Introduction

Operational costs are a crucial aspect of running a business effectively, and CFOs play a key role in managing and reducing these expenses. By analyzing costs, leveraging technology, focusing on key performance indicators (KPIs), utilizing managed services, and optimizing vendor negotiations, CFOs can create a robust framework for cost reduction. Additionally, strategies such as outsourcing non-core functions, optimizing inventory, and workforce efficiency can further enhance operational cost savings.

This article explores real-world case studies and considerations for CFOs to successfully navigate cost reduction strategies while maintaining operational efficiency and long-term financial health.

Understanding Operational Costs

Operational expenses are the total of outlays essential for a business to operate smoothly and effectively. These encompass expenses like labor and raw materials, along with additional expenditures such as rent and insurance. To reduce these expenses without jeopardizing quality or performance, a thorough approach is essential. By thoroughly examining every expenditure, CFOs can identify areas where savings are feasible and develop specific approaches to reduce expenses.

For example, AT&T tackled entrenched bureaucracies by listening to employee feedback and modernizing outdated systems that had persisted for decades. Similarly, Check Technologies utilizes the power of their Data Platform to make informed decisions, optimize operations, and initiate improvements based on data-driven insights, resulting in efficiencies.

Embracing technology is another way to reduce expenses. The use of online systems and AI can streamline operations, enhancing efficiency and minimizing errors. An example of this is BILL Spend & Expense, which curtails costs associated with manual data entry and paper invoices.

Recognizing the importance of KPIs, as Peter Drucker said, "What gets measured gets managed," is crucial. By focusing on KPIs, a business ensures active management of its operations, leading to better financial health and customer satisfaction. This strategic method is not only for short-term benefits; it establishes the foundation for continuous expansion, with approaches like customer retention demonstrating cost-effectiveness in the long run.

Furthermore, as businesses invest heavily in technology, aligning IT budgets with business strategy becomes integral to success. Managed services such as those provided by Insight have enabled companies to save thousands of hours, allowing them to focus on strategic initiatives.

To sum up, through the analysis of expenses, utilization of technology, emphasis on KPIs, and the use of managed services, businesses can establish a strong structure for .

Calculating Operating Costs

Comprehending and handling operational expenses is vital for any organization, and the secret lies in the specifics. For instance, AT&T recognized the importance of challenging long-standing systems and policies to streamline operations. In a similar vein, CFOs must be meticulous in tracking and analyzing expenses. This begins by categorizing expenses into different departments or expense centers, ensuring accurate allocation of expenses, and adopting robust accounting methods. Such practices enable a detailed perspective on expenses, which is crucial for making decisions and recognizing areas for reducing expenses.

Steel companies, for instance, handle various departments, making standard expense accounting an effective tool to evaluate typical operating conditions against actual expenditures. Meanwhile, IT infrastructure continues to play a significant role in managing expenses, with global tech spending reaching trillion-dollar heights. This emphasizes the significance of technology competence intertwined with business planning.

Direct expenses, like materials and labor, are tangible aspects included in the calculation of Goods Sold (COGS) and are crucial to comprehend for pricing strategies. The idea behind cost-plus pricing is simple: determine the production expense and include a markup. This demands accuracy and a comprehension of the overall ownership expense, as exemplified by Apple's approach, where the value is achieved throughout the device's lifespan. Technology further aids in this process by reducing errors and ensuring accurate markups.

In the pursuit of operational efficiency, adopting technology like AI can result in substantial reductions in expenses by accelerating processes and minimizing errors. This is exemplified by BILL Spend & Expense, which automates and streamlines spend tracking and expense management.

In the end, the objective is to guarantee that operating expenses stay a portion of revenue. By implementing approaches like reference-based pricing, where expenses are determined based on Medicare rates as practiced by Pacific Steel, CFOs can attain greater clarity and management over expenditures. This proactive strategy for is essential for a company's financial well-being and competitive advantage.

Strategies for Reducing Operational Costs

Optimizing procedures and harnessing technology are efficient approaches for decreasing expenses, which directly improves an organization's financial well-being. For instance, Travel Charme Strandhotel Bansin utilized technology to streamline operations, resulting in more efficient guest services and operational workflows. Likewise, the Optimization of Expenses pillar in the Well-Architected Framework showcases that combining the knowledge of both financial and technology teams can result in improved management of expenses.

Operational expenses, which include payroll, inventory, and insurance, must be managed astutely to ensure a business thrives. Technology plays a pivotal role here; by adopting tools such as BILL Spend & Expense, companies can automate processes and eliminate expenses linked to manual data entry and paper-based systems.

To efficiently control expenses, it's essential to track . As management expert Peter Drucker stated, "What gets measured gets managed." This means closely tracking operational efficiency and customer satisfaction metrics to gain valuable insights and make informed decisions. Moreover, adopting simple changes like going paperless, printing on both sides, or reducing print margins can significantly reduce waste and energy use.

Finally, taking into account the guidance from industry professionals, a well-rounded approach to optimization of expenses is suggested. Instead of broad technology transformations, incremental experimentation, coupled with strong stakeholder support and effective change management, can yield substantial benefits. As shown by the experience of a semiconductor foundry, establishing measurable objectives and selecting appropriate tools for digitalizing R&D can expedite time to market, diminish development expenses, and enhance quality.

Vendor Negotiation and Management

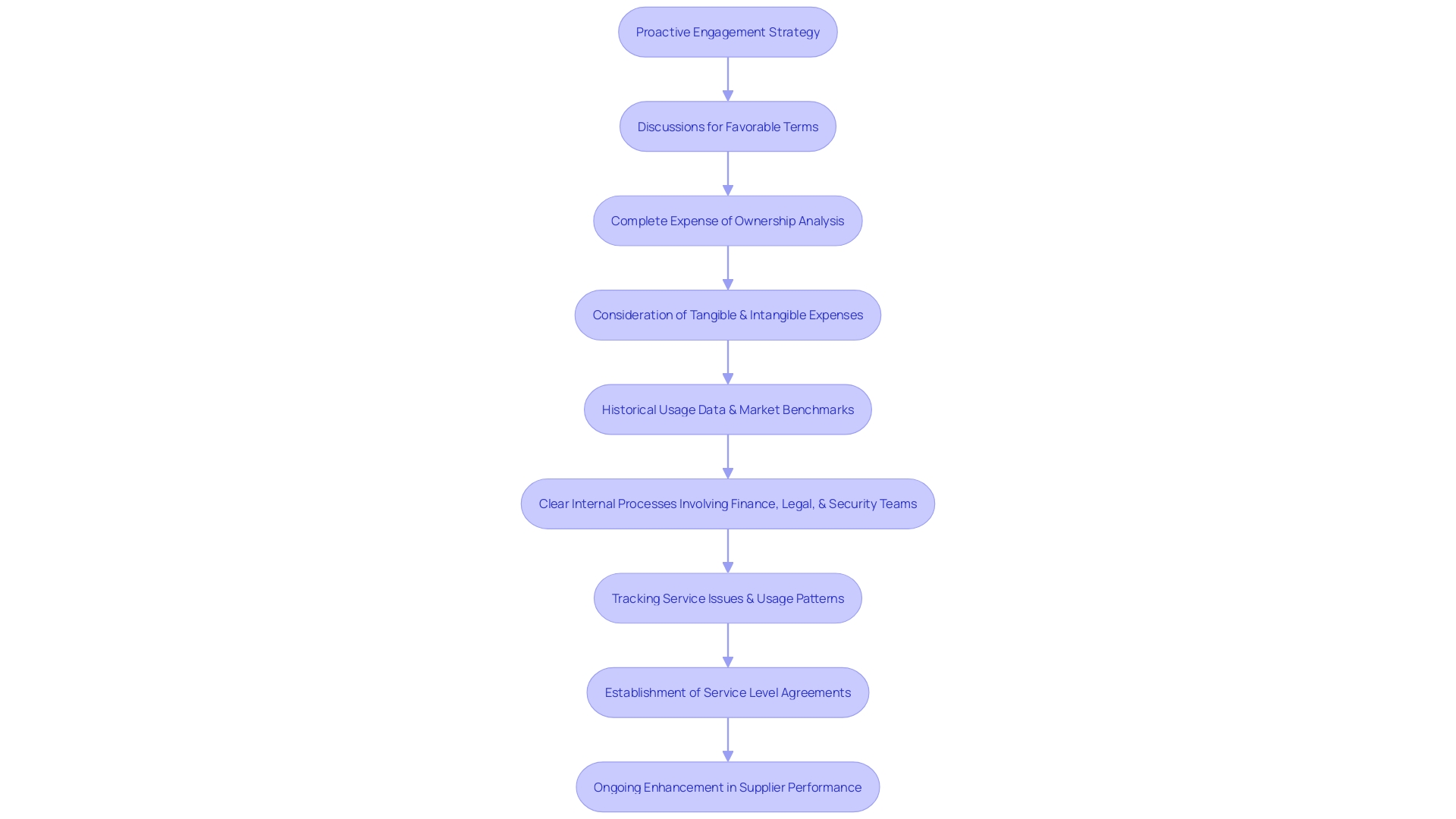

Attaining savings in vendor negotiations is crucial for financial leaders, and this can be accomplished through a proactive engagement strategy with suppliers. Through discussions for favorable terms, financial officers can obtain beneficial pricing and reductions, which are crucial for optimizing expenses. To maximize the benefits of this, it's advantageous to consider the complete expense of ownership analysis, which takes into account both tangible and intangible expenses associated with procuring goods or services. For instance, a comprehensive analysis would include not only the purchase price and maintenance fees but also management, training, and potential downtime—factors that can significantly impact the organization's bottom line if overlooked.

Understanding the is equally critical. By arming oneself with historical usage data and market benchmarks, a CFO can enter negotiations with a robust knowledge base, enhancing their bargaining position. This data-driven approach, supported by clear internal processes involving Finance, Legal, and Security teams, ensures that all stakeholder needs are addressed and that the organization is primed for success. Moreover, tracking service issues and usage patterns allows for the establishment of service level agreements, ensuring vendors remain accountable and consistently deliver value. By taking such actions, financial officers at the executive level can promote ongoing enhancement in supplier performance, ensuring that expenses related to business operations are not only decreased but also in line with the company's long-range financial plans.

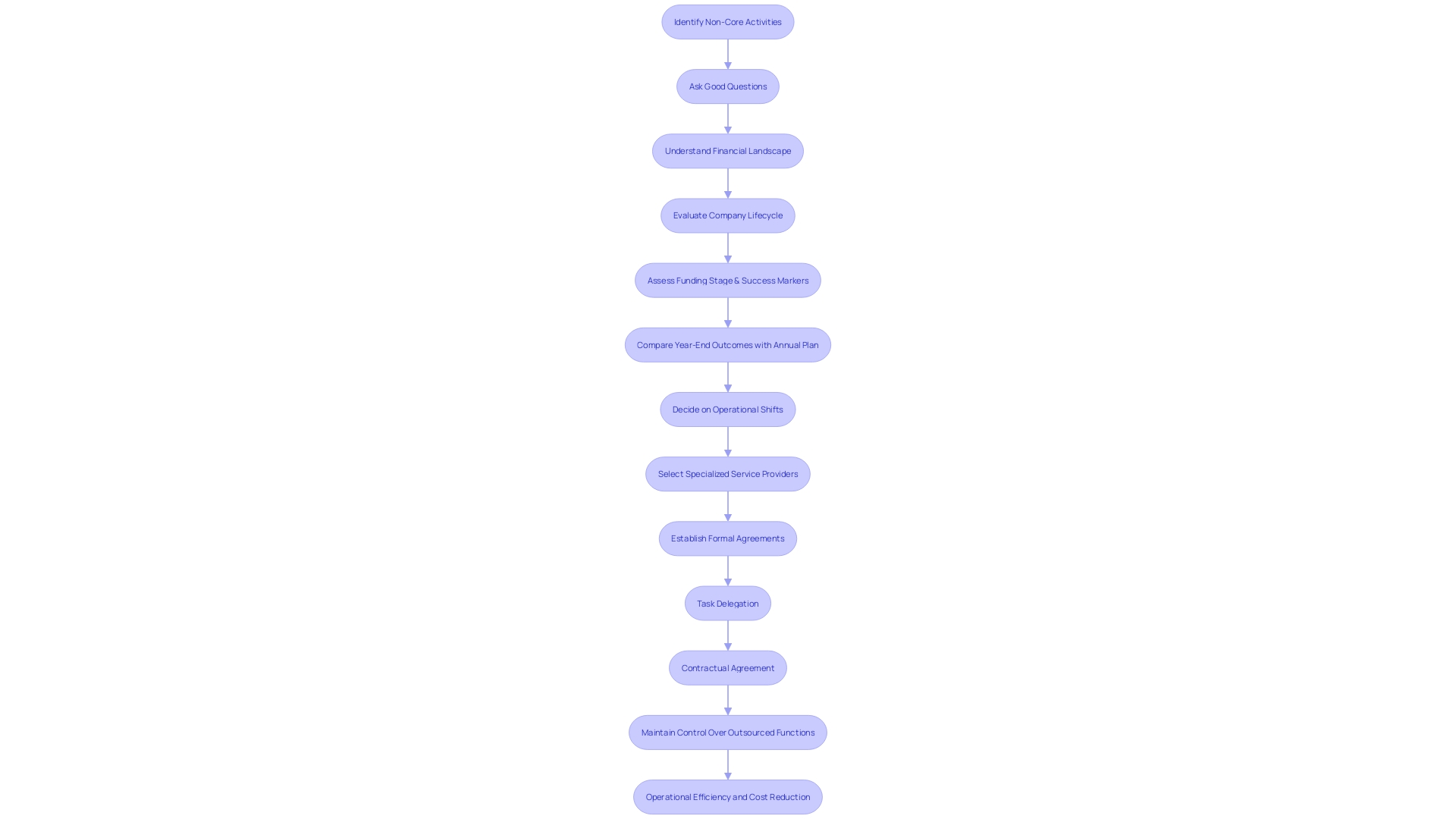

Outsourcing Non-Core Functions

Embracing strategic outsourcing is a key avenue for CFOs to reduce expenses and streamline core business functions. When non-core activities like IT support and customer service are outsourced, companies can benefit from the expertise of . This not only enhances efficiency but also significantly trims overheads. For instance, AT&T found that by addressing long-standing bureaucratic processes, they could better serve both employees and customers, echoing a broader trend in operational efficiency. Similarly, Delivery Hero tackled the challenge of account lockouts by rethinking IT service delivery, reducing resolution times from 35 minutes to a swift process, thereby eliminating unnecessary downtime. Enel's digital transformation further exemplifies this, where AI-managed IT service tickets reduced case resolution times from a day to under two minutes, boosting productivity. When considering offshore development, reducing expenses is a compelling factor. Outsourcing to areas with decreased labor expenses can result in significant savings, as observed with IT staff offshoring, where collaboration is also facilitated by reasonably priced real estate. However, it's crucial to select the right outsourcing partner to safeguard data security and uphold service quality. Formal agreements and clearly defined service levels are instrumental in maintaining control over outsourced functions, ensuring that they align with the company's standards and strategic objectives.

Inventory Optimization

Efficient inventory management is a crucial strategy for CFOs aiming to streamline expenses and uphold a strong cash flow. In the automotive industry's shift to electric vehicles (EVs), firms are redefining their focus from profit margins to net working capital optimization, where inventory plays a significant role. This shift presents an opportunity to revamp value chains and implement structural changes that can positively impact inventory levels. Reducing product complexity, for instance, can directly influence the number of stock keeping units (SKUs) required, thereby decreasing inventory requirements.

Real-time inventory tracking and advanced software tools are transforming inventory management by offering more accurate demand forecasting and reducing waste. With systems that update instantaneously upon sale or receipt of an item, businesses can maintain optimal stock levels. This is especially crucial for industries experiencing transformative changes, such as the automotive sector's transition to EVs, where supply chain network design and sales operations planning become key.

New regulations are also influencing financial reporting practices. The Financial Accounting Standards Board is advocating for increased openness in software expenses within cash-flow statements. This reflects a wider trend where technology investments are crucial for managing facets like inventory.

The importance of inventory management is reiterated by experts who advocate for tailored to business specifics, such as the product type, business size, and required accuracy levels. This ensures the right amount of inventory is on hand, avoiding overstocks and stockouts. As the automotive industry shows, aligning inventory management with broader strategic transformations can result in significant gains in efficiency and savings.

Workforce Optimization

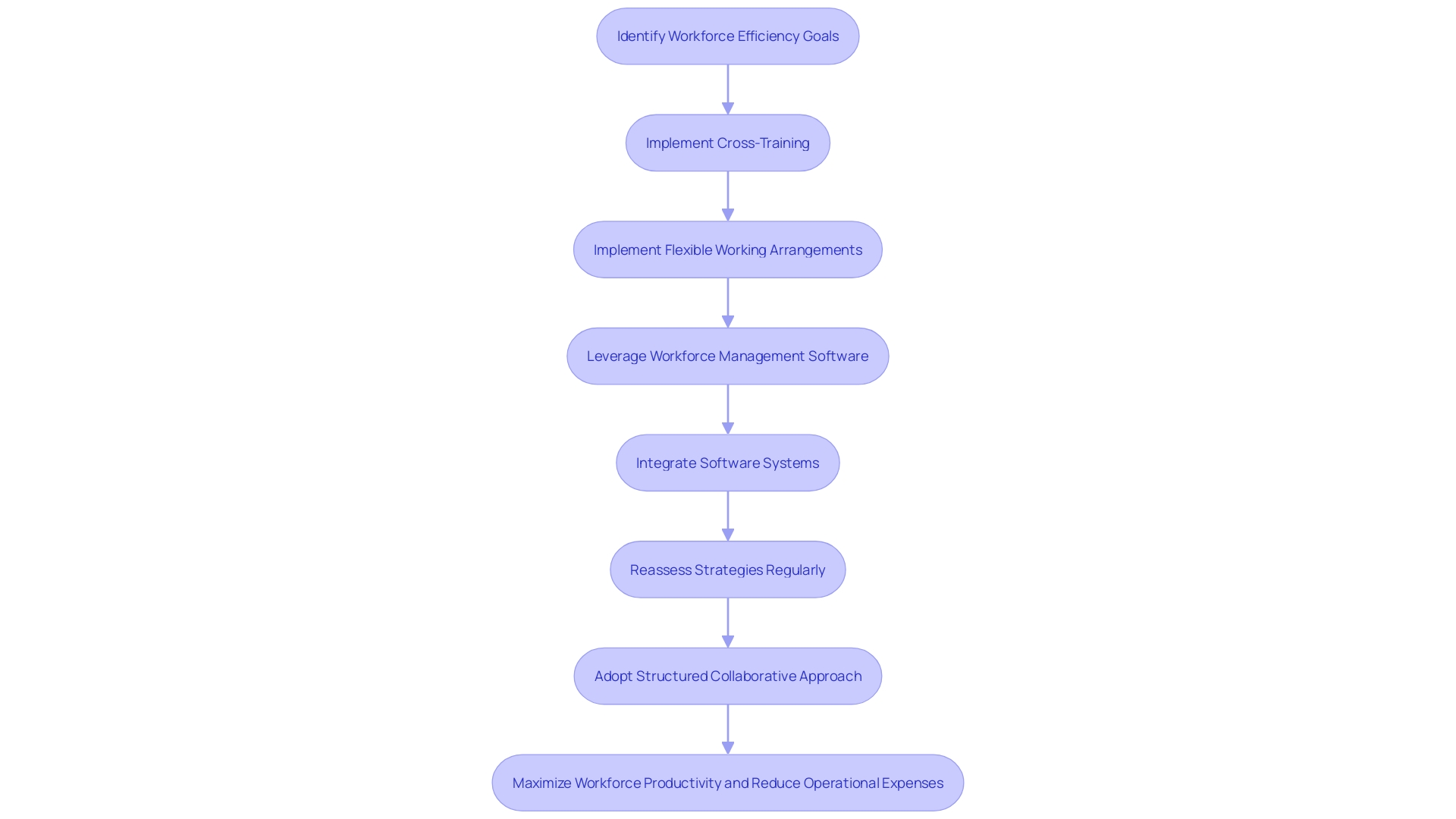

Maximizing workforce efficiency is crucial for CFOs aiming to reduce operational expenses while safeguarding productivity. One approach is through cross-training, which not only promotes versatility but also prepares employees to cover various roles as needed, thereby reducing the necessity for a larger staff. Flexible working arrangements are another approach that can result in savings. By enabling employees to work from home or with flexible schedules, organizations can potentially decrease expenses linked to physical office spaces. Moreover, leveraging advanced workforce management software to enhance scheduling can align staffing more closely with actual demand, thus avoiding the expense of underutilized labor.

The experience of Somerset Academies of Texas illustrates the benefits of integrating various software systems to streamline processes and prevent inefficiencies. In contrast, AT&T's historical adherence to legacy systems and processes underscores the significance of regularly reassessing and updating strategies to avoid the pitfalls of bureaucracy and inefficiency. Similarly, Pacific Steel's strategic overhaul of their health care expense structures through detailed analysis and reference-based pricing demonstrates the potential for significant savings in other operational areas when a proactive and transparent approach is adopted.

These real-world cases emphasize the need for financial officers to embrace a . It's about instituting a consistent framework for assessing and managing workforce productivity, as evident from the insights shared by industry leaders during a round table on enhancing employee experience. By implementing these strategies, financial officers can promote optimization of expenses throughout an organization's lifecycle, resulting in more knowledgeable choices and improved financial results.

Continuous Improvement and Monitoring

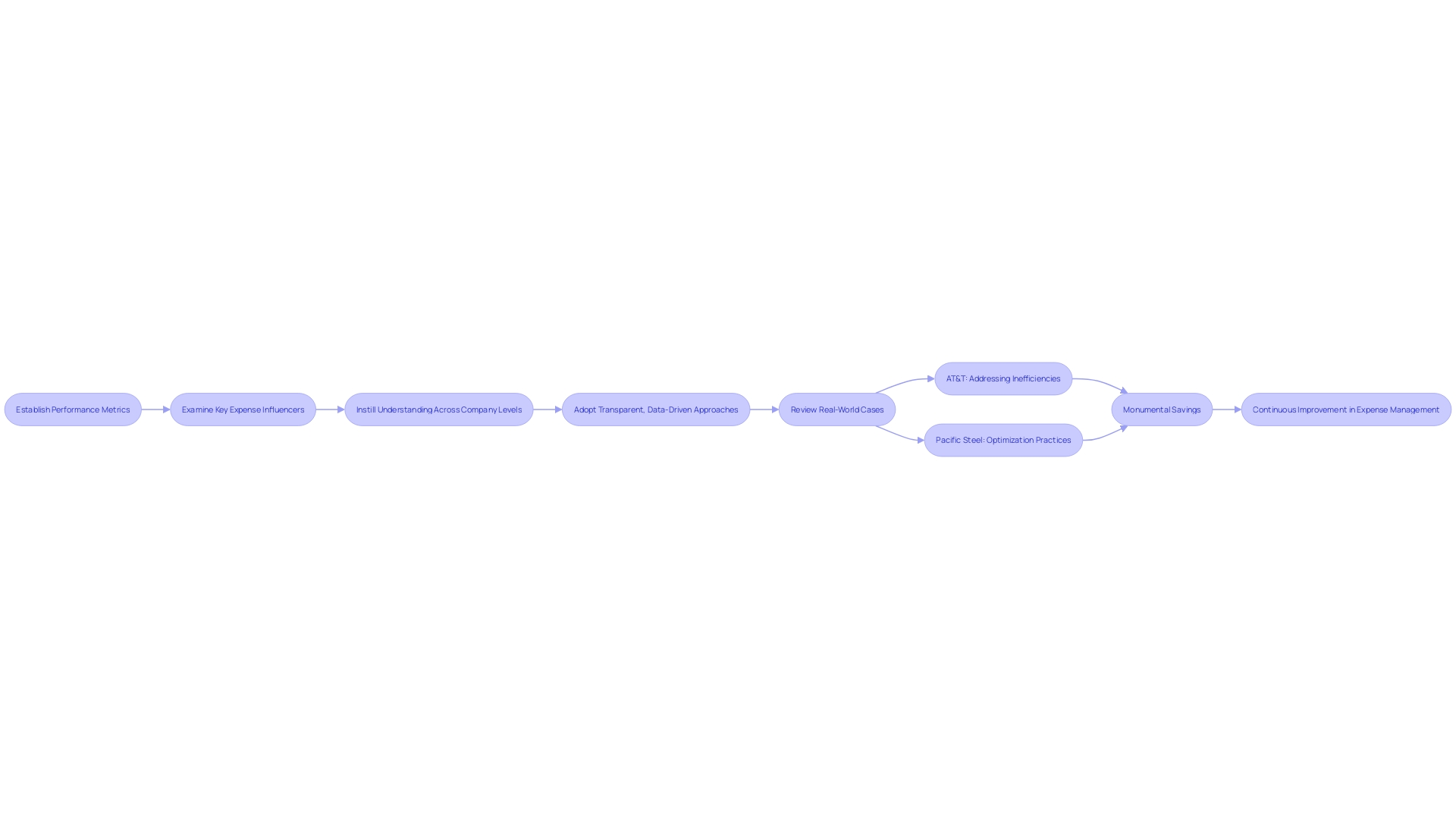

To drive sustainable reduction, CFOs must inculcate a continuous improvement ethos across their organizations. This means not only establishing strict performance metrics but also closely examining key expense influencers on a continuous basis. Moreover, it is crucial to instill in every level of the company a profound understanding of the implications related to expenses. Real-world cases such as AT&T's historical bureaucracy and Pacific Steel's health care expense overhaul illustrate the monumental savings that can arise from addressing long-standing inefficiencies and adopting transparent, data-driven approaches. For example, by paying close attention to 'raindrops' in their operations, AT&T achieved savings equivalent to millions of dollars and hours. Similarly, unveiled significant overpayments, leading to substantial cost reductions. The data is indicating; fewer than half of companies have fully adopted necessary engineering practices or report satisfactory engineering efficiency, indicating a widespread requirement for optimization. As workforce dynamics evolve, with younger and remote workers expressing feelings of disengagement, addressing employee well-being through improvements becomes increasingly pertinent. Furthermore, the convergence of operational efficiency and advanced technologies such as AI is shaping industries, with companies like Pfizer and BlackRock prioritizing financial control while investing in future productivity tools. Embracing this dual approach of expense management and value delivery is paramount. By adopting a comprehensive strategy that involves clear communication of the change rationale, tangible examples of enhancements, and delineated responsibilities, CFOs can not only achieve but also maintain a cost-conscious culture that aligns with long-term financial success.

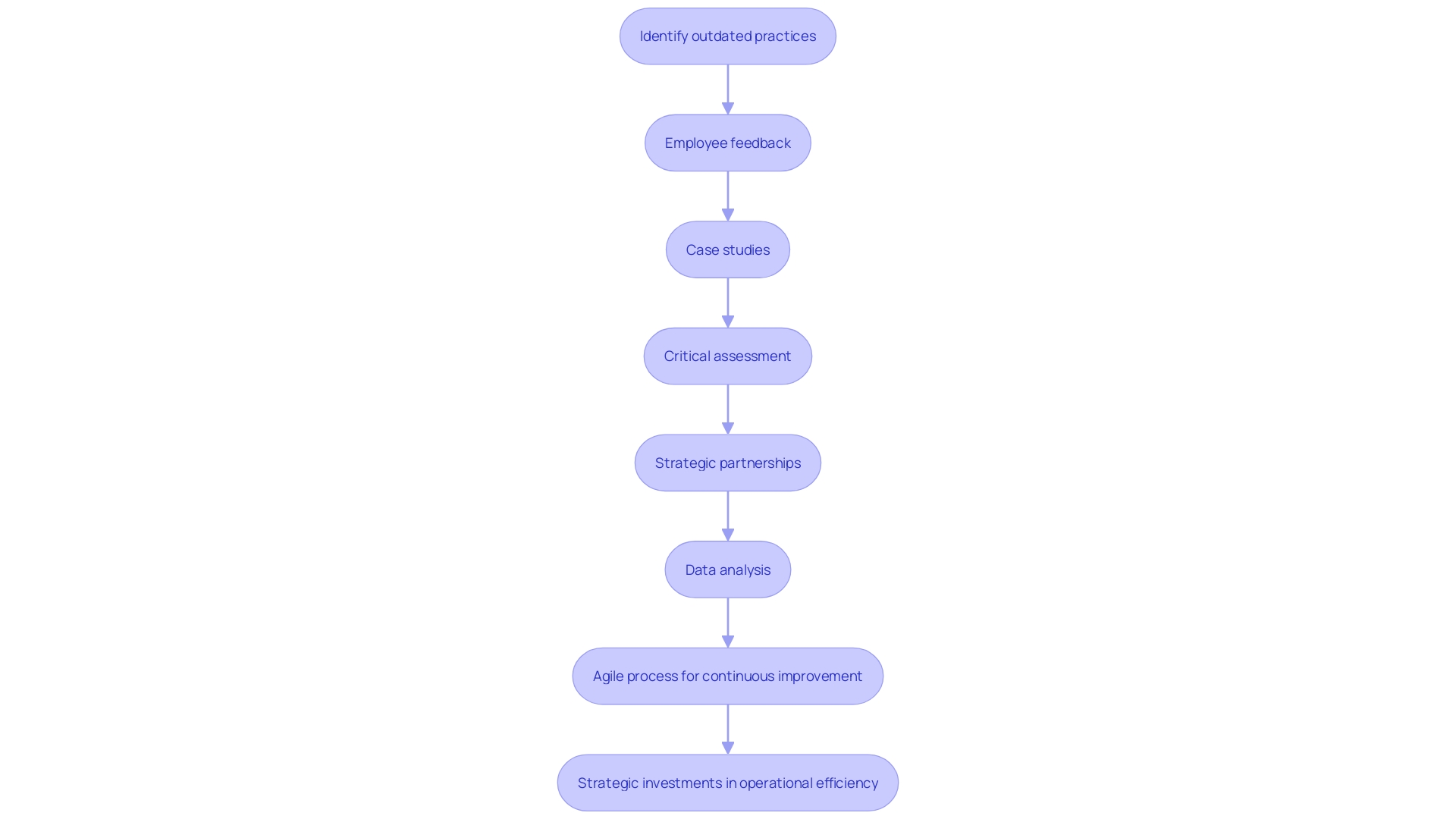

Case Studies: Successful Cost Reduction Implementations

By examining real-life scenarios, Chief Financial Officers can extract practical insights on minimizing operational expenses. For instance, AT&T's historical complexity due to its long-standing operations in regulated industries led to entrenched systems that went unquestioned for years. However, an employee survey expressing frustration with existing processes became a catalyst for change. Similarly, Somerset Academies of Texas, under the leadership of Austin Morgenroth, Director of Technology Services & Communications, streamlined its disparate software systems into a more cohesive infrastructure, addressing issues caused by a lack of integration.

Furthermore, a case study of Pacific Steel & Recycling is particularly enlightening. The organization, struggling with unclear healthcare expenses and inefficiencies, transitioned to a self-funded structure and embraced reference-based pricing. This strategic move, facilitated by deeper analysis of insurance claims and a partnership with USI Insurance Services, allowed the company to align its healthcare expenses more closely with Medicare rates.

These narratives showcase a common theme: the imperative for organizations to critically assess and revamp outdated practices. As highlighted by The Boston Consulting Group, the effectiveness of data scientists can be hampered by mundane tasks, resulting in only 44% of models reaching production. An agile process, encompassing stages from defining business cases to operationalization, supports continuous improvement and can substantially reduce unnecessary expenditures.

As stated by a prominent consultancy specialist, 'We have established a strong basis...[and] will keep investing in individuals, resources, technology, and collaborations.' This encompasses the multifaceted approach required for CFOs to not only achieve reductions in expenses but also through strategic investment in resources that enhance operational efficiency.

Challenges and Considerations in Cost Reduction

Efficient expense reduction approaches are essential to a CFO's responsibility, guaranteeing the financial well-being in the long run while upholding the excellence of operations. However, the journey toward leaner operations can be complex. Take Pacific Steel & Recycling, for instance. By scrutinizing their insurance claims data and adopting reference-based pricing, they uncovered significant overpayments relative to Medicare rates. This revelation led to a substantial overhaul of their healthcare structure, demonstrating how transparency and data-driven strategies can lead to substantial savings.

Similarly, AT&T's historic bureaucracy, dating back to 1885, presented a formidable challenge. Nevertheless, through identifying inefficiencies referred to as 'raindrops', the company saved 3.6 million hours and evaded over $230 million in expenses. This example underscores the importance of a comprehensive approach that assesses the minutiae of processes and systems to eliminate unnecessary expenses.

In view of the Biden administration's new directive for federal agencies to take into account the climate impact of their purchases, CFOs are reminded of the wider ramifications of reduction efforts. This policy shift toward environmentally conscious purchasing reflects a growing trend of evaluating cost-cutting measures not just by immediate savings but also by their long-term sustainability and operational impact.

The Well-Architected Framework emphasizes the importance of collaboration across departments in managing expenses, particularly between financial and technology teams. This synergy is crucial for creating a that integrates business outcomes with technological investments.

Moreover, a statement from Stefania, a technical principal at Thoughtworks, captures the twofold emphasis on expenses and effective functioning. She mentions, 'Both concentrate on expenses and finances.'. And the other side of it actually are on optimization and efficiency This dual focus is a reminder that cost-cutting initiatives should not compromise the intrinsic value or performance of the organization's services or products.

As we consider these real-world cases and expert insights, it's clear that CFOs must navigate cost reduction strategies by proactively addressing potential challenges, maintaining operational efficiency, and ensuring that cost-cutting does not come at the expense of quality or long-term viability.

Conclusion

In conclusion, CFOs have a crucial role in managing and reducing operational costs. By analyzing costs, leveraging technology, focusing on KPIs, utilizing managed services, and optimizing vendor negotiations, CFOs can create a robust framework for cost reduction.

Embracing technology, such as online systems and AI, streamlines operations and minimizes errors. Tools like BILL Spend & Expense automate processes, reducing costs associated with manual data entry and paper invoices.

Focusing on KPIs and aligning IT budgets with business strategy ensures active management of operations and long-term financial health. Managed services save operational hours and allow for concentration on strategic initiatives.

Outsourcing non-core functions enhances efficiency and reduces overhead costs. Strategic outsourcing provides access to specialized service providers and expertise, leading to cost savings and streamlined core business functions.

Optimizing inventory management through real-time tracking and advanced software tools enables accurate demand forecasting and reduces waste.

Workforce optimization, through cross-training and flexible working arrangements, leads to cost reductions while safeguarding productivity. Advanced workforce management software aligns staffing with actual demand, minimizing the expense of underutilized labor.

To drive sustainable cost reduction, CFOs must foster a culture of continuous improvement and monitoring. Rigorous performance metrics and deep awareness of cost implications at every level of the organization are essential.

Vendor negotiation and management are pivotal for achieving cost savings. Proactive engagement, supported by historical usage data and market benchmarks, enables CFOs to secure advantageous pricing and discounts.

In navigating cost reduction strategies, CFOs must address potential challenges, maintain operational efficiency, and ensure that cost-cutting efforts do not compromise quality or long-term viability. By adopting a comprehensive approach and considering real-world case studies, CFOs can successfully navigate cost reduction strategies while maintaining operational efficiency and long-term financial health.

Frequently Asked Questions

What are operational costs?

Operational costs are the total expenses necessary for a business to function effectively. This includes costs like labor, raw materials, rent, and insurance.

How can businesses reduce operational costs?

Businesses can reduce operational costs by thoroughly analyzing expenditures, embracing technology, focusing on key performance indicators (KPIs), and utilizing managed services.

Why is technology important in reducing operational costs?

Technology enhances efficiency by streamlining operations, minimizing errors, and automating processes. Tools like BILL Spend & Expense help in managing expenses effectively.

What role do KPIs play in managing operational costs?

KPIs help track operational efficiency and customer satisfaction, allowing businesses to make informed decisions and actively manage their operations.

How can outsourcing affect operational expenses?

Outsourcing non-core functions like IT support can lead to significant savings and efficiency gains, as specialized service providers often have the expertise to streamline processes.

What is the significance of vendor negotiation in cost reduction?

Effective vendor negotiation can lead to better pricing and terms, thus optimizing expenses. A comprehensive analysis of total ownership costs helps in negotiations.

How can businesses effectively track and categorize their expenses?

Categorizing expenses into departments or expense centers and adopting robust accounting methods provide a detailed perspective, essential for decision-making.

What strategies can CFOs use for workforce optimization?

CFOs can maximize workforce efficiency through cross-training employees, offering flexible work arrangements, and leveraging advanced workforce management software.

How does inventory management impact operational costs?

Efficient inventory management allows businesses to maintain optimal stock levels, reducing waste and improving cash flow, particularly during shifts in industry dynamics.

What is the importance of continuous improvement in managing operational costs?

A culture of continuous improvement helps organizations regularly assess and refine their operations, leading to ongoing cost reductions and enhanced efficiency.

Can you provide examples of successful cost reduction implementations?

Examples include AT&T's modernization efforts based on employee feedback and Pacific Steel's transition to reference-based pricing for better healthcare cost management.

What challenges might companies face when reducing operational costs?

Challenges include overcoming entrenched bureaucracies, ensuring that cost-cutting measures do not compromise quality, and navigating changes in regulatory environments.

How can businesses ensure that cost-cutting strategies are sustainable?

By evaluating the long-term impact of cost reductions on operational performance and aligning these strategies with broader business objectives, companies can achieve sustainable savings.