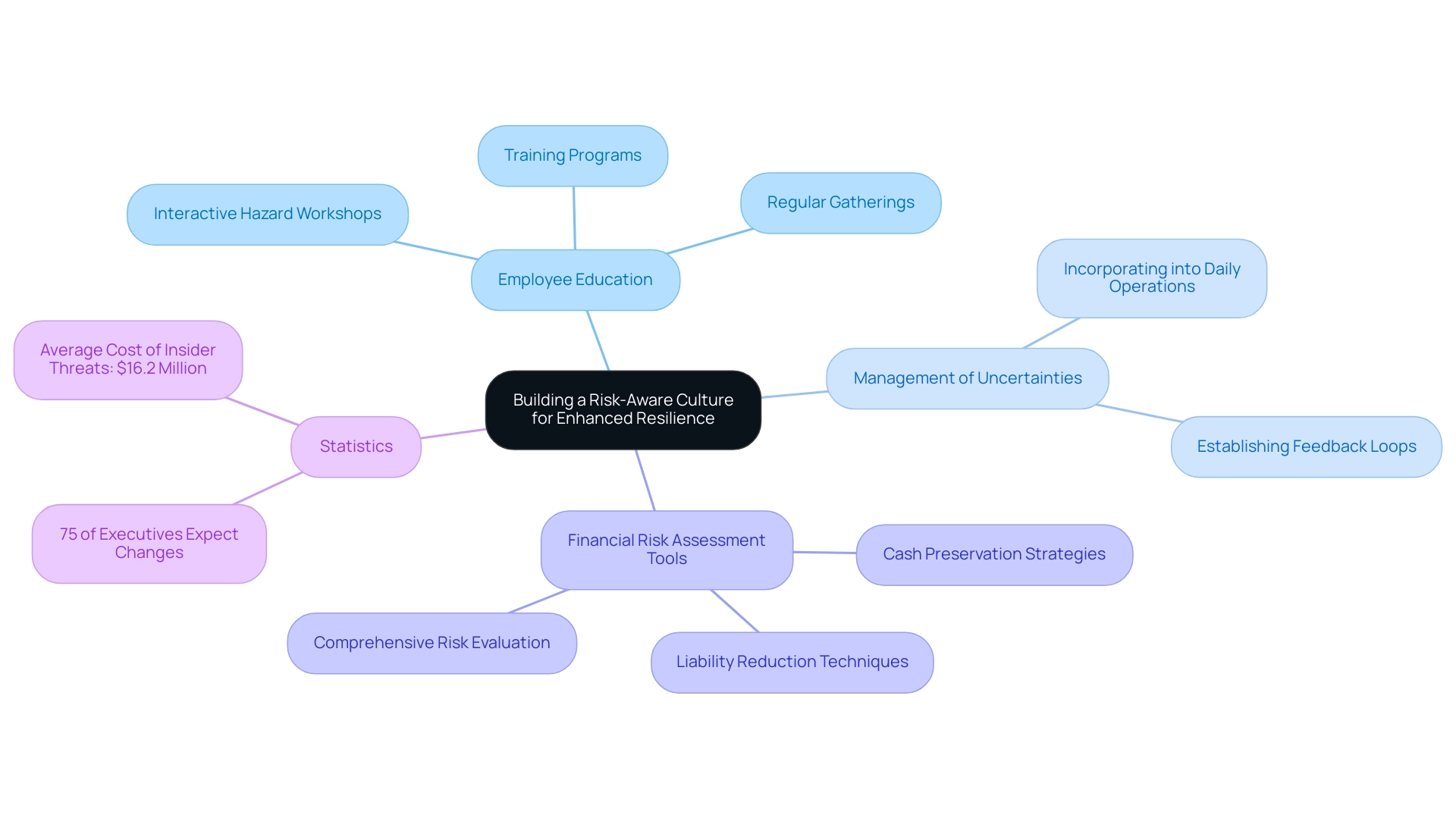

Building a Risk-Aware Culture for Enhanced Resilience

Fostering a culture that is aware of potential challenges is essential for organizations dedicated to effectively managing financial uncertainties, particularly in light of the urgent need for financial risk assessment tools for comprehensive and effective risk evaluation cureinsure.xyz. Such evaluations not only pinpoint opportunities for cash preservation and liability reduction but also improve overall efficiency and mitigation strategies. This cultural transformation begins with educating employees about potential threats and fostering an environment where open communication is encouraged.

Incorporating management of uncertainties into daily operations and establishing feedback loops can significantly enhance participation in awareness initiatives. Tools such as thorough monetary assessments, training programs, and interactive hazard workshops play a crucial role in this process. For example, regular gatherings centered on budget evaluation techniques can instill awareness of uncertainties into the organizational fabric.

Significantly, research shows that:

- 75% of executives expect substantial changes in their companies’ approach to business continuity planning and crisis management, highlighting the urgent need for a proactive attitude towards awareness of threats.

- The average yearly expense of insider threats is rising to $16.2 million, urging organizations to acknowledge the economic effects of insider dangers and boost their investments in threat management programs.

By prioritizing transparency and accountability through the use of financial risk assessment tools for comprehensive and effective risk evaluation cureinsure.xyz, businesses not only enhance their resilience but also position themselves to navigate monetary challenges more adeptly.

To investigate our specialized Assessment service, which offers a structured method for identifying monetary challenges and opportunities, click the 'Assessment' button now. As Beaupérin emphasizes, recent legislative measures such as the EU Artificial Intelligence Act highlight the pressing need for robust controls and education around financial risks in the workplace.

Conclusion

In today's intricate financial environment, organizations must adopt a proactive approach to financial risk management. Understanding the diverse sources of financial risks—from market fluctuations to talent retention—is essential for safeguarding stability and profitability. By implementing robust assessment tools, such as the Risk Assessment Matrix, businesses can identify and prioritize vulnerabilities, allowing for effective resource allocation and mitigation strategies.

Mitigating financial risks requires a comprehensive strategy that includes:

- Optimizing the cash conversion cycle

- Diversifying investments

- Enhancing internal controls

Utilizing tools like scenario analysis and stress testing not only prepares organizations for potential risks but also empowers them to make informed decisions that align with their financial goals. The integration of continuous risk monitoring further ensures that businesses remain agile, capable of responding to changes in market conditions and emerging threats.

Crisis management plays a pivotal role in navigating financial uncertainties. By developing adaptable response plans and utilizing real-time analytics, CFOs can enhance their organizations' resilience against unexpected challenges. Building a risk-aware culture is equally crucial; fostering open communication and ongoing education about financial risks empowers employees to contribute actively to risk management efforts.

Ultimately, the journey toward effective financial risk management is ongoing. By prioritizing assessment, mitigation, continuous monitoring, and crisis preparedness, organizations can not only navigate uncertainties but also thrive amidst them. As the financial landscape continues to evolve, embracing these strategies will be vital for ensuring long-term success and sustainability.

Frequently Asked Questions

What are the main causes of monetary uncertainties?

Monetary uncertainties can arise from market variations, credit failures, and operational shortcomings.

What is the significance of understanding monetary uncertainties?

Understanding monetary uncertainties is vital for effective monetary management, as it helps organizations navigate financial vulnerabilities.

What percentage of leaders identified 'attracting and retaining talent' as a top concern in 2024?

In 2024, 61% of leaders acknowledged 'attracting and retaining talent' as a top concern.

How can financial risk assessment tools aid organizations?

Financial risk assessment tools help recognize possible hazards, allowing entities to take a proactive approach in managing risks.

What does the case study 'Technological Advancements and Risks' highlight?

It highlights the challenge of not utilizing rigorous data analytics for market intelligence, emphasizing the importance of data-driven decision-making in management.

What change occurred after the 2023 regional banking crisis regarding financial due diligence?

After the crisis, 52% of organizations increased the financial due diligence performed on their banking partners.

What is the Risk Assessment Matrix and how is it used?

The Risk Assessment Matrix is a framework that enables businesses to categorize threats by their likelihood and potential impact, helping prioritize threats and allocate resources for mitigation.

What strategies should CFOs prioritize to reduce monetary risks?

CFOs should prioritize mastering the cash conversion cycle, investment diversification, improved credit checks, and implementation of strong internal controls.

Why is diversification important for investors?

Diversification is essential as it balances potential returns with exposure to market challenges, helping to produce steady returns while safeguarding against risks.

How can companies utilize financial risk assessment tools?

Companies can use tools like scenario analysis and stress testing to assess the potential effects of various threat factors on economic results.

What role does inventory management software play in risk reduction?

Inventory management software helps monitor stock levels, decreasing the likelihood of overstocking and the associated economic pressure.

How can CFOs enhance their economic strategies?

CFOs can adopt strategies for optimal business performance, which provides a comprehensive framework for enhancing economic strategies and achieving sustainable growth.