Overview

Creating a risk assessment template for financial institutions necessitates the identification of potential threats, a thorough analysis of their impacts, and the development of tailored mitigation strategies that align with regulatory requirements and organizational objectives. This article provides a step-by-step guide that underscores the significance of collaboration, the integration of technology, and the necessity of continuous monitoring. These elements are crucial to ensuring that the template remains relevant and effective in addressing the evolving risks within the financial sector.

Introduction

In the intricate world of finance, the ability to identify and manage risk is paramount for the stability and success of institutions. As financial entities grapple with an evolving landscape marked by diverse threats—from credit and operational risks to compliance challenges—establishing a robust risk assessment framework becomes not just beneficial, but essential. Moreover, the increasing emphasis on Environmental, Social, and Governance (ESG) factors further complicates the risk management equation, prompting organizations to adapt and innovate in their strategies.

This article delves into the multifaceted nature of risk assessment in financial institutions, offering insights into effective methodologies, the integration of advanced technologies, and the necessity for continuous improvement in compliance practices. Through a comprehensive exploration, financial leaders can equip themselves with the knowledge needed to navigate uncertainties and foster sustainable growth in an ever-changing environment.

Understanding Risk Assessment in Financial Institutions

Evaluating potential threats in monetary establishments is an essential procedure guided by a risk assessment template for financial institutions. This template includes the identification, analysis, and assessment of possible dangers that could negatively impact the organization’s operations and economic stability. In 2025, financial institutions encounter a diverse array of challenges, including credit, operational, market, and compliance challenges. Each of these hazards presents unique obstacles that require customized strategies for effective oversight.

The significance of a robust hazard oversight structure cannot be overstated. Such frameworks not only assist institutions in complying with evolving regulatory requirements but also align with their strategic objectives. In fact, 77% of corporate compliance professionals acknowledge the importance of staying updated on Environmental, Social, and Governance (ESG) developments, indicating an increasing understanding of the broader consequences of oversight.

As Sharavanan noted, '91% of business leaders believe their company has a responsibility to act on ESG issues,' emphasizing the critical role of ESG considerations in managing potential challenges.

Frequent evaluations of vulnerabilities are crucial for monetary entities to implement a risk assessment template for financial institutions, ensuring they remain alert to possible dangers. Current statistics reveal that a substantial percentage of monetary institutions are conducting regular evaluations, with many leaders recognizing that third-party breaches pose a significant cyber threat, as highlighted by 35% of surveyed executives. This underscores the necessity for proactive measures in management, particularly in light of the changing compliance landscape for 2024, which mandates the use of a risk assessment template for financial institutions.

Recent trends indicate a significant shift towards the adoption of advanced technologies, such as artificial intelligence (AI) and machine learning (ML), to enhance compliance and combat economic crime. Notably, 43% of organizations facing pressure to boost revenue express a desire to implement these technologies, reflecting a transformative approach to evaluation practices.

Effective hazard handling structures in monetary organizations are characterized by their flexibility and responsiveness to new challenges. Expert opinions emphasize that a well-structured management approach not only safeguards assets but also fosters sustainable growth. As monetary entities navigate the complexities of the current environment, the incorporation of innovative evaluation techniques will be crucial in ensuring long-term resilience and success.

Step-by-Step Guide to Developing a Risk Assessment Template

-

Define the Scope: Begin by clearly delineating the specific areas within the financial organization that the assessment will encompass. This may include various departments, product lines, or service offerings, ensuring a comprehensive understanding of the institution's operational landscape.

-

Identify Hazards: Compile a thorough list of potential challenges associated with the defined scope. Engage with stakeholders throughout the organization to collect varied insights and viewpoints on the challenges they perceive, encouraging a collaborative approach to identifying potential issues.

Assess Threats: Evaluate the likelihood and potential impact of each identified threat. Utilize a matrix to categorize these threats based on their severity, which aids in prioritizing them for further action. This systematic evaluation is crucial for effective management of uncertainties. Notably, with over 100 system integrations completed in supply-chain automation, leveraging technology can significantly enhance the assessment process. Our team at Transform Your Small/ Medium Business supports a shortened decision-making cycle throughout the turnaround process, allowing your team to take decisive action to preserve your business.

-

Develop Mitigation Strategies: For each identified threat, outline specific strategies aimed at mitigating or managing the issue. This may involve implementing robust controls, developing contingency plans, or enhancing existing processes to reduce vulnerability. The recent financial crisis has underscored the necessity of reevaluating monetary policy and administrative strategies, as highlighted by Pin Aleksandr Sheremeta, Managing Partner, who noted that the crisis severely impacted expenses during the month-end close.

Document the Risk Assessment Template for Financial Institutions: Create a formalized document that encapsulates all identified threats, assessments, and corresponding mitigation strategies. Ensure that this document is user-friendly and accessible, facilitating ease of use for all stakeholders involved in the management process. We continually monitor the success of our plans and teams through our client dashboard, which provides real-time business analytics to continually diagnose your business health.

-

Review and Revise: Establish a routine for regularly evaluating the risk assessment template to ensure its relevance and effectiveness. Modifications should be implemented as needed to accommodate emerging challenges or changes within the organization, ensuring that the template evolves alongside the organization's operational environment. For example, a case study on Cyber Threat Evaluation demonstrates the serious repercussions of cybersecurity assaults on monetary entities, highlighting the necessity for continuous investment in cybersecurity strategies to reduce dangers.

Identifying and Analyzing Risks: The Foundation of Your Template

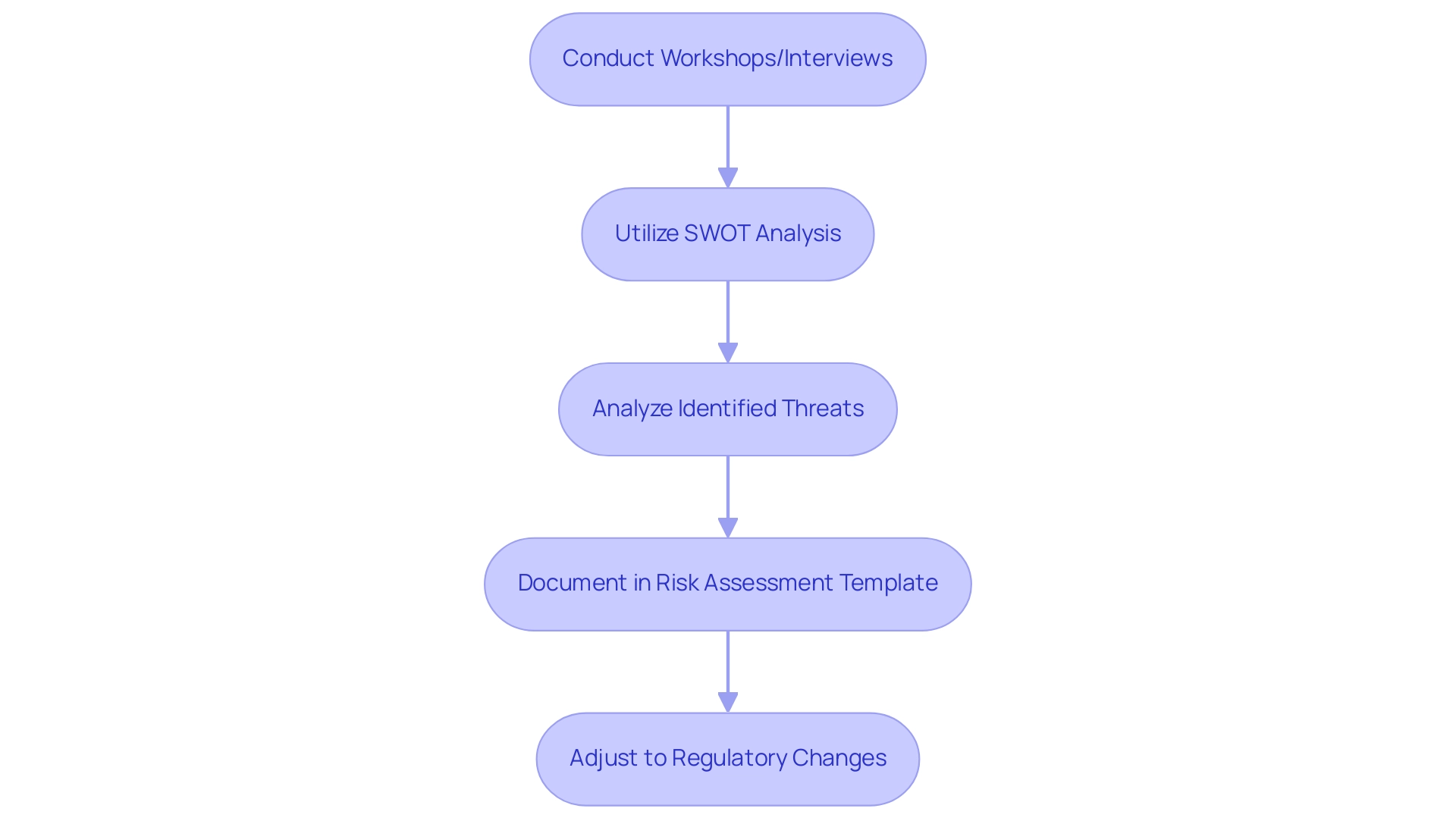

Identifying and analyzing threats in financial institutions necessitates a meticulous evaluation of both internal and external factors that may influence operations. This procedure should commence by arranging workshops or conducting interviews with key stakeholders, ensuring a broad spectrum of viewpoints on potential challenges is gathered. Such a collaborative method not only enhances the identification process but also fosters a culture of awareness and proactive management, essential for streamlined decision-making.

Utilizing tools such as SWOT analysis (Strengths, Weaknesses, Opportunities, Threats) is vital for effectively categorizing and prioritizing risks. In 2025, the application of SWOT analysis has proven especially effective, enabling organizations to systematically evaluate their vulnerabilities and strengths within the context of evolving economic landscapes. For example, as monetary institutions adapt to innovations like digital currencies and advanced hedging strategies, a thorough SWOT analysis can illuminate critical areas for improvement and opportunity, facilitating continuous monitoring of business performance.

A recent case study titled "Risk Management Innovations: A Top Trend in 2025" underscores how organizations are leveraging technology to enhance economic decision-making and develop innovative approaches to mitigate economic volatility. This aligns with insights from Eugene Goyne, EY Asia-Pacific Financial Services Regulatory Lead, who stated, 'The ground beneath the feet of banks and financial services firms is always shifting,' emphasizing the necessity for proactive management of uncertainties and operationalizing turnaround lessons.

Once threats are identified, it is crucial to analyze each one by evaluating its likelihood of occurrence and potential impact on the organization. This analysis should be documented in a risk assessment template for financial institutions, providing a structured overview of the threat landscape. Recent statistics indicate that 81% of bank leaders are now willing to leverage AI for cyber attack prevention and detection, highlighting the growing significance of technology in management.

Moreover, with anticipated standardized licensing frameworks for crypto service providers and enhanced oversight of stablecoins, monetary entities must adjust their evaluation processes to navigate these regulatory changes effectively. By incorporating these insights into the evaluation process, financial institutions can enhance their decision-making capabilities and develop innovative strategies to mitigate economic volatility effectively.

Evaluating and Treating Risks: Key Components of Your Template

Recognizing and examining threats is just the beginning; the next step involves a thorough assessment grounded in severity and potential organizational impact. Implementing a matrix for assessing threats is crucial for categorizing these challenges into distinct levels—such as low, medium, and high—based on their likelihood and impact. This organized method not only assists in prioritizing challenges but also enables informed decision-making, particularly when supported by real-time analytics that provide immediate insights into business health.

For each high-priority threat identified, it is essential to develop comprehensive treatment strategies. These strategies may encompass:

- Avoidance

- Reduction

- Sharing

- Acceptance

These should be tailored to the specific context of the financial institution. Documenting these strategies within the risk assessment template for financial institutions is vital, ensuring that each risk is paired with a clear action plan.

This plan should delineate responsibilities for execution and continuous oversight, fostering accountability and proactive leadership.

Current trends indicate that financial institutions are increasingly adopting data-driven strategies to enhance workforce resilience and close operational gaps. As organizations confront emerging challenges—ranging from climate impacts, such as significant weather-related losses in the solar energy sector, to cyber threats—investing in resilience and collaborating with management partners is essential. As Cliff Huntington, general manager of Transform Your Small/ Medium Business, noted, "Business leaders are recognizing that ESG challenges represent a business concern and are taking steps to address it alongside their enterprise initiatives."

By concentrating on these areas, institutions can better prepare for uncertainties, ensuring sustained success and growth in an evolving landscape. Furthermore, case studies from 2025, such as 'Proactive Strategies for Clients in 2025 and Beyond,' illustrate the effectiveness of matrix implementation in banking, highlighting how proactive strategies can lead to enhanced treatment outcomes. Additionally, articles on navigating volatility, typically ranging from 5 to 10 minutes in length, provide further insights into effective management practices.

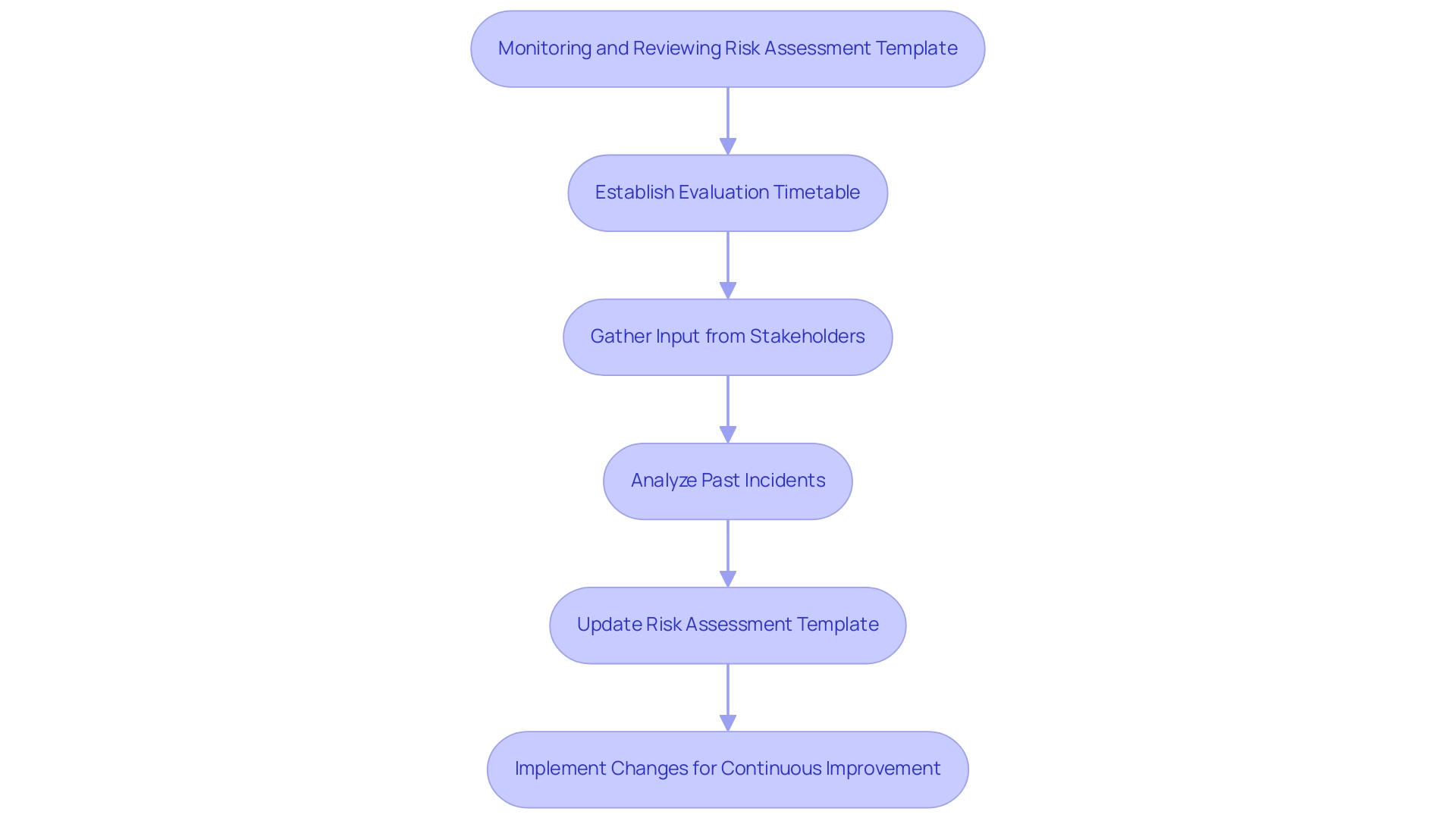

Monitoring and Reviewing Your Risk Assessment Template for Continuous Improvement

Monitoring and reviewing the risk assessment template for financial institutions is crucial for ensuring its effectiveness in an ever-changing landscape. Establishing a consistent evaluation timetable—whether annually or semi-annually—ensures that identified challenges and treatment strategies remain relevant. During these evaluations, gathering input from stakeholders is vital, as 77% of corporate compliance experts emphasize the importance of staying informed about evolving threats, particularly those related to environmental, social, and governance (ESG) factors.

Moreover, a recent report by Thomson Reuters highlighted that 61% of participants expect the costs associated with senior compliance officers to increase, underscoring the growing importance of effective oversight within organizations.

Analyzing incidents that have transpired since the last assessment offers valuable insights into the efficacy of current strategies. This iterative process not only aids in updating the risk assessment template for financial institutions to align with organizational changes and regulatory requirements but also adapts to shifts in the external environment. The compliance landscape for 2024 is marked by continuous evolution and heightened complexity, necessitating proactive oversight.

Case studies, such as the one titled "Importance of Comprehensive Threat Management," illustrate that organizations proactively addressing potential risks through thorough management significantly enhance their chances of success. By persistently refining the risk assessment template for financial institutions, monetary organizations can ensure they are equipped to navigate uncertainties and foster sustainable growth.

Ensuring Compliance: Aligning Your Risk Assessment with Regulatory Standards

Adherence to regulatory standards is paramount in the evaluation process for financial institutions. Begin by identifying the specific regulations applicable to your organization, including those set forth by the Federal Reserve, FDIC, and OCC. Your risk assessment template for financial institutions should encompass critical sections that address these regulatory requirements, such as:

- Customer due diligence

- Anti-money laundering (AML) measures

- Data protection protocols

Notably, 67% of global executives find ESG regulations overly complex, highlighting the need for clarity in compliance practices. Furthermore, 53% of businesses have been found to leave sensitive data files accessible to unauthorized employees, underscoring the importance of stringent data protection measures.

To maintain compliance, it is essential to regularly update your risk assessment template for financial institutions to reflect any regulatory changes. This proactive approach not only ensures adherence to current standards but also enhances the overall effectiveness of your compliance strategy. Training all staff involved in the risk assessment process on these compliance requirements is crucial, as 77% of corporate risk and compliance professionals emphasize the importance of staying informed about the latest ESG developments.

Implementing best practices in compliance can lead to significant cost savings; organizations have reported millions in savings through centralized governance and regular audits, as illustrated in the case study titled "Cost Savings from Compliance Best Practices." By adopting a structured approach to compliance, institutions can reduce expenses while enhancing compliance effectiveness. The average expense of compliance in the services sector totals $30.9 million, highlighting the monetary implications of compliance.

As regulatory standards change in 2025, aligning your evaluations of potential issues with these standards will be essential for navigating the complexities of monetary affairs and ensuring sustainable growth.

Leveraging Technology for Enhanced Risk Assessment

Integrating technology into the evaluation process is crucial for enhancing operational effectiveness and precision within monetary organizations. Employing a risk assessment template for financial institutions significantly streamlines operations by offering features such as automated threat identification, real-time monitoring, and sophisticated data analysis. These tools empower monetary organizations to manage large volumes of data swiftly, enabling the identification of emerging threats with greater accuracy.

Moreover, technology fosters collaboration among parties by providing a centralized platform for recording and sharing assessment findings. This cooperative approach not only enhances clarity but also ensures that all relevant stakeholders are informed and engaged in the threat oversight process.

As the landscape of monetary services evolves, particularly with the rise of fintech and digital-first platforms, it is imperative for organizations to regularly evaluate the technology utilized in their risk assessment templates. This ongoing assessment guarantees that the tools employed align with the organization's shifting needs and the latest industry trends. For instance, the increasing popularity of super apps, which integrate various monetary services, underscores the necessity for banking entities to adopt adaptable risk assessment templates.

The emergence of FinTech startups and super apps is transforming the banking sector, emphasizing convenience and a wide array of service options for consumers.

In 2023, the U.S. experienced unprecedented weather and climate disasters costing $28 billion, resulting in $95.1 billion in damages. This reality highlights the urgent need for organizations to implement strategies that mitigate the impacts of climate-related emergencies. Additionally, fraud remains a significant threat within monetary establishments, as noted by Rafael DeLeon, reinforcing the need for effective risk assessment templates to combat fraud.

Looking ahead to 2025, the integration of oversight software is anticipated to become even more critical, with data indicating a substantial rise in its adoption across the sector. Furthermore, managing third-party AI challenges is vital for effective management strategies in organizations utilizing externally developed AI tools. Financial institutions that leverage these technologies will not only enhance their capabilities through risk assessment templates but also position themselves to adeptly navigate the complexities of a rapidly evolving financial landscape.

Conclusion

The landscape of risk assessment in financial institutions is continuously evolving, driven by the need for robust frameworks to manage an array of challenges, including credit, operational, and compliance risks. The integration of Environmental, Social, and Governance (ESG) factors adds another layer of complexity, necessitating that organizations adapt their strategies to remain compliant and aligned with regulatory standards. By prioritizing regular risk assessments and employing advanced technologies such as artificial intelligence and machine learning, financial institutions can enhance their ability to identify, evaluate, and mitigate risks effectively.

Moreover, the adoption of a structured risk assessment template is vital for ensuring comprehensive coverage of risks while fostering a culture of proactive risk management. This template should be regularly reviewed and updated based on stakeholder feedback and shifts in the regulatory environment, thereby ensuring its relevance and effectiveness. As organizations navigate the complexities of the financial sector, the commitment to continuous improvement and innovation in risk management practices will be crucial for achieving long-term resilience and success.

Ultimately, the proactive management of risks not only safeguards assets but also supports sustainable growth in a rapidly changing landscape. Financial institutions that embrace these principles will be better equipped to face uncertainties and capitalize on emerging opportunities, reinforcing their position in the market and ensuring compliance with evolving standards. As the financial world continues to shift, the focus on comprehensive risk assessment will remain a cornerstone for achieving stability and fostering sustainable growth.

Frequently Asked Questions

What is the purpose of a risk assessment template for financial institutions?

The purpose of a risk assessment template for financial institutions is to identify, analyze, and assess potential threats that could negatively impact the organization’s operations and economic stability.

What types of challenges do financial institutions face in 2025?

Financial institutions face a diverse array of challenges in 2025, including credit, operational, market, and compliance challenges, each requiring customized strategies for effective oversight.

Why is a robust hazard oversight structure important for financial institutions?

A robust hazard oversight structure is important because it helps institutions comply with evolving regulatory requirements and aligns with their strategic objectives, ultimately safeguarding their operations.

What percentage of corporate compliance professionals recognize the importance of staying updated on ESG developments?

77% of corporate compliance professionals acknowledge the importance of staying updated on Environmental, Social, and Governance (ESG) developments.

How do business leaders view their responsibility regarding ESG issues?

91% of business leaders believe their company has a responsibility to act on ESG issues, highlighting the critical role of these considerations in managing potential challenges.

What is the significance of frequent evaluations of vulnerabilities for monetary entities?

Frequent evaluations of vulnerabilities are crucial for monetary entities to implement a risk assessment template effectively, ensuring they remain alert to possible dangers.

What recent trends are impacting the risk assessment processes in financial institutions?

Recent trends indicate a significant shift towards adopting advanced technologies, such as artificial intelligence (AI) and machine learning (ML), to enhance compliance and combat economic crime.

What are the steps involved in the risk assessment process for financial institutions?

The steps involved in the risk assessment process include: 1. Define the Scope 2. Identify Hazards 3. Assess Threats 4. Develop Mitigation Strategies 5. Document the Risk Assessment Template 6. Review and Revise.

How should financial institutions document their risk assessment?

Financial institutions should create a formalized document that encapsulates all identified threats, assessments, and corresponding mitigation strategies, making it user-friendly and accessible for all stakeholders.

Why is it important to regularly review and revise the risk assessment template?

It is important to regularly review and revise the risk assessment template to ensure its relevance and effectiveness, accommodating emerging challenges or changes within the organization.