Overview

Turnaround management is a strategic process focused on revitalizing struggling organizations through targeted interventions aimed at reversing negative trends and restoring profitability. The article emphasizes that effective turnaround management involves comprehensive strategies, including financial restructuring, operational improvements, and leadership changes, all supported by real-time analytics to monitor performance and facilitate informed decision-making.

Introduction

In a landscape where organizations frequently confront financial distress and operational inefficiencies, turnaround management emerges as a vital lifeline. This strategic approach not only seeks to restore profitability but also emphasizes the importance of leveraging innovative technologies like AI and machine learning to drive effective change. By assessing financial health and operational performance, companies can implement targeted interventions that stabilize their foundations and set the stage for sustainable growth.

With a focus on key strategies—ranging from financial restructuring to leadership transformation—CFOs are equipped to navigate the complexities of revitalizing their organizations. As the challenges of resistance to change and resource constraints loom large, understanding the intricacies of turnaround management becomes essential for steering businesses toward long-term success.

Defining Turnaround Management: An Overview

Turnaround management is a critical process aimed at revitalizing struggling entities through targeted strategic interventions and operational improvements, particularly by leveraging AI and machine learning to enhance efficiency. This multifaceted approach encompasses a series of deliberate actions aimed at reversing negative trends, restoring profitability, and stabilizing the organization. Turnaround management is typically activated in response to financial distress, poor performance, or market challenges, beginning with a thorough assessment of the organization's financial health, operational efficiency, and market positioning.

It highlights the significance of efficient decision-making cycles, enabling your team to take decisive actions that protect the organization. Continuous monitoring through real-time analytics—available via client dashboards—ensures that performance is consistently evaluated, enabling quick adjustments in strategy as needed. The client dashboard serves as a vital tool for tracking key performance indicators and diagnosing organizational health in real-time.

As Schulz aptly puts it, 'Starting a business is incredibly difficult, and the odds are stacked against you in so many ways,' emphasizing the challenges entities encounter. In fact, entities that invest in professional development opportunities see engagement increase by 15% and retention by 34%, further underscoring the importance of cultivating a skilled workforce during revitalization efforts. Successful case studies, like those featured in the article 'Resources for Small Business Success,' illustrate how entities can navigate challenges and attain remarkable recoveries through effective turnaround management by utilizing available resources and support networks.

Additionally, with nearly 70% of remote workers reporting burnout from excessive digital communication, adaptive management strategies become even more pronounced in today's business landscape. Resources from entities such as the Small Business Administration can offer valuable guidance and assist in overcoming challenges during management recovery. Thus, mastering change management—driven by a dedication to implementing lessons learned and fostering strong connections—is vital for CFOs focused on guiding their enterprises toward long-term success.

Key Strategies for Effective Turnaround Management

Effective recovery management necessitates a comprehensive approach that encompasses several critical strategies:

- Financial Restructuring: This strategy focuses on renegotiating debts, enhancing cash flow management, and pinpointing cost-cutting opportunities. A meticulous financial assessment reveals areas for liability reduction, which is fundamental for stabilizing the organization's financial base. Richard, a seasoned business recovery consultant, emphasizes that many businesses fall short by being out of touch with the competitive market environment and, more importantly, with our own customers' changing needs. Therefore, understanding these dynamics is key to successful restructuring and mastering the Cash Conversion Cycle for optimal performance, with a focus on maintaining a budget aligned with the $99.00 pricing strategy for consulting services.

- Operational Improvements: Streamlining operations is vital for boosting efficiency and minimizing overhead costs. This could involve process reengineering, optimizing supply chain management, and leveraging technology to automate tasks. An independent team is typically formed around 24 months before scheduled maintenance to conduct comprehensive reviews and challenge existing scopes, which is crucial for informed decision-making. This approach aligns with the Champion - Challenger Process, where formalizing champion and challenger roles enhances planning and decision-making in turnaround management, enabling quick hypothesis testing and adjustments based on real-time analytics. The 'Decide & Execute' process is implemented here by rapidly assessing operational changes, while 'Update & Adjust' ensures ongoing refinement based on performance metrics.

- Leadership and Turnaround Management Changes: A successful turnaround often necessitates a shift in leadership to introduce fresh perspectives and drive necessary changes. Engaging interim management or restructuring the leadership team can significantly enhance direction and accountability, thereby fostering a culture poised for transformation.

- Market Repositioning: Grasping market dynamics and repositioning the organization in alignment with consumer needs is essential. This might involve redefining the value proposition, targeting new customer segments, or pivoting towards innovative product lines. By formalizing champion and challenger roles, companies can encourage rigor in planning and scope challenges, ultimately leading to informed Go or No-Go decisions prior to maintenance events, which is vital for effective market repositioning. The testing of hypotheses within these strategies allows businesses to adapt swiftly to market feedback and make data-driven decisions.

- Stakeholder Engagement: Maintaining transparent communication with stakeholders—employees, creditors, and suppliers—is essential for building support and fostering a collaborative recovery process. Quantitative factors, such as profitability trends and market share, combined with qualitative issues like employee dissatisfaction, must be clearly defined and addressed to navigate the complexities of management change successfully. This dedication to implementing lessons acquired through the recovery process not only fosters strong, enduring relationships but also improves overall business performance.

By adopting these strategies, entities can effectively navigate the challenges of turnaround management, emerging more robust, resilient, and better prepared for sustainable growth.

The Importance of Financial Assessment in Turnaround Management

A thorough monetary assessment is critical to the success of initiatives in turnaround management. By systematically analyzing financial statements, cash flow projections, and operational metrics, entities can uncover both challenges and opportunities for improvement through a structured approach that emphasizes streamlined decision-making and real-time analytics. This process encompasses several key components:

-

Identify & Plan: Our team will identify underlying business issues and work collaboratively to create a plan that mitigates weaknesses and allows the business to reinvest in key strengths.

-

Cash Flow Analysis: A thorough examination of cash flow trends is vital for identifying liquidity challenges and areas where cash conservation can have a significant impact.

Effective cash flow management is not just a reactive measure but a proactive strategy that can stabilize operations during turbulent times.

-

Cost Structure Examination: Delving into fixed and variable costs unveils inefficiencies within the organization. This analysis can pinpoint areas ripe for cost reduction, ultimately enhancing the bottom line and streamlining operations.

-

Debt Evaluation: Careful assessment of existing debts and liabilities is crucial. Comprehending these obligations enables improved negotiation of terms or possible restructuring, alleviating monetary strain and fostering a more sustainable economic environment.

-

Performance Metrics Review: Regular assessment of key performance indicators (KPIs) offers benchmarks for organizational performance against industry standards. This insight empowers leaders to identify areas needing prompt intervention and improvement, supporting continuous performance monitoring and relationship-building.

-

Test & Measure: We are pragmatic in our approach to data. We test every hypothesis to deliver maximum return on invested capital in both the short and long term.

-

Decide & Execute: Our team supports a shortened decision-making cycle throughout the recovery process to allow your team to take decisive action to preserve your business.

-

Update & Adjust: We continually monitor the success of our plans and teams through our client dashboard, which provides real-time business analytics to continually diagnose your business health.

-

Ratio Analysis: Incorporating ratio analysis into the economic assessment process is essential for evaluating business performance. This method allows entities to evaluate their monetary well-being via different ratios, offering a clearer view of operational effectiveness and profitability.

By conducting a thorough fiscal evaluation, organizations can develop a targeted recovery strategy that emphasizes urgent measures while establishing the groundwork for long-term viability. As emphasized by PLANERGY, 'We’ve assisted in saving billions of dollars for our clients through improved spend management, process automation in purchasing and finance, and minimizing monetary risks.' This emphasizes the significance of utilizing economic evaluations to drive effective turnaround management strategies and achieve measurable outcomes.

Moreover, practical applications of monetary assessment, such as vertical analysis, evaluate a single column of numbers in statements, facilitating comparison of data within a single reporting period. This method exemplifies how entities can utilize financial assessments to enhance decision-making processes and operationalize lessons learned.

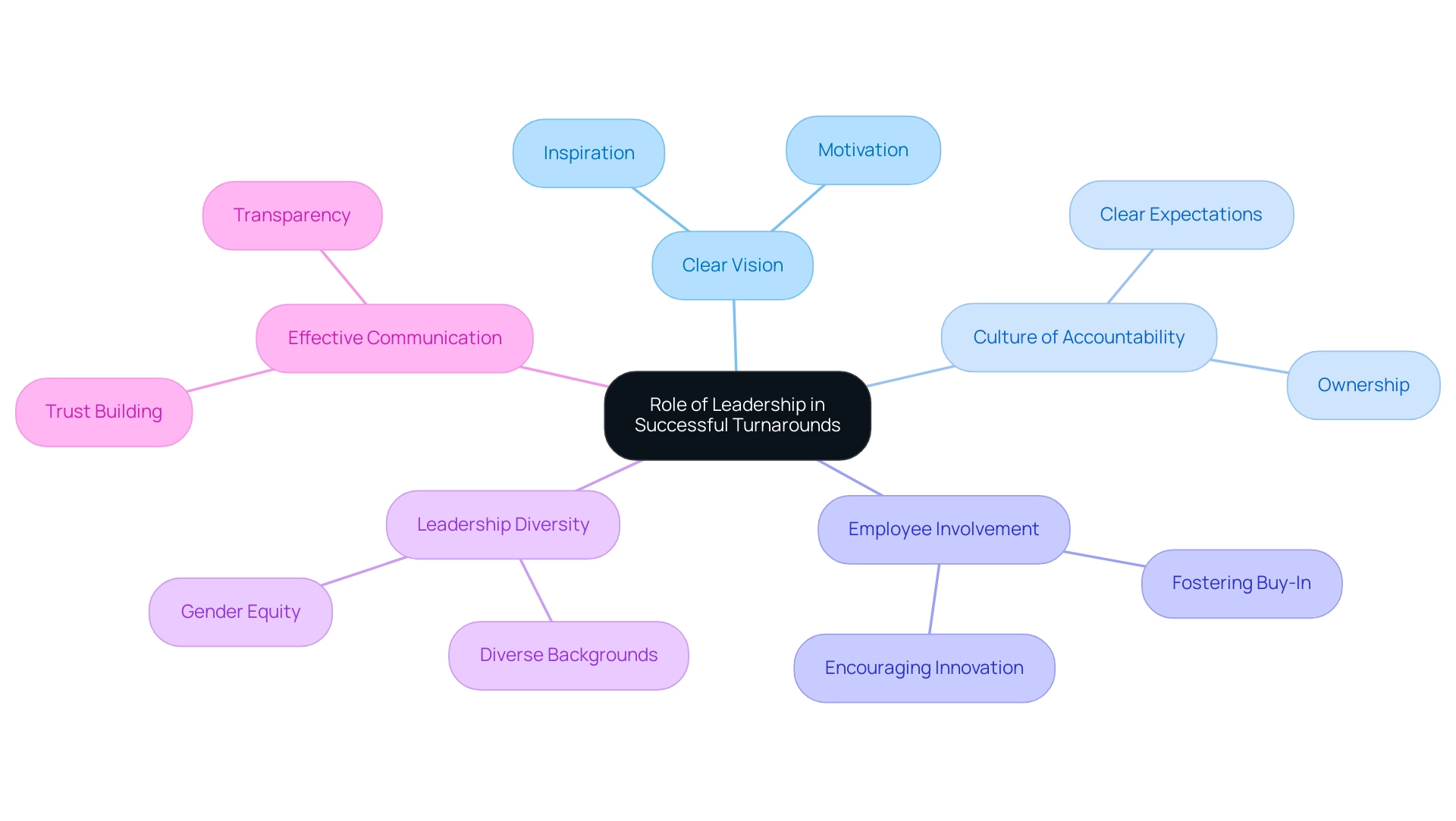

Role of Leadership in Successful Turnarounds

Effective leadership is essential in turnaround management during transitions, especially as organizations grapple with the complexities of change. A clear vision is paramount; leaders must articulate a compelling future that not only inspires but also motivates employees to embrace necessary transformations. This aligns with the statistic that indicates 76% of those struggling with change failed to consider their organizational culture—underscoring that a strong, cohesive culture is essential for success.

Equally important is fostering a culture of accountability.

By establishing clear expectations and encouraging ownership within the workforce, leaders can significantly enhance employee engagement and productivity during the recovery process. Tough decisions are also part of the equation; leaders must be prepared to make difficult choices, such as downsizing or reallocating resources, which require decisiveness and resilience.

Moreover, involving employees in the recovery journey is crucial. This involvement not only fosters buy-in but also invites innovative solutions that can drive meaningful improvements. As mentioned in our operational strategy, we continually monitor the success of our plans through real-time analytics and client dashboards, which allow for ongoing diagnostics of organizational health and operational adjustments.

These processes emphasize the importance of 'Decide & Execute' and 'Update & Adjust' methodologies in our approach.

Industry experts like Peter Griscom, M.S., with extensive experience in manufacturing and technology, and Jason Collyer, a Top 100 COO specializing in supply chain transformation, exemplify the caliber of leadership needed in these challenging times. Their backgrounds in Lean Finance and leadership in recovery bring valuable insights into integrating businesses effectively and operationalizing lessons learned.

The current landscape of leadership diversity cannot be overlooked. With just 18% of employees believing their leaders come from varied backgrounds and only 21% of entities actively seeking diverse candidate pools, those that emphasize diversity within their leadership groups are likely to create a more inclusive atmosphere favorable to successful transformations. The case study titled 'The State of Diversity in Leadership' illustrates that while the U.S. workforce is becoming more diverse, women and people of color remain underrepresented in leadership roles.

Firms with gender equity indicate greater revenue growth, highlighting the concrete advantages of diverse leadership in guiding entities through difficult periods.

Ultimately, effective communication is essential in turnaround management during recovery. Leaders must ensure that their vision and expectations are communicated clearly to all employees, fostering an environment of transparency and trust that is essential for navigating change successfully.

Challenges in Implementing Turnaround Strategies

Implementing turnaround management recovery strategies presents a series of formidable challenges that companies must navigate with precision and foresight. Key obstacles include:

- Resistance to Change: A significant factor in turnaround efforts is employee resistance, which often manifests in hesitancy to adopt new strategies. Research indicates that entities experiencing a return on investment (ROI) reduction of more than 10% face notable pushback, scoring an average of 5.5 on a scale of negative impact. Furthermore, a score of 3.5 indicates a somewhat negative impact, highlighting that even moderate declines in ROI can lead to resistance and complicate the implementation of new strategies. To combat this, a commitment to operationalizing the lessons learned from previous experiences can foster a culture that embraces change.

- Limited Resources: Financial constraints are a common obstacle, as entities may lack the capital needed to effectively implement turnaround initiatives. This situation necessitates a meticulous prioritization of actions to ensure that resources are allocated efficiently. By utilizing real-time analytics via client dashboards, CFOs can monitor economic health continuously and make informed decisions that enhance resource allocation. Testing hypotheses regarding resource allocation can further enhance ROI, ensuring that investments yield the best possible outcomes.

- Short-Term Focus: The pressure to meet immediate financial demands can lead entities to overlook long-term strategic goals, resulting in decisions that may jeopardize future viability. Streamlined decision-making processes can help maintain a balance between short-term needs and long-term objectives, enabling organizations to preserve their business while executing strategic plans. For instance, companies that prioritize long-term investments in technology often see sustained growth despite initial costs.

- Stakeholder Expectations: Balancing the expectations of stakeholders—including investors and creditors—can complicate the recovery process, particularly when there is pressure for swift results. Proactively engaging with stakeholders and clearly communicating the recovery strategy can alleviate some of these pressures, leading to a more supportive environment for change. A case in point is how a well-communicated recovery plan at Company X led to increased investor confidence, allowing for necessary investments in the recovery process.

As Noman aptly noted, "Managerial cognition includes stakeholders' competitive environment, formulates strategies that orient towards the external environment, and perceives the potential uses of a company's resources to respond to an environmental change." By proactively anticipating these challenges and devising strategic responses, organizations can significantly enhance their chances of successful management. The case of Kenya Airways underscores the importance of leadership and employee involvement during such transitions.

Authoritative leadership, effective management-union negotiations, and the operationalization of lessons learned are crucial for overcoming resistance and fostering a culture receptive to change. Recognizing that different leadership approaches are necessary during turnaround situations compared to stable operational periods can also provide a roadmap for CFOs aiming to cultivate a more resilient business model. Furthermore, the economic challenges faced by companies in Greece during downturns illustrate the broader context in which these strategies must be implemented, emphasizing the need for CFOs to navigate external pressures effectively.

Conclusion

Turnaround management is not merely a reactive measure; it is a proactive strategy essential for revitalizing struggling organizations. By implementing key strategies such as:

- Financial restructuring

- Operational improvements

- Leadership changes

- Market repositioning

- Stakeholder engagement

companies can effectively navigate the complexities of their situations. A thorough financial assessment serves as the backbone of these efforts, allowing organizations to identify weaknesses and opportunities for improvement, ensuring that they are equipped to make informed decisions that drive sustainable growth.

Leadership plays a pivotal role in the success of turnaround initiatives. A clear vision, a culture of accountability, and effective communication are crucial components that foster employee engagement and innovation. By embracing diversity within leadership teams, organizations can cultivate a more inclusive environment that enhances their ability to adapt and succeed in challenging times.

However, the journey is fraught with challenges, including:

- Resistance to change

- Limited resources

Addressing these obstacles requires a commitment to operationalizing lessons learned and leveraging real-time analytics for informed decision-making. By balancing short-term demands with long-term strategic goals, organizations can not only survive but thrive in the face of adversity.

In conclusion, mastering turnaround management is imperative for CFOs aiming to steer their organizations toward a prosperous future. By embracing a comprehensive approach that prioritizes strategic interventions and fosters a culture of resilience, businesses can emerge stronger, more agile, and better prepared for sustainable success in an ever-evolving marketplace.

Frequently Asked Questions

What is turnaround management?

Turnaround management is a critical process aimed at revitalizing struggling organizations through targeted strategic interventions and operational improvements, particularly by leveraging AI and machine learning to enhance efficiency.

When is turnaround management typically activated?

Turnaround management is typically activated in response to financial distress, poor performance, or market challenges.

What are the initial steps in the turnaround management process?

The initial steps include a thorough assessment of the organization's financial health, operational efficiency, and market positioning.

How does real-time analytics contribute to turnaround management?

Continuous monitoring through real-time analytics, available via client dashboards, ensures that performance is consistently evaluated, enabling quick adjustments in strategy as needed.

What role does professional development play in turnaround management?

Investing in professional development opportunities can increase employee engagement by 15% and retention by 34%, underscoring the importance of cultivating a skilled workforce during revitalization efforts.

What are some critical strategies for effective recovery management?

Key strategies include financial restructuring, operational improvements, leadership changes, market repositioning, and stakeholder engagement.

What is involved in financial restructuring?

Financial restructuring focuses on renegotiating debts, enhancing cash flow management, and identifying cost-cutting opportunities to stabilize the organization's financial base.

How can operational improvements boost efficiency?

Streamlining operations through process reengineering, optimizing supply chain management, and leveraging technology to automate tasks can significantly enhance efficiency and reduce overhead costs.

Why might a shift in leadership be necessary during a turnaround?

A shift in leadership can introduce fresh perspectives and drive necessary changes, enhancing direction and accountability within the organization.

What is the importance of market repositioning in turnaround management?

Market repositioning involves understanding market dynamics and aligning the organization with consumer needs, which is essential for redefining the value proposition and targeting new customer segments.

How does stakeholder engagement contribute to recovery?

Transparent communication with stakeholders—employees, creditors, and suppliers—builds support and fosters a collaborative recovery process, addressing both quantitative and qualitative issues effectively.

What are the expected outcomes of successfully implementing turnaround management strategies?

Successfully implementing these strategies can help entities navigate challenges, emerging more robust, resilient, and better prepared for sustainable growth.