Introduction

In an era defined by rapid change and financial uncertainty, corporate restructuring consulting emerges as a crucial lifeline for organizations grappling with operational and strategic realignment. As businesses face mounting pressures—from evolving market dynamics to increased competition—the need for expert guidance becomes paramount.

Restructuring consultants leverage their extensive industry experience to conduct comprehensive assessments, identify cash preservation opportunities, and craft tailored strategies that not only stabilize financial health but also position companies for sustainable growth. With services ranging from interim management to bankruptcy case management, these consultants play an essential role in navigating the complexities of transformation, ensuring that organizations not only survive but thrive in challenging environments.

As CFOs confront multifaceted challenges, understanding the value of restructuring consulting can be the key to unlocking a resilient and competitive future.

What is Corporate Restructuring Consulting?

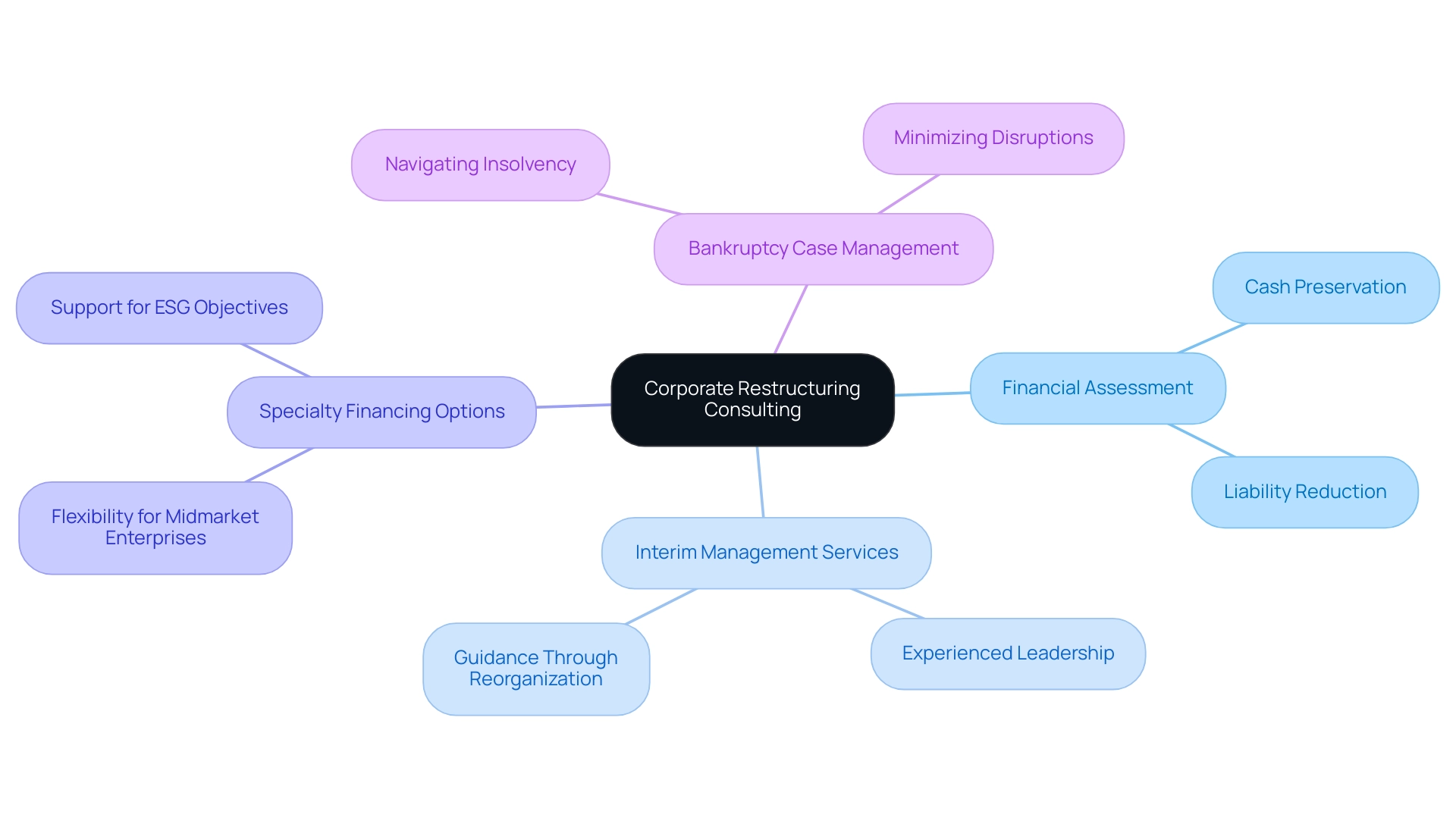

Corporate restructuring consulting firms serve as an essential advisory service aimed at helping businesses in realigning their operations, finances, and strategies during challenging times or significant changes. This specialized consulting begins with a comprehensive financial assessment, crucial for identifying opportunities to preserve cash and reduce liabilities. Corporate restructuring consulting firms, leveraging extensive industry expertise—such as eCapital's network of over 600 specialists in asset evaluation, FinTech solutions, and customer support—partner closely with small to medium enterprises to craft tailored strategies aimed at stabilizing financial health, optimizing processes, and fostering growth.

A crucial element of these strategies involves:

- Interim management services, which deliver experienced leadership to direct organizations through the reorganization process

- Specialty financing options that provide flexibility for midmarket enterprises to support their ESG objectives while restoring financial stability

- Bankruptcy case management, ensuring that businesses navigate the complexities of insolvency effectively while minimizing disruptions

Real-world applications, such as amend-and-extend transactions, illustrate the complexities involved in corporate reorganization, where negotiations occur between patient lenders and companies seeking more manageable terms on existing debt.

As CFOs confront multifaceted challenges, the action-oriented guidance offered by corporate restructuring consulting firms becomes essential, enabling companies to navigate complex transformations effectively and emerge more resilient and competitive. In a landscape marked by increasing competition and evolving expectations, insights derived from comprehensive evaluations and strategic planning are invaluable for driving efficiencies, enhancing returns, and achieving long-term sustainability.

Types of Services Offered by Restructuring Consulting Firms

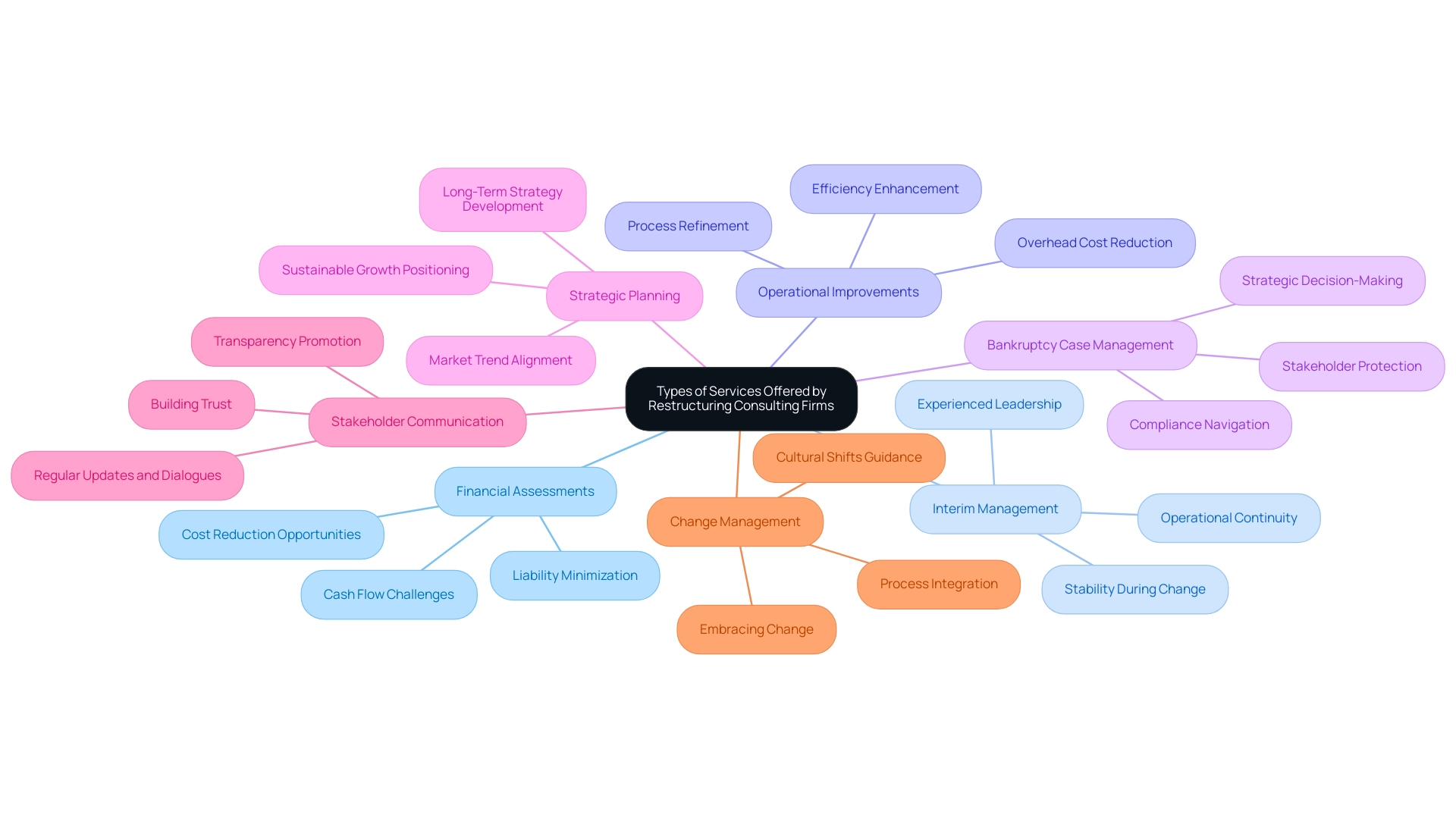

Corporate restructuring consulting firms are integral to navigating the complexities of corporate transformation, offering a diverse array of services tailored to address specific challenges. Key offerings include:

-

Financial Assessments: Comprehensive evaluations of financial statements are crucial for pinpointing cash flow challenges, liabilities, and potential areas for cost reduction.

Highlighting comprehensive financial evaluations reinforces the importance of cash conservation and liability minimization, especially as companies increasingly focus on data-driven insights to guide their reorganization strategies.

-

Interim Management: This service provides experienced leaders on a temporary basis to oversee operations during the restructuring process. Their hands-on executive leadership is pivotal in maintaining continuity and stability, ensuring that the organization remains on course while implementing necessary changes.

Given the challenges in sourcing top talent and increasing salaries for advisors, effective interim management becomes essential.

-

Operational Improvements: By analyzing and refining business processes, consultants enhance efficiency and reduce overhead costs. This operational focus is essential for organizations aiming to rebuild their financial footing and drive growth, thus uncovering value and mitigating risks.

-

Bankruptcy Case Management: In circumstances where bankruptcy is a consideration, consulting firms provide specialized services to navigate the complexities of the bankruptcy process, ensuring compliance and strategic decision-making to protect stakeholder interests.

-

Strategic Planning: Developing long-term strategies that align with emerging market trends and organizational objectives is crucial. Consultants work closely with leadership to craft approaches that stabilize the company while positioning it for sustainable growth in a competitive landscape.

-

Stakeholder Communication: Managing relationships with creditors, investors, and employees is vital during the process of reorganization. Building trust among stakeholders is essential, as underscored by recent studies. Consultants aid in promoting transparency and trust through regular updates, open dialogues, and organized communication strategies, essential in reducing resistance and instilling confidence during the reorganization process.

-

Change Management: Guiding organizations through significant shifts in culture, processes, and systems is a cornerstone of successful transformation initiatives. Consultants from corporate restructuring consulting firms facilitate this transition, ensuring that changes are embraced and integrated into the organizational fabric.

As the global corporate restructuring consulting firms market continues to expand, with a CAGR of 5.6% from 2018 to 2023, the demand for these services is more pronounced than ever. The focus on building trust in deal-making highlights the importance of effective leadership and communication during this pivotal phase, ensuring streamlined decision-making and continuous performance monitoring.

The Role of Restructuring Consultants in Business Recovery

Corporate restructuring consulting firms are integral to facilitating successful recovery, particularly in a landscape marked by significant financial challenges. Their roles encompass several critical functions:

-

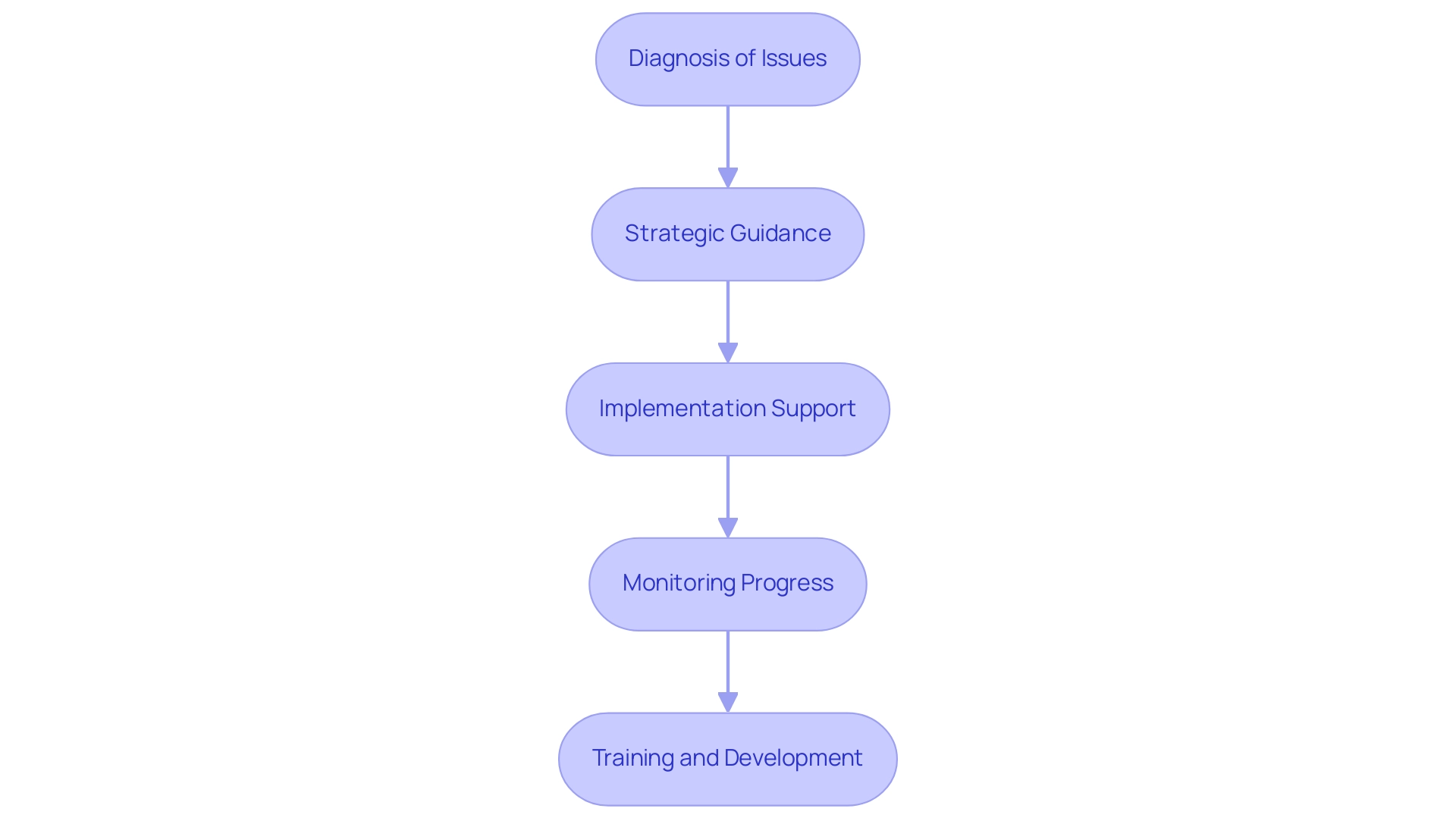

Diagnosis of Issues: Consultants delve into the intricacies of financial distress and operational inefficiencies, employing comprehensive assessments to unearth root causes that may hinder recovery efforts.

This process aligns with mastering the cash conversion cycle, providing a foundation for enhanced business performance.

-

Strategic Guidance: They provide actionable recommendations grounded in industry best practices, ensuring strategies are tailored to the unique circumstances of each organization. Comprehending the key factors and historical challenges that affect lenders' choices is essential for efficient reorganization, forming a core part of the consultants' strategic guidance.

Their insights facilitate streamlined decision-making and real-time analytics, essential for organizational turnaround.

-

Implementation Support: Consultants play a crucial role in the execution of reorganization plans, collaborating with businesses to ensure that necessary changes are not only adopted but also integrated seamlessly into operations. This operationalization of lessons learned is vital for building strong, lasting relationships within the organization.

-

Monitoring Progress: By establishing metrics and key performance indicators (KPIs), advisors track the effectiveness of implemented strategies, making real-time adjustments to optimize outcomes—a critical aspect of performance monitoring in today’s financial environment.

-

Training and Development: They focus on equipping organizational leaders and employees with the skills and knowledge essential for sustaining improvements post-restructuring, reinforcing a commitment to continuous improvement.

In light of expected record debt maturities in the commercial real estate sector over the next three years, the role of restructuring advisors becomes even more vital. As noted by a Certified Consulting Professional,

But as with everything in life there are trade-offs; you will travel more, and the pay isn't quite as good in most cases.

This emphasizes the substantial dedication needed from advisors and enterprises alike.

However, the proactive planning illustrated in the case study on healthcare companies demonstrates that early action can maximize options and prepare organizations for potential challenges over the next 18 months. This comprehensive analysis of troubled circumstances is vital for maneuvering through the intricacies of today's financial landscape, emphasizing the crucial role of strategic support offered by corporate restructuring consulting firms. Additionally, the pricing for these comprehensive services typically starts at $99.00, reflecting the value of the strategies implemented to enhance business performance.

Benefits of Hiring Restructuring Consultants

Engaging restructuring consultants offers a multitude of advantages that can significantly enhance an organization’s recovery trajectory:

- Expertise and Experience: Consultants bring specialized knowledge and skills that may not be readily available internally. This infusion of expertise elevates the quality of decision-making, particularly in complex financial environments. As noted by M&I - Brian, corporate restructuring consulting firms and elite boutiques are playing a significant role in providing this specialized knowledge, which is crucial for effective restructuring.

- Objectivity: An external perspective is invaluable, allowing advisors to identify underlying issues without the biases that often cloud internal judgment. This objectivity fosters more effective problem-solving and strategic planning, particularly during the comprehensive review that aligns key stakeholders with the objectives of corporate restructuring consulting firms.

- Resource Optimization: By reallocating resources efficiently, corporate restructuring consulting firms can help professionals direct focus towards critical areas that are pivotal for recovery and growth, ensuring that efforts are concentrated where they will yield the most impact. Their strategic planning also addresses underlying commercial issues, reinforcing key strengths.

- Streamlined Decision-Making: Utilizing established methodologies and frameworks, corporate restructuring consulting firms expedite the restructuring process. Their approach supports a shortened decision-making cycle, allowing your team to take decisive action to preserve the organization, reducing downtime while enhancing the momentum necessary for successful implementation.

- Real-Time Analytics for Performance Monitoring: Continuous monitoring of success through real-time business analytics helps diagnose your organization's health, allowing for timely updates and adjustments. This commitment to operationalizing lessons learned ensures that the turnaround strategies are not only effective but also sustainable. For example, corporate restructuring consulting firms actively monitor outcomes and enhance strategies based on performance data, ensuring that lessons learned are incorporated into ongoing operations.

- Enhanced Financial Performance: Implementing tailored strategies can lead to substantial improvements in cash flow, a reduction in liabilities, and an overall increase in profitability. For instance, companies that partnered with Consultport reported an expenditure of $350,000, which resulted in an impressive cost saving of approximately 53%. Moreover, the anticipated increase in starting salaries for the 2025 recruiting cycle reflects a competitive market for seasoned professionals, further underscoring the value of hiring top talent.

- Networking and Career Advancement: Involving advisory experts not only offers instant financial advantages but also creates substantial networking possibilities. As demonstrated in the case study titled "Networking and Career Advancement in Turnaround Consulting," the cooperative work atmosphere encourages relationships with top executives, potentially resulting in career growth and opportunities in distressed groups.

By utilizing the expertise and skills of corporate restructuring consulting firms, organizations are better equipped to handle financial difficulties and attain sustainable growth. Additionally, throughout the reorganization process, consultants will rigorously test hypotheses related to identified issues, ensuring that strategies are data-driven and aligned with organizational objectives.

Challenges in Corporate Restructuring and How Consultants Can Help

Corporate reorganization poses a range of challenges that can significantly impact the success of the process. Among these challenges are:

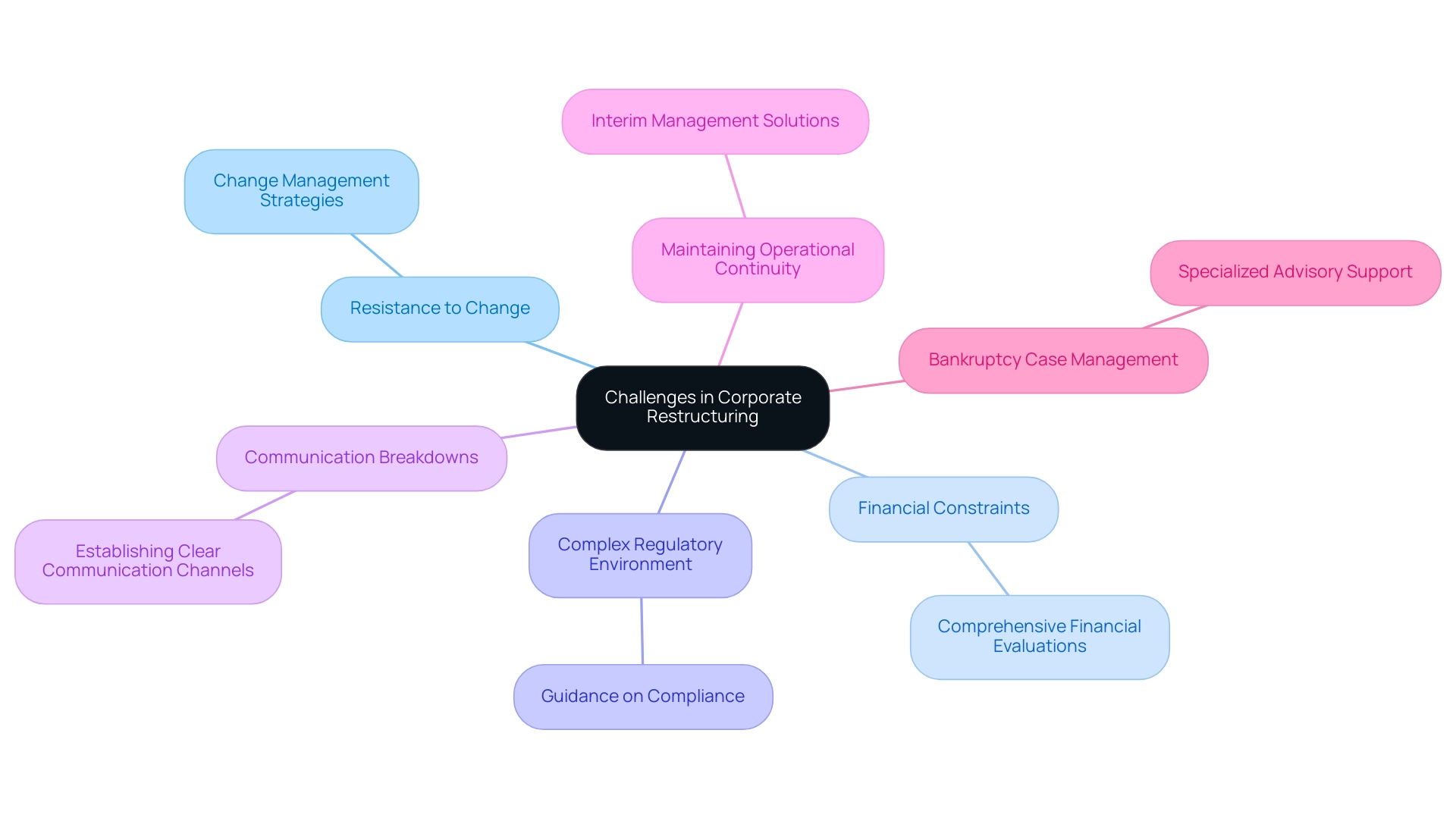

- Resistance to Change: A common hurdle is the resistance from employees and stakeholders towards new processes and structures. This can stall progress and undermine initiatives. As James Sleight from PKF Littlejohn Advisory notes, "Why do Credit Unions fail?" This underscores the critical nature of addressing resistance during the reorganization. To mitigate this, consultants implement change management strategies that facilitate smoother transitions and help stakeholders embrace new directions.

- Financial Constraints: Often, limited cash flow can serve as a major obstacle in reorganization efforts. Corporate restructuring consulting firms perform comprehensive financial evaluations to uncover opportunities for cash preservation and liability reduction, ensuring that firms possess the essential resources to manage the reorganization process efficiently. Their expertise allows for a comprehensive approach to financial health, which is essential for long-term stability.

- Complex Regulatory Environment: The legal and compliance landscape can be intricate and daunting. Corporate restructuring consulting firms with expertise in regulatory issues play an essential role in guiding organizations through these complexities, ensuring compliance is maintained throughout the transformation journey. This is vital for mitigating risks associated with non-compliance and maintaining operational credibility.

- Communication Breakdowns: Ineffective communication can lead to confusion and mistrust among stakeholders. Corporate restructuring consulting firms are instrumental in establishing clear communication channels and developing strategies that engage all parties effectively, fostering transparency and trust during times of change. This collaborative approach is key to ensuring all stakeholders are aligned and informed.

- Maintaining Operational Continuity: Balancing organizational changes with daily operational demands can be particularly challenging. Corporate restructuring consulting firms often provide interim management solutions, offering hands-on executive leadership that ensures core operations continue seamlessly while necessary changes are implemented. This dual focus on reorganization and operational stability is vital for sustaining business momentum and enhancing overall performance.

- Bankruptcy Case Management: In situations where reorganization results in bankruptcy, specialized advisors are crucial for handling the intricacies of bankruptcy case management. Their guidance ensures that entities navigate this challenging process while minimizing liabilities and protecting stakeholder interests.

As the landscape of corporate transformation evolves—especially with projected default rates for European highly leveraged speculative companies anticipated to rise to around 4% in 2024—the involvement of corporate restructuring consulting firms becomes increasingly critical. The rise in liability management exercises (LMEs) since 2022, particularly among sponsor-owned companies, indicates a shift in how private equity firms manage distressed assets. Their diverse expertise is essential, as few firms rely solely on one independent vendor during these complex processes.

By addressing these challenges through decisive action, streamlined decision-making, and real-time analytics, organizations can position themselves for successful restructuring outcomes.

Conclusion

Navigating the complexities of corporate restructuring is no small feat, especially in today's fast-paced and uncertain economic landscape. The insights drawn from this exploration underscore the pivotal role that restructuring consultants play in guiding organizations through financial and operational realignments. From conducting thorough financial assessments to implementing strategic planning and interim management, these experts equip businesses with the tools necessary to stabilize and thrive.

The benefits of engaging restructuring consultants are manifold. Their specialized expertise and objective perspective enable organizations to identify and address underlying issues effectively, while their guidance helps streamline decision-making processes. Furthermore, the emphasis on change management and stakeholder communication fosters an environment of trust and collaboration, crucial for overcoming resistance and ensuring a smooth transition.

As companies face mounting pressures—be it from evolving market dynamics, financial constraints, or regulatory complexities—the strategic value of restructuring consulting becomes increasingly evident. By leveraging the capabilities of these professionals, organizations can not only navigate immediate challenges but also lay the groundwork for sustainable growth and resilience in the future. The time to act is now; embracing expert guidance in restructuring can unlock the potential for a more robust and competitive business landscape.

Frequently Asked Questions

What is the primary role of corporate restructuring consulting firms?

Corporate restructuring consulting firms provide advisory services to help businesses realign their operations, finances, and strategies during challenging times or significant changes.

What initial step do corporate restructuring consulting firms take when working with businesses?

They begin with a comprehensive financial assessment to identify opportunities for preserving cash and reducing liabilities.

What types of expertise do these consulting firms leverage?

They utilize extensive industry expertise, such as networks of specialists in asset evaluation, FinTech solutions, and customer support.

What specific services do corporate restructuring consulting firms offer?

Key services include financial assessments, interim management, operational improvements, bankruptcy case management, strategic planning, stakeholder communication, and change management.

How do interim management services benefit organizations during restructuring?

Interim management provides experienced leadership on a temporary basis, ensuring continuity and stability while implementing necessary changes.

What is the importance of operational improvements in corporate restructuring?

Operational improvements enhance efficiency and reduce overhead costs, which are essential for organizations aiming to rebuild their financial footing and drive growth.

How do consulting firms assist with bankruptcy case management?

They provide specialized services to navigate the complexities of bankruptcy, ensuring compliance and strategic decision-making to protect stakeholder interests.

Why is strategic planning crucial during corporate restructuring?

Strategic planning helps develop long-term strategies that align with market trends and organizational objectives, stabilizing the company for sustainable growth.

What role does stakeholder communication play in the restructuring process?

Effective stakeholder communication builds trust among creditors, investors, and employees, promoting transparency and reducing resistance during the reorganization.

How does change management contribute to successful corporate transformation?

Change management guides organizations through significant shifts in culture, processes, and systems, ensuring that changes are embraced and integrated effectively.

What is the current trend in the corporate restructuring consulting market?

The market is expanding, with a compound annual growth rate (CAGR) of 5.6% from 2018 to 2023, indicating a growing demand for these services.