Overview

Corporate restructuring services are essential for CFOs, as they involve strategic initiatives designed to realign an organization's operations, finances, or management frameworks. This realignment aims to enhance effectiveness and profitability, particularly during economic downturns. These services not only lead to improved economic stability but also foster operational efficiency and bolster market competitiveness. Consequently, they establish a robust foundation for sustainable growth and long-term success.

In today's challenging economic landscape, the need for such services is more pressing than ever. CFOs must recognize the value of these initiatives in navigating uncertainties and driving their organizations forward. By prioritizing corporate restructuring, they can position their companies for resilience and adaptability, ensuring they thrive in a competitive marketplace.

In conclusion, embracing corporate restructuring services is not just a reactive measure; it is a proactive strategy that empowers organizations to achieve enduring success. CFOs are encouraged to take decisive action and explore these transformative solutions to secure their organization's future.

Introduction

In the dynamic landscape of business, corporate restructuring services have emerged as a vital lifeline for organizations striving to enhance their operational efficiency and financial stability. As companies face mounting pressures from economic fluctuations, regulatory changes, and evolving consumer demands, the need for strategic realignment becomes increasingly evident.

These services encompass a wide range of initiatives—from financial and operational restructuring to organizational changes and bankruptcy management—all designed to navigate complex challenges and foster sustainable growth. With the right approach, businesses can not only overcome immediate hurdles but also position themselves for long-term success in a competitive marketplace.

The transformative power of restructuring is not merely a reactive measure; it is an essential strategy for thriving in an ever-changing economic environment.

Define Corporate Restructuring Services

Corporate restructuring services include a variety of strategic initiatives aimed at realigning an organization's operations, finances, or management frameworks. These offerings are particularly essential during economic downturns or when a company seeks to enhance its effectiveness and profitability. The reorganization process may involve:

- Debt modification

- Operational adjustments

- Mergers and acquisitions

- Divestitures

- Bankruptcy case management

With over 100 years of collective expertise, Transform Your Small/Medium Business provides extensive turnaround and reorganization consulting solutions, including temporary management and economic evaluations, specifically tailored for small to medium enterprises to help reduce costs, optimize operations, and increase revenues.

Recent trends indicate that more than a third of business leaders recognize the significant impact of environmental issues on their operations, underscoring the need for flexible reorganization strategies that incorporate sustainability. The success rates of corporate transformation initiatives vary, yet integrated approaches that leverage comprehensive support from skilled experts tend to yield superior outcomes. A survey revealed that only a small fraction of businesses engage a single independent external vendor during restructuring, highlighting the demand for integrated, all-in-one solutions capable of addressing complex challenges efficiently.

Expert opinions emphasize the importance of corporate restructuring in maintaining economic stability. These corporate restructuring services not only tackle urgent financial issues but also establish a foundation for sustainable growth. A thorough fiscal review can identify opportunities to conserve cash and reduce liabilities, while timely actions and collaborative strategies are vital for stabilizing economic positions and enhancing operations during business recovery. Successful instances of corporate restructuring illustrate how organizations can emerge stronger and more competitive by embracing transformational change. Ultimately, the objective of corporate restructuring services is to enhance a company's financial stability and operational effectiveness, ensuring long-term sustainability and growth.

Contextualize the Need for Restructuring in SMBs

Small to medium enterprises (SMEs) frequently operate under stringent financial constraints, contending with challenges such as:

- Fluctuating market demands

- Limited access to funding

- Heightened competition

Economic downturns, regulatory changes, and shifting consumer behaviors can exacerbate these challenges, often leading to cash flow problems and operational inefficiencies. For example, a small enterprise generating $1 million annually might incur litigation fees exceeding $20,000, which can severely strain financial resources and worsen existing difficulties, as evidenced by data from the Bureau of Labor Statistics and the U.S. Small Enterprise Administration.

By 2025, these pressures will intensify, necessitating a proactive approach to corporate restructuring services. Implementing effective corporate restructuring services, such as the innovative 'Rapid30' plan developed by the SMB team, allows organizations to:

- Optimize operations

- Reduce costs

- Realign to better serve customer needs

This plan not only uncovers underlying issues through a collaborative approach but also outlines a clear roadmap for improvement, demonstrating the transformative power of strategic business consulting. The 'Rapid30' plan emphasizes the importance of testing and measuring outcomes to ensure maximum return on invested capital, highlighting the necessity of data-driven decision-making.

Notably, sectors such as healthcare and social assistance exhibit higher survival rates, underscoring the critical need for strategic adaptation and effective reform measures. Successful case studies reflecting economic adaptation to inflationary pressures illustrate that many SMBs have adeptly navigated economic challenges by reassessing spending strategies and embracing operational efficiencies. This underscores that corporate restructuring services are not merely a reactive response but an essential pathway to sustainable growth.

As Kelly Main, a Marketing Editor and Writer, aptly notes, 'Your monetary situation is unique and the products and offerings we review may not be suitable for your circumstances,' emphasizing the need for tailored strategies that address the specific challenges faced by SMBs.

Explore Types of Corporate Restructuring Services

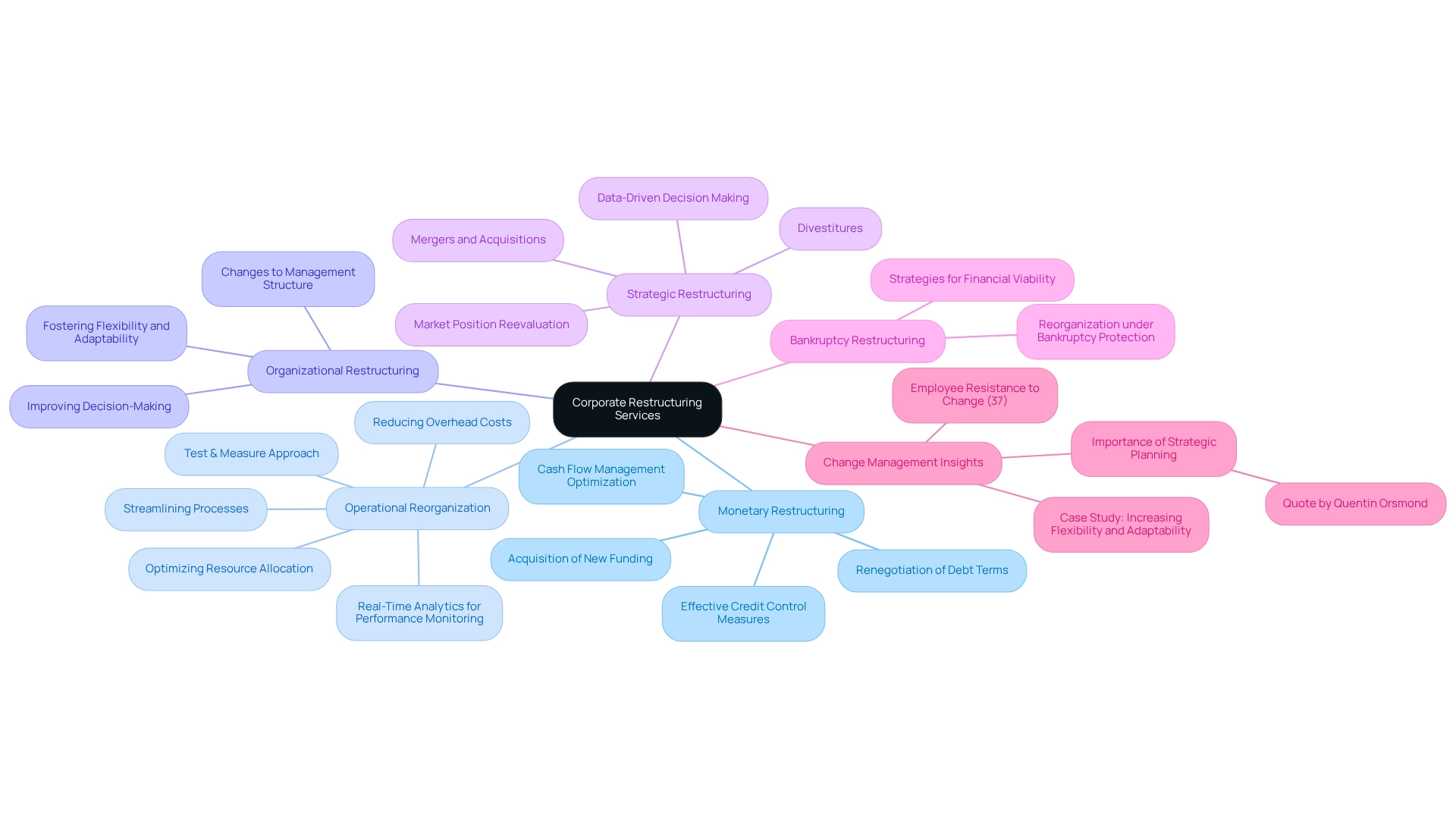

Corporate restructuring services encompass a variety of methods tailored to meet the specific needs of companies. These can be categorized as follows:

- Monetary Restructuring: This strategy focuses on reorganizing a company's financial obligations, potentially involving the renegotiation of debt terms or the acquisition of new funding to improve liquidity. In 2025, companies are increasingly adopting innovative financial adjustment strategies to navigate economic uncertainties, particularly those that emphasize cash preservation and liability reduction. Key strategies include optimizing cash flow management and implementing effective credit control measures to master the cash conversion cycle.

- Operational Reorganization: Aimed at enhancing efficiency, operational reorganization involves streamlining processes, reducing overhead costs, and optimizing resource allocation. This type of reorganization is vital for organizations striving to remain competitive, especially in a rapidly changing market environment. The use of real-time analytics facilitates continuous monitoring of business performance, enabling organizations to make swift decisions and operationalize lessons learned from past experiences. The 'Test & Measure' approach is essential here, as it entails testing hypotheses to ensure maximum return on invested capital.

- Organizational Restructuring: This entails changes to the company's management structure or workforce, thereby improving decision-making and accountability. As organizations adapt to new challenges, fostering a culture of flexibility and adaptability becomes crucial, as evidenced by case studies showcasing enhanced effectiveness during reorganization efforts.

- Strategic Restructuring: This type involves a reevaluation of the company's market position, potentially leading to mergers, acquisitions, or divestitures to align with long-term objectives. Strategic reorganization is increasingly relevant as companies seek to capitalize on emerging opportunities within their industries, guided by data-driven insights that inform decision-making.

- Bankruptcy Restructuring: Specifically designed for companies facing insolvency, this process allows businesses to reorganize under bankruptcy protection, with the aim of emerging as financially viable entities. The importance of having a well-defined strategy for bankruptcy reorganization cannot be overstated, as it is essential for achieving successful outcomes.

In 2025, the landscape of corporate restructuring services is evolving, with a significant emphasis on financial reorganization strategies that prioritize cash preservation and liability reduction. A recent survey revealed that 37% of employees resist change, underscoring the necessity for effective change management practices during organizational adjustments. As Quentin Orsmond, a Change Manager and Prosci Certified Advanced Instructor, articulates, "But, for these changes to be successful, they need a plan or strategy to guide their transformation initiatives." This statement underscores the critical role of strategic planning in managing the complexities of organizational change.

Highlight Key Benefits and Characteristics of Restructuring Services

Numerous key advantages offered by corporate restructuring services are vital for businesses aiming to enhance their economic well-being and operational efficiency.

- Enhanced Economic Stability: By addressing debt issues and optimizing cash flow, organizations can restore their economic health, significantly reducing the risk of insolvency. This proactive approach is crucial, especially during financial distress, where a focused cash management strategy can be the difference between survival and failure. For instance, the case study titled 'A Cash Management Survival Guide' emphasizes that in critical situations, the finance department must prioritize short-term liquidity to ensure the company's survival.

- Enhanced Operational Efficiency: Restructuring facilitates the streamlining of processes and the elimination of redundancies, resulting in reduced operational costs and heightened productivity. This efficiency not only conserves resources but also enables organizations to allocate funds more strategically. By identifying underlying issues and collaboratively planning solutions, organizations can operationalize turnaround lessons that lead to continuous performance monitoring. The 'Test & Measure' approach ensures that every hypothesis is tested to maximize returns on investment.

- Increased Market Competitiveness: Through restructuring, companies can adapt to evolving market conditions, thereby positioning themselves more favorably against competitors. This adaptability is vital in a rapidly changing economic landscape, where agility can lead to significant advantages. Real-time analytics play a crucial role in this process, enabling organizations to make informed decisions that enhance their competitive edge.

- Strategic Focus: Restructuring clarifies organizational goals and aligns resources effectively, enabling businesses to concentrate on their core competencies and explore growth opportunities. As Quentin Orsmond mentions, reorganization 'clarifies the vision, aligns team and individual objectives with the organization's strategic direction, and helps ensure that the entire company works toward the same goals.' This strategic alignment is essential for long-term success and sustainability, allowing for streamlined decision-making that supports ongoing improvement.

- Stakeholder Confidence: Successfully navigating the reorganization process can bolster trust among investors, creditors, and customers. This boosted confidence nurtures long-term relationships and support, which are essential for ongoing viability. Ongoing observation of business performance via real-time analytics can enhance these connections by demonstrating dedication to progress and transparency.

In conclusion, organizations aiming to navigate obstacles and attain sustainable growth, particularly in a context where economic stability is crucial, can benefit significantly from corporate restructuring services. Incorporating relevant statistics on the impact of restructuring on financial stability would further strengthen this overview, illustrating the effectiveness of these services.

Conclusion

Corporate restructuring services are essential for the survival and growth of organizations, particularly small to medium businesses (SMBs) facing economic pressures. By embracing a variety of strategic initiatives—ranging from financial and operational restructuring to organizational changes—companies can effectively navigate complexities and position themselves for sustainable success. The ability to adapt to market fluctuations, regulatory changes, and evolving consumer demands is not just beneficial; it is essential in today’s business landscape.

The benefits of these services are manifold. Improved financial stability leads to lower insolvency risks, while enhanced operational efficiency drives productivity and reduces costs. Moreover, restructuring fosters a strategic focus that aligns resources with core competencies, ultimately increasing competitiveness in the marketplace. As businesses adapt and thrive through these transformative processes, they also build stakeholder confidence, reinforcing the trust necessary for long-term viability.

In conclusion, corporate restructuring is far from a mere reactive measure; it is a proactive and essential strategy for organizations aiming not only to survive but to thrive in an ever-changing economic environment. By investing in comprehensive restructuring services, businesses can overcome immediate challenges and lay a solid foundation for enduring success, ensuring they are well-equipped to face the future with resilience and agility.

Frequently Asked Questions

What are corporate restructuring services?

Corporate restructuring services include strategic initiatives aimed at realigning an organization’s operations, finances, or management frameworks, especially during economic downturns or when enhancing effectiveness and profitability.

What specific initiatives are involved in the reorganization process?

The reorganization process may involve debt modification, operational adjustments, mergers and acquisitions, divestitures, and bankruptcy case management.

Who provides restructuring consulting solutions for small to medium enterprises?

Transform Your Small/Medium Business offers extensive turnaround and reorganization consulting solutions tailored specifically for small to medium enterprises.

What recent trends have been observed regarding corporate restructuring and environmental issues?

More than a third of business leaders recognize the significant impact of environmental issues on their operations, highlighting the need for flexible reorganization strategies that incorporate sustainability.

What factors contribute to the success of corporate transformation initiatives?

Integrated approaches that leverage comprehensive support from skilled experts tend to yield superior outcomes in corporate transformation initiatives.

How do businesses typically engage external vendors during restructuring?

A survey revealed that only a small fraction of businesses engage a single independent external vendor during restructuring, indicating a demand for integrated, all-in-one solutions to address complex challenges efficiently.

Why is corporate restructuring important for economic stability?

Corporate restructuring tackles urgent financial issues and establishes a foundation for sustainable growth, which is vital for maintaining economic stability.

How can a thorough fiscal review benefit a company during restructuring?

A thorough fiscal review can identify opportunities to conserve cash and reduce liabilities, which are essential for stabilizing economic positions and enhancing operations during recovery.

What is the ultimate objective of corporate restructuring services?

The objective of corporate restructuring services is to enhance a company’s financial stability and operational effectiveness, ensuring long-term sustainability and growth.