Overview

Choosing the right interim CFO services in Bangalore involves evaluating candidates based on their experience, cultural fit, scope of services, and reputation to ensure they meet your organization's specific needs during transitional periods. The article underscores that a well-selected interim CFO can provide immediate expertise, streamline decision-making, and maintain operational continuity, which are crucial for navigating economic challenges effectively.

Introduction

In today's dynamic business landscape, organizations face an array of financial challenges that demand agile and effective leadership. Interim CFO services have emerged as a strategic solution, providing critical financial expertise during transitional periods or crises. These specialized professionals not only enhance cash flow management and compliance oversight but also empower businesses to navigate complex financial environments with confidence.

As the demand for interim CFOs continues to rise, understanding their roles and the unique advantages they bring can be pivotal for organizations striving for operational continuity and growth. This article delves into the various types of interim CFO services available, key considerations for selection, and the cost implications, offering a comprehensive guide for businesses looking to bolster their financial leadership in uncertain times.

Understanding Interim CFO Services: What They Offer

Interim CFO services Bangalore provide companies with essential leadership during transitional periods or crises, utilizing strategies for mastering the cash conversion cycle to improve overall business performance. These professionals deliver a wealth of strategic expertise, focusing on streamlined decision-making and real-time analytics essential for and performance monitoring. Their roles encompass:

- Strategic monetary planning

- Cash flow management

- Compliance oversight

- Risk assessment

This enables organizations to navigate complex economic landscapes adeptly.

By operationalizing turnaround lessons through continuous performance monitoring, temporary chief financial executives not only implement effective monetary controls but also establish best practices that enhance operational efficiency. Hiring a temporary CFO enables businesses to maintain operational continuity and concentrate on growth while ensuring their monetary health is effectively overseen. Notably, in 2024, 29% of S&P 500 CFO appointments were women, reflecting a significant trend in leadership diversity that is critical in today's business environment.

The case study titled 'CFO Retirement and Transition Trends' highlights a decrease in retirement rates for CFOs, illustrating a growing demand for experienced leaders in finance. As Rick Stefanone, Senior Director of Sales at Consero Global, observes, 'The outlook for 2025 shows an increased focus on FP&A reporting and M&A activity,' highlighting the changing landscape of temporary CFO services. The market for interim CFO services Bangalore is expected to expand considerably in 2024, indicating the rising acknowledgment of their worth in promoting organizational stability and improving economic performance.

Additionally, our services are guided by 20 strategies for optimal business performance, ensuring a comprehensive approach to managing resources. The investment for these temporary CFO services is competitively priced at $99.00, making it accessible for businesses aiming to enhance their financial leadership.

Key Factors to Consider When Choosing Interim CFO Services

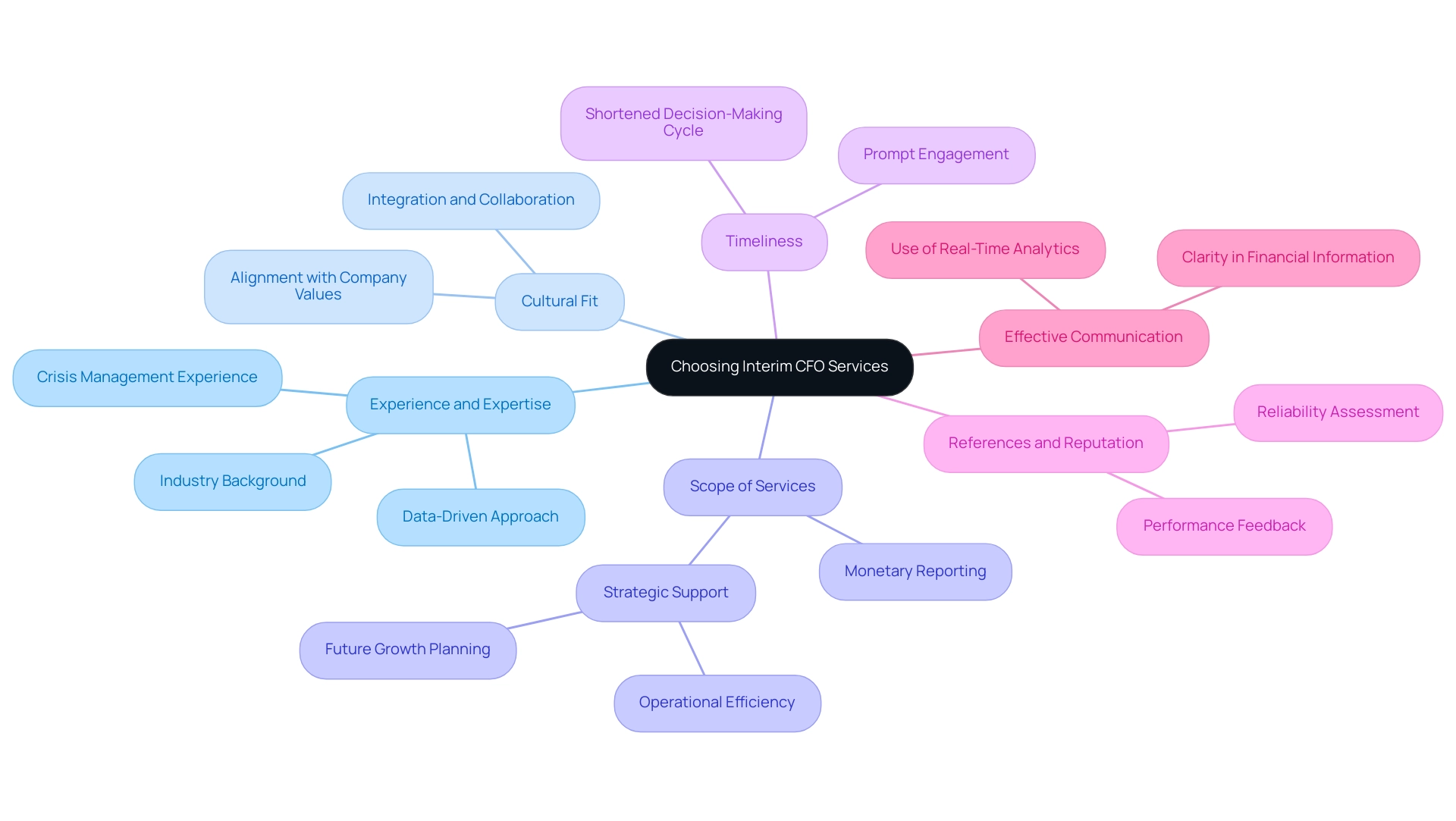

When choosing , several key factors warrant careful consideration:

- Experience and Expertise: Evaluate the candidate's specific background within your industry. Look for individuals who have demonstrated success in organizations similar to yours, particularly in navigating crisis situations or pivotal transitions. Their pragmatic approach to data, including testing hypotheses to maximize return on invested capital, can deliver significant value.

- Cultural Fit: It’s essential that the temporary CFO aligns with your company’s culture and values. A strong cultural fit fosters smoother integration and collaboration, which is vital for maintaining morale and operational continuity during transitions, especially when utilizing interim CFO services in Bangalore.

- Scope of Services: Clearly define the interim CFO services in Bangalore that are provided by the temporary CFO. While some may specialize in areas like monetary reporting or compliance, others may provide comprehensive strategic support, including planning for future growth or operational efficiency. Ensuring they can operationalize lessons learned throughout the turnaround process is crucial.

- Confirm the readiness of interim CFO services in Bangalore to meet your timeline and operational demands. Their capacity to engage promptly can be crucial, particularly for businesses facing urgent economic challenges, allowing for a shortened decision-making cycle.

- References and Reputation: Conduct thorough reference checks and review performance feedback to assess the candidate's reliability and effectiveness. A strong track record can provide confidence in their ability to lead.

- Effective communication is paramount during transitional periods, especially when utilizing interim CFO services in Bangalore. Ensure that the candidate can articulate complex financial information clearly and persuasively to stakeholders, including board members and staff. Additionally, the use of real-time business analytics through a client dashboard can facilitate ongoing monitoring of performance, helping to continuously diagnose your business health.

In a rapidly evolving marketplace, particularly as the global finance and accounting outsourcing market continues to flourish—valued at $60 billion—skilled temporary CFOs can be a game changer. As emphasized by Sarah Friar, CFO of OpenAI, 'The right leadership can steer organizations toward successful outcomes amid uncertainty.' Furthermore, a CFO adept in performance metrics and KPIs enhances operational efficiency and keeps the company on track toward strategic objectives, as demonstrated in our case study on performance metrics and KPI proficiency.

The Advantages of Engaging Interim CFO Services

Utilizing interim CFO services Bangalore offers a variety of benefits designed to address the changing requirements of organizations. These benefits include:

- Expertise on Demand: Organizations gain immediate access to specialized expertise without the long-term commitment that comes with a full-time hire. This flexibility enables companies to adjust swiftly to economic challenges, especially during periods of unpredictability.

- Streamlined Decision-Making: With an emphasis on rapid decision-making processes, temporary financial leaders empower organizations to take decisive actions that maintain and improve business well-being. This accelerated method is essential for organizations needing to pivot swiftly in response to market conditions, ensuring that decisions are made based on validated hypotheses to maximize returns on invested capital.

- Real-Time Analytics: Utilizing advanced client dashboards, temporary chief financial officers provide organizations with real-time business analytics, allowing for continuous monitoring and adjustment of economic strategies. This capability ensures that businesses remain agile and informed, effectively diagnosing their economic health and operationalizing lessons learned from previous strategies.

- Focused Attention: Interim CFOs are equipped to dedicate their efforts to specific challenges, ensuring that critical issues are prioritized and addressed promptly. This focused approach can significantly enhance problem-solving efficiency.

- Cost-Effective Solutions: Choosing a temporary CFO often proves to be more economical than hiring a permanent replacement, particularly for short-term needs or project-based work. Given the 116% year-over-year growth in demand for temporary leadership support roles, organizations are increasingly recognizing the economic benefits of interim CFO services in Bangalore.

- Strategic Insight and Change Management: These professionals introduce fresh perspectives and innovative solutions to resource management, aligning economic strategies with broader business objectives. This capability is vital for companies navigating changing market conditions, particularly as 64% of chief financial officers express optimism regarding the near-term U.S. economic environment’s potential positive influence on their organizations.

- Operational Continuity: Acting chief financial officers play a key role in maintaining economic stability during transitions, ensuring that daily operations proceed seamlessly without interruption.

Additionally, organizations struggling with the cultivation of encounter heightened turnover risks, making the role of acting chief financial officers even more essential. In areas like nonprofits and government organizations, where 37% of search efforts are aimed at temporary leadership roles, the importance of these positions in sustaining critical monetary operations is clearly emphasized. By utilizing temporary chief money officers, organizations not only tackle urgent monetary needs but also strategically prepare for future expansion, particularly in a context where supporting finance leaders is crucial.

Exploring Different Types of Interim CFO Services

Interim CFO services Bangalore encompass a range of roles designed to meet specific organizational requirements, especially during periods of economic uncertainty. These roles include:

-

Crisis Management Executives: Essential during critical situations, such as bankruptcy or severe cash flow challenges, these professionals focus on stabilizing finances and implementing immediate corrective measures to restore confidence and viability.

They leverage real-time analytics and utilize a client dashboard to make informed decisions swiftly, preserving business health.

-

: Engaged for distinct initiatives, these financial leaders manage high-stakes projects like mergers and acquisitions, restructuring, or system implementations. Their expertise ensures that projects align with monetary goals and are executed efficiently, utilizing streamlined decision-making processes that shorten the decision-making cycle.

-

Operational Chief Financial Officers: With a keen focus on enhancing fiscal operations, Operational Chief Financial Officers streamline processes to improve efficiency and ensure compliance. Their role is crucial in fostering a culture of operational excellence within the monetary team, supported by continuous performance monitoring through real-time analytics and the client dashboard.

-

Advisory Financial Officers: Providing strategic guidance without the burden of daily management, these professionals collaborate closely with existing financial teams, offering insights and advice that help steer organizations toward their long-term objectives.

Their ability to analyze business performance in real-time aids in building strong relationships and trust within the organization.

-

Transitional Financial Officers: When organizations undergo significant changes, such as leadership transitions or restructurings, Transitional Financial Officers ensure continuity and stability. Their experience is essential for navigating the complexities of change, assisting in preserving operational integrity during uncertain times, while also implementing lessons learned from previous turnaround efforts.

As the demand for interim CFO services in Bangalore has surged, with a reported 78% increase in requests for C-suite temporary positions, it underscores the pressing need for leadership continuity amid ongoing economic challenges. With 15.7% of financial leaders indicating that inflation is their primary concern heading into 2023, the expertise of temporary financial executives becomes increasingly relevant. Moreover, 61% of CFOs indicate that integration with their existing systems is the greatest challenge of financial automation, emphasizing the operational aspects that temporary CFOs must navigate.

Comprehending these specific types of temporary CFO services and their strategic applications, including strategies for mastering the cash conversion cycle, can provide organizations with the necessary tools to effectively navigate crises and enhance overall performance.

Cost Considerations for Interim CFO Services in Bangalore

When evaluating the cost of temporary CFO services in Bangalore, businesses must carefully assess several key factors:

- Hourly Rates vs. Retainer Fees: Determine whether the CFO charges based on an hourly rate or a fixed retainer fee. Hourly rates can fluctuate widely depending on the CFO's expertise and the current market demand.

- Scope of Work: The complexity and breadth of the services required will significantly impact the overall cost. Extensive engagements that demand greater involvement typically attract higher fees.

- Market Rates: It is crucial to research the average market rates for interim CFO services in Bangalore to secure competitive pricing. In 2024, businesses can expect varying rates influenced by experience and market conditions.

- Value Proposition: Assess the potential return on investment. A skilled temporary CFO can not only save costs—outsourcing CFO services can reduce overhead expenses—but also enhance performance, validating the investment in their services. As Sunil Gupta notes,

Working with Solutions has been a game-changer for our business,

highlighting the significant impact a skilled CFO can have on real-time analytics and strategic decision-making.

- Benefits of Virtual CFO Services: In addition to cost savings, virtual CFO services enhance financial reporting and analysis, ensuring transparency and compliance while identifying areas for financial performance optimization. This is crucial for businesses aiming to operationalize lessons learned and implement quick decision-making processes.

- Collaborative Planning: Interim financial officers work closely with businesses to identify underlying issues and collaboratively develop actionable plans. This partnership ensures that strategies are tailored to the specific needs of the organization.

- Test & Measure: Interim financial officers utilize a data-driven approach to evaluate the effectiveness of their strategies. By testing hypotheses and measuring results, they can modify their plans to optimize returns on investment.

- : Virtual chief officers offer strategic insights and assist businesses in aligning their statements with organizational objectives. By utilizing these services, companies can enhance their economic positions and recognize growth opportunities, as shown in the case study on strategic monetary planning and analysis.

- Negotiation: Many temporary CFOs are open to negotiation, especially for longer-term contracts. Therefore, it's advisable to engage in discussions about pricing options to optimize your investment.

By considering these factors and focusing on streamlined decision-making and real-time analytics, alongside the collaborative planning and testing of strategies, businesses can make informed decisions about hiring interim CFO services in Bangalore, which ultimately enhances their financial management and strategic planning.

Conclusion

Interim CFO services are proving to be indispensable for organizations navigating financial uncertainties. These professionals bring specialized expertise to the table, offering critical support in areas such as:

- Cash flow management

- Compliance oversight

- Strategic financial planning

By engaging interim CFOs, businesses can enhance decision-making processes, maintain operational continuity, and ensure swift adaptations to changing market conditions. The increase in demand for these services reflects a growing recognition of their value in fostering stability and driving performance.

When selecting an interim CFO, careful consideration of experience, cultural fit, and the specific scope of services is essential. As organizations face unique challenges, the right interim CFO can offer tailored solutions that align with both immediate needs and long-term objectives. With the continued expansion of the interim CFO market, the strategic advantages of these roles are evident in their ability to facilitate effective change management and enhance overall financial health.

Ultimately, investing in interim CFO services is not merely a stopgap measure but a strategic move that positions organizations for sustained growth and resilience. As businesses continue to confront evolving challenges, leveraging the expertise of interim CFOs can provide the necessary foundation for navigating complexities and achieving financial success. With the right leadership in place, organizations can confidently steer through uncertainty and emerge stronger in the face of adversity.

Frequently Asked Questions

What are interim CFO services and their purpose?

Interim CFO services provide essential leadership during transitional periods or crises by utilizing strategies to improve the cash conversion cycle and overall business performance. These professionals focus on streamlined decision-making and real-time analytics for effective business turnaround and performance monitoring.

What key roles do interim CFOs perform?

Interim CFOs engage in strategic monetary planning, cash flow management, compliance oversight, and risk assessment to help organizations navigate complex economic landscapes.

How do interim CFOs contribute to operational efficiency?

They operationalize turnaround lessons through continuous performance monitoring, implement effective monetary controls, and establish best practices that enhance operational efficiency.

What is the significance of hiring a temporary CFO?

Hiring a temporary CFO allows businesses to maintain operational continuity, focus on growth, and ensure their monetary health is effectively overseen.

What recent trends are observed in CFO appointments?

In 2024, 29% of S&P 500 CFO appointments were women, indicating a significant trend toward leadership diversity in the business environment.

What does the case study on CFO retirement and transition trends reveal?

The case study highlights a decrease in retirement rates for CFOs, suggesting a growing demand for experienced financial leaders.

What is the expected market trend for interim CFO services in 2024?

The market for interim CFO services is expected to expand considerably in 2024, reflecting a rising acknowledgment of their value in promoting organizational stability and improving economic performance.

What is the investment cost for interim CFO services?

The investment for temporary CFO services is competitively priced at $99.00, making it accessible for businesses looking to enhance their financial leadership.

What factors should be considered when choosing interim CFO services?

Key factors include experience and expertise, cultural fit, scope of services, readiness to meet timeline demands, references and reputation, and effective communication skills.

Why is effective communication important for interim CFOs?

Effective communication is crucial during transitional periods to articulate complex financial information clearly and persuasively to stakeholders, ensuring smooth operations and decision-making.

How does the global finance and accounting outsourcing market relate to interim CFOs?

The global finance and accounting outsourcing market, valued at $60 billion, indicates that skilled temporary CFOs can significantly impact organizations, steering them toward successful outcomes amid uncertainty.