Overview

This article presents ten strategies for effectively managing long-term financial risk. It emphasizes the significance of:

- Comprehensive financial assessments

- Diversification

- Robust internal controls

- Continuous monitoring

- Other key elements

These strategies are underpinned by evidence demonstrating their capacity to enhance resilience and stability for small and medium enterprises (SMEs) within an uncertain economic landscape. Ultimately, these approaches empower SMEs to identify risks and seize opportunities for growth.

Introduction

In the dynamic landscape of small and medium enterprises (SMEs), navigating financial risks is paramount for sustainable growth and resilience. A comprehensive financial assessment serves as a critical tool, enabling businesses to scrutinize their cash flow, liabilities, and overall financial health. By identifying vulnerabilities and uncovering opportunities for improvement, regular assessments not only fortify risk management strategies but also foster a culture of financial awareness.

As SMEs increasingly anticipate revenue growth and workforce expansion, understanding their financial landscape has never been more crucial. This article explores the multifaceted approach to financial assessments, highlighting the importance of proactive strategies, expert guidance, and the integration of technology to empower businesses in their quest for stability and success.

Transform Your Small/ Medium Business: Comprehensive Financial Assessments for Risk Management

A thorough monetary evaluation is crucial for small and medium enterprises (SMEs) striving to effectively manage long-term financial risk amid economic uncertainties. This process entails a comprehensive examination of cash flow, liabilities, and overall financial condition, enabling companies to identify weaknesses and aspects ready for enhancement. Regular assessments not only help in identifying risks but also reveal opportunities for , which are essential for mitigating long-term financial risk.

Recent statistics show that 69% of small enterprises expect revenue growth in the coming year, with 37% intending to increase their workforce. This optimism underscores the significance of proactive economic health evaluation, particularly in the manufacturing sector, where 56% of companies anticipate expanding their workforce. The expanding business population, which experienced a 6.8% rise in the UK during the 2013-2014 period, further emphasizes the growing necessity for effective monetary evaluations as businesses develop.

Moreover, performing comprehensive monetary evaluations can greatly influence management approaches to address long-term financial risk. By understanding their financial landscape, SMEs can implement targeted measures to mitigate long-term financial risk, thereby ensuring they remain resilient in a competitive market. Expert guidance, such as that provided in the Business Valuation Report priced at $3,500.00, can enhance these assessments by utilizing AI/ML strategies to uncover value and reduce costs. As noted by Fundera, "80% of entrepreneurs invest additional hours working," highlighting the commitment needed to manage resources efficiently.

The advantages of regular monetary evaluations extend beyond immediate risk management; they promote a culture of economic awareness and strategic planning, ultimately leading to enhanced operational efficiency while effectively managing long-term financial risk. Streamlined decision-making processes and real-time analytics, supported by continuous performance monitoring, enable organizations to adapt swiftly to changing conditions. Minor enterprises are acknowledged as the foundation of the economy, playing an essential role in job creation and revenue generation, making economic evaluations even more vital. To discover additional information on how our evaluation services can assist your enterprise flourish, reach out to us today.

Diversification: Spread Your Investments to Minimize Risk Exposure

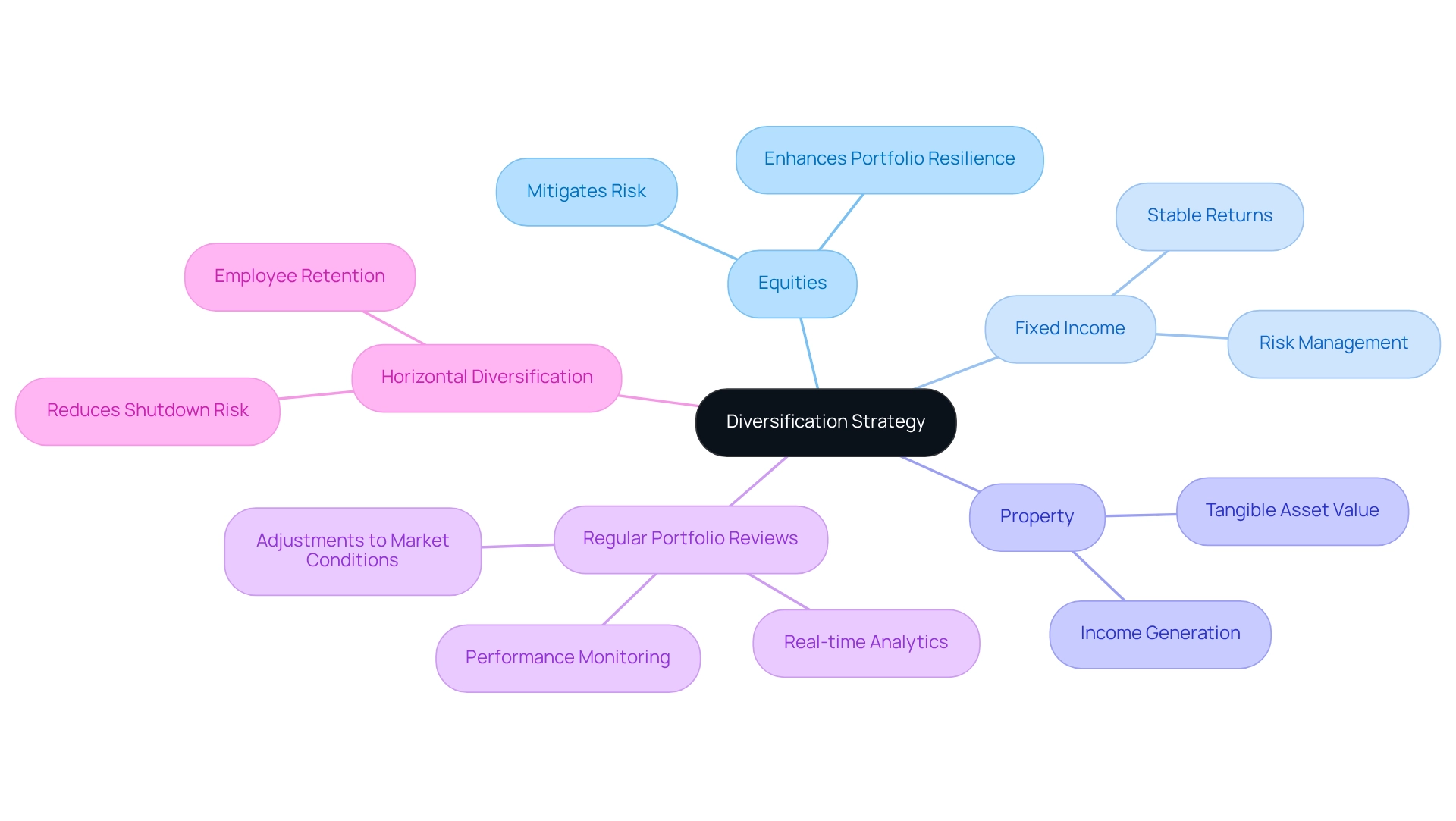

Investing in a diverse range of asset categories—such as equities, fixed income, and property—is essential for mitigating financial vulnerability among small enterprises. This strategy not only diminishes the impact of losses from any single investment but also bolsters overall portfolio resilience. A compelling case study on SMEs within the agrifood supply chain demonstrated that those employing horizontal diversification were markedly less likely to experience shutdowns or layoffs during market disruptions, including the challenges posed by the COVID-19 pandemic. This underscores the critical importance of diversification in fostering organizational resilience, as it enables companies to spread risk across various sectors.

Moreover, conducting regular portfolio reviews and making adjustments in response to market conditions are vital for sustaining an optimal level of diversification. As financial analysts emphasize, "This resource does not offer legal or investment guidance," highlighting the necessity for careful consideration in investment strategies. Diversification acknowledges the inherent limitations in predicting market fluctuations, allowing companies to navigate uncertain economic landscapes more adeptly. Current trends indicate that early-stage investors are increasingly engaged in overseeing their investments, further emphasizing the need for small enterprises to adopt robust diversification strategies to shield against unforeseen events.

To enhance decision-making and performance monitoring, CFOs should utilize real-time analytics to continuously evaluate their investment strategies. By employing client dashboards that provide real-time analytics, CFOs can assess their financial health and make informed adjustments to their portfolios. This proactive approach not only supports effective diversification but also cultivates a culture of continuous improvement and relationship-building within the organization. By balancing growth opportunities with potential inefficiencies, businesses can strategically position themselves for sustainable success.

To implement , CFOs must conduct regular portfolio reviews, evaluating the performance of various asset classes and making necessary adjustments to align with evolving market conditions.

Strong Internal Controls: Safeguard Your Assets and Ensure Compliance

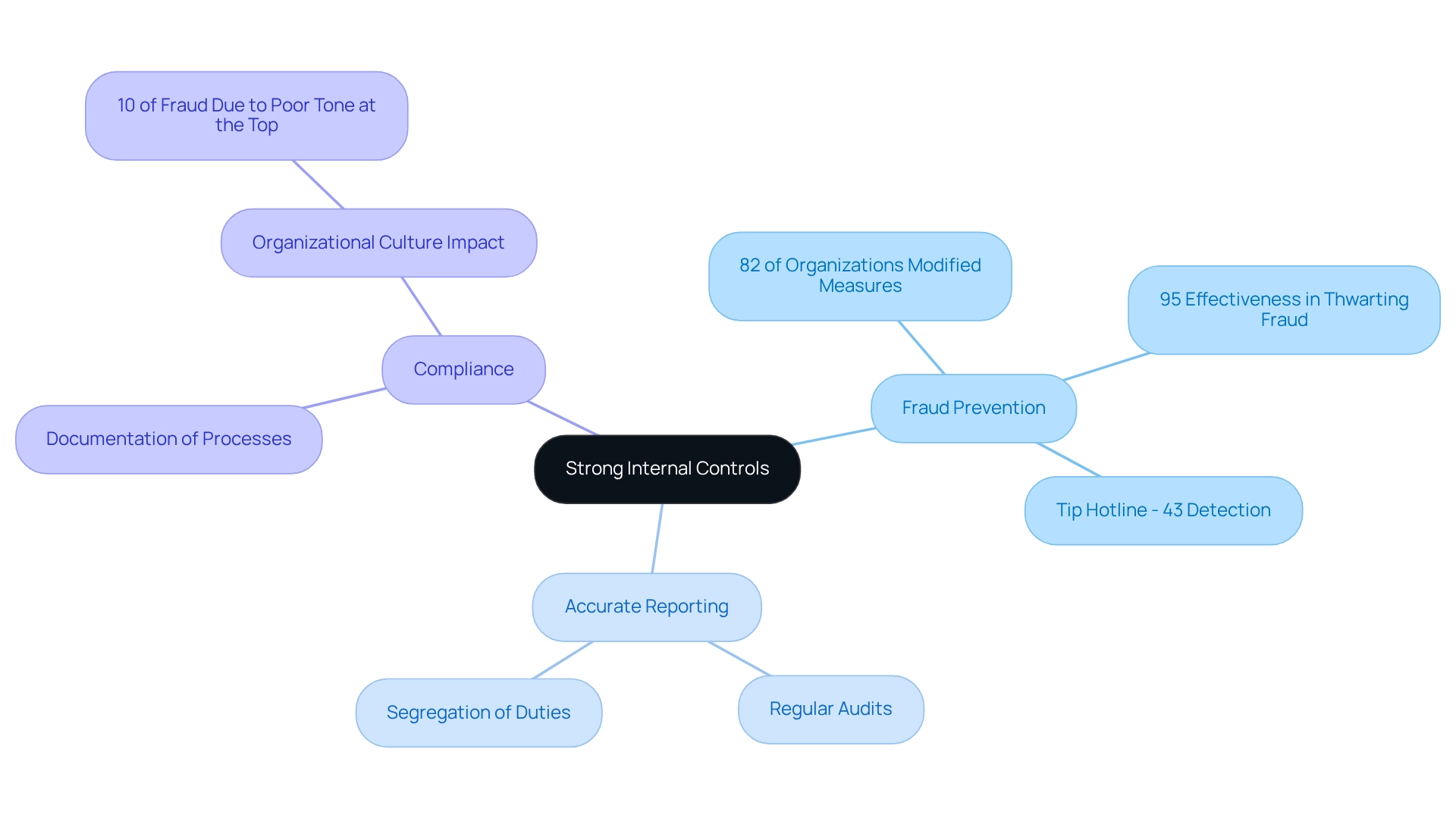

Robust internal controls encompass a comprehensive array of policies and procedures that govern monetary transactions and reporting. These controls are vital for preventing fraud, ensuring accurate reporting, and maintaining compliance with relevant laws and regulations. In 2024, a striking 82% of organizations modified their anti-fraud measures after experiencing fraud, highlighting the imperative for strong internal controls. Notably, 95% of these adjustments are anticipated to be effective in thwarting future fraud, underscoring the necessity of evolving internal controls in response to incidents.

Regular audits and assessments of these controls not only identify weaknesses but also present opportunities for enhancement, thereby bolstering overall financial security. Effective internal controls can significantly reduce the likelihood of occupational fraud, a phenomenon notably influenced by organizational culture; a detrimental tone at the top has been associated with 10% of such fraud cases. By fostering a culture of transparency and accountability, companies can further mitigate uncertainties. The financial repercussions of fraud are considerable, with large organizations facing a median loss of $138,000 per incident, as reported by .

Key components of robust internal controls include:

- Segregation of duties

- Regular reconciliations

- Thorough documentation of monetary processes

Furthermore, establishing a dedicated tip hotline can markedly enhance the likelihood of detecting fraud, as tips account for 43% of fraud detection cases. Implementing these strategies not only safeguards assets but also strengthens compliance initiatives, ultimately leading to sustainable growth and resilience against financial challenges.

Insurance Coverage: Protect Against Unforeseen Financial Risks

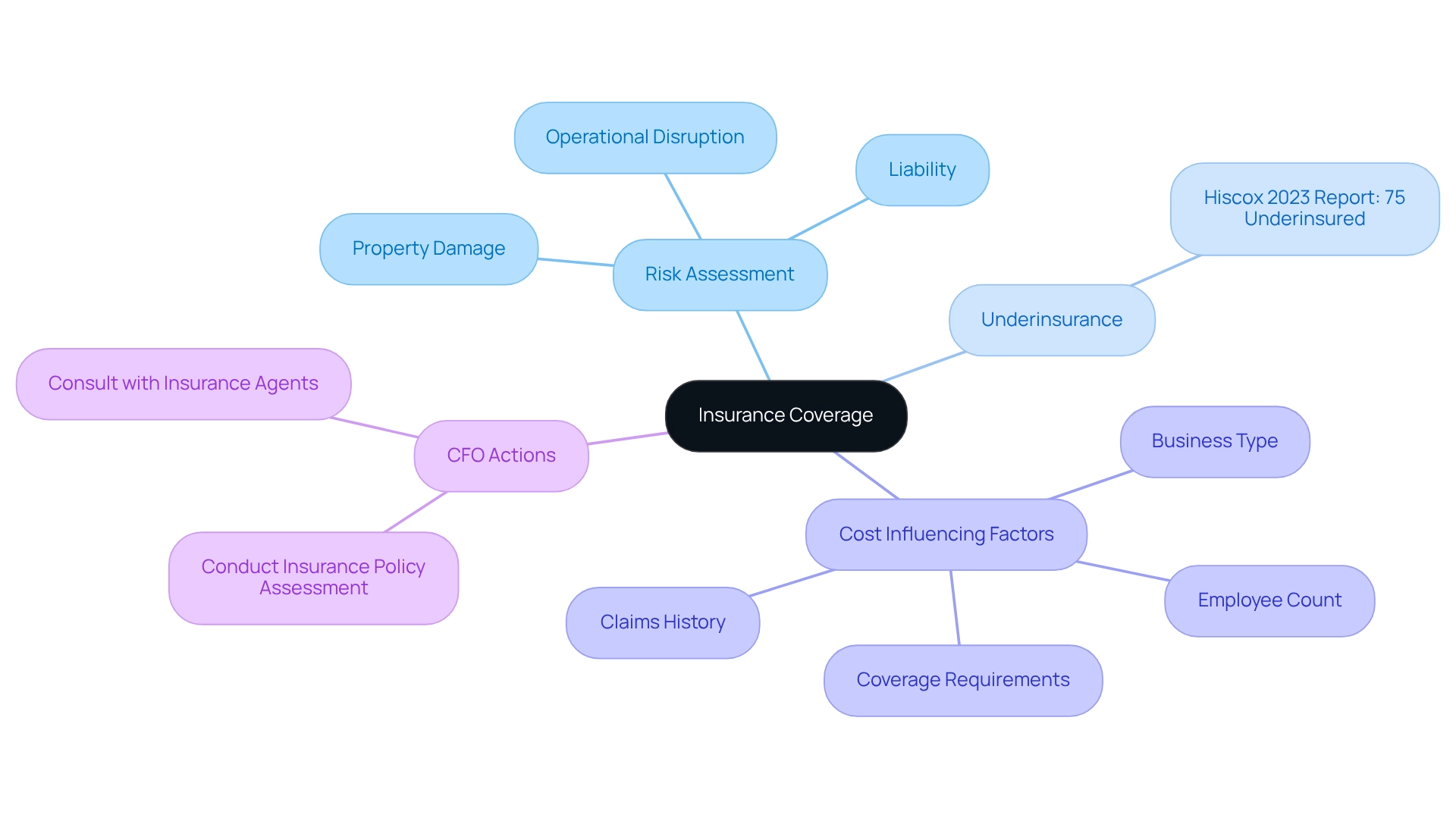

To effectively manage monetary risks, companies must in relation to potential hazards such as property damage, liability, and operational disruption. Comprehensive insurance coverage acts as a crucial safeguard against significant financial losses, providing peace of mind in uncertain times. Regular evaluations and adjustments of insurance policies are vital to ensure that coverage remains sufficient as the commercial landscape evolves.

Significantly, the Hiscox 2023 Report indicates that 75% of small enterprises are underinsured, underscoring the necessity for proactive engagement in annual insurance renewals and transparent communication with insurance agents regarding major changes. This vigilance is particularly essential given fluctuating revenues, as it empowers companies to adapt their insurance strategies to their evolving risk profiles. According to industry experts, the primary factors influencing small enterprise insurance costs include business type, employee count, coverage requirements, and prior claims history.

By prioritizing comprehensive coverage, SMEs can bolster their resilience against unforeseen economic challenges, ultimately fostering sustainable growth. As a critical next step, CFOs should conduct a thorough assessment of their current insurance policies and consult with their agents to ensure that their coverage adequately reflects their organization’s specific challenges.

Regular Financial Audits: Identify Risks and Ensure Financial Health

Regular fiscal audits are essential for businesses aiming to assess their economic health and ensure compliance with regulations. These audits not only uncover discrepancies and inefficiencies but also highlight potential areas that pose long-term financial risk and require immediate attention. For instance, a family-operated eatery employed a monetary assessment to identify its most lucrative menu items, guiding its approach to grow by launching two additional locations. This illustrates how audits can directly impact growth plans.

In 2025, statistics indicate that approximately 70% of small enterprises participate in audits at least yearly, viewing them as an essential part of their economic strategy rather than merely a requirement. By acting on the suggestions obtained from audit results, companies can strengthen their monetary practices to reduce long-term financial risk, leading to enhanced stability and resilience.

Moreover, technology has revolutionized the audit process, making it more efficient and accurate through advanced tools like data analytics and automated reporting. The integration of real-time commercial analytics, enabled by our client dashboard, allows companies to continuously monitor , promoting a shortened decision-making cycle during critical turnaround processes. This proactive strategy not only improves the effectiveness of audits but also enables organizations to take decisive actions based on real-time insights.

The case study titled 'Technology and Financial Audits' emphasizes how adopting these technological advancements improves the efficiency of audits, allowing organizations to detect long-term financial risks more promptly and precisely. As highlighted by industry specialists, the top accountants are not merely monetary managers; they are crucial in influencing economic outcomes, emphasizing the transformative impact of regular audits in protecting and improving a company's fiscal well-being.

Adequate Cash Reserves: Ensure Liquidity and Financial Stability

To ensure liquidity and economic stability, companies must maintain cash reserves adequate to cover three to six months of operating costs. This monetary buffer not only provides flexibility in managing unexpected expenses but also diminishes the reliance on credit during economic downturns.

Regular evaluations of cash flow are critical, allowing companies to adjust reserve levels in response to changing conditions. Our Monetary Assessment service offers a thorough evaluation that can help identify opportunities to conserve cash and reduce liabilities, essential for navigating economic uncertainties.

A survey revealed that 41% of small enterprise owners express concern over pandemic-related debt, underscoring the importance of cash reserves in this context. This concern is particularly pronounced among Black small-business owners, with 55% sharing similar worries, highlighting the economic pressures many face.

Maintaining adequate cash reserves is vital for small enterprises, as it directly impacts their ability to sustain operations and recover from economic shocks, helping to reduce long-term financial risk. Effective strategies for managing cash reserves include:

- Setting clear financial goals

- Leveraging technology for real-time fiscal monitoring through our client dashboard

- Adopting disciplined budgeting practices

Notably, 90% of small enterprise owners believe their accounting specialists play a crucial role in their success, emphasizing the value of financial expertise in effectively managing cash reserves.

By prioritizing cash reserves and utilizing real-time analytics, organizations can enhance their financial resilience and prepare for long-term success. We encourage you to engage with to gain deeper insights into optimizing your cash reserves.

Scenario Planning and Stress Testing: Prepare for Financial Downturns

Scenario planning is a strategic method that involves creating comprehensive forecasts of various potential future occurrences and their impacts on an organization. This approach empowers organizations to visualize different scenarios, ranging from economic downturns to market shifts, and evaluate their possible effects on operations and finances. Stress testing these scenarios is essential, as it uncovers vulnerabilities within the organization and prepares appropriate responses to mitigate long-term financial risk, making it crucial to regularly update these plans in response to evolving market conditions to bolster resilience against economic shocks.

For example, a comparative analysis of changes in capital requirements revealed that significant increases for foreign banks in the U.S. were directly influenced by shifts in regulatory methodologies. This underscores the need for companies to proactively adjust their monetary strategies, particularly through effective stress assessments to address long-term financial risk. Current trends indicate that stress testing is increasingly vital for small and medium-sized enterprises, providing them with the insights necessary to navigate economic downturns effectively.

By employing scenario planning, organizations can not only prepare for potential challenges but also seize opportunities that arise during turbulent times. Statistics show that companies engaged in scenario planning are better equipped to manage uncertainties, resulting in improved economic outcomes. The interest in these topics is evident, with 330,349 views on related blog articles highlighting their significance in the economic community.

In 2025, successful instances of stress testing among medium-sized firms will demonstrate the effectiveness of these approaches in fostering economic resilience. As industry specialists emphasize, the relationship between uncertainty and return is complex and variable, making it imperative for CFOs to prioritize scenario planning and stress testing to effectively manage long-term financial risk as integral components of .

The commitment to operationalizing lessons learned through the turnaround process can significantly enhance decision-making cycles, enabling teams to take decisive actions based on real-time analytics. Suze Orman aptly noted that economic independence entails freedom from concerns about life's unpredictabilities, underscoring the broader implications of effective financial management. Additionally, BPI's testimony suggests that inviting public comment on scenarios and supervisory models would enhance transparency and improve model accuracy in stress testing, reflecting the evolving practices in the field.

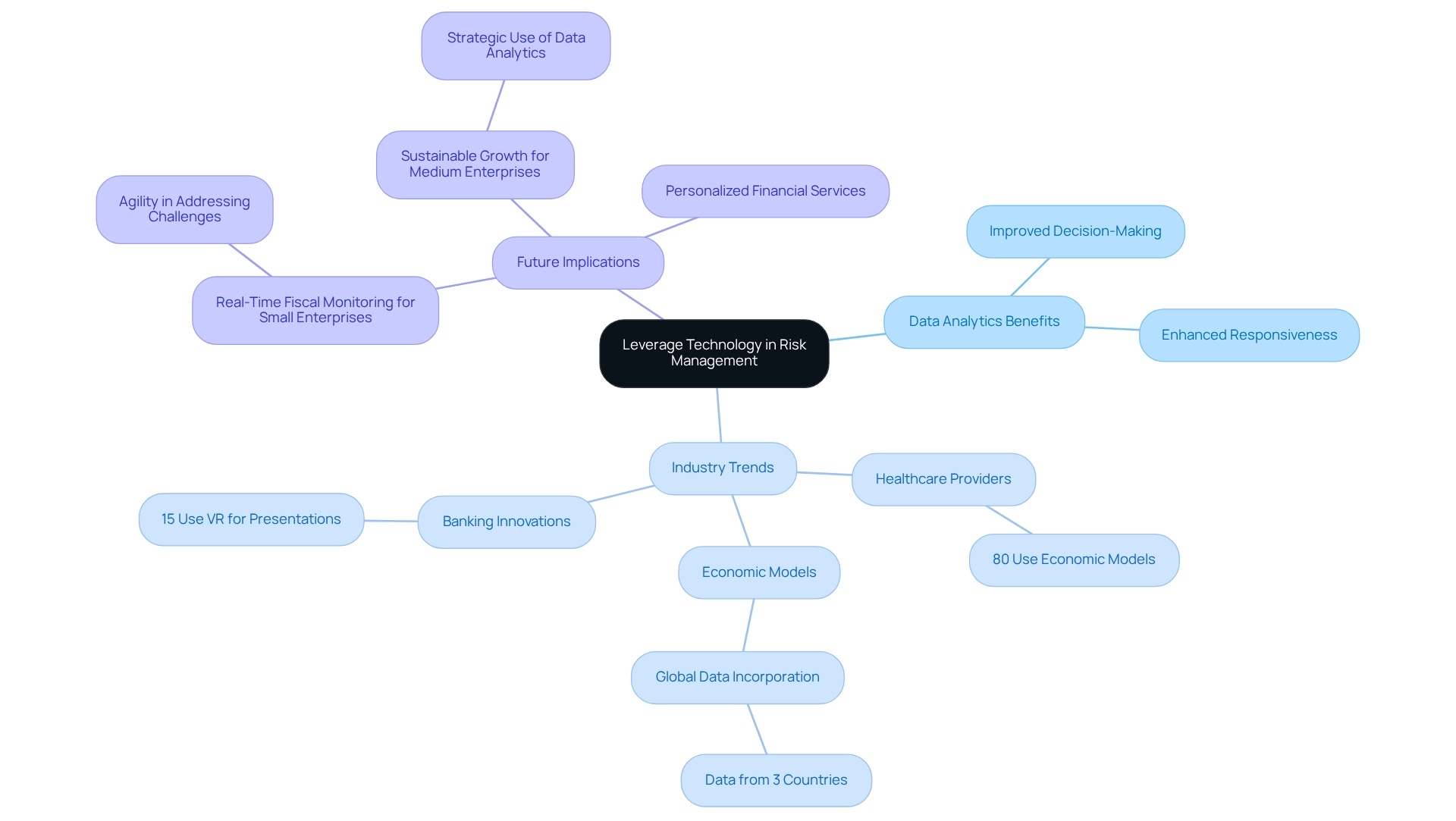

Leverage Technology: Use Data Analytics for Informed Risk Management

Data analytics tools empower companies to effectively track financial performance, recognize trends, and assess exposure in real-time. By harnessing technology, organizations can make informed decisions based on accurate data, significantly enhancing their responsiveness to potential risks. Our approach emphasizes testing hypotheses and operationalizing lessons learned, thereby supporting a streamlined decision-making cycle that is crucial for effective turnaround strategies.

A recent trend reveals that:

- 80% of healthcare providers employ economic models to improve resource allocation, underscoring the cross-industry relevance of data analytics for effective decision-making.

- Economic models typically incorporate data from at least three distinct nations, illustrating a global perspective in evaluation.

- Notably, 15% of banking institutions have begun experimenting with Virtual Reality (VR) for immersive economic model presentations, showcasing innovative methods in the field.

Investing in advanced analytics capabilities not only leads to more effective risk management strategies but also helps in mitigating long-term financial risk while enhancing performance monitoring. For small enterprises in 2025, utilizing data analytics can facilitate real-time fiscal monitoring, enabling them to address challenges with agility. in medium enterprises demonstrates that improved economic decision-making is achievable through the strategic use of data analytics, ultimately fostering sustainable growth. Moreover, the increasing emphasis on tailored monetary services highlights how technology is transforming economic decision-making, making it more relevant to the unique requirements of companies today.

Strategic Partnerships: Share Risks and Enhance Financial Resilience

Strategic partnerships offer companies a pathway to access new markets, resources, and expertise, effectively distributing the risks associated with expansion and new initiatives. Collaborating with other organizations not only enhances financial resilience but also fosters a robust support network that aids in navigating challenges. For instance, small enterprises engaging in strategic alliances can experience significant advantages, including enhanced cash flow management and decreased operational expenses.

In 2025, the trend of risk sharing through partnerships is gaining momentum, with many organizations recognizing that collaboration can lead to innovative solutions and shared expertise. Data suggest that enterprises utilizing strategic collaborations experience a 20% rise in economic stability compared to those that operate independently. Additionally, RollWorks experienced a 7% increase in integration usage after just one quarter, highlighting the tangible benefits of collaboration.

Moreover, such as the alliance between Ben & Jerry’s and Wattpad, which sought to improve brand perception within the LGBTQ+ community, illustrate how partnering with the right associates can foster growth and economic stability. By streamlining decision-making procedures and utilizing real-time analytics, organizations can continually monitor their performance and adjust strategies as necessary.

As John Smit, Senior Channel Sales Manager at Introhive, noted, prioritizing ecosystem qualified leads (EQLs) can significantly enhance sales outcomes. By distributing uncertainties and utilizing data-informed insights, organizations can not only protect their economic wellbeing but also mitigate long-term financial risk while preparing for enduring achievement in an increasingly competitive environment.

Continuous Monitoring: Stay Ahead of Economic Indicators to Manage Risks

To effectively manage , businesses must establish a robust system for continuously monitoring key economic indicators, including:

- Interest rates

- Inflation

- Unemployment rates

- Market trends

As of February 2025, the inflation rate stands at 2.8%, highlighting the need for caution in money management. By staying informed about these indicators, organizations can make timely adjustments to their strategies and operations, thereby minimizing the impact of adverse economic conditions.

Our consulting services include thorough financial reviews that emphasize streamlined decision-making and real-time analytics, enabling CFOs to preserve cash and reduce liabilities. Regular reviews of economic data not only help identify emerging risks but also uncover potential opportunities for mitigating long-term financial risk. We assist the 'Identify & Plan' stage by diagnosing organizational health and the 'Decide & Execute' stage through actionable insights.

Moreover, our client dashboard offers real-time analytics, ensuring that CFOs have the tools necessary to navigate the complexities of today's economic landscape. This proactive approach is essential for small to medium-sized businesses aiming to achieve sustainable success. We encourage CFOs to leverage our expertise in financial assessment and risk management to enhance their strategic planning.

Conclusion

Navigating the financial landscape is paramount for the sustainability and growth of small and medium enterprises (SMEs). Comprehensive financial assessments serve as vital tools that empower these businesses to pinpoint vulnerabilities, optimize cash flow management, and enact proactive strategies. By consistently evaluating their financial health, SMEs not only fortify their risk management frameworks but also cultivate a culture of financial awareness, leading to substantial cost savings and revenue growth.

Moreover, the integration of technology—such as real-time analytics and data-driven decision-making—enables businesses to swiftly adapt to fluctuating market conditions. This proactive approach, coupled with robust internal controls, sufficient cash reserves, and diversified investment strategies, aids SMEs in mitigating risks and seizing emerging opportunities. Regular financial audits further bolster this resilience, offering invaluable insights that inform strategic planning and enhance operational efficiency.

Ultimately, the dedication to comprehensive financial assessments and the adoption of innovative tools and strategies position SMEs for long-term success. As the business environment continues to shift, prioritizing these financial practices not only safeguards assets but also reinforces the foundational elements necessary for sustainable growth. By taking decisive action today, SMEs can navigate uncertainties with confidence, ensuring their lasting impact on the economy.

Frequently Asked Questions

Why is a thorough monetary evaluation important for SMEs?

A thorough monetary evaluation is crucial for SMEs to manage long-term financial risk amid economic uncertainties. It helps identify weaknesses, assess cash flow and liabilities, and reveals opportunities for cost savings and revenue growth.

What recent statistics highlight the importance of financial evaluations for small enterprises?

Recent statistics indicate that 69% of small enterprises expect revenue growth in the coming year, with 37% planning to increase their workforce. Additionally, 56% of manufacturing companies anticipate workforce expansion, emphasizing the need for proactive economic health evaluations.

How can comprehensive monetary evaluations influence management strategies?

Comprehensive monetary evaluations can guide management in implementing targeted measures to mitigate long-term financial risk, ensuring resilience in a competitive market.

What role does expert guidance play in monetary evaluations?

Expert guidance, such as that provided in a Business Valuation Report, can enhance monetary evaluations by utilizing AI/ML strategies to uncover value and reduce costs.

What are the benefits of regular monetary evaluations for SMEs?

Regular monetary evaluations promote a culture of economic awareness and strategic planning, leading to improved operational efficiency and effective management of long-term financial risk.

How does diversification help small enterprises mitigate financial vulnerability?

Investing in a diverse range of asset categories, such as equities, fixed income, and property, helps small enterprises spread risk and enhances overall portfolio resilience, reducing the impact of losses from any single investment.

What are the key components of effective diversification strategies?

Key components include conducting regular portfolio reviews, adjusting investments based on market conditions, and utilizing real-time analytics for informed decision-making.

What is the significance of robust internal controls for organizations?

Robust internal controls are essential for preventing fraud, ensuring accurate reporting, and maintaining compliance with laws and regulations. They help identify weaknesses and enhance overall financial security.

What are some key components of strong internal controls?

Key components include segregation of duties, regular reconciliations, thorough documentation of monetary processes, and establishing a dedicated tip hotline for fraud detection.

How can organizations foster a culture of transparency and accountability?

Organizations can mitigate uncertainties by fostering a culture of transparency and accountability, which helps reduce the likelihood of occupational fraud and strengthens compliance initiatives.