Overview

A financial risk assessment questionnaire serves as a structured tool meticulously crafted to identify and analyze the potential economic risks that a company may encounter. This instrument not only enhances hazard management strategies but also plays a pivotal role in fostering organizational resilience.

By detailing its significance, the article illustrates how such questionnaires empower organizations to recognize vulnerabilities, comply with regulatory requirements, and refine decision-making processes. Ultimately, this leads to sustainable growth and resilience in an increasingly complex business landscape.

Consequently, adopting a financial risk assessment questionnaire is not merely beneficial; it is essential for organizations aiming to thrive amid uncertainty.

Introduction

In the dynamic landscape of modern finance, organizations are increasingly turning to financial risk assessment questionnaires as essential tools for navigating potential vulnerabilities. These structured instruments not only help in identifying and evaluating risks but also play a pivotal role in shaping strategic decisions that drive long-term growth.

As the complexities of regulatory compliance and market fluctuations intensify, the importance of these assessments has never been more pronounced. With a growing emphasis on proactive risk management, businesses are discovering that a comprehensive understanding of their financial health is crucial for resilience in an unpredictable environment.

This article delves into the intricacies of financial risk assessment questionnaires, exploring their key components, the types of risks they address, and the benefits they bring to organizations striving for sustainable success.

Defining Financial Risk Assessment Questionnaires

A financial risk assessment questionnaire serves as an essential organized instrument for recognizing and analyzing the potential economic dangers a company may face. Generally comprising a set of focused inquiries, these surveys delve into the economic stability of a business, its operational practices, and its vulnerability to various threat factors. By systematically gathering and examining this data, companies can effectively identify weaknesses and formulate strategies to mitigate hazards.

In 2025, the use of financial risk assessment questionnaires has become increasingly prevalent, with a significant percentage of enterprises utilizing these tools to enhance their hazard management frameworks. Recent trends reveal that 35% of executives prioritize adherence to regulatory challenges, underscoring the necessity for robust evaluation processes. As noted by Secureframe, this statistic highlights the critical emphasis on compliance, particularly relevant for CFOs and financial leaders tasked with ensuring their companies are well-equipped to navigate potential monetary challenges.

The importance of the financial risk assessment questionnaire cannot be overstated; it not only facilitates a comprehensive understanding of a company's exposure landscape but also empowers CFOs to make informed decisions that foster sustainable growth. Successful application of monetary vulnerability evaluation instruments has been observed in numerous small enterprises, where they have contributed to enhanced resilience and operational effectiveness. For instance, entities that have integrated these surveys into their management strategies report improved preparedness for economic uncertainties.

A pertinent case study involves Protiviti, which aids technology leaders in managing conflicting priorities regarding cybersecurity, showcasing how effective evaluation tools can bolster a company's resilience.

Expert insights affirm that the financial risk assessment questionnaire is crucial for promoting a proactive approach to managing uncertainties. By leveraging these resources, companies can more effectively align their monetary strategies with their overarching business objectives, ultimately resulting in more efficient threat management and enduring success. Furthermore, as workforce expectations for remote or hybrid work evolve, CFOs must adapt their management strategies to address these emerging challenges, further emphasizing the significance of monetary evaluation questionnaires in today's dynamic business landscape.

The Importance of Financial Risk Assessments in Business Strategy

Financial evaluations are essential for companies, offering critical insights into potential vulnerabilities that could jeopardize financial stability. For CFOs, these evaluations go beyond mere compliance; they form the backbone of effective strategic planning and resource allocation. By identifying threats early, organizations can implement proactive measures to mitigate them, thus ensuring long-term sustainability and growth.

Moreover, regular evaluations empower businesses to adapt to evolving market conditions and regulatory landscapes, enhancing their resilience against unforeseen challenges.

In 2025, as 67% of global executives express concerns about the complexity of ESG regulations, the need for a financial risk assessment questionnaire becomes increasingly clear. These evaluations not only guide CFO decision-making but also significantly influence strategic planning, enabling companies to navigate the complexities of today’s business environment with agility. Transform Your Small/Medium Business facilitates a streamlined decision-making process during the turnaround phase, empowering your team to take decisive action to safeguard your business.

For instance, a recent case study revealed that 52% of cybersecurity professionals reported a rise in attacks compared to the previous year, underscoring the growing threat landscape organizations must traverse. Firms that have implemented robust financial evaluations in response to such threats have reported enhanced strategic planning processes, leading to improved resource management and operational efficiency. Our team utilizes a range of methodologies, including scenario analysis and stress testing, to deliver comprehensive evaluations.

We consistently track the effectiveness of our strategies through a client dashboard that provides real-time business analytics, facilitating ongoing performance monitoring and relationship-building.

As Heather Kane, Broking Leader at WTW, remarked, "Organizations that remain vigilant and flexible will be better positioned to seize opportunities and maintain stability amid uncertainty." Ultimately, financial evaluations are not merely tools for compliance; they are integral components of a comprehensive business strategy aimed at fostering long-term success.

Key Components of a Financial Risk Assessment Questionnaire

A well-structured financial risk assessment questionnaire encompasses several critical components that provide a holistic view of an organization's financial health:

- Financial Health Metrics: This section includes inquiries about cash flow, profitability, and liquidity ratios, which are essential for assessing the entity's financial stability. These metrics serve as indicators of the company's ability to meet its short-term obligations and sustain operations, particularly in a landscape where real-time analytics inform timely decision-making.

- Operational Risks: Questions in this category focus on operational processes, supply chain dependencies, and workforce management. By recognizing potential interruptions in these areas, entities can proactively reduce threats that may impact their overall performance. Streamlined decision-making processes enhance responsiveness during critical turnaround phases.

- Market Risks: This component assesses exposure to market fluctuations, including interest rates, currency exchange rates, and commodity prices. Understanding these dangers is essential, especially in an environment where 35% of compliance leaders identify adherence and regulatory challenges as their primary concern, emphasizing the interrelation of market dynamics and regulatory pressures. Continuous monitoring through real-time analytics, enabled by our client dashboard, assists entities in adapting effectively to these changes.

- Regulatory Compliance: Assessing conformity to financial regulations and standards is vital, as non-compliance can significantly influence a company's vulnerability. With only 33% of leaders in charge of uncertainties planning to increase overall spending in the next 12 months, ensuring compliance becomes even more critical in resource-constrained environments. As Angie Peterson, CHRO, noted, "I felt we could completely trust your guidance as you’d really taken the time to understand us and our needs, at a very detailed level. Your insights and recommendations were so spot on..."

- Credit Risks: This section entails evaluating the entity's creditworthiness and the probability of default on obligations. By comprehending credit challenges, businesses can improve their monetary relationships and responsibilities, ultimately boosting cash flow and profitability.

By addressing these essential elements through a financial risk assessment questionnaire, entities cultivate a thorough comprehension of their economic uncertainty environment. This understanding allows them to make knowledgeable choices that enhance their durability and sustainability while implementing lessons learned from recovery experiences. The integration of a shortened decision-making cycle throughout this process allows for decisive actions that preserve business health.

Types of Financial Risks Addressed in Assessments

Monetary vulnerability evaluations, such as a financial risk assessment questionnaire, are essential for entities to recognize and handle various threats that can impact their economic well-being. The primary categories of financial risks typically addressed in these assessments include:

- Market Risk: This refers to the potential for losses due to fluctuations in market prices or interest rates. As market conditions change, businesses must adjust their strategies to mitigate potential losses. In 2025, a substantial proportion of organizations are prioritizing market uncertainty in their evaluations, reflecting a rising awareness of its influence on economic stability.

- Credit Exposure: This situation arises when a borrower fails to meet their repayment obligations. Efficient credit management is crucial for maintaining economic stability, particularly in unpredictable economic conditions.

- Liquidity Exposure: Organizations face liquidity exposure when they cannot meet short-term financial obligations due to an imbalance between their liquid assets and liabilities. This threat can lead to severe operational challenges if not properly managed.

- Operational Threat: This encompasses dangers arising from internal processes, human factors, and systems, along with external events. Notably, 35% of business and tech leaders recognize third-party breaches as a significant cyber threat, emphasizing the necessity of thorough assessments. Organizations must establish robust operational controls to mitigate these threats. The case study titled "Impact of AI and Automation on Data Breach Management" illustrates that entities leveraging AI and automation extensively reported $1.88 million lower data breach costs and identified breaches nearly 100 days faster on average compared to those that did not utilize these technologies.

- Legal and Compliance Risk: Financial losses can result from legal actions or failure to comply with regulations. In this context, 67% of global executives find ESG regulation overly complex, with 70% seeking more guidance from regulators. Organizations must remain informed about regulatory changes to effectively reduce this threat.

Understanding these threats is essential for companies to formulate targeted approaches for alleviation, which can be outlined in a financial risk assessment questionnaire. Specialist viewpoints emphasize that entities utilizing advanced technologies in their management processes report significant advantages. By addressing these various monetary challenges, organizations can not only protect their assets but also prepare for sustainable growth in an increasingly intricate economic environment.

Moreover, 33% of leaders in management intend to increase expenditures in the upcoming 12 months, as per the PwC Pulse Survey, suggesting a proactive strategy towards managing monetary uncertainties.

How to Create and Implement a Financial Risk Assessment Questionnaire

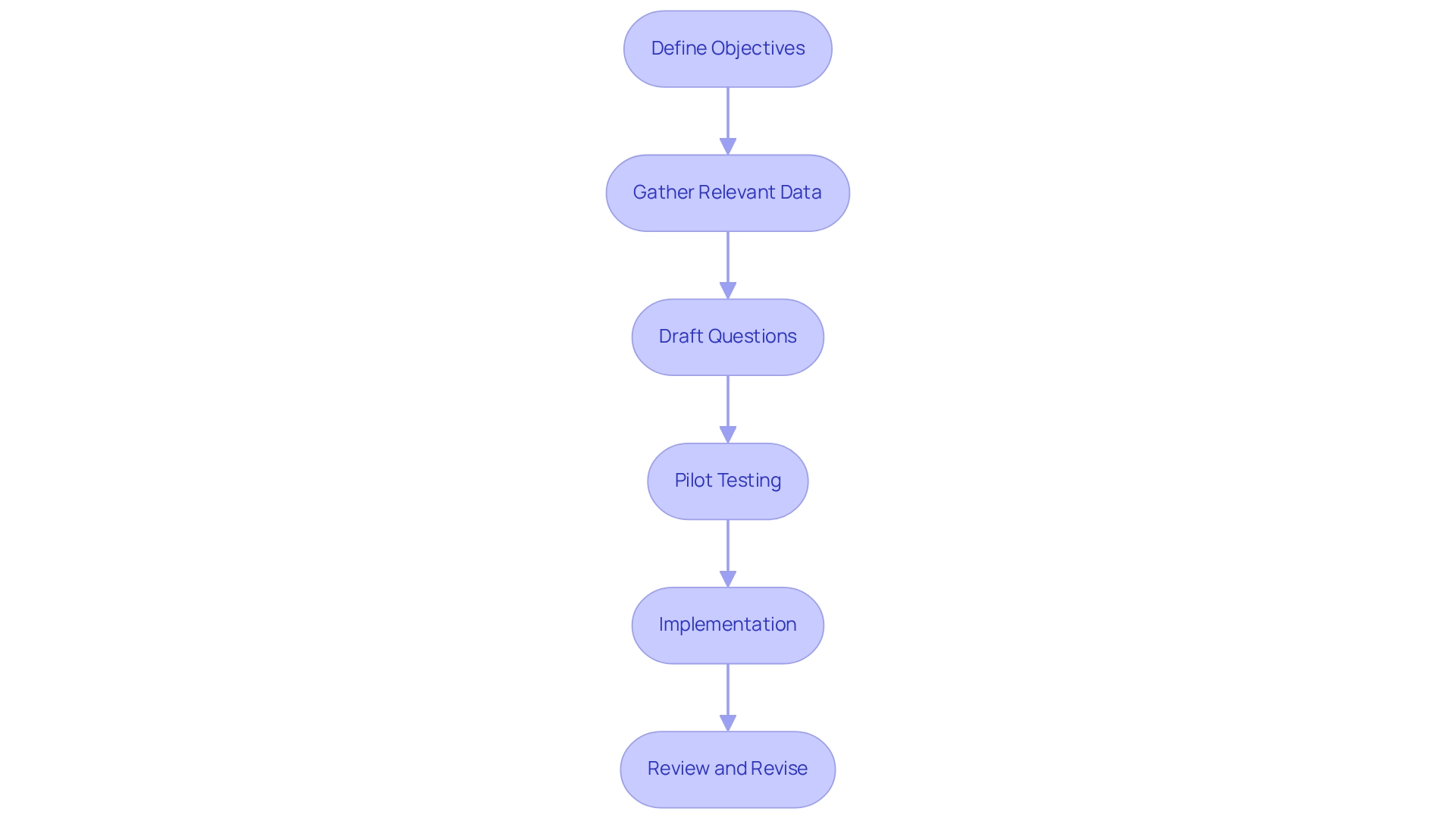

Developing and executing a monetary threat evaluation questionnaire is an essential procedure that encompasses several important stages:

- Define Objectives: Begin by clearly outlining the purpose of the assessment. Identify the specific monetary risks that need evaluation, such as credit risk, market risk, and operational risk. This foundational step ensures that the questionnaire aligns with the organization's strategic goals.

- Gather Relevant Data: Collect historical monetary data, operational metrics, and market analysis. This information is crucial for guiding the questionnaire and aids in comprehending the context of the threats being evaluated. Utilizing data analytics can enhance the accuracy of the insights derived from this step.

- Draft Questions: Create inquiries that thoroughly address all essential elements of monetary risk. Ensure that the questions are clear, concise, and tailored to elicit actionable responses. Incorporating a mix of quantitative and qualitative questions can provide a well-rounded view of the financial landscape.

- Pilot Testing: Conduct a pilot test of the questionnaire with a small, representative group within the organization. This step is crucial for identifying any issues or areas for improvement, allowing for adjustments before a full rollout. Feedback from this phase can significantly enhance the effectiveness of the final questionnaire.

- Implementation: Roll out the questionnaire organization-wide, ensuring that all relevant stakeholders are engaged in the process. Effective communication regarding the purpose and significance of the evaluation can encourage involvement and support from all tiers of the organization.

- Review and Revise: Regularly assess the questionnaire to ensure it remains pertinent and efficient in tackling new challenges. This iterative process is essential, as economic environments can shift quickly, requiring updates to the evaluation tools utilized. By adhering to these steps, organizations can develop a comprehensive economic vulnerability questionnaire that not only detects potential threats but also facilitates informed decision-making and strategic planning. Implementing best practices, such as regularly updating the questionnaire and involving cross-functional teams in its development, can further enhance its effectiveness.

The significance of monetary vulnerability evaluations is underscored by the statistic that system catastrophic failure occurs once every decade (ARO = 0.1), showcasing the potential for substantial losses if threats are not sufficiently evaluated. Moreover, conveying uncertainty values in monetary terms renders the outcomes of these evaluations practical and relatable for CFOs, enabling improved economic decision-making. Additionally, citing optimal methods for supplier monetary uncertainty management illustrates how organizations can efficiently implement monetary evaluations. By consistently examining service level agreements and developing monetary health surveys, companies can maintain a current awareness of supplier economic conditions, thus minimizing the chance of operational disruptions caused by supplier economic instability. Ultimately, these actions not only align with the company's goal of assisting businesses in overcoming obstacles and attaining sustainable development but also reinforce the importance of organized monetary evaluations in fostering economic stability and growth.

Benefits of Regular Financial Risk Assessments for Organizations

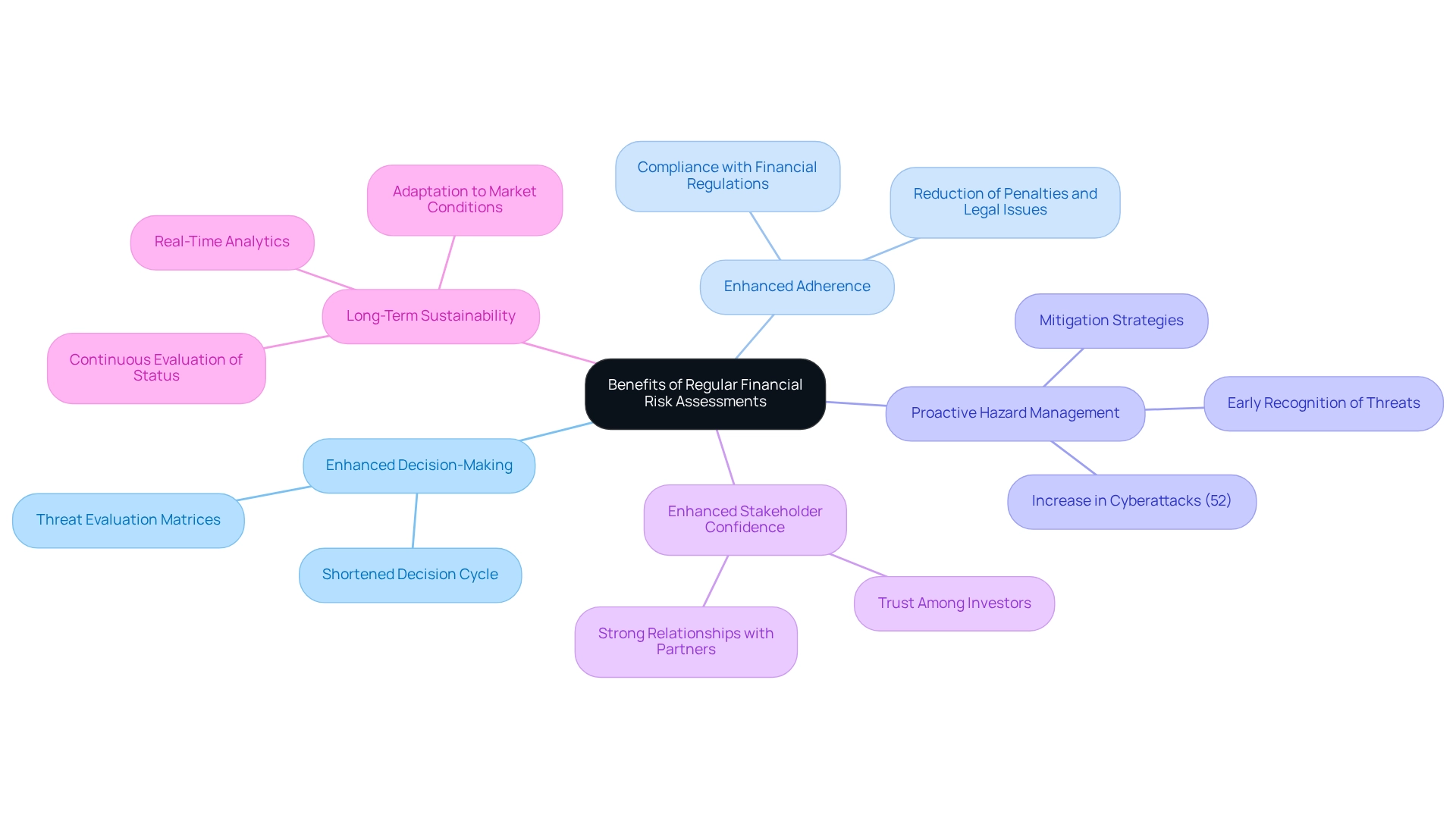

Frequent monetary evaluations provide numerous benefits for entities, significantly influencing their overall performance and strategic direction.

Enhanced Decision-Making: A comprehensive understanding of a company's risk profile, obtained through the financial risk assessment questionnaire, empowers leaders to make informed decisions that align with their strategic objectives. This clarity is crucial in navigating complex financial landscapes. By endorsing a shortened decision-making cycle, entities can take decisive actions that preserve their business during challenging times. Employing instruments such as threat evaluation matrices can further improve the analysis of dangers and enhance decision-making.

Enhanced Adherence: Regular evaluations guarantee that entities comply with financial regulations, thus reducing the likelihood of facing penalties and legal issues. This proactive approach to compliance is essential in today’s regulatory environment.

Proactive Hazard Management: Early recognition of possible threats allows entities to execute effective mitigation strategies before problems escalate. For instance, the increase in cyberattacks—reported by 52% of surveyed cybersecurity professionals—highlights the growing threat landscape and the need for enhanced cybersecurity measures. This foresight not only protects assets but also preserves organizational integrity.

Enhanced Stakeholder Confidence: A proven dedication to strong management practices cultivates trust among investors, customers, and partners. This confidence is vital for maintaining strong relationships and securing future investments.

Long-Term Sustainability: By consistently overseeing and handling economic uncertainties through real-time analytics, entities can attain enhanced stability and promote sustainable development over time. This ongoing vigilance, supported by a financial risk assessment questionnaire, is key to adapting to changing market conditions and ensuring resilience. The application of client dashboards for real-time business analytics enables organizations to continuously evaluate their status and modify strategies as required.

In 2025, the advantages of regular monetary threat evaluations are more evident than ever, with 33% of threat leaders planning to increase their expenditure on management initiatives, 57% sustaining current budgets, and 8% aiming to decrease spending, according to the PwC Pulse Survey. This trend highlights the increasing acknowledgment of the significance of monetary evaluations in improving organizational decision-making and overall performance. Moreover, while 86% of healthcare providers think data analytics can greatly enhance patient care, this demonstrates the wider relevance of evaluation instruments across different industries, including finance.

As entities encounter a progressively intricate threat environment, the execution of organized monetary evaluations becomes not merely advantageous but crucial for ongoing achievement.

Challenges in Financial Risk Assessment and How to Overcome Them

Carrying out financial evaluations presents significant challenges that organizations must navigate effectively:

Data Availability: Accessing accurate and comprehensive data often proves to be a major obstacle. In 2025, many organizations reported difficulties in obtaining the essential information needed for thorough evaluations, resulting in incomplete reviews and flawed strategies.

Stakeholder Opposition: Resistance from stakeholders can hinder the evaluation process. Some may question the value of these evaluations, fearing disruption to established practices. Engaging stakeholders from the beginning and demonstrating the benefits of evaluations can help mitigate this opposition.

Complexity of Threats: The economic landscape is ever-evolving, with new challenges emerging from factors such as fluctuating interest rates and global instability. This complexity complicates the development of effective evaluation tools that can adapt to changing conditions. Notably, 35% of risk executives cite compliance and regulatory risk as their primary concern, highlighting the necessity of addressing these issues in the financial risk assessment questionnaire.

Resource Limitations: Limited resources often impede organizations' ability to conduct comprehensive evaluations. Many small and medium-sized enterprises struggle to implement advanced compliance tools, widening the gap between them and larger entities. This issue is particularly relevant as instability heightens loan default rates, especially in vulnerable regions.

To address these challenges, organizations can adopt several strategies:

- Invest in Data Management Systems: Improving data accessibility through robust data management systems can significantly enhance the quality of assessments.

- Engage Stakeholders Early: Cultivating buy-in from stakeholders at the outset fosters a collaborative environment and encourages acceptance of necessary changes.

- Simplify the Assessment Process: Concentrating on key challenges rather than attempting to tackle every potential issue can streamline the assessment process, making it more manageable.

- Allocate Dedicated Resources: Committing specific resources to management initiatives ensures that assessments are thorough and effective.

Case studies exemplify these strategies in action. For instance, financial institutions facing economic uncertainties in 2025 have successfully employed stress testing and scenario analysis to navigate volatility. By diversifying income sources and proactively addressing uncertainties, these organizations have adapted to the challenges posed by the current economic climate.

This proactive approach is vital as organizations prioritize the management of uncertainties, with 33% of industry leaders planning to increase expenditures according to the PwC Pulse Survey.

In conclusion, while challenges in financial evaluations are prevalent, organizations can implement targeted strategies to enhance their evaluation processes and ultimately achieve superior outcomes.

Leveraging Technology in Financial Risk Assessments

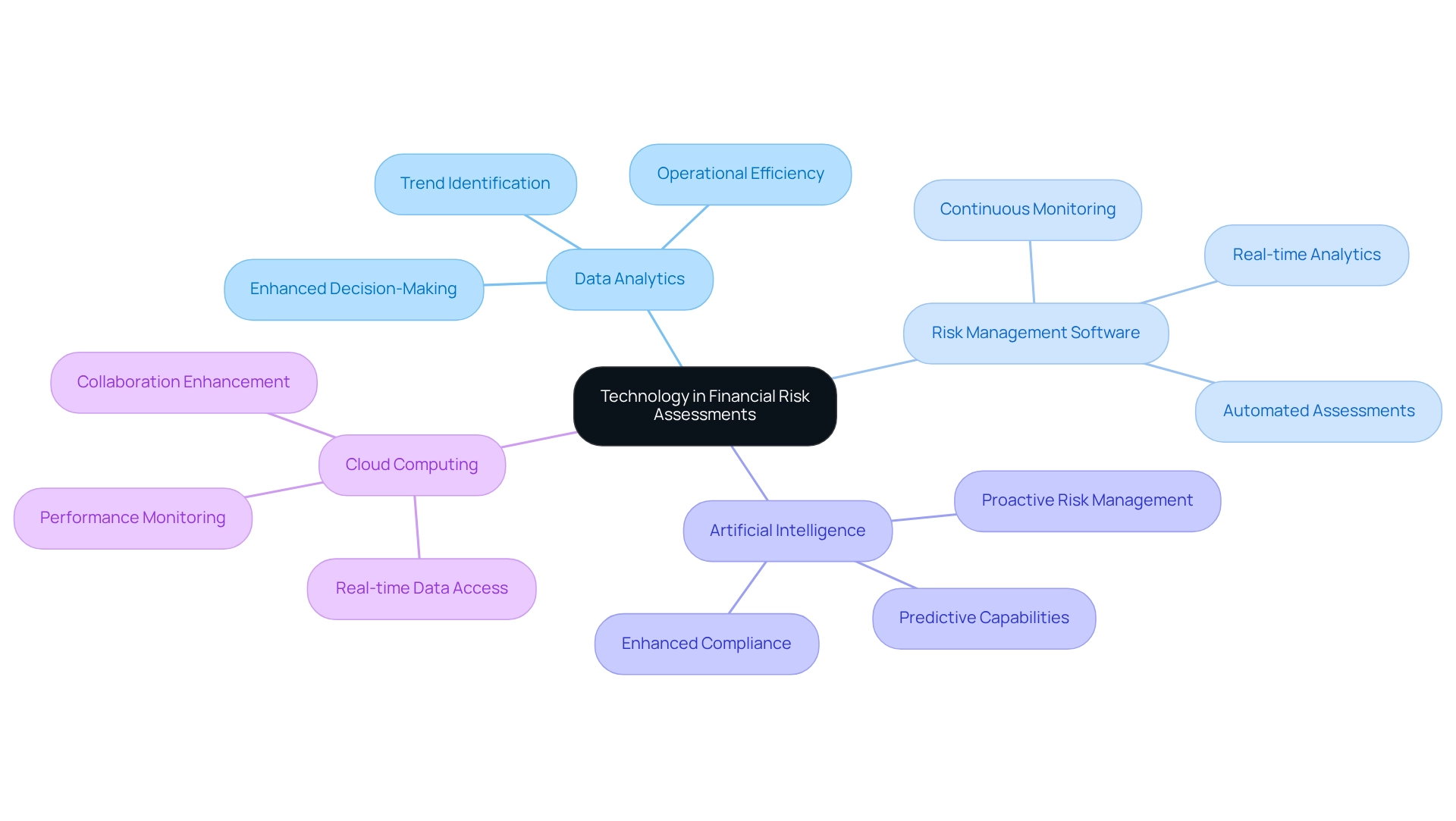

Technology plays a pivotal role in enhancing financial evaluations, particularly through the implementation of a financial risk assessment questionnaire that streamlines data gathering, analysis, and reporting. The following key technologies are instrumental in this process:

- Data Analytics: Advanced analytics tools adeptly manage large volumes of information, enabling entities to identify trends and potential issues with remarkable accuracy. The precision of models such as XG boost has been shown to range from 91% to 96%, underscoring the effectiveness of data-driven methodologies in assessing potential challenges. Additionally, Transform Your Small/Medium Business facilitates a reduced decision-making cycle throughout the turnaround process, empowering your entity to act decisively based on these insights.

- Risk Management Software: Specialized software automates the assessment process, simplifying the tracking and management of threats over time. This automation not only enhances efficiency but also ensures that entities can respond swiftly to emerging risks. Continuous monitoring via client dashboards provides real-time business analytics, allowing for ongoing evaluations of business health and performance. Our team consistently monitors the success of our strategies and teams through this dashboard, enabling timely updates and adjustments.

- Artificial Intelligence: AI significantly improves predictive capabilities, allowing entities to foresee risks before they materialize. This proactive stance is vital in today’s fast-paced financial environment, where timely decision-making can mitigate potential losses. As noted by Rob Gutierrez, nearly three-fourths (75%) of executives anticipate substantial changes in their organization’s approach to business continuity planning and crisis management, emphasizing the crucial role of technology in this transformation.

- Cloud Computing: Cloud-based solutions enhance collaboration and data sharing among stakeholders, which is essential for a comprehensive evaluation process. By facilitating real-time access to information, these solutions improve the overall effectiveness of assessments and foster relationship-building through ongoing performance monitoring.

The integration of these technologies not only boosts the precision and effectiveness of financial evaluations but also empowers businesses to make informed decisions through a financial risk assessment questionnaire that fosters sustainable growth. For instance, organizations that have successfully leveraged data analytics for financial management have reported enhanced compliance and operational efficiency, illustrating the tangible benefits of adopting these advanced tools. Furthermore, simulation findings indicate that the proposed model effectively navigates investment allocation and uncertainties, reinforcing the argument for the efficacy of these technologies.

Additionally, the case study titled 'Maximizing Success with AI Use Assessment and Strategic Vendor Selection' showcases real-world applications of AI in managing uncertainties, underlining its impact on compliance and operational optimization. As we progress into 2025, the role of technology in the financial risk assessment questionnaire is set to evolve further, shaping the future of risk management strategies.

Conclusion

Understanding and implementing financial risk assessment questionnaires is crucial for organizations aiming to navigate the complexities of today's financial landscape. These structured tools not only help identify and evaluate potential financial vulnerabilities but also enable strategic decision-making that aligns with long-term growth objectives. By focusing on key components—such as financial health metrics, operational risks, market fluctuations, regulatory compliance, and credit risks—organizations can gain a comprehensive view of their risk profile.

The benefits of regular financial risk assessments are substantial. They enhance decision-making, improve compliance, foster proactive risk management, and increase stakeholder confidence. As organizations face an increasingly intricate risk environment, the adoption of advanced technologies—such as data analytics, risk management software, artificial intelligence, and cloud computing—will further improve the effectiveness of these assessments. These technologies streamline processes, enhance accuracy, and empower organizations to make informed decisions that drive sustainable growth.

While challenges in conducting financial risk assessments exist, such as data availability and stakeholder resistance, targeted strategies can mitigate these obstacles. Investing in robust data management and engaging stakeholders early can significantly enhance the assessment process.

Ultimately, financial risk assessment questionnaires are not merely compliance tools; they are integral to a comprehensive business strategy that promotes resilience and long-term success. As organizations continue to adapt to evolving market conditions, embracing these assessments will be vital in ensuring stability and fostering sustainable growth in an unpredictable financial environment.

Frequently Asked Questions

What is a financial risk assessment questionnaire?

A financial risk assessment questionnaire is an organized tool used to identify and analyze potential economic risks that a company may face. It consists of focused inquiries that explore the financial stability, operational practices, and vulnerabilities of a business.

Why are financial risk assessment questionnaires important for companies?

These questionnaires help companies understand their exposure to financial risks and empower CFOs to make informed decisions that support sustainable growth. They also facilitate the identification of weaknesses and the formulation of strategies to mitigate hazards.

How prevalent are financial risk assessment questionnaires in 2025?

In 2025, the use of financial risk assessment questionnaires has become increasingly common, with a significant percentage of enterprises employing these tools to improve their risk management frameworks.

What trends are observed regarding executives' concerns in 2025?

A notable trend is that 35% of executives prioritize adherence to regulatory challenges, highlighting the necessity for strong evaluation processes, particularly for CFOs and financial leaders.

How do financial risk assessment questionnaires contribute to small businesses?

Many small enterprises that have integrated financial risk assessment questionnaires into their management strategies report enhanced resilience and operational effectiveness, leading to improved preparedness for economic uncertainties.

Can you provide an example of a company that utilizes financial risk assessment questionnaires?

Protiviti is an example of a company that assists technology leaders in managing conflicting priorities regarding cybersecurity, demonstrating how effective evaluation tools can strengthen a company's resilience.

How do financial evaluations benefit CFOs beyond compliance?

Financial evaluations are essential for strategic planning and resource allocation. They help identify threats early, allowing organizations to implement proactive measures that ensure long-term sustainability and growth.

What challenges do companies face regarding ESG regulations in 2025?

In 2025, 67% of global executives express concerns about the complexity of ESG regulations, emphasizing the importance of financial risk assessment questionnaires in guiding CFO decision-making and strategic planning.

What methodologies are used in financial evaluations?

Various methodologies, including scenario analysis and stress testing, are employed to deliver comprehensive financial evaluations, which help organizations enhance their strategic planning processes and resource management.

What is the overall significance of financial evaluations in business strategy?

Financial evaluations are integral components of a comprehensive business strategy aimed at fostering long-term success. They enable organizations to remain vigilant and flexible, positioning them better to seize opportunities and maintain stability amid uncertainty.