Overview

This article provides a comprehensive guide for conducting vendor financial risk assessments, highlighting their critical role in ensuring supplier reliability and operational continuity. It details a systematic process that encompasses essential components such as:

- Financial statement reviews

- Creditworthiness evaluations

- Ongoing monitoring

Evidence suggests that proactive assessments can significantly mitigate risks and enhance decision-making in supplier relationships. By understanding these key elements, organizations can fortify their supplier partnerships and secure their operational foundations.

Introduction

In an increasingly interconnected business landscape, the financial health of vendors plays a pivotal role in determining an organization’s success. As companies depend on external partners for essential services and products, understanding the financial risks associated with these relationships becomes imperative.

Vendor financial risk assessments serve as a crucial tool for organizations, enabling them to systematically evaluate the stability and creditworthiness of their suppliers. This article delves into the key components of these assessments, the importance of proactive financial evaluations, and best practices for integrating these evaluations into vendor management strategies.

By adopting a comprehensive approach to vendor financial risk assessment, organizations can not only mitigate potential disruptions but also foster stronger, more reliable partnerships that drive sustained business growth.

Understanding Vendor Financial Risk Assessments

Supplier monetary stability evaluations are systematic reviews designed to recognize and examine the economic soundness and credit reliability of suppliers. These evaluations are crucial for organizations aiming to mitigate potential challenges associated with supplier relationships, ensuring they partner with financially stable entities. A vendor financial risk assessment encompasses essential elements such as examining financial reports, analyzing credit ratings, and assessing the vendor's overall market position.

Understanding these components is vital for organizations to safeguard their economic interests and ensure operational continuity.

Key Components of Vendor Financial Risk Assessments

- Financial Statements Review: Analyze balance sheets, income statements, and cash flow statements to gauge financial health.

- Vendor Financial Risk Assessment: Utilize credit rating agencies as part of to evaluate the supplier's creditworthiness.

- Market Position: Perform a vendor financial risk assessment to analyze the supplier's status in the sector and any potential market threats that could influence their economic stability.

The Importance of Financial Risk Assessments in Vendor Management

Conducting vendor financial risk assessments is essential for organizations striving to ensure that their suppliers can meet contractual commitments and uphold operational dependability. These evaluations play a crucial role in identifying potential economic hazards that could disrupt supply chains or lead to significant monetary losses. By proactively assessing vendor financial health, organizations can achieve several key objectives:

- Mitigate Risks: Early identification and resolution of potential financial issues can prevent escalation, safeguarding the organization from unexpected disruptions.

- Ensure Compliance: Performing is critical, as numerous regulatory frameworks necessitate due diligence in supplier selection, making monetary evaluations vital for adherence to these standards.

- Enhance Decision-Making: Utilizing a vendor financial risk assessment allows for informed decisions regarding supplier partnerships, fostering more reliable and sustainable business relationships. The integration of real-time analytics into this process enables organizations to continuously monitor supplier performance, facilitating quicker adjustments and more effective decision-making.

In 2025, the significance of vendor financial risk assessments in supplier management has never been more evident. A considerable portion of companies acknowledges that these evaluations are essential for maintaining supplier reliability and operational effectiveness. For example, a recent survey revealed that 41% of participants identified supply chain management and optimization as the primary application for artificial intelligence, underscoring the necessity for robust economic assessments in supplier relationships.

Furthermore, entities that have conducted vendor financial risk assessments report enhanced supplier dependability. A significant case study titled 'Enhancing Supply Chain Resilience: A Retail Chain's Approach' demonstrated that by implementing these assessments for their suppliers, the retail chain was able to reduce supply chain interruptions by 30%, ultimately improving their operational resilience. This case illustrates how continuous monitoring and real-time analytics can apply lessons learned during turnaround efforts, further strengthening supplier relationships.

The advantages of monetary evaluations extend beyond mere compliance; they empower organizations to establish stronger, more reliable supplier relationships. As Cynthia Williams, Ford's global director of sustainability, stated, "Creating new visibility and accountability for a global supply chain is essential for building a more sustainable and equitable business environment." By understanding the economic condition of their suppliers, businesses can utilize vendor financial risk assessments to navigate the complexities of supply chains more effectively and mitigate uncertainties associated with supplier financial instability.

This proactive approach not only protects the organization but also cultivates a more sustainable and equitable business environment. Moreover, using a client dashboard for real-time analytics can expedite the decision-making process, allowing organizations to respond swiftly to any emerging financial challenges.

Identifying Key Financial Risks in Vendor Relationships

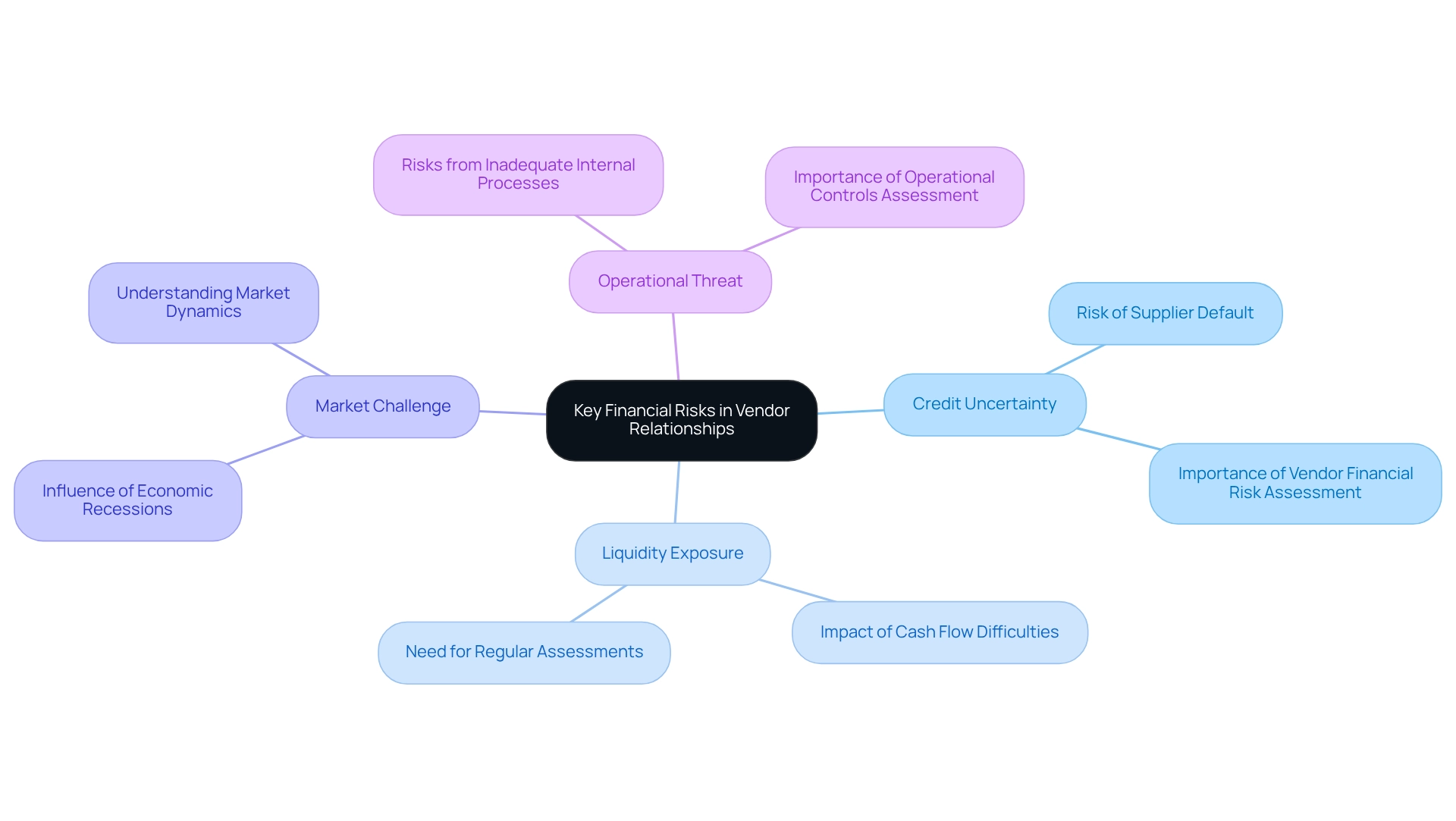

Key monetary uncertainties in supplier connections encompass several essential areas that organizations must observe closely:

- Credit Uncertainty: This denotes the possibility that a supplier may default on their obligations due to economic instability. Although specific data on credit exposure in supplier collaborations were not shared, it is imperative for CFOs to conduct a vendor financial risk assessment prior to engagement to mitigate potential defaults.

- Liquidity Exposure: This challenge arises when a supplier encounters cash flow difficulties, significantly impacting their ability to deliver products or services on time. Recent statistics highlight that liquidity challenges are prevalent among small businesses, although specific figures were not disclosed in the provided context. Regular vendor financial risk assessments of the economic health of suppliers are crucial for CFOs to effectively address these challenges.

- Market Challenge: External factors, such as economic recessions or sector-specific issues, can adversely affect a supplier's economic performance. Recent updates from Fannie Mae regarding loan performance data illustrate how market fluctuations can influence supplier stability, particularly in sectors reliant on credit. This case study underscores the importance of understanding market dynamics in supplier management.

- Operational Threat: This encompasses risks stemming from inadequate internal processes or systems within a supplier's operations, potentially leading to financial losses. A thorough assessment of operational controls is essential to avert serious repercussions for both parties involved. Identifying these risks early enables organizations to implement proactive strategies, such as enhanced due diligence and vendor financial risk assessments, along with ongoing monitoring, to mitigate potential impacts on their operations and economic health. By effectively managing these monetary challenges, companies can overcome obstacles and achieve sustainable growth, aligning with of fostering resilience in supplier partnerships.

Step-by-Step Process for Conducting Vendor Financial Risk Assessments

To effectively carry out a supplier economic risk evaluation, follow this comprehensive step-by-step process:

- Collect Economic Data: Begin by requesting essential monetary documents from the supplier, including statements, credit reports, and tax returns. This foundational data is crucial for a thorough vendor financial risk assessment.

- Examine Fiscal Condition: Meticulously assess the supplier's monetary statements to gauge essential metrics such as profitability, liquidity, and solvency ratios. This analysis provides insights into the vendor financial risk assessment by evaluating the supplier's overall economic stability and operational efficiency.

- Evaluate Creditworthiness: Assess the supplier's credit ratings and payment histories. This step is vital for the vendor financial risk assessment, evaluating the supplier's dependability and capacity to fulfill monetary commitments, significantly influencing your organization’s exposure to uncertainty.

- Identify Red Flags: Remain vigilant for signs of financial distress, such as declining revenues, increasing debt levels, or negative cash flow. Promptly identifying these warning signs can help mitigate potential threats linked to vendor financial risk assessment in supplier relationships.

- Document Findings: Compile a comprehensive report summarizing the evaluation results, including any identified risks and concerns. This documentation is essential for transparency and can serve as a reference for future vendor financial risk assessments.

- Make Informed Choices: Utilize the insights gained from the evaluation to make strategic decisions regarding supplier engagement. This may involve negotiating terms, establishing conditions for collaboration, or, in certain instances, opting out of engagement entirely.

In 2025, the significance of a well-organized vendor financial risk assessment process cannot be overstated, particularly as nearly 25% of all data breaches, linked to ransomware or harmful cyber attacks according to IBM, stem from supplier-related vulnerabilities. The objectives of supplier evaluations include conducting a vendor financial risk assessment to manage threats more effectively, lower expenses, protect against data breaches, and streamline regulatory adherence. By implementing these measures, organizations can enhance their vendor financial risk assessment, improve uncertainty management, lower costs, and strengthen compliance with regulatory standards, ultimately leading to more secure and profitable supplier relationships.

As Elaine, a freelance Procurement and Supply Chain writer, emphasizes, ' are essential for protecting an organization’s interests.' Moreover, utilizing a supplier evaluation checklist is crucial for a thorough vendor financial risk assessment, assisting organizations in avoiding significant consequences from overlooked supplier hazards. Furthermore, a vendor financial risk assessment can categorize supplier uncertainties into various categories, such as cybersecurity, operational, geographic, monetary, compliance, and reputational challenges, each requiring specific assessment standards based on the organization's tolerance for uncertainty.

Best Practices for Effective Vendor Financial Risk Assessment

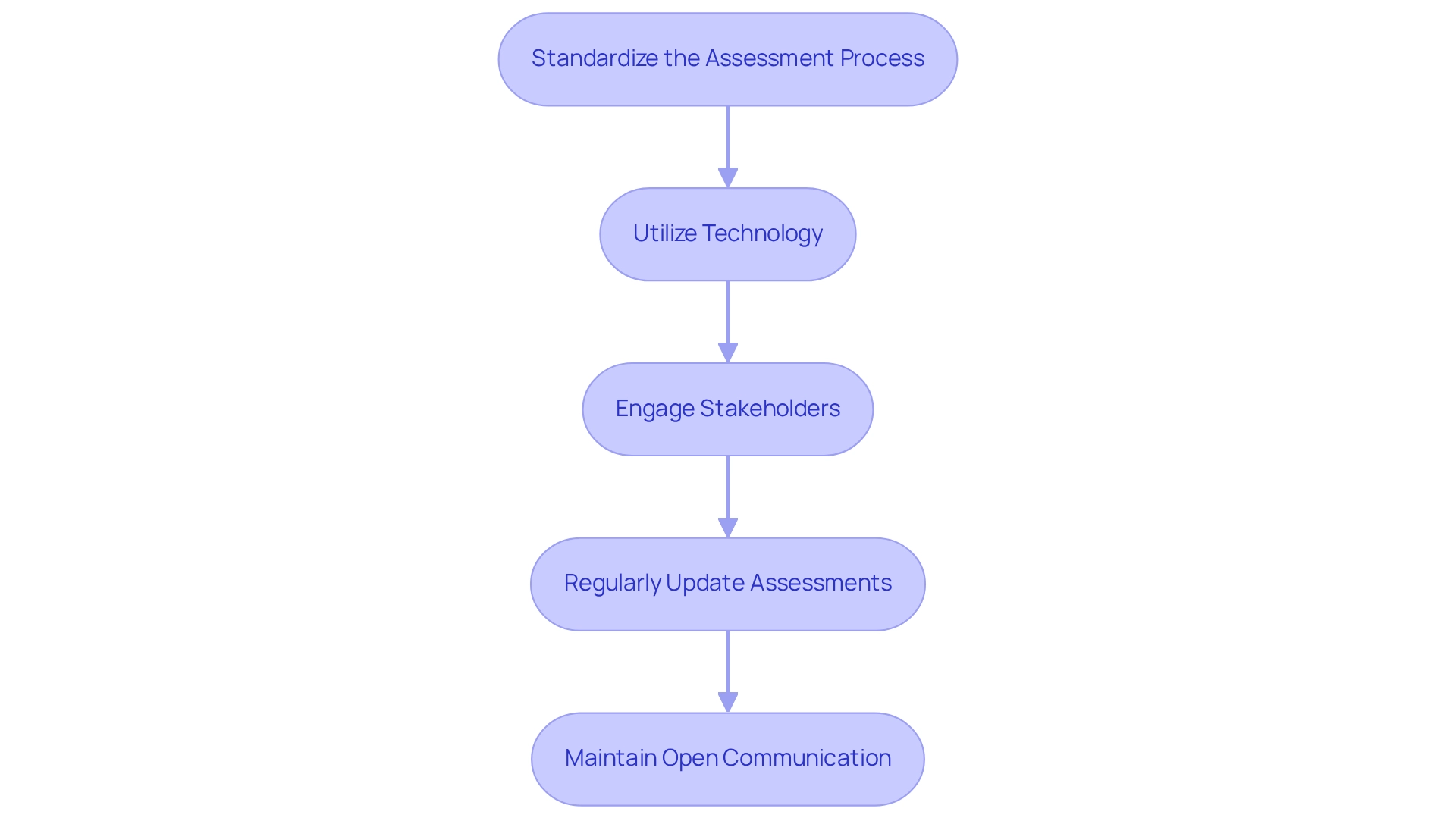

To enhance the effectiveness of vendor financial risk assessments, consider implementing the following best practices:

- Standardize the Assessment Process: Establish a consistent framework for evaluating all vendors. This consistency not only streamlines the vendor financial risk assessment but also ensures that all suppliers are held to the same criteria, minimizing the chance of oversight.

- Utilize Technology: Leverage advanced financial analysis tools and software to streamline data collection and analysis. Automation playbooks can greatly improve response actions by applying 'If This, Then That' criteria, enabling faster and more precise evaluations. According to a recent study, organizations that implement such automation see a marked improvement in their risk management processes.

- Engage Stakeholders: Involve relevant departments, such as procurement and finance, in the assessment process. This collaboration promotes varied insights and guarantees that all facets of supplier performance are taken into account, resulting in more informed decision-making.

- Regularly Update Assessments: Implement a vendor financial risk assessment to conduct periodic reviews of supplier economic stability and remain aware of any changes that could impact your organization. Remaining proactive in this respect can help in performing a vendor financial risk assessment to avert potential disruptions and monetary losses. It is also essential to recognize warning signs in suppliers' business continuity strategies to reduce operational uncertainties.

- Maintain Open Communication: Encourage clear dialogue with suppliers concerning monetary expectations and performance. This dialogue not only builds trust but also allows for early identification of potential issues, enabling timely interventions. As Adam Vanscoy, a Senior Security Analyst, mentions, "Our supplier security evaluations are now a finely-tuned operation from where we began utilizing UpGuard."

By embracing these optimal methods, organizations can greatly enhance their supplier evaluation procedures, ensuring they are well-prepared to manage the intricacies of today's business landscape. Furthermore, compliance with evolving regulatory requirements regarding data protection is essential, as violations can lead to fines and reputational damage. illustrates how effective provider management can result in significant enhancements in security management and operational efficiency.

Tools and Techniques for Vendor Financial Risk Assessment

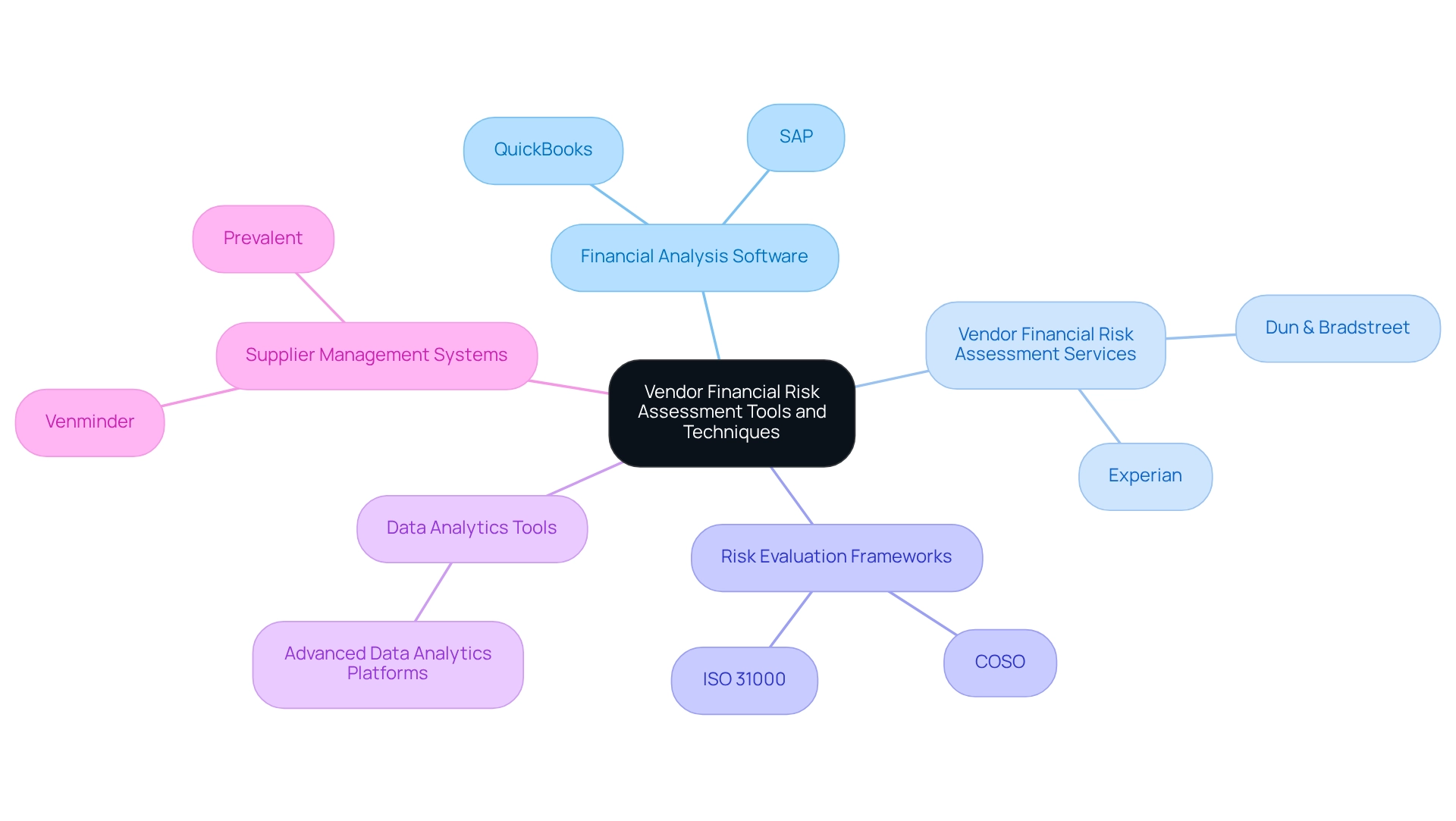

Several tools and techniques can facilitate vendor financial risk assessments:

- Financial Analysis Software: Leverage powerful software such as QuickBooks or SAP to conduct thorough financial analyses.

- Vendor Financial Risk Assessment Services: Engage with reputable services like Dun & Bradstreet or Experian to acquire detailed credit reports, enhancing your understanding of vendor stability.

- Risk Evaluation Frameworks: Implement established frameworks like COSO or ISO 31000 to systematically guide , ensuring comprehensive evaluations.

- Data Analytics Tools: Utilize advanced data analytics platforms to conduct vendor financial risk assessments by identifying trends and anomalies within supplier monetary data, thereby uncovering potential risks.

- Supplier Management Systems: Adopt platforms such as Venminder or Prevalent to streamline supplier evaluations and facilitate effective vendor financial risk assessments, promoting efficiency in your processes.

Continuous Monitoring and Reassessment of Vendor Financial Risks

Ongoing observation of vendor financial risk assessment is crucial for upholding a strong supply chain and protecting organizational interests. Key practices to implement include:

- Scheduled Reviews: Establish a systematic timeline for periodic assessments, ideally conducting reviews on a quarterly or bi-annual basis. This regular rhythm enables organizations to perform a vendor financial risk assessment, allowing them to remain aware of supplier performance and economic well-being, and ensuring prompt actions when needed.

- Utilize key performance indicators (KPIs) to conduct a vendor financial risk assessment and evaluate supplier financial health. Metrics such as revenue growth, profit margins, and liquidity ratios are vital for a vendor financial risk assessment, as they provide valuable insights into a supplier's stability and operational efficiency. By consistently monitoring these indicators, organizations can identify trends and potential challenges early, supported by real-time business analytics from the client dashboard of Transform Your Small/ Medium Business, which facilitate informed decision-making and enhance the vendor financial risk assessment process.

- Alert Systems: Implement automated alert systems that notify stakeholders of significant changes in a vendor's financial status as part of the vendor financial risk assessment. These alerts can be triggered by fluctuations in key metrics, enabling proactive vendor financial risk assessment and management of potential risks before they escalate, thus streamlining the decision-making process during critical turnaround phases.

- Feedback loops are essential for collecting input from internal teams about supplier performance and reliability, particularly in the context of vendor financial risk assessment. Consistent feedback from departments that engage with suppliers can reveal problems that may not be apparent through financial metrics alone, thereby enhancing the vendor financial risk assessment and improving operational efficiency.

Nicholas Sollitto emphasizes the importance of these practices, stating, "Explore how Trust Exchange is revolutionizing the security questionnaire process, freeing security teams from the burden of repetitive, manual tasks." This highlights the need for efficient processes in vendor management. The significance of these practices is underscored by the fact that 96% of organizations recognize a return on investment (ROI) from vendor financial risk assessment activities.

Moreover, tools such as ProcessUnity, employed by , can assist these practices efficiently in vendor financial risk assessment by offering real-time analytics that guide continuous evaluations.

Furthermore, the case study titled 'Amending a Filed Exemption' demonstrates the significance of prompt actions in supplier evaluations. Covered Entities must ensure adherence to the Cybersecurity Regulation within 180 days of losing their exempt status, emphasizing the need for continuous monitoring and timely updates to supplier evaluations.

By emphasizing ongoing surveillance and conducting vendor financial risk assessments, companies can improve their robustness against monetary challenges linked to suppliers, ultimately aiding in sustainable development.

Integrating Financial Risk Assessments into Vendor Management Strategies

To successfully incorporate monetary evaluation processes into , organizations must follow these essential steps:

- Align with Business Objectives: Monetary evaluations must be closely connected with the organization’s overarching business goals and management frameworks. This alignment guarantees that supplier evaluations aid in strategic decision-making and liability reduction efforts, particularly in recognizing opportunities for vendor financial risk assessment to maintain cash and lessen obligations.

- Create a Supplier Management Policy: Establish a formal supplier management policy that clearly outlines the procedures for conducting monetary evaluations and monitoring supplier performance. This policy should encompass criteria for evaluating supplier monetary stability and mechanisms for ongoing evaluation, concentrating on revealing value and minimizing expenses through thorough monetary reviews.

Extensive training for relevant personnel on the importance of vendor financial risk assessment and the methods for conducting them efficiently is essential. Equipping staff with the appropriate knowledge improves the quality of evaluations and fosters a culture of awareness, especially concerning cash preservation and efficiency.

- Encourage Collaboration: Promote interdepartmental teamwork to ensure that evaluations are central to supplier selection and management decisions. By engaging multiple departments, organizations can obtain varied perspectives and guarantee that all pertinent elements are taken into account in the evaluation procedure.

As organizations encounter growing pressures to enhance their supplier management procedures in 2025, implementing a vendor financial risk assessment will be essential. Statistics indicate that 40% of legal, compliance, and privacy leaders prioritize enhancing third-party risk management, underscoring the need for robust policies and practices. Moreover, aligning supplier evaluations with business goals is crucial, as 77% of professionals acknowledge the significance of remaining informed about ESG advancements, which can impact vendor financial risk assessment and supplier selection standards.

Furthermore, the monetary consequences of inadequate vendor management are substantial, with cloud waste averaging 30% of organizations’ cloud budgets in 2021 and rising to 32% in 2022. This emphasizes the necessity of thorough vendor financial risk assessments in economic evaluations. Additionally, as noted in the Cost of Compliance Report 2023, 61% of respondents anticipate the expense of senior compliance officers to rise, indicating the economic pressures organizations encounter in compliance and management.

By implementing these approaches, organizations can more effectively manage economic uncertainties linked to their vendor financial risk assessment. The Hackett Group’s 2024 Key Issues Study also forecasts an 8% increase in procurement workload, emphasizing the need for enhanced vendor risk management strategies to address productivity and efficiency gaps. Transform Your Small/ Medium Business offers comprehensive financial assessment services to help organizations achieve these goals.

Conclusion

In today’s complex business environment, the significance of vendor financial risk assessments cannot be overstated. By systematically evaluating the financial stability and creditworthiness of suppliers, organizations can effectively mitigate risks and ensure the reliability of their vendor relationships. The essential components of these assessments include:

- Review of financial statements

- Credit ratings

- Market position

These components collectively contribute to informed decision-making and operational continuity.

Moreover, the proactive approach of integrating financial risk assessments into vendor management strategies is crucial for fostering sustainable partnerships. Organizations that embrace these evaluations not only safeguard their interests but also enhance their operational resilience. Continuous monitoring and reassessment further emphasize the need for organizations to remain vigilant in tracking vendor performance and financial health, allowing for timely interventions when necessary.

Ultimately, adopting best practices in vendor financial risk assessments empowers organizations to navigate the intricacies of supply chains while building stronger, more reliable partnerships. As the landscape of vendor management continues to evolve, integrating these assessments into strategic frameworks will be vital for achieving sustained business growth and ensuring compliance with regulatory requirements. By prioritizing financial stability in vendor relationships, organizations can position themselves for success in an increasingly interconnected marketplace.

Frequently Asked Questions

What are supplier monetary stability evaluations?

Supplier monetary stability evaluations are systematic reviews designed to assess the economic soundness and credit reliability of suppliers, helping organizations mitigate potential challenges associated with supplier relationships.

Why are vendor financial risk assessments important?

Vendor financial risk assessments are crucial for ensuring that suppliers can meet contractual commitments and maintain operational dependability, as they help identify potential economic hazards that could disrupt supply chains or lead to monetary losses.

What are the key components of vendor financial risk assessments?

The key components include: Financial Statements Review: Analyzing balance sheets, income statements, and cash flow statements; Creditworthiness Evaluation: Utilizing credit rating agencies to assess the supplier's credit ratings; Market Position Analysis: Evaluating the supplier's status in the sector and potential market threats.

How do vendor financial risk assessments help organizations?

They help organizations mitigate risks, ensure compliance with regulatory frameworks, and enhance decision-making regarding supplier partnerships, ultimately fostering reliable and sustainable business relationships.

What role does real-time analytics play in vendor financial risk assessments?

Real-time analytics enable organizations to continuously monitor supplier performance, facilitating quicker adjustments and more effective decision-making.

What impact do vendor financial risk assessments have on supply chain management?

Organizations that conduct these assessments report enhanced supplier dependability, with case studies showing significant reductions in supply chain interruptions and improved operational resilience.

How can vendor financial risk assessments contribute to a sustainable business environment?

By understanding the economic condition of suppliers, organizations can navigate supply chain complexities more effectively and mitigate uncertainties, thus fostering a more sustainable and equitable business environment.