Overview

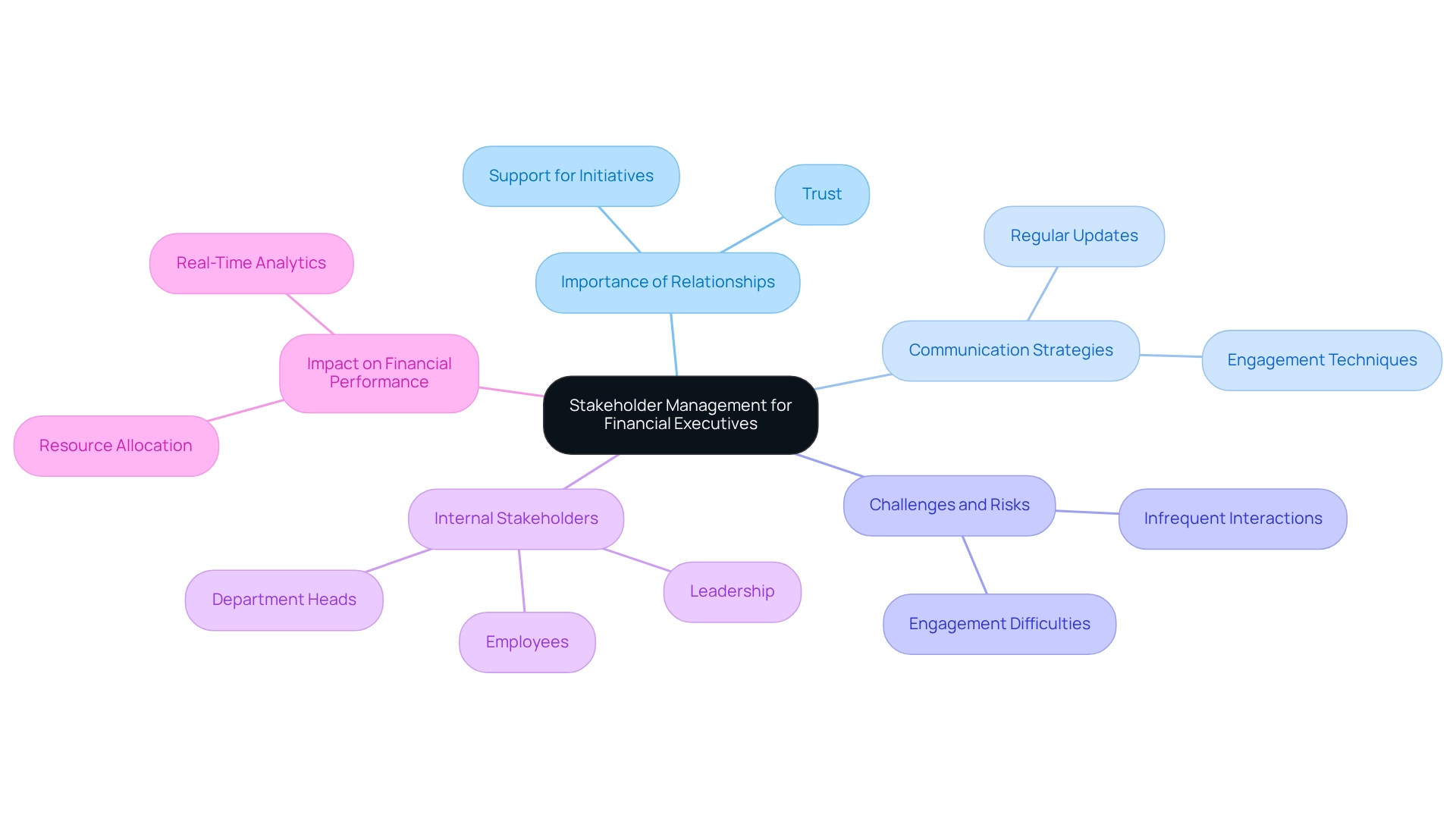

Stakeholder management stands as a strategic process that entails the identification, analysis, and engagement with individuals or groups vested in a company's operations. For financial executives, this practice is vital to ensuring organizational success. Effective stakeholder management not only enhances decision-making but also fosters collaboration and improves financial performance. By aligning stakeholder interests with organizational goals, it adeptly addresses the complexities of communication and resource allocation within a dynamic business environment.

Introduction

In a world where business landscapes are continually shifting, the ability to effectively manage stakeholder relationships has emerged as a critical factor for organizational success. Stakeholder management transcends mere engagement; it is a strategic process that influences decision-making, resource allocation, and ultimately, financial performance.

As companies navigate the complexities of modern operations—balancing remote work and addressing diverse stakeholder expectations—understanding the nuances of stakeholder dynamics is essential. This article delves into the fundamental principles of stakeholder management, the challenges faced by financial executives, and the best practices that can enhance engagement and drive sustainable growth in an increasingly interconnected business environment.

Understanding Stakeholder Management: A Fundamental Overview

Understanding stakeholder management involves a strategic process of identifying, analyzing, and engaging with individuals or groups who have a vested interest in a company's operations. For financial executives, this practice is vital as it influences decision-making, resource allocation, and the overall success of the organization. By effectively managing stakeholders—ranging from employees and customers to investors and suppliers—executives can ensure that diverse needs and expectations are recognized and addressed.

This cooperative method not only improves financial results but also aids in long-term sustainability.

In 2025, the importance of engaging with interested parties is underscored by the fact that 64% of project leaders in finance are balancing remote and on-site work, emphasizing the necessity for a global perspective and synchronized communication strategies. This is crucial for navigating the complexities of managing interested parties in an increasingly interconnected world. Moreover, the concerning statistic that half of all Project Management Offices shut down within three years highlights the need for ongoing value and alignment with organizational objectives, directly influencing participant engagement and management.

Effective participant engagement strategies are vital for cultivating a positive business atmosphere. Our group concentrates on pinpointing fundamental business challenges and jointly developing strategies to address vulnerabilities, enabling entities to reinvest in essential strengths. The application of techniques such as Six Sigma in financial institutions has shown considerable enhancements in operational efficiency and quality, highlighting the advantages of systematic participant oversight.

By aligning the interests of involved parties with organizational objectives, companies can leverage such methodologies to enhance collaboration and drive results. As funding for project oversight training increases by 18%, it becomes more evident that proficient project leaders play a vital role in attaining project success and, consequently, organizational goals.

Ultimately, understanding stakeholder management is crucial, as the significance of engaging with interested parties cannot be overstated; it is a foundation of business achievement that allows organizations to navigate complexities and promote growth in a constantly changing environment. Our pragmatic approach to data ensures that we test every hypothesis to deliver maximum return on invested capital, reinforcing the commitment to operationalizing lessons from the turnaround process to build strong, lasting relationships.

The Importance of Stakeholder Management for Financial Executives

For financial executives, grasping the concept of stakeholder management is not merely a straightforward task; it is a crucial component in achieving strategic objectives. Meaningful interactions with interested parties foster greater trust, enhance communication, and garner additional support for financial initiatives. Research indicates that 33% of executives most frequently collaborate with leadership, highlighting the significance of these relationships in driving organizational success.

By comprehending the perspectives of involved parties, executives can more effectively anticipate challenges and mitigate risks, leading to more informed decision-making. However, those with infrequent interactions with executive leadership report greater difficulties in engagement, underscoring the need for regular communication.

In times of crisis, such as during restructuring or turnaround efforts, maintaining robust relationships with stakeholders becomes imperative. The essence of stakeholder management involves engaging internal stakeholders—employees, leadership, and department heads—through consistent communication and collaboration. This approach not only motivates teams but also aligns them with organizational goals, thus preventing project delays and resource conflicts. Such proactive strategies are essential for securing the necessary resources and support for recovery initiatives.

A commitment to implementing insights gained during the turnaround process can further strengthen these connections, ensuring that all parties involved remain engaged and informed.

Moreover, effective oversight of stakeholders can profoundly impact financial performance. Organizations that utilize real-time analytics to monitor business health and performance are better equipped to navigate financial crises, as they can enhance collaboration and resource allocation through trust and communication. For CFOs in 2025, adopting targeted engagement strategies that prioritize streamlined decision-making and continuous performance monitoring will be vital in fostering resilience and driving sustainable growth amidst evolving market challenges.

Key Principles of Effective Stakeholder Management

Effective management of interested parties is anchored in several fundamental principles that guide financial executives in fostering strong relationships and enhancing organizational resilience:

-

Identification: Recognizing all relevant parties is crucial, as understanding their interests, influence, and potential impact on the organization forms a foundational step. This ensures that no key player is overlooked, allowing for a comprehensive engagement strategy.

-

Engagement: Actively involving interested parties in decision-making processes fosters collaboration and empowers them to contribute meaningfully. Encouraging involvement from the outset makes individuals feel valued and invested in the outcomes, leading to more favorable results. As noted by respondents, this involves persuading a powerful set of audiences who wield significant control within the organization. Streamlined decision-making processes, supported by real-time analytics, can significantly enhance this engagement, enabling quicker responses to the needs and concerns of involved parties.

-

Communication: Maintaining open lines of communication is essential for transparency and trust-building. Regular updates and accessible reports on how participant involvement influences decisions can significantly enhance relationships. Stakeholders should be encouraged to participate from the beginning and have access to reports detailing how their involvement has impacted decisions. In fact, studies indicate that customers expect businesses to respond via live chat within 48 seconds, underscoring the need for prompt and effective communication. Employing real-time business analytics can further enhance this communication, ensuring interested parties are informed and engaged.

-

Feedback: Encouraging and incorporating input from involved parties is vital for refining strategies and improving outcomes. By actively seeking feedback, companies can adjust their strategies to better fulfill the needs of interested parties, ultimately resulting in increased satisfaction and loyalty. A thorough participant management platform streamlines monitoring and reporting of interaction metrics, facilitating the collection and analysis of feedback. This ongoing performance evaluation enables entities to implement insights gained from participant interactions, enhancing relationships over time.

-

Monitoring: Ongoing evaluation of interested parties' relationships allows entities to modify interaction strategies as needed. This proactive approach helps identify potential issues early and manage risks effectively. The concept of Engagement ROI measures the worth of participant involvement, illustrating how effective interaction can enhance planning and decision-making processes. By assessing the return on investment from participation, companies can refine their tactics and fortify relationships with interested parties, ultimately resulting in improved outcomes. Furthermore, the commitment to implementing insights from the turnaround process can further strengthen stakeholder trust and collaboration.

By adhering to these principles, financial leaders at Transform Your Small/Medium Business can create a robust stakeholder engagement framework that addresses stakeholder management, improving organizational adaptability and fostering sustainable growth.

Identifying and Categorizing Stakeholders: Who Are They?

Stakeholders can be categorized into distinct groups based on their relationship to the organization, which is crucial for effective management and engagement strategies:

- Primary Stakeholders: These individuals or groups are directly impacted by the organization's actions. This category encompasses employees, customers, and investors, all of whom have a vested interest in the entity's performance and outcomes.

- Secondary Stakeholders: This group includes those who are indirectly impacted by the entity's operations. Examples include suppliers, community members, and regulatory bodies. While they may not be directly involved in the entity's core activities, their influence can significantly affect the entity's reputation and operational success.

- Key Stakeholders: These are individuals or groups with substantial influence over the organization’s success, such as board members and major investors. Their decisions and opinions can shape strategic directions and impact overall performance.

Understanding these categories allows financial executives to effectively prioritize engagement efforts, which raises the question: what is stakeholder management? As noted by the Project Management Institute (PMI), 'the project management team must … manage and then influence those expectations to ensure a successful project.' This prompts further inquiry: what is stakeholder management in the context of effectively managing involved parties?

In a notable case study involving an international technical project, the project manager emphasized the necessity of clearly defined roles and responsibilities. The project encountered difficulties associated with communication barriers and the alignment of interested parties. However, the involvement of customers and vendors throughout all project phases was crucial.

The project team maintained a robust communication strategy that helped identify and address design and implementation barriers early on, significantly contributing to the project's overall success.

Furthermore, a software company recently attained a Net Promoter Score of +70, indicating high customer satisfaction. This statistic highlights the significance of customized communication approaches in nurturing positive connections with involved parties.

By categorizing interested parties and utilizing real-time analytics through the client dashboard provided by Transform Your Small/ Medium Business, financial executives can develop targeted engagement strategies that address the unique needs of each group. This approach not only enhances organizational resilience but also operationalizes lessons learned from past experiences, ultimately fostering stronger relationships and improving overall performance.

Strategies for Engaging Stakeholders Effectively

To effectively engage stakeholders, financial executives can adopt a variety of strategic approaches:

- Regular Communication: Establishing a consistent communication schedule is crucial for keeping interested parties informed about organizational developments. This transparency fosters trust and encourages ongoing dialogue.

- Participation in Decision-Making: Actively engaging interested parties in relevant discussions and decisions not only enhances their sense of ownership but also leads to better-informed outcomes. Companies with efficient interest group plans are 40% more likely to finish projects punctually and within budget, emphasizing the importance of this strategy. Transform Your Small/ Medium Business supports a shortened decision-making cycle throughout the turnaround process, allowing your team to take decisive action to preserve your business.

- Tailored Messaging: Customizing communication to address the specific interests and concerns of various groups is essential. This targeted strategy ensures that messages resonate and engage interested parties more effectively.

- Building Relationships: Investing time in relationship-building activities, such as networking events and one-on-one meetings, can significantly enhance connections with involved parties. Strong connections result in enhanced advocacy and support, as demonstrated by high Net Promoter Scores (NPS) that signify robust loyalty among involved parties. As Justin Lagac, Account Manager and Business Development Team Leader, observes, "When he's not working, Justin enjoys cooking - particularly when it includes barbecue," highlighting the significance of personal relationships in engaging with partners. Our commitment to operationalizing the lessons learned through the turnaround process further enhances these relationships.

- Feedback Mechanisms: Establishing avenues for involved parties to offer input and voice concerns is essential for ensuring their opinions are acknowledged. This not only enhances participant satisfaction but also enables organizations to adapt and respond to their needs more effectively. We continually monitor the success of our plans through our client dashboard, which provides real-time business analytics to diagnose your business health.

Integrating digital tools and data analysis can further improve these strategies, as these innovations have revolutionized interactions with interested parties, allowing businesses to better comprehend and fulfill their expectations. For example, Enel Green Power Mexico effectively enhanced its information handling and cooperation among parties by utilizing specialized interaction software, which resulted in better communication and participant involvement. By adopting these best practices, financial executives can significantly enhance communication and engagement with interested parties, which raises the question of what is stakeholder management and how it supports their organizational objectives.

Additionally, we are pragmatic in our approach to data, testing every hypothesis to deliver maximum return on invested capital in both the short and long term.

Common Challenges in Stakeholder Management and How to Overcome Them

Understanding stakeholder management is crucial, as it frequently encounters a variety of challenges that can impede effective decision-making and project success. Key challenges include:

- Conflicting Interests: Stakeholders often have competing priorities, leading to significant complications. For instance, one participant may prioritize project completion before a vacation, while others may have different timelines or objectives, creating friction in the decision-making process. To alleviate this, a streamlined decision-making cycle can be implemented, allowing for quicker resolutions that align with the needs of involved parties.

- Communication Barriers: Effective communication is essential; however, miscommunication or insufficient dialogue can lead to misunderstandings and undermine trust among interested groups. This is particularly critical as 41% of organizations report that demonstrating the added value of their project management office (PMO) is their biggest challenge. Utilizing real-time analytics through the client dashboard offered by Transform Your Small/ Medium Business can enhance communication by supplying involved parties with current information, fostering transparency and trust.

- Resource Constraints: Limited resources can restrict the ability to engage all participants adequately. This can lead to feelings of neglect among certain groups, further complicating relationships with involved parties. Significantly, just 34% of underperformers provide comparable training, emphasizing the significance of training in addressing management challenges with involved parties. By strategically distributing resources and applying insights gained from past experiences, organizations can ensure that all parties feel valued and informed.

To navigate these challenges successfully, financial executives should adopt several strategies:

- Prioritize Clear Communication: Establishing open lines of communication helps to clarify expectations and reduce misunderstandings. Regular updates and feedback loops, supported by real-time business analytics from Transform Your Small/ Medium Business, can foster a culture of transparency.

- Understand Perspectives of Involved Parties: Actively seeking to comprehend the diverse viewpoints of involved parties can facilitate better alignment and collaboration. This understanding is essential for addressing conflicting interests effectively, especially when decisions need to be made quickly.

- Strategic Resource Allocation: Distributing resources carefully guarantees that essential participants are engaged and informed. This may involve prioritizing specific parties based on their influence and interest in the project, thereby optimizing the turnaround process.

- Test Hypotheses: Regularly evaluating hypotheses connected to participant involvement and project results can help deliver maximum return on invested capital, ensuring that strategies remain effective and aligned with participant needs.

By implementing these strategies, financial executives can enhance participant relations, ultimately leading to more successful project results and sustainable growth.

The Role of Communication in Successful Stakeholder Management

Effective communication serves as the foundation for understanding stakeholder management, encompassing not just the dissemination of information but also the active engagement with concerns and feedback. Key strategies for fostering robust communication include:

- Transparency: Openly sharing organizational goals, challenges, and changes cultivates trust among involved parties. Research by Gray et al. (2012) suggests that various sources of knowledge can improve structural understanding and acknowledge complexity, emphasizing the significance of transparency in relationships with involved parties. A practical example of this is Asana, which publishes the minutes from its board meetings for employees, ensuring clarity on the company's strategic priorities.

- Consistency: Providing regular updates and maintaining consistent messaging keeps interested parties informed and engaged, which is crucial for building long-term relationships. A study analyzing voluntary disclosure practices in non-profit organizations revealed that while transparency enhances credibility, it can also introduce challenges such as increased bureaucracy. This emphasizes the necessity for careful management of transparency initiatives to prevent possible challenges.

- Two-Way Dialogue: Encouraging feedback and facilitating discussions empower participants, making them feel valued and involved in the decision-making process. Involving employees in discussions regarding transparency practices has demonstrated the ability to promote mutual trust and understanding, further strengthening relationships with interested parties. Current trends highlight the significance of this dialogue, as entities are encouraged to actively involve employees in discussions about transparency practices.

By prioritizing these effective communication strategies, financial executives can significantly strengthen relationships with interested parties. Understanding stakeholder management is crucial for enhancing collaboration and ultimately driving success within the entity.

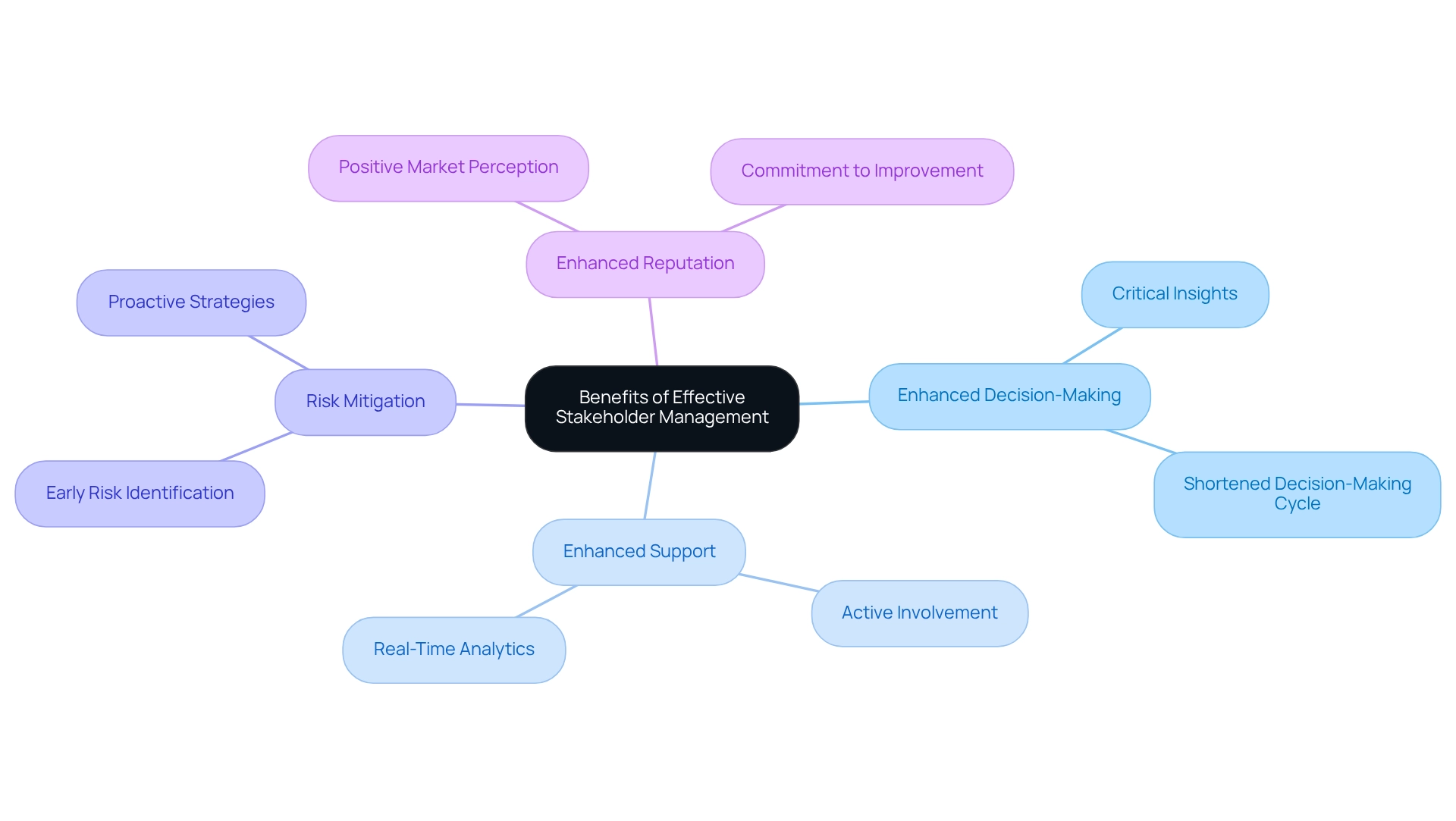

Benefits of Effective Stakeholder Management for Financial Performance

Effective stakeholder management is pivotal for enhancing financial performance, yielding several key benefits:

- Enhanced Decision-Making: Engaged stakeholders provide critical insights that can significantly refine strategic decisions. Their diverse perspectives help identify opportunities and challenges that may not be immediately apparent, leading to more informed choices. By streamlining decision-making processes, organizations can act decisively, especially during turnaround situations. This approach ensures that input from interested parties is effectively utilized. Transform Your Small/ Medium Business supports this by facilitating a shortened decision-making cycle throughout the turnaround process.

- Enhanced Support: When interested parties understand what stakeholder management entails, their active involvement increases the likelihood of championing initiatives, facilitating smoother implementation of financial strategies. This support is crucial during times of change, ensuring that projects receive the necessary backing to succeed. Ongoing observation of participant engagement through real-time analytics can further enhance this support, enabling businesses to modify strategies as required. Our client dashboard provides real-time business analytics to continually diagnose your business health.

- Risk Mitigation: By grasping the essence of stakeholder management, entities can actively collaborate with involved parties to identify possible risks early in the process. Understanding the concerns of interested parties allows businesses to implement strategies to address these issues before they escalate, thereby reducing the likelihood of financial setbacks. Utilizing real-time business analytics enhances this proactive approach, providing insights into stakeholder management and enabling teams to continuously diagnose business health. Transform Your Small/ Medium Business emphasizes testing every hypothesis to deliver maximum return on invested capital in both the short and long term.

- Enhanced Reputation: Solid connections with interested parties boost a company’s reputation, which can draw in new clients and investors. A favorable view in the market is frequently associated with successful collaboration with interested parties, illustrating the significance of stakeholder management through a dedication to openness and teamwork. This reputation can be further strengthened by showcasing a commitment to strategic business improvement and operational excellence.

The financial implications of these benefits are substantial. For example, organizations that efficiently handle relationships with interested parties can experience enhanced communication quality, greater task completion rates, and heightened satisfaction among those involved. This leads to a better understanding of stakeholder management and its contribution to a positive return on investment (ROI) in involvement initiatives. A study uncovered that investment strategies concentrating on firms with strong governance generated abnormal returns of 8.5% each year, highlighting the financial benefits of effective oversight of involved parties.

A practical example of this can be observed in the case of Enel Green Power Mexico, which aimed to enhance its involvement with interested parties by improving information management and collaboration. By utilizing Borealis participant interaction software, they improved their collaboration efforts, resulting in more effective participant involvement and streamlined communication. This case illustrates the importance of stakeholder management, demonstrating how enhanced participant involvement can directly influence financial results by promoting better decision-making and operational efficiency.

In 2025, understanding stakeholder management is crucial, as the influence of participant involvement on business success remains clear. Organizations are increasingly acknowledging the importance of including lower voice and value participants in significant projects. This approach not only fosters growth but also enhances overall decision-making processes. As Emmanuel Acquah from Project Management observes, 'Strong alignment among interested parties reduces risks, enhances communication, and builds trust, ensuring smoother execution and better results.'

By prioritizing engagement with interested parties and leveraging real-time analytics, financial executives can drive sustainable growth and navigate challenges more effectively.

Best Practices for Financial Executives in Stakeholder Management

To enhance the management of interested parties, financial executives must adopt the following best practices:

- Create a Participant Engagement Plan: Establish clear objectives, strategies, and timelines for involving participants. This structured approach clarifies stakeholder management by ensuring that all parties are aligned and aware of their roles in the process.

- Utilize Technology: Embrace advanced tools and platforms that facilitate effective communication and participant analysis. The incorporation of purpose-built participant coordination software significantly improves collaboration, security, and data processing abilities, advancing beyond conventional spreadsheets. Organizations are encouraged to transition from spreadsheets to specialized management software to enhance collaboration, security, and data handling capabilities. Furthermore, leveraging real-time analytics supports a shortened decision-making cycle, enabling teams to take decisive actions that preserve business health.

- Regularly Review Relationships: To understand stakeholder management, it is crucial to continuously assess and adapt engagement strategies based on feedback from involved individuals and evolving dynamics. This proactive approach enables organizations to remain responsive to the needs of interested parties, which is essential for sustaining strong relationships. Utilizing real-time business analytics aids in diagnosing stakeholder management and adjusting strategies accordingly. Training teams on relationship engagement is essential, equipping members with the necessary skills and knowledge to manage relationships effectively. This training promotes a culture of involvement and ensures that all employees comprehend the significance of interactions with relevant parties.

- Celebrate Successes: Acknowledge and celebrate milestones accomplished through partner collaboration. Recognizing these achievements strengthens favorable connections and promotes continuous involvement.

Integrating these methods can result in enhanced project outcomes, as firms with efficient participant involvement are 40% more likely to complete projects punctually and within budget. Additionally, with 39% of social media users seeking quick responses, the need for fast and efficient engagement strategies is more critical than ever. As a practical tool, Simply Stakeholders is recommended for its features such as mapping participants and AI-driven analysis, which can support these best practices while enabling continuous performance monitoring.

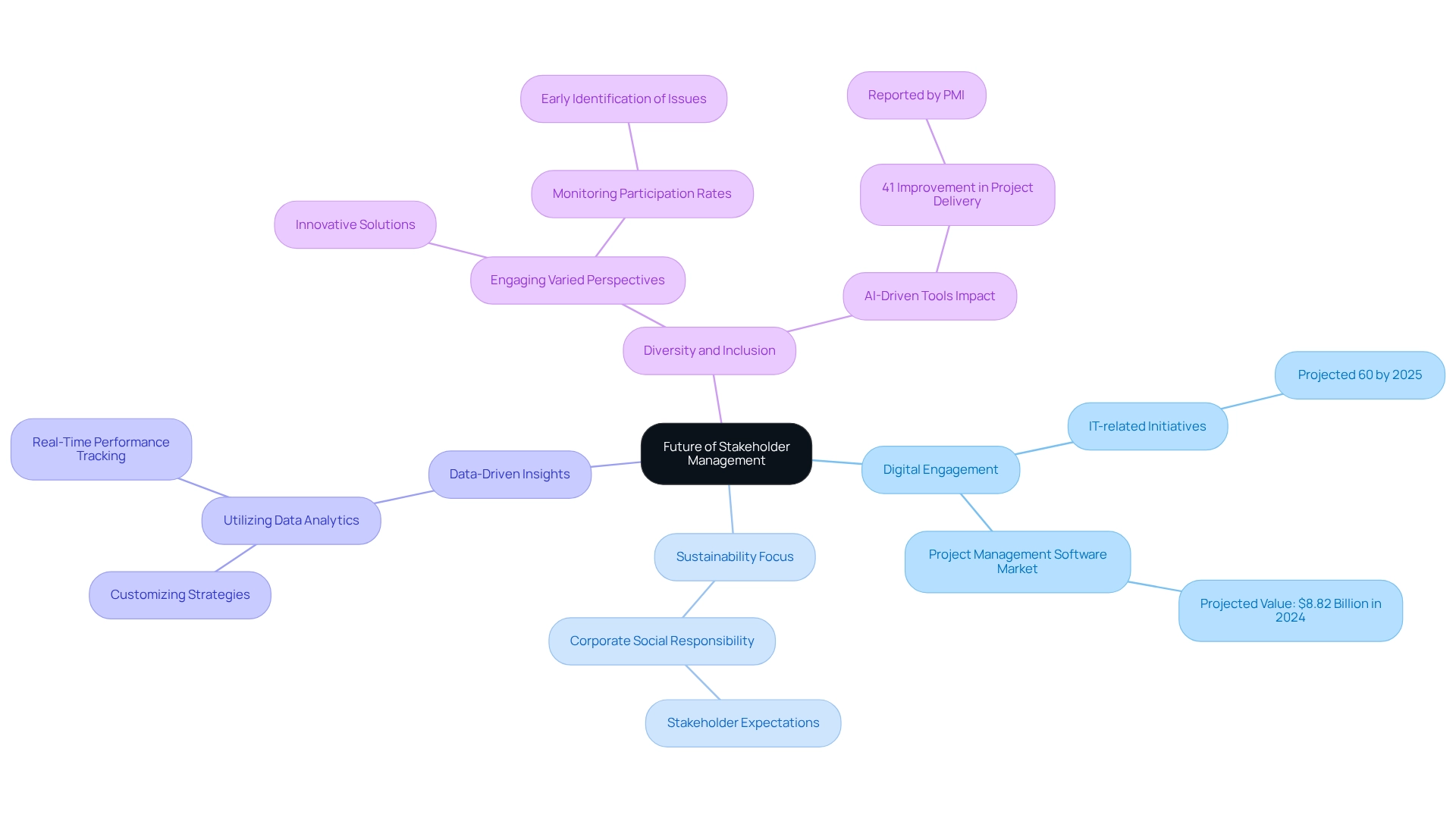

The Future of Stakeholder Management: Trends and Considerations for Financial Executives

The environment of managing interested parties is in a state of constant evolution, shaped by technological advancements, shifting societal expectations, and regulatory changes. Financial executives must monitor key trends that are redefining stakeholder engagement:

- Digital Engagement: The increasing reliance on digital tools is transforming communication and engagement with involved parties. By 2025, more than 60% of initiatives within firms are anticipated to be IT-related, underscoring the vital role of technology in nurturing effective relationships with stakeholders. Furthermore, the worldwide project management software industry is projected to reach a value of $8.82 billion in 2024, highlighting the escalating significance of technology in this domain.

- Sustainability Focus: There is a growing emphasis on corporate social responsibility, with stakeholders progressively expecting firms to prioritize sustainability in their operations and decision-making processes.

- Data-Driven Insights: Utilizing data analytics is becoming crucial for comprehending the needs and preferences of involved parties. This approach enables companies to customize their strategies efficiently, enhancing interaction and satisfaction. By consistently tracking performance through real-time analytics, organizations can assess their business health and implement lessons learned, ensuring that strategies remain responsive and effective.

- Diversity and Inclusion: Recognizing the importance of varied participant perspectives is essential for informed decision-making. Engaging a diverse array of viewpoints can lead to more innovative solutions and stronger relationships with stakeholders. A case study on early identification of issues emphasizes the necessity of assessing participant engagement. By monitoring participation rates, organizations can proactively address signs of disengagement, preventing potential conflicts that could result in project delays or failures. This proactive approach not only strengthens relationships with stakeholders but also enhances overall project delivery. For instance, metrics such as participation rates can indicate when parties are losing interest, allowing teams to address issues preemptively and improve relations with involved individuals. Additionally, according to PMI, 41% of project delivery specialists reported significant improvements in project execution since implementing AI-driven tools and methods for project oversight. By staying attuned to these trends and employing a pragmatic approach to data testing and decision-making, financial executives can refine their strategies regarding stakeholder management, ensuring they are well-positioned to drive long-term organizational success.

Conclusion

Effective stakeholder management is indispensable for financial executives seeking to navigate the complexities of modern business landscapes. By prioritizing the identification, engagement, and communication with stakeholders, organizations can build trust and foster collaboration, ultimately enhancing decision-making and financial performance. The principles of effective stakeholder management—such as maintaining open lines of communication, actively involving stakeholders in processes, and continuously seeking feedback—serve as the foundation for sustainable growth.

As the business environment evolves, the importance of digital engagement, sustainability, and data-driven insights cannot be overstated. Embracing these trends enables organizations to tailor their strategies to meet diverse stakeholder needs, ensuring that all voices are heard and valued. Moreover, recognizing the unique perspectives of various stakeholder groups enhances innovation and strengthens relationships, paving the way for successful project outcomes.

In conclusion, the commitment to robust stakeholder management practices is not merely a tactical approach; it is a strategic necessity that can significantly impact an organization’s long-term success. By operationalizing lessons learned and leveraging technology to enhance engagement, financial executives can position their organizations to thrive in an increasingly interconnected world. Now is the time to embrace these best practices and drive forward with a focus on stakeholder collaboration and engagement to secure a prosperous future.

Frequently Asked Questions

What is stakeholder management?

Stakeholder management is a strategic process of identifying, analyzing, and engaging with individuals or groups who have a vested interest in a company's operations. It is essential for financial executives as it influences decision-making, resource allocation, and overall organizational success.

Why is stakeholder management important for financial executives?

It is crucial for financial executives because it fosters meaningful interactions with stakeholders, enhances trust and communication, and supports financial initiatives. Effective stakeholder management leads to better decision-making and helps anticipate challenges and mitigate risks.

What are the key principles of effective stakeholder management?

The key principles include: 1. Identification: Recognizing all relevant parties and understanding their interests and influence. 2. Engagement: Actively involving stakeholders in decision-making processes. 3. Communication: Maintaining open lines of communication for transparency and trust-building. 4. Feedback: Encouraging and incorporating stakeholder input to improve strategies and outcomes. 5. Monitoring: Ongoing evaluation of relationships to identify potential issues and manage risks effectively.

How does stakeholder engagement impact financial performance?

Effective stakeholder engagement can significantly enhance financial performance by improving collaboration, resource allocation, and trust. Organizations that utilize real-time analytics to monitor business health are better equipped to navigate financial crises and drive sustainable growth.

What challenges do organizations face in stakeholder management?

Organizations face challenges such as the need for regular communication, particularly in times of crisis, and the difficulty of engaging stakeholders who have infrequent interactions with executive leadership. Additionally, the statistic that half of all Project Management Offices shut down within three years highlights the importance of ongoing value and alignment with organizational objectives.

How can organizations ensure that stakeholder management contributes to long-term sustainability?

By aligning the interests of stakeholders with organizational objectives and implementing systematic oversight techniques, organizations can enhance collaboration, drive results, and promote long-term sustainability. Regularly testing hypotheses and operationalizing lessons learned also reinforces strong stakeholder relationships.