Introduction

In the realm of financial management, understanding the intricacies of financial assessments is paramount for organizations striving for success. These assessments serve as a critical tool for evaluating an organization's financial health, identifying strengths and weaknesses that can inform strategic decision-making. By analyzing key metrics such as income, expenses, and cash flow patterns, businesses can uncover pivotal insights that drive operational improvements and foster sustainable growth.

As organizations navigate the complexities of their financial landscapes, the implementation of structured assessment processes becomes essential. This article delves into the definition, purpose, and practical applications of financial assessments, while also addressing common challenges and their significant impact on overall business performance. Through a comprehensive exploration of these topics, CFOs will gain valuable strategies to enhance financial management and optimize resource allocation, ultimately leading to improved outcomes across the board.

Understanding Financial Assessments: Definition and Purpose

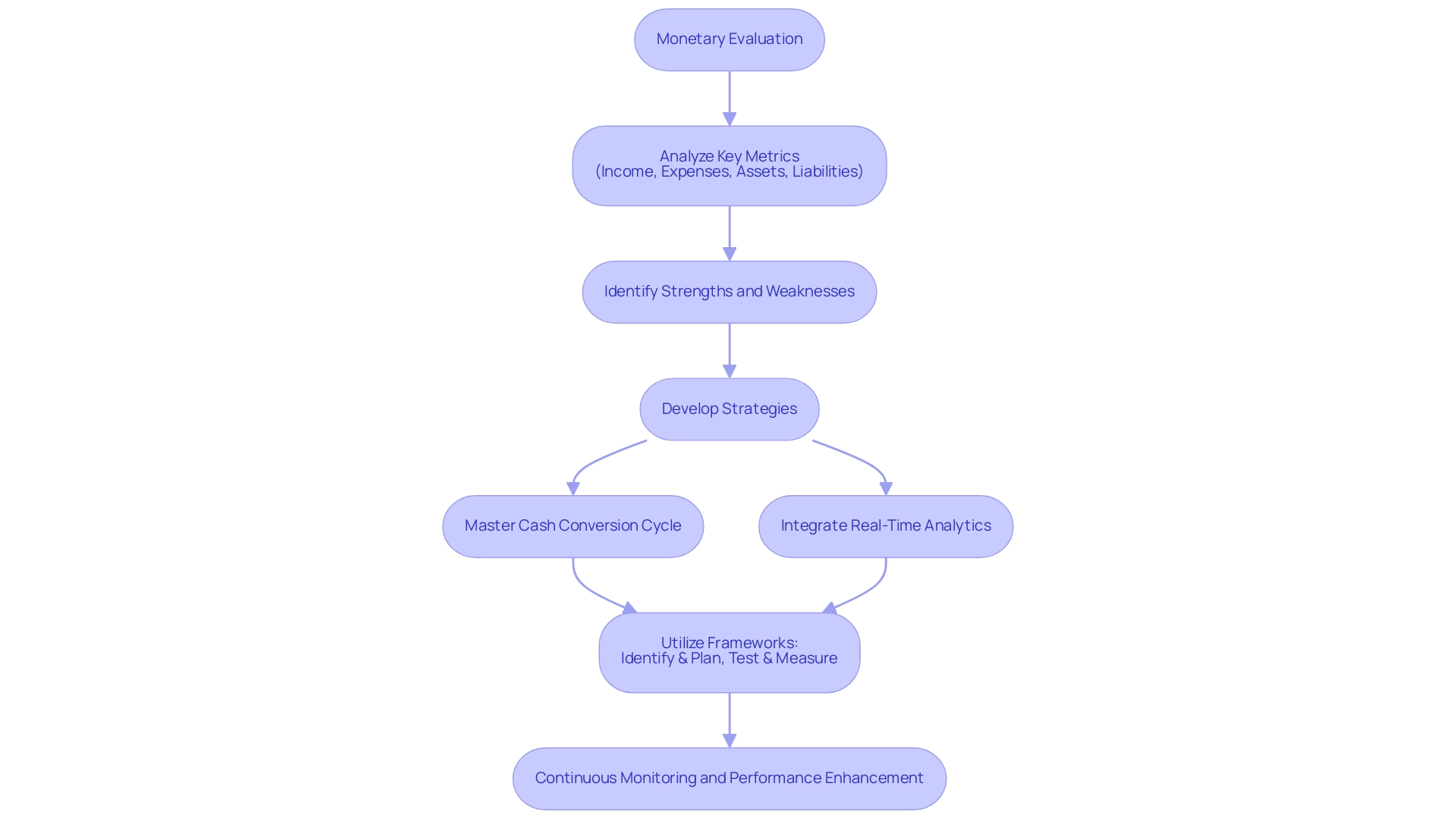

A monetary evaluation is a systematic analysis of an organization's economic health, concentrating on key metrics such as income, expenses, assets, and liabilities. The main goal of a monetary evaluation is to pinpoint strengths and weaknesses in resource management, facilitating informed decision-making. This process often involves analyzing monetary statements, cash flow patterns, and budgetary practices to develop a comprehensive understanding of fiscal performance.

For companies, especially those in trouble, a comprehensive evaluation can uncover essential areas requiring enhancement. By integrating strategies for mastering the cash conversion cycle, including the 20 strategies for optimal organizational performance, and employing real-time analytics, CFOs can guide strategic initiatives that not only restore stability but also drive sustainable growth.

Utilizing frameworks like 'Identify & Plan' and 'Test & Measure' allows for a structured approach to addressing economic challenges. Moreover, leveraging tools such as a client dashboard for real-time business analytics supports continuous monitoring and operationalizing lessons learned, fostering strong relationships and enhancing overall business performance.

Practical Applications of Financial Assessments in Social Services and Personal Finance

Financial evaluations play an instrumental role in both social services and personal finance, enabling improved financial management and strategic resource allocation. In social services, these evaluations are vital for organizations to determine funding needs, optimize resource distribution, and ensure accountability to stakeholders.

For instance, the ChildStat program, inspired by the CompStat initiative utilized in police precincts, showcases how structured evaluations can improve service delivery and emphasize areas for enhancement. As Brenda McGowan, DSW Professor at Fordham University, points out,

- "In reading each of the cases presented here, students are encouraged to consider the range of information available, any interesting or troubling omissions or contradictions in the facts the CPS worker was able to gather, your case evaluation, the subsequent service recommendations you would make, and any glaring deficiencies in the larger service and/or policy environment highlighted by this case."

A nonprofit might carry out a monetary evaluation to identify inefficiencies, ensuring that resources are effectively tailored to meet community needs.

In the field of personal finance, individuals utilize economic evaluations to create budgets, plan for retirement, and manage debt. By thoroughly assessing their income and expenditures, they can make well-informed decisions that enhance their economic well-being and support long-term objectives.

The results of these monetary evaluations can lead to more effective budgeting strategies, improved credit scores, and enhanced savings plans. Ultimately, economic evaluations are essential instruments that lead both organizations and individuals towards sustainable monetary practices, paving the way for improved results and enhanced accountability.

The Process of Conducting a Financial Assessment

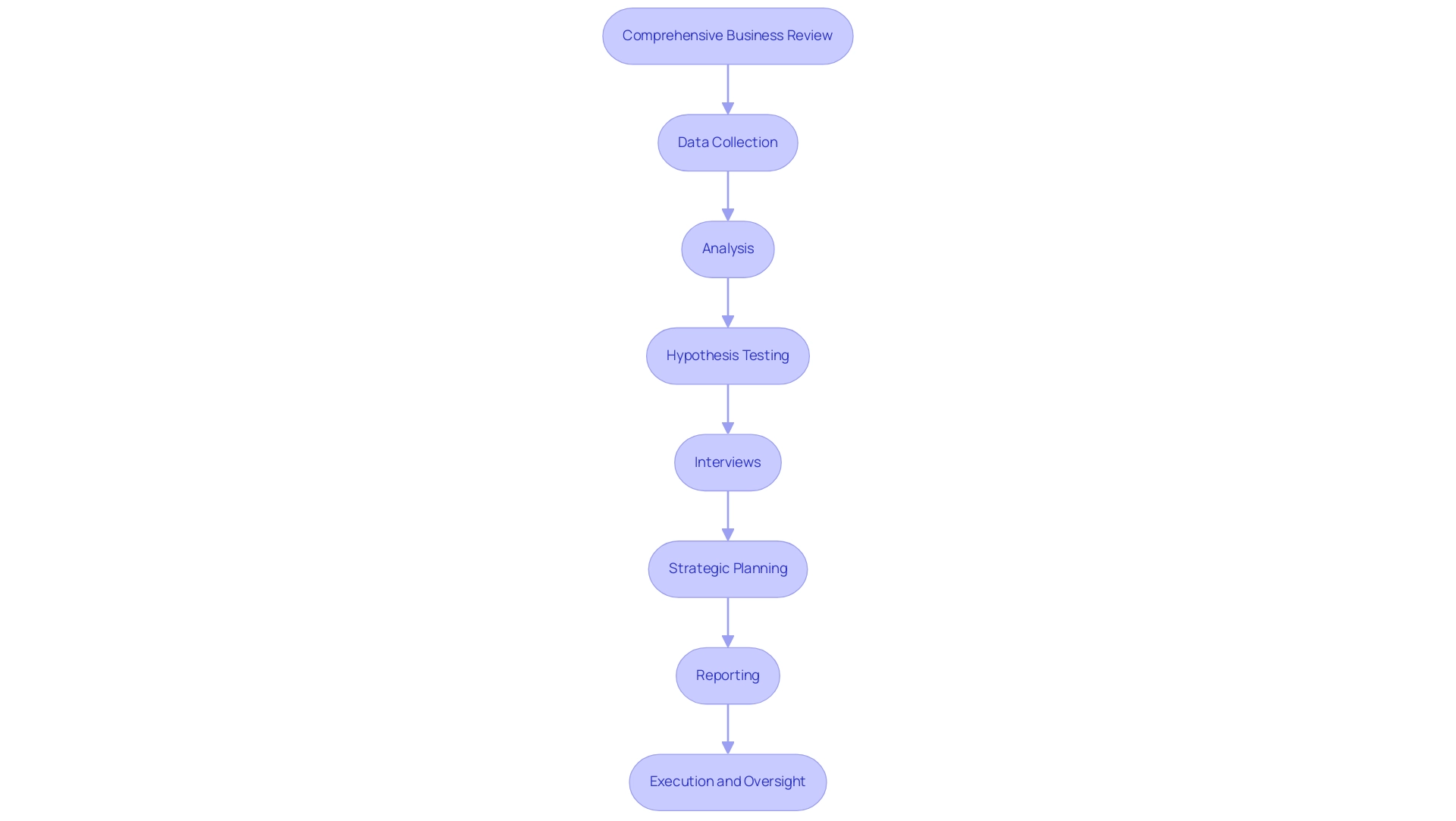

Conducting a monetary assessment typically involves several key steps:

- Comprehensive Business Review: Begin with a thorough review to align key stakeholders and understand the business situation beyond the numbers.

- Data Collection: Gather relevant monetary documents, including income statements, balance sheets, and cash flow statements.

- Analysis: Evaluate the data to identify trends, discrepancies, and areas of concern, utilizing ratio analysis and benchmarking against industry standards, while also considering liquidity and solvency.

- Hypothesis Testing: Adopt a pragmatic approach by testing every hypothesis to ensure maximum return on invested capital.

- Interviews: Engage with stakeholders, such as CFOs and department heads, to gain qualitative insights into operational challenges and monetary practices.

- Strategic Planning: Collaboratively create a plan to address identified issues and reinforce strengths, ensuring alignment with the organization’s strategic goals and supporting a shortened decision-making cycle.

- Reporting: Compile findings into a comprehensive report that highlights key issues, opportunities for improvement, and actionable recommendations.

- Execution and Oversight: Collaborate with management to implement the plan derived from the evaluation results, aided by continuous real-time analytics via client dashboards to consistently track organizational health and adjust strategies as necessary.

This structured method enables businesses to navigate monetary challenges effectively while operationalizing lessons learned for future success.

Common Challenges in Financial Assessments

Several challenges can arise during financial evaluations, including:

- Data Inaccuracy: Incomplete or inaccurate financial records can lead to misleading conclusions. It's essential to ensure that all data is verified and up-to-date to facilitate effective cash preservation and liability reduction.

- Stakeholder Resistance: Employees may be hesitant to share information or may resist changes proposed by the evaluation. Engaging stakeholders early in the process can help mitigate this issue and foster a collaborative environment for improvement.

- Scope Creep: Assessments can expand beyond their intended scope, leading to delays and increased costs. Clearly defining the evaluation's objectives upfront is crucial to maintain focus and efficiency.

- Implementation Difficulties: Even with a robust evaluation, executing recommendations can be challenging. This requires effective change management strategies and ongoing support from leadership.

By proactively tackling these challenges and aligning with customized turnaround and restructuring services, organizations can significantly improve the effectiveness of financial assessments, ultimately leading to better outcomes and preserving organizational value.

Our team utilizes a comprehensive approach, starting with the 'Observe & Evaluate' phase to align key stakeholders and grasp the context of operations. We then 'Identify & Plan' by collaboratively pinpointing underlying issues and developing strategies to address them, ensuring that our efforts are data-driven and focused on maximizing return on invested capital.

The Impact of Financial Assessments on Business Performance

Financial evaluations play a crucial role in enhancing business performance by offering clarity and direction. Organizations that regularly carry out these evaluations are better positioned to identify inefficiencies and implement solutions, leading to cost reductions and enhanced profitability.

For example, a retail chain that conducted an extensive economic evaluation successfully optimized its supply chain operations, achieving a significant 15% decrease in overhead expenses. Moreover, these evaluations aid in strategic planning by aligning monetary goals with operational realities, enabling companies to make informed choices regarding investments and resource distribution.

By integrating streamlined decision-making processes and real-time analytics, organizations can continuously monitor their performance and adapt swiftly to market challenges. The shortened decision-making cycle allows teams to act decisively, while the collaborative approach in creating plans to mitigate weaknesses ensures that all perspectives are considered.

Additionally, utilizing a client dashboard provides real-time business analytics, enabling ongoing diagnosis of business health. Ultimately, companies that leverage effective financial assessments and embrace an iterative approach to testing and executing strategies are more likely to achieve sustainable growth.

Conclusion

Financial assessments are indispensable for organizations aiming to optimize their financial health and drive sustainable growth. By systematically evaluating key metrics such as income, expenses, and cash flow, businesses can identify strengths and weaknesses that inform strategic decision-making. The structured approach to conducting these assessments not only ensures a comprehensive review of financial performance but also fosters collaboration among stakeholders, allowing for the development of actionable plans that align with organizational goals.

Moreover, the practical applications of financial assessments extend beyond mere numbers; they play a crucial role in enhancing accountability and resource allocation in various sectors, including social services and personal finance. By harnessing the power of financial assessments, organizations can not only address immediate challenges but also pave the way for long-term improvements and efficiencies.

Despite the challenges that may arise during the assessment process, such as data inaccuracies and stakeholder resistance, proactive strategies can mitigate these issues. Emphasizing a collaborative environment and clearly defined objectives is vital in overcoming obstacles and ensuring successful implementation of recommendations. Ultimately, organizations that embrace financial assessments can expect to see significant enhancements in their overall business performance, enabling them to adapt swiftly to market dynamics and achieve lasting success.

Frequently Asked Questions

What is a monetary evaluation?

A monetary evaluation is a systematic analysis of an organization's economic health, focusing on key metrics such as income, expenses, assets, and liabilities. Its main goal is to identify strengths and weaknesses in resource management to facilitate informed decision-making.

Why is a monetary evaluation important for companies?

For companies, especially those facing challenges, a comprehensive evaluation can reveal critical areas needing improvement. It helps in mastering the cash conversion cycle, guiding strategic initiatives to restore stability and drive sustainable growth.

What frameworks are used in monetary evaluations?

Frameworks like 'Identify & Plan' and 'Test & Measure' are utilized to address economic challenges systematically. These frameworks support structured approaches to improve resource management and operational performance.

How do financial evaluations benefit social services and personal finance?

In social services, financial evaluations help organizations determine funding needs and optimize resource distribution. In personal finance, individuals use economic evaluations to create budgets, plan for retirement, and manage debt, enhancing their financial well-being.

What are the key steps in conducting a monetary assessment?

The key steps include: 1. Comprehensive Business Review 2. Data Collection 3. Analysis 4. Hypothesis Testing 5. Interviews 6. Strategic Planning 7. Reporting 8. Execution and Oversight.

What challenges can arise during financial evaluations?

Challenges include data inaccuracy, stakeholder resistance, scope creep, and implementation difficulties. Addressing these proactively is crucial for effective financial assessments.

How do financial evaluations enhance business performance?

Financial evaluations provide clarity and direction, helping organizations identify inefficiencies, implement solutions, and align monetary goals with operational realities. This leads to cost reductions, improved profitability, and better strategic planning.

What role does real-time analytics play in financial evaluations?

Real-time analytics supports continuous monitoring of business performance, enabling organizations to adapt quickly to market challenges and ensure that decision-making processes are streamlined and data-driven.