Overview

This article explores how businesses can select the most appropriate financial risk assessment tools to effectively mitigate economic threats. It underscores the importance of understanding specific financial risks, evaluating methodologies, and considering essential features such as real-time analytics and integration capabilities. These elements are crucial for choosing the right tool. Supported by case studies that illustrate successful implementations across various sectors, the article provides actionable insights for organizations aiming to enhance their financial risk management strategies.

Introduction

In today's increasingly complex financial landscape, organizations encounter a multitude of risks that can jeopardize their stability and growth. From market fluctuations to regulatory compliance challenges, the necessity for effective financial risk assessment tools has reached a critical juncture. These tools not only assist businesses in identifying and evaluating potential threats but also empower them to make informed decisions that safeguard their financial health.

As companies navigate the evolving terrain of financial risks, grasping the methodologies, technologies, and best practices behind these tools becomes essential for fostering resilience and ensuring sustainable growth.

This article explores the various facets of financial risk assessment, providing insights into:

- The types of risks businesses face

- The methodologies employed

- The key features to consider when selecting the appropriate tools for effective risk management

Understanding Financial Risk Assessment Tools

Financial risk assessment tools encompass a variety of methods and software applications specifically designed to detect, assess, and rank the economic threats facing enterprises. These tools empower organizations to systematically evaluate potential risks to their economic stability, thereby facilitating informed decision-making. Ranging from simple spreadsheets to advanced software solutions that leverage analytics and machine learning, financial risk assessment tools are indispensable for navigating today's complex economic landscapes.

Recent statistics reveal that nearly one-third of companies have been impacted by fraud or monetary crime in the past five years, underscoring the urgent need for robust financial risk assessment tools. Furthermore, a significant 35% of executives responsible for oversight cite compliance and regulatory challenges as their primary concern, highlighting the escalating difficulties organizations face in managing these requirements. Secureframe reports that 35% of executives acknowledge compliance and regulatory challenges as their foremost issue, emphasizing the critical necessity for effective management strategies.

The methodologies employed in financial risk assessment tools vary considerably, yet they typically include:

- Qualitative and quantitative analysis

- Scenario modeling

- Stress testing

These tools enable companies to evaluate their vulnerability to various financial challenges and develop strategies to mitigate them effectively. Additionally, the integration of financial risk assessment tools with real-time analytics enhances the decision-making process, allowing organizations to respond swiftly to emerging threats.

For instance, organizations that have adopted real-time threat monitoring have significantly improved their ability to react to market fluctuations, reducing response times from days to mere minutes. As Goldman Sachs noted, 'Real-time threat monitoring has transformed our capacity to manage market fluctuations, shortening our response time from days to minutes.' This capability not only enhances operational efficiency but also fosters a proactive approach to managing uncertainties, highlighting the importance of continuous performance monitoring through financial risk assessment tools.

By 2025, advancements in financial risk assessment tools are increasingly focusing on automation and continuous oversight, with platforms like Data at the forefront of streamlining compliance processes and ensuring audit readiness. Data's innovations are crucial for companies aiming to maintain a competitive edge in a more regulated environment, reinforcing the significance of integrating financial risk assessment tools into organizational workflows for effective evaluation and relationship development.

Expert insights underscore that the integration of financial risk assessment tools into organizational workflows is vital for sustainable growth. Analysts assert that these tools enable companies to make strategic decisions based on comprehensive assessments, ultimately bolstering their resilience amid economic uncertainties.

Types of Financial Risks Businesses Encounter

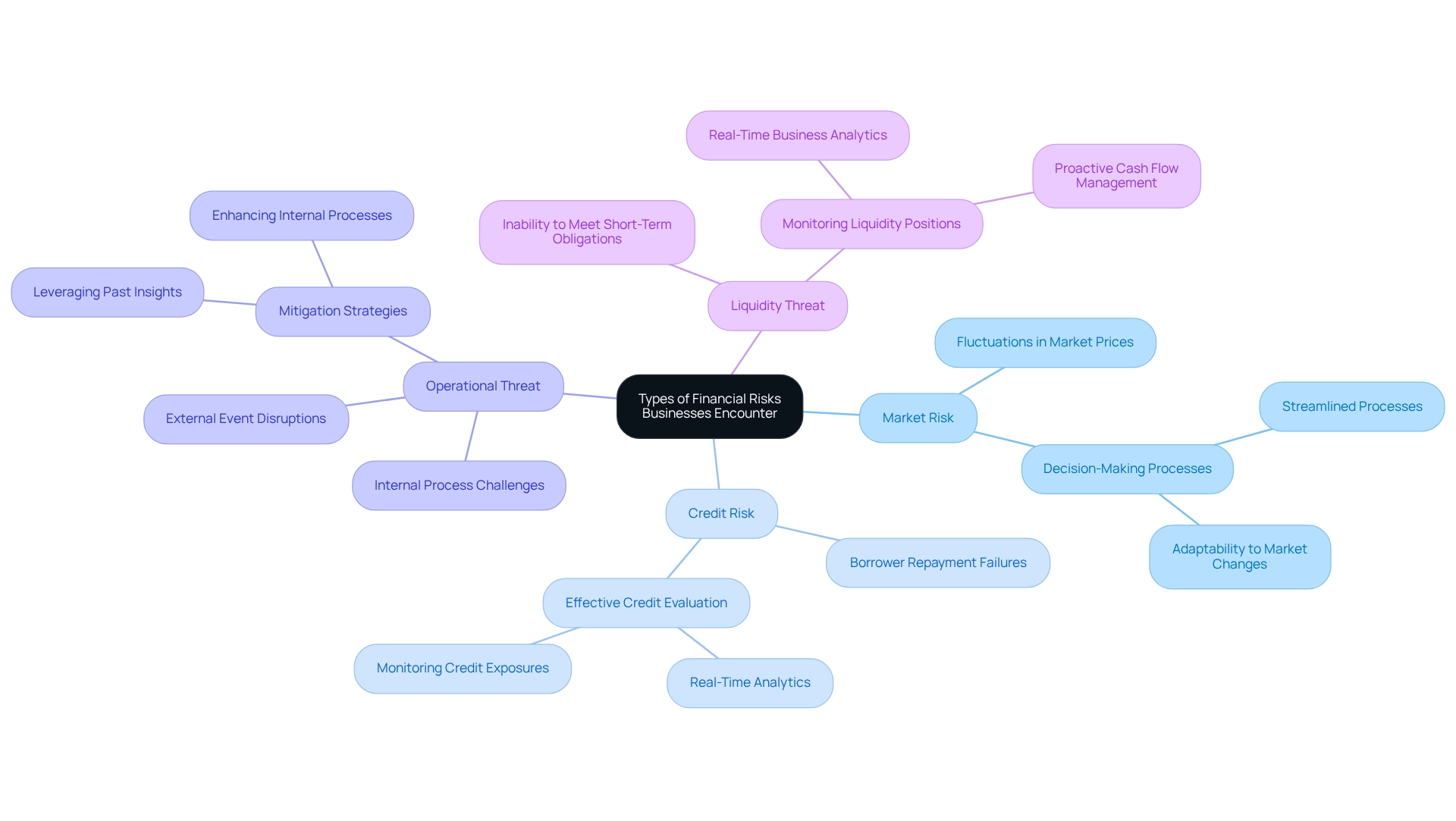

Companies encounter a variety of financial challenges that can significantly impact their operations and sustainability. Understanding these risks is crucial for effective management. The primary financial challenges include:

- Market Risk: This refers to the potential for losses resulting from fluctuations in market prices. As market conditions evolve, businesses must be prepared to adapt to changes that could affect their profitability. Streamlined decision-making processes enhance responsiveness to these market shifts, allowing for quicker adjustments that protect profitability.

- Credit Risk: This threat occurs when a borrower fails to meet their repayment responsibilities, leading to potential losses for lenders. Effective credit evaluation is essential, particularly for medium-sized businesses that may experience tighter cash flows. Utilizing real-time analytics aids in monitoring credit exposures and making informed decisions swiftly.

- Operational Threat: This encompasses challenges arising from internal processes, personnel, systems, and external events. As noted by experts L. Allen and T. Bali, operational threats, while less common, can have severe effects on an entity’s operations. Such hazards can disrupt organizational continuity and result in substantial monetary consequences. By leveraging insights from past experiences, organizations can enhance their internal processes and effectively mitigate these challenges.

- Liquidity Threat: This is the risk that an enterprise may be unable to fulfill its short-term monetary obligations due to an imbalance between its liquid assets and liabilities. Maintaining adequate liquidity is essential for operational stability. Continuous monitoring through real-time business analytics, such as those provided by Transform Your Small/Medium Business's client dashboard, offers insights into liquidity positions, enabling proactive cash flow management.

Comprehending these financial dangers is essential for selecting appropriate financial risk assessment tools. Recent statistics indicate that small to medium-sized enterprises (SMEs) are particularly vulnerable to these challenges, with many struggling to manage them effectively. For instance, companies with dedicated hazard management staff report lower threat intensity compared to those without such positions, as emphasized in the case study titled 'Role of Management in Threat Assessment.' This underscores the significance of organized threat evaluation practices.

As we progress through 2025, trends indicate a growing recognition of the necessity for robust management strategies, especially in light of the difficulties posed by the COVID-19 pandemic. This shift in perspective highlights the imperative for companies to implement comprehensive financial risk assessment tools to navigate these complexities and safeguard their economic well-being. Furthermore, expertise in threat management significantly mitigates the impact of potential dangers to SMEs, reinforcing the case for investing in effective threat management solutions.

Transform Your Small/Medium Business emphasizes the importance of a 'Test & Measure' approach to ensure data-informed decision-making in addressing these financial challenges.

Methodologies for Financial Risk Assessment

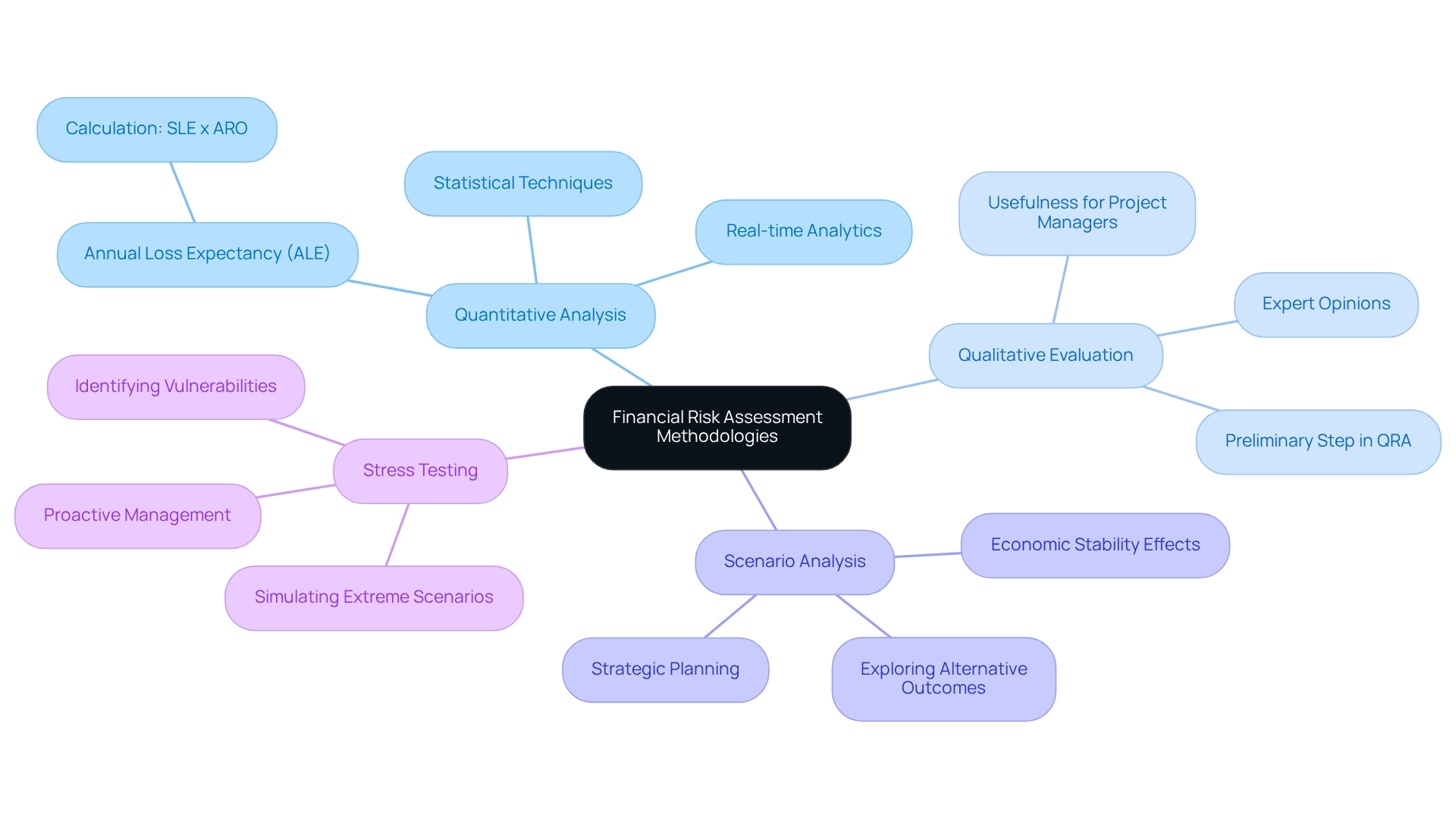

Financial risk assessment methodologies can be broadly categorized into several key approaches, each offering unique insights and applications:

- Quantitative Analysis: This method utilizes statistical techniques to assess uncertainty, relying heavily on historical data to predict future outcomes. It is particularly effective in providing measurable insights. Studies indicate that organizations utilizing quantitative analysis can significantly enhance their risk management strategies. For instance, the Annual Loss Expectancy (ALE) is a critical metric derived from this approach, calculated by multiplying the Single Loss Expectancy (SLE) with the Annual Rate of Occurrence (ARO). This calculation not only validates the investment in countermeasures but also aligns with our services aimed at assisting enterprises in streamlining operations and reducing liabilities, demonstrating the tangible benefits of quantitative assessments. Moreover, our client dashboard provides real-time business analytics, allowing CFOs to continually monitor the success of these strategies and make informed decisions swiftly.

- Qualitative Evaluation: Conversely, qualitative evaluation highlights personal judgment and expert opinions to assess uncertainties that may not be easily quantifiable. This approach is increasingly relevant in complex scenarios where quantitative data is scarce. Recent trends highlight the effectiveness of qualitative risk assessments as a preliminary step in more comprehensive evaluations, particularly beneficial for project managers navigating uncertain environments. Our expertise in this area enables us to help organizations recognize opportunities for growth even when confronted with limited data, promoting a culture of continuous improvement and relationship-building through ongoing performance monitoring.

- Scenario Analysis: This methodology involves exploring potential future events by analyzing various alternative outcomes. It allows organizations to prepare for different possibilities, enhancing strategic planning and decision-making. Key aspects of scenario analysis involve its capacity to incorporate various variables and its emphasis on comprehending the effects of different scenarios on economic stability. By applying insights gained from previous situations, organizations can enhance their strategies and boost their resilience.

- Stress Testing: Stress testing assesses how specific adverse conditions could affect an organization’s financial health. By simulating extreme scenarios, businesses can identify vulnerabilities and develop strategies to mitigate potential impacts. This approach is essential for guaranteeing resilience amid economic variations and unforeseen difficulties, emphasizing the significance of proactive management of uncertainties.

Each of these methodologies presents distinct advantages and limitations, and the selection of an appropriate approach often hinges on the specific context, the data available, and the financial risk assessment tools used. As financial environments change, the incorporation of both quantitative and qualitative approaches using financial risk assessment tools is becoming more prevalent. This enables organizations to utilize the advantages of each to develop a more resilient management framework. Recent case studies, such as the one titled 'Risk Management Strategy,' illustrate that companies employing a combination of financial risk assessment tools have achieved greater resilience and profitability, underscoring the importance of a comprehensive risk assessment strategy.

Furthermore, it is essential to acknowledge that a common problem in quantitative assessment is the lack of sufficient data to be analyzed, which can hinder effective decision-making. By tackling these challenges, our services are intended to assist companies in overcoming barriers and attaining sustainable growth. Additionally, we emphasize the importance of a 'Test & Measure' approach, ensuring that hypotheses are rigorously tested to maximize returns on investment.

Our collaborative planning process further enhances our ability to address business challenges effectively, allowing for continuous adjustments based on real-time analytics.

Traditional vs. Modern Financial Risk Assessment Tools

Conventional economic evaluation methods, such as manual spreadsheets and simple models, often lead to inefficiencies and are susceptible to human error. In contrast, contemporary financial risk assessment tools harness advanced technologies to enhance accuracy and streamline processes, particularly through efficient decision-making and real-time analytics. Key innovations include:

- Automated Risk Evaluation Software: These solutions significantly reduce the time required for evaluations by providing real-time data analysis and comprehensive reporting capabilities. This automation enables companies to allocate resources more effectively, allowing teams to focus on complex tasks instead of manual checks. Consequently, a shortened decision-making cycle becomes essential for organizational turnaround.

- AI and Machine Learning: By utilizing sophisticated algorithms, these technologies can analyze vast datasets to predict potential threats with greater precision. The integration of AI and machine learning into evaluation processes has been shown to enhance both accuracy and operational effectiveness, with a notable increase in adoption among small enterprises. This transformation is crucial for operationalizing turnaround lessons and improving overall organizational performance.

- Integrated Risk Management Platforms: These platforms offer a holistic view of uncertainty across the organization, enabling informed decision-making. By consolidating various uncertainty elements into a single interface, companies can more effectively navigate the complexities of their economic environments, continuously monitoring performance through real-time analytics.

The shift to contemporary financial risk assessment tools is not merely a trend; it represents a critical evolution in response to the growing complexities of financial environments. Recent statistics reveal that 93% of CFOs report shorter invoice processing times due to the implementation of digital technologies and automation, highlighting the tangible benefits of adopting these advanced tools. Furthermore, a study underscored that 87% of small enterprises possess customer information vulnerable to cyber threats, emphasizing the urgent need for robust risk management strategies.

As Komron Rahmonbek, SEO Manager, asserts, "There is no reason not to take action since strong, cost-effective protection is possible even for organizations with modest IT budgets." This transition to automated solutions not only enhances operational efficiency but also fortifies companies against potential economic setbacks, particularly in safeguarding sensitive customer information.

Key Features to Consider in Risk Assessment Tools

When selecting a financial risk assessment tool, it is essential to evaluate several key features that can significantly impact its effectiveness:

- User-Friendly Interface: A tool must be intuitive and easy to navigate, ensuring accessibility for all users, regardless of their technical background. Research indicates that a user-friendly interface is crucial, as it directly influences user adoption and satisfaction. In a recent study, only 85 out of 161 senior employees at retail Islamic banks in Bahrain completed questionnaires, highlighting the importance of user-friendly designs that encourage engagement and usability.

- Real-Time Data Analytics: The capability to analyze data in real-time is vital for making informed decisions swiftly. Organizations increasingly recognize that financial risk assessment tools, along with real-time analytics, not only enhance responsiveness but also improve overall risk management strategies, especially in dynamic environments. This aligns with the need for continuous organizational performance monitoring, allowing entities to quickly adjust their strategies based on current data. As noted by Samuel Folorunsho Ayodele Sonuga, "End-to-end AI pipeline optimization is critical for improving the efficiency and performance of recommendation systems, which play a pivotal role in personalizing user experiences across various domains."

- Customizable Reporting: Efficient resources should provide customizable reporting options that address specific business needs. This adaptability enables organizations to leverage financial risk assessment tools to produce insights that are directly pertinent to their distinct vulnerability profiles and operational contexts, enhancing decision-making.

- Integration Capabilities: A strong evaluation mechanism should seamlessly connect with existing systems. This integration is crucial for preserving data consistency and improving usability across multiple platforms, ultimately resulting in more unified management processes.

- Scalability: As companies progress, their evaluation instruments must be able to expand to satisfy increasing requirements. A scalable solution guarantees that organizations can use financial risk assessment tools to adjust their management strategies in accordance with their growth and evolving project management requirements.

The COVID-19 pandemic has further emphasized the necessity for effective management solutions, as it revealed weaknesses in supply chains and operational disruptions. This has resulted in a heightened need for management software, highlighting the significance of choosing resources that include these essential features. These characteristics together guarantee that the chosen resource efficiently assists the organization's management strategy, allowing enterprises to handle uncertainties and strengthen resilience against upcoming disruptions.

Implementing Financial Risk Assessment Tools Effectively

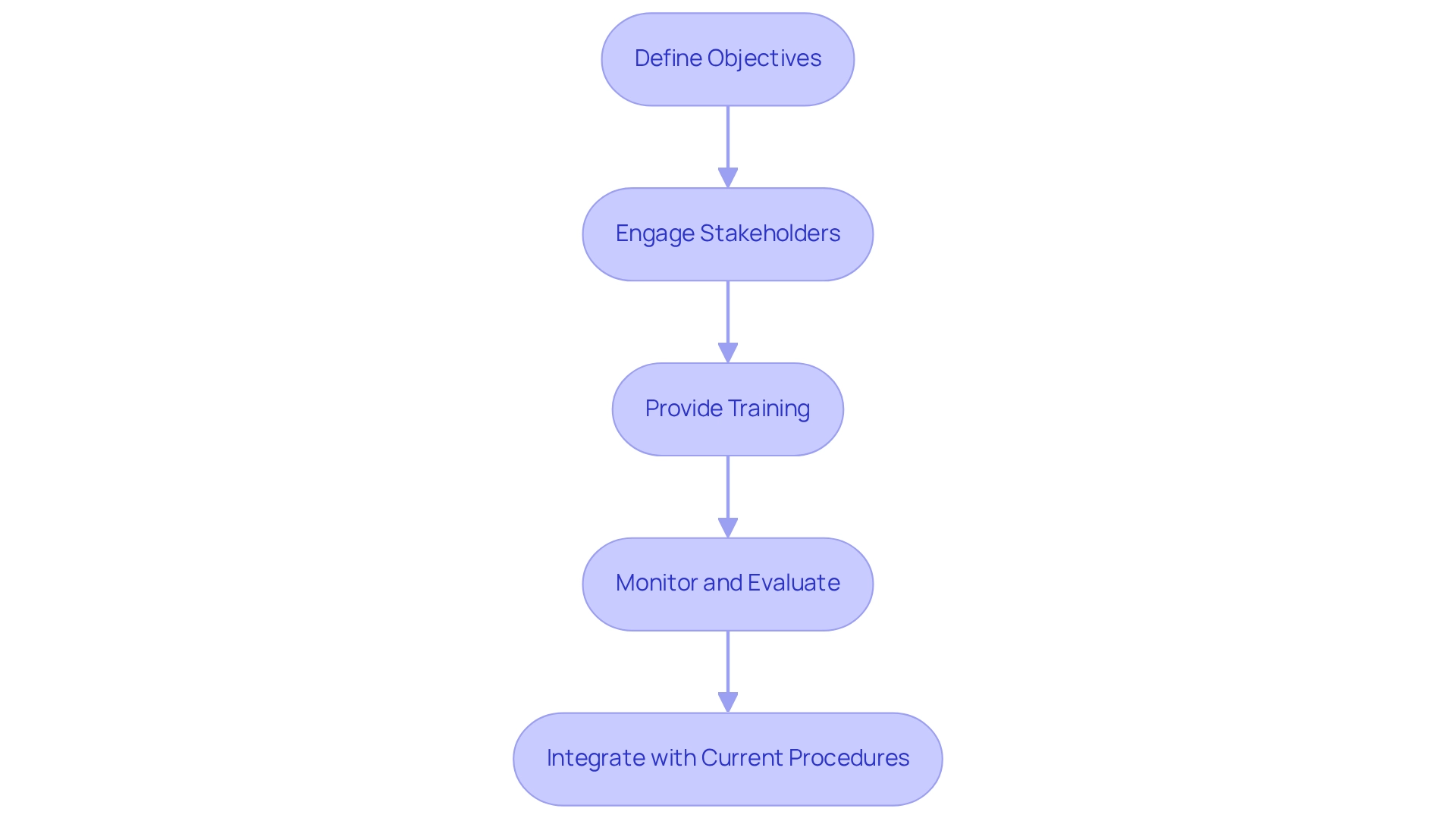

To implement financial risk evaluation instruments effectively, organizations should adhere to the following steps:

- Define Objectives: Clearly outline the specific goals the organization aims to achieve with the resource, ensuring alignment with overall business strategy.

- Engage Stakeholders: Actively involve key stakeholders throughout the selection and implementation process. This engagement is vital, as studies show that organizations with robust stakeholder involvement experience a 30% higher success rate in implementation. Involving stakeholders encourages support and guarantees that the resource addresses the varied requirements of the organization. Notably, 35% of risk executives identify compliance and regulatory risk as their top concern, highlighting the importance of stakeholder engagement in addressing these issues.

- Provide Training: Offer comprehensive training programs for users to maximize the system's potential. Research indicates that organizations that invest in training experience a 25% increase in resource utilization and effectiveness.

- Monitor and Evaluate: Continuously assess the system's performance against predefined metrics and make necessary adjustments. Frequent assessments assist in recognizing areas for enhancement and guarantee that the resource stays pertinent to changing organizational requirements. In light of the significant decrease in organizations achieving full PCI compliance—from 43.4% in 2020 to 14.3% in 2023—this step is increasingly vital. Additionally, leveraging real-time analytics through the client dashboard provided by Transform Your Small/ Medium Business can enhance the monitoring process, allowing organizations to diagnose their business health continuously and make informed decisions swiftly.

- Integrate with Current Procedures: Ensure that the instrument complements and enhances existing management frameworks and processes. A seamless integration can result in a 40% enhancement in operational efficiency, as the resource becomes part of the organization's workflow instead of an isolated solution. Moreover, with 92% of threat leaders observing cyber advancements attentively, incorporating these tools is crucial for tackling emerging dangers.

By adhering to these steps, organizations can utilize financial risk assessment tools to boost decision-making and enhance stability, ultimately resulting in more robust business operations. A comprehensive monetary assessment, as provided by Transform Your Small/ Medium Business, can assist in recognizing chances to conserve cash and lessen obligations, which is vital as noted by the PwC Pulse Survey, where 33% of leaders in uncertainty management intend to boost expenditure on managing challenges. This monetary commitment is essential as organizations maneuver through the intricacies of compliance, with the ISO establishing 25,729 international compliance standards across 173 nations, highlighting the worldwide significance of adherence in fiscal assessment.

Case Studies: Successful Implementation of Risk Assessment Tools

Numerous organizations have effectively integrated financial risk assessment tools, resulting in notable enhancements to their risk management frameworks, particularly in the context of streamlined decision-making and real-time analytics, as emphasized by Transform Your Small/ Medium Business.

Retail Company X: By introducing an automated evaluation system, this retailer accomplished an impressive 30% decrease in operational uncertainties within the first year. This transformation facilitated more informed inventory management decisions, ultimately leading to improved efficiency and cost savings.

Hospitality Group Y: The adoption of a comprehensive risk management platform allowed this hospitality group to streamline its compliance processes. Consequently, they encountered a 25% reduction in regulatory fines, demonstrating the system's effectiveness in managing intricate regulatory environments.

Manufacturing Firm Z: Through the use of scenario analysis tools, this manufacturing firm was able to identify potential supply chain disruptions proactively. This foresight allowed them to reduce threats effectively, ensuring that production levels stayed stable despite external pressures.

Circularity in Retail: As sustainability becomes a priority for consumers, retailers are adopting circular business strategies. This change not only strengthens brand loyalty but also introduces new monetary challenges that must be evaluated. The incorporation of financial risk assessment tools is essential in managing these challenges.

Christian Beckner, Vice President of Retail Technology and Cybersecurity, highlights the significance of these resources, stating, 'Genuine gratitude to NRF subject matter experts for their insights on the changing environment of management challenges in retail.'

These case studies demonstrate the significant advantages gained from the strategic use of financial risk assessment tools, highlighting their essential role in improving operational resilience and adherence across different sectors. As almost 80% of organizations encountered at least one supply chain disruption in the past year, the significance of these resources in protecting operational continuity cannot be overstated. Moreover, with persistent geopolitical strife resulting in changes in economies and escalating monetary pressures, the need for companies to implement efficient evaluation strategies has never been more pressing.

By recognizing fundamental organizational challenges and strategizing appropriately, companies can utilize these resources to enhance their investment returns.

Key Takeaways for Choosing the Right Tool

When selecting a financial risk assessment tool, it is crucial to take the following steps:

- Recognize Your Threats: Start by pinpointing the particular financial challenges your company faces. With 36% to 53% of small enterprises encountering lawsuits each year, comprehending these challenges is essential for efficient management. As Ariane Chapelle, a partner at BDO, observes, 'Comprehending operational threats is vital for businesses to manage challenges efficiently.' This understanding lays the groundwork for effective risk management.

- Evaluate Methodologies: Assess which assessment methodologies align with your organizational needs. Ongoing observation can assist in recognizing possible issues promptly, enabling timely actions that reduce danger. Our team at Transform Your Small/ Medium Business supports a shortened decision-making cycle throughout the turnaround process, enabling decisive actions that preserve your business.

- Assess Features: Look for resources that offer essential features for effective risk management. This includes capabilities for analyzing market trends and consumer behavior, which can inform your financial strategies. Moreover, resources that provide real-time analytics for enterprises, like a client dashboard, can improve your capacity to track performance consistently and modify strategies as necessary.

- Plan for Implementation: Develop a clear strategy for incorporating the selected resource into your organization. A well-organized execution strategy guarantees that the resource is employed efficiently and fulfills your organizational goals.

- Learn from Others: Review case studies to gain insights into how similar organizations have successfully leveraged these tools. For example, the case analysis on litigation uncertainties emphasizes that small enterprises encounter considerable legal obstacles, with an average liability lawsuit costing a minimum of $54,000. This highlights the significance of thorough evaluation in handling potential litigation challenges.

By adhering to these key takeaways, businesses can enhance their risk management capabilities and select the most suitable financial risk assessment tools to navigate their unique challenges, while also fostering a culture of continuous performance monitoring and relationship-building through real-time analytics.

Conclusion

Understanding and managing financial risks is paramount for businesses seeking to ensure their stability and growth in today's dynamic environment. This article has explored the various types of financial risks organizations face, including:

- Market risks

- Credit risks

- Operational risks

- Liquidity risks

It emphasizes the necessity for effective financial risk assessment tools. These tools not only enable businesses to identify and evaluate potential threats but also facilitate informed decision-making that can significantly enhance resilience against uncertainties.

The methodologies employed in financial risk assessment, such as:

- Quantitative analysis

- Qualitative assessment

- Scenario analysis

- Stress testing

provide organizations with a comprehensive framework for understanding their risk landscape. Moreover, the transition from traditional to modern risk assessment tools, leveraging automation and real-time analytics, underscores the importance of integrating advanced technologies to improve accuracy and efficiency in risk management.

Key features to consider when selecting a financial risk assessment tool include:

- User-friendliness

- Real-time data analytics

- Customizable reporting

- Integration capabilities

- Scalability

By prioritizing these features, organizations can ensure that the tools they choose effectively support their risk management strategies and adapt to evolving challenges.

In conclusion, the implementation of robust financial risk assessment tools is not just beneficial; it is essential for fostering resilience and sustaining growth in an increasingly complex financial landscape. As businesses navigate the intricacies of compliance and market fluctuations, investing in effective risk management solutions will empower them to make strategic decisions that safeguard their financial health and ensure long-term success.

Frequently Asked Questions

What are financial risk assessment tools?

Financial risk assessment tools are methods and software applications designed to detect, assess, and rank economic threats facing enterprises, enabling organizations to evaluate potential risks to their economic stability and facilitate informed decision-making.

Why are financial risk assessment tools important?

They are crucial for navigating complex economic landscapes, especially as nearly one-third of companies have been impacted by fraud or monetary crime, and 35% of executives cite compliance and regulatory challenges as a primary concern.

What methodologies do financial risk assessment tools typically include?

Common methodologies include qualitative and quantitative analysis, scenario modeling, and stress testing.

How do real-time analytics enhance financial risk assessment tools?

The integration of real-time analytics allows organizations to respond swiftly to emerging threats, improving their ability to react to market fluctuations and reducing response times from days to minutes.

What are the primary financial challenges companies face?

The main financial challenges include market risk, credit risk, operational threats, and liquidity threats, each of which can significantly impact a company's operations and sustainability.

What is market risk?

Market risk refers to the potential for losses due to fluctuations in market prices, requiring businesses to adapt to changes that could affect their profitability.

What is credit risk?

Credit risk occurs when a borrower fails to meet repayment obligations, potentially leading to losses for lenders, making effective credit evaluation essential.

What does operational threat encompass?

Operational threat includes challenges from internal processes, personnel, systems, and external events that can disrupt organizational continuity and result in significant monetary consequences.

What is liquidity threat?

Liquidity threat is the risk that a company may be unable to meet short-term monetary obligations due to an imbalance between liquid assets and liabilities, necessitating adequate liquidity for operational stability.

How can companies mitigate financial risks effectively?

Companies can mitigate financial risks by implementing structured threat evaluation practices, utilizing financial risk assessment tools, and continuously monitoring their financial positions with real-time analytics.