Introduction

Understanding the intricacies of financial reporting is paramount for any organization aiming to thrive in today’s competitive landscape. At the heart of this process lies the Profit and Loss Statement (P&L), a powerful tool that provides a comprehensive snapshot of a company's revenues, costs, and overall profitability over a defined period. This essential document not only reveals a business's financial health but also serves as a strategic guide for informed decision-making.

As financial leaders grapple with the challenges of modern market dynamics, mastering the components and implications of the P&L statement becomes critical. From recognizing revenue streams to navigating the complexities of cash versus accrual accounting, this article delves into the foundational aspects of P&L statements, equipping CFOs with the insights necessary for driving sustainable growth and maximizing value.

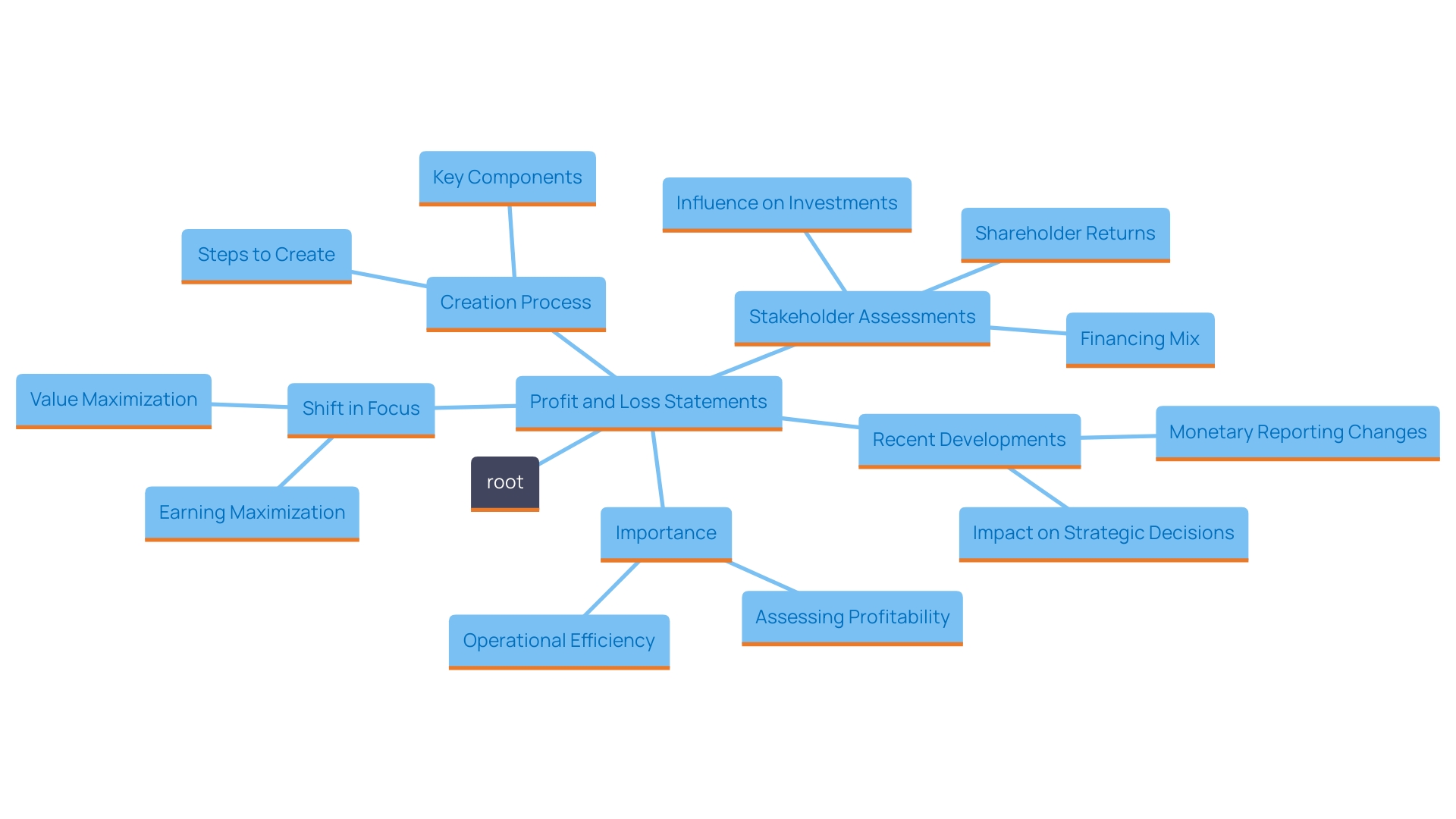

What is a Profit and Loss Statement?

A Profit and Loss Report (P&L), frequently called an income report, is a crucial document that summarizes a company's revenues, costs, and expenses over a specified period, usually a fiscal quarter or year. This crucial document not only highlights a company's ability to generate profit but also serves as a transparent reflection of its economic health.

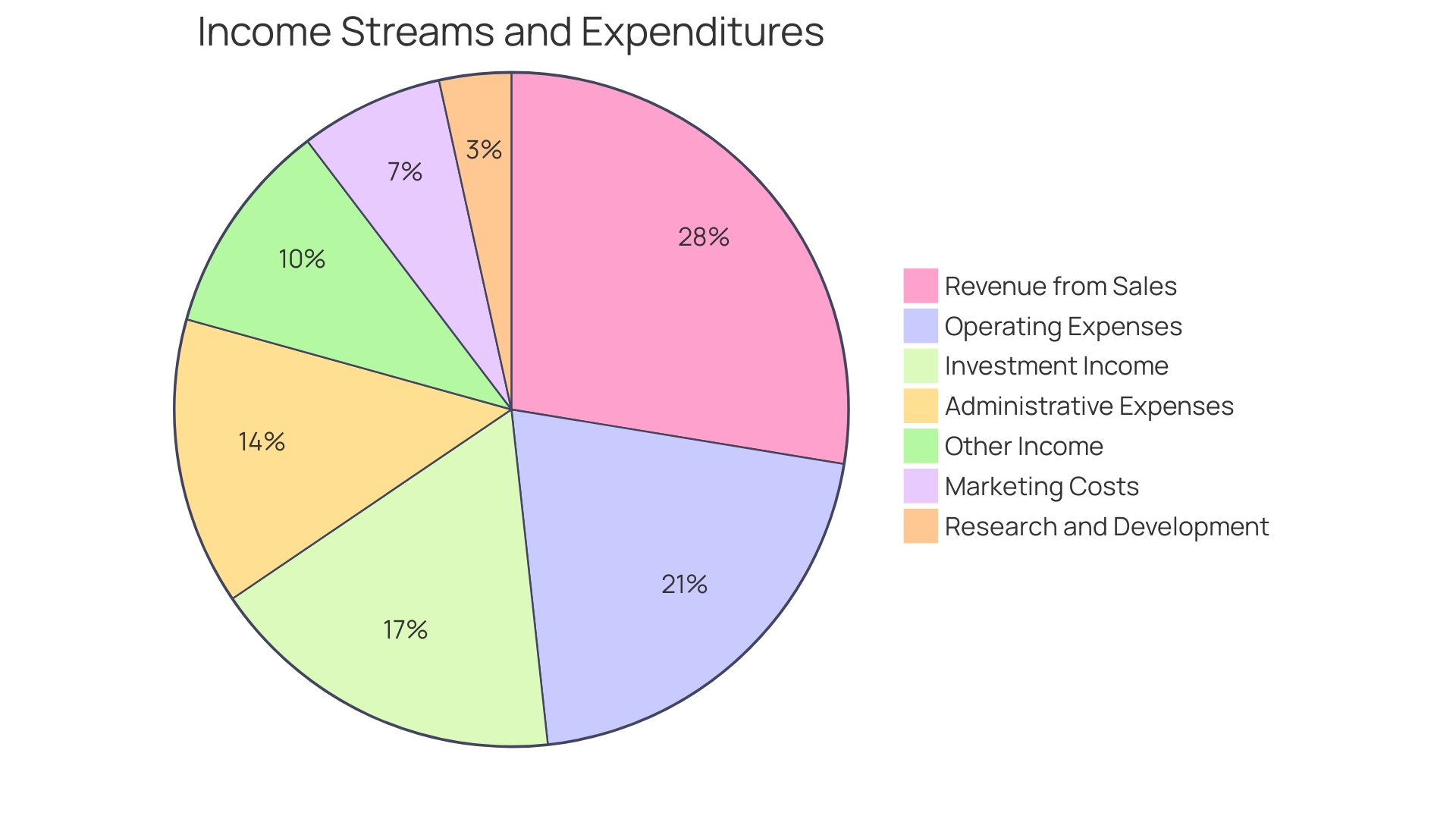

The P&L report offers detailed insights into income streams and expenditures, ultimately revealing the net income or loss for the period. Grasping this assertion is essential for CFOs and financial strategists, as it establishes the foundation for making informed choices regarding investments, cash management, and overall business strategy.

Moreover, the P&L statement contributes to broader discussions around value maximization in corporate finance. 'While traditional views may emphasize revenue maximization, the modern approach recognizes that companies, particularly those with significant growth potential, may prioritize scaling and market positioning over immediate financial returns.'. This strategic shift is evident in sectors like social media and technology, where businesses often accept short-term losses to .

As monetary leaders navigate their organizations, they must interpret P&L figures in the context of their broader goals, ensuring that they are not merely chasing profits but also fostering sustainable growth and value creation. This viewpoint corresponds with the feeling that a well-organized P&L report is not merely a documentation of previous results but an instrument for influencing future strategies and guaranteeing adherence to monetary regulations.

Key Components of a Profit and Loss Statement

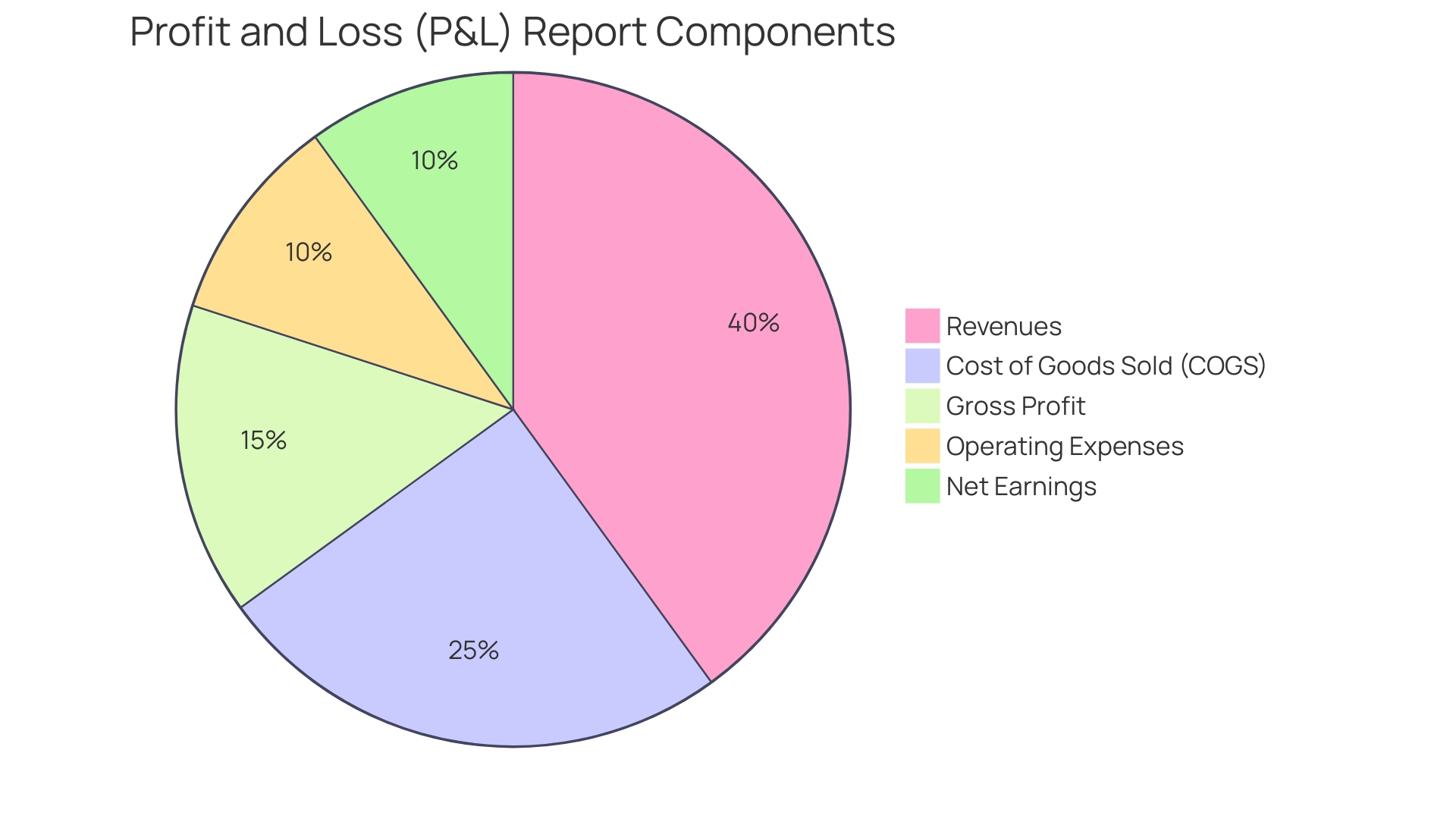

A Profit and Loss (P&L) report, also referred to as an income report, is a fundamental financial document that provides a comprehensive view of a company's over a specific period. The key components of this statement include:

- Revenues (Sales): This figure represents the total income generated from selling goods or providing services. It is the lifeblood of any enterprise; without sufficient revenue, a company cannot cover its operating expenses or achieve profitability. Regular monitoring of revenue helps businesses assess their market presence and the effectiveness of their sales strategies.

- Cost of Goods Sold (COGS): This line item encompasses all direct costs associated with producing goods or delivering services, such as materials and labor. The equation for determining gross earnings is straightforward: Gross Earnings = Sales Revenue – Cost of Goods Sold. Understanding COGS is crucial, as it directly impacts gross profit and, subsequently, net profit.

- Gross Profit: This metric reflects the basic profitability of a company's core operations, calculated by subtracting COGS from total revenue. It serves as a clear indicator of how efficiently a company produces its goods or services and lays the groundwork for further operational analysis.

- Operating Expenses: These are the costs required to run the business that are not directly tied to production. They include salaries, rent, utilities, and other overheads. Tracking operating expenses is crucial for managing costs and ensuring that they do not diminish gross earnings.

- Net Earnings (Bottom Line): Often called the bottom line, net earnings offer a clear view of a company’s economic condition. It is determined by deducting all expenses, including operating and production costs, from total revenue. A positive net gain indicates effective management and operational efficiency, while a negative figure can signal the need for strategic adjustments.

Each of these components plays a vital role in evaluating a business's economic health. They enable stakeholders to gauge operational efficiency and profitability, offering insights that can inform strategic decisions and enhance value creation. As noted in industry observations, while maximizing profit is often a goal, the focus should also be on value maximization to ensure long-term sustainability and growth.

Cash Basis vs. Accrual Basis Accounting

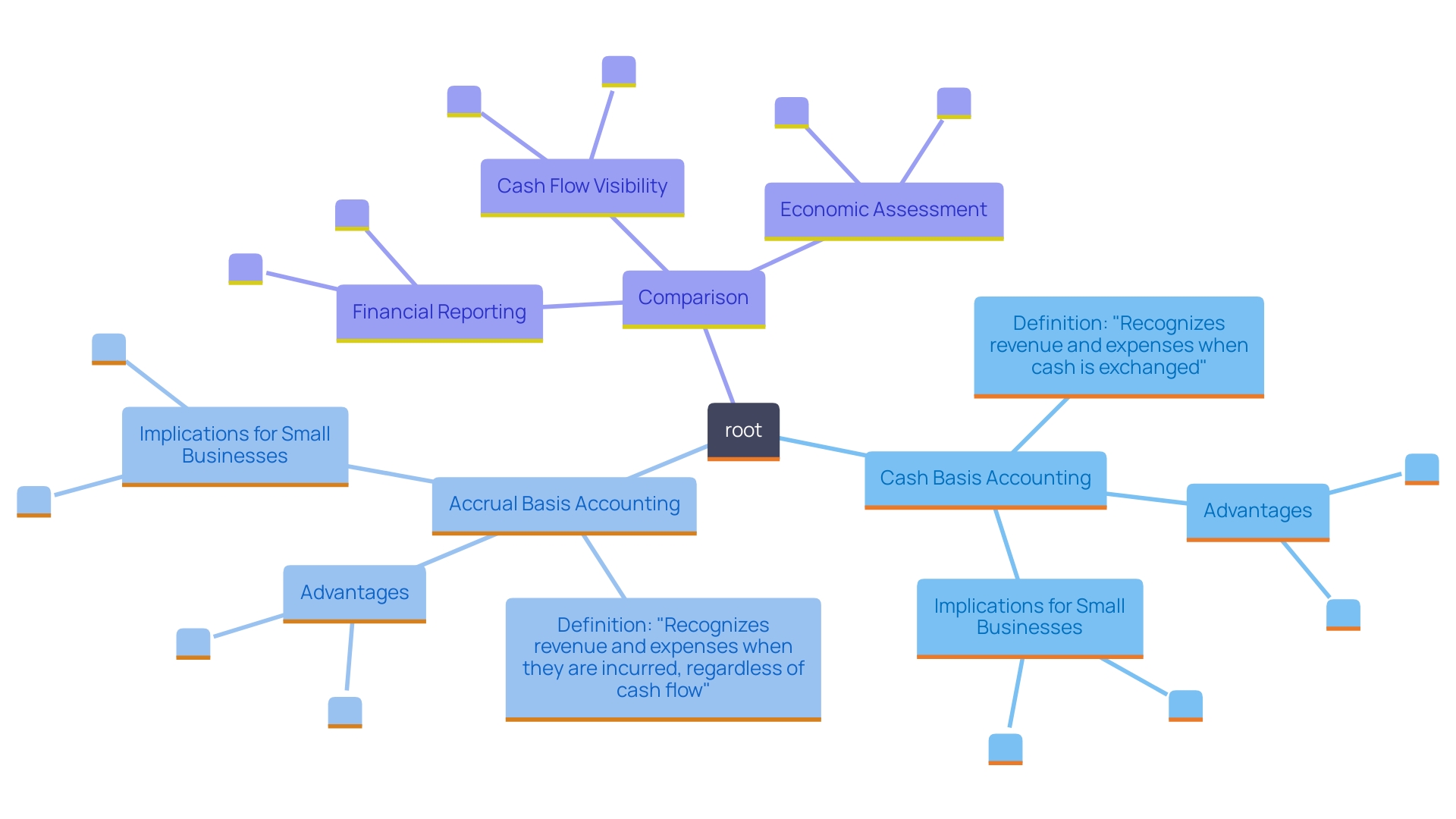

The cash basis method of accounting simplifies financial reporting by recognizing revenues and expenses only when cash is actually received or paid. This approach offers a clear and prompt perspective on , making it especially beneficial for small enterprises that need to monitor their liquidity closely. On the other hand, accrual basis accounting captures revenues and expenses when they are incurred, regardless of cash transactions. This method reflects the economic activity of an organization more comprehensively, as it accounts for money that is owed or to be received, offering a fuller picture of profitability.

Comprehending these essential distinctions is vital for precise reporting and analysis of resources. For instance, a small enterprise that relies on cash basis accounting may miss out on opportunities to showcase potential growth when income is recorded only upon receipt. In contrast, enterprises using accrual accounting can present a more robust economic position by accounting for all earned revenues and incurred expenses, even before cash changes hands.

Furthermore, the choice between these methods can significantly impact cash management strategies. 'The cash basis method may seem less intricate, but it can result in misleading insights about a company’s economic status over time.'. As mentioned in a recent conversation about money management challenges, small business owners must navigate the intricacies of cash flow management, ensuring that they not only track inflows and outflows but also effectively communicate their monetary standing to stakeholders.

How to Read a Profit and Loss Statement

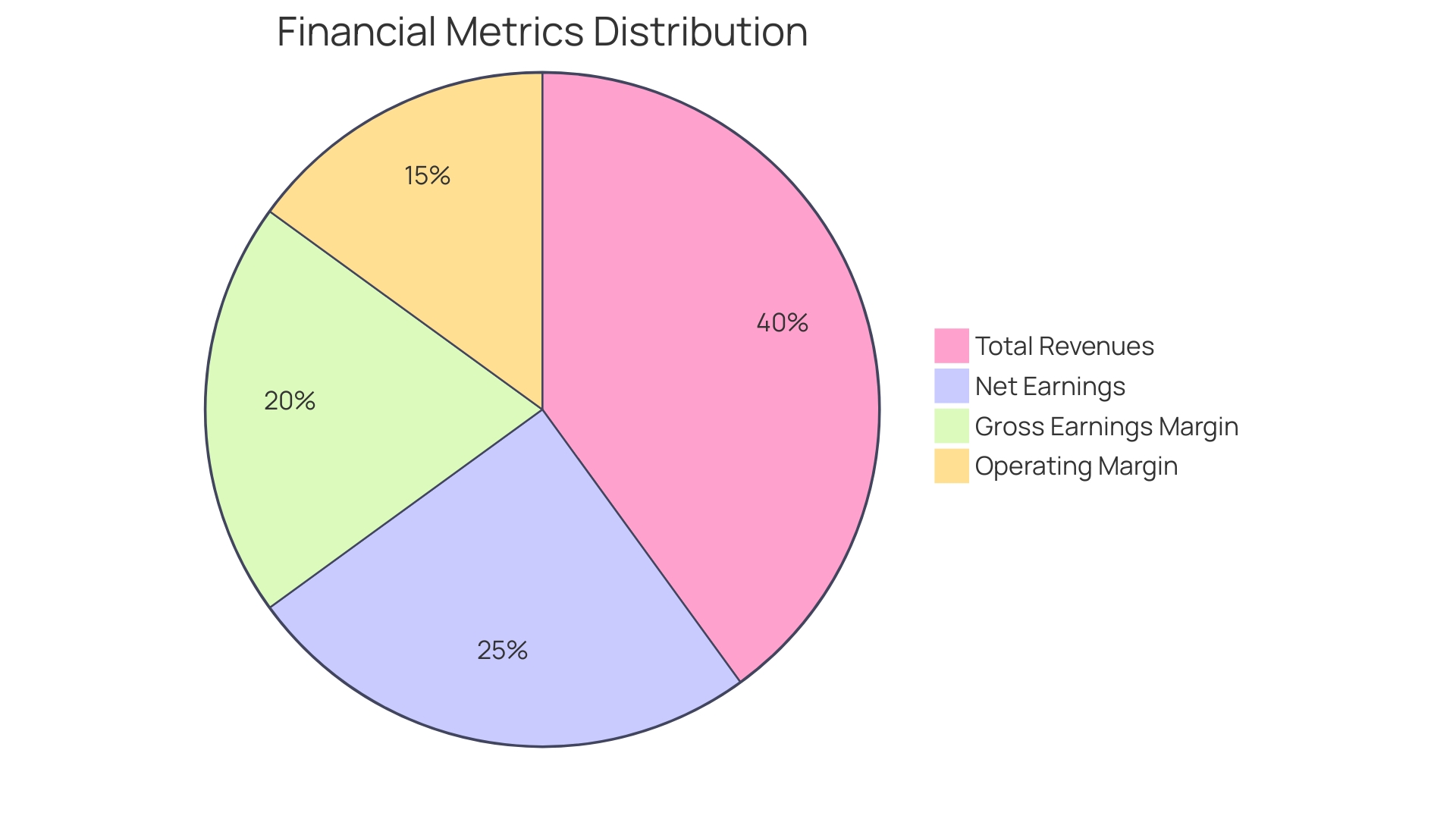

Reading a Profit and Loss (P&L) statement is essential for understanding the financial health of an organization. It entails a thorough analysis of the top line, which signifies total revenues, and the bottom line, showing net earnings. These figures are pivotal in assessing a company’s overall performance. To gain deeper insights, it is essential to calculate key metrics such as gross earnings margin and operating margin, which reflect the efficiency of organizational operations.

Moreover, analyzing trends over multiple periods can unveil critical patterns in commercial growth or potential challenges. For instance, if a company observes a declining gross earnings margin over time, it may signal rising costs or pricing pressures, necessitating strategic adjustments. As one expert noted, "While private businesses are often described as profit maximizers, the truth is that they should be value maximizers," emphasizing the importance of aligning economic metrics with broader business objectives.

Incorporating insights from industry-specific case studies, such as the hospitality sector, can further enhance understanding. Many hotel operators face the challenge of interpreting their P&L reports effectively. By recognizing the relationship between income and expenses across various departments, they can implement more effective strategies to boost profitability. This is particularly important in an evolving market, where socio-cultural, economic, and technological factors continuously shape customer expectations and operational efficiencies.

Ultimately, mastering the nuances of P&L statements empowers executives to make informed monetary decisions that drive , ensuring that their organizations not only meet immediate economic targets but also pave the way for long-term success.

Calculating Key Figures in a Profit and Loss Statement

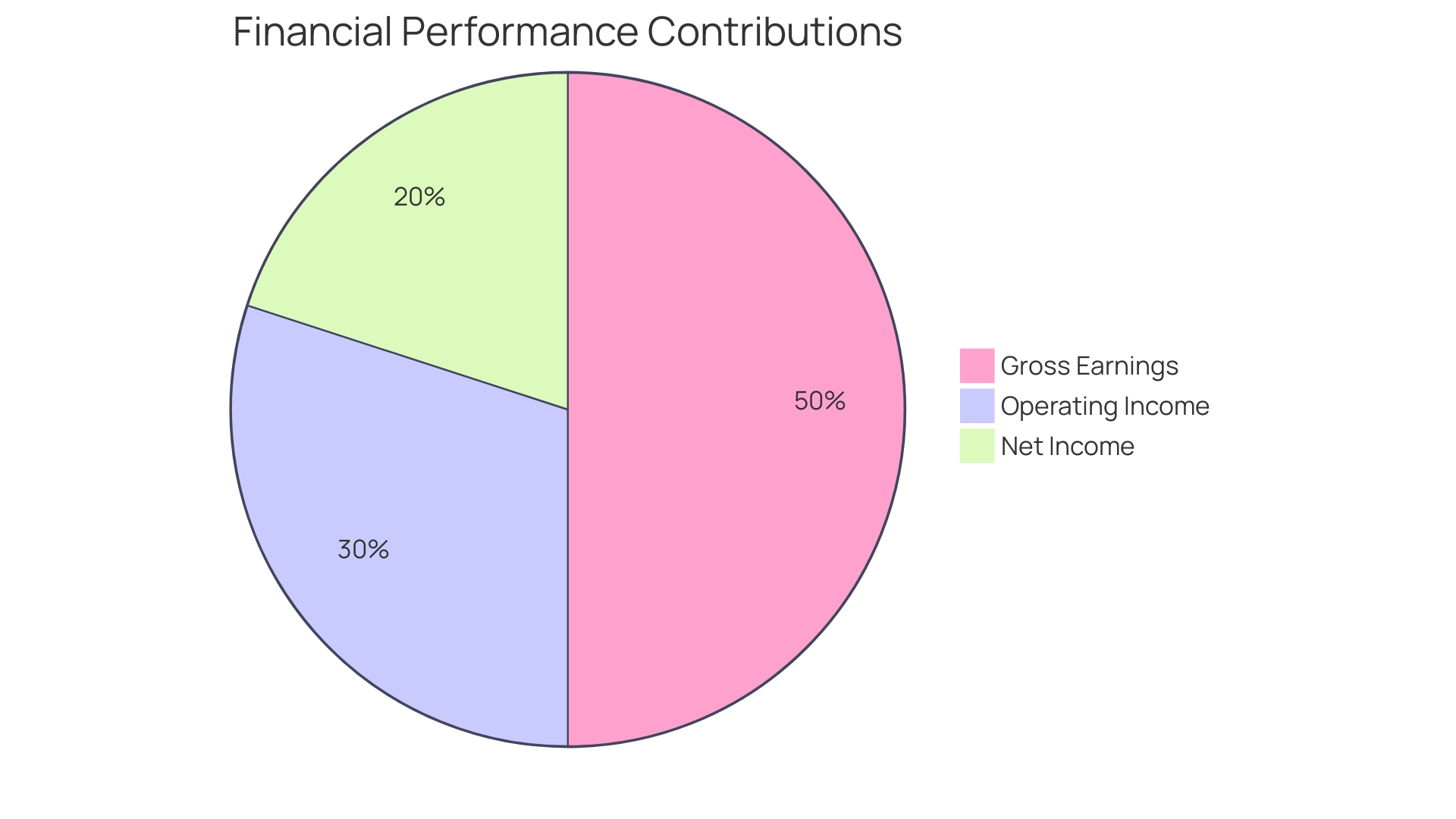

Understanding key is vital for performance evaluation and strategic decision-making. 'Gross earnings, operating income, and net income are foundational metrics that emerge from the relationship between revenue and associated costs.'. For instance, gross earnings are calculated by subtracting the Cost of Goods Sold (COGS) from total sales, providing insight into the efficiency of production and pricing strategies.

Operating income further refines this analysis by accounting for operating expenses, illustrating how well a company can generate earnings from its core business operations. Net income, often referred to as the bottom line, takes into consideration all expenses, including taxes and interest, highlighting the overall profitability of the organization.

These profitability metrics are crucial for stakeholders, enabling them to gauge economic health and make informed decisions regarding investments and resource allocation. As noted in recent analyses, a company’s ability to balance immediate profitability with long-term value creation is increasingly important. Although profit maximization is a traditional goal, many contemporary firms prioritize value maximization, a strategy that may involve accepting lower profits now for greater growth potential in the future.

Moreover, understanding these figures within the context of market position and competitive advantage can further enhance insights. Businesses that show steady innovation and flexibility often attain superior economic results, offering a strong basis for evaluating their future development and stability.

Understanding the Importance of Profit and Loss Statements

Profit and Loss Statements play a critical role in evaluating a company's profitability and operational efficiency. These declarations provide a thorough perspective on income sources, expense management methods, and economic trends, rendering them essential for decision-makers, investors, and analysts alike when evaluating organizational performance.

The creation of these assertions is not merely about compiling figures; it is about translating a business's operational realities into financial projections that can influence strategic decisions. For instance, understanding how to read and build an income statement, along with the balance sheet and cash flow statement, is essential. This knowledge not only aids in assessing current performance but also in forecasting future viability.

A notable trend in recent years highlights the divergence between earning maximization and value maximization. Many businesses, particularly those in the technology and green energy sectors, have prioritized growth over immediate profitability. This shift reflects a broader strategy where companies may choose to accept lower profits or even losses in the short term to enhance long-term growth potential. As articulated in corporate finance, while some mature companies may see a convergence between these two objectives, for most, they remain distinct. This distinction is crucial when interpreting Profit and Loss Statements, as it can reveal a company's strategic priorities and risk appetite.

Recent developments in monetary reporting further underscore the importance of these statements. For instance, a bank recently disclosed a shift in its operational model concerning private corporate bonds, which involved reclassifying bonds from a fair value approach to an amortized cost basis. 'This change, motivated by the requirement for stability and a new business framework, demonstrates how external influences and strategic alterations can affect reporting and profitability indicators.'.

Thus, Profit and Loss Statements serve not just as historical records but as and investment decision-making, guiding stakeholders through the complexities of economic performance.

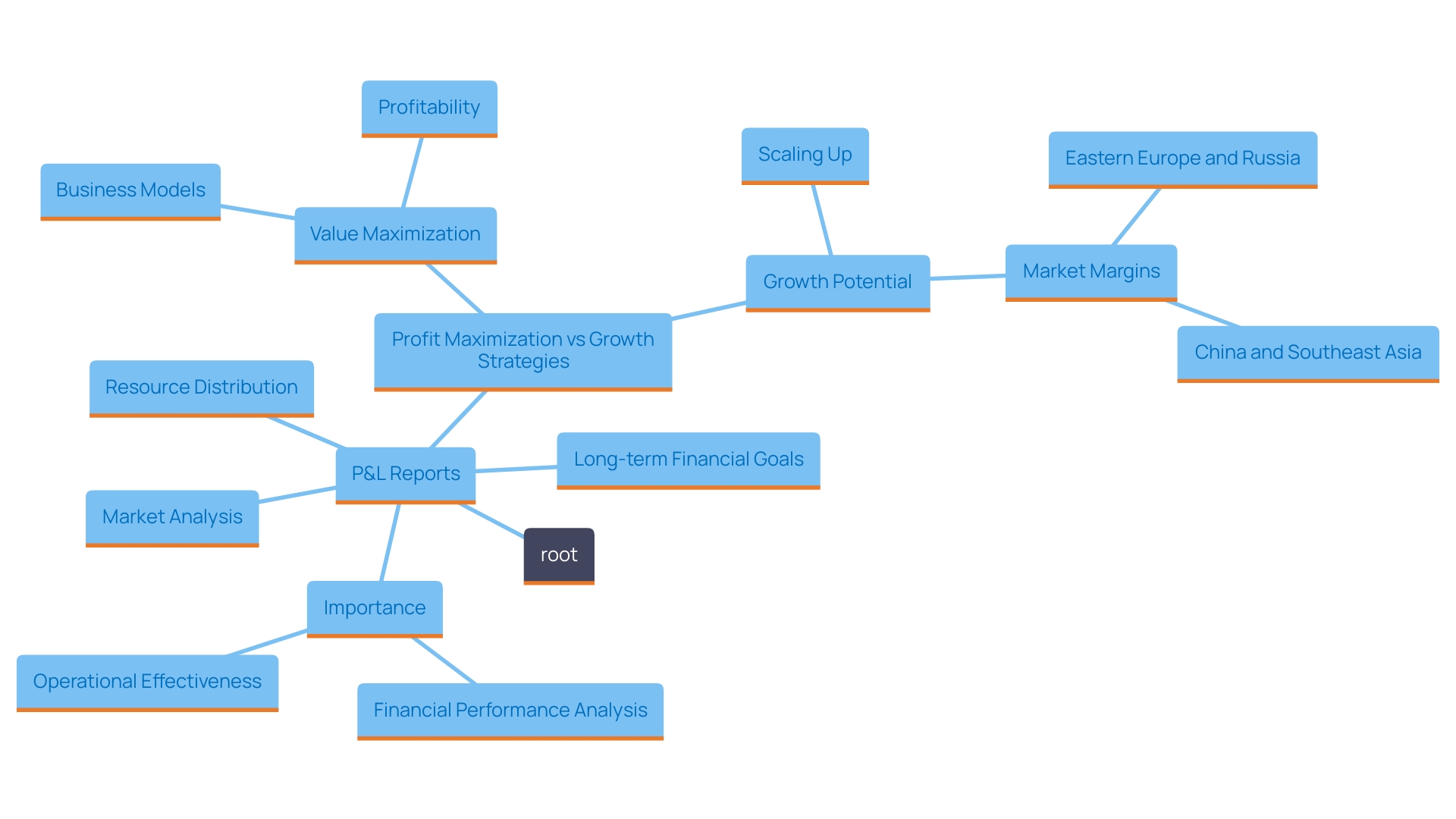

Using Profit and Loss Statements for Financial Analysis

Profit and Loss (P&L) reports serve as essential instruments for , providing a comprehensive view of a company's financial performance over a specific period. These declarations enable organizations to not only compare actual performance against budgets but also to scrutinize profit margins and identify potential cost-saving opportunities.

Consistently examining P&L reports is vital for strategic decision-making. It assists companies in evaluating their operational effectiveness and economic well-being, allowing them to make informed choices regarding resource distribution and investment approaches. In fact, the insights gained from analyzing these statements can guide organizations in aligning their short-term operational needs with long-term financial goals.

Furthermore, a thorough evaluation goes beyond simple financial numbers. It includes a market analysis to understand shifts in market share and the factors influencing these changes. This holistic approach empowers organizations to adapt their strategies proactively, ensuring they remain competitive in an ever-evolving landscape.

As noted in recent discussions surrounding company valuation, the focus should not solely rest on profit maximization. Companies with growth ambitions often prioritize scaling operations over immediate profitability, a strategy essential for long-term value creation. This viewpoint emphasizes the significance of comprehending not only the figures, but also the foundational models influencing these economic results.

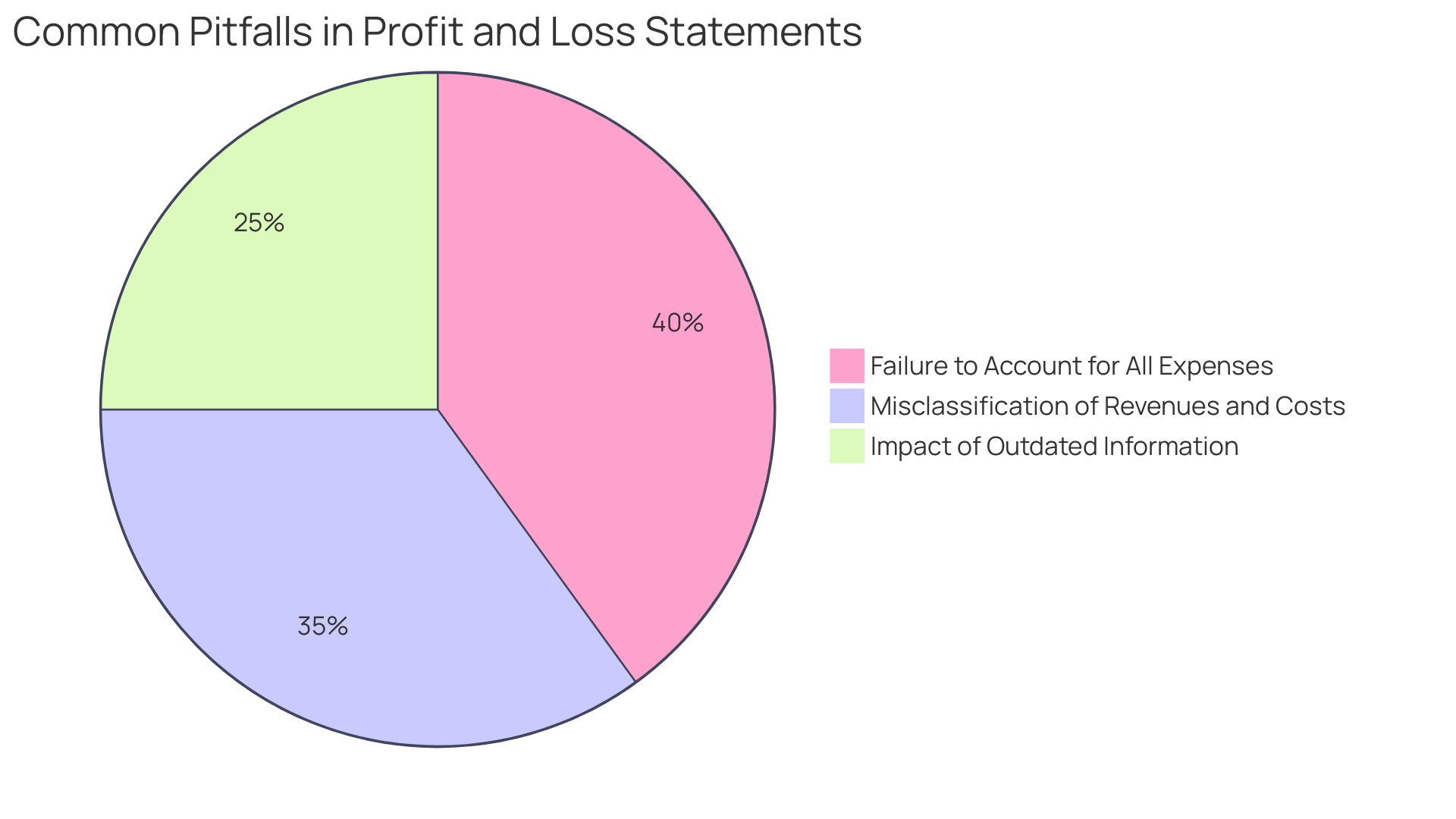

Common Mistakes to Avoid When Creating a Profit and Loss Statement

Common pitfalls in Profit and Loss (P&L) statements can significantly undermine a business's monetary clarity and decision-making process. One frequent mistake is the , which can lead to an inflated view of profitability. For instance, operational costs, such as utilities and maintenance, might be overlooked, skewing the economic picture. Misclassifying revenues and costs also poses a risk; for instance, treating capital expenditures as operational expenses can mislead stakeholders about economic health.

Frequent updates to the P&L report are vital to guarantee precision. Outdated monetary information can lead to misguided strategies and missed opportunities. A thorough comprehension of financial reports is essential in today’s rapid-paced corporate landscape, where choices must rely on reliable information instead of conjectures. The P&L statement serves as a vital tool to juxtapose total expenses against revenue, delivering a clear and empirical foundation for informed decision-making.

As highlighted by industry experts, "Sales or revenue is the lifeblood of any business, representing the total income generated from selling goods or providing services over a specified period." Regular monitoring of these metrics is crucial for gauging market presence and the effectiveness of sales strategies. Mistakes or omissions in the P&L can mislead prospective investors, who depend on proof of economic stability and growth potential rather than mere assertions. Thus, maintaining a diligent approach to P&L statements is not just a best practice, but a necessity for sound financial management.

Conclusion

Mastering the Profit and Loss Statement (P&L) is essential for any organization aiming for financial clarity and strategic growth. This document not only provides a snapshot of revenues and expenses but also serves as a cornerstone for informed decision-making. Understanding its key components—such as revenues, costs, gross profit, operating expenses, and net profit—enables CFOs to assess their organization's financial health effectively.

The distinction between cash and accrual accounting further emphasizes the importance of accurate financial reporting. While cash basis accounting offers immediate insights into liquidity, accrual accounting presents a more comprehensive view of financial performance. Recognizing these nuances allows organizations to make strategic adjustments that align with both short-term and long-term objectives.

Moreover, the P&L statement is not merely a historical record; it is a powerful tool for financial analysis and forecasting. By evaluating trends, calculating key metrics, and avoiding common pitfalls, businesses can uncover opportunities for growth and cost savings. This proactive approach not only enhances operational efficiency but also positions organizations to adapt to market changes and maximize long-term value.

Ultimately, leveraging the insights derived from P&L statements is crucial for driving sustainable growth and maintaining competitive advantage. By focusing on value maximization rather than solely profit maximization, organizations can navigate the complexities of modern financial landscapes and achieve their strategic goals. Embracing this perspective is vital for any CFO committed to steering their organization toward enduring success.

Frequently Asked Questions

What is a Profit and Loss (P&L) report?

A P&L report, also known as an income report, summarizes a company's revenues, costs, and expenses over a specific period, typically a fiscal quarter or year. It highlights the company's ability to generate profit and reflects its economic health.

What are the key components of a P&L report?

The main components include: Revenues (Sales), Cost of Goods Sold (COGS), Gross Profit, Operating Expenses, and Net Earnings (Bottom Line).

Why is the P&L report important for businesses?

The P&L report provides detailed insights into income and expenditures, helping stakeholders assess operational efficiency and profitability. It serves as a foundation for strategic decisions regarding investments and cash management.

How do P&L reports influence business strategy?

P&L reports help executives interpret financial data within the context of broader business goals, ensuring that companies focus not just on immediate profits but also on fostering sustainable growth and long-term value creation.

What is the difference between cash basis and accrual basis accounting in the context of P&L reporting?

Cash Basis Accounting recognizes revenues and expenses only when cash is received or paid, while Accrual Basis Accounting recognizes them when incurred, regardless of cash transactions, offering a more comprehensive view of profitability.

How can analyzing P&L statements assist in financial decision-making?

By examining trends in gross earnings and operating margins over time, businesses can identify growth patterns or challenges, allowing for strategic adjustments and aligning operational needs with long-term financial goals.

What are some common pitfalls to avoid when creating P&L statements?

Common mistakes include failing to account for all expenses, misclassifying revenues and costs, and using outdated financial information, which can misrepresent a company's financial health.

How does the P&L report contribute to discussions on value maximization in corporate finance?

While traditional views emphasize profit maximization, modern approaches recognize that companies, especially those in growth sectors, may prioritize scaling and market positioning over immediate financial returns to enhance long-term value.

What role do industry-specific case studies play in understanding P&L reports?

Case studies can illustrate how different sectors interpret P&L reports and adapt strategies accordingly, such as hotel operators analyzing income and expenses across departments to boost profitability.

How should businesses use P&L reports to communicate with stakeholders?

Organizations should present P&L reports as vital tools for strategic alignment and investment decision-making, ensuring that stakeholders understand the company's economic performance and growth potential.