Overview

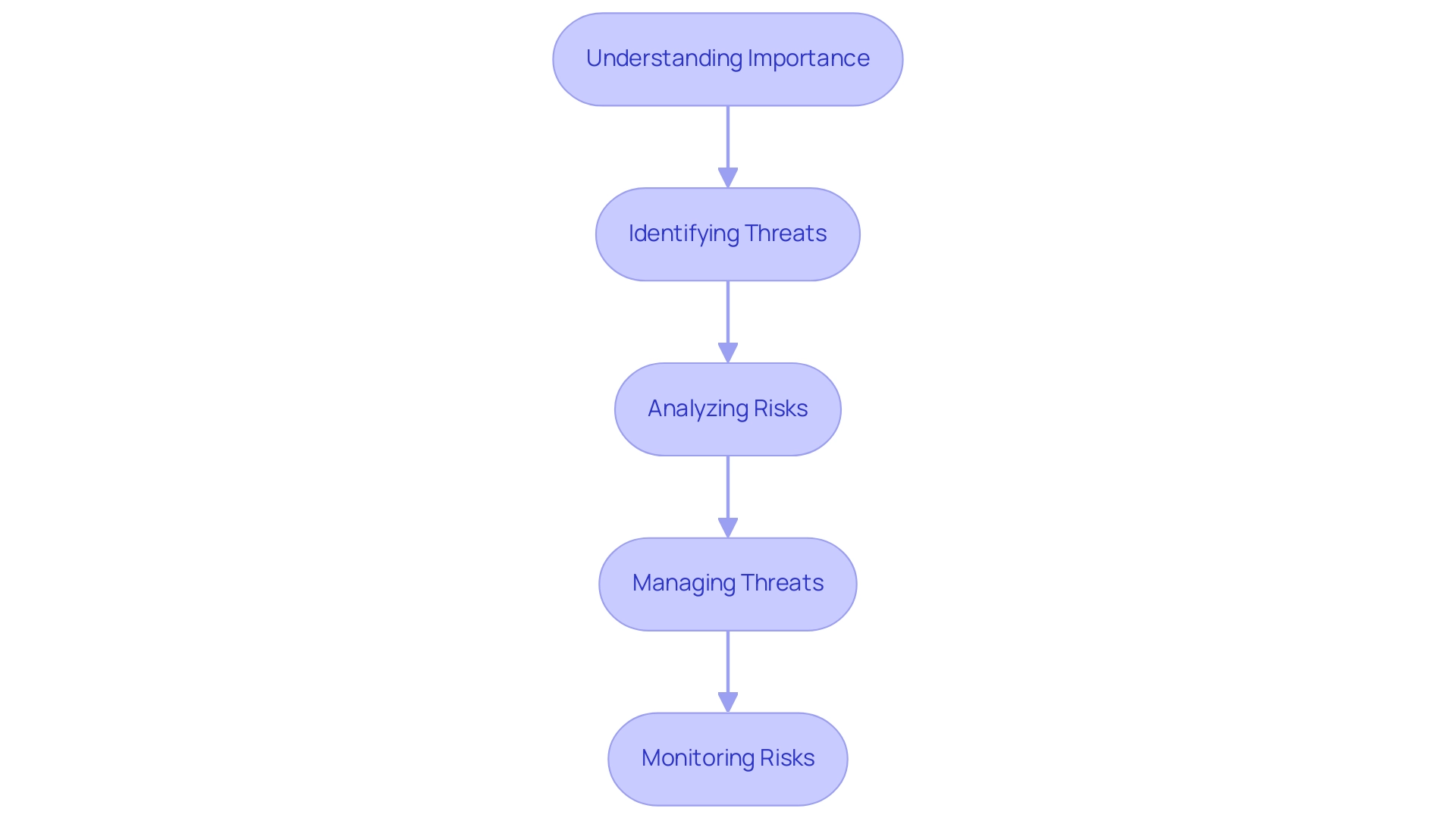

The article centers on conducting a financial risk assessment, detailing a structured process that encompasses:

- Identifying financial risks

- Analyzing financial risks

- Evaluating financial risks

- Treating financial risks

- Monitoring financial risks

It underscores the significance of these assessments in safeguarding assets and ensuring compliance. Supported by compelling statistics and pertinent case studies, the article highlights the potential repercussions of overlooking financial risks, including:

- Substantial losses

- Reputational harm

This comprehensive overview not only informs but also serves as a call to action for organizations to prioritize financial risk management.

Introduction

In today's increasingly intricate financial landscape, organizations confront a multitude of risks that can jeopardize their stability and growth. Financial risk assessment stands out as a crucial process, empowering businesses to identify, analyze, and effectively mitigate potential threats. As the stakes escalate—especially in light of regulatory pressures and cybersecurity challenges—grasping the nuances of financial risk, from market fluctuations to operational vulnerabilities, has never been more imperative.

This article explores the essential components of financial risk assessment, offering insights into how organizations can adeptly navigate these challenges and protect their assets while positioning themselves for sustainable growth. With practical strategies and tools at their disposal, businesses can revolutionize their approach to risk management, ensuring resilience in an ever-evolving economic environment.

Understanding Financial Risk Assessment: Definition and Importance

Monetary hazard evaluation represents a structured procedure aimed at recognizing, examining, and assessing potential economic threats, as detailed in the financial risk assessment pdf, that could adversely impact an entity. In 2025, the significance of conducting financial risk assessment pdfs cannot be overstated; these assessments play a critical role in safeguarding assets, ensuring compliance with regulations, and maintaining operational stability. Notably, 35% of executives in charge prioritize compliance and regulatory challenges as their primary concern, underscoring the necessity for robust management strategies.

Understanding the various challenges an organization faces facilitates the development of effective mitigation strategies, ultimately enhancing economic well-being and sustainability. The situation of Target serves as a stark warning regarding the repercussions of neglecting monetary dangers. Following a major data breach, the company faced an $18.5 million class action settlement and suffered considerable reputational damage, highlighting the imperative for regular evaluations to avert such detrimental outcomes.

Furthermore, recent statistics reveal that 88% of entities allocate less than 10% of their IT security budget to insider threat management, indicating a significant gap in preparedness that can severely affect monetary assessments. As cyberattacks continue to escalate—42% of cybersecurity professionals reported an increase in attacks compared to the previous year—businesses must prioritize comprehensive financial risk assessment pdfs to strengthen their defenses against emerging threats.

In this context, Transform Your Small/Medium Business supports a shortened decision-making cycle throughout the turnaround process, empowering your entity to take decisive action based on real-time analytics. We consistently monitor the success of our strategies through a client dashboard that provides real-time business analytics, enabling continuous performance tracking and relationship-building. As noted by Marijn Overvest, founder of Procurement Tactics, "Risk oversight is crucial as it fortifies a company’s defenses against dangers and uncertainties."

This perspective reinforces the notion that effective management of uncertainties not only protects assets but also enhances overall resilience. By integrating economic evaluations into their strategic planning, companies can position themselves for sustainable growth in an increasingly complex business landscape. Our comprehensive assessment tools and templates further empower organizations to conduct a financial risk assessment pdf to effectively evaluate and mitigate threats, ensuring a proactive approach to economic stability.

Identifying Different Types of Financial Risks: A Comprehensive Overview

Organizations confront a spectrum of economic uncertainties that can significantly impact their stability and growth. Understanding these risks is crucial for effective financial risk assessment of monetary challenges, particularly in mastering the cash conversion cycle and enhancing overall business performance. The primary categories of financial risks include:

- Market Risk: This pertains to the potential for losses due to fluctuations in market prices, which can influence investments and overall economic performance. Current market conditions reveal heightened volatility, making it imperative for businesses to closely monitor these changes. Furthermore, the increasing regulation surrounding climate-related hazard quantification and disclosure is reshaping the landscape of financial uncertainty, necessitating robust data and modeling to avoid misrepresentation.

- Credit Risk: This arises when a borrower fails to meet their repayment obligations, leading to potential losses for the lender. Medium-sized enterprises frequently encounter credit challenges when extending credit to customers or investing in other businesses. Implementing strong credit assessment frameworks can effectively mitigate these challenges.

- Liquidity Risk: Organizations may face difficulties in meeting short-term financial obligations if there is a mismatch between their liquid assets and liabilities. This risk has become increasingly relevant as businesses navigate uncertain economic conditions, underscoring the need for effective cash flow management strategies. Mastering the cash conversion cycle is essential for enhancing cash flow and profitability, especially as managing workforce expectations for remote or hybrid work has diminished in priority, reflecting the shifting dynamics that can impact liquidity.

- Operational Risk: This encompasses risks arising from internal processes, personnel, systems, or external events. In the context of digital transformation, entities must bolster their operational resilience to counteract potential disruptions. Recent case studies in cybersecurity illustrate how firms like Protiviti assist organizations in enhancing their resilience through robust testing programs and improved business continuity management.

By systematically identifying and analyzing these challenges, companies can concentrate their evaluation efforts on the areas that pose the greatest threat to their economic well-being. Streamlined decision-making processes and real-time analytics are vital for monitoring performance and operationalizing turnaround lessons. As Michael Thor, Managing Director in the Internal Audit practice, emphasizes, 'Understanding and addressing these challenges is essential for sustainable development in today's complex economic environment.'

This proactive approach not only safeguards against potential losses but also equips entities for sustainable growth.

At Transform Your Small/Medium Business, we provide comprehensive strategies for mastering the cash conversion cycle, priced at $99.00, to enhance your cash flow and profitability. Our tools and models are designed to facilitate an efficient financial risk assessment, ensuring your organization can navigate monetary challenges with confidence.

Step 1: Identifying Financial Risks in Your Organization

To effectively identify financial risks within your organization, adhere to the following structured approach:

- Review Financial Statements: Begin by conducting a thorough analysis of your balance sheets, income statements, and cash flow statements. Look for irregularities or trends that may indicate potential dangers. For instance, an increasing gross profit margin over multiple fiscal periods can indicate positive company performance, while sudden fluctuations may warrant further investigation. Remember, net income is determined by subtracting a company's expenses from its gross revenue, which is essential for understanding overall economic health.

- Conduct Interviews: Engage with key stakeholders, including department heads and finance officers, to gather insights on perceived threats. These interviews can uncover vital information about operational challenges and economic pressures that may not be immediately obvious from the numbers alone. The effect of these discussions can significantly improve your understanding of the organization's threat landscape. As Thomas R. Ittelson noted, "Officers who sign off on statements that they know to be inaccurate will go to jail (if and when caught)," highlighting the importance of accuracy in reporting.

- Utilize Assessment Tools: Implement systematic tools such as SWOT analysis or evaluation matrices to identify potential hazards. These frameworks assist in categorizing risks according to their likelihood and impact, enabling a more organized assessment of vulnerabilities. Economic ratios are essential tools that summarize fiscal statements and assess a company's fiscal health. Analysts calculate various ratios, including liquidity, profitability, efficiency, solvency, and market value ratios, to evaluate different aspects of a company's performance. Additionally, leveraging real-time analytics can enhance your ability to monitor these ratios continuously, ensuring timely adjustments to your strategies.

- Monitor External Factors: Stay vigilant regarding market trends, economic indicators, and regulatory changes that could affect your organization. The cash flow statement, for instance, offers a detailed summary of cash movements from operational, investment, and financing activities, emphasizing the liquidity accessible to your company and its importance in recognizing financial challenges. By incorporating continuous performance monitoring into your evaluation process, you can adjust your strategies based on real-time data, ultimately preserving cash and reducing liabilities.

By systematically identifying threats through these steps, you can create a comprehensive profile for your entity, enabling proactive management and strategic decision-making. This approach not only assists in threat identification but also improves the overall financial well-being of the organization, ensuring long-term sustainability. For a more thorough evaluation, consider utilizing the financial risk assessment pdf provided by Transform Your Small/ Medium Business.

Step 2: Analyzing Financial Risks: Techniques and Tools

Once threats have been identified, the next crucial step is to analyze them effectively. Several techniques and tools can enhance this analysis:

- Quantitative Analysis: Employ statistical methods to quantify the likelihood and potential impact of identified threats. Methods like Value at Risk (Var) are commonly applied, with research suggesting that about 80% of financial institutions use Var for evaluation. This method provides a clear numerical estimate of potential losses, allowing organizations to make informed decisions based on empirical data. Additionally, for a Generalized Pareto distribution with zeta less than 1/2, the variance can be expressed as lambda squared divided by the product of (1 minus zeta) squared and (1 minus 2 times zeta). This mathematical foundation assists in comprehending model contributions.

- Qualitative Analysis: This approach involves evaluating uncertainties through subjective judgment and expert experience. Techniques such as scenario analysis and expert opinions can offer valuable insights into potential outcome scenarios. For example, organizations frequently hold workshops with stakeholders to collect varied viewpoints, revealing issues that quantitative methods might miss. As Amit Kumar Jha observed, 'Each metric has its own strengths and limitations, and selecting the appropriate measurement depends on an investment or portfolio’s specific context and requirements.'

- Threat Assessment: Assigning scores to hazards based on their potential impact and likelihood is essential for prioritization. This method enables organizations to concentrate on the most essential threats first. By creating a scoring matrix, businesses can systematically assess potential issues, ensuring that resources are allocated effectively to mitigate the highest-priority threats. The case study on the SOA Medical Dataset Analysis illustrates how model uncertainty is evaluated by comparing different univariate models, highlighting the importance of understanding the contributions of various assumptions.

- Software Tools: Utilizing management software can significantly enhance the analysis process. These tools automate data gathering and analysis, offering real-time insights into exposure. For instance, advanced analytics platforms can combine both quantitative and qualitative data, allowing entities to visualize their exposure landscape comprehensively.

By employing these techniques, organizations can achieve a more nuanced understanding of their threat landscape, facilitating better decision-making and strategic planning. Ongoing investment in these analytical tools and methodologies is essential for adapting to the changing economic environment and ensuring sustainable growth. The ongoing process of quantitative data analysis highlights the significance of continuous learning and collaboration in the management of uncertainties.

Step 3: Evaluating Risks: Prioritization and Risk Appetite

Assessing financial uncertainties is a vital procedure that requires a clear understanding of their significance, which can be effectively documented in a financial risk assessment PDF concerning your entity's tolerance for challenges. To navigate this evaluation effectively, follow these structured steps:

- Define Risk Tolerance: Begin by determining the extent of uncertainty your entity is willing to accept in pursuit of its strategic objectives. This definition should reflect both the organization's culture and its long-term goals, ensuring alignment with the overall business strategy. Notably, 67% of global executives find navigating appetite complexities challenging, underscoring the necessity of a clear definition.

- Prioritize Threats: Employ a matrix to categorize threats based on their likelihood of occurrence and potential impact. This visual tool enables you to focus on high-impact, high-likelihood challenges first, ensuring that resources are allocated to the most pressing threats. Recent trends indicate that 35% of business and tech executives regard third-party breaches as one of the most alarming cyber threats, highlighting the importance of addressing this concern in your prioritization.

- Engage Stakeholders: Involve key stakeholders throughout the evaluation process. Their insights are invaluable in ensuring that all perspectives are considered, leading to more comprehensive evaluations. Engaging stakeholders not only fosters collaboration but also enhances the credibility of the evaluation process. Awareness of knowledge and data is essential in minimizing the risk of identity theft, making informed decision-making crucial.

- Document Findings: Maintain thorough documentation of the evaluation process in the financial risk assessment PDF, including the rationale behind prioritization decisions related to potential issues. This record serves as a reference for future evaluations and assists in monitoring the effectiveness of mitigation strategies. As highlighted in the case study on ESG compliance, entities are encouraged to adopt compliance automation platforms to enhance their security and compliance posture.

By adopting this structured approach, organizations can allocate resources more effectively and develop targeted mitigation strategies that align with their defined appetite for uncertainty. This is particularly crucial in today's environment, where 35% of business and tech leaders identify third-party breaches as a major cyber threat, emphasizing the need for robust mitigation practices. As Sara Lynch aptly states, "There is no better way to encourage that entrepreneurial thinking than watching one of the classic business movies to inspire you," reminding us of the innovative mindset necessary in managing challenges.

Step 4: Treating Financial Risks: Strategies for Mitigation

To effectively address financial risks, organizations should consider the following strategies:

- Risk Avoidance: This strategy involves altering plans to completely evade potential dangers. While it can prevent losses, it may also lead to missed opportunities. Businesses must thoroughly assess the trade-offs between evading dangers and the potential advantages of taking measured chances. A case study titled "Pros and Cons of Avoidance" illustrates that while steering clear of dangers can prevent losses, it may also result in increased costs and missed opportunities, emphasizing the need for a balanced approach.

- Hazard Mitigation: Implementing measures to reduce the likelihood or impact of threats is crucial. Approaches like diversifying investments, improving internal controls, and performing regular evaluations can significantly decrease uncertainties. For instance, companies that implemented strong internal controls reported a 30% reduction in discrepancies, highlighting the effectiveness of proactive management of potential issues. Furthermore, our team at Transform Your Small/Medium Business can assist in identifying underlying issues and collaboratively developing a strategy to enhance your economic position.

- Risk Transfer: This strategy involves shifting uncertainty to a third party, often through insurance or outsourcing certain operations. By transferring uncertainties, companies can safeguard themselves from substantial monetary losses. For example, organizations that utilize comprehensive insurance policies can protect against unforeseen events, thereby stabilizing their economic outlook.

- Risk Acceptance: In certain situations, organizations may opt to accept uncertainty when the expenses of mitigation surpass potential losses. This strategy necessitates a thorough examination of the impact on financial stability, as outlined in a financial risk assessment PDF. According to recent findings, 58% of leaders identified economic conditions as a top threat in 2024, underscoring the necessity for businesses to weigh their acceptance strategies carefully. Furthermore, with 52% of surveyed cybersecurity experts facing more assaults, entities must remain vigilant in their acceptance choices.

By utilizing these approaches, entities can efficiently manage their monetary uncertainties and perform a financial risk assessment PDF to improve overall stability. Continuous business performance monitoring and relationship-building through real-time analytics are essential for operationalizing turnaround lessons. Customized consulting services, particularly those that are technology-driven, can further aid in identifying the most appropriate method for each distinct circumstance, ensuring that businesses are well-prepared to handle the intricacies of monetary challenges.

Step 5: Monitoring and Reviewing Financial Risks: Best Practices

Monitoring and evaluating monetary threats is an ongoing and vital procedure for organizations seeking to protect their economic well-being, which can be documented in a financial risk assessment pdf. To enhance your financial management strategy, consider these best practices:

- Establish Key Risk Indicators (KRIs): Develop specific metrics that serve as early warning signs for potential threats. The design and communication of these KRIs are crucial, as they complement existing identification methods and enhance the overall effectiveness of the Enterprise Risk Management (ERM) process.

- Regular Reviews: Schedule periodic assessments of the management strategy to evaluate its effectiveness. Statistics suggest that organizations performing regular evaluations are better equipped to adjust to shifting threat landscapes, significantly improving the effectiveness of their mitigation strategies. For instance, with the average expense of a data breach reaching $44.35 million, utilizing a financial risk assessment pdf is essential for comprehending and handling these threats.

- Engage Stakeholders: Maintain open lines of communication with all stakeholders. This ensures that everyone is informed about current challenges and the strategies in place to mitigate them, fostering a culture of transparency and collaboration.

- Utilize Technology: Leverage advanced technology to automate monitoring processes. Automation not only streamlines the tracking of KRIs but also helps prevent them from becoming outdated and allows for better tracking of remedial actions, providing real-time insights into exposure.

Transform Your Small/Medium Business supports a shortened decision-making cycle throughout the turnaround process, enabling your entity to take decisive action to maintain its economic well-being. Tools such as Bitsight Financial Quantification enable entities to simulate monetary exposure across different scenarios, thereby facilitating a financial risk assessment pdf that aids in improved prioritization of technology investments and strategy formulation. As mentioned by Vice Vicente, who has advised more than 120 clients, establishing security and compliance programs is vital for effective oversight. By applying these best practices, organizations can take a proactive approach toward economic challenges, ultimately resulting in enhanced resilience and sustainable development. Furthermore, comprehending monetary exposure through case studies on cyber incidents can demonstrate the real-world effects of insufficient management strategies, as detailed in the financial risk assessment pdf.

Leveraging Technology in Financial Risk Assessment: Tools and Innovations

Technological advancements are crucial in enhancing the procedures outlined in the financial risk assessment PDF for addressing monetary uncertainties. The following tools and advancements are essential for effective evaluation:

- Data Analytics: Advanced analytics empower organizations to uncover patterns and trends within monetary data, facilitating the early detection of potential hazards. This method not only enhances threat identification but also supports strategic decision-making. As noted by Katleho King Title, Group Managing Director at Nayabo Solutions, 'Your article provides a comprehensive and insightful overview of how data analytics is transforming financial markets.' This statement underscores the significant impact of data analytics on decision-making and hazard oversight, particularly within the context of the financial risk assessment PDF, ongoing business performance assessment, and the implementation of turnaround lessons.

- Risk Oversight Software: The adoption of advanced oversight software has surged in 2025, with organizations leveraging these solutions to automate threat evaluation processes and refine their financial risk assessment PDF. These tools deliver immediate insights, enabling companies to respond swiftly to emerging threats and enhance overall mitigation strategies. RegTech solutions, in particular, aid institutions in making more precise and agile decisions by integrating technologies such as AI and big data analytics, thereby supporting a shortened decision-making cycle throughout the turnaround process.

- Artificial Intelligence: AI technologies are revolutionizing monetary threat management by analyzing extensive datasets to predict potential dangers based on historical patterns. This capability allows organizations to make more accurate and agile decisions, significantly bolstering their financial risk assessment PDF frameworks. Investing in retraining programs for the workforce is essential to adapt to the changes brought about by AI, ensuring that teams are well-equipped to leverage these technologies effectively. This approach is vital for uncovering value and reducing costs through comprehensive assessments focused on cash preservation and efficiency.

- Blockchain Technology: The integration of blockchain technology facilitates secure and transparent transaction processes, effectively reducing the likelihood of fraud. By ensuring data integrity, blockchain enhances trust and accountability in monetary transactions.

The impact of these technologies is highlighted by case studies demonstrating their effectiveness. For instance, monetary institutions that simulate various market conditions using historical data have shown enhanced resilience against market fluctuations, thereby improving their management strategies. The case study titled 'Market Risk Analysis' illustrates this capability, equipping institutions to prepare for market fluctuations.

As the landscape of monetary evaluation evolves, the role of technology becomes increasingly essential, empowering entities to navigate complexities with enhanced assurance and accuracy.

The CFO's Role in Financial Risk Assessment: Responsibilities and Challenges

CFOs play a pivotal role in financial risk assessment, with responsibilities that encompass several key areas:

- Strategic Oversight: CFOs ensure that threat mitigation strategies align with the organization's overarching goals and objectives, fostering a proactive approach to potential financial dangers. This includes utilizing real-time analytics to monitor business health and adjust strategies as necessary, which is crucial for effective turnaround management.

- Resource Allocation: Effective distribution of resources is crucial for addressing identified challenges. CFOs must prioritize investments in strategies outlined in the financial risk assessment pdf to protect the entity’s economic well-being. For example, Mosaic combines statements and enterprise software to offer a single source of truth for FP&A teams, improving the efficiency and accuracy of resource allocation. Additionally, utilizing real-time business analytics enables CFOs to make informed decisions swiftly, preserving the entity's competitive edge.

- Compliance Management: Maintaining compliance with relevant regulations and standards is a fundamental responsibility. CFOs supervise compliance with financial regulations, ensuring that the entity operates within legal frameworks while conducting a financial risk assessment pdf to manage uncertainties.

- Stakeholder Communication: Clear communication of the financial risk assessment pdf and strategies regarding uncertainties to stakeholders, including the board of directors and investors, is essential. This transparency fosters trust and guarantees that all parties are informed about the organization’s exposure stance.

Despite these responsibilities, CFOs encounter significant challenges. Balancing urgent monetary pressures with long-term goal setting can be especially challenging. A recent study emphasized that 70% of CFOs reported challenges in aligning short-term financial goals with broader hazard control strategies.

Additionally, the evolving economic landscape necessitates that CFOs remain agile, adapting their management frameworks to address emerging threats effectively. As Joe Garafalo, Founder and COO, pointed out, "Market uncertainty is the possibility that macroeconomic changes could harm your business’s ability to stay competitive."

In 2025, the role of the CFO in evaluating uncertainties is more crucial than ever, as organizations encounter growing complexities in their economic environments. CFOs are advised to use economic models to plan for growth and implement customer success teams to retain existing customers. By utilizing technology and data analysis, including real-time performance monitoring tools, CFOs can enhance the accuracy and efficiency of their evaluations, ultimately driving better decision-making and fostering sustainable growth.

Moreover, efficient cash flow management is essential for startups to prevent economic instability and capitalize on growth opportunities, demonstrating the significance of CFO duties in monetary assessment.

Key Takeaways and Additional Resources for Financial Risk Assessment

Performing a monetary hazard evaluation is a complex procedure that includes several crucial steps:

Understanding the definition and importance of a financial risk assessment involves recognizing what financial evaluation entails and its significance in safeguarding organizational assets. Identifying different types of financial threats is essential; categorizing challenges such as market, credit, operational, and liquidity concerns within a financial risk assessment ensures a thorough evaluation. Analyzing and evaluating threats involves assessing dangers based on their probability of occurring and potential effects on the entity, which is crucial for prioritizing threat oversight efforts. Managing threats requires implementing effective mitigation strategies tailored to the specific challenges identified in the financial risk assessment, ensuring that the organization is prepared to address potential difficulties. Monitoring and reviewing risks continuously establishes a framework for ongoing financial risk assessment to adapt to changing circumstances and maintain economic resilience.

To further enhance your understanding and application of risk management, consider the following resources:

- Risk management textbooks: Comprehensive guides that cover theoretical and practical aspects of management.

- Online courses on risk assessment: Interactive learning platforms that provide insights into the latest methodologies and tools.

- Industry reports and whitepapers: Up-to-date analyses on risk trends, offering valuable data and expert opinions.

Utilizing these resources can significantly improve the processes outlined in the financial risk assessment, leading to enhanced organizational resilience. For instance, sophisticated analytical tools have been shown to enhance planning accuracy, enabling businesses to create detailed budgets and forecasts while reducing uncertainty. The integration of real-time business analytics enables continuous monitoring of economic health, facilitating timely decision-making and adjustments to strategies as needed.

A case study on improving planning accuracy illustrates how these tools can lead to better strategic planning and a competitive advantage. As the terrain of monetary exposure administration changes, remaining aware of contemporary developments and specialist perspectives on financial risk assessment will be essential for CFOs seeking to tackle obstacles efficiently in 2025. Significantly, handling workforce expectations for remote or hybrid work has diminished in importance, indicating a belief that these challenges will be addressed, which may influence economic evaluations.

Moreover, solutions for enhancing operational resilience through business continuity, IT disaster recovery, and cybersecurity incident response are vital in the context of a financial risk assessment. Furthermore, the organization's backing for a shortened decision-making cycle during the turnaround process enables prompt action in evaluating uncertainties, ensuring that entities can adapt quickly to emerging challenges. As Michael Thor, Managing Director in the Internal Audit practice of Protiviti, emphasizes, understanding these dynamics is essential for effective financial risk management.

Conclusion

In an era where financial landscapes are increasingly complex, the importance of comprehensive financial risk assessment cannot be overstated. Organizations must proactively identify, analyze, and evaluate a range of potential financial risks—ranging from market fluctuations to operational vulnerabilities—to safeguard their assets and ensure sustainable growth. By understanding the various types of risks, such as market, credit, liquidity, and operational risks, businesses can develop robust mitigation strategies that enhance their overall financial health.

The structured approach to risk management outlined in this article provides a clear pathway for organizations to navigate the intricacies of financial risk assessment. From identifying and analyzing risks to prioritizing them according to the organization’s risk appetite, every step is crucial for fostering resilience. Moreover, leveraging technology—such as data analytics and risk management software—empowers organizations to make informed decisions and respond swiftly to emerging threats.

Ultimately, the role of CFOs and financial leaders is pivotal in driving effective risk management practices. By aligning risk assessment strategies with organizational goals and maintaining open communication with stakeholders, they can navigate the challenges posed by an evolving economic environment. Continuous monitoring and adaptation are essential to ensure that organizations remain resilient and agile in the face of financial uncertainties.

In conclusion, prioritizing financial risk assessment not only protects against potential losses but also positions organizations to seize growth opportunities in a rapidly changing landscape. Embracing these practices and utilizing available resources will enhance operational resilience, ensuring that businesses are well-equipped to thrive in the future.

Frequently Asked Questions

What is monetary hazard evaluation?

Monetary hazard evaluation is a structured procedure aimed at recognizing, examining, and assessing potential economic threats that could adversely impact an entity.

Why are financial risk assessments important in 2025?

Financial risk assessments are critical for safeguarding assets, ensuring compliance with regulations, and maintaining operational stability, especially as 35% of executives prioritize compliance and regulatory challenges.

What can happen if organizations neglect monetary dangers?

Neglecting monetary dangers can lead to significant repercussions, as illustrated by Target's $18.5 million class action settlement following a major data breach, which also resulted in considerable reputational damage.

What percentage of IT security budgets do organizations allocate to insider threat management?

Recent statistics indicate that 88% of entities allocate less than 10% of their IT security budget to insider threat management, highlighting a significant gap in preparedness.

What are the primary categories of financial risks?

The primary categories of financial risks include: 1. Market Risk: Potential losses due to fluctuations in market prices. 2. Credit Risk: Losses arising when a borrower fails to meet repayment obligations. 3. Liquidity Risk: Difficulties in meeting short-term financial obligations due to mismatches between liquid assets and liabilities. 4. Operational Risk: Risks from internal processes, personnel, systems, or external events.

How can organizations effectively identify financial risks?

Organizations can identify financial risks by: 1. Reviewing financial statements for irregularities or trends. 2. Conducting interviews with key stakeholders to gather insights. 3. Utilizing assessment tools like SWOT analysis or evaluation matrices. 4. Monitoring external factors such as market trends and regulatory changes.

What role does real-time analytics play in financial risk assessment?

Real-time analytics enhances the ability to monitor financial ratios continuously, allowing organizations to make timely adjustments to their strategies and improve overall financial well-being.

How does Transform Your Small/Medium Business assist with financial risk assessment?

Transform Your Small/Medium Business provides comprehensive strategies and tools for mastering the cash conversion cycle and conducting effective financial risk assessments, ensuring organizations can navigate monetary challenges with confidence.