Introduction

In the intricate world of corporate finance, debt modification accounting stands as a critical tool for organizations seeking to navigate financial challenges and optimize their performance. As companies grapple with evolving market conditions and cash flow pressures, understanding the nuances of debt modifications becomes paramount. This article delves into the essential components of debt modification accounting, from recognizing various types of modifications to adhering to accounting standards that ensure compliance and transparency.

By exploring key considerations and strategic implementation steps, CFOs will be equipped with the knowledge necessary to make informed decisions that bolster their organization’s financial health and align with long-term objectives.

Understanding the Basics of Debt Modification Accounting

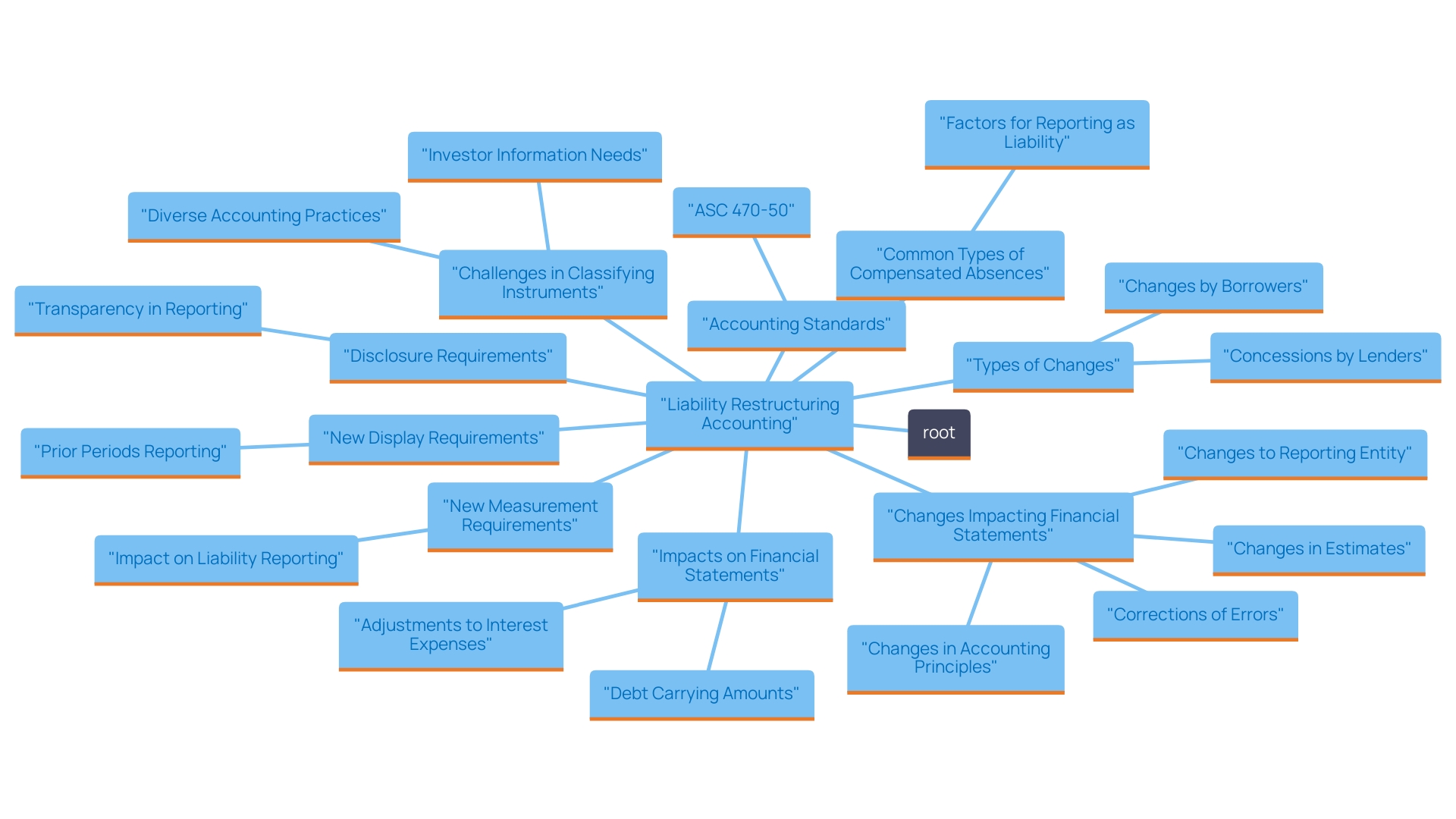

Liability restructuring accounting entails altering the conditions of an existing financial agreement, which can have substantial effects on a company's financial statements. Key concepts include:

- : Understand whether the alteration is a concession made by the lender or a change initiated by the borrower.

- Accounting Standards: Acquaint yourself with ASC 470-50, which offers guidance on how to account for adjustments, including when to acknowledge a troubled financial restructuring.

- Impact on Financial Statements: Recognize that changes in the debt's terms may necessitate adjustments to interest expense recognition and the carrying amount of the debt.

- Disclosure Requirements: Be aware of the necessity to reveal important changes in the accounting statements to ensure transparency for stakeholders.

By comprehensively understanding these basics, CFOs can make informed decisions that align with their organization’s financial objectives.

Key Considerations for Companies in Debt Modification Accounting

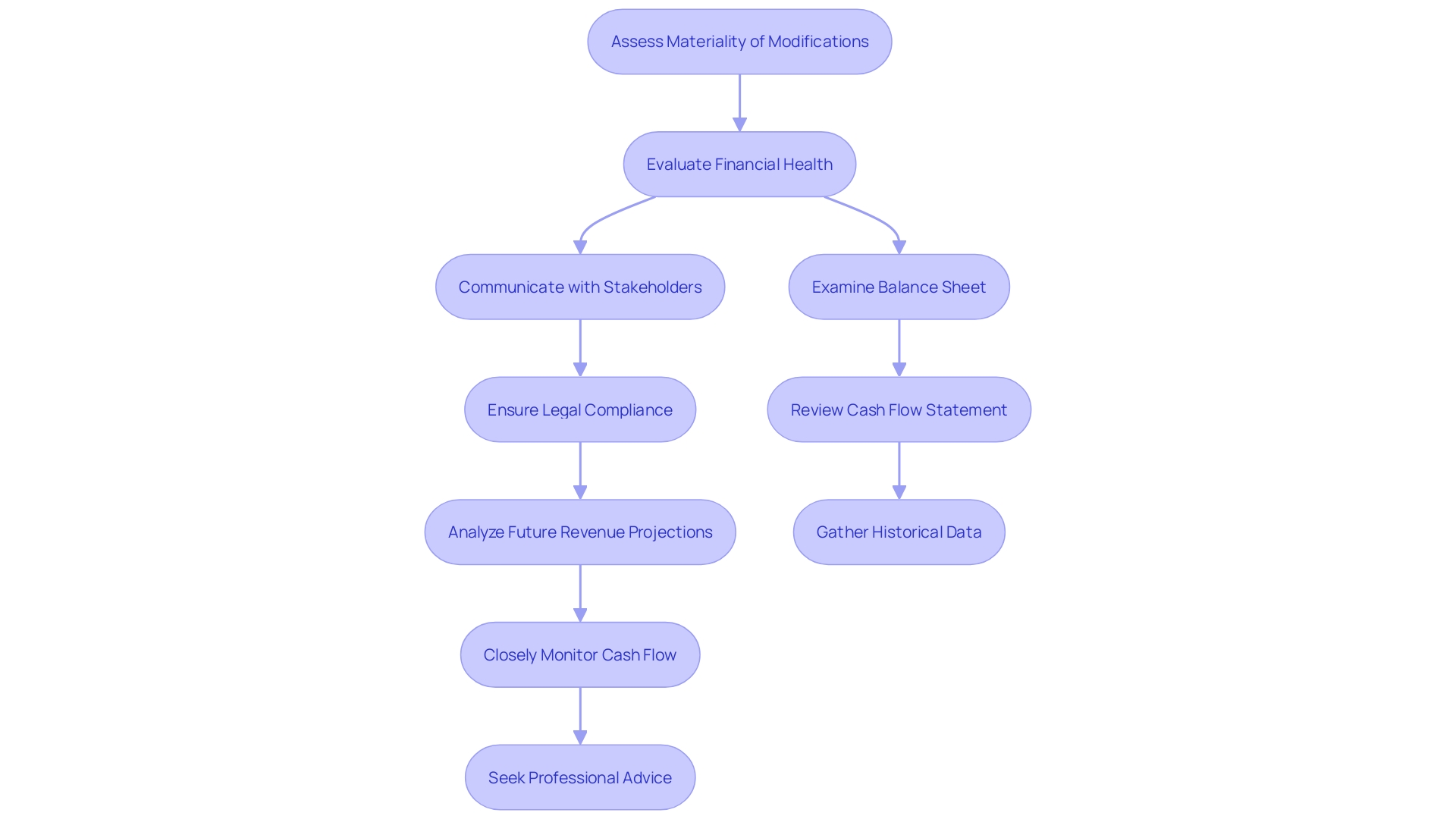

When managing liability adjustment accounting, companies should consider the following:

- Materiality of Modifications: Assess whether the changes in terms are significant enough to require reclassification of the debt or adjustments in reporting.

- Evaluation of Financial Health: Conduct a thorough assessment of the company’s current financial standing to determine if changes are necessary and beneficial. Insights from our can provide a detailed analysis of your business's worth, aiding in strategic decisions.

- Stakeholder Communication: Create a communication plan for informing stakeholders, including investors and creditors, about the changes and their implications.

- Legal and Regulatory Compliance: Ensure that any changes adhere to relevant laws and accounting standards to avoid potential legal ramifications.

- Future Revenue Flow Projections: Analyze how the modified terms will influence future revenue streams and economic stability, ensuring alignment with long-term strategic objectives.

By applying strategies from our whitepaper, 'Mastering the Cash Conversion Cycle: 20 Strategies for Optimal Business Performance', CFOs can improve cash flow and profitability while effectively overseeing changes to obligations. Addressing these considerations enables CFOs to manage the intricacies of loan alteration more effectively, ensuring sound fiscal oversight and compliance.

Implementing a Debt Modification Strategy

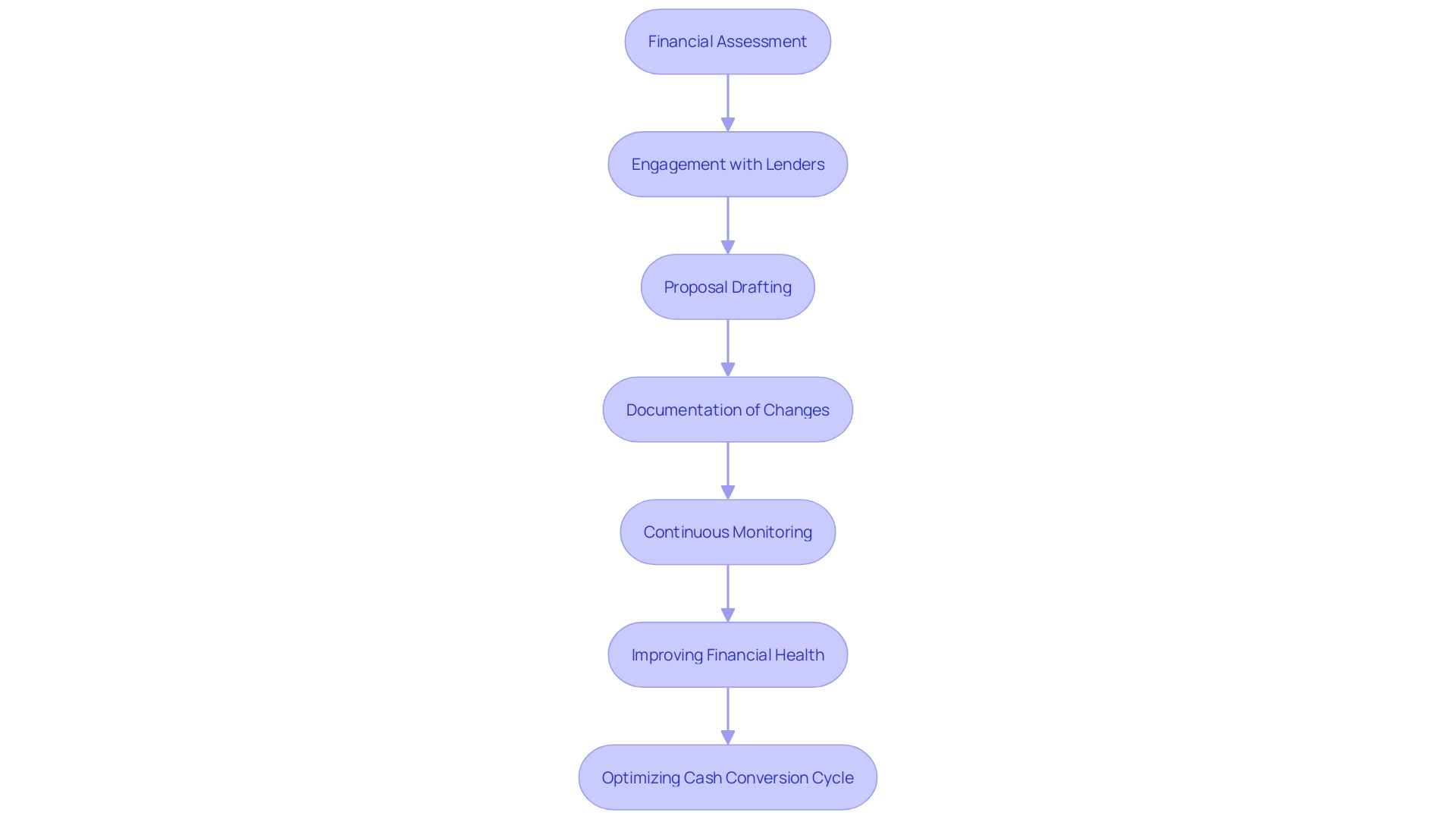

To implement a successful debt modification strategy and enhance your organization’s financial health, follow these steps:

- Conduct a Financial Assessment: Analyze your organization’s financial statements to identify areas where liability modification can alleviate liquidity pressures and optimize your Cash Conversion Cycle (CCC). Comprehending the CCC enables you to observe how swiftly cash moves through your business, facilitating improved financial management.

- Engage with Lenders: Open channels of communication with lenders to negotiate terms that are mutually beneficial, emphasizing your commitment to meeting obligations. Highlight how improvements in your CCC can positively impact your ability to service debt.

- Draft a Change Proposal: Prepare a clear proposal outlining the requested changes, supported by monetary data and projections. Include specific CCC metrics to demonstrate how changes will enhance cash flow.

- Document Changes: Ensure all alterations are well-documented, including the reasoning for changes and their anticipated effect on economic performance. This documentation should connect the modifications back to your CCC improvements.

- Monitor and Adjust: Utilize real-time analytics to continuously track performance and make adjustments as necessary to stay aligned with strategic goals. This ongoing evaluation not only strengthens decision-making but also operationalizes the lessons learned during the turnaround process. By monitoring CCC metrics, you can identify trends and make proactive adjustments.

By adhering to these steps, companies can efficiently handle their liabilities, enhance economic stability, and prepare themselves for long-term growth. Each step is essential for ensuring that alterations to liabilities align with overall economic strategies and operational efficiency.

Evaluating the Impact of Debt Modification on Financial Statements

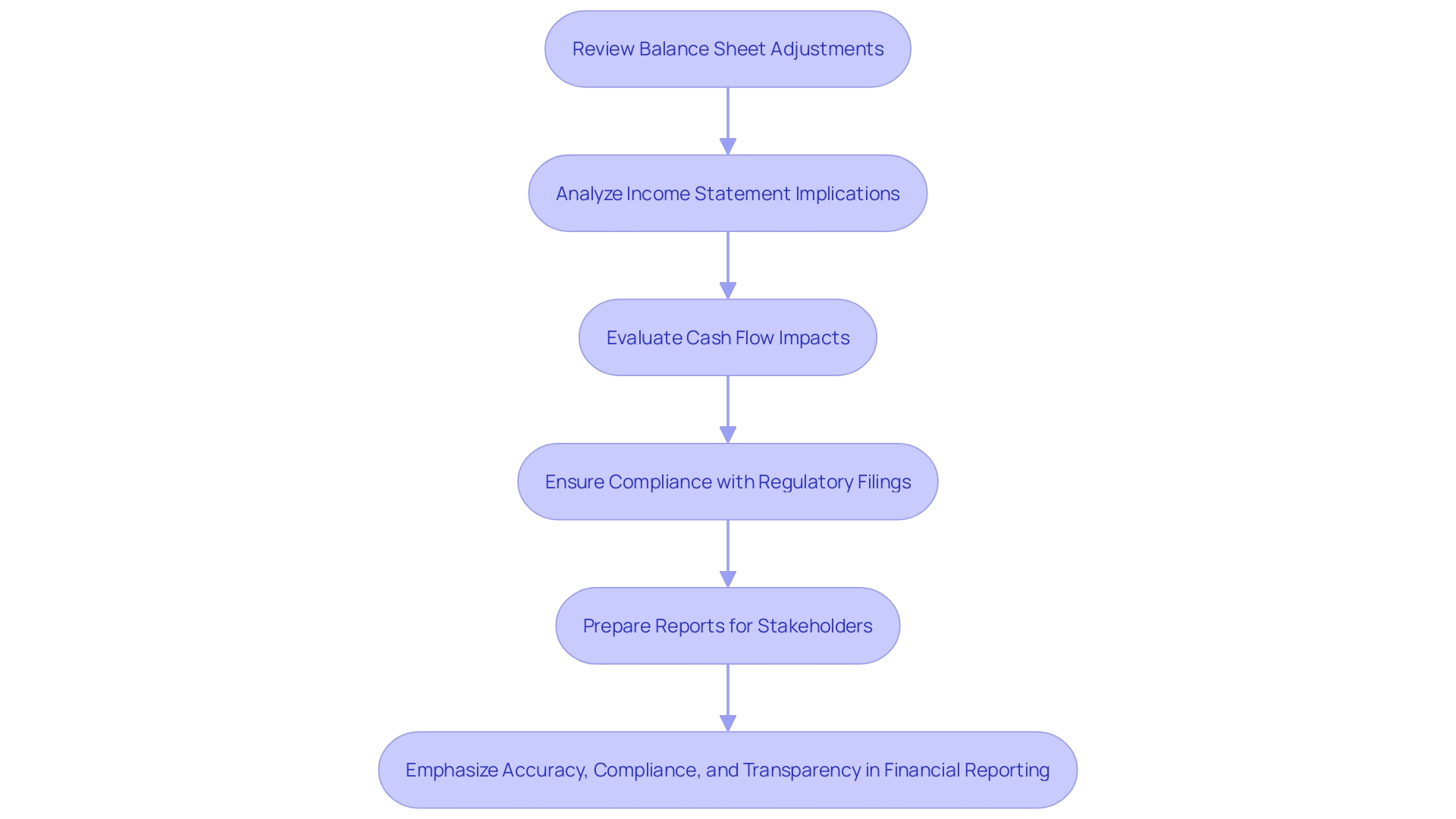

After implementing financial modifications, it is crucial to evaluate their impact on financial statements to ensure accuracy and compliance with accounting standards.

- Balance Sheet Adjustments: Carefully review the balance sheet to reflect the carrying amounts of obligations based on modified terms. Under U.S. GAAP, the fair value of an embedded conversion option must differ by at least 10 percent of the original carrying amount to be considered substantially different. This ensures that , such as those seen in Troubled Debt Restructurings (TDRs), are accurately recorded.

- Income Statement Considerations: Analyze the impact of modified interest rates on net income and profitability metrics. Variations in interest expense resulting from loan adjustments can greatly impact the income statement, necessitating exact calculations to ensure precise financial reporting and comprehension of how these adjustments affect overall profitability.

- Cash Flow Statements: Evaluate how loan adjustments influence funds from operating, investing, and financing activities. Future repayment obligations must be thoroughly evaluated to understand their impact on cash flow projections. For instance, the shift from LIBOR to alternative interest rates requires amendments to loan agreements, with temporary relief provided by FASB until December 31, 2024.

- Regulatory Filings: Ensure all financial adjustments are reported in regulatory filings in compliance with accounting standards and regulations. Gain recognition is precluded unless the carrying amount exceeds the total undiscounted future cash flows of the restructured debt. This requirement necessitates diligent documentation and adherence to regulatory guidelines, particularly in the context of TDRs.

- Stakeholder Reporting: Prepare detailed reports for stakeholders that outline the modifications, their rationale, and their projected impact on financial performance. As Thomas Arseneau, Managing Director and Tampa Bay Market Leader at Centri Business Consulting, emphasizes, 'effective communication and transparency are essential in maintaining stakeholder trust.'

By meticulously evaluating these impacts, especially through the lens of TDRs and related accounting changes, CFOs can ensure compliance with accounting standards, maintain transparency, and foster trust among stakeholders.

Conclusion

Understanding debt modification accounting is essential for CFOs aiming to navigate the complexities of corporate finance effectively. By grasping the various types of modifications, adhering to accounting standards like ASC 470-50, and recognizing the implications for financial statements, organizations can make informed decisions that support their financial health.

Key considerations such as the materiality of modifications, stakeholder communication, and future cash flow projections are critical in developing a robust debt modification strategy. Engaging with lenders and drafting clear proposals can facilitate beneficial negotiations, while continuous monitoring of financial performance ensures alignment with strategic goals.

Finally, evaluating the impact of modifications on financial statements is crucial for maintaining accuracy and compliance. Careful adjustments to balance sheets, income statements, and cash flow projections, along with transparent reporting to stakeholders, will reinforce trust and ensure long-term success.

In a rapidly changing financial landscape, proactive management of debt modifications will not only enhance organizational resilience but also position companies for sustainable growth. Taking these strategic steps will empower CFOs to navigate financial challenges confidently and align their organizations with future opportunities.

Frequently Asked Questions

What is liability restructuring accounting?

Liability restructuring accounting involves altering the conditions of an existing financial agreement, which can significantly affect a company's financial statements.

What are the key concepts in liability restructuring accounting?

Key concepts include types of changes (whether initiated by the lender or borrower), accounting standards (specifically ASC 470-50), the impact on financial statements (adjustments to interest expense and debt carrying amounts), and disclosure requirements for transparency.

How do changes in debt terms affect financial statements?

Changes in debt terms may require adjustments to interest expense recognition and the carrying amount of the debt, impacting the overall financial statements.

What should companies consider when managing liability adjustment accounting?

Companies should assess the materiality of modifications, evaluate financial health, communicate with stakeholders, ensure legal and regulatory compliance, and analyze future revenue flow projections.

What steps should be taken to implement a successful debt modification strategy?

Steps include conducting a financial assessment, engaging with lenders, drafting a change proposal, documenting changes, and monitoring performance using real-time analytics.

How should companies evaluate the impact of financial modifications on their financial statements?

Companies should review balance sheet adjustments, analyze income statement impacts, evaluate cash flow statements, ensure regulatory filings are accurate, and prepare detailed reports for stakeholders.

What is the significance of the fair value of an embedded conversion option in debt modifications?

Under U.S. GAAP, the fair value must differ by at least 10 percent from the original carrying amount to be considered substantially different, ensuring accurate recording of significant changes in financial terms.

Why is stakeholder communication important in liability restructuring accounting?

Effective communication and transparency are essential in maintaining stakeholder trust, especially when outlining modifications and their projected impact on financial performance.