Overview

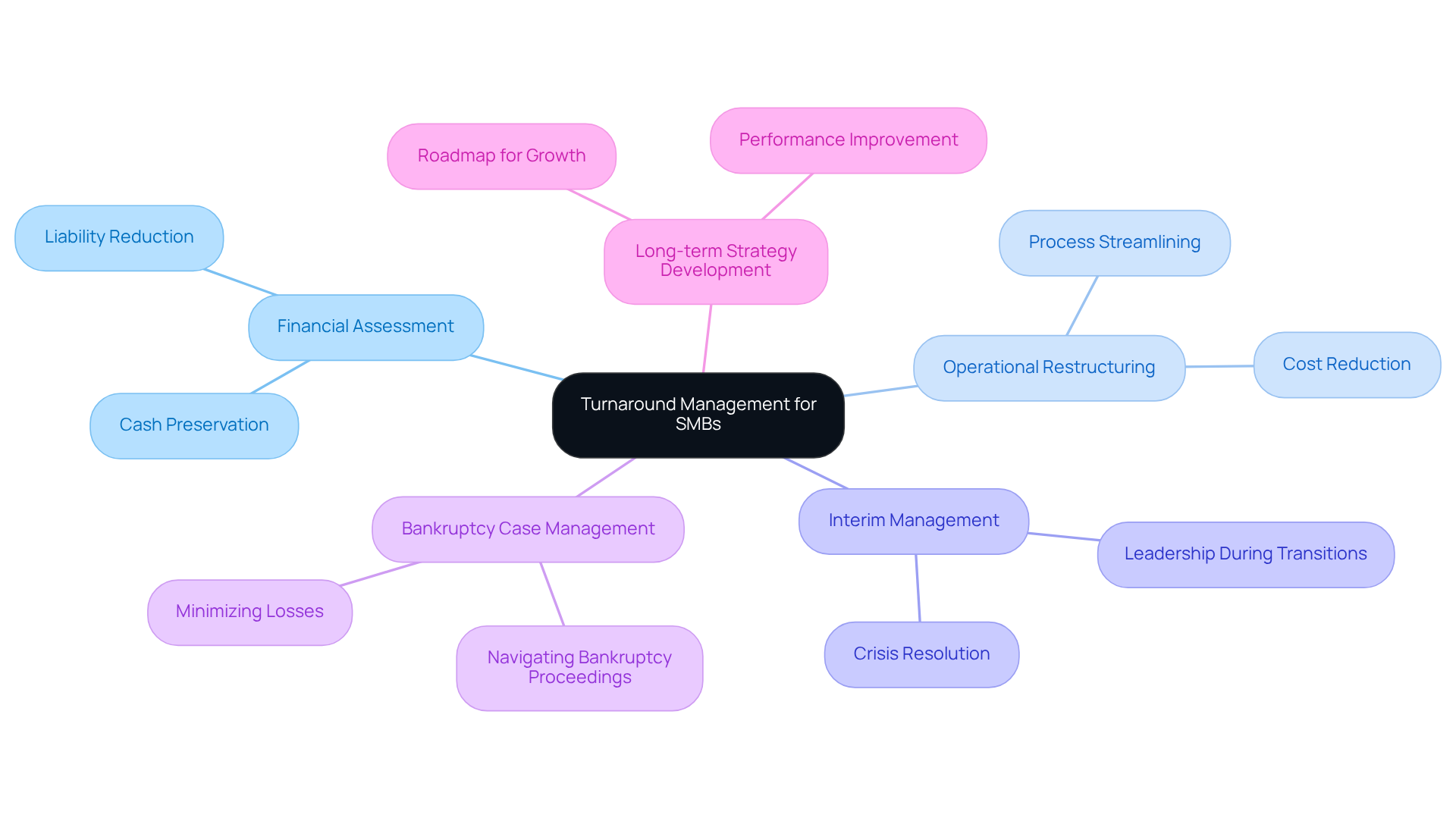

This article identifies the leading turnaround management companies that play a pivotal role in the success of small and medium businesses (SMBs) by delivering specialized consulting services. It underscores how these firms employ strategies such as:

- Financial assessments

- Operational restructuring

- Interim management

to effectively revitalize distressed businesses. By doing so, they ensure long-term sustainability and profitability, making them invaluable partners in the business landscape.

Introduction

Turnaround management companies play a pivotal role in revitalizing small and medium businesses (SMBs) facing financial distress. By providing tailored consulting services, these firms empower organizations to navigate crises effectively, enhance operational efficiency, and secure long-term sustainability. As businesses grapple with increasing market pressures and economic uncertainties, a crucial question arises: which turnaround management companies stand out in their ability to deliver impactful results? This article delves into ten leading firms specializing in turnaround management, offering insights into their strategies and success stories that could transform the future of SMBs.

Transform Your Small/ Medium Business: Comprehensive Turnaround and Restructuring Consulting

Turnaround management companies offer essential (SMBs) that are facing crises. These services involve a variety of strategies designed to revitalize operations, enhance economic health, and ensure long-term sustainability. Through [comprehensive financial assessments](https://bcg.com/capabilities/business-transformation/turnaround-and-restructuring-services), consultants pinpoint areas for improvement, streamline operations, and implement effective management practices. This proactive approach not only preserves cash but also reduces liabilities, empowering businesses to successfully navigate challenging times. The expertise of turnaround management companies is invaluable, as they provide extensive knowledge tailored to the unique needs of SMBs, ensuring that strategies are both practical and impactful.

Key components of comprehensive consulting include:

- Financial Assessment: A thorough financial review can help identify opportunities to preserve cash and reduce liabilities, ensuring a solid foundation for recovery.

- Operational Restructuring: Streamlining processes to enhance efficiency and reduce costs is vital for improving overall performance.

- Interim Management: Providing experienced leadership during transitions maintains stability and direction, crucial for crisis resolution and transformational change through the Rapid-30 process.

- Bankruptcy Case Management: Assisting enterprises in navigating bankruptcy proceedings minimizes losses and facilitates a smoother recovery process.

- Long-term Strategy Development: Crafting a roadmap for sustainable growth post-crisis focuses on both short and long-term performance improvement with proven success.

Amplēo: Expert Insights on Turnaround Management Strategies

Amplēo distinguishes itself through its innovative strategy for recovery management, highlighting tailored solutions that address the distinct challenges companies encounter. Key strategies include:

- Data-Driven Decision Making: By leveraging analytics, Amplēo informs strategic choices and operational adjustments, ensuring decisions are based on solid data rather than intuition. Organizations that adopt data-driven decision-making are statistically 23 times more likely to acquire customers and 19 times more likely to be profitable.

- Stakeholder Engagement: Amplēo prioritizes involving key stakeholders throughout the recovery process, significantly enhancing buy-in and support. Research indicates that early stakeholder engagement can make transformations four times more likely to succeed, underscoring the critical role of collaboration in achieving turnaround goals.

- Agile Methodologies: The implementation of flexible strategies allows Amplēo to adapt swiftly to shifting market conditions. This agility is essential in today’s fast-paced commercial environment, where the ability to pivot can determine a company's survival.

- Decide & Execute: Amplēo supports a shortened decision-making cycle, enabling teams to take decisive actions that maintain organizational health. This approach ensures that organizations can respond quickly to emerging challenges.

- Update & Adjust: Ongoing evaluation of organizational performance through real-time analytics is a cornerstone of Amplēo's approach. By utilizing a client dashboard, organizations can diagnose their health and make necessary adjustments swiftly.

Through these methods, Amplēo has successfully directed numerous enterprises during crises, demonstrating the effectiveness of a utilized by turnaround management companies. Their success stories reflect the impact of data-driven insights and stakeholder collaboration in fostering sustainable growth. For example, Red Roof Inn's focused promotion during unfavorable weather circumstances illustrates how data-informed approaches can yield noteworthy commercial results. Client testimonials further illustrate the effectiveness of the 'Rapid30' plan, highlighting the transformative impact of Amplēo's strategies on organizational performance.

![]()

Boston Consulting Group (BCG): Turnaround and Restructuring Services for Profitability

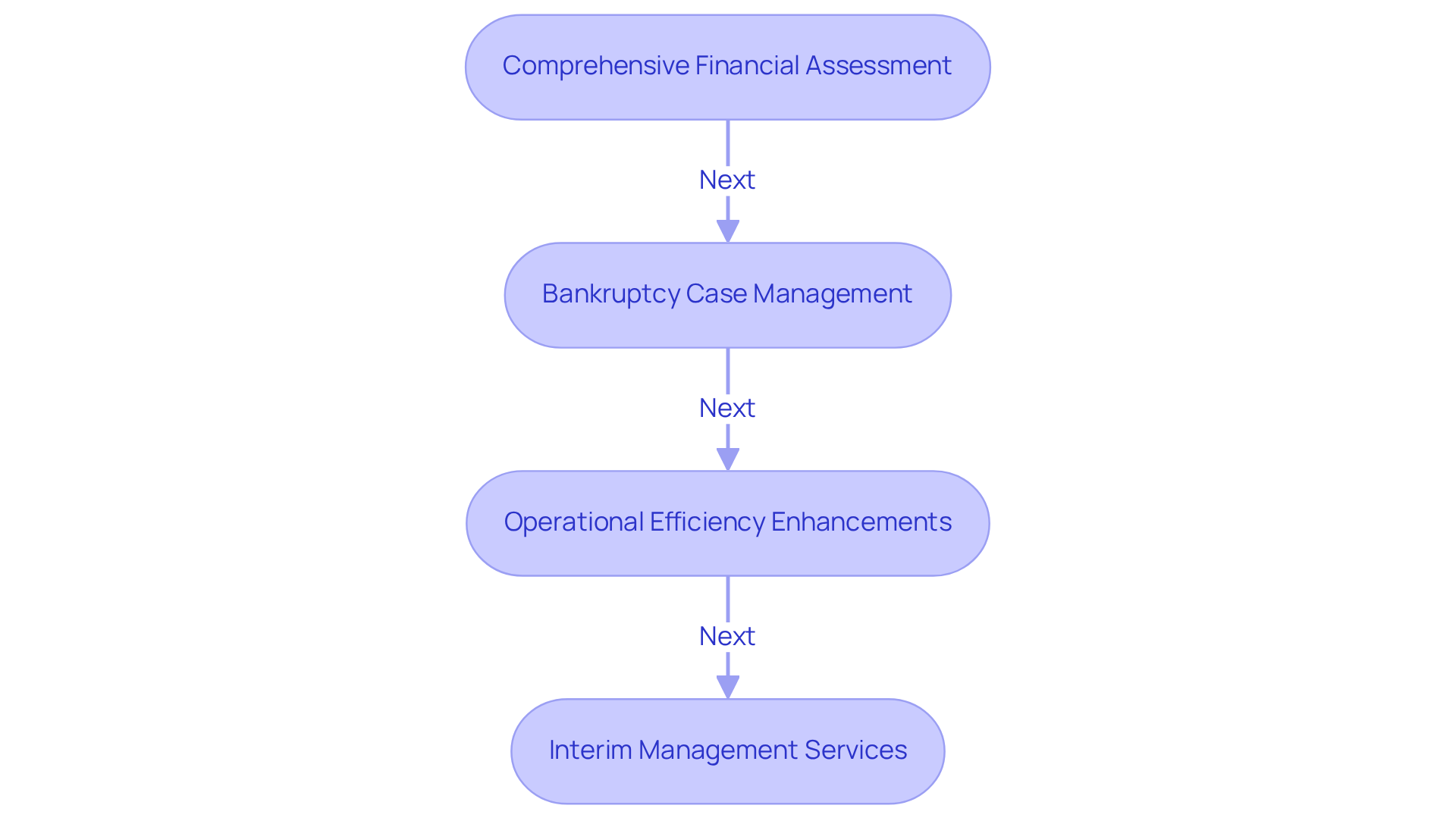

Transform Your Small/Medium Enterprise offers specialized turnaround and restructuring services designed to enhance profitability for companies facing challenges. Our approach encompasses:

- Comprehensive Financial Assessment: We conduct thorough financial reviews to uncover opportunities for cash preservation and liability reduction, ensuring businesses can stabilize their financial positions.

- Bankruptcy Case Management: Our expert assistance during bankruptcy procedures empowers companies to navigate financial distress effectively.

- Operational Efficiency Enhancements: By streamlining processes, we lower expenses and improve service delivery, enabling organizations to focus on their core strengths.

- Interim Management Services: We provide hands-on executive leadership for crisis resolution and transformational change through our Rapid-30 process, emphasizing decisive action and collaborative strategies.

Every client interaction begins with a meticulous review of operations to align key stakeholders and gain a deeper understanding of your organization and circumstances beyond the numbers. Our proven track record in helping organizations restore profitability underscores the importance of in recovery efforts, tailored specifically for small to medium enterprises.

Faber: Tailored Turnaround Management Services for Corporate Renewal

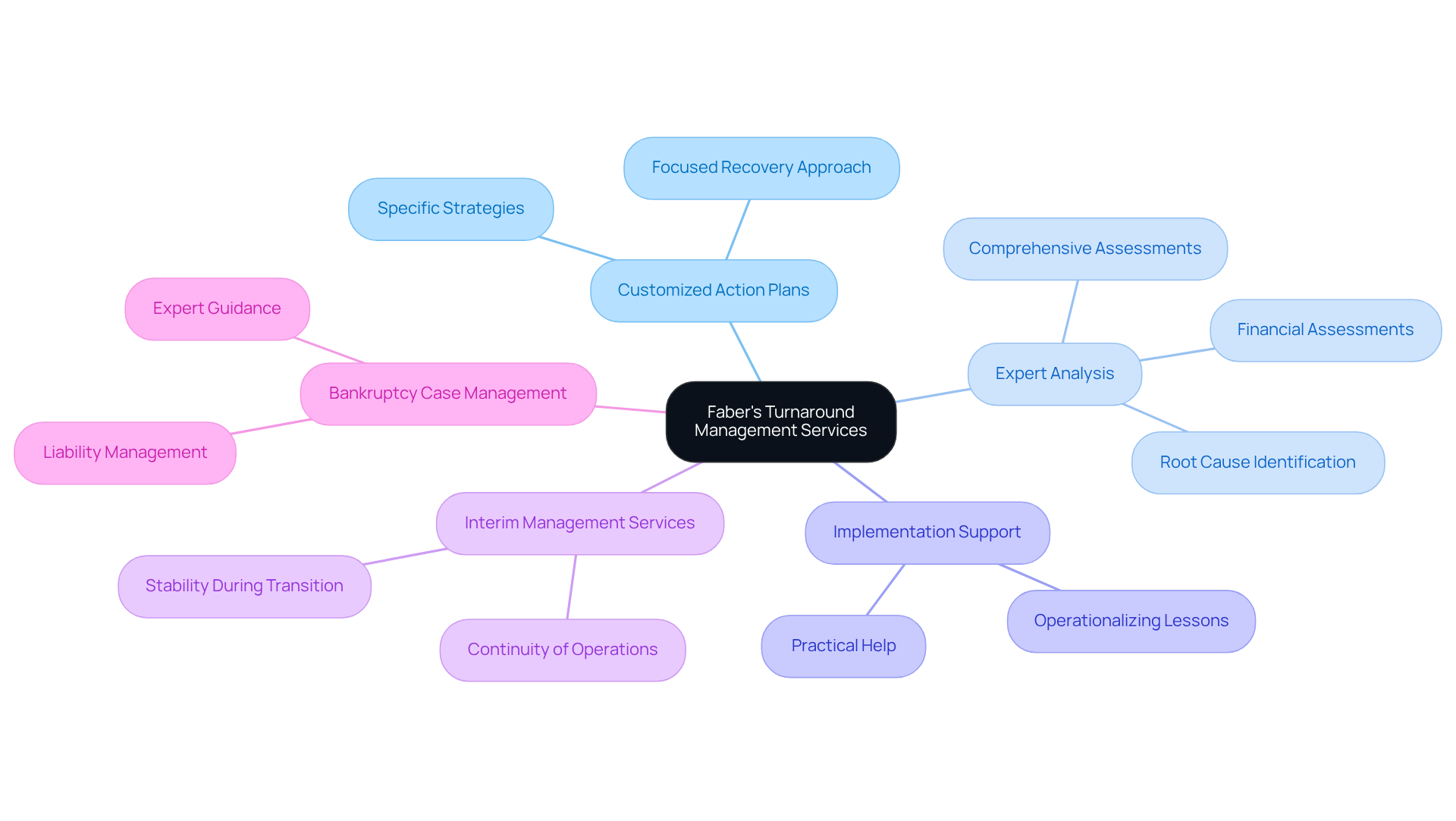

Faber excels in delivering tailored turnaround management companies services designed to meet the distinct needs of each client. Their offerings include:

- Customized Action Plans: Crafting specific strategies that address the unique operational and financial challenges faced by businesses, ensuring a focused approach to recovery.

- Expert Analysis: Performing comprehensive assessments to uncover the root causes of decline and identify opportunities for improvement, enabling informed decision-making. This analysis frequently entails detailed economic reviews and operational audits, essential for grasping the specific context of each client. Faber emphasizes thorough financial assessments for cash preservation and liability reduction, ensuring that businesses can navigate their challenges effectively.

- Implementation Support: Offering practical help to clients in executing recovery strategies effectively, ensuring that plans are not only created but also successfully implemented. Faber's commitment to operationalizing lessons learned through the turnaround process fosters strong, lasting relationships with clients.

- Interim Management Services: Providing interim management solutions to assist organizations through transitional periods, ensuring stability and continuity during times of change.

- Bankruptcy Case Management: Providing expert guidance and support in navigating bankruptcy processes, helping clients manage their liabilities and emerge stronger.

Faber's dedication to customization empowers businesses to tackle their specific challenges head-on, which is crucial for turnaround management companies in improving the chances of corporate renewal. This , with success rates for personalized solutions indicating a significant enhancement in client results, especially as businesses adjust to changing market needs.

G2 Capital Advisors: Revitalizing Financial and Operational Performance

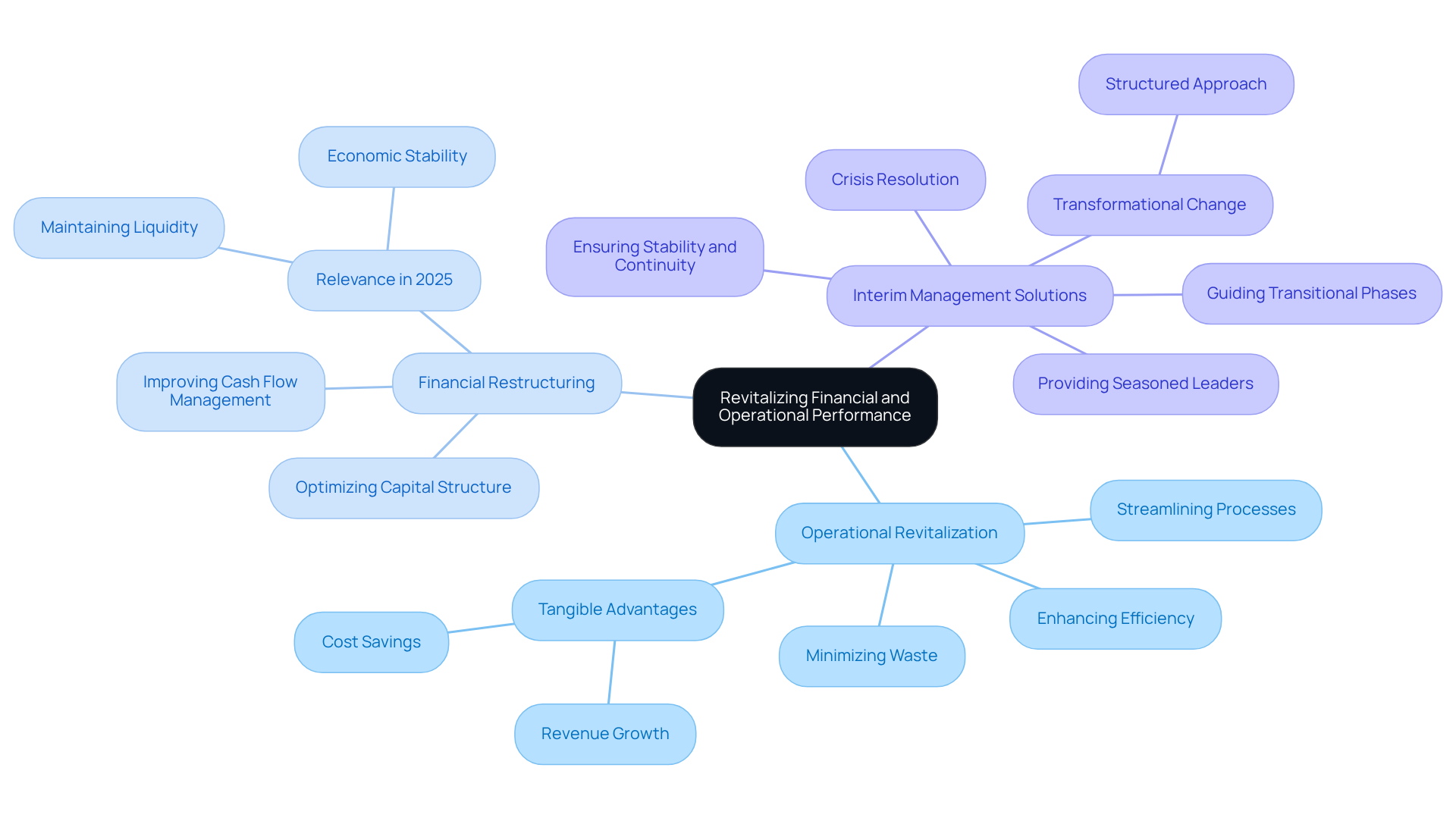

Transform Your Small/ Medium Business emphasizes the critical necessity for as part of the strategies used by turnaround management companies. Their comprehensive approach encompasses several key areas:

- Operational Revitalization: By streamlining processes, Transform Your Small/ Medium Business enhances efficiency and minimizes waste, enabling businesses to operate more effectively. Their tailored strategies have proven beneficial, helping clients save money and grow revenues, thereby demonstrating the tangible advantages of operational revitalization.

- Financial Restructuring: They assist clients in optimizing their capital structure, a vital step for improving cash flow management. This becomes increasingly relevant in 2025, as companies face mounting pressures to maintain liquidity and economic stability.

- Interim Management Solutions: Transform Your Small/ Medium Business provides seasoned leaders to guide organizations through transitional phases, ensuring stability and continuity during critical times. Their hands-on executive leadership is essential for crisis resolution and transformational change through a structured approach.

Through this dual focus on financial and operational aspects, Transform Your Small/ Medium Business collaborates with turnaround management companies to empower businesses to attain sustainable growth and recovery. Their commitment to ongoing performance evaluation and relationship development through real-time analytics ensures that lessons learned during the recovery process are effectively implemented. As Eddie B., an investor at EB Homes & Properties, remarked, "Discover how digital tools streamlined my leasing, accounting, and tenant management, saving time and enhancing operations." This statement underscores the effectiveness of Transform Your Small/ Medium Business' strategies in real-world applications.

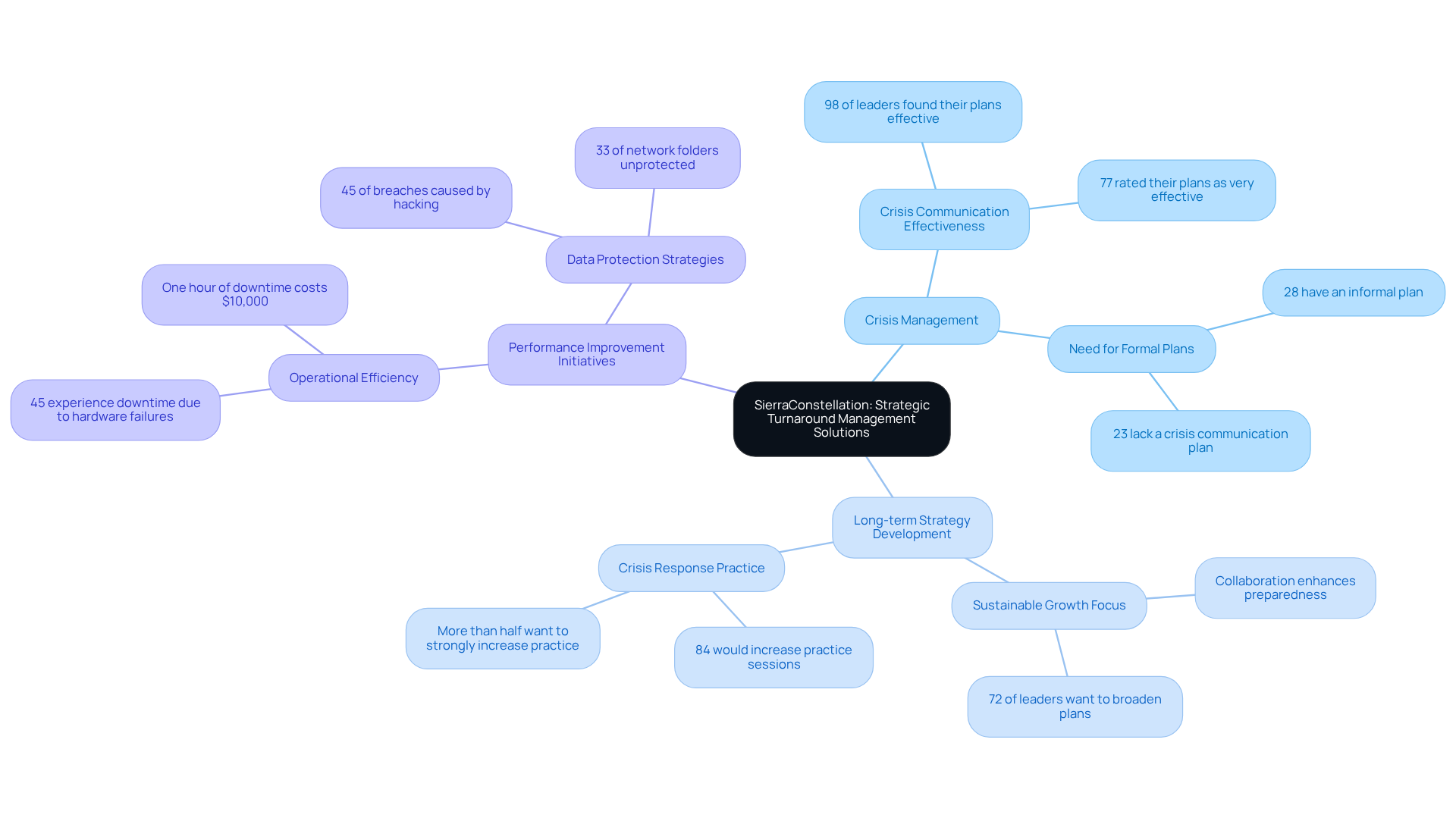

SierraConstellation: Strategic Turnaround Management Solutions

Transform Your Small/Medium Enterprise provides strategic solutions through turnaround management companies designed to revitalize companies in distress. Their offerings encompass:

- Crisis Management: They create immediate action plans that stabilize operations during crises, ensuring businesses can respond swiftly and effectively. With 98% of leaders finding their activated crisis communications plans effective and 77% rating their plans as very effective, the importance of a is undeniable.

- Long-term Strategy Development: Transform Your Small/Medium Business develops comprehensive plans focused on sustainable growth post-crisis. This proactive approach is essential, as organizations that collaborate with turnaround management companies to practice their crisis response plans significantly enhance their preparedness and success rates. Notably, 28% of organizations operate with an informal crisis communications plan, underscoring the need to formalize crisis management strategies.

- Performance Improvement Initiatives: By identifying and implementing changes to boost operational efficiency, they aid organizations in streamlining operations and reducing overhead. This is particularly vital, as 45% of companies experience downtime due to hardware failures, with just one hour of downtime costing small enterprises $10,000, highlighting the necessity for robust performance strategies.

Transform Your Small/Medium Company's structured methodology ensures that organizations not only navigate challenges effectively but also emerge stronger and more resilient in the long term. As Warren Buffett wisely stated, "By failing to prepare, you are preparing to fail," reinforcing the critical importance of having structured crisis management plans.

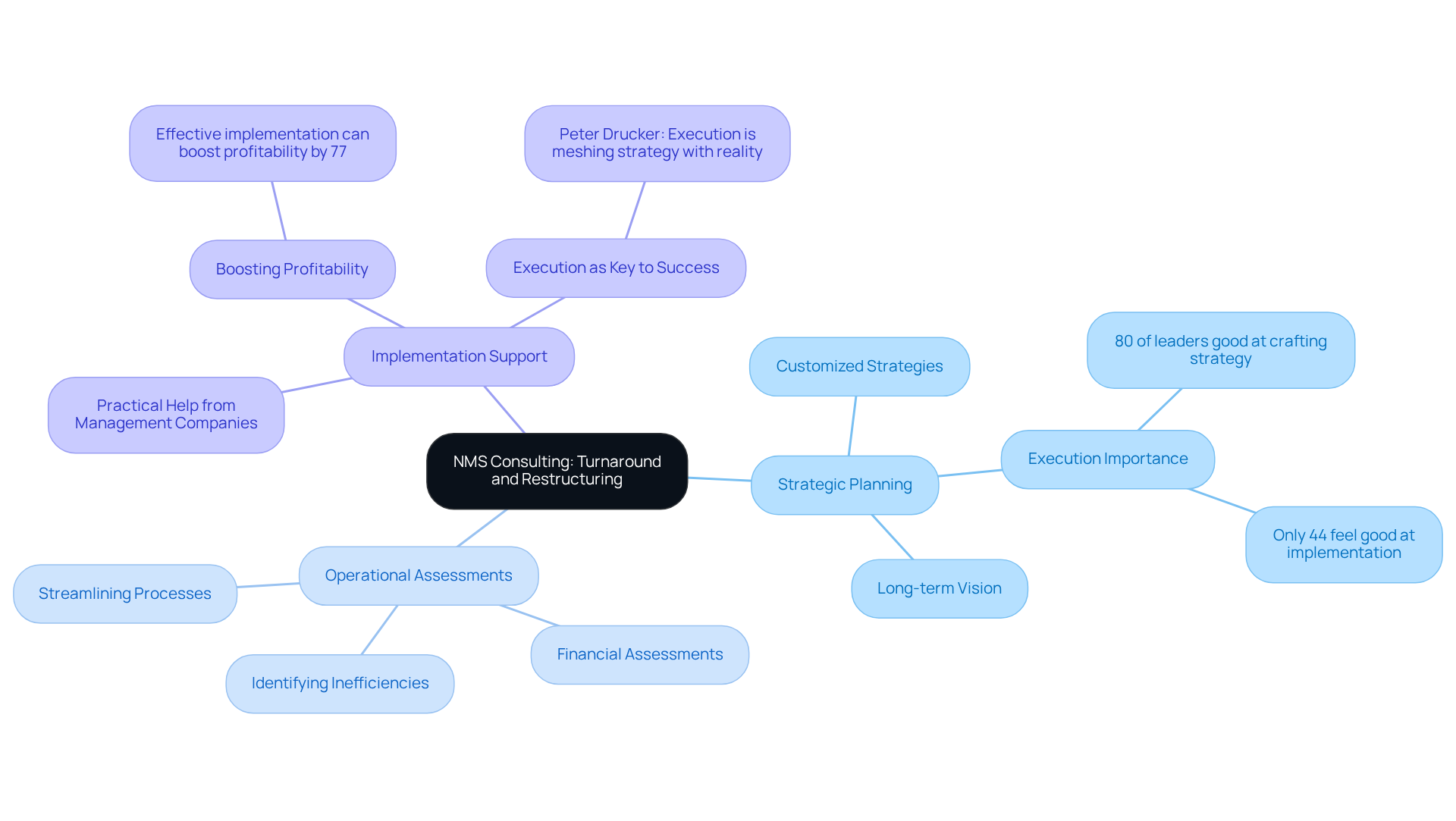

NMS Consulting: Expert Guidance in Turnaround and Restructuring

Transform Your Small/ Medium Business excels in delivering expert guidance for turnaround and restructuring initiatives, focusing on three core areas:

- Strategic Planning: They develop customized strategies tailored to address specific business challenges, ensuring alignment with organizational goals and market demands. This approach is crucial, as effective strategic planning can significantly enhance resource allocation and drive impactful results. Notably, while 80% of leaders feel their company is good at crafting strategy, only 44% feel they are good at implementation, underscoring the importance of execution in strategic planning.

- Operational Assessments: Through comprehensive evaluations, Transform Your Small/ Medium Business identifies inefficiencies and areas ripe for improvement. Their operational evaluations have a proven history of success, allowing organizations to streamline processes and improve overall performance. With a focus on and the role of turnaround management companies, they help businesses save money and reduce overhead while growing revenues.

- Implementation Support: Transform Your Small/ Medium Business offers practical help from turnaround management companies in executing turnaround approaches, ensuring that clients can effectively translate plans into action. This assistance is crucial, as studies show that organizations that effectively implement new growth plans can boost profitability by as much as 77%. As Peter Drucker noted, "Execution is the ability to mesh strategy with reality, align people with goals, and achieve the promised results."

By concentrating on these key areas, Transform Your Small/ Medium Enterprise empowers small to medium enterprises to navigate their unique challenges and achieve sustainable growth, reinforcing their commitment to delivering tailored solutions that drive long-term success. Furthermore, they possess specialized teams for the retail, restaurant, hospitality, and leisure sectors, further enhancing their all-encompassing strategy for management improvement.

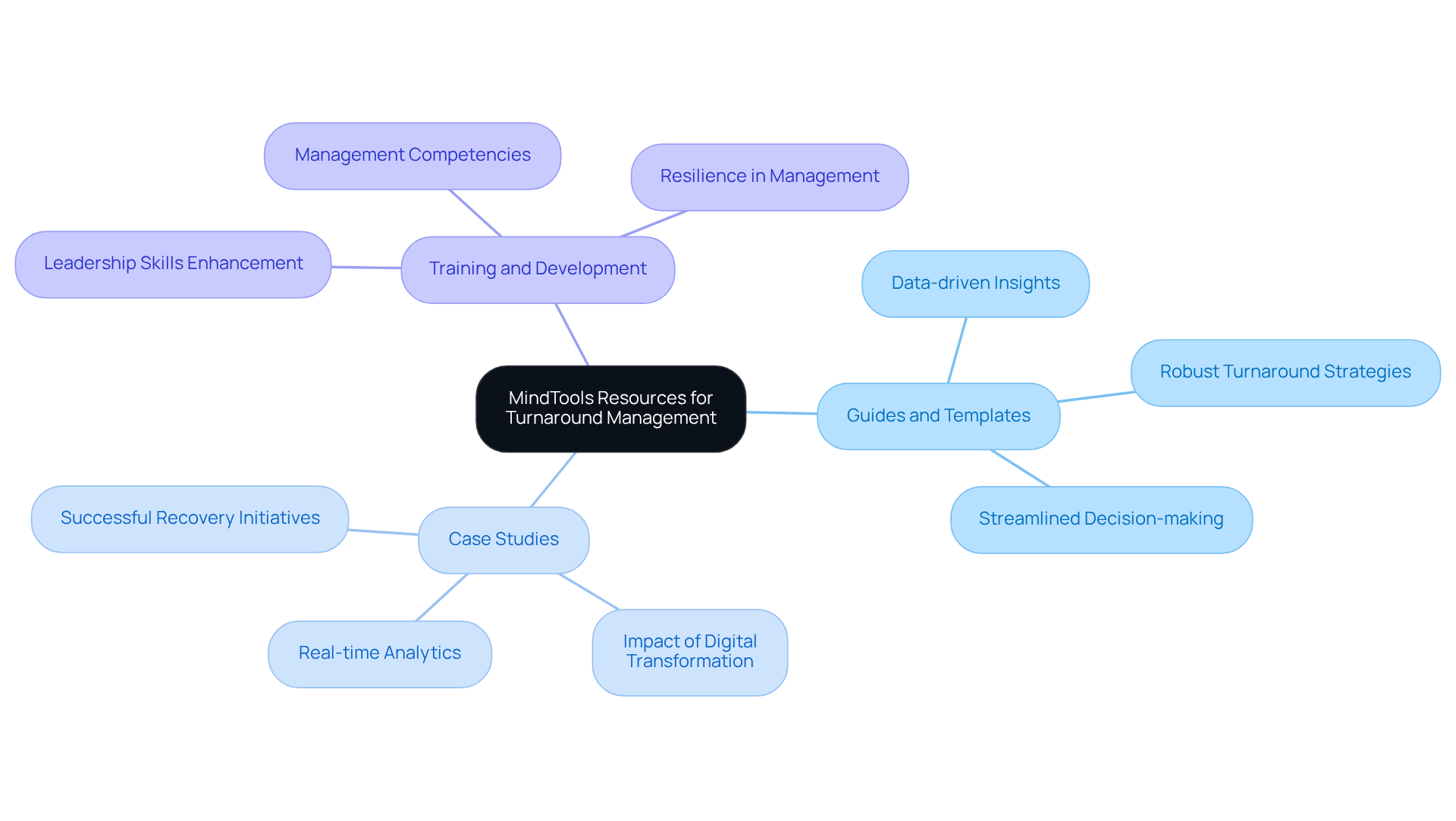

MindTools: Resources for Effective Turnaround Management

MindTools provides an extensive array of resources essential for effectively managing change, a critical need for organizations navigating challenging times. Their offerings include:

- Guides and Templates: These practical tools empower organizations to formulate robust turnaround strategies, ensuring a structured approach to crisis management. By rigorously testing hypotheses and leveraging data-driven insights, organizations can optimize their return on invested capital both in the short and long term, all while benefiting from a streamlined decision-making process.

- Case Studies: Featuring successful recovery initiatives, these case studies serve as vital sources of inspiration and insight, showcasing real-world applications and outcomes of effective strategies. Notably, companies investing in digital transformation consistently outperform their peers over time, underscoring the necessity of adapting to technological advancements. Furthermore, the continuous assessment of success via real-time analytics, facilitated by a client dashboard, enables organizations to assess their health and adjust strategies as needed.

- Training and Development: MindTools presents courses aimed at enhancing leadership and management skills, equipping teams with the competencies required to drive transformational change. As Tony Robbins aptly states, "Every problem is a gift — without problems we would not grow," highlighting the significance of resilience in management during recovery. This commitment to cultivates strong, enduring relationships, which are vital for sustained success.

By leveraging MindTools' resources, businesses can acquire the knowledge and tools necessary for proficiently managing change, which is essential for the effectiveness of turnaround management companies, ultimately fostering resilience and sustainable growth.

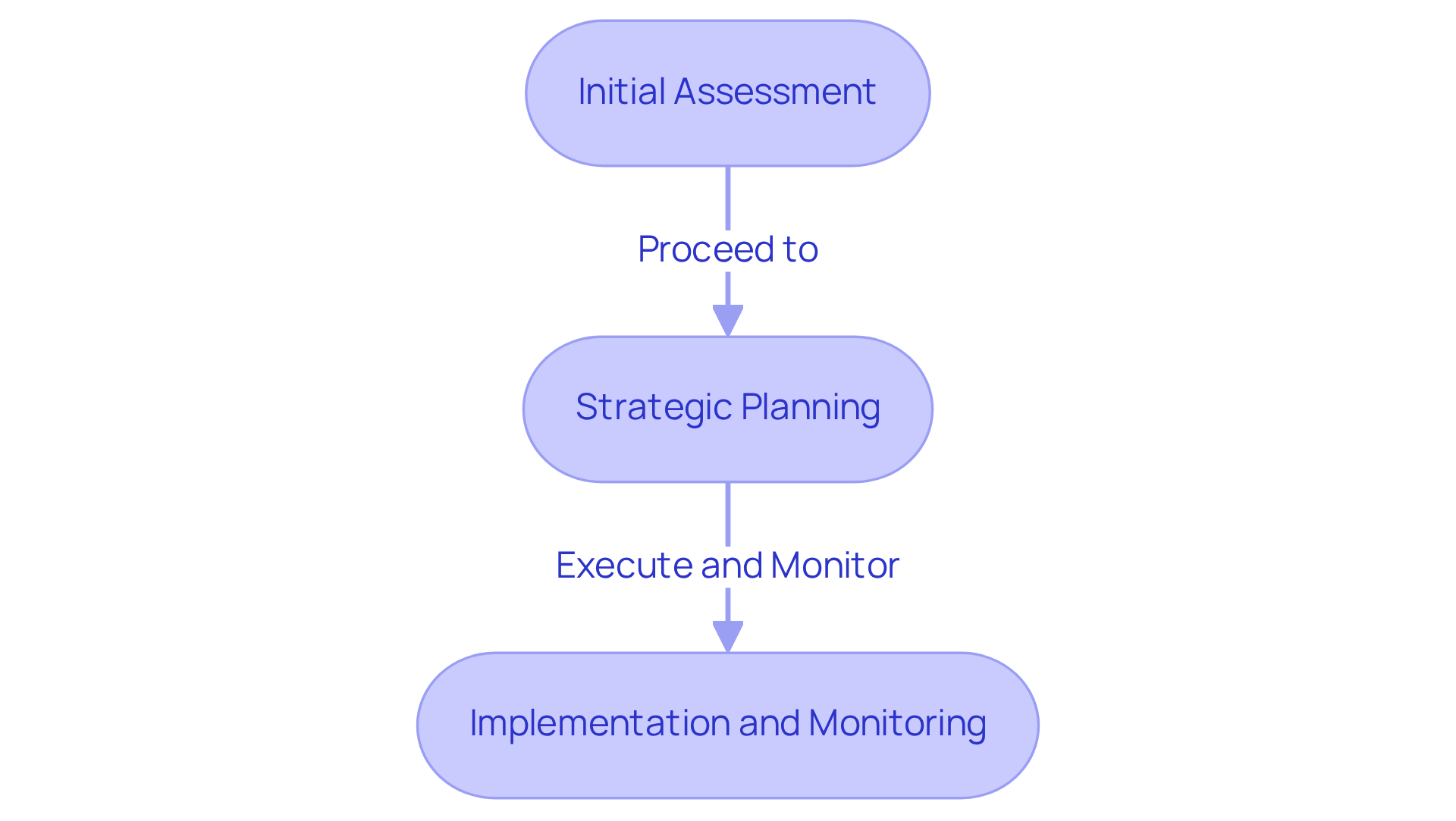

Acclime: Structured Company Management and Turnaround Steps

Transform Your Small/Medium Business presents a systematic approach to company management and recovery efforts, as utilized by turnaround management companies. This process encompasses:

- Initial Assessment: Conducting a thorough financial review to identify opportunities for cash preservation and liability reduction. Studies indicate that companies performing comprehensive evaluations significantly enhance their recovery success rates. As Bill Gates aptly noted, measuring performance is essential for thriving in business.

- Strategic Planning: Crafting a clear roadmap for recovery and growth by leveraging tailored turnaround management companies and restructuring consulting services that emphasize operational efficiency and interim management.

- Implementation and Monitoring: Executing the plan while continuously tracking progress through real-time analytics, facilitating swift decision-making and necessary adjustments. This method supports a shortened decision-making cycle, enabling decisive actions to stabilize financial positions and enhance operations.

To augment the effectiveness of the initial assessment, organizations should actively involve key stakeholders in the evaluation process. This fosters a collaborative environment that promotes open communication and diverse perspectives.

Transform Your Small/Medium Enterprise's ensures that organizations have a clear path to navigate during their recovery journey.

ConsultingCheck: Insights and Templates for Liquidity Planning

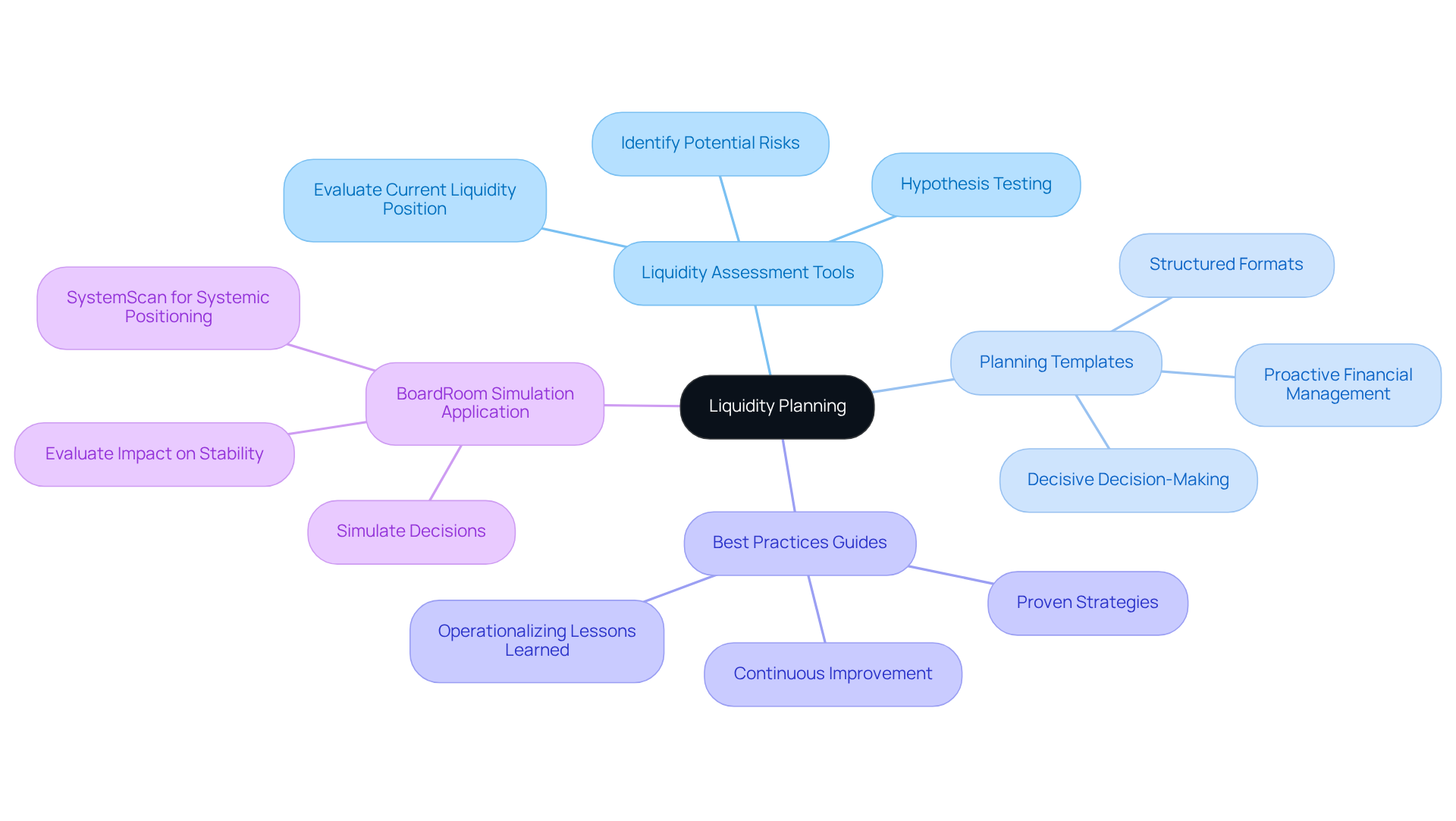

ConsultingCheck delivers essential insights and templates specifically designed for liquidity planning during the efforts of turnaround management companies, emphasizing streamlined decision-making and real-time analytics. Their offerings include:

- Liquidity Assessment Tools: These tools empower businesses to thoroughly evaluate their current liquidity position, identifying potential risks that could jeopardize financial stability. By testing hypotheses related to liquidity, organizations can make informed decisions that enhance their economic well-being.

- Planning Templates: Structured formats assist organizations in crafting effective liquidity management plans, ensuring a proactive approach to financial challenges. This fosters a decisive decision-making process, enabling teams to act swiftly in maintaining stability.

- Best Practices Guides: Proven strategies are provided to help sustain liquidity during challenging times, equipping enterprises with the knowledge to navigate crises successfully. These guides underscore the importance of operationalizing lessons learned from past experiences to promote continuous improvement.

Moreover, the BoardRoom simulation application enhances these resources by allowing companies to conduct a SystemScan, assessing their systemic positioning and simulating decisions to evaluate their impact on stability. By leveraging ConsultingCheck's liquidity assessment tools, planning templates, and best practices guides, businesses can significantly bolster their liquidity planning efforts, ensuring they possess the financial stability necessary to navigate through crises while continuously monitoring their performance.

Conclusion

Turnaround management companies are essential in revitalizing small and medium businesses (SMBs) facing crises. They offer tailored consulting services that enhance operational efficiency, improve financial health, and ensure long-term sustainability. Their expertise is vital for navigating complex challenges, making them indispensable partners in the journey toward recovery and growth.

Throughout this article, various leading turnaround management companies have been highlighted, each showcasing unique strategies and methodologies. From Amplēo's data-driven decision-making and stakeholder engagement to Boston Consulting Group's comprehensive financial assessments and operational efficiency enhancements, the insights reveal diverse approaches employed to address the specific needs of SMBs. Additionally, firms like Faber and G2 Capital Advisors emphasize the importance of customized action plans and revitalizing both financial and operational performance, respectively, underscoring the multifaceted nature of turnaround management.

In a landscape where many businesses face unprecedented challenges, leveraging the services of turnaround management companies is more critical than ever. By adopting structured methodologies and embracing innovative strategies, organizations can not only survive but thrive in adverse conditions. The insights provided in this article serve as a call to action for SMBs to seek out expert guidance, ensuring they are equipped to transform their operations and secure a prosperous future.

Frequently Asked Questions

What is the role of turnaround management companies for small and medium businesses (SMBs)?

Turnaround management companies provide essential consulting services to SMBs facing crises, focusing on revitalizing operations, enhancing economic health, and ensuring long-term sustainability through various strategies.

What are the key components of comprehensive consulting offered by turnaround management companies?

Key components include financial assessment, operational restructuring, interim management, bankruptcy case management, and long-term strategy development.

How does financial assessment benefit businesses in crisis?

A thorough financial review helps identify opportunities to preserve cash and reduce liabilities, providing a solid foundation for recovery.

What is operational restructuring and why is it important?

Operational restructuring involves streamlining processes to enhance efficiency and reduce costs, which is vital for improving overall business performance.

What role does interim management play during a turnaround?

Interim management provides experienced leadership during transitions, maintaining stability and direction crucial for crisis resolution and transformational change.

How do turnaround management companies assist businesses with bankruptcy?

They help navigate bankruptcy proceedings, minimizing losses and facilitating a smoother recovery process.

What strategies does Amplēo use in turnaround management?

Amplēo employs data-driven decision making, stakeholder engagement, agile methodologies, a shortened decision-making cycle, and ongoing performance evaluation.

Why is data-driven decision making important for companies?

Organizations that use data-driven decision making are statistically more likely to acquire customers and achieve profitability, as decisions are based on solid data rather than intuition.

How does stakeholder engagement contribute to successful transformations?

Early involvement of key stakeholders enhances buy-in and support, making transformations significantly more likely to succeed.

What is the significance of agile methodologies in turnaround management?

Agile methodologies allow companies to adapt quickly to changing market conditions, which is essential for survival in a fast-paced commercial environment.

What does the 'Rapid-30' process entail?

The 'Rapid-30' process emphasizes decisive action and collaborative strategies, providing hands-on executive leadership for crisis resolution and transformational change.

How does Boston Consulting Group (BCG) approach turnaround and restructuring services?

BCG conducts comprehensive financial assessments, offers bankruptcy case management, enhances operational efficiency, and provides interim management services to help organizations restore profitability.