Overview

This article outlines essential cash preservation strategies that CFOs can implement to bolster financial stability within their organizations. It underscores the necessity of:

- Conducting thorough financial assessments

- Crafting effective budgets

- Diversifying investments

- Maintaining adequate cash reserves

Each of these elements plays a pivotal role in managing risks and ensuring liquidity in today’s volatile economic landscape. Moreover, understanding these strategies not only mitigates risks but also positions organizations for sustainable growth. Consequently, CFOs are encouraged to adopt these practices to navigate the complexities of financial management effectively.

Introduction

In a landscape where financial stability is paramount for small and medium enterprises, understanding the nuances of cash flow management can make all the difference. With rising concerns over late payments and economic uncertainties, businesses must adopt comprehensive financial assessment services that not only pinpoint inefficiencies but also reveal opportunities for cost reduction.

By leveraging innovative strategies, such as:

- Diversification of investments

- Meticulous budgeting

Organizations can build a robust financial framework that safeguards against market volatility. Moreover, as the economic environment continues to evolve, the integration of technology and expert insights into financial planning will be crucial for sustaining growth and ensuring long-term success. This article delves into essential strategies that empower businesses to enhance their financial health, navigate risks, and secure their future.

Transform Your Small/ Medium Business: Comprehensive Financial Assessment Services

A thorough economic evaluation service is crucial for small and medium enterprises striving to improve liquidity management. This involves a detailed examination of flow statements, balance sheets, and income statements to reveal inefficiencies and pinpoint opportunities for cost reduction. A comprehensive fiscal assessment can assist in recognizing opportunities for cash preservation strategies and in lessening obligations, which is essential for sustaining economic stability.

Moreover, frequent financial evaluations not only assist organizations in optimizing operations but also allow precise prediction of future financial requirements, equipping them for unexpected costs. In fact, 51% of small and medium enterprises (SMEs) view accounts receivable and collections as a key issue, and notably, 37% of small business owners have contemplated closing their operations because of delayed payment problems. This highlights the importance of efficient financial flow strategies.

Furthermore, mastering the currency conversion cycle through strategic methods can greatly improve organizational performance and profitability. The incorporation of cloud-based accounting software has transformed how SMEs handle their resources, facilitating better decision-making and ultimately resulting in enhanced economic outcomes. By utilizing technology, companies can enhance their monetary evaluations through cash preservation strategies, ensuring they retain funds and sustain stability in a continuously changing economic environment.

As mentioned by ForwardAI, 10% of overdue payments are regarded as bad debt, emphasizing the economic effect of late payments on SMEs. Additionally, with 54% of U.S. small enterprises having pursued a business loan or line of credit in 2018, the monetary pressures on SMEs further highlight the significance of cash preservation strategies for efficient liquidity management.

To implement these methods successfully, consider the following practical suggestions:

- Frequently examine revenue flow statements to recognize patterns;

- Establish a strong accounts receivable procedure to reduce delayed payments;

- Use assessment services to gain insights into cost-saving opportunities.

Diversification: Mitigate Risks Through Asset Allocation

Diversifying investments among different asset classes—such as stocks, bonds, and real estate—is a crucial strategy for mitigating risks associated with market fluctuations. By allocating financial resources across various investment types, companies can utilize cash preservation strategies to safeguard their cash reserves from significant losses during economic downturns. A well-structured portfolio should feature a mix of high-risk and low-risk assets, achieving a balance between potential returns and safety.

Recent trends reveal that small businesses are increasingly recognizing the advantages of diversification. Studies indicate that companies that implement diverse investment strategies can bolster their market position and enhance profit margins. As one analyst noted, "Diversification can enhance revenue and lower reliance on a single income source, but it may also lead to increased expenses and complexity that accompany certain risks."

Moreover, economic analysts stress that effective asset allocation is vital for sustaining economic stability. In 2025, the emphasis on currency-hedged ETFs has gained momentum, serving as a buffer against exchange rate fluctuations and facilitating safer foreign investments. This trend underscores the necessity of creating a balanced investment portfolio that not only seeks growth but also employs cash preservation strategies to prioritize risk mitigation. Additionally, investing in self-storage has emerged as a stable option during economic downturns, further illustrating the merits of diversification.

Successful asset allocation examples demonstrate that businesses can achieve a harmonious balance that aligns with their financial objectives and risk tolerance. Corporate diversification strategies, including horizontal and vertical integration, have proven effective in enhancing market share while reducing costs. By adopting these strategies, CFOs can navigate the complexities of investment while ensuring sustainable growth and resilience in challenging economic climates.

Fixed Income Investments: Secure Steady Cash Flow

Investing in fixed income securities, such as government and corporate bonds, offers companies a reliable source of income—especially advantageous in today’s economic landscape. These investments typically present lower risk compared to equities, making them an appealing choice for stabilizing financial flow during uncertain times. By strategically allocating a portion of their investment portfolio to fixed income, organizations can utilize cash preservation strategies to secure predictable cash inflows, essential for covering operational expenses and maintaining financial health.

In 2025, average returns on fixed income investments are projected to provide small businesses with a cushion against market volatility. Current statistics reveal that fixed income securities have demonstrated resilience during economic downturns, reinforcing their value as a cornerstone of a balanced investment strategy. Corporate bonds, in particular, can play a crucial role in stabilizing liquidity, frequently providing steady returns that help mitigate economic risks. Moreover, government bonds are recognized for their dependability, contributing to consistent monetary inflows that enhance overall financial stability.

Alan Wynne, a Global Investment Strategist, notes that with the resurgence of diversification, this discussion centers on global equities and fixed income. This underscores the significance of integrating fixed income investments into a diversified portfolio. Furthermore, investors are encouraged to transition from liquid assets to short-term municipal bonds or high-quality corporate options for improved returns, offering practical guidance for CFOs aiming to refine their investment strategies.

Additionally, the integration of real-time analytics and streamlined decision-making processes can substantially enhance how CFOs manage these investments. By consistently monitoring performance through client dashboards, companies can make informed decisions that improve their financial flow management approaches. As organizations navigate challenging times, the advantages of investing in fixed income securities become increasingly evident, paving the way for sustainable growth and effective cash preservation strategies for enhanced cash flow management. It is also crucial for CFOs to remain vigilant about potential conflicts of interest, such as those that may arise with firms like J.P. Morgan, which could influence investment decisions.

To further bolster monetary stability, CFOs should routinely assess their investment strategies, identifying underlying operational issues and formulating plans to mitigate vulnerabilities while measuring the returns on their investments.

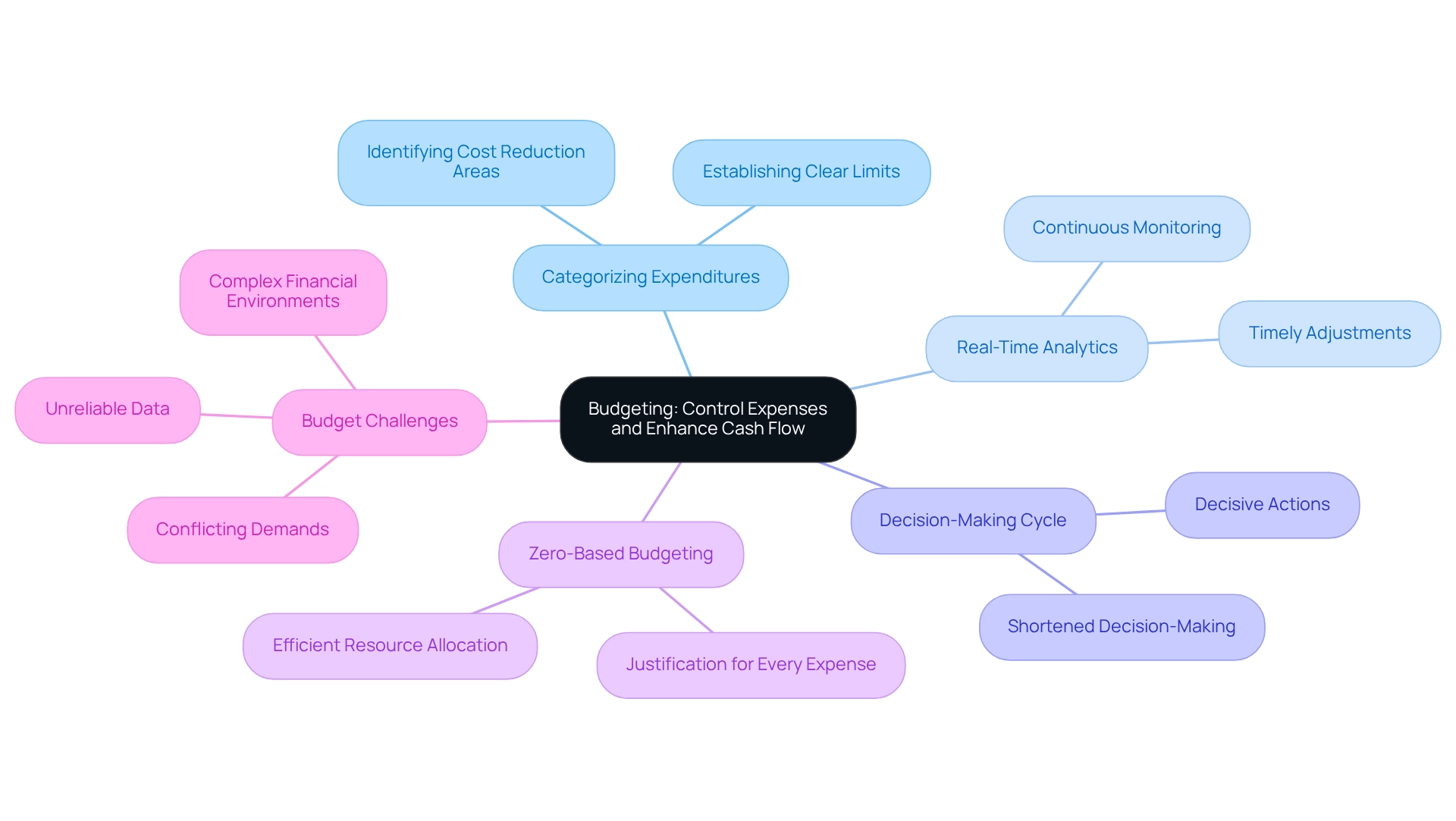

Budgeting: Control Expenses and Enhance Cash Flow

A meticulously crafted budget is essential for organizations aiming to track their income and expenses effectively. By categorizing expenditures and establishing clear limits, organizations can pinpoint areas ripe for cost reduction. Frequent evaluations and modifications to the budget enable companies to adjust to changing economic environments, thereby maintaining a strong cash flow.

Moreover, the integration of real-time analytics into the budgeting process, facilitated by our client dashboard, allows CFOs to continuously monitor financial health and make timely adjustments that enhance decision-making and operational efficiency. The shortened decision-making cycle supports this process, enabling decisive actions that preserve business resources.

As noted, budget analysis can be a powerful instrument for achieving public interest and common good, reinforcing the critical role of budgeting in organizational success. The adoption of zero-based budgeting further strengthens cash preservation strategies by requiring justification for every expense, ensuring that resources are allocated efficiently and strategically. This method not only improves monetary discipline but also cultivates a culture of responsibility, essential for managing the intricacies of today's economic landscape.

As Grant Cardone aptly states, "Don’t think you need to earn a certain amount of money to become wealthy. It’s how you manage your money that determines how much you have left to live the life you want."

Furthermore, budget analysts frequently encounter difficulties like intricate economic conditions and competing requirements, emphasizing the need for efficient budgeting approaches and the potential for creative solutions.

Market Volatility: Develop Strategies to Protect Cash Reserves

Market Volatility: Develop Cash Preservation Strategies

To protect cash reserves during periods of market volatility, organizations must implement effective cash preservation strategies through robust contingency plans. This involves cash preservation strategies, which include maintaining larger cash reserves and diversifying investment portfolios. Here are some practical approaches:

- Maintain Higher Cash Reserves: Aim to keep a buffer sufficient to cover at least three to six months of operating expenses.

- Diversify Investment Portfolios: Spread investments across various asset classes to mitigate risk.

- Hedge Against Currency Fluctuations: Employ instruments designed to protect against adverse currency movements.

- Utilize Options for Protection: Explore options contracts to shield against potential investment losses.

Our team will identify underlying issues within the company and collaborate to formulate a plan that addresses weaknesses, enabling the organization to reinvest in its key strengths. By continuously monitoring performance and evaluating investment theories, companies can adapt their strategies in real-time, effectively managing uncertainties and enhancing economic stability.

Risk Management: Identify and Mitigate Financial Threats

Executing a thorough risk management plan is essential for recognizing possible economic threats that small enterprises may encounter in 2025. These threats include:

- Economic downturns

- Supply chain disruptions

- Regulatory changes

- Dangers linked to climate change, such as extreme weather events

Routine monetary evaluations, such as those provided by Transform Your Small/ Medium Business, are crucial; they allow enterprises to identify weaknesses and create effective cash preservation strategies that protect resources while reducing obligations. Key strategies involve:

- Diversifying suppliers to lessen reliance

- Ensuring adherence to changing regulations

- Establishing emergency funds to cushion against unforeseen economic shocks

Proactive actions not only protect financial flow but also improve overall monetary stability, contributing to sustainable growth and enduring success.

According to a recent survey of 3,778 respondents, effective risk management practices significantly contribute to sustainable growth and long-term success. Companies are increasingly recognizing that the interconnectedness of risks—highlighted in the Allianz Risk Barometer—requires a holistic approach to navigate complexities effectively. By prioritizing risk control and loss avoidance, CFOs can better prepare their organizations for unforeseen events, ultimately enhancing cash preservation strategies and supporting operational resilience.

For effective risk assessments, CFOs may consider utilizing frameworks such as the COSO ERM framework, which provides structured guidance for identifying and managing risks. Moreover, utilizing real-time analytics can enable a shortened decision-making cycle, permitting rapid actions that improve organizational performance and implement lessons learned from previous experiences.

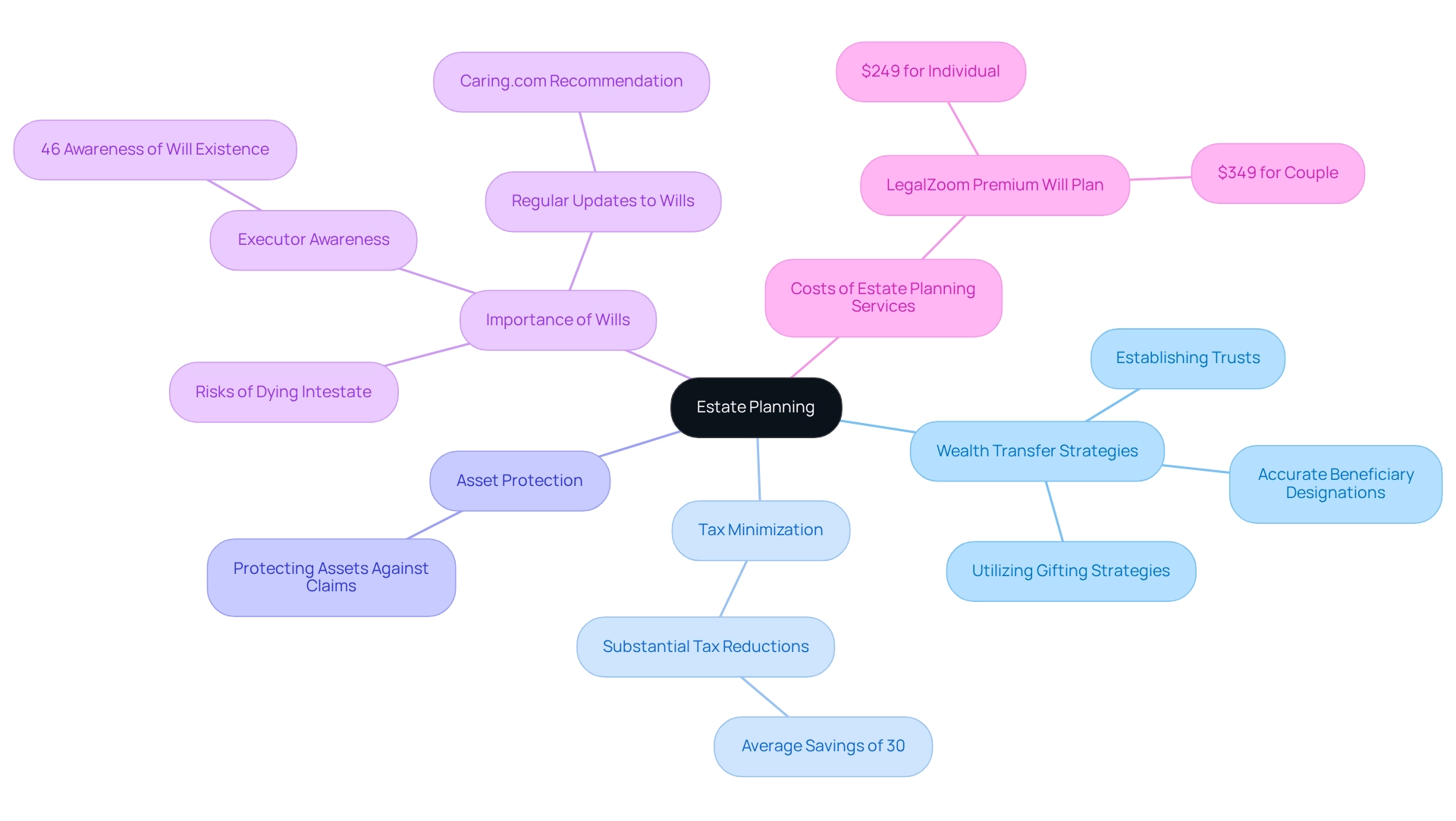

Estate Planning: Ensure Wealth Transfer and Preservation

Effective estate planning is crucial for entrepreneurs aiming to transfer wealth to heirs while minimizing tax obligations. This involves developing a robust strategy that may include:

- Establishing trusts

- Utilizing gifting strategies

- Ensuring accurate beneficiary designations

By proactively planning, companies can protect their assets against potential claims and preserve their wealth for future generations. Importantly, successful estate planning can result in substantial tax reductions; small enterprises can save an average of 30% in taxes through strategic planning.

Moreover, a recent study revealed that only 46% of will executors were aware of the existence of a will, underscoring the necessity of clear communication regarding estate plans. Interacting with wealth advisors can also offer perspectives on reducing tax obligations during asset transfer, ensuring that owners are well-prepared to manage these intricacies.

The expenses linked to estate planning services, like LegalZoom's premium will estate plan priced at $249 for an individual and $349 for a couple, emphasize the monetary commitment necessary for effective planning. Additionally, the risks of dying intestate highlight the importance of having a will, as it leaves the courts to decide who receives your assets. Caring.com emphasizes the importance of drafting a will and making regular updates to avoid such situations.

Overall, a thorough estate plan not only safeguards assets but also incorporates cash preservation strategies, ensuring effective wealth transfer and long-term economic stability.

Cash Reserves: Build a Safety Net for Unforeseen Challenges

Building a strong reserve of funds is essential for establishing cash preservation strategies that can support an enterprise during unexpected difficulties. Financial experts advocate for cash preservation strategies that involve maintaining reserves equivalent to three to six months of operating expenses. This safety net allows companies to utilize cash preservation strategies to manage unforeseen expenses—like equipment malfunctions or abrupt revenue drops—without accumulating debt.

In 2025, the importance of cash preservation strategies is highlighted by the ongoing economic instability, making it essential for small enterprises to prioritize this approach. To effectively create a safety net, companies should utilize real-time analytics to routinely evaluate and modify their cash preservation strategies in reaction to changing market conditions. This proactive strategy not only protects against possible downturns but also improves overall economic stability.

By employing a client dashboard that offers real-time business analytics, CFOs can consistently assess their business health and make informed choices regarding financial reserves. Effective cash preservation strategies used by medium enterprises highlight the importance of disciplined savings and strategic monetary planning.

For example, the Dollar's ongoing supremacy in international trade, despite doubts regarding its stability, demonstrates the significance of preserving liquidity and flexibility in financial management. By applying optimal methods for resource preservation and employing efficient decision-making processes, CFOs can guarantee their organizations are prepared to confront any economic uncertainties that may emerge.

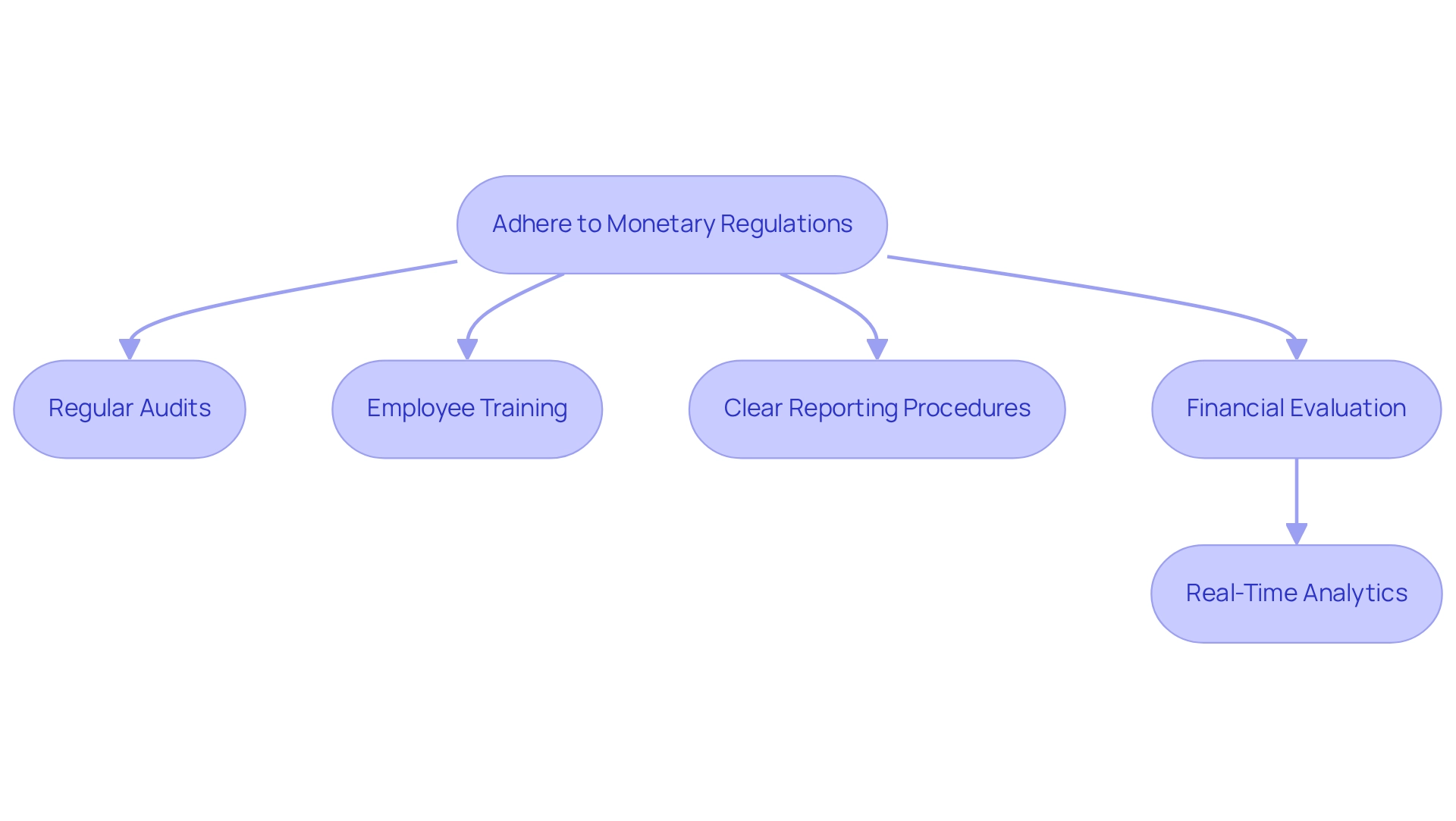

Financial Compliance: Adhere to Regulations to Protect Assets

Monetary Compliance: Follow Regulations to Safeguard Assets

Adhering to monetary regulations is essential for businesses to avoid costly penalties and protect their assets. Companies must establish robust compliance programs that encompass:

- Regular audits

- Employee training

- Clear reporting procedures

A thorough Financial Evaluation is vital; it can uncover opportunities for cash preservation strategies that sustain liquidity and reduce liabilities, ultimately supporting compliance initiatives. Staying informed about changes in regulations and ensuring that all monetary practices align with legal requirements is crucial for maintaining economic stability and safeguarding reserves.

Moreover, employing real-time analytics can streamline decision-making processes. This capability enables CFOs to continuously monitor organizational health and make informed adjustments to enhance overall performance. To fully leverage the advantages of a Financial Assessment, CFOs should schedule regular reviews and use the insights gained to proactively address potential compliance issues.

Consult Financial Advisors: Gain Expert Insights for Cash Preservation

Engaging with monetary consultants offers companies essential insights into tailored cash preservation strategies. These specialists are adept at identifying lucrative investment opportunities, optimizing liquidity management, and crafting comprehensive financial strategies that align with specific organizational needs. By leveraging real-time analytics and performance monitoring, companies can consistently assess their financial health and make informed decisions that align with cash preservation strategies while minimizing liabilities.

Regular consultations foster adaptability, enabling organizations to respond swiftly to evolving market conditions, thereby bolstering their financial stability. Camille Soulier correctly points out that to align a team towards a common goal, it’s essential to demonstrate how their daily efforts are reflected in measurable results. This underscores the importance of aligning team efforts with financial metrics.

For instance, platforms like Spendesk illustrate how modern financial tools enhance visibility and control over expenditures, empowering finance teams to manage costs effectively while allowing employees to make purchases without upfront payments. Moreover, the importance of thorough financial evaluations cannot be overstated; they play a pivotal role in identifying opportunities for cash preservation strategies and mitigating risks.

Furthermore, employing strategic debt, as advocated by industry leaders such as Grant Cardone, can improve cash flows and support growth initiatives. By integrating expert guidance into their financial strategies, CFOs can significantly bolster their organizations' resilience and long-term success. Consequently, CFOs are urged to actively pursue financial advisors to implement cash preservation strategies and strengthen their efforts.

Conclusion

In an increasingly unpredictable economic landscape, effective cash flow management stands as a cornerstone for the success of small and medium enterprises. By implementing comprehensive financial assessment services, businesses can uncover inefficiencies and identify opportunities for cost reduction, ultimately enhancing their financial health. The significance of meticulous budgeting, diversification of investments, and maintaining adequate cash reserves cannot be overstated. These strategies not only bolster resilience against market fluctuations but also ensure businesses are well-prepared for unforeseen challenges.

Moreover, the integration of technology, such as cloud-based accounting software and real-time analytics, plays a pivotal role in streamlining financial processes. This allows organizations to make informed decisions swiftly, adapt to changes, and safeguard their operations against potential risks. Engaging with financial advisors further enriches this approach, providing specialized insights that can lead to tailored cash preservation strategies.

As businesses continue to navigate the complexities of the modern economy, prioritizing financial discipline and strategic planning will be essential. By fostering a culture of accountability and proactive risk management, organizations can secure their future and achieve sustainable growth. Ultimately, the commitment to effective financial practices not only protects assets but also paves the way for long-term success in a competitive market.

Frequently Asked Questions

Why is a thorough economic evaluation service important for small and medium enterprises (SMEs)?

A thorough economic evaluation service is crucial for SMEs as it helps improve liquidity management by examining financial statements to identify inefficiencies and opportunities for cost reduction, which is essential for sustaining economic stability.

How can frequent financial evaluations benefit SMEs?

Frequent financial evaluations assist organizations in optimizing operations, allowing for precise prediction of future financial requirements and equipping them to handle unexpected costs.

What percentage of SMEs see accounts receivable and collections as a key issue?

51% of small and medium enterprises view accounts receivable and collections as a key issue.

What are some practical suggestions for improving financial health in SMEs?

Practical suggestions include frequently examining revenue flow statements, establishing a strong accounts receivable procedure to reduce delayed payments, and using assessment services to gain insights into cost-saving opportunities.

How can diversification of investments mitigate risks for SMEs?

Diversifying investments among various asset classes, such as stocks, bonds, and real estate, helps mitigate risks associated with market fluctuations and safeguards cash reserves from significant losses during economic downturns.

What role do fixed income securities play in a company's investment strategy?

Fixed income securities, such as government and corporate bonds, provide a reliable source of income and lower risk compared to equities, helping to stabilize financial flow during uncertain times.

What is the projected impact of fixed income investments on small businesses in 2025?

Average returns on fixed income investments are projected to provide small businesses with a cushion against market volatility, reinforcing their value in a balanced investment strategy.

How can technology enhance financial evaluations for SMEs?

The incorporation of cloud-based accounting software allows SMEs to handle resources more effectively, facilitating better decision-making and improving monetary evaluations through cash preservation strategies.

What is the significance of effective asset allocation for SMEs?

Effective asset allocation is vital for sustaining economic stability, as it helps businesses balance growth with risk mitigation by creating a diversified investment portfolio.

What should CFOs do to bolster monetary stability in their organizations?

CFOs should routinely assess their investment strategies, identify operational issues, formulate plans to mitigate vulnerabilities, and measure the returns on their investments to ensure monetary stability.