Introduction

Asset-Based Lending (ABL) is rapidly gaining traction as a strategic financing solution for businesses navigating today's challenging economic landscape. By allowing companies to utilize their assets—ranging from inventory to accounts receivable—as collateral, ABL not only provides swift access to capital but also enhances cash flow management and facilitates growth opportunities. As traditional lending avenues tighten, with banks imposing stricter standards, ABL emerges as a critical alternative, especially for midsize firms seeking liquidity in uncertain times.

This article delves into the mechanics of ABL, its key components, the types of assets eligible for collateral, and the benefits and challenges associated with this financing method. Understanding ABL's intricacies empowers businesses to make informed decisions, ensuring they can leverage their assets effectively while positioning themselves for sustainable growth.

How ABL Works

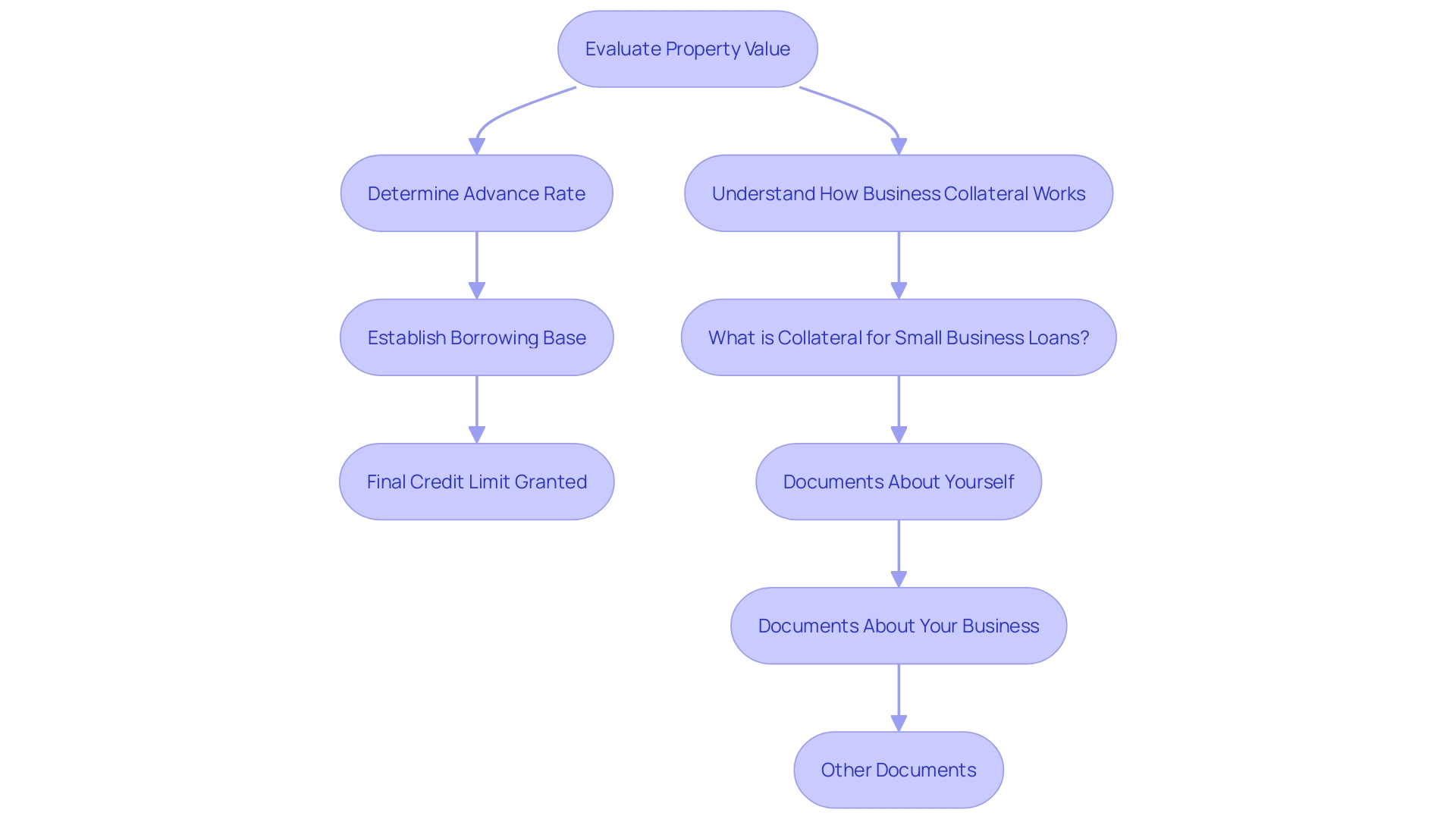

Collateral-Based Lending (ABL) functions as a strategic financing option allowing companies to utilize their resources as security for loans. This approach not only facilitates rapid access to capital but also plays a pivotal role in optimizing cash flow, funding day-to-day operations, and seizing growth opportunities. The process begins with a thorough evaluation of the property value, followed by determining the advance rate, which is crucial for establishing a borrowing base. This base determines the credit limit granted to the enterprise, ensuring that it aligns with the actual asset value.

A significant aspect of ABL is its adaptability in the current financial landscape. As conventional lenders have tightened their borrowing criteria, especially since the Great Recession, many enterprises are seeking alternative funding options. For instance, private equity firms and non-bank lenders have increasingly entered the market, offering competitive terms that accommodate the needs of midsize companies. Investment firms like Blackstone and Ares Capital Corp. are capitalizing on this shift, positioning themselves as viable alternatives to traditional banks, which have faced regulatory pressures to maintain higher capital reserves.

Furthermore, the recent October 2023 Senior Loan Officer Opinion Survey uncovered a trend of stricter lending standards across different sectors, emphasizing the significance of ABL in preserving liquidity for enterprises. This environment underscores the necessity for companies to , with ABL standing out for its capacity to provide immediate cash relief and sustain operational continuity.

As emphasized by industry specialists, the effectiveness of ABL lies in its ability to assist organizations in navigating financial uncertainties while fostering growth. As one fund manager stated, "Our job as fund managers is to make sure our investors' capital is well used: to create additional value, to support the companies that need it." This sentiment resonates across the industry, emphasizing the significance of ABL as a tool for not just survival, but also for strategic expansion.

Key Components of ABL

Asset-Based Lending (ABL) is characterized by several essential components that are integral to its structure and function. At the core is the borrowing base, which establishes the maximum amount a lender is willing to extend to a borrower, determined by the assessed value of the collateral. This base is crucial as it directly influences the capital a business can access.

Advance rates also play a vital role, determining the percentage of the item's value that can be borrowed. These rates vary depending on the type of collateral, with certain assets, such as accounts receivable, typically being eligible for higher advance rates than others, like inventory.

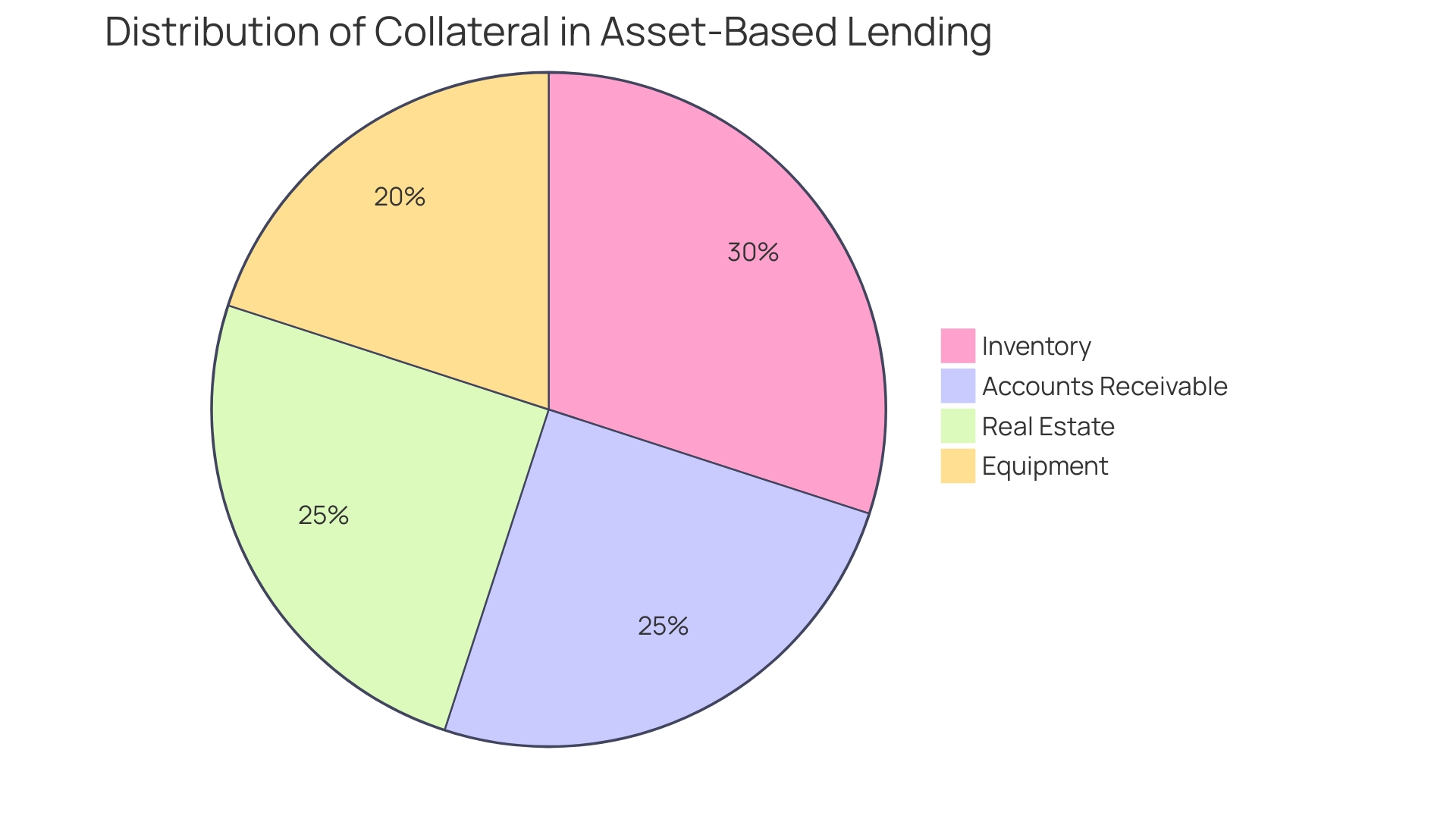

The accepted in ABL can be diverse, encompassing inventory, accounts receivable, equipment, and real estate. Each type of collateral presents different risk profiles and liquidity levels, which lenders assess before issuing loans. For instance, real estate often requires that its market value be equal to or greater than the loan amount to ensure adequate coverage in case of default.

Grasping these elements is not just theoretical; it has considerable consequences for companies looking for funding. A recent survey indicated tighter lending standards across commercial and industrial loans, emphasizing the importance of presenting strong collateral to secure favorable borrowing conditions. Therefore, awareness of how these elements interact can empower businesses to make informed decisions when considering ABL as a financing option.

Types of Assets Used as Collateral

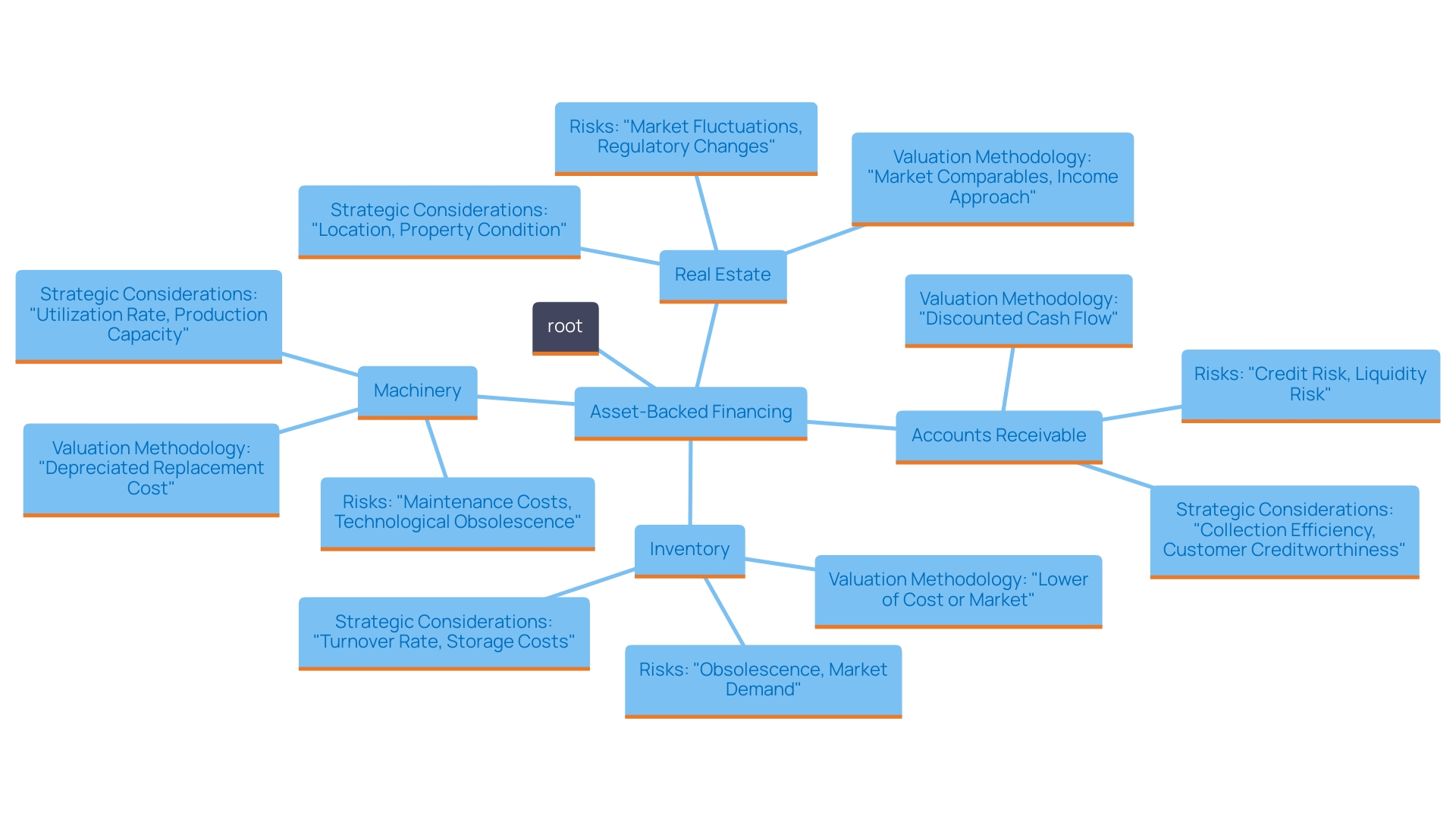

Companies can utilize a range of resources to obtain asset-backed financing (ABL), including accounts receivable, inventory, machinery, and real estate. Each asset type has distinct valuation methodologies and associated risks that demand careful consideration.

Accounts receivable, for example, can be evaluated based on the financial health and creditworthiness of customers. This process often enables companies to borrow against the amounts owed from customers without needing to sell the invoices outright. This method is beneficial because it enables companies to maintain control over the collection of payments, thereby preserving customer relationships and confidentiality. In contrast, when businesses engage in factoring, they sell their invoices to a third party at a discount to improve cash flow, but they relinquish control over collections, making this a less confidential option.

The valuation of inventory is also critical and can fluctuate based on market demand. Businesses must understand how to assess their inventory's worth accurately, as lenders often require collateral that matches or exceeds the loan amount. For instance, if real estate is used as collateral, its valuation must be equal to or greater than the loan requested. This ensures that lenders have sufficient security to mitigate their risk, as they typically prefer collateral that offsets 100% of the borrowed amount.

Understanding these dynamics is essential for . As emphasized in a recent study by the Secured Finance Network, the environment of secured funding is changing. In 2024, we may observe a shift toward more cash purchasers in the commercial vehicle sector, resulting in heightened demand for floorplan support to sustain optimal inventory levels. This trend highlights the importance for companies to strategically assess their assets and the related funding alternatives accessible to them.

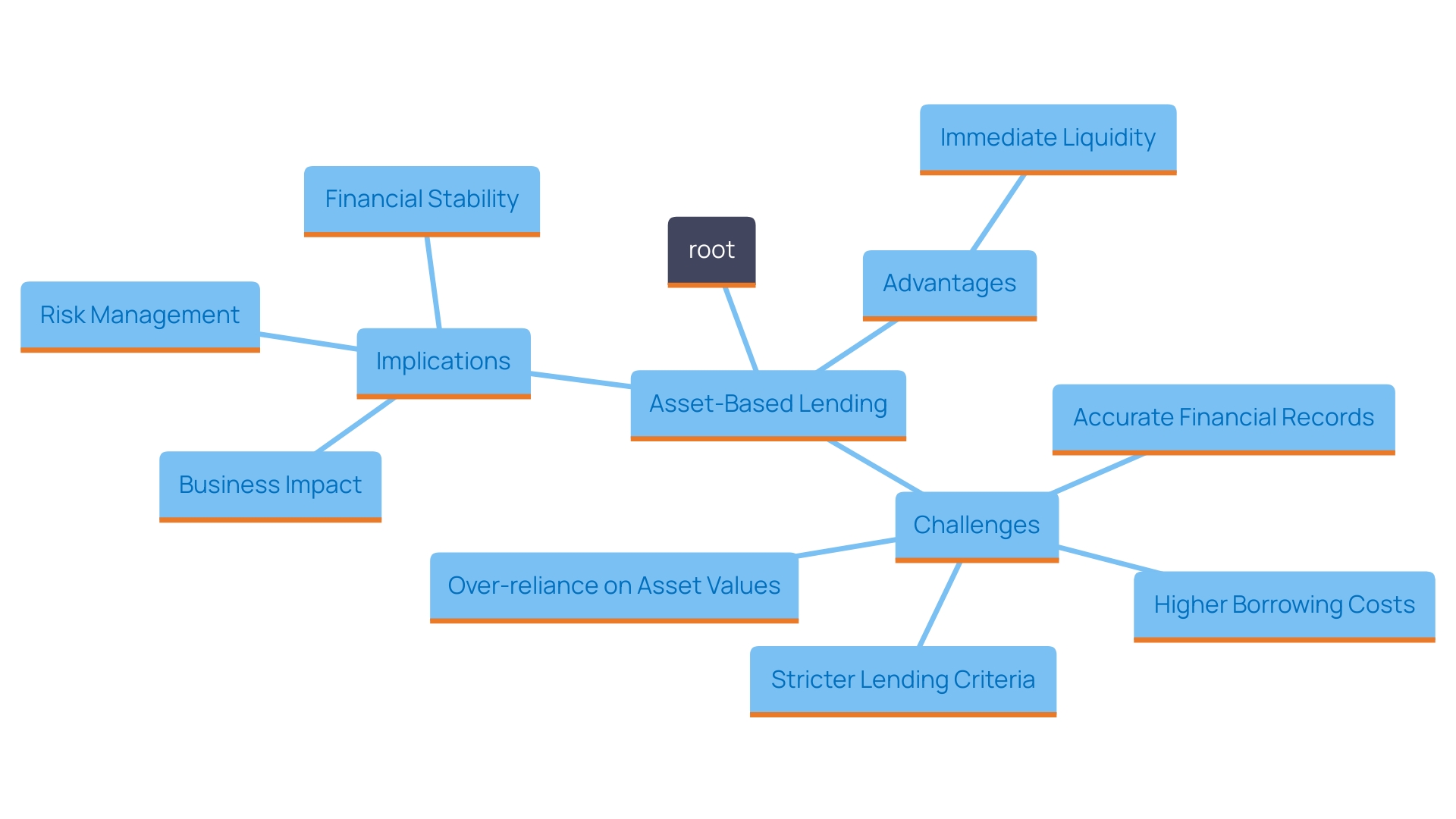

Benefits of ABL

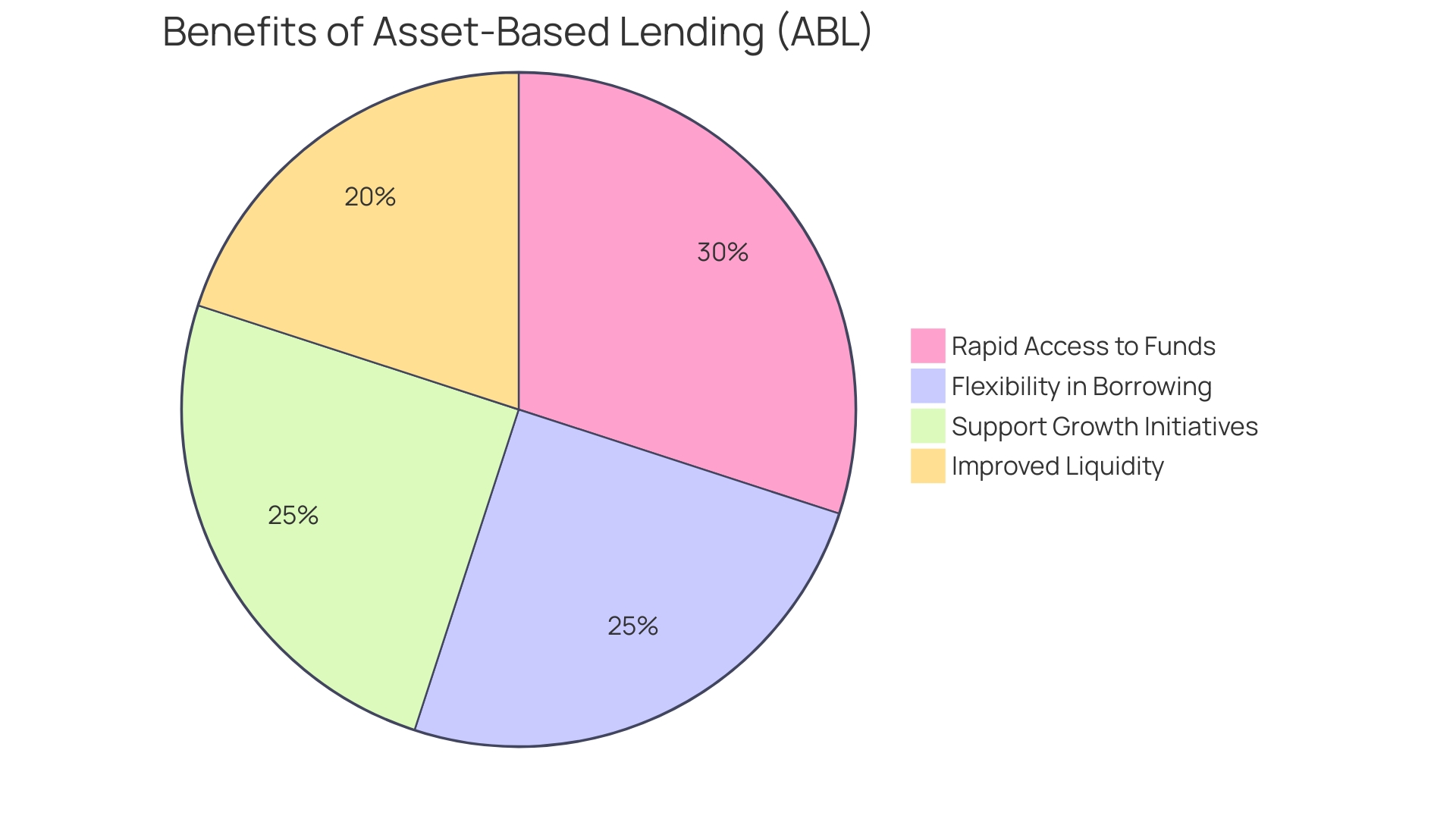

Asset-Based Lending (ABL) offers a range of compelling advantages that can significantly enhance an organization's financial agility. One of the standout benefits is the rapid access to funds it provides. Unlike conventional loans, which frequently entail prolonged approval procedures, ABL enables businesses to obtain funding swiftly, meeting efficiently.

ABL is inherently more flexible than conventional lending options. It allows companies to borrow against their current asset values—such as inventory or accounts receivable—rather than relying solely on historical cash flow. This flexibility is particularly advantageous for firms that may face fluctuating revenue streams or those engaged in seasonal sales cycles.

Moreover, leveraging ABL can improve a company's liquidity position, making it easier to navigate cash flow challenges and support growth initiatives. By utilizing ABL, companies can maintain operational stability and invest in expansion opportunities without the risk of diluting ownership through equity funding.

The current landscape underscores the growing relevance of ABL. With traditional financing avenues tightening due to rising interest rates and stringent lending standards, ABL stands out as a viable option for companies aiming to bridge the widening funding gap, particularly in sectors that are asset-light or have complex cash conversion cycles. A recent report indicates that 41% of users of new digital financial products reported increased growth activities, such as enhanced sales, highlighting the effectiveness of agile lending products like ABL.

As the financial landscape continues to evolve, understanding the strategic implications of ABL can empower organizations to make informed decisions, ultimately supporting their long-term growth objectives.

Challenges and Considerations

Asset-based lending (ABL) offers significant advantages, yet it also comes with notable challenges that businesses must navigate carefully. One critical aspect is the necessity for maintaining accurate and timely , as lenders closely scrutinize property values to determine creditworthiness. This level of oversight means that any discrepancies in financial reporting can have immediate repercussions on access to capital.

Additionally, the cost of borrowing through ABL can be higher than traditional loan options. Charges and interest levels are frequently heightened because of the perceived risk linked to asset-backed funding. Businesses should be prepared for this financial reality, as it can impact overall profitability. As per the October 2023 Senior Loan Officer Opinion Survey, lending criteria for commercial and industrial loans have become stricter, indicating a careful stance from lenders concerning value evaluation and risk assessment.

Another concern is the potential for over-reliance on asset-based financing. 'While ABL can provide crucial liquidity, fluctuations in the values of holdings can create vulnerabilities.'. If the market value of collateral assets declines, firms may find themselves in a precarious situation, leading to financial strain. Industry experts highlight the significance of comprehending risk profiles and market conditions, as these elements are crucial when evaluating the feasibility of using ABL as a primary funding strategy.

In summary, while ABL can offer immediate financial solutions, companies must approach it with a comprehensive understanding of its costs and risks to avoid pitfalls that could jeopardize their financial stability.

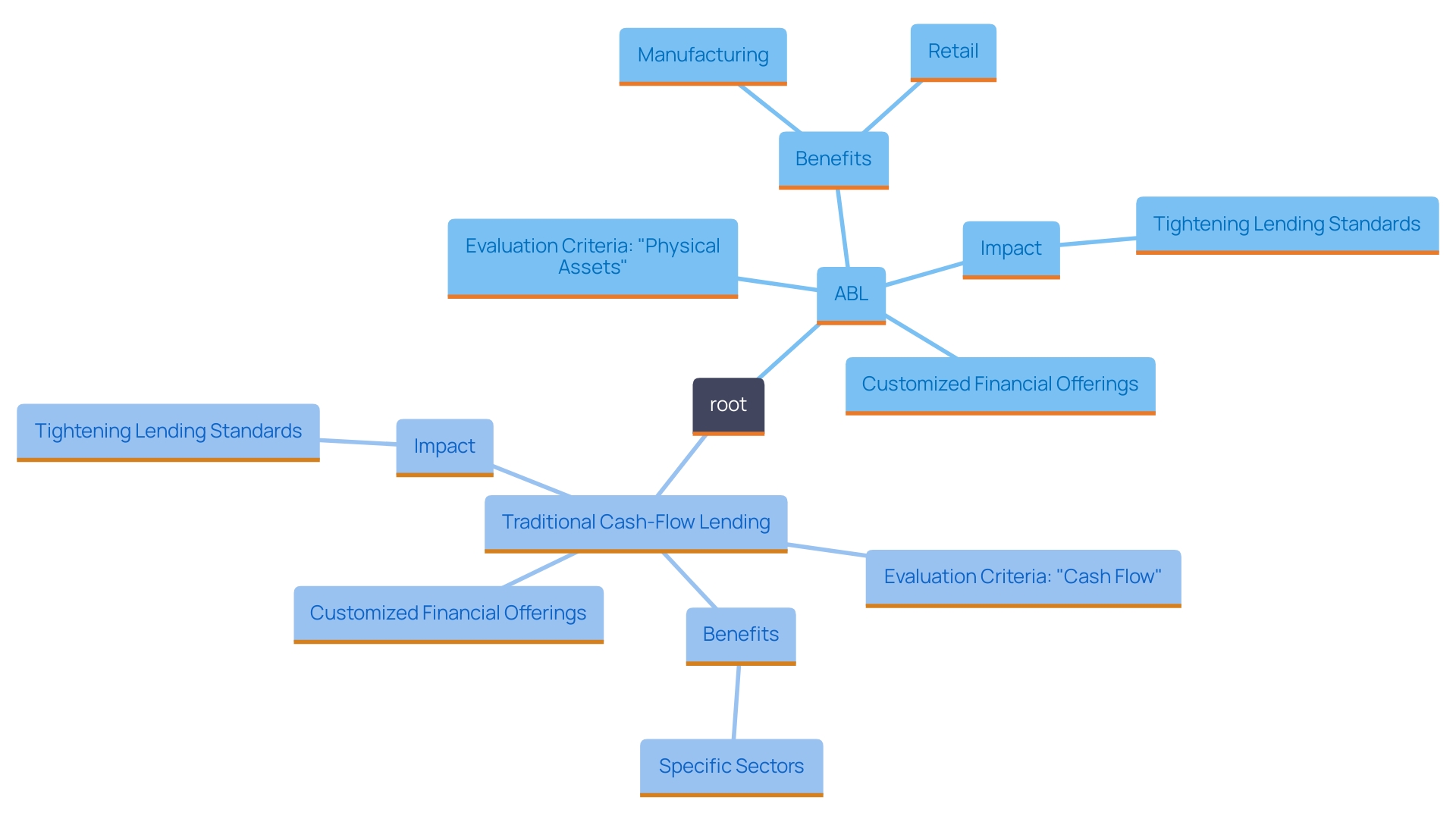

Comparing ABL to Traditional Cash-Flow Lending

Grasping the distinctions between Asset-Based Lending (ABL) and traditional cash-flow lending is crucial for organizations seeking optimal financing solutions. Traditional loans typically hinge on a company's historical cash flow and profitability, evaluating the financial health based on past earnings and revenue streams. In contrast, ABL concentrates on the worth of physical resources, such as inventory and receivables, which can offer a more immediate foundation for securing funding.

This resource-focused method can be especially beneficial for companies that have significant tangible resources but may face challenges with cash flow due to unpredictable market situations or seasonal demand. For instance, businesses in sectors such as manufacturing or retail, which frequently maintain substantial inventory, might discover ABL to be a more feasible choice in contrast to traditional loans that may disregard their resource potential in favor of past cash evaluations.

Moreover, in the context of current economic trends, many small and medium enterprises (SMEs) are experiencing tightening lending standards, as evidenced by the October 2023 Senior Loan Officer Opinion Survey. The survey suggested that banks have noted stricter criteria for commercial loans, which can further hinder access to conventional funding for enterprises facing cash flow difficulties. In this environment, ABL emerges as a critical lifeline, enabling companies to leverage their assets for liquidity.

Furthermore, the emergence of customized financial offerings created to satisfy the distinct requirements of enterprises highlights the changing environment of SME funding. As noted in recent observations, both the supply and demand for loans are contracting, signaling a paradigm shift. This shift is particularly pronounced for asset-light enterprises and those with challenging cash conversion cycles, highlighting the necessity for alternative financing options like ABL.

Ultimately, ABL offers a viable pathway for businesses to secure funding by turning their physical assets into working capital, thereby addressing the that traditional lending may not adequately support.

Conclusion

Asset-Based Lending (ABL) stands out as a vital solution for businesses navigating the complexities of today's economic environment. By allowing companies to leverage their tangible assets—such as accounts receivable, inventory, and equipment—ABL not only provides quick access to capital but also enhances operational liquidity. This financing method is particularly advantageous for midsize firms that may struggle to meet the stringent requirements of traditional lenders.

The key components of ABL, including the borrowing base and advance rates, highlight the flexibility and adaptability of this financing option. Understanding the types of assets that can serve as collateral is crucial for businesses aiming to optimize their borrowing potential. Each asset type carries unique valuation methodologies and associated risks, making it essential for organizations to evaluate their assets strategically.

While ABL offers numerous benefits, such as rapid funding and improved cash flow management, it is not without challenges. Businesses must maintain accurate financial records and be aware of the potentially higher costs associated with asset-based financing. Moreover, over-reliance on ABL can expose firms to risks related to fluctuating asset values.

In light of tightening lending standards and evolving market conditions, ABL presents a compelling alternative to traditional cash-flow lending. By understanding the intricacies of ABL and its role in supporting operational stability and growth, businesses can make informed financing decisions that align with their long-term objectives. Embracing this strategic approach can empower organizations to navigate financial uncertainties and seize new opportunities for expansion.

Frequently Asked Questions

What is Asset-Based Lending (ABL)?

ABL is a financing option where companies use their assets, such as inventory, accounts receivable, and real estate, as collateral to secure loans. This method allows for quick access to capital and helps optimize cash flow.

How does ABL work?

The process starts with evaluating the value of a company’s assets to determine an advance rate, which establishes the borrowing base. This base defines the maximum credit limit a lender will provide, ensuring it aligns with the asset's actual value.

What are the types of collateral accepted in ABL?

Common collateral types in ABL include accounts receivable, inventory, equipment, and real estate. Each type has different risk profiles and liquidity levels, affecting the borrowing terms.

What are the benefits of using ABL?

Key advantages of ABL include rapid access to funds compared to traditional loans, flexibility in borrowing against current asset values, improved liquidity to navigate cash flow challenges, and support for growth initiatives without diluting ownership.

What challenges are associated with ABL?

Challenges include the need for accurate and timely financial records, potentially higher borrowing costs due to perceived risks, and the risk of over-reliance on asset-based financing, which can lead to vulnerabilities if asset values fluctuate.

How does ABL differ from traditional cash-flow lending?

Traditional loans focus on a company's historical cash flow and profitability, while ABL focuses on the value of physical assets. This makes ABL a more suitable option for businesses with substantial tangible resources but inconsistent cash flow.

Why has ABL gained popularity in recent years?

The tightening of lending standards by traditional banks, especially after the Great Recession and recent regulatory pressures, has pushed many companies to seek alternative funding options like ABL, which can provide immediate cash relief.

How do advance rates impact ABL?

Advance rates determine the percentage of an asset's value that can be borrowed. These rates vary based on asset type; for instance, accounts receivable often have higher advance rates than inventory.

What should companies consider before opting for ABL?

Companies should evaluate the accuracy of their financial records, the associated costs of borrowing, the risks of fluctuating asset values, and their overall reliance on asset-based financing.

How can ABL support growth in a changing financial landscape?

ABL provides a viable alternative for companies to secure funding by leveraging their physical assets, particularly in sectors facing tighter lending standards and complex cash conversion cycles. This can help address liquidity challenges that traditional lending may not meet effectively.