Introduction

Crafting a comprehensive business strategy goes beyond simply analyzing the numbers on a balance sheet. It requires a dynamic approach that intertwines profit and value maximization. This is where the importance of profit and loss projections in business planning comes into play.

By shifting from static profit and loss statements to a 12-month rolling forecast, companies can gain a more fluid and forward-thinking perspective. This article explores the key components of a profit and loss statement, steps to prepare a 12-month profit and loss projection, utilizing templates for projecting income statements, best practices for accurate forecasting, demonstrating performance to investors and lenders, and common mistakes to avoid in profit and loss projections. By following these insights, CFOs can enhance their financial planning and guide their organizations towards sustainable growth.

Importance of Profit and Loss Projections in Business Planning

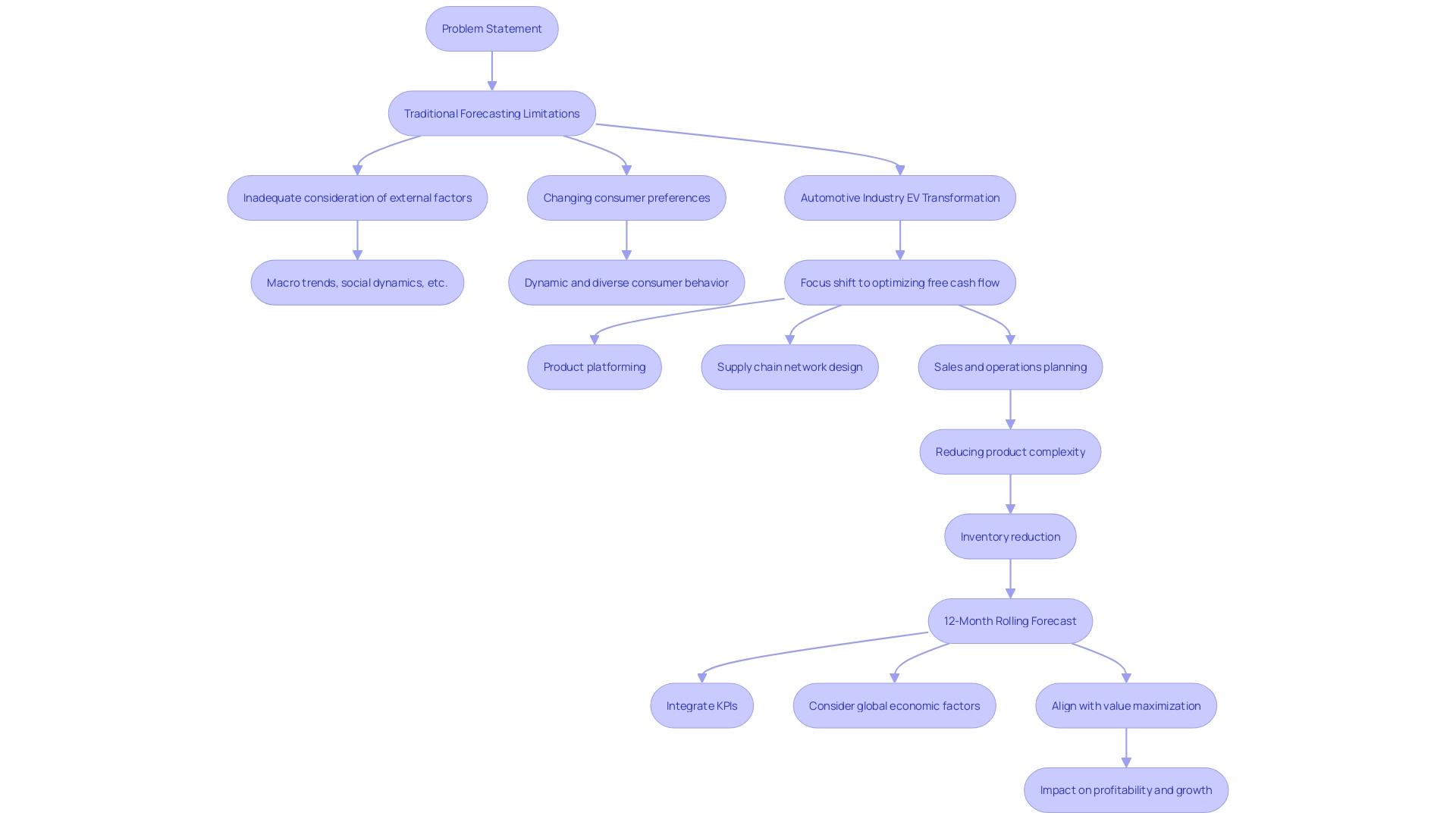

Gaining insights into the trajectory of a company goes beyond the numbers on a balance sheet, it involves developing a strategy that intertwines profit and . A serves as a dynamic blueprint that reflects both immediate financial realities and long-term objectives. It's a necessary pivot from traditional gain and loss statements, which are static and backward-looking, to a more fluid, forward-thinking approach. This shift allows for a comprehensive assessment of and growth opportunities ahead.

A rolling forecast does more than just project revenue and expenses; it aligns with the strategic vision that drives every aspect of an enterprise. For growth-focused companies, this might mean accepting lower earnings or enduring losses in the short term to bolster long-term growth prospects. This approach has been the cornerstone for many of today's market leaders in sectors such as technology and renewable energy, despite the critique that they sometimes place too much emphasis on scaling at the expense of profitability.

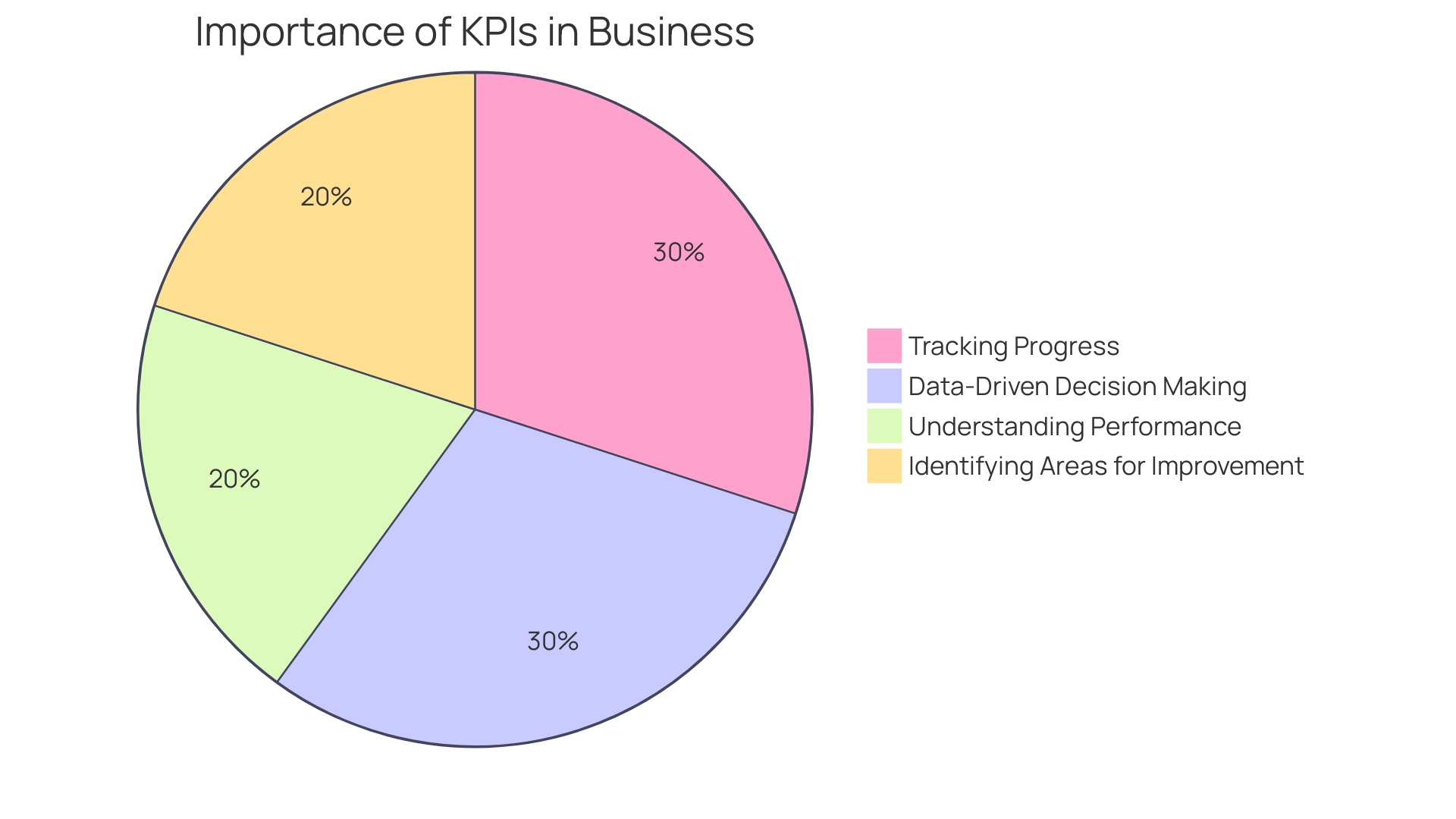

To effectively utilize the potential of a rolling forecast, businesses must integrate that offer direct insight into economic health, operational efficiency, and customer satisfaction. In practice, this could involve a focus on customer retention to boost profitability, as retaining customers is often more cost-effective than acquiring new ones.

Moreover, understanding the global economic landscape is crucial. For instance, companies in Eastern Europe and Russia may exhibit higher margins due to the dominance of natural resource companies and reduced competition due to sanctions. On the other hand, businesses operating in Chinese and Southeast Asian markets might encounter reduced net margins, questioning the premise that bigger markets always result in increased earnings.

Essentially, a 12-month rolling forecast is not only a document related to finances but also a strategic tool that should be consistently updated and aligned with the overarching objective of value maximization. It's a reflection of a company's adaptability to market conditions and commitment to sustainable growth.

Key Components of a Profit and Loss Statement

The economic wellbeing of a business is often revealed in its , also referred to as the income statement. This document encapsulates the monetary activities of a company over a specified period, detailing revenues, costs, and expenses to reveal the ability. The key components of this statement are critical for creating precise financial projections. These components include revenue, which represents the income generated from sales before any expenses are deducted. Next, the (COGS) details the direct costs attributable to the production of the goods sold by the company. Operating expenses, although not tied directly to production, are necessary for the day-to-day functions of the business such as rent, utilities, and payroll. The gross profit margin, calculated by subtracting COGS from revenue, reflects the efficiency of production and service delivery. Net operating income then takes into account the operating expenses, offering insight into the operational profitability. Expenses and other costs are also considered, resulting in a clear picture of the company's net profitâthe ultimate indicator of performance. By analyzing these elements, companies can plan effectively, similar to hoteliers who, by understanding the intricacies of their P&L statements, can make informed choices to maximize profitability. A strong understanding of these components enables businesses to not just meet but exceed their objectives, turning insights into action for sustained growth and success.

Steps to Prepare a 12 Month Profit and Loss Projection

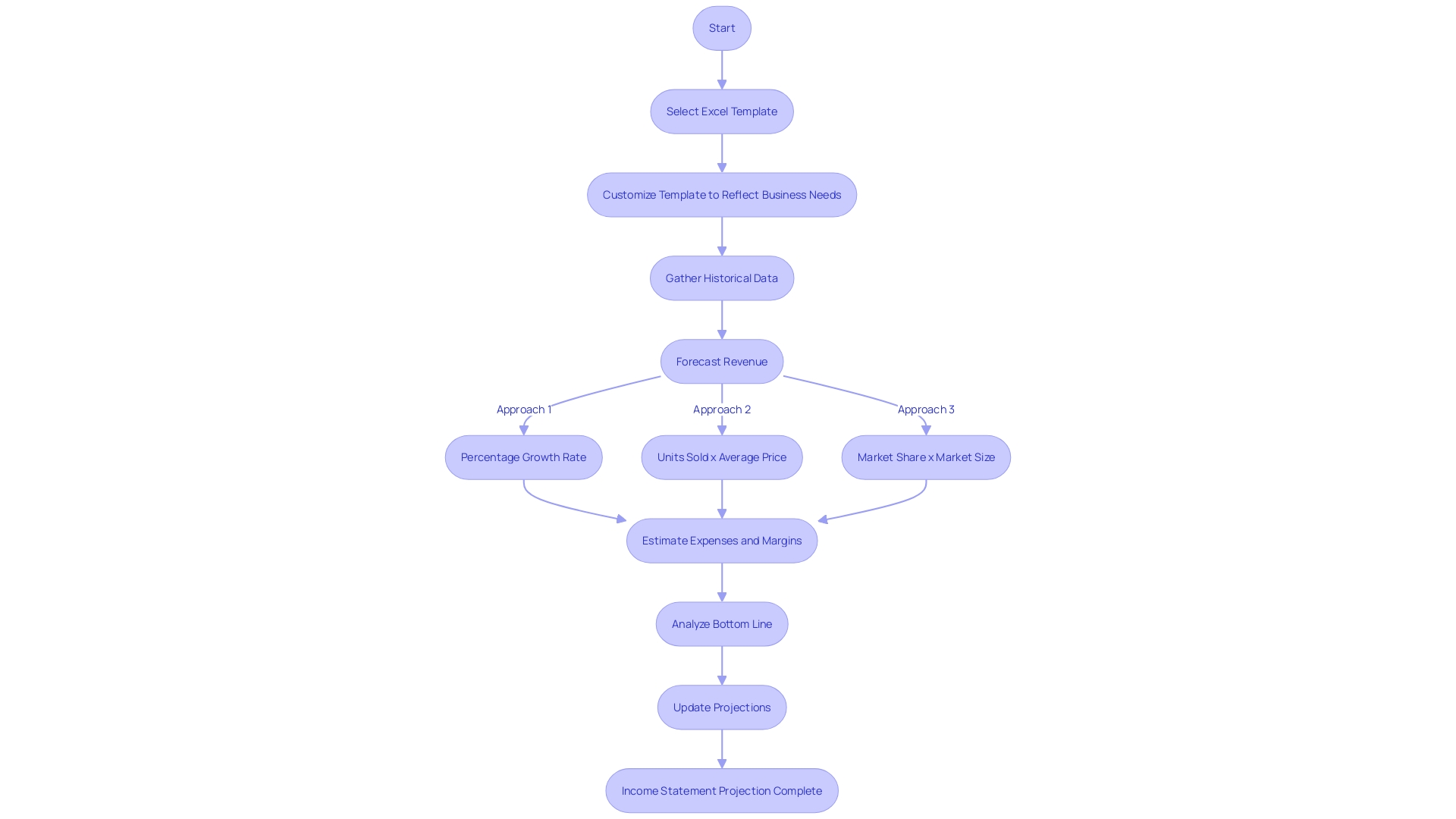

Creating a 12-month rolling requires careful attention to detail and the capacity to anticipate future performance. Start by gathering a comprehensive set of , like sales records, expense reports, and previous statements, to guide your projections. With at least three years of data, you can discern that affect your business's monetary path.

For an accurate revenue estimate, analyze past sales trends while considering market conditions and potential growth drivers. Next, calculate the cost of goods sold (COGS) based on historical cost analysis and projected changes in material and labor costs. Operating expenses must also be projected, taking into account fixed costs and variables that could affect future spending.

Taxes and other obligatory expenditures should not be overlooked as they have a significant effect on net earnings. To simplify this intricate procedure, utilize Excel templates created for forecasting finances, which can offer a structured method and integrate industry benchmarks for more accurate forecasts.

Remember, as Peter Drucker famously stated, "What gets measured gets managed." By closely monitoring key performance indicators (KPIs) and analyzing your earnings and expenses statements, you gain the clarity needed to devise strategies that not only enhance short-term profitability but also set the foundation for sustained long-term growth. By focusing on and optimizing operational efficiency, you can ensure that your profit and loss forecasts are not just numbers on a spreadsheet, but a roadmap to the economic health of your company.

Utilizing Templates for Projecting Income Statements

Templates for income statement predictions are powerful tools for businesses aiming to streamline their . These templates facilitate a structured approach to evaluating profitability, allowing you to focus on strategy rather than getting bogged down in the minutiae of data entry. They also offer a standardized method for tracking key performance indicators, highlighting Peter Drucker's wisdom that 'What gets measured gets managed.'

Using Excel templates for P&L forecasts can provide insights that extend beyond just top-line numbers. By analyzing the bottom line, you unearth the true factors impacting your hotel's , enabling more informed decision-making. It's crucial to base your projections on solid , ideally spanning at least three years to capture seasonal trends and long-term patterns.

When selecting an , choose one that aligns with your business's specific needs and can be easily customized. This customization is crucial to accurately reflecting your economic landscape, from revenue and operating costs to . Once in place, maintaining and updating your projections becomes a more manageable task.

It's crucial to keep in mind that while templates provide a starting point, they are not a replacement for a profound comprehension of your company's economic dynamics. As echoed by InvestorPlace Earnings, the swift automation of reporting underscores the significance of being able to interpret and act on data promptly. A well-maintained ensures you're not only informed but also ready to steer your organization towards .

Best Practices for Accurate Forecasting

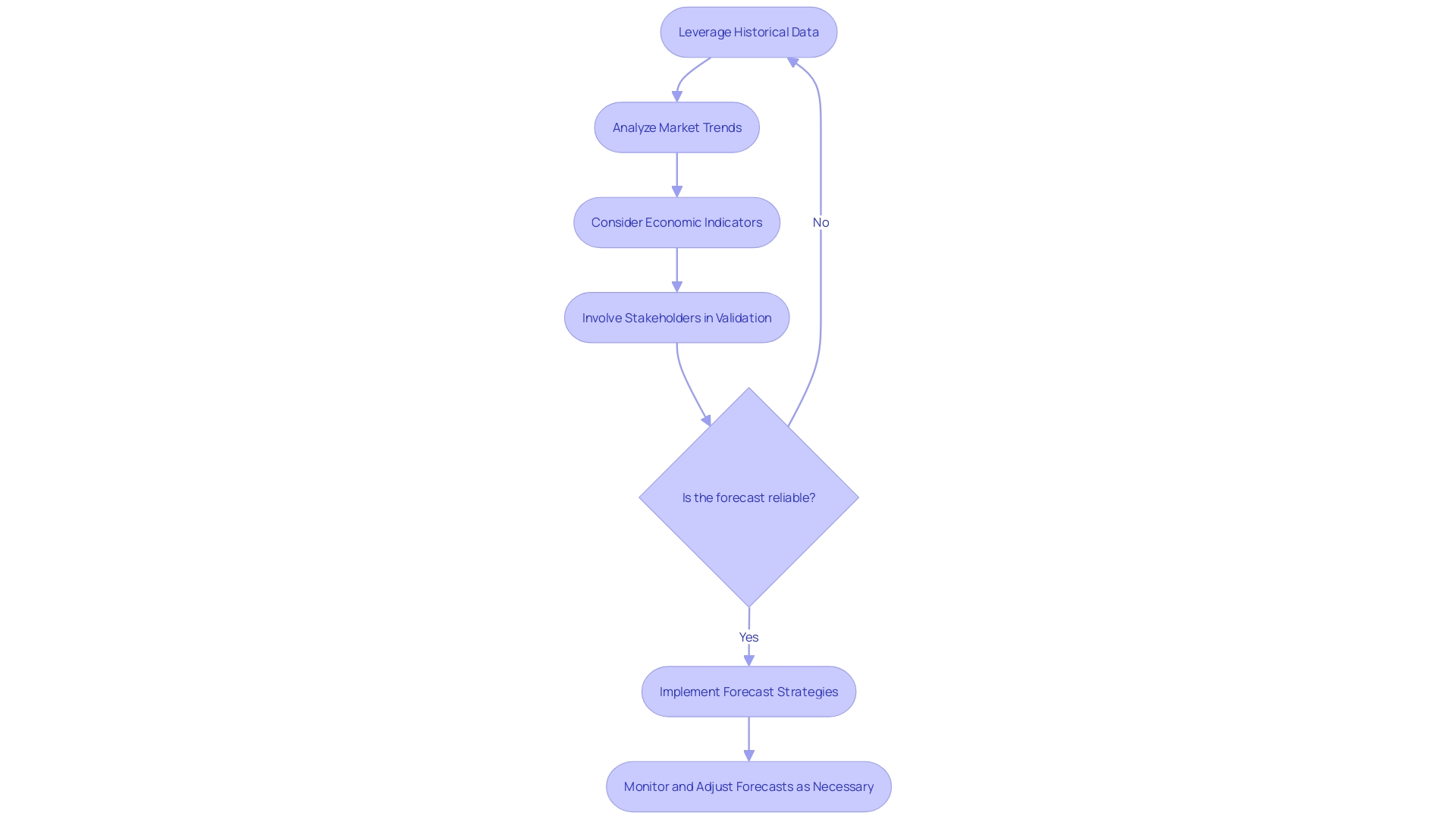

To navigate the intricacies of , CFOs must embrace a dynamic and comprehensive approach. While accuracy is a common benchmark, the true measure of success lies in that propels the organization ahead. This involves leveraging historical data, understanding market trends, and considering economic indicators. For instance, a solid forecast is rooted in the analysis of past performance, encompassing sales records and , which aids in identifying growth patterns and potential anomalies.

It is critical to acknowledge the interplay between forecasting and budgeting. Forecasting, the art of predicting future business performance, is integral to and progress monitoring. The beginning of the year presents an optimal opportunity to harness this strategic tool, ensuring it is grounded in data and aligned with the company's overarching goals.

Moreover, CFOs should maintain a balance between the supply and demand equation, while steering clear of the drawbacks of undersupply, which may result in decreased earnings and customer discontent. Involving is vital, as it guarantees a wider outlook and support, ultimately resulting in more dependable income and expense estimates.

By concentrating on these practices, CFOs can better manage , adhere to monetary regulations, and align short-term operations with long-term monetary objectives, thereby driving the organization towards .

Demonstrating Performance to Investors and Lenders

When presenting profit and loss projections, it's crucial to effectively . This not only aids in internal decision-making but also bolsters the confidence of investors and lenders in your company's potential. Showing (KPIs) is crucial, as these figures are instrumental in illustrating your business's health and operational efficiency. Visual aids can serve to create a compelling narrative around your data, making it accessible and easily digestible for stakeholders. For example, by employing the most effective methods of clarity and transparency in your visual displays can significantly improve the understanding of your forecasts.

Additionally, it's important to articulate the assumptions that underpin your . To ensure that the dependability of your predictions, it is important to justify and clearly state assumptions regarding market conditions and cost estimates. This for an informed assessment of the potential risks associated with your projections. As mentioned in professional guidance, it is vital to emphasize on clarity, relevance, accuracy, and timeliness in your monetary communication to avoid misinterpretation and to ensure your message has the intended impact.

In the context of a rapidly evolving economic landscape, where conventional economic instruments like promissory notes are being digitized to overcome limitations like verification inefficiencies and market accessibility, it's evident that the way we present and interpret economic data is also transforming. Highlighting the strength of your fiscal models and forecasts in this digital age can additionally foster trust in investors and lenders, especially as they navigate the intricacies of new regulatory environments and market forces.

In the end, by effectively showcasing your income and expense estimates with an emphasis on important measures, visual transparency, and clearly stated presumptions, you establish your company as a reliable and future-oriented organization in the view of external stakeholders. This method not only shows your dedication to fiscal responsibility but also highlights your flexibility to the ongoing digital transformation in reporting and analysis.

Common Mistakes to Avoid in Profit and Loss Projections

To ensure that are both accurate and reliable, it's critical to avoid common pitfalls that could otherwise distort the . Major errors to prevent include overestimating revenues and underestimating expenses, which could greatly distort the economic landscape and result in misguided business decisions. It's equally important to consider that could affect performance. By exploring historical data and comprehending revenue streams, CFOs can create a more precise portrayal of their company's trajectory. This involves a meticulous analysis of sales records, expense reports, and , ideally over a span of three years or more, to capture both seasonal fluctuations and long-term trends. Additionally, distinguishing between various revenue sources—be it product sales, service fees, or subscription income—is crucial for a nuanced forecast. Understanding the complexities of and their function in the economic cycle is crucial for a thorough profit and loss statement. Moreover, staying abreast of economic indicators, such as interest rates and their correlation with inflation, can offer valuable insights into the broader market dynamics that affect a company's profitability. In the face of ever-evolving market conditions, as evidenced by companies like Manhattan Associates which reported a significant 20.4% year-on-year revenue increase, CFOs must be vigilant in their forecasting efforts. Embracing this approach not only prepares businesses for future challenges but also aligns them with the ultimate goal of , which often requires balancing short-term profitability with long-term growth prospects.

Conclusion

Crafting a comprehensive business strategy requires a dynamic approach that intertwines profit and value maximization. Shifting from static profit and loss statements to a 12-month rolling forecast allows companies to gain a more fluid and forward-thinking perspective. By integrating key performance indicators (KPIs) and leveraging templates for financial forecasting, businesses can create precise projections that align with their specific needs.

Regularly updating profit and loss statements and tracking KPIs helps guide financial planning and ensures sustainable growth.

To ensure accurate forecasting, CFOs must embrace a dynamic and comprehensive approach. This involves leveraging historical data, understanding market trends, and considering economic indicators. By balancing supply and demand, engaging stakeholders, and aligning short-term operations with long-term financial objectives, CFOs can drive their organizations towards sustainable growth.

When presenting profit and loss projections to investors and lenders, it's crucial to communicate the financial trajectory effectively. Highlighting KPIs and utilizing visual aids can make the data accessible and easily digestible. By articulating assumptions and emphasizing the robustness of financial models, CFOs can instill confidence in external stakeholders.

To ensure accurate and reliable profit and loss projections, it's critical to avoid common mistakes such as overestimating revenues and underestimating expenses. By delving into historical data, understanding revenue streams, and staying abreast of economic indicators, CFOs can create a more accurate representation of their company's financial trajectory. This approach prepares businesses for future challenges and aligns them with the ultimate goal of value maximization.

By following these insights, CFOs can enhance their financial planning and guide their organizations towards sustainable growth. By embracing a comprehensive and dynamic approach to profit and loss projections, CFOs can make informed decisions, optimize profitability, and demonstrate their commitment to fiscal responsibility.

Frequently Asked Questions

What are profit and loss projections?

Profit and loss projections, also known as income statements, are financial documents that estimate a company's revenues, costs, and expenses over a specific period, usually 12 months. They help assess the company's profitability and financial health.

Why are profit and loss projections important for business planning?

Profit and loss projections provide insights into a company’s financial trajectory, enabling strategic decision-making. They allow businesses to align immediate financial realities with long-term objectives, assess profitability, and identify potential risks and growth opportunities.

What is a 12-month rolling forecast?

A 12-month rolling forecast is a dynamic financial blueprint that is continually updated to reflect changing market conditions and business objectives. It moves beyond traditional static statements by offering a forward-looking approach to financial planning.

How does a rolling forecast differ from traditional profit and loss statements?

Unlike traditional profit and loss statements, which are static and reflect past performance, a rolling forecast is adaptable and focuses on future financial scenarios, allowing for ongoing adjustments based on the latest data and market conditions.

What key components are included in a profit and loss statement?

Key components of a profit and loss statement include: Revenue (total income generated from sales), Cost of Goods Sold (COGS) (direct costs related to production), Operating Expenses (costs necessary for daily business operations), Gross Profit Margin (revenue minus COGS), Net Operating Income (gross profit minus operating expenses), and Net Profit (overall profitability after all expenses are deducted).

How can businesses create accurate profit and loss projections?

To create accurate projections, businesses should gather at least three years of historical financial data, analyze past sales trends and consider market conditions, estimate future revenues and costs, including COGS and operating expenses, factor in taxes and other obligatory expenditures, and utilize templates for structured forecasting.

What role do key performance indicators (KPIs) play in profit and loss projections?

KPIs provide direct insight into a business's economic health, operational efficiency, and customer satisfaction. Using KPIs helps companies identify areas for improvement and align their financial forecasts with strategic goals.

What common mistakes should be avoided in profit and loss projections?

Common mistakes include overestimating revenues and underestimating expenses, failing to consider industry trends and potential risks, neglecting to analyze various revenue sources, and ignoring the importance of understanding operating expenses and economic indicators.

How can businesses effectively communicate their profit and loss projections to investors and lenders?

Businesses should clearly articulate their financial trajectory using visual aids for better understanding, justify the assumptions behind their forecasts to enhance transparency, and emphasize key performance indicators that illustrate financial health and operational efficiency.

What is the ultimate goal of profit and loss projections?

The ultimate goal of profit and loss projections is to maximize value while balancing short-term profitability with long-term growth. This involves making informed decisions that enhance economic health and adapt to changing market conditions.