Overview

A financial risk assessment report is a vital document that identifies, evaluates, and prioritizes potential threats to an organization's financial stability, while offering strategic recommendations for risk mitigation. The article emphasizes its importance by detailing how such reports enable informed decision-making and enhance resilience, particularly in a rapidly changing economic landscape, as demonstrated by the integration of advanced technologies and continuous monitoring practices.

Introduction

In a world where financial landscapes are increasingly volatile, the ability to effectively assess and manage financial risks is paramount for organizations aiming to sustain growth and stability. Financial risk assessment reports stand as essential tools, meticulously evaluating potential threats that could undermine an organization’s financial health. By systematically identifying and analyzing risks—from market fluctuations to compliance challenges—these reports empower leaders to make informed decisions that safeguard assets and enhance operational resilience.

As the business environment evolves, the integration of advanced methodologies and real-time analytics in risk assessments not only streamlines decision-making but also aligns strategies with long-term objectives. With a significant number of executives recognizing the urgent need for robust financial risk management, the insights derived from these assessments are more crucial than ever for navigating uncertainty and ensuring organizational success.

Defining Financial Risk Assessment Reports

A financial risk assessment report is a crucial document that carefully examines the array of potential threats to an organization's economic stability. This thorough examination entails a systematic investigation of essential economic elements such as market volatility, credit uncertainties, operational challenges, and regulatory compliance. The main goal of the financial risk assessment report is to identify vulnerabilities and suggest strong strategies for mitigation.

As Zheng mentions, 'Not only derived the main component scores of enterprise monetary uncertainty through principal component analysis but also suggested a related monetary uncertainty evaluation model.' By doing so, entities are enabled to make informed monetary decisions and protect their assets against unpredictable challenges. As emphasized by recent trends, 75% of executives anticipate significant changes in their company's approach to business continuity planning and crisis management, highlighting the importance of effective monetary evaluation.

Furthermore, our approach emphasizes streamlined decision-making through a shortened cycle, allowing your team to take decisive action during the turnaround process. The integration of advanced technologies like AI and machine learning allows organizations to handle large volumes of unstructured data, adjusting to changing threat patterns that conventional methods might neglect. This proactive strategy not only improves the precision of the financial risk assessment report but also greatly influences overall organizational performance, making these reports essential in today's dynamic business landscape.

Continuous monitoring through client dashboards provides real-time analytics, facilitating relationship-building and operationalizing lessons learned during turnarounds. This continuous evaluation permits prompt updates and modifications to strategies based on performance metrics. For instance, a recent case study titled 'Benchmarking Revenue Performance Against Industry Averages' revealed that despite negative growth in C2, it achieved better revenue compared to other companies, while C3 showed better growth but lacked in revenue compared to C2 and C5.

Furthermore, the proportion of fiscal spending on urban and rural residence insurance to GDP was 1.27% in 2020, projected to surpass 2% in 2050, emphasizing the wider economic context and its consequences for evaluation strategies.

The Importance of Conducting Financial Risk Assessments

Carrying out monetary threat evaluations is crucial for entities aiming to maneuver through intricacy and unpredictability in the current corporate landscape. These evaluations provide a systematic structure for recognizing and alleviating potential economic risks, which are essential components of a financial risk assessment report, thus guiding strategic planning and improving decision-making processes. With 75% of executives believing there will be significant changes in their company's approach to business continuity planning and crisis management, it is evident that monetary uncertainties are becoming increasingly intertwined with operational viability and workforce stability.

Moreover, with 61% of leaders admitting that attracting and retaining talent will be a significant threat by 2034, entities must understand that effective financial evaluations can enhance resilience and strategic planning in response to these challenges. Our team supports a streamlined decision-making cycle throughout the turnaround process, allowing your entity to take decisive action based on real-time analytics. This cycle is designed to reduce delays in decision-making, enabling quicker responses to emerging challenges.

We continually monitor the success of our plans through a client dashboard that provides real-time business metrics, facilitating effective diagnosis of your business health. This dashboard not only enhances transparency but also empowers stakeholders with actionable insights. This approach fosters compliance with regulatory requirements and ensures that resources are allocated efficiently to protect assets and maintain stakeholder confidence.

In a climate marked by rapid change and economic volatility, a financial risk assessment report can significantly influence a company's ability to thrive by supporting the proactive identification of risks through robust testing programs. This comprehensive method to managing uncertainties demonstrates the vital significance of conducting a financial risk assessment report as a foundation for sustainable organizational success.

Key Components of a Financial Risk Assessment Report

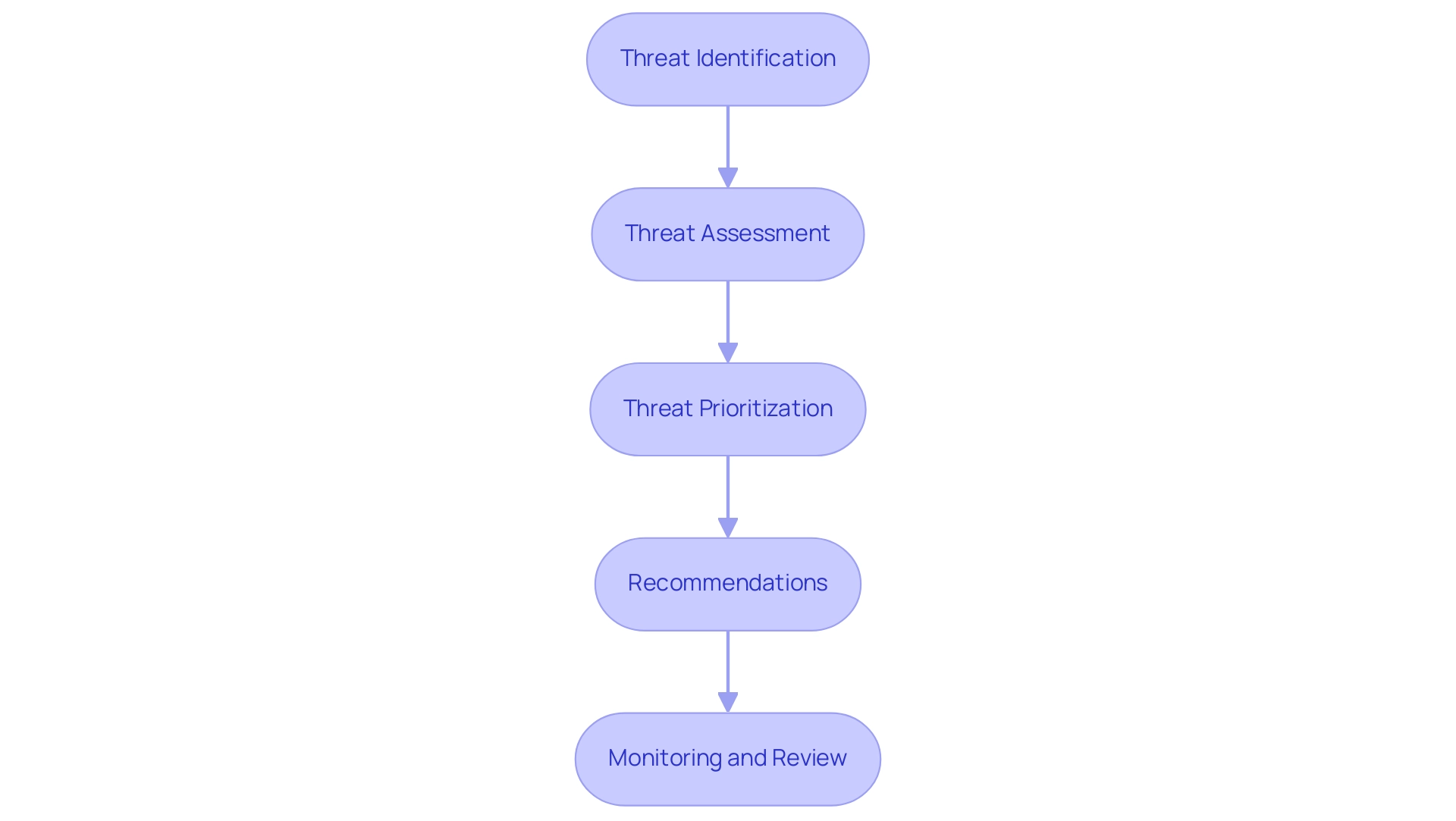

A thorough financial threat evaluation report includes several essential elements aimed at systematically tackling potential dangers to a company's financial well-being:

- Threat Identification: This foundational step involves recognizing various threats that could impact the organization, such as market volatility, credit exposures, operational inefficiencies, and compliance pitfalls. A robust identification process is essential to ensure no potential risk is overlooked, and it often requires a collaborative effort among stakeholders.

- Threat Assessment: Following identification, a thorough examination is conducted to evaluate each threat's potential impact and likelihood. This analysis employs both quantitative and qualitative methods, allowing organizations to gain a nuanced understanding of risk severity.

- Threat Prioritization: In this phase, threats are prioritized based on their severity and probability. This evaluation enables organizations to concentrate resources on addressing the most critical challenges, aligning risk management efforts with business priorities.

- Recommendations: The financial risk assessment report concludes with practical strategies aimed at reducing the identified threats. These recommendations may encompass implementing financial controls, making necessary operational adjustments, or pursuing strategic pivots to enhance resilience.

- Monitoring and Review: Finally, the report outlines a plan for continuous monitoring and periodic reviews, leveraging a client dashboard for real-time analytics to assess business health. This proactive approach ensures that the organization remains vigilant and responsive to evolving challenges, a practice underscored by recent findings indicating that nearly 75% of executives foresee significant changes in business continuity planning and crisis management strategies. Furthermore, the streamlined decision-making cycle throughout the turnaround process empowers your team to take decisive action based on live data insights. Additionally, case studies on hazard management strategies can demonstrate how monetary institutions effectively apply these practices.

As we near 2024, the latest economic vulnerability evaluation reports are anticipated to include these elements with an emphasis on ethical and responsible modeling, which can generate significant value for both clients and the wider monetary ecosystem. Significantly, Fitch expects that the high yield default rate will decrease to 2.0% to 3.0% in 2025, further highlighting the importance of efficient evaluation in the present economic environment. This iterative process not only aids in effective management of uncertainties but also highlights the significance of clear communication concerning evaluation outcomes, including the testing of hypotheses to achieve maximum return on invested capital.

Methodologies for Conducting Financial Risk Assessments

The methodologies for conducting a financial risk assessment report encompass a diverse range of approaches, each offering unique insights tailored to an organization's specific needs and emphasizing the importance of thorough financial assessments for cash preservation and liability reduction. Key methodologies include:

-

Qualitative Assessment: This approach utilizes expert judgment and stakeholder interviews to identify potential challenges and evaluate their impact.

It is especially beneficial in grasping the nuances of uncertainties that may not be easily quantifiable, directly contributing to opportunities for cash preservation.

-

Quantitative Analysis: Utilizing statistical models and economic metrics, this data-oriented approach offers a thorough viewpoint on uncertainty.

Methods like simulations and stress testing are frequently employed to predict possible economic effects, making it an essential tool for CFOs concentrating on efficiency and management.

-

Scenario Analysis: By examining a variety of uncertainties, this technique allows organizations to anticipate potential outcomes and prepare for diverse financial futures, thus enhancing strategic planning and uncovering value while reducing costs.

-

Threat Mapping: This visual tool illustrates the relationships and interactions between various threats.

The Bowtie Hazard Analysis, for instance, offers stakeholders a clear depiction of threats, causes, and outcomes, with studies indicating that it can enhance communication about dangers by up to 50%.

This allows prioritized threat management and supports cash preservation initiatives. Furthermore, insurance plays a vital role in managing uncertainties by transferring the possibility of potential loss to another party for a fee or premium, thus providing an additional layer of protection for organizations.

As MetricStream articulates,

Our suite of Connected GRC solutions serves as the cornerstone of your awareness-driven corporate culture, weaving various threads of data into an insightful, understandable, and actionable analysis.

Furthermore, it is crucial to differentiate between threat analysis and threat evaluation; while threat evaluation identifies and examines the variety of potential dangers and weaknesses, threat analysis concentrates on ascertaining the effect and probability of these identified threats. Each of these approaches aids in the creation of a comprehensive financial risk assessment report framework, ensuring that entities can effectively navigate the intricacies of the economic environment, preserve cash, and diminish liabilities. To learn more about how our Financial Assessment service can help you implement these methodologies effectively, click the button below.

Implications of Financial Risk Assessments on Business Strategy

The consequences of monetary evaluations on corporate strategy are both essential and extensive for CFOs. By effectively identifying potential financial threats, organizations can leverage real-time analytics to create a financial risk assessment report that aids in making informed decisions aligned with their long-term objectives. For instance, a thorough evaluation of potential issues may uncover the need to diversify income sources or adjust pricing approaches to alleviate existing market challenges.

Furthermore, these evaluations serve a crucial function in directing resource distribution, ensuring that the financial risk assessment report informs the allocation of funds to projects offering the greatest return on investment and the least vulnerability. Notably, 86% of executives, excluding tax and HR leaders, have identified cybersecurity as a primary concern, prompting many entities to prioritize IT investments. According to the PwC Pulse Survey:

- 33% of leaders in the field plan to increase their budgets.

- 57% will maintain their current spending levels.

This financial risk assessment report reveals a distinct pattern where monetary evaluations not only guide strategic choices but also improve resilience within organizations, allowing them to skillfully manage uncertainties and capture emerging opportunities. For instance, private companies are increasingly concentrating on growth after postponed investments, with 61% mentioning talent acquisition and retention as significant concerns. They are boosting investments in IT and cybersecurity, although only 34% plan to raise compensation for existing employees, indicating a cautious approach.

Furthermore, with the technology sector accounting for 49.3% of participants, it is clear that industries most involved with monetary evaluations are prioritizing these strategies. As highlighted by industry specialists, incorporating strong financial evaluations into the financial risk assessment report is vital for long-term success and sustainability, as it promotes streamlined decision-making and continuous performance monitoring. In this context, a collaborative approach to planning solutions is vital, allowing teams to collectively address weaknesses and reinvest in key strengths to enhance overall organizational performance.

Furthermore, adopting a pragmatic approach to data testing ensures that decisions are evidence-based, maximizing returns on investment while minimizing risks.

Conclusion

In today's rapidly evolving financial landscape, the importance of comprehensive financial risk assessment reports cannot be overstated. By systematically identifying and analyzing potential risks, organizations can safeguard their financial stability and make informed decisions that align with their strategic objectives. The integration of advanced methodologies, such as qualitative and quantitative assessments, ensures a thorough understanding of risks, enabling organizations to respond proactively rather than reactively.

Furthermore, the insights gained from these assessments empower leaders to prioritize resource allocation, enhance operational resilience, and adapt to emerging challenges. With a significant proportion of executives acknowledging the critical connection between financial risk management and organizational success, embracing robust risk assessment practices is essential. This proactive approach not only mitigates potential threats but also positions organizations to capitalize on new opportunities, fostering sustainable growth in an uncertain environment.

As organizations prepare for the future, it is imperative to continuously refine risk assessment strategies, leveraging real-time analytics and ongoing monitoring to stay ahead of evolving risks. By committing to a culture of risk awareness and informed decision-making, businesses can navigate complexities with confidence, ensuring long-term viability and success in a competitive marketplace.

Frequently Asked Questions

What is a financial risk assessment report?

A financial risk assessment report is a document that examines potential threats to an organization’s economic stability, including market volatility, credit uncertainties, operational challenges, and regulatory compliance.

What is the main goal of a financial risk assessment report?

The main goal is to identify vulnerabilities within an organization and suggest effective strategies for mitigating these risks.

How can financial risk assessments benefit organizations?

They enable organizations to make informed monetary decisions, protect assets against unpredictable challenges, and improve overall organizational performance.

What recent trend highlights the importance of financial risk assessment?

Seventy-five percent of executives anticipate significant changes in their company's approach to business continuity planning and crisis management, indicating the increasing importance of effective monetary evaluations.

How does technology play a role in financial risk assessments?

The integration of advanced technologies like AI and machine learning helps organizations handle large volumes of unstructured data, allowing them to adapt to changing threat patterns more effectively than conventional methods.

What is the significance of continuous monitoring in financial risk assessments?

Continuous monitoring through client dashboards provides real-time analytics that facilitate relationship-building and timely updates to strategies based on performance metrics.

What does the client dashboard provide?

The client dashboard offers real-time business metrics that enhance transparency and empower stakeholders with actionable insights.

Why is it crucial for entities to conduct financial risk evaluations in today's corporate landscape?

Financial risk evaluations provide a systematic structure for recognizing and alleviating potential economic risks, which is essential for guiding strategic planning and improving decision-making processes.

What is the projected trend regarding fiscal spending on insurance?

The proportion of fiscal spending on urban and rural residence insurance to GDP was 1.27% in 2020 and is projected to surpass 2% by 2050.

How does a financial risk assessment report influence a company's ability to thrive?

It supports the proactive identification of risks through robust testing programs, which is vital for sustainable organizational success in a climate of rapid change and economic volatility.